New Cycles and Old Rules in Crypto VC

TechFlow Selected TechFlow Selected

New Cycles and Old Rules in Crypto VC

As M&A and IPO become the mainstream exit routes, and as LP types diversify and fund cycles extend, will crypto VCs—especially Asian VCs—rebound in the new cycle?

Author: Guyu, ChainCatcher

An undeniable and obvious fact is that crypto VCs have been declining over the past few market cycles. The returns, influence, and clout of nearly all VC firms have diminished to varying degrees, with many investors now turning up their noses at VC tokens.

There are numerous contributing factors. For instance, as most VCs tend to dump tokens and promote too many capital-driven projects, users have grown resentful toward VC-backed tokens. More capital is flowing into narratives with low VC exposure such as memes and AI agents, resulting in poor liquidity for VC tokens. Additionally, the token unlock periods for VCs are becoming increasingly prolonged, slowing exit timelines and placing them at a disadvantage.

Several seasoned investors have offered their explanations. Jocy Lin, founder of IOSG Ventures, believes that during the 2021 bull cycle, the primary market was flooded with liquidity, enabling VCs to raise large sums quickly. This capital surplus led to inflated valuations and amplified narrative-driven investment patterns. Many VCs remain stuck in the "easy money" mindset of previous cycles, assuming that products and tokens are unrelated, overly chasing grand narratives and potential sectors while neglecting true product-market fit (PMF) and sustainable revenue models.

Jocy Lin further explains that the core issue facing crypto VCs is a mismatch between value capture and risk assumption. They endure the longest lock-up periods and assume the highest risks, yet occupy the weakest position in the ecosystem—exploited layer by layer by exchanges, market makers, and KOLs. When the narrative-driven model collapses, native VCs without industry resources lose their foundation: money is no longer scarce; liquidity and certainty are.

In Will, partner at Generative Ventures’ view, exchanges and market makers have become the real extractors of liquidity and premium in this cycle. Most projects use VC funds for just two things: marketing hype and exchange listing fees. These projects are essentially marketing companies required to pay hefty fees to exchanges and market makers. Moreover, VC token allocations today are often locked for 2–3 years post-listing—longer than in traditional securities markets—resulting in extremely poor liquidity expectations upon unlocking, making it difficult to generate profits.

Anthony Zhu, founding partner at Enlight Capital, believes that Asian VCs focused primarily on token strategies are trapped in a death spiral in the current altcoin downturn. The quick-profit effects of the previous bull market created strong path dependency among both LPs and GPs. When this path is stretched or disappears entirely, VCs face dual pressure from LPs' short-term return expectations and project fundamentals drifting off course, leading to distorted actions. The current situation is essentially a misalignment between certain LPs, GPs, and market opportunities.

