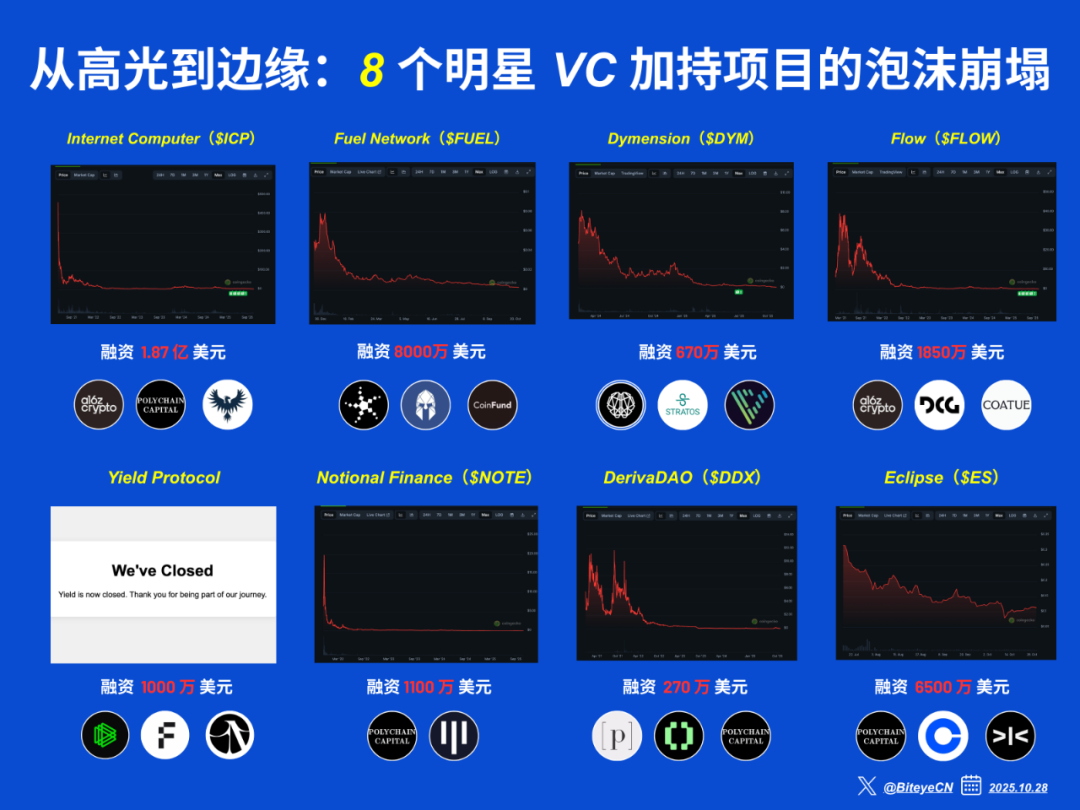

From spotlight to the edge: The bursting of bubbles in 8明星 VC-backed projects

TechFlow Selected TechFlow Selected

From spotlight to the edge: The bursting of bubbles in 8明星 VC-backed projects

Is the model unsustainable and the ecosystem failing to launch? Or are competitors too strong and market demand insufficient?

Author: Viee, Core Contributor at Biteye

Editor: Denise, Core Contributor at Biteye

In the crypto industry, every bull market spawns countless "highlight projects": backed by top-tier VCs, listed on major exchanges, and embraced by retail investors. But time is the sharpest litmus test—some projects have seen their prices drop 90%, even over 99% from their peaks, with declining community interest year after year.

This article reviews eight projects once highly anticipated during bull markets and backed by star VC firms. From ICP to DYM, we analyze their funding backgrounds, market cap trajectories, and the deeper reasons behind their steep declines—was it due to unsustainable models? Delayed ecosystem launches? Or overwhelming competition and insufficient market demand?

Internet Computer ($ICP)

Once in the top five, now down 99.5%

Internet Computer (ICP), launched by the Dfinity Foundation, positions itself as a decentralized "internet computer," aiming to enable smart contracts to natively run internet services. Development began in 2018, and ICP debuted at the peak of the 2021 bull market in May, immediately entering the top five in cryptocurrency market capitalization and attracting significant attention.

ICP attracted elite Silicon Valley VCs including a16z, Polychain Capital, Multicoin, and CoinFund, raising a total of $187 million. The token initially traded at hundreds of dollars, peaking near $700, but rapidly declined, falling below $20 within two months. As of 2025, ICP has been trading around $3, down more than 99% from its peak.

Key reasons for its failure include valuation bubbles, rushed launch, initial liquidity shortages, and criticism over governance and centralization. Additionally, slow ecosystem development failed to deliver on early promises of "reinventing the internet."

Fuel Network ($FUEL)

Big ambitions for modular execution layer, reality yet to catch up

Fuel Network is a Layer 2 scaling solution for Ethereum, aiming to separate execution from consensus and data availability to improve throughput and reduce costs.

The project received backing from institutions such as Blockchain Capital, The Spartan Group, and CoinFund, reportedly raising at least $80 million in strategic funding.

However, Fuel Network has failed to meet expectations in terms of token performance and ecosystem growth. FUEL currently trades around $0.003, with a market cap in the tens of millions, down over 94% from its peak. With numerous Ethereum L2 solutions and modular chain approaches emerging, Fuel's long-term differentiation remains uncertain.

