Outlier Ventures Q1 2025 Funding Report: L1 and Infrastructure Still Favored, VCs Seek "Stable Happiness"

TechFlow Selected TechFlow Selected

Outlier Ventures Q1 2025 Funding Report: L1 and Infrastructure Still Favored, VCs Seek "Stable Happiness"

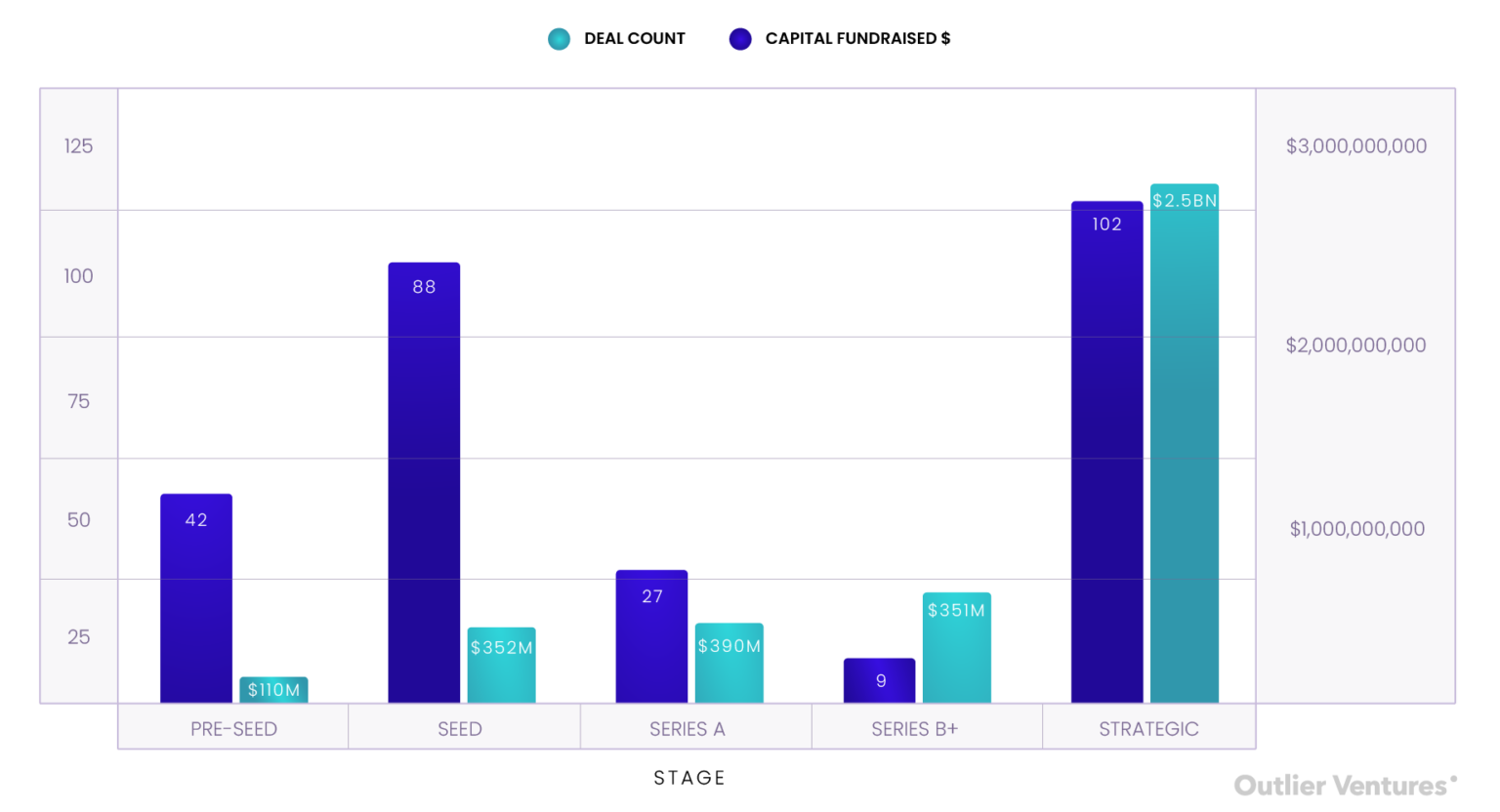

Strategic funding rounds dominated the market, with 102 deals attracting $2.5 billion in capital, continuing the trend of sovereign funds and ecosystem financing supporting large-scale infrastructure and Layer 1 projects.