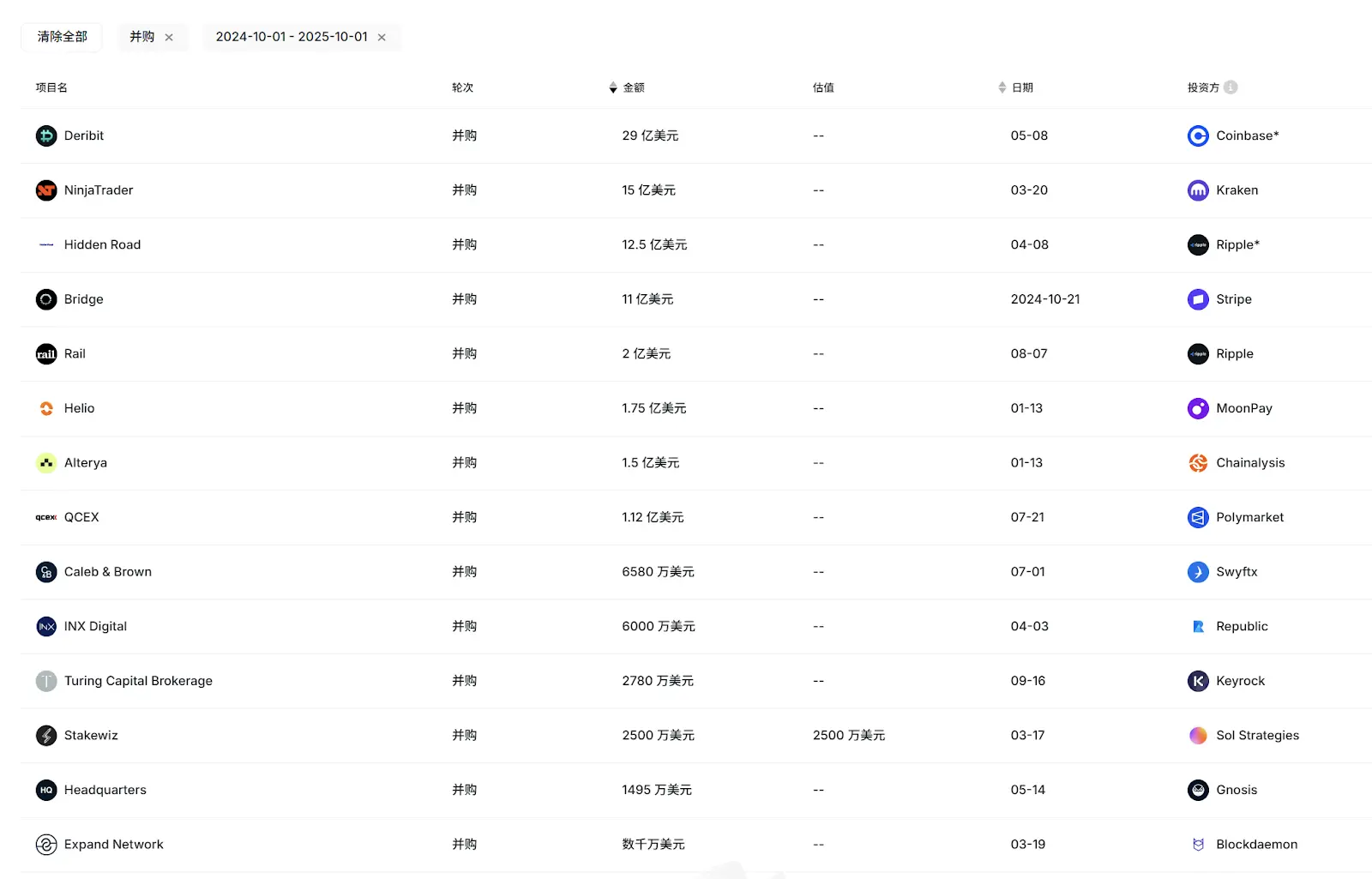

Beyond the general decline of the VC sector, an even more notable phenomenon is that Asian VCs' overall activity and influence appear to have declined more sharply in this cycle. In RootData’s recently released 2025 Top 50 VCs list—ranked by activity and exit performance—only 2–3 Asian VCs, such as OKX Ventures, made the cut. In the recent wave of IPOs and major M&A exits (Circle, Gemini, Bridge, Deribit, etc.), only IDG Capital achieved significant returns through its early investment in Circle, while other Asian VCs were largely absent.

Further data shows that previously active and high-performing Asian VCs such as Foresight Ventures, SevenX Ventures, Fenbushi Capital, and NGC Ventures conducted fewer than 10—or even fewer than 5—investments this year, with minimal fundraising progress.

From once dominating the scene to now falling silent, how did Asian VCs end up in such a dire situation?

1. Why Can’t Asian VCs Compete With Western VCs?

Under the same macro conditions, Asian VCs are outperformed by their Western counterparts—a disparity attributed by some interviewees to fund structure, LP composition, and internal ecosystem differences.

Jocy Lin of IOSG Ventures argues that Asia suffers from a severe lack of mature LPs. As a result, most Asian VC funds rely heavily on high-net-worth individuals and entrepreneurs from traditional industries, along with idealistic OGs from the crypto space. Compared to the U.S. and Europe, they lack support from long-term institutional LPs and endowment funds. This forces Asian VCs to prioritize theme-based speculative investments under LP exit pressure rather than systematic risk management and exit planning, resulting in shorter fund lifespans and greater vulnerability during market contractions.

“In contrast, most Western funds operate on 10-year-plus cycles, with more mature governance, post-investment support, and risk hedging frameworks, allowing them to maintain steadier performance through downturns,” said Jocy Lin, who also took to X urging exchanges to redirect their multi-hundred-million-dollar market rescue funds into VC investments that can recycle capital back to founders.

Jocy Lin added that Western funds generally follow a people-centric investment philosophy. Founders who can sustainably manage projects through cycles in the crypto industry demonstrate exceptional entrepreneurial resilience—these individuals are rare, and while some Western investors have succeeded with this approach, its success rate in crypto remains limited.

Moreover, rising project valuations driven by U.S. funds have dragged down many co-investing Asian funds. Due to shorter fund cycles and a focus on short-term cash returns, Asian funds have begun to diverge—some betting on higher-risk sectors like gaming and social, others aggressively entering secondary markets. Yet neither strategy has yielded excess returns in the volatile altcoin market, with some suffering severe losses. “Asian funds are deeply loyal and faithful, but this cycle has relatively let them down,” lamented Jocy Lin.

