September Web3 Funding Report: Capital Chasing Liquidity and Maturity

TechFlow Selected TechFlow Selected

September Web3 Funding Report: Capital Chasing Liquidity and Maturity

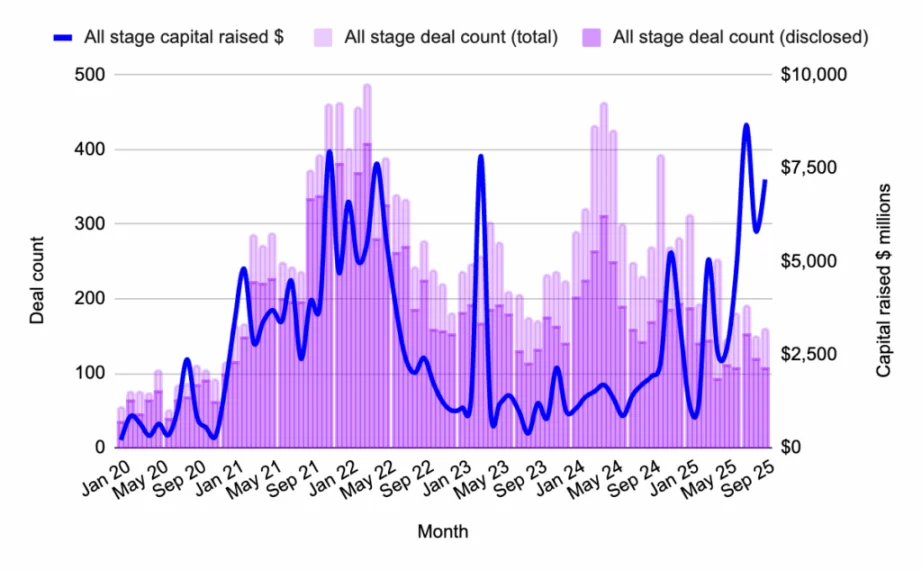

160 deals raised $7.2 billion, the highest total since the spring surge.

Author: Robert Osborne, Outlier Ventures

Translation: AididiaoJP, Foresight News

Web3 fundraising surged in September 2025 but has not yet peaked.

160 deals raised $7.2 billion—the highest total since the spring surge. However, apart from the notable exception of Flying Tulip at the seed stage, late-stage capital dominated, continuing the trend seen in the previous two months.

Market Overview: Strong but Top-Heavy

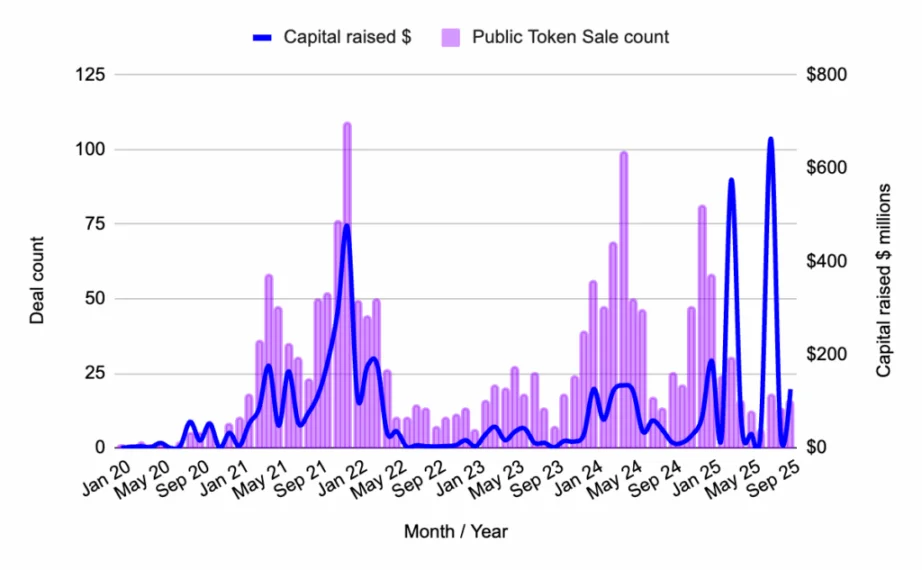

Figure 1: Web3 capital deployment and number of deals by stage from January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised (disclosed): $7.2 billion

-

Disclosed deals: 106

-

Total deals: 160

At first glance, September appeared to be a bold return of risk appetite. But aside from the outlier Flying Tulip, most capital flowed into later-stage companies. This continues the trend observed in our recent quarterly market report and aligns with VC insights gathered at Token2049 in Singapore. September 2025 reaffirms that while early-stage deal activity remains active, real capital is seeking maturity and liquidity.