Author: Robert Osborne

Translation: TechFlow

Overview

-

In Q1 2025, Web3 fundraising remained stable with a total capital raised of $7.7 billion, nearly matching the record-breaking Q4 2024 ($7.9 billion). However, the number of deals declined by 34%, reaching the lowest level since Q3 2023.

-

Binance raised $2 billion in a single round, accounting for over a quarter of the total capital this quarter. Excluding this deal, actual market activity amounted to approximately $5.7 billion, aligning closely with the average level seen in 2024.

-

Strategic funding rounds dominated the market, attracting $2.5 billion across 102 deals, continuing the trend of sovereign funds and ecosystem capital backing large-scale infrastructure and Layer 1 projects.

-

Early-stage funding showed divergence: Seed round sizes dropped to their lowest in two years ($4.4 million), while Pre-seed rounds remained strong ($2.9 million). Series A funding continued to be squeezed, with only 27 deals completed, though average round size rebounded to $15.6 million.

-

The category landscape reflects both fragmentation and focus. The Networks category led in total funding (driven largely by Binance), while Data, Wallets, and Consumer Infrastructure showed high median funding amounts. Developer Tooling attracted the most investor participation but with smaller round sizes, highlighting its role as the "long tail" within infrastructure.

-

Token fundraising made a strong comeback: 96 public and private sales raised $1.6 billion—the strongest quarterly performance since 2022. Notable cases include World Liberty ($590 million) and TON ($400 million).

Market Overview: Capital Concentration Over Deal Volume

Q1 2025 Web3 fundraising presents a unique contrast: while total capital deployed remains high at $7.7 billion—nearly reaching the record $7.9 billion in Q4 2024—the number of deals sharply declined to just 603. What does this mean? Investors are deploying larger sums into fewer companies, prioritizing capital concentration over broad distribution.

