The Startup Revolution in the AI Era: How Seed-Strapping Model Disrupts Traditional Financing Thinking?

TechFlow Selected TechFlow Selected

The Startup Revolution in the AI Era: How Seed-Strapping Model Disrupts Traditional Financing Thinking?

Why is it most suitable for AI-native companies?

Author: Henry Shi

Translation: Random Squad

Introduction by the Random Squad

Henry Shi is Co-founder and COO of Super.com (formerly Snapcommerce), having successfully scaled the company to $150 million in annual revenue.

Recently, after in-depth conversations with over 100 founders, Henry summarized four early-stage startup funding models, supported by detailed data analysis—offering fresh perspectives you won't want to miss. Enjoy!

Henry Shi recently exited his startup, which achieved $150 million in annual revenue and had raised $200 million in funding. He discovered a startling truth: 90% of founders are building companies fundamentally wrong.

For decades, entrepreneurs have been trapped in a false binary: either bootstrap (meaning years of financial struggle) or raise capital (often sacrificing control). But in 2025, AI has changed everything. Henry has witnessed a revolution in company-building, as the smartest founders adopt an emerging model that few are talking about.

Based on conversations with over 100 founders and learning from top performers on the Lean AI Leaderboard, Henry has distilled four ways to build and fund a company—and offers his recommendations.

