Q2 2025 Web3 Funding Trends Report

TechFlow Selected TechFlow Selected

Q2 2025 Web3 Funding Trends Report

This quarter's funding trends show it is no longer a broad-spectrum game, but rather a highly deliberate investment of conviction.

Author: Robert Osborne, Outlier Ventures

Translation: AididiaoJP, Foresight News

Summary

-

Web3 venture investment surged to $9.6 billion, the second-highest quarterly total on record, despite a drop in disclosed deals to just 306 rounds.

-

Capital concentration intensified. Fewer companies raised larger amounts, with median round sizes rising across all stages. Series A funding reached $17.6 million, the highest level in over two years.

-

Seed round sizes increased. The median seed round jumped to $6.6 million, reversing the decline seen in Q1, signaling renewed investor confidence in early-stage ventures.

-

Private token sales remained stable, with only 15 deals raising $410 million. Public token sales dropped 83%, with just 35 events raising $134 million.

-

Infrastructure continues to dominate, leading in both capital and investor interest across cryptocurrency, mining & validation, and compute networks.

-

The consumer category shows signs of life, particularly in financial services and marketplaces, though funding size and deal share remain relatively small.

This quarter’s funding trends show this is no longer about casting a wide net—it’s about deep conviction investing.

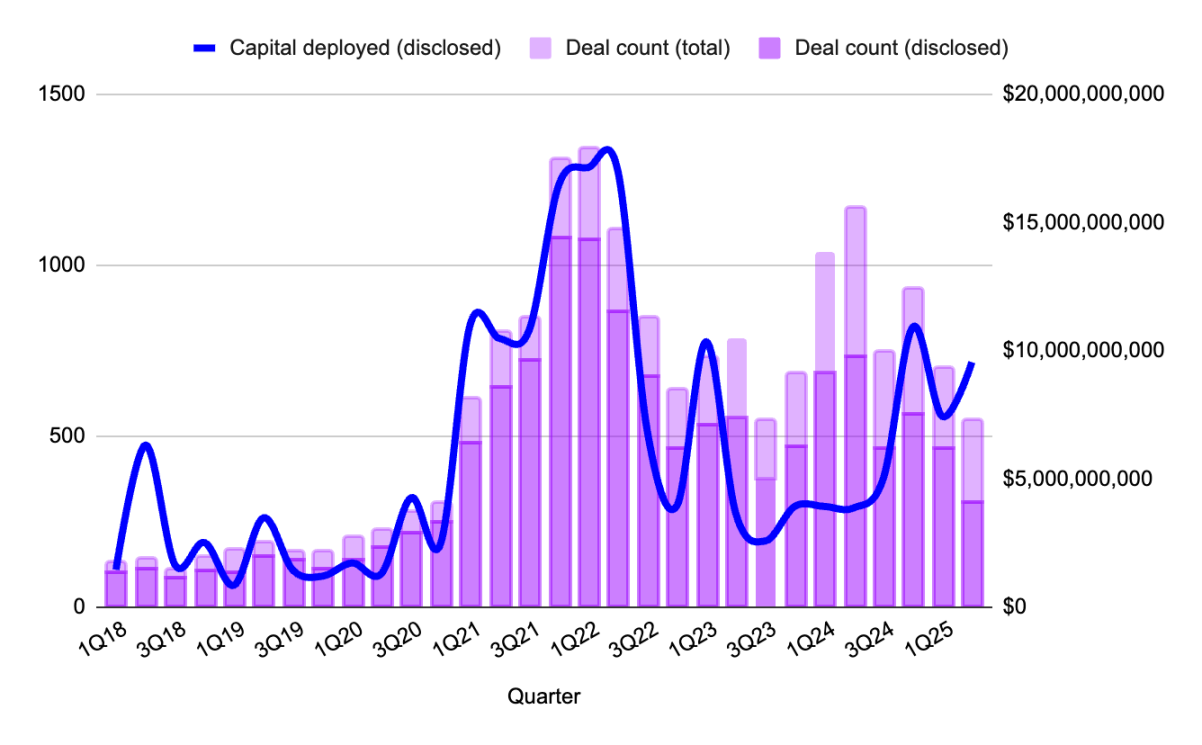

Market Overview: Capital Concentration

At first glance, the numbers appear contradictory: Web3 venture funding surged while deal counts plummeted. But within the broader context of adjustments we've tracked since 2024, the logic becomes clear: investors are shifting from broad exposure to deeper, more strategic bets—and Q2 2025 solidified this shift.