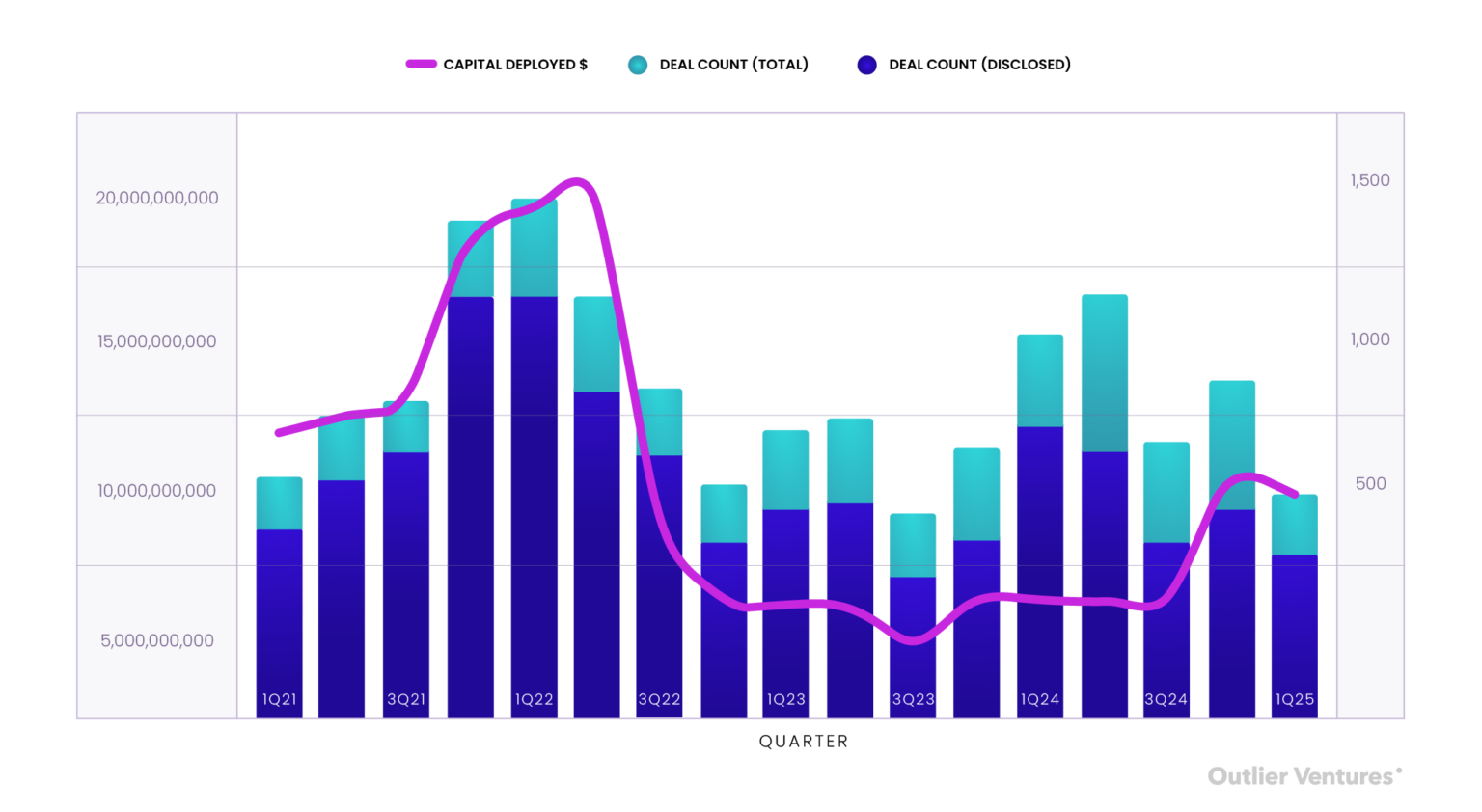

Figure 1: Quarterly Web3 deal count and capital raised, Q1 2021 to Q1 2025

Source: Outlier Ventures, Messari

This divergence highlights an ongoing shift in investor strategy. As market liquidity gradually recovers and sentiment turns optimistic, venture firms appear to be doubling down on "category winners" and increasingly mature infrastructure projects, rather than spreading capital across early-stage, high-risk long-tail ventures. Similar to Q4 2024, most capital flowed into late-stage rounds and ecosystem-defining projects—those with strong market traction, backing from prominent investors, or well-defined token strategies ready for market launch. (For deeper insight into the shift from consumer-focused to infrastructure-driven investments, see our prior analysis: Everything You Know About Web3 Fundraising Is Wrong.)

However, the headline $7.7 billion figure masks underlying realities. Binance’s $2 billion raise—led by UAE-based MGX Capital and billed as the largest private crypto investment to date—accounted for over 25% of all capital deployed this quarter. Excluding this outlier, total fundraising drops to around $5.7 billion, much closer to 2024’s average levels (which were below $4 billion prior to Q4 2024). This suggests continuity in investor interest rather than a sudden surge in fundraising activity.

Even excluding this anomaly, capital deployment shows resilience. Late-stage growth rounds in infrastructure and AI-related sectors continue to attract attention. Phantom’s $150 million Series C, Flowdesk’s $91.8 million raise, and LayerZero’s $50 million expansion round signal that a cohort of maturing infrastructure companies is consolidating market share and moving toward revenue scalability.

Funding Stage: Strategic Capital Takes the Lead

Q1 2025 funding data by stage reinforces a central theme: strategic capital dominance.