1. Traditional Funding: How Most Founders Are Failing

Model 1: Bootstrapping

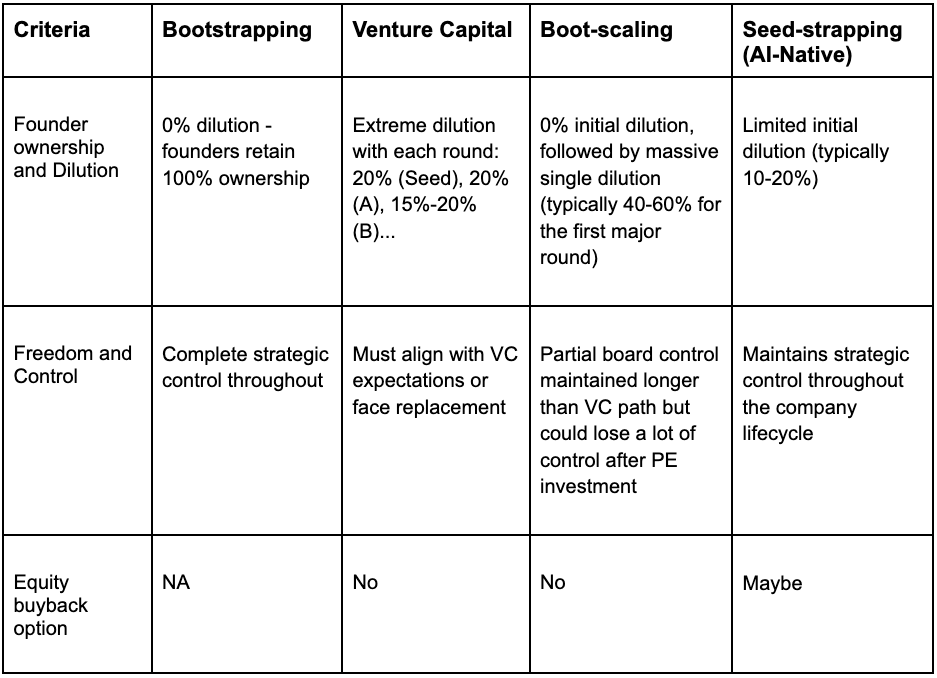

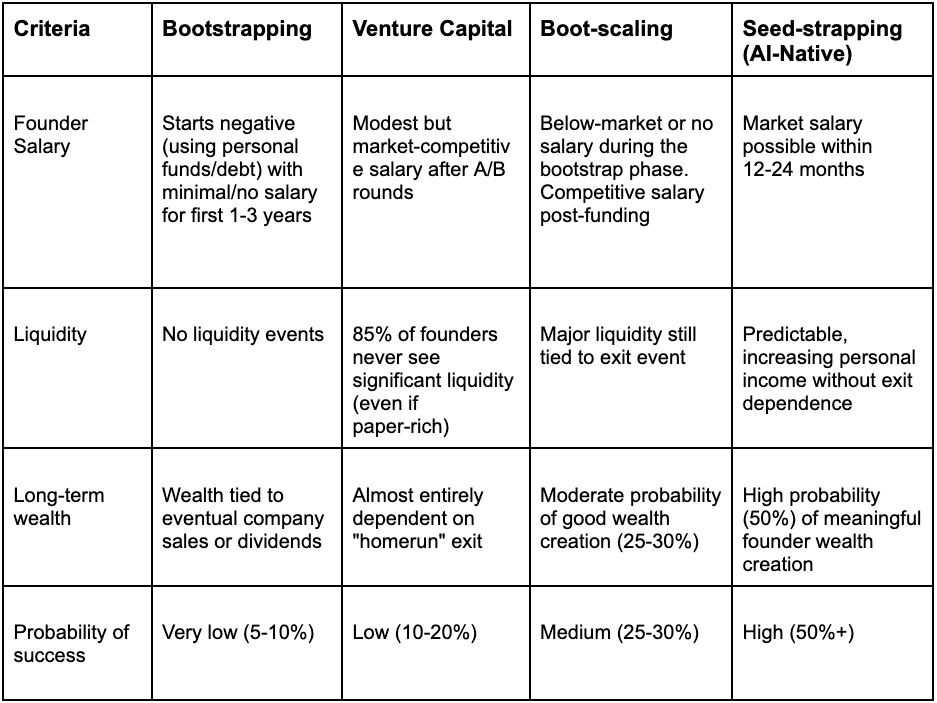

Founders self-fund everything—maxing out credit cards and draining savings—while retaining 100% ownership. Under this model, 90% of startups fail within the first three years, with higher failure rates than those accepting outside funding.

Eight out of ten bootstrapped companies fail within 18 months due to capital constraints. Founders endure years of personal financial deficits with no guarantee of survival. Even successful bootstrapped companies typically take over five years to reach six-figure revenues—and that’s while working 80-hour weeks at sub-minimum-wage hourly rates.

Model 2: Venture Capital

Among VC-backed startups, 75% never return money to investors. Only 0.1% become unicorns that deliver outsized returns, like the success stories reported by TechCrunch.

Yet under this model, all founders must operate as if they’ll be part of that 0.1%. They give up large equity stakes in each round: 20% in seed, 20% in Series A, 15–20% in Series B, and so on.

By Series C, founders typically own just 15% of the company—and 99% of startups never even reach this stage. A founder who builds a $50 million company via VC often ends up personally poorer than one who bootstraps a $10 million company.

Model 3: Boot-Scaling

Entrepreneurs bootstrap until momentum is achieved, then raise a large round—typically from private equity.

The advantage is retaining ownership early on, but significant risks remain: enduring years of financial strain during bootstrapping, followed by massive dilution (40–50%) and loss of control when selling to private equity buyers, who may also damage company culture.

The risk is high: founders drain personal funds and bet everything on one “scale” event—which fails 72% of the time.

2. The New Model: Made Possible by AI

Model 4: Seed-Strapping (for AI-native companies)

This is what excites Henry most about the future of company-building for AI-native businesses. Founders need investors who understand the desire for ownership and control, and are willing to provide $100K–$1M in seed funding.

From day one, focus shifts to revenue and profitability—not vanity metrics that impress VCs. Founders grow revenue without further dilution, enabling 100% business focus without fear of running out of cash or chasing VC rounds.

As AI disrupts startup economics, more founders are scaling AI-powered services with outcome-based pricing—previously impossible—now achieving rapid profitability and growing ARR into the seven- or even eight-figure range.

Under this model, founders earn consistent profits from day one, without waiting for uncertain exits. Over time, they may even buy back equity and increase their ownership. The greatest advantage? Compounding revenue growth from the earliest stages.