Market Highlight: Flying Tulip ($200 million, Seed Round, $1 billion valuation)

Flying Tulip raised $200 million at a unicorn valuation during its seed stage. The platform aims to unify spot, perpetuals, lending, and structured yields into a single-chain exchange using a hybrid AMM/order book model, supporting cross-chain deposits and volatility-adjusted borrowing.

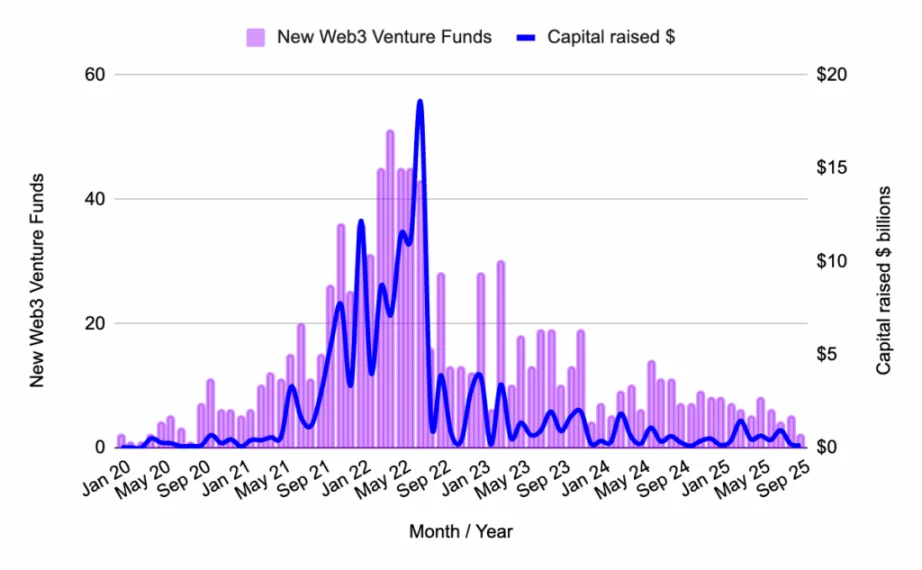

Web3 Venture Funds: Smaller in Scale

Figure 2: Number of launched Web3 venture funds and capital raised from January 2020 to September 2025. Source: Messari, Outlier Ventures.

New funds launched in September 2025:

-

Onigiri Capital, $50 million: Focused on early-stage infrastructure and fintech in Asia.

-

Archetype Fund III, $100 million: Focused on modular infrastructure, developer tools, and consumer protocols.

Fund launches cooled in September 2025. Only two new funds were announced, both relatively small and highly thematic. This reflects selectivity rather than slowdown: VCs are still raising funds, but around sharper, more focused themes.

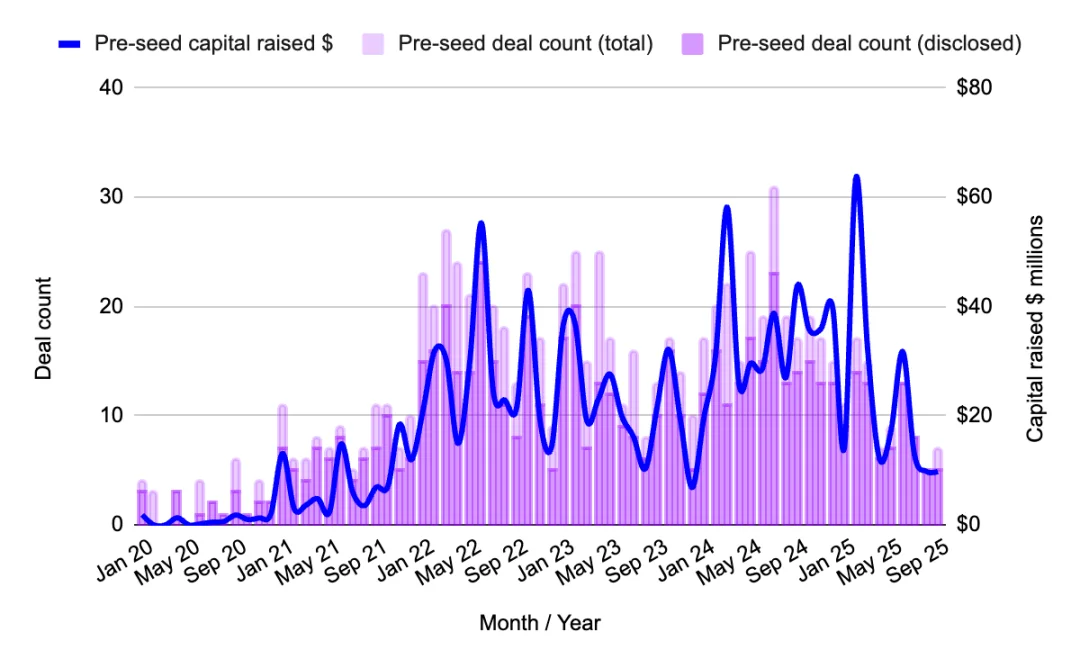

Pre-Seed Rounds: Nine-Month Downward Trend Continues

Figure 3: Capital deployment and number of deals in pre-seed stage from January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $9.8 million

