Invested in top-tier VC but lost half the principal in four years—what's wrong with crypto funds?

TechFlow Selected TechFlow Selected

Invested in top-tier VC but lost half the principal in four years—what's wrong with crypto funds?

Some crypto funds outperform Bitcoin during bull markets through leverage or early positioning, and offer risk hedging and diversification opportunities; however, long-term performance varies widely.

Author: PANews, Zen

Recently, Akshat Vaidya, co-founder and investment head of Arthur Hayes' family office Maelstrom, publicly disclosed a dismal investment return on X, sparking widespread discussion in the crypto community.

Vaidya stated that four years ago he invested $100,000 into Pantera Capital’s early-stage token fund (Pantera Early-Stage Token Fund LP), which is now worth only $56,000—nearly a 50% loss of principal.

In contrast, Vaidya pointed out that during the same period, Bitcoin's price roughly tripled, while returns from many seed-stage crypto projects surged 20–75 times. Vaidya lamented: "While the specific year you enter the market matters, losing 50% in any cycle is arguably the worst performance." This sharp critique directly questioned the fund's performance, igniting heated debate within the industry about the performance and fee structures of major crypto funds.

The "3/30" Era of Market Frenzy

The "3/30" fee structure specifically criticized by Vaidya refers to an annual 3% management fee plus a 30% carried interest on investment gains—significantly higher than the traditional hedge fund and venture capital standard of "2/20," which entails a 2% management fee and 20% performance fee.

At the peak of crypto market euphoria, some prominent institutional funds leveraged strong deal flow and track records to charge above-standard fees, such as 2.5% or even 3% management fees and 25% to 30% performance fees on excess returns. Pantera, whom Vaidya mocked, exemplifies this high-fee model.

As the market has evolved, crypto fund fee structures have gradually shifted. After experiencing bull and bear cycles, under pressure from LP negotiations and fundraising challenges, crypto funds are generally moving toward lower-cost models. Recently raised crypto funds have started making concessions—such as reducing management fees to 1–1.5%, or charging higher performance fees only on超额 returns—in an effort to better align interests with investors.

Currently, cryptocurrency hedge funds typically adopt the classic "2% management fee and 20% performance fee" structure, but funding allocation pressures have driven average fees downward. Data from Crypto Insights Group shows current management fees averaging close to 1.5%, while performance fees vary by strategy and liquidity, trending toward 15%–17.5%.

Crypto Funds Struggle to Scale

Vaidya’s post also sparked debate over the scale of crypto funds. He bluntly stated that, with few exceptions, large cryptocurrency venture funds have generally delivered poor returns, harming limited partners. His goal in posting was to use data to remind and educate people that crypto venture investing does not scale—even well-known brands with top-tier investors fall short.

A segment of the community supports his view, arguing that raising excessive capital has become a drag on performance for early-stage crypto funds. Leading firms like Pantera, a16z Crypto, and Paradigm have recently raised hundreds of millions, even billions, of dollars in crypto funds. However, efficiently deploying such massive capital in the relatively nascent crypto market is extremely difficult.

Faced with limited project pipelines, large funds are forced to cast a wide net, investing across numerous startups. This results in diluted stakes and inconsistent quality, leading to over-diversification and an inability to capture outsized returns.

In contrast, smaller funds or family offices, with more manageable capital sizes, can apply stricter project screening and concentrate bets on high-quality opportunities. Supporters argue this "small and focused" approach is more likely to outperform the market. In his comments, Vaidya himself expressed agreement with the idea that “the issue isn't early-stage tokens, but fund size,” and emphasized that “an ideal early-stage crypto fund must be small and flexible.”

However, there are dissenting voices challenging this radical stance. They argue that while large funds may face diminishing marginal returns when chasing early-stage deals, their overall industry value shouldn’t be dismissed based on one poor investment. Large crypto funds often possess abundant resources, professional teams, and extensive networks, enabling them to provide meaningful post-investment support and drive ecosystem development—advantages individual investors and small funds cannot match.

Moreover, large funds are often able to participate in larger funding rounds or infrastructure projects, providing the deep capital necessary for industry growth. For example, certain blockchain protocols and exchanges requiring hundred-million-dollar financing rely heavily on participation from major crypto funds. Therefore, large funds have legitimate roles—provided they maintain alignment between fund size and market opportunity, avoiding excessive bloat.

Notably, some commentators in this controversy suggest Vaidya’s public criticism of peers carries a marketing undertone—as the head of Arthur Hayes’ family office, he is currently crafting a differentiated strategy and raising capital for his own fund. Maelstrom is preparing to launch a new fund exceeding $250 million, targeting acquisitions of mid-sized crypto infrastructure and data companies.