For example:

$100,000 growing at 30% annually for 5 years yields far more than starting the same growth two years later.

$100,000 × 1.3^5 = $371,000,

$100,000 × 1.3^3 = $219,000,

A 70% higher return.

3. Why AI Makes Seed-Strapping the Ultimate Model

AI has fundamentally disrupted startup economics:

-

YC reports that 25% of codebases in YC W25 are nearly entirely AI-generated.

-

Over 15 AI-native companies have reached eight-figure ARR within 1–2 years—with teams under 50 people.

-

With AI generating full functional systems, parts of software development costs are approaching zero.

These changes unlock new opportunities: solo founders now have a real shot at building $100 million companies. Henry knows vertical experts who, using AI with zero employees, have already hit $3–5 million in ARR.

Capital efficiency has dramatically improved. Companies that required $3 million to launch in 2020 can now start with $100,000. Time-to-market for AI-native companies has shrunk from months or years to just weeks.

Average contract value (ACV) for AI services is significantly higher than traditional SaaS—because AI services can charge based on outcomes, not per-seat licensing. These services can also tap into payroll budgets, which are multiples larger than software budgets.

Profitability is easier than ever. Historically, salaries consumed 70–80% of startup funding—the largest expense. Now, AI-native companies can operate with minimal or zero staff, achieving over 80% profit margins from day one, without years of burning cash to build large teams.

Finally, Seed-Strapping retains flexibility—founders keep options open for cash flow, acquisition, or VC fundraising—without clear downsides.