Figure 1: Quarterly Web3 deal count and funding volume. Source: Outlier Ventures, Messari

Only 306 disclosed deals (those with published funding details) were recorded this quarter—the lowest since mid-2023. Yet funding volume soared to nearly $10 billion, nearly 30% higher than last quarter—without any single outlier deal distorting the data. Instead of one massive raise, we see a cluster of dense $50 million to $250 million rounds concentrated in strategic areas like rollup infrastructure and validator liquidity. The defining feature this quarter: fewer bets, larger rounds, higher barriers to entry.

The result is a market that feels smaller, but more serious. In the post-mega-fund environment, investors aren’t chasing every pitch deck—they’re evaluating narrative strength, protocol dependencies, and distribution advantages. Funding isn't granted for potential anymore; it's earned through indispensability.

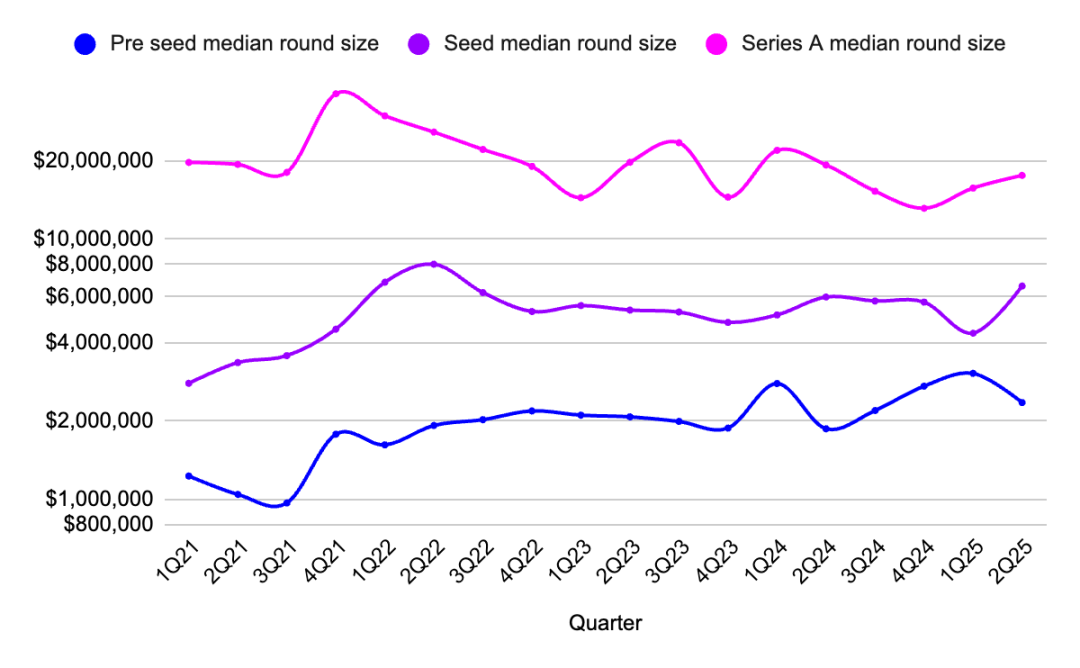

Web3 Startup Funding by Stage: The Return of Series A

After a year in the shadows, Series A funding has returned to center stage.

The median Series A round climbed to $17.6 million—the highest since early 2022—with 27 deals raising a combined $420 million. These are no longer "quasi-B rounds" masquerading as A rounds; they are precise, deliberate capital allocations to companies demonstrating strong product-market fit (PMF), often with growing revenue and well-designed token mechanics.

Figure 2: Quarterly median funding size for pre-seed, seed, and Series A rounds. Source: Outlier Ventures, Messari

Seed rounds also rebounded, with the median seed size rising to $6.6 million amid a slight increase in total deal count. This signals a return of investor appetite for early-stage risk, at least in high-potential areas like AI-native infrastructure or validator tooling. Meanwhile, pre-seed rounds held steady at a median of $2.35 million, confirming what we’ve observed over the past year: early-stage projects still exist.

In 2024, capital was concentrated at both ends—optimism in pre-seed and maturity in Series B and beyond. Series A had been the valley of lost conviction, but risk markets don’t stay frozen forever. Infrastructure takes time to build, and scaling takes even longer. That moment has now arrived.