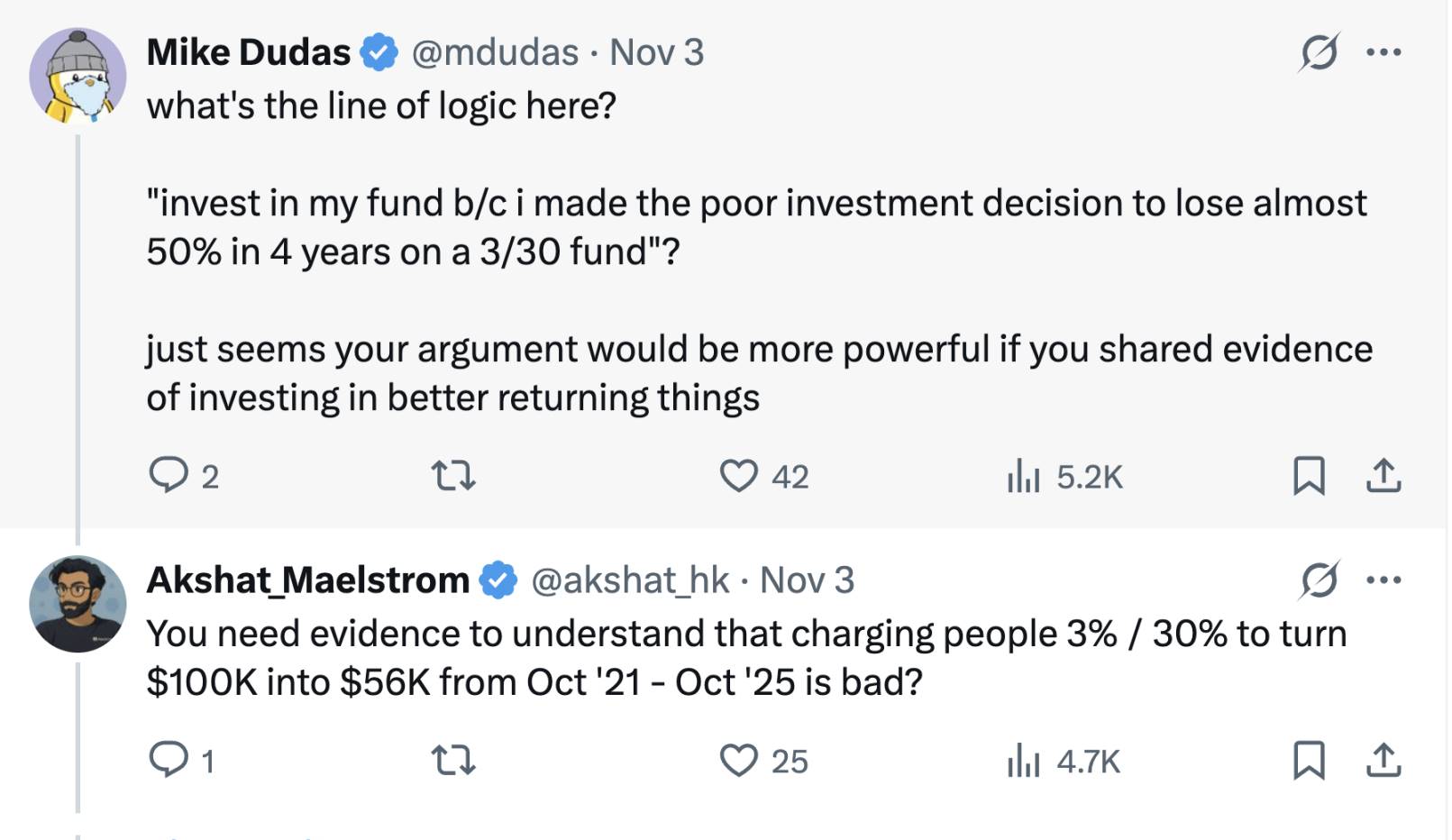

Thus, Vaidya may be leveraging criticism of competitors to highlight Maelstrom’s differentiated focus on value investing and cash flow generation. Mike Dudas, co-founder of 6th Man Ventures, remarked that if someone wants to promote their family office’s new fund performance, they should do so through their own track record—not by attacking others for attention.

"Nothing Beats Just Buying BTC"

By comparing fund returns with a simple Bitcoin buy-and-hold strategy through personal experience, Vaidya revived a perennial question: For investors, is it better to just buy Bitcoin rather than entrust money to a crypto fund?

This question may have different answers depending on the market phase.

During earlier bull markets, top-tier crypto funds significantly outperformed Bitcoin. For instance, in the market surges of 2017 and 2020–2021, astute fund managers achieved returns far exceeding Bitcoin’s appreciation by front-running emerging projects or employing leverage strategies.

High-performing funds can also offer professional risk management and downside protection. During bear markets—when Bitcoin prices halve or drop further—certain hedge funds have successfully avoided massive losses, or even generated positive returns, using short positions and quantitative hedging strategies, thereby reducing volatility risk.

Additionally, for many institutions and high-net-worth individuals, crypto funds provide diversified exposure and access to specialized channels. These funds can invest in areas inaccessible to individual investors, such as private sale token offerings, early equity investments, and DeFi yield opportunities. The seed-stage projects Vaidya mentioned, which appreciated 20–75 times, would be difficult for retail investors to access at early valuations without the connections and expertise of fund managers—assuming those managers actually possess superior selection and execution capabilities.

From a long-term perspective, the crypto market is fast-evolving, and professional investing versus passive holding each have their place.

For crypto practitioners and investors alike, this controversy surrounding Pantera’s fund offers a timely reminder: in the ever-changing landscape of crypto bull and bear cycles, rationally evaluating and selecting the investment approach best suited to one’s strategy is key to maximizing wealth creation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News