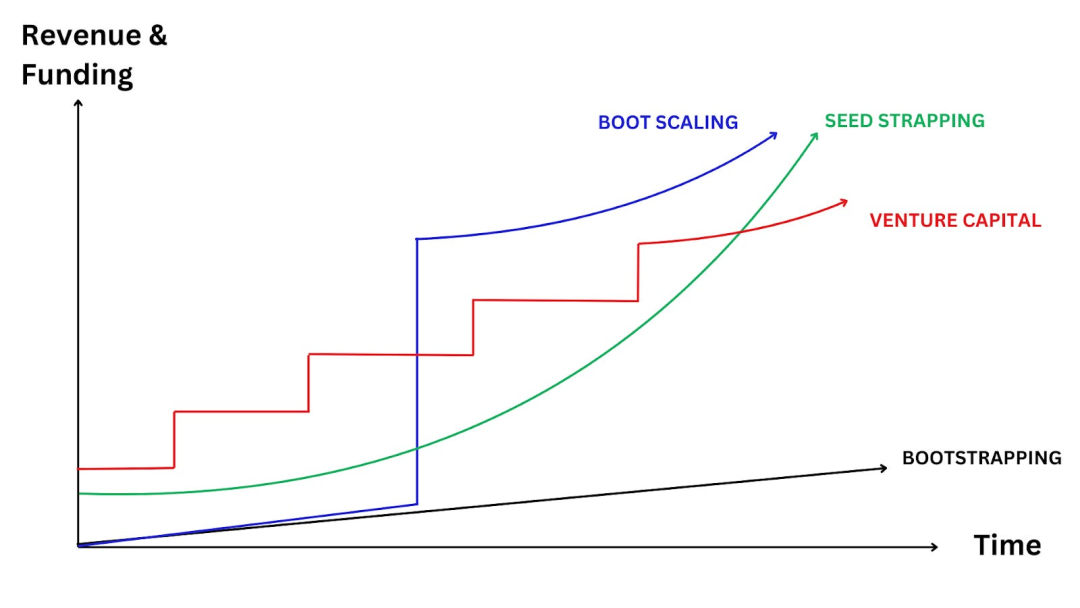

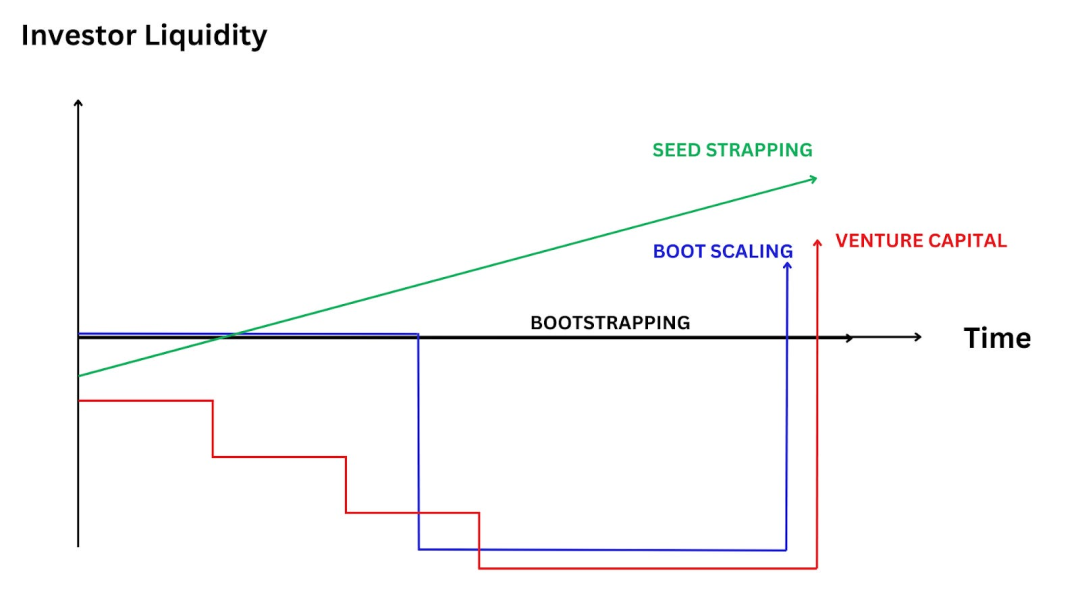

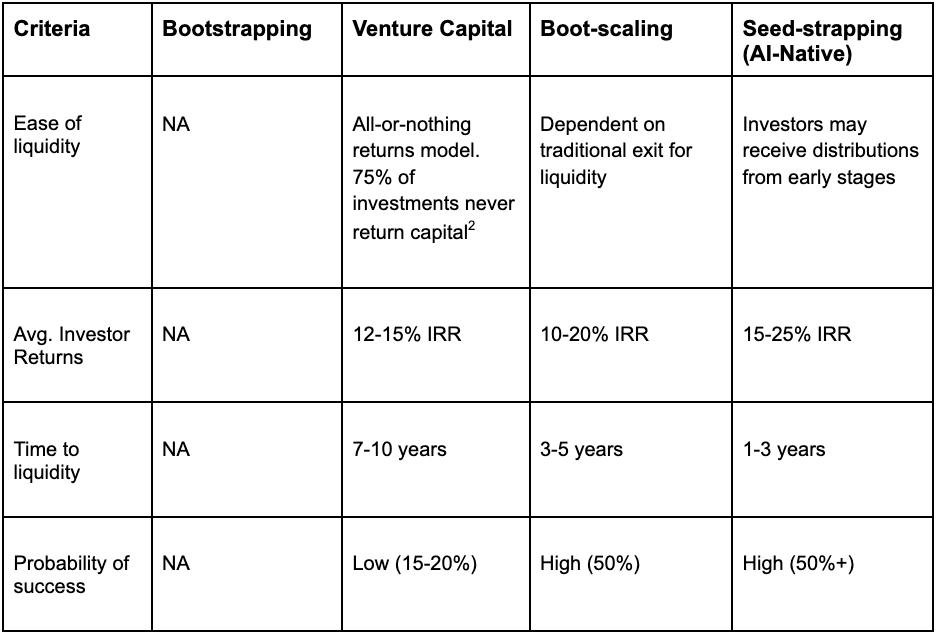

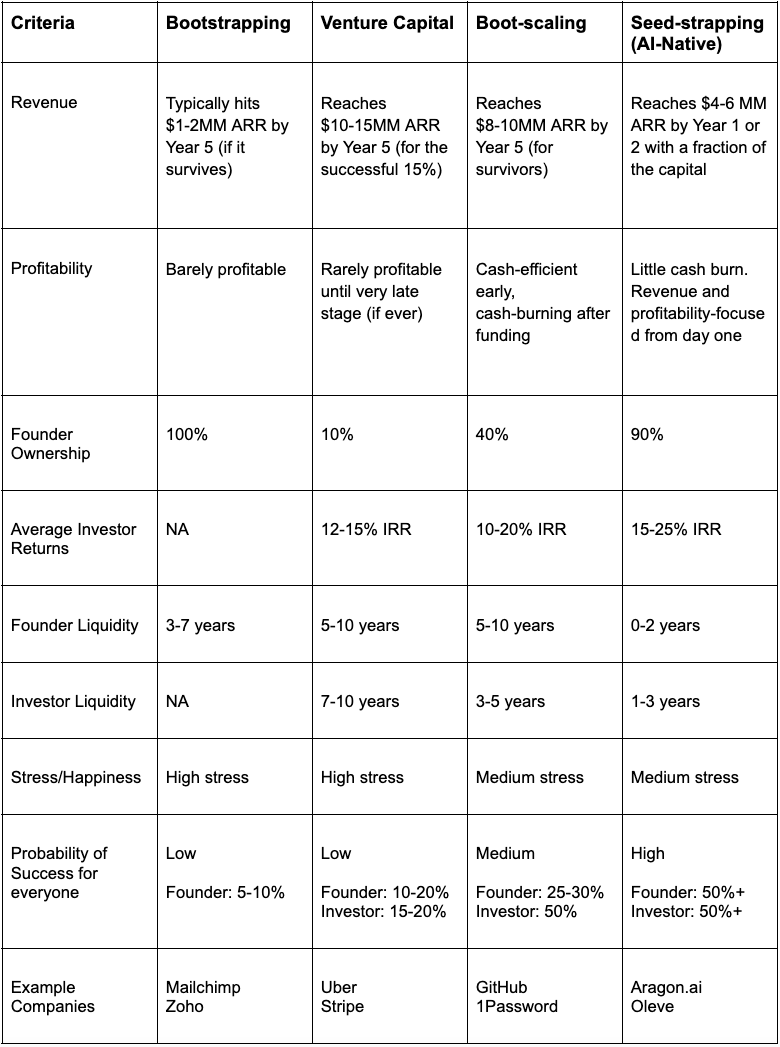

4. Visual Comparison of the Four Models

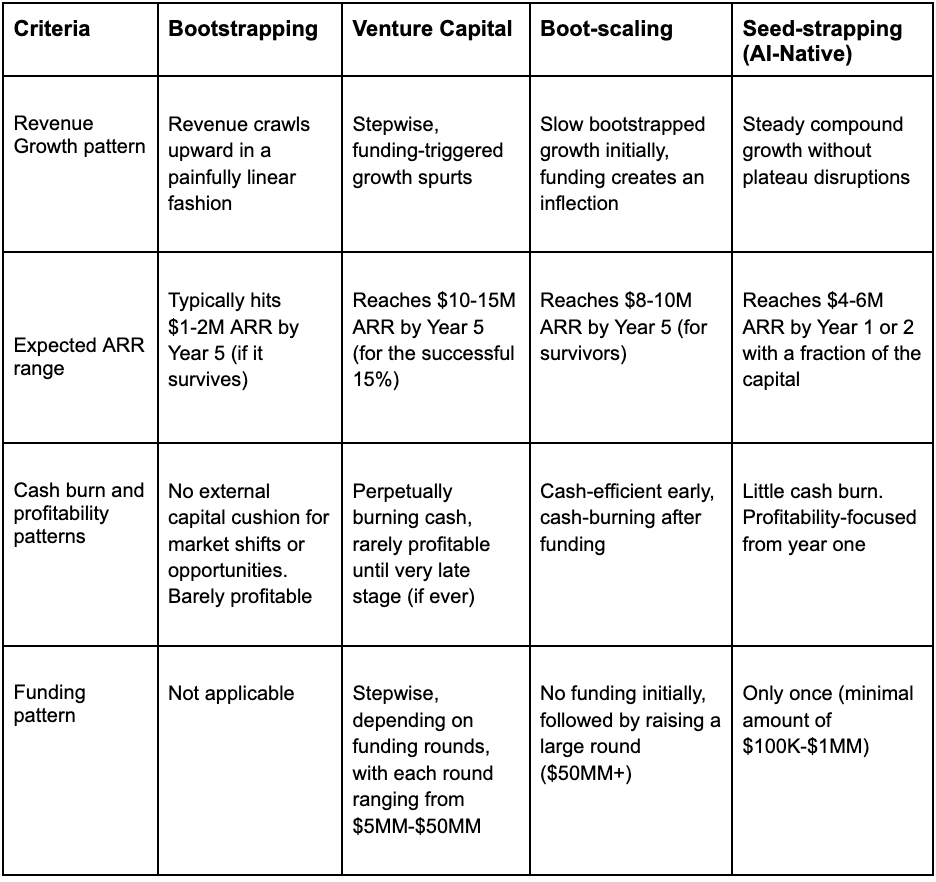

Henry breaks down each model based on metrics that truly matter to founders and investors.