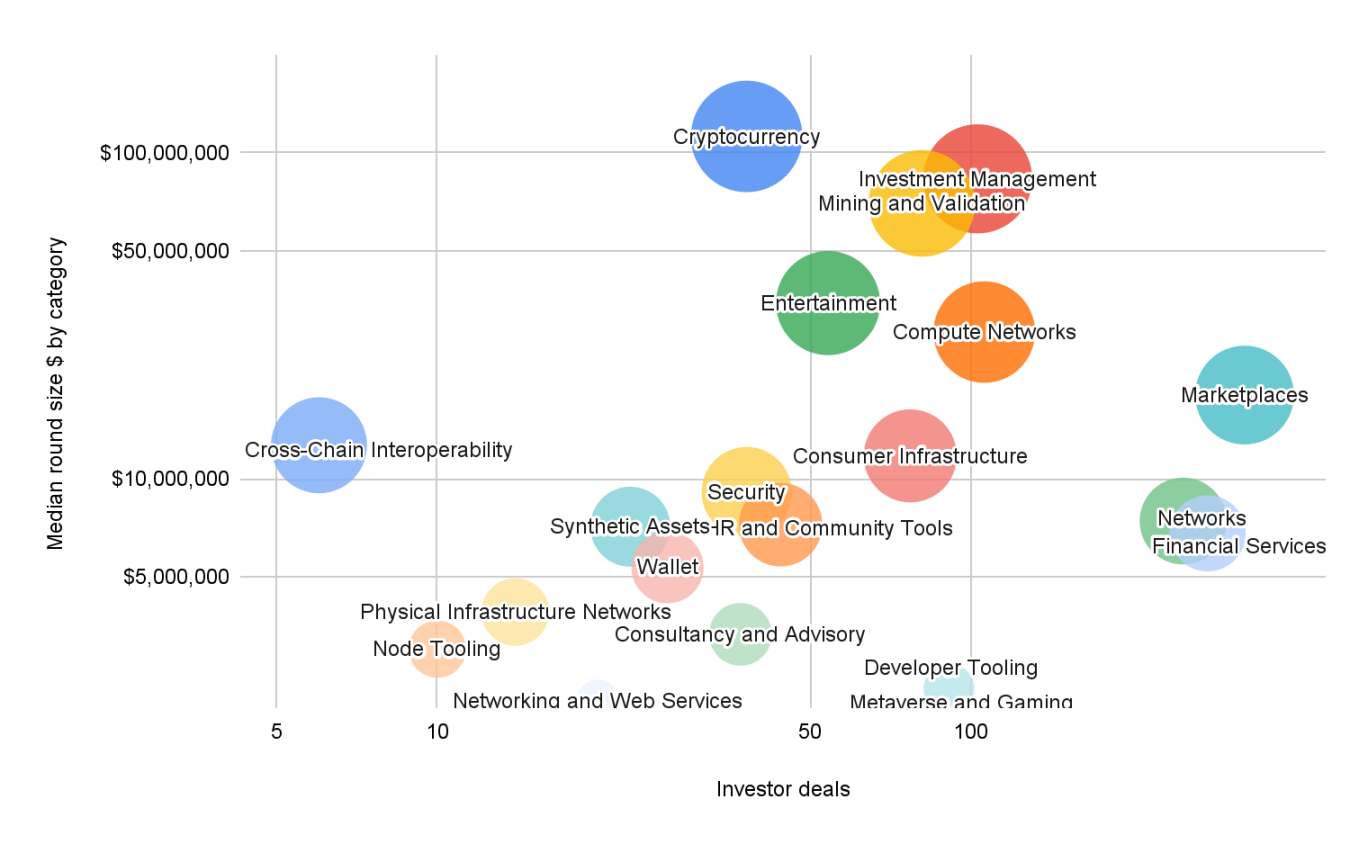

Infrastructure Investment Dominates Web3 Capital Flows

This quarter’s capital-weighted map of Web3 categories reads like a blueprint of a post-consumer transformation.

Figure 3: Average funding size and stage distribution by category in Q1 2025. Source: Outlier Ventures, Messari

Note: “Investor deals” refers to the total number of times investors participated in funding rounds within a given category, not the number of unique investors. If one investor participated in three rounds, it counts as three investor deals.

The largest rounds occurred in infrastructure (median $112 million), mining & validation (median $83 million), and compute networks (median $70 million). These are not speculative tokens, but foundational infrastructure supporting validator networks, modular blockspace, and AI-aligned consensus systems—layers that define long-term blockchain investment strategy. The investor logic is clear: strengthen the base layer, then accelerate application-layer development.

Other notable infrastructure areas include consumer infrastructure (median $11.7 million) and asset management (median $83 million). These sit at the intersection of infrastructure and user experience (UX)—high-functionality products with technical depth and long-term composability.

Developer tools once again attracted strong investor interest (91 investor deals), but with smaller funding amounts. This is a familiar pattern for this long-tail, low-CapEx sector. Yet it remains a playground for early teams and those willing to engage in grant and token option programs.

Financial services, entertainment, and marketplaces saw healthy deal volumes and moderate median funding sizes (ranging from $6 million to $18 million), indicating steady, cautious investor attention. However, volumes remain far below 2021–2022 levels. Investors haven’t lost interest in consumer apps—they’re simply waiting for new offerings.