Strategic rounds accounted for only 18% of total deal volume but captured over 32% of capital deployed—$2.5 billion across 102 deals. This continues the trend observed at the end of 2024: major crypto players, ecosystem funds, and state-backed entities are actively making targeted, high-conviction investments closely aligned with national, institutional, or protocol-level interests. These rounds typically concentrate on Layer 1 blockchains, middleware protocols, and token infrastructure—where capital allocation is driven not just by ROI, but by deep alignment of interests and objectives.

In contrast, early-stage funding remains fragmented. Pre-seed and Seed rounds together made up nearly a quarter (24%) of total deal volume but captured only 6% of capital. Average Pre-seed rounds were around $2.6 million; Seed rounds averaged $4 million, significantly below 2024 medians. This indicates valuation compression, smaller check sizes, and stricter terms for founders—marking a return to “real due diligence”: founders must now demonstrate market traction, not just vision, to secure funding.

Chart 2: Number of deals and amount raised in Q1 2025 across stages from Pre-seed to Series B+ and strategic rounds. Further analysis on token activity follows below

Source: Outlier Ventures, Messari

Series A funding remains under pressure. Only 27 Series A deals were recorded this quarter—less than 5% of total volume—but they attracted $392 million, averaging about $14.5 million per round. Investors appear to be skipping Series A altogether, either entering via option-like positions at the seed stage or waiting until later, lower-risk stages like Series B+ where token strategies are clearer.

Late-stage investment held steady. Just nine Series B+ deals raised $531 million, averaging nearly $59 million per round. These companies typically have proven business models and token mechanisms, often preparing for exchange listings or treasury management. In many cases, these are no longer traditional VC investments but resemble growth-stage quasi-private equity deals.

Overall, stage-based data confirms a broader narrative: the fundraising market is polarized—not just between consumer and infrastructure projects, but also between early experimentation and late-stage, high-conviction bets. The middle ground—Series A—is precisely where risk appetite vanishes and capital is currently least willing to go.

If deal volume reflects market sentiment and capital deployment reveals investor conviction, then funding medians reflect founder bargaining power. In Q1 2025, this power is steadily shifting away from seed-stage teams.