Anthony Zhu shares similar views, noting that Western funds are generally larger with deeper pockets, allowing for more flexible investment strategies and better performance in non-linear bull markets.

Another key factor is that Western projects enjoy more diverse exit routes beyond simple exchange listings. In the recent M&A surge, the main acquirers have been top-tier Western crypto firms and financial institutions. Due to geographic, cultural, and other factors, Asian crypto projects have not been high-priority targets. Additionally, most current IPO candidates have Western backgrounds.

Source: RootData

With smoother equity exit channels, Western VCs tend to diversify their portfolios. Many Asian VCs, constrained by team background, fund structure, and exit limitations, often avoid equity investments altogether—thereby missing out on numerous 10x or even 100x opportunities.

However, Anthony emphasizes that while Asian crypto VCs focused on token investments have underperformed since the last cycle, certain Asian dollar-denominated VCs investing in equity have excelled. “Mainstream institutional VC investors are more patient—their performance shows up over long cycles. Asia hosts some of the world’s best crypto innovators building groundbreaking products. More Asian projects will enter mainstream Western exit channels in the future. Asia needs more long-term capital to support outstanding early-stage ventures.”

Will offers a contrarian perspective. In his view, the poor performance of Asian VCs stems from being too close to Chinese-speaking exchanges—the closer they are, the worse off they are—because they pin their exit hopes on exchange listings. But in this cycle, exchanges are the biggest extractors of liquidity. “Had these VCs read the room earlier, they should’ve bought exchange tokens like BNB, OKB, or BGB instead of funding countless small projects dependent on exchange listings, only to get locked in themselves.”

2. Transformation of VCs and the Industry

Crisis breeds change—the massive reshuffling of the crypto VC landscape is inevitable. If 2016–2018 marked the rise of the first generation of crypto VCs and 2020–2021 the second, we may now be entering the era of the third generation.

In this cycle, alongside the renewed focus on dollar-denominated equity investments, some VCs are shifting toward the more liquid secondary market and related OTC areas. For example, LD Capital has fully pivoted to secondary markets over the past year, taking large positions in ETH, UNI, and others, sparking widespread discussion and emerging as one of Asia’s most active players in the secondary space.

Jocy Lin says IOSG will not only place greater emphasis on primary market equity and protocol investments but also expand beyond its existing research capabilities to explore OTC opportunities, passive investments, structured products, and other strategies to better balance risk and return.

Nonetheless, IOSG will remain active in the primary market. “In terms of investment preferences, we’ll focus more on projects with real revenue, stable cash flow, and clear user demand—not just narrative-driven bets. We want to back products and business models capable of organic growth even in environments lacking macro liquidity,” said Jocy Lin.

Speaking of cash flow and revenue, the most prominent project this cycle is Hyperliquid, which generated over $100 million in revenue in the past 30 days according to DeFillama. Yet Hyperliquid never raised VC funding—its community-driven, VC-independent development model sets a new precedent. Will more high-quality projects emulate Hyperliquid, further diminishing the role of crypto VCs? And to what extent will KOL rounds and community rounds replace traditional VC roles?

Anthony believes that for certain types of DeFi projects like Perp protocols, models similar to Hyperliquid may persist due to small team sizes and strong profitability, but this may not apply universally. In the long run, VCs remain vital catalysts for large-scale industry growth and crucial bridges connecting institutional capital with early-stage projects.

“Hyperliquid’s success largely stems from its self-sustaining product loop—as a perpetual contract protocol, it inherently generates revenue and market momentum. But this doesn’t mean the ‘no VC’ model is universally replicable. For most projects, VCs remain essential sources of early-stage R&D funding, compliance guidance, and long-term capital,” said Jocy Lin, adding that in any niche of traditional TMT—be it AI or healthcare—no sector thrives without VC and capital involvement. An industry without VCs is inherently unhealthy. The VC moat hasn’t disappeared—it’s evolved from providing capital to offering resources and patience.

Jocy Lin shared a statistic: projects backed by top-tier VCs have a 40% three-year survival rate, whereas purely community-driven projects survive at less than a 10% rate.

On KOL and community rounds, Jocy Lin acknowledges their rise is reshaping early-stage fundraising. They help build consensus and community momentum early on, especially effective in marketing and go-to-market strategies. However, their support is largely limited to narrative dissemination and short-term user mobilization, offering little help in long-term governance, compliance, product strategy, or institutional scaling.