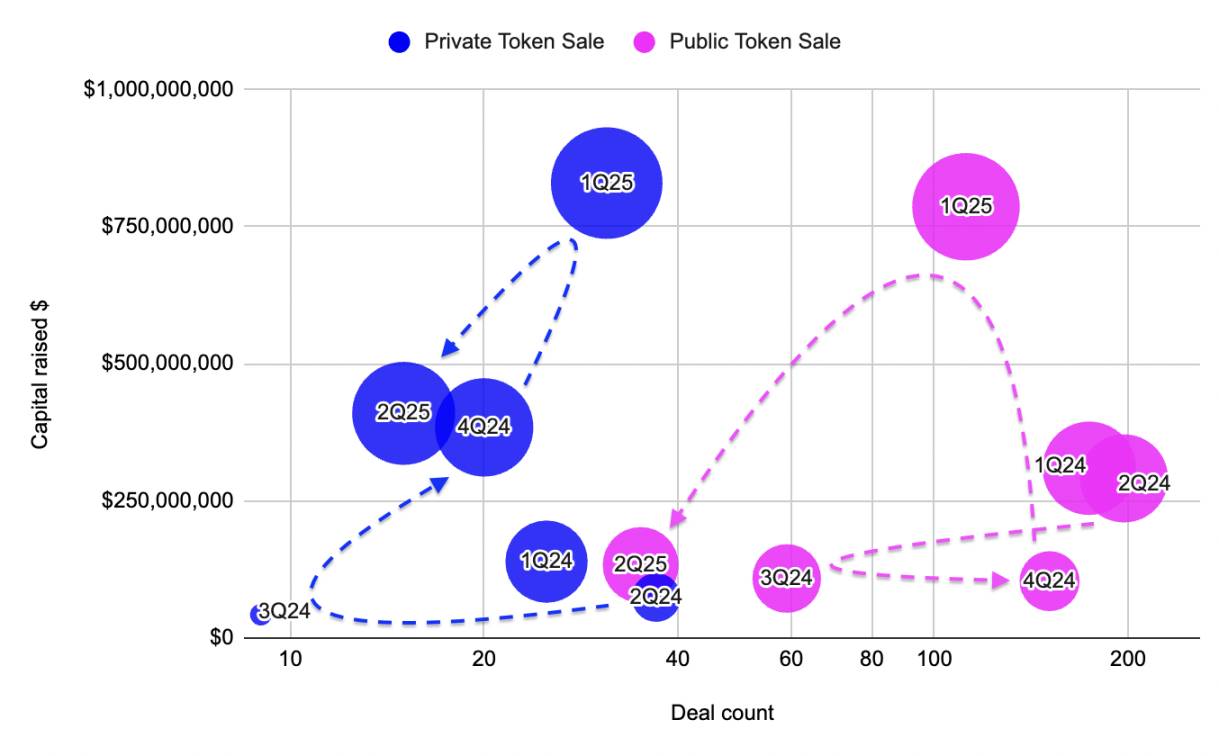

Q2 2025 Token Funding: Private vs. Public

Following a hot Q1, token funding entered a quieter phase in Q2—but this shift resembles reallocation, not retreat.

Figure 4: Comparison of private and public token sales in funding volume and deal count from 2022 to 2024. Source: Outlier Ventures, Messari

Private token sales raised $410 million through just 15 deals, with a median round size of $29.3 million—the highest since 2021. This rise in high-value private allocations highlights the current Web3 funding landscape: alignment and strategic partnerships matter more than hype. These are not meme coins driven by speculation or utility tokens disguised as protocols—validator alliances, L2 treasuries, and modular rollup ecosystems are quietly consolidating liquidity.

In contrast, public token sales collapsed. Only 35 raises were completed, down from 112 in Q1, totaling just $134 million with median sizes halved. Even retail-favorite launches struggled to gain traction, with most volume concentrated in a few high-profile projects. Beyond that, market sentiment feels less bearish and more观望—a wait-and-see stance rather than full withdrawal.

The divergence between private and public sales continues a trend tracked since late 2023. Public token launches surge during market euphoria, while private rounds reflect consistency, not hype.

Conclusion

Investors are seeking clearer narratives, stronger infrastructure, and builders who understand how to navigate this new funding environment.

If 2024 was a year of recovery and restructuring, Q2 2025 feels like one of silent execution.

Capital is flowing—but only to a select few. Deal flow is shrinking, yet round sizes are growing. Infrastructure continues to win—not due to bias, nor any major ideological shift.

For founders, the path is narrower, but not impassable. Early deals still happen. Series A is back. And private tokens have regained a real seat at the table—as long as they align with strategic, scalable, protocol-dependent goals.

In short: we’ve moved beyond broad market hype cycles. This is a slow, pressurized climb toward essential infrastructure and enduring applications.

The conclusion is simple: this market doesn’t need another hype cycle. It needs inevitability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News