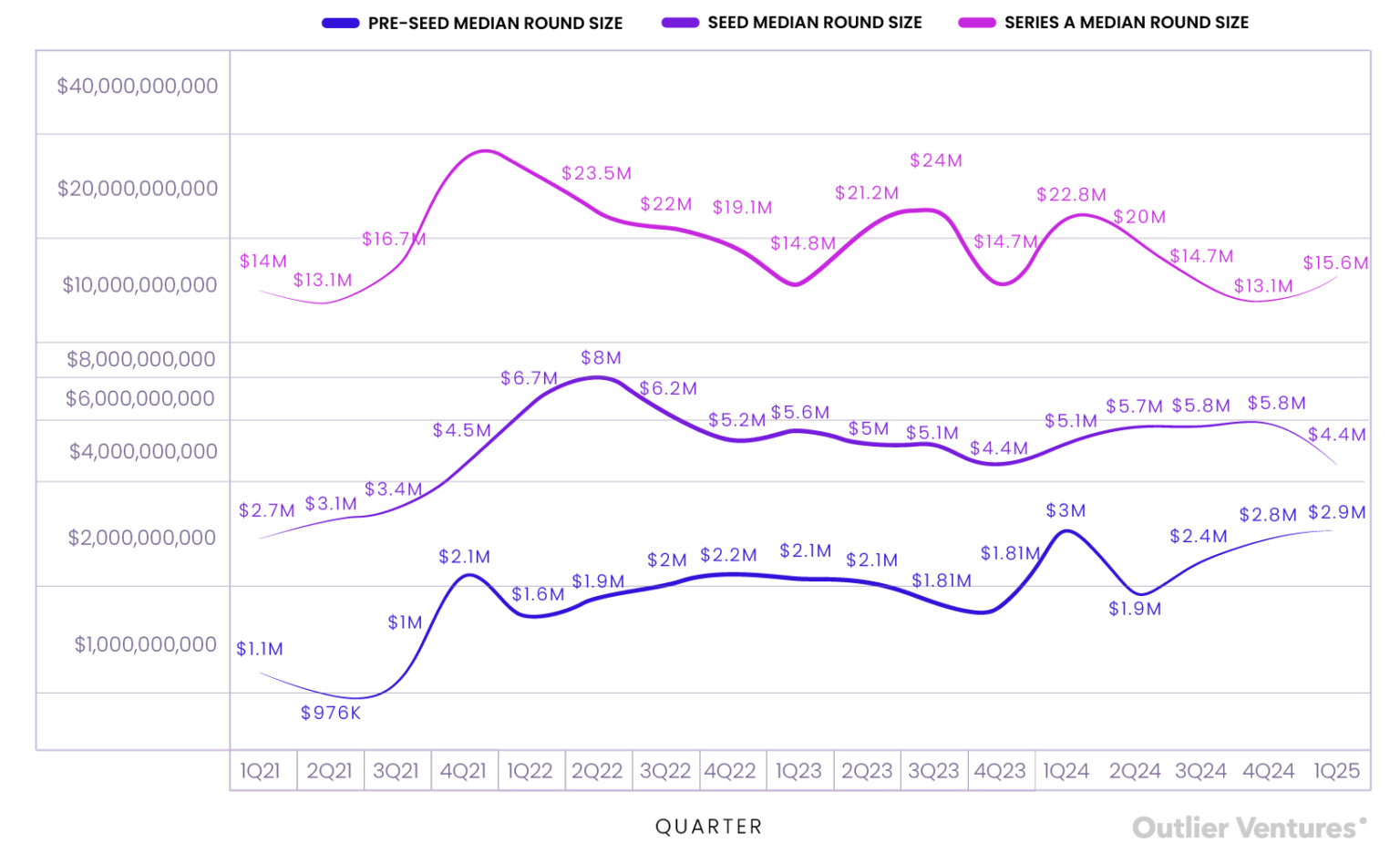

Chart 3: Median funding amounts from Pre-seed to Series A rounds, Q1 2021 to Q1 2025

Source: Outlier Ventures, Messari

The Pre-seed median reached $2.9 million—nearly matching Q1 2024's peak and close to triple the 2021 average—signaling a quiet resurgence of confidence at the earliest stage. Accelerators, ecosystem funds, and angel syndicates still favor early bets with options, especially on high-conviction narratives like DePIN, native AI infrastructure, and onchain agent tooling. For founders, this remains the most capital-friendly phase.

Seed rounds, however, took a hit. The median dropped to $4.4 million, down from over $5.8 million last quarter and hitting the lowest level since Q4 2022. This is a strong signal that the middle stage is shrinking. Investors are reducing check sizes, tightening terms, or bypassing this stage entirely unless projects already show clear KPIs or distribution strength. The "spray-and-scale" model is clearly gone.

Series A saw a slight rebound, with the median rising to $15.6 million—above the previous quarter’s cyclical low of $13.2 million. Still, this remains far below peaks in 2021 and early 2022, when medians often exceeded $30 million. More importantly, deal volume was extremely low (only 27), underscoring market selectivity. These Series A rounds aren’t nominal—they’re priced more like mini-Series B rounds, reserved only for companies with revenue, traction, and executable token strategies.

In short, the “barbell effect” persists: capital flows to idea-stage and traction-stage ventures, but the middle is being abandoned. This isn’t a funding winter—it’s a reset and rebalancing of founder expectations.

Capital Flows: Category Highlights

At the category level, Q1 2025 continues to highlight fragmented capital deployment and diverging investor enthusiasm.

