On the verge of launch, Pump.fun's $1 billion ICO dream hangs in the balance after account suspension?

TechFlow Selected TechFlow Selected

On the verge of launch, Pump.fun's $1 billion ICO dream hangs in the balance after account suspension?

Bans, lawsuits, and uncertainty—how much of Pump.fun's spotlight remains?

Text: Fairy, ChainCatcher

Editing: TB, ChainCatcher

One step from the goal, yet choked at the throat.

At the critical juncture just before TGE, Pump.fun’s official and founder X accounts were suspended, bringing resurfacing shadows of multiple legal lawsuits.

On the verge of monetization, this sudden silence feels particularly significant. Suspensions, lawsuits, and uncertainty—how much brilliance remains for Pump.fun?

Dream of launching a token abruptly halted?

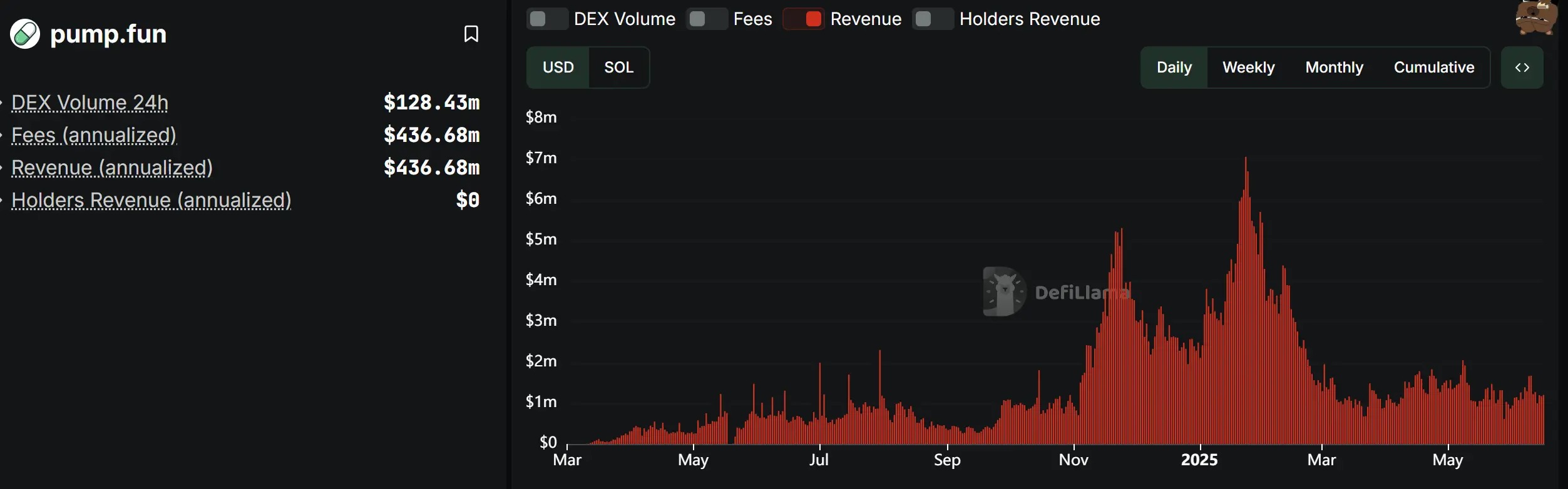

Pump.fun is no longer at its peak. According to Defillama data, the platform hit a record daily revenue of over $7 million on January 23, but has since steadily declined, recently hovering around $1 million per day.

Meanwhile, overall Meme market enthusiasm has cooled, with Meme launch platforms sprouting up like mushrooms after rain, intensifying competition. During this period, although Pump.fun attempted innovations such as launching its own AMM and "live issuance" features, these failed to generate significant traction. Under mounting pressures, token launch has been seen by the community as Pump.fun's "final cash grab."

Image: Defillama

According to reports by The Block and Blockworks, Pump.fun plans to raise up to $1 billion through an ICO and is considering introducing a "revenue-sharing" mechanism. The project’s valuation for the ICO stands at $4 billion, with a total token supply cap expected at 10 trillion tokens, offered privately at $0.004 per token. In terms of token distribution, approximately 25% will be made available to the public, with another 10% reserved for airdrops.