Today, Asian crypto VCs are hitting their lowest point in years. Rapid shifts in internal and external ecosystems and narrative logic have pushed VCs onto divergent paths—some names have faded into history, some remain hesitant, while others are boldly reconfiguring themselves to forge healthier, more sustainable relationships with projects.

Yet the extractive behavior of market makers and exchanges persists, exacerbated by Binance Alpha’s frequent listings. Breaking free from this negative ecosystem and finding breakthroughs in exit pathways and investment strategies remains one of the greatest challenges for the next generation of VC models.

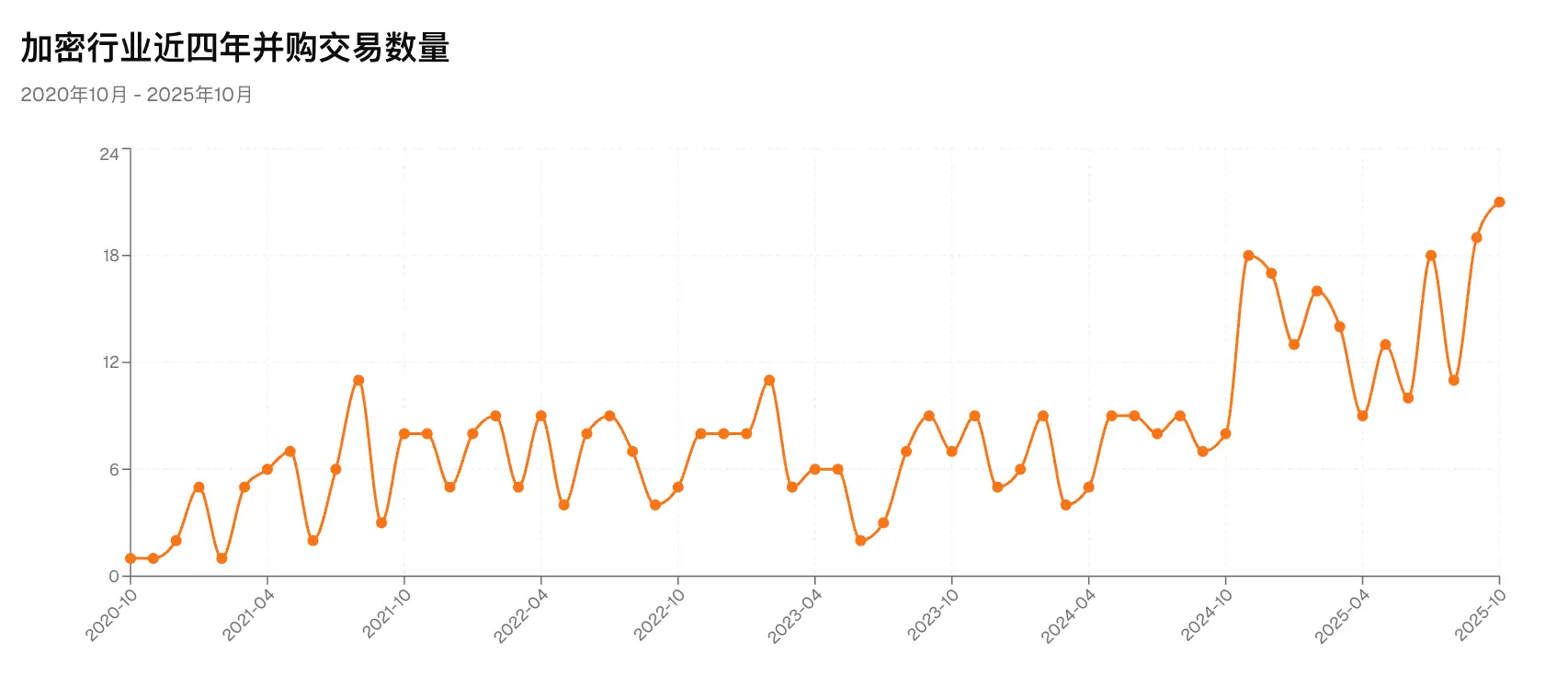

Recently, crypto giants like Coinbase have clearly accelerated their M&A integration pace. According to RootData, merger and acquisition activities in the first ten months of this year exceeded 130 deals, with at least seven crypto companies going public. Total fundraising by crypto-related listed companies (including DAT firms) surpassed $16.4 billion, all record highs. Reliable sources indicate that a well-known Asian traditional VC firm has launched a dedicated equity investment fund with a lifespan of around 10 years—more VCs are aligning with the “old rules” of the equity investment world.

This may be one of the strongest signals the market has sent to VCs in the new cycle: opportunities in the crypto primary market remain abundant, and the golden age of equity investing may already be here.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News