Chaos in the Internet Capital Market: Order and Disorder in Decentralized Financing

TechFlow Selected TechFlow Selected

Chaos in the Internet Capital Market: Order and Disorder in Decentralized Financing

ICM is not the enemy, but it is not the solution at present either.

Author: Choze, Crypto KOL

Translation: Felix, PANews

A new model is emerging: loud, fast, and highly speculative. It’s called the Internet Capital Market (ICM), viewed by some as the most exciting development in crypto, and by others as the most dangerous distraction.

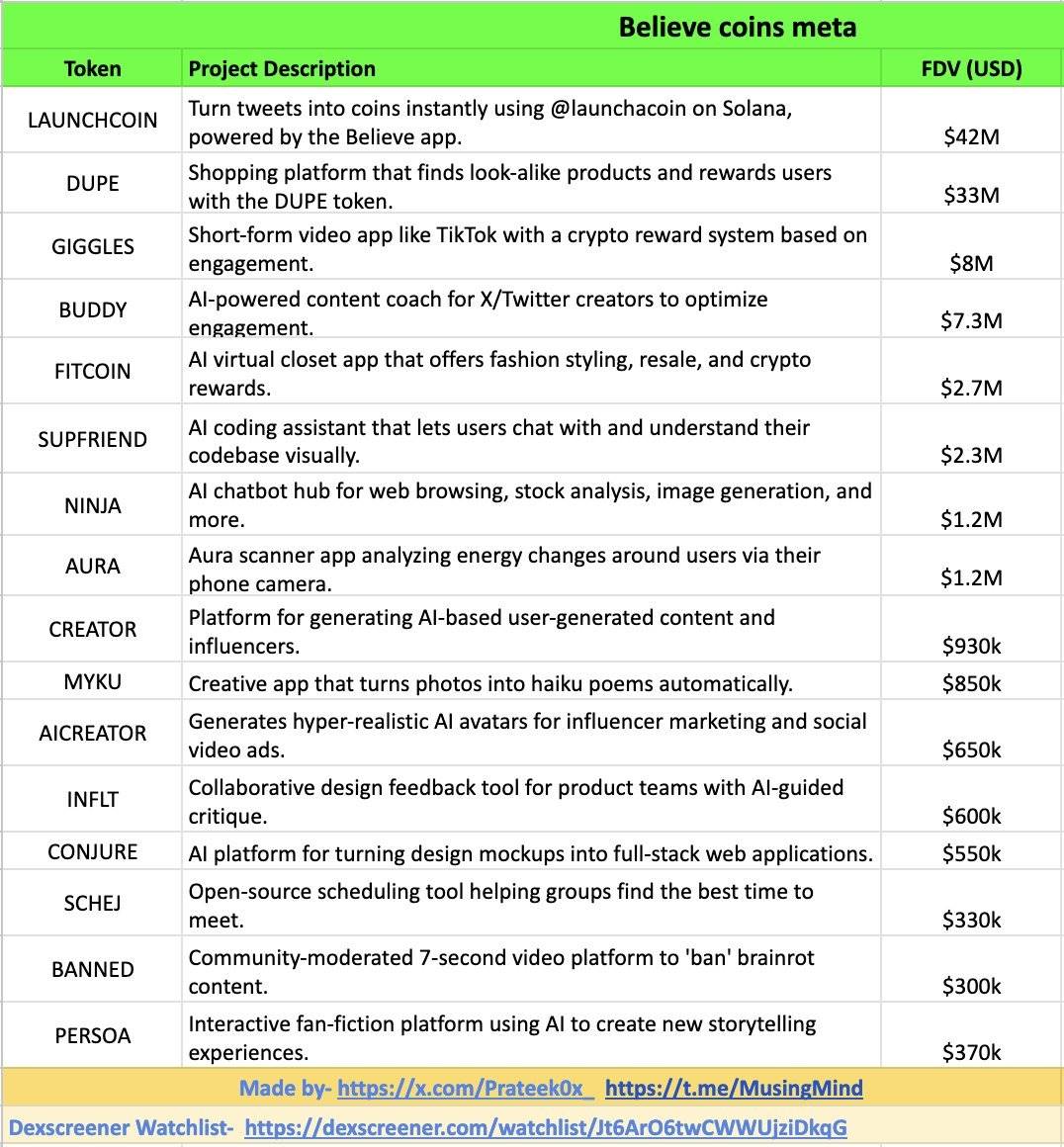

In 2025, a wave of independent developers began issuing tradable tokens directly on X (yes, right here) for internet-native applications, using tools like Launchcoin and Believe. The result? A permissionless market where ideas become tokens, hype becomes capital, and speculation becomes product appeal.

ICM is gaining attention, but the bigger question isn’t whether it will catch on—it’s whether this model is sustainable.

What is ICM?

ICM is a decentralized platform where capital flows directly to app developers and creators. No venture capitalists, no banks, no app stores. It blurs the lines between crowdfunding, token issuance, and equity speculation.

Developers launch an idea. The public participates via tokens. Trading volume grows, fees accumulate, and developers profit. If enough people believe, the token surges. If not, it dies. This is the core mechanism behind platforms like Believe and Launchcoin.

Supporters argue ICM democratizes innovation. Critics say it financializes virtual products. Perhaps both are true.

Bull Case: Speculate First, Build Later

The strongest arguments for ICM can be summarized in four points:

-

Permissionless idea funding: Anyone with internet access can support builders. No VC meetings, no gatekeepers.

-

Aligned revenue: Builders earn 50% of trading fees, providing direct funding to kickstart their product.

-

F friction viral distribution: By tying token launches to X posts, distribution speed matches meme coin dynamics.

-

Cultural unlock: ICM aligns with the trend of "Vibe Coding" (PANews note: a programming paradigm assisted by AI). Independent developers, creators, and niche founders leverage retail capital to go from zero to one.

This flywheel has gained massive momentum:

-

$DUPE surged to a $38 million market cap within days

-

$BUDDY achieved $300K ARR (Annual Recurring Revenue) through an AI creation tool

-

$FITCOIN reached 300K downloads and millions of impressions

The pitch is highly compelling: fund ideas instantly, harness hype, then rely on community belief to build the product.

Source: @Prateek0x_

Bear Case: Tokenized Noise

But beneath the surface lie deep structural risks:

-

Poor product-market fit: Many ICM tokens launch with no functionality or proof of demand—just gimmicks and memes.

-

Speculation over substance: Retail investors buy based on hype cycles, not business fundamentals.

-

Short-termism: Since builders earn trading fees immediately, there's little incentive to sustain long-term value.

-

Lack of legal safeguards: Most ICM tokens aren't equity, aren't regulated, and offer no accountability.

-

Low user stickiness: Tokens may spike quickly but crash just as fast. Alignment between users and platforms is hard to maintain.

In my view, this trend risks hijacking the “ICM” label, diluting its original promise of on-chain IPOs and liquid digital equity, turning it into a gambling ground filled with pump-and-dump meme coins.

Even among active traders, many openly admit their sole intent is quick profits—suggesting that even so-called believers are playing short-term games.

Believe: Infrastructure or Enabler?

At the heart of the ICM ecosystem