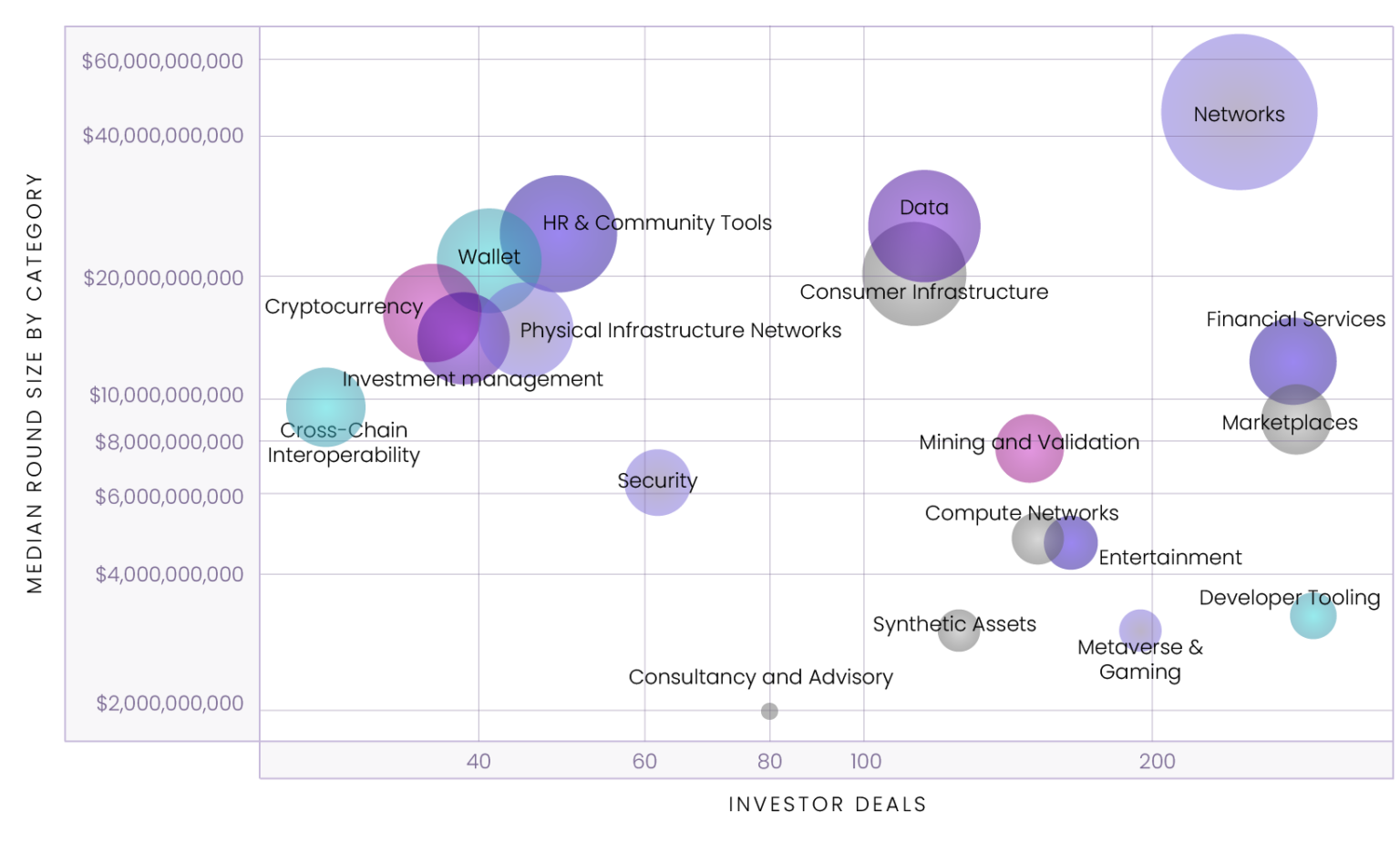

As expected, Networks topped the list with a median round size of $45.1 million—significantly boosted by Binance’s $2 billion strategic raise. Even excluding this outlier, 243 investment deals in this category reveal strong institutional, strategic fund, and ecosystem interest in Layer 1 and scalability projects. Network infrastructure remains the “core zone” for capital—a domain where investors want to signal serious intent.

Chart 4: Average funding stage and round size by category in Q1 2025

Source: Outlier Ventures, Messari

Note: “Investor transactions” refer to the total number of times investors participated within a category, not the number of distinct investors. If one investor participates in three rounds, it counts as three investor transactions.