1. Revenue Growth + Funding Trajectory

Seed-Strapping combines the best of both worlds: initial capital gives founders freedom to execute without fearing cash depletion or constant fundraising. Compared to pure bootstrapping, it enables faster growth while maintaining sustainable unit economics.

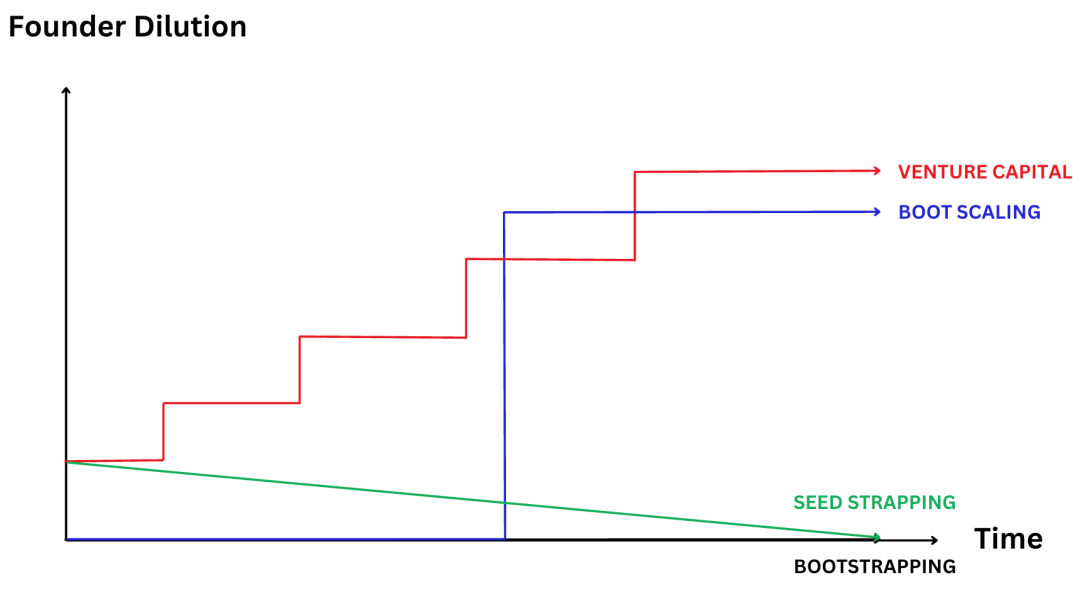

2. Founder Equity Dilution & Control

Seed-Strapping is the only model where founders can potentially increase ownership over time through equity buybacks. Founders gain capital support without falling into the endless dilution cycle of VC. This model enables strong strategic control—achieving perfect balance between ownership and leverage.