In addition, crypto KOL AB Kuai.Dong disclosed a potential timeline for Pump.fun's market debut: June 21 for announcement of private sale and listing details, June 25 launching a three-day "subscription" event, and June 28 revealing the official trading start date.

Just four days before the planned announcement, the situation took a sharp turn. Suddenly, Pump.fun’s official account and that of its founder were suspended on X. This wave of suspensions had already begun quietly last week, with numerous active “shitcoin” KOLs, Telegram bot trading platforms, and their X accounts—including BullX, Bloom, and Nova—successively banned. The Meme ecosystem plunged into turmoil and confusion, possibly forcing Pump.fun’s token launch plans into indefinite suspension.

Multiplying Risks: Class-action Lawsuits and Founder’s Past

Regarding the sudden wave of account suspensions, speculation runs rampant within the community. Some believe it may relate to violations of X’s API usage policies, involving alleged scraping of black-market data. Others speculate the crackdown targets excessive liquidity extraction or even deeper potential fraud mechanisms. There are also views suggesting X is tightening regulations on promotion of high-volatility, high-risk financial products like Meme coins.

More concerning, however, are the series of legal actions mounting against Pump.fun.

In December 2024, the UK Financial Conduct Authority (FCA) issued a stern warning to Pump.fun, stating it was offering financial services or products without authorization. Subsequently, Pump.fun blocked access for UK users.

In 2025, class-action lawsuits began emerging in North America against the platform and its executives:

-

January 16: U.S. cryptocurrency law firm BurwickLaw filed a lawsuit on behalf of multiple harmed investors;

-

January 30: Investor Diego Aguilar initiated a class-action suit accusing the project of violating U.S. securities laws while illegally collecting nearly $500 million in fees, describing its operations as a "new hybrid of Ponzi scheme and pump-and-dump."

Beneath these controversies lies further scrutiny surrounding co-founder Dylan Kerler. He has long faced allegations linking him to multiple past "shitcoin" rug pulls. According to a WIRED investigation, a developer using the name Dylan Kerler launched eight cryptocurrency projects back in 2017, earning about $75,000 worth of ETH from eBitcoinCash and EthereumCash.

The developer promoted these tokens on BitcoinTalk, then dumped holdings at their peak, causing EthereumCash to crash by 88%. A promotional account named "DOMAINBROKER" once publicly shared an email address bearing Dylan Kerler’s name. That individual also claimed in a Telegram group to be from Brighton, UK—the same region where Pump.fun co-founder Dylan Kerler has voter registration records, and where company registration documents list the same address.

Community Has Long Been Frustrated With Pump.fun

In reality, dissatisfaction within the community has been brewing for some time. Every one to two weeks, Pump.fun transfers accumulated transaction fee revenues to Kraken exchange. Over the past year and a half, the platform has sold approximately 4.179 million SOL, totaling as much as $751 million, at an average price of around $179.89.

Image: Yu Jin

Yet user returns tell a different story. Data from Dune shows that among roughly 4.257 million addresses conducting more than 10 token trades on pump.fun over the past six months, over 60% are currently at a loss. About 2.408 million addresses (56.6%) lost between $0 and $1,000, approximately 1,700 addresses lost over $100,000, and 46 addresses suffered losses exceeding $1 million.

Among profitable addresses, most gains are minimal. The largest group—916,500 addresses (21.5%)—earned profits between $0 and $1,000.

Besides, since May 12 when Pump.fun introduced creator revenue sharing, most creators received only a small slice of the pie.

Among the 3,566 creators tracked by Solanafloor, 83.4% earned less than $1,000—34.9% earned under $100, and 48.5% earned between $100 and $1,000. Only 1.8% managed to earn more than $5,000.

Undeniably, Pump.fun once shone brightly during the Meme craze, serving as a key driver behind market euphoria. But as excitement rapidly fades and suspension storms erupt, this former feast is quickly cooling down. Facing unfavorable timing, weak conditions, and waning support, how can Pump.fun break through to find a second spring?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News