Developer Tooling attracted the most investor participation—290 investor transactions—but had a median round size of just $3.1 million. This contrast underscores Developer Tooling’s role as the infrastructure “long tail”: high interest, low risk, and modular potential. These are often small, fast deals—engineer-led, protocol-aligned, sometimes subsidized by grants.

On the consumer side, Metaverse and Gaming recorded 193 investor transactions with a median raise of just $2.9 million, reflecting a shift from content-heavy investments to “infrastructure-for-fun.” Entertainment followed a similar pattern—median of $4.65 million across 164 investor transactions—again showing VCs remain interested in audience-centric Web3 projects, albeit cautiously.

Marketplaces and Financial Services stood out due to high investor engagement—279 and 277 investor transactions respectively—but differed in capital intensity. Marketplaces had a median of $9 million, signaling renewed interest in transactional infrastructure and tokenized commerce. Financial Services had a median of $11.98 million, making it one of the highest-funded consumer categories this quarter.

Within infrastructure, Consumer Infrastructure ($19.3 million), Wallets ($20.7 million), and Data ($24.3 million) all showed high median funding and moderate investor engagement—indicating that despite less spotlight than Networks or Compute, these areas benefit from a return to fundamentals: user experience (UX), composability, and data liquidity.

At the other end, Consultancy & Advisory and News & Information had low median funding (~$2 million) and limited investor participation—categories struggling to prove venture-scale potential, possibly squeezed by public goods funding or native monetization models.

This quarter’s “middleweight” standout categories—Cross-Chain Interoperability ($9.7 million), Security ($6.4 million), and Compute Networks ($4.8 million)—reflect technically robust, low-profile infrastructure layers still receiving meaningful support. These are no longer frontier areas but becoming part of the expected tech stack.

Token Fundraising Resurgence: Strategic Private Sales and Public Offerings Rebound

In Q1 2025, token fundraising marked a clear reversal of 2024 trends: high-value, high-conviction private sales returned strongly, alongside a revival of large-scale public offerings.

There were 69 public token sales this quarter, raising $798 million in total. World Liberty Financial led with $590 million—accounting for nearly 74% of all public token fundraising. Meanwhile, private token sales raised $771 million through just 27 deals, led by TON Foundation’s $400 million raise. Overall, token fundraising reached $1.6 billion in Q1, surpassing any single quarter in 2024.