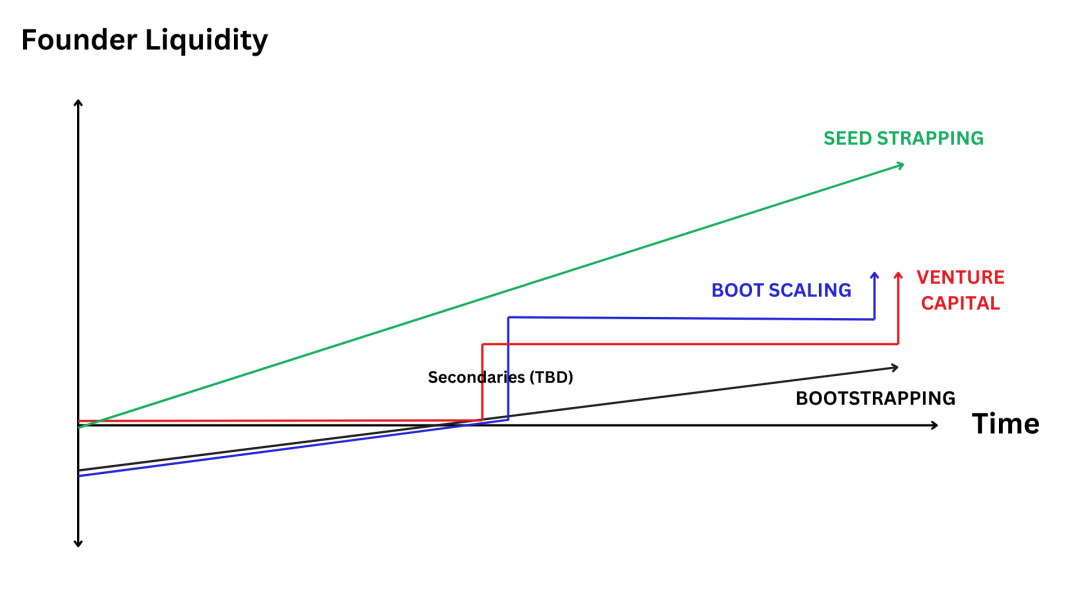

3. Founder Liquidity (Money in Pocket)

Seed-Strapping is the only model that consistently prioritizes putting money in the founder’s pocket—even in early stages. While other founders spend years hoping for a unicorn exit that may never come, Seed-Strapped founders accumulate substantial personal wealth year after year through profit distributions. This is financial freedom without selling or going public.

4. Investor Returns & Liquidity

Seed-Strapping creates a win-win between founders and investors unmatched by other models. Investors don’t wait ten years for uncertain, illiquid returns—they receive early and ongoing liquidity. This stability aligns investor incentives with sustainable growth, rather than pushing premature exits or unnecessary fundraising rounds (their interests are truly aligned with founders).

5. Summary of the Four Models:

6. Psychological Impact

Beyond numbers, there are psychological differences:

Bootstrapped founders often feel trapped by their own "success," creating jobs they can't escape.

VC-backed founders face the highest stress—chasing growth while fearing runway depletion.

Boot-Scaling founders describe it as a rollercoaster: struggling early, then pressured to prove themselves to investors.

Seed-Strapped founders report the highest satisfaction, freedom, and sense of control—while maintaining flexibility and multiple future options (cash flow, sale, VC raise, etc.).

7. The Path Forward for AI-Native Companies

For founders building AI-native companies, Seed-Strapping offers an ideal balance:

-

Sufficient capital to effectively leverage AI tools.

-

Minimal or zero equity dilution, preserving founder ownership.

-

Rapid personal profitability.

-

No need to chase VC rounds, yet still achieve compounding growth.

-

Opportunity to build a “one-person billion-dollar company” as scalability barriers vanish.

-

Flexibility with multiple future options (cash flow, sale, VC raise, etc.).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News