-

Disclosed deals: 5

-

Median round size: $1.9 million

Pre-seed fundraising continues to decline in both deal count and capital raised. The stage remains weak, with few prominent investors participating. For founders at this stage, funding is scarce, but those who succeed do so through tight narratives and strong technical conviction.

Pre-Seed Highlight: Melee Markets ($3.5 million)

Built on Solana, Melee Markets allows users to speculate on influencers, events, and trending topics—a blend of prediction markets and social trading. Backed by Variant and DBA, it's an elegant attempt to capture attention flows as an asset class.

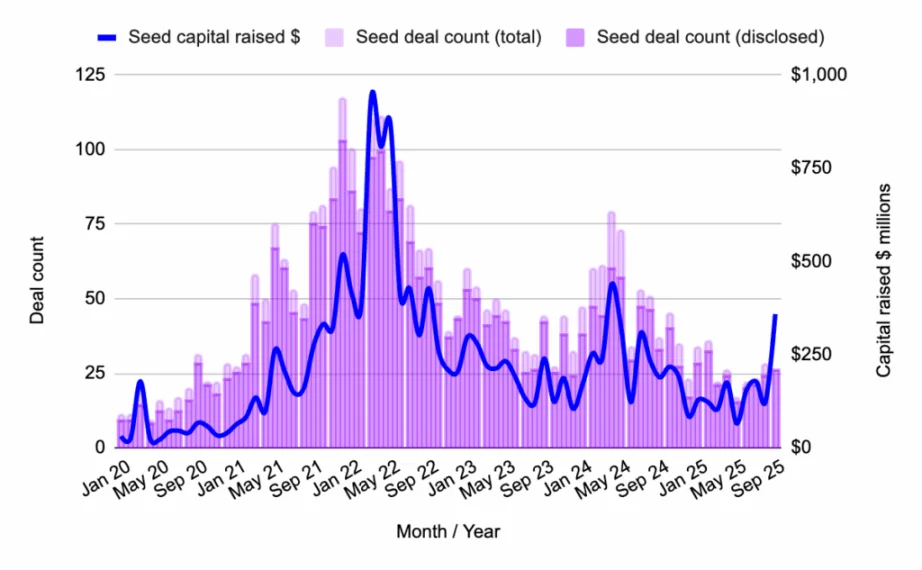

Seed Rounds: A Tulip Mania

Figure 4: Capital deployment and number of deals in seed stage from January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $359 million

-

Disclosed deals: 26

Seed-stage fundraising saw significant growth, entirely driven by Flying Tulip’s $200 million round. Without it, funding levels would have been roughly in line with previous months.

More importantly, Flying Tulip’s structure is not typical fundraising. Its on-chain redemption rights give investors capital security and yield exposure without sacrificing upside potential. The project isn’t just consuming its funding; it’s using DeFi yields to fund growth, incentives, and buybacks. This is a DeFi-native innovation in capital efficiency that could influence how future protocols self-fund.

Although Flying Tulip’s investors do retain the right to withdraw their capital at any time, this remains a major capital commitment from Web3 VCs—capital that would otherwise have been deployed into other early-stage projects via less liquid instruments such as SAFE or SAFT. It reflects another trend among Web3 investors: seeking more liquid asset exposure.