Dymension ($DYM)

A new attempt at RollApps architecture, price down over 97%

Dymension is a project focused on "modular blockchain" infrastructure, offering an L1 network that enables developers to quickly deploy app-specific chains ("RollApps"). Its design separates consensus and settlement layers, aiming to enhance scalability and customization through RollApp deployment within its ecosystem.

Launched in 2022 and debuting its DYM token in early 2024, Dymension had clear technical positioning and support from investment firms like Big Brain Holdings, Stratos, and Cogitent Ventures. Yet market performance has been poor—DYM has dropped over 97% from its peak. Data shows its all-time high was close to $8.50, while current prices hover around $0.10. Although the project remains operational, ecosystem progress is slow, and community and user engagement fall short of expectations.

Flow ($FLOW)

Once a star NFT chain, now faded into obscurity

Flow is a high-performance public chain developed by Dapper Labs, targeting NFTs and gaming applications. In October 2020, the FLOW token launched via a CoinList public sale and enjoyed active ecosystem growth during the 2021 NFT boom.

The project secured strong funding—Dapper Labs raised over $18.5 million across multiple rounds from 2018 to 2021, backed by a16z, DCG, Coatue, and others. FLOW reached its all-time high of about $42 in April 2021 before steadily declining with the broader market. By 2025, the price had fallen to $0.28, down over 96% from its peak, with a significantly reduced market cap.

Flow's decline closely correlates with the cooling NFT market. Over-reliance on a single hit application left it without sustained growth momentum, lacking long-term user retention and real demand.

Yield Protocol

Fixed-rate protocol backed by Paradigm, shut down in 2023

Yield Protocol was an Ethereum-based lending platform specializing in fixed-term, fixed-rate loans, using fyTokens to create bond-like financial products. Launched in 2019, it was considered a pioneer in DeFi’s fixed-income space.

In June 2021, Yield completed a $10 million Series A round led by Paradigm, with participation from Framework Ventures, CMS Holdings, and other well-known firms.

However, in October 2023, Yield Protocol officially announced the shutdown of its platform, and its website went offline shortly after.

The core reason for failure was insufficient demand for fixed-rate lending, making it difficult to sustain an active market. Amid a broader DeFi downturn and increasing regulatory pressure, Yield could not establish a viable product model and chose to cease operations—a rare case among prominent VC-backed projects to formally shut down in recent years.

Notional Finance ($NOTE)

Fixed-rate lending protocol, gradually marginalized

Notional Finance is a fixed-rate lending protocol on Ethereum, allowing users to borrow assets like USDC, DAI, ETH, and WBTC at fixed rates and fixed terms, aiming to fill the gap for stable-yield products in DeFi.

In May 2021, Notional closed its Series A round led by Coinbase Ventures, with participation from Polychain Capital, Pantera Capital, and other leading firms, raising over $11 million.

As of 2025, NOTE’s market cap stands at approximately $1.66 million, down over 99% from its peak, with daily trading volume under $1,000. Community activity and protocol updates are minimal.

Notional faces similar issues as Yield Protocol: limited user adoption of fixed-rate products in DeFi and insufficient liquidity. Additionally, its unique design differs significantly from mainstream lending protocols, resulting in low user migration incentives, ultimately leading to market marginalization.

DerivaDAO ($DDX)

From star derivatives DEX to market irrelevance

DerivaDAO is a decentralized perpetual contract exchange project first proposed in 2020, aiming to combine the user experience of centralized exchanges (CEX) with the security of decentralized exchanges (DEX). Emphasizing community governance, it sought to replace centralized operations with a DAO structure.

In July 2020, DerivaDAO raised $2.7 million from top VCs including Polychain, Coinbase Ventures, and Dragonfly. Though modest in size, the investor lineup was considered elite. After launching in 2021, DDX briefly reached $15 before rapidly declining. By 2025, DDX has traded between $0.01 and $0.04, down over 99% from its peak, with its market cap nearly erased.

Delayed product delivery, lack of competitive features, and an aggressive early mining incentive model that led to rapid token distribution without sufficient trading demand contributed to its downfall. Meanwhile, strong competitors like DYDX made it difficult for DerivaDAO to gain traction.

Eclipse ($ES)

Next-gen L2 infrastructure experiment, down over 64%

Eclipse is a Layer 2 solution combining Ethereum's security with Solana's high performance. The mainnet launched in 2024, with the ES token introduced in July 2025.

The project attracted notable VCs such as Placeholder, Hack VC, and Polychain Capital, raising approximately $65 million.

Yet market performance shows a significant pullback. According to CoinGecko, ES remains tradable but has dropped roughly 64% from its peak. Eclipse's ecosystem is still in early stages, facing fierce competition from other roll-up and modular chain solutions vying for dominance in the L2 space, with its path to market adoption still unclear.

Conclusion

This article is not meant as criticism or to stir emotions, but rather to offer a sober reflection on these "crash case studies" from the last cycle before the next one begins.

These projects once had the brightest capital, narratives, and communities—but still couldn’t escape trajectories of de-pegging, collapse, stagnation, and marginalization. In a market deeply intertwined with finance and technology, fundraising, token price, and hype alone are far from enough. Does the business model hold? Can users stay? Is the product continuously evolving? These are the true variables determining a project’s fate.

These stories remind us: don’t just look at VC endorsements or short-term surges—learn to assess whether the long-term structure is sound.

When the tide recedes, only real value remains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News