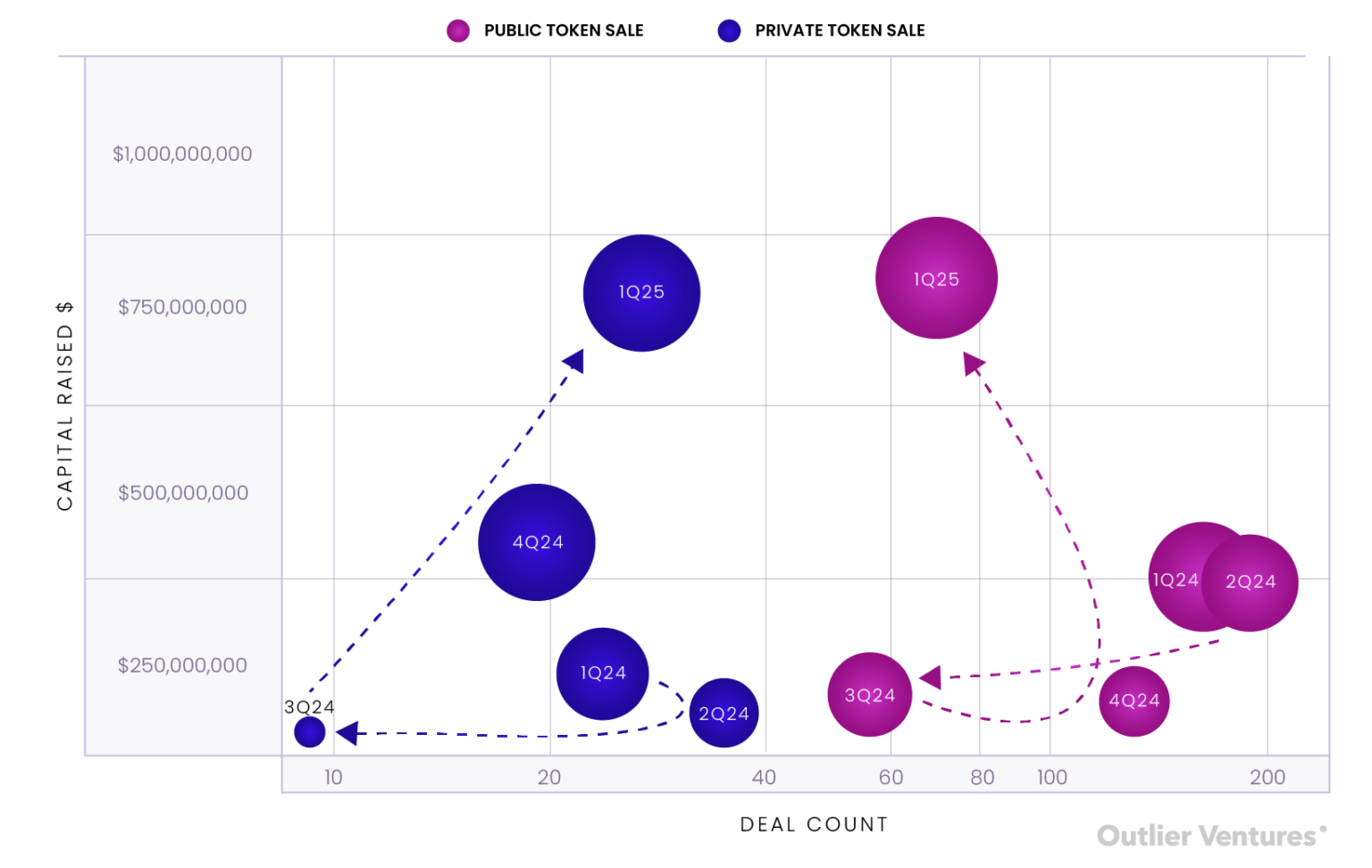

Chart 5: Comparison of private vs. public token sales by capital raised and deal count, 2022–2024

Source: Outlier Ventures, Messari

Contrast with last year: in Q1 2024, public sales vastly outnumbered private ones (163 vs. 24), but raised less overall ($296 million vs. $140 million). That market favored liquid launches, retail participation, and community-driven tokenomics. Q1 2025 represents the pendulum swinging the other way: centralized, institution-led token allocations are back in favor—both a sign of growing confidence and a preference for control, lock-up mechanisms, and OTC pricing.

Most notably, it’s not just absolute growth but structural change: public sales now account for less than 60% of total token fundraising deals, yet raise only slightly more capital than private sales—even though public deals outnumber private ones by more than two to one. This per-deal capital gap reveals a fundamental market shift.

Private token deals are back—larger, deeper, and more strategic. These are no longer simple IDOs or hype-driven quick listings, but pivotal moves shaping entire ecosystems—tightly linked to L1 treasuries, foundation missions, or cross-border capital flows.

Meanwhile, public sales appear top-heavy. Excluding World Liberty, the remaining 68 public rounds averaged just $3 million—showing that while market access is expanding, large-scale retail demand remains concentrated on a few high-trust, high-brand projects.

Final Thoughts: Navigating a Divergent Market

Q1 2025 confirms what many insiders feel: this isn’t a bear market, but a more focused one. Capital hasn’t disappeared—it’s become more selective, strategic, and increasingly directed toward infrastructure, tangible outcomes, and long-term narratives.

This quarter also marks the return of a healthy dual-track dynamic: private rounds for strategic control, public rounds for market presence and liquidity. For the first time in over a year, both private and public fundraising channels are thriving simultaneously.

For founders, the path forward is clear: you don’t need to “time the market”—you need to build things that “will inevitably happen.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News