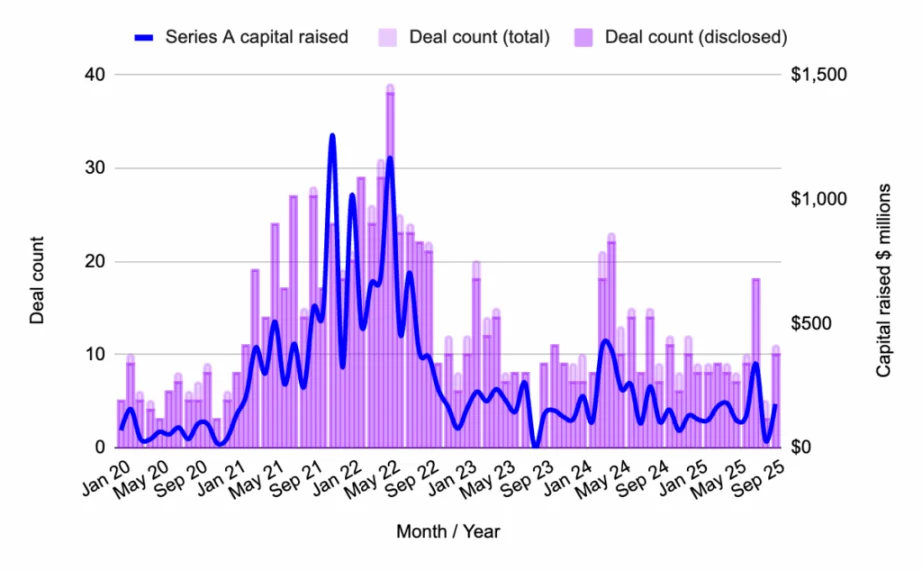

Series A: Stabilizing

Figure 5: Capital deployment and number of deals in Series A stage from January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $177 million

-

Disclosed deals: 10

-

Median round size: $17.7 million

After a sharp drop in August, Series A activity recovered slightly in September, though it was not a breakout month. Deal volume and capital deployed were close to 2025 averages. Investors remain selective, backing later-stage momentum rather than chasing early growth.

Series A Highlight: Digital Entertainment Asset ($38 million)

Singapore-based Digital Entertainment Asset raised $38 million to build a Web3 gaming, ESG, and advertising platform with real-world payment functionality. Backed by SBI Holdings and ASICS Ventures, it reflects ongoing Asian interest in integrating blockchain with mainstream consumer industries.

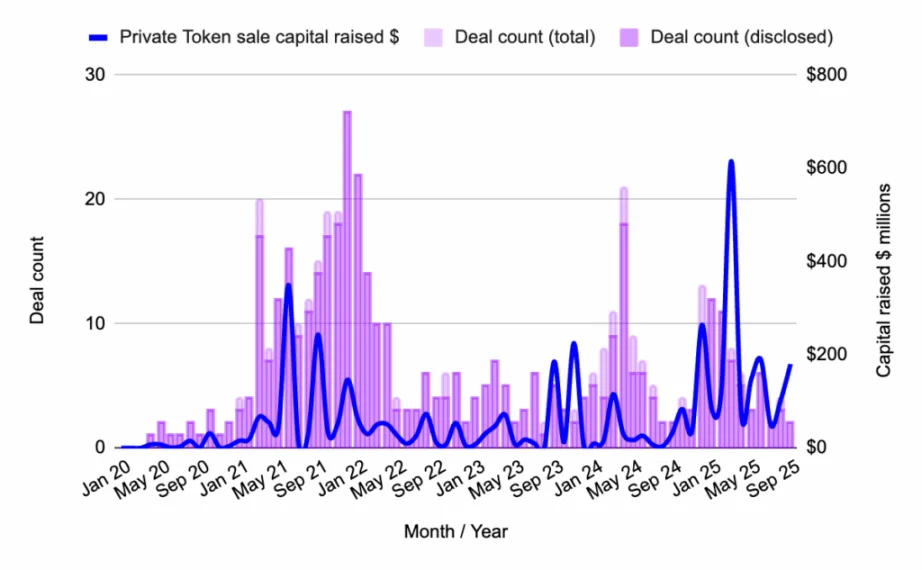

Private Token Sales: Big Money, Big Names

Figure 6: Capital deployment and number of deals in private token sales from January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $180 million

-

Disclosed deals: 2

Private token activity remained concentrated, with one large raise doing most of the work. The pattern from recent months continues: fewer token rounds, larger checks, and exchange-driven plays absorbing liquidity.

Highlight: Crypto.com ($178 million)

Crypto.com raised a massive $178 million, reportedly in collaboration with Trump Media. The exchange continues advancing its global accessibility and mass-market crypto payment tools.

Public Token Sales: Bitcoin’s Yield Moment

Figure 7: Capital deployment and number of deals in public token sales from January 2020 to September 2025. Source: Messari, Outlier Ventures.

-

Total capital raised: $126.2 million

-

Disclosed deals: 16

Public token sales remain active, driven by two compelling narratives: Bitcoin yield (BTCFi) and AI agents. This reminds us that public markets are still chasing stories.

Highlight: Lombard ($94.7 million)

Lombard is bringing Bitcoin into DeFi by launching LBTC, an interest-bearing, cross-chain, liquid BTC asset designed to unify Bitcoin liquidity across ecosystems. This is part of the growing "BTCFi" trend—earning DeFi yields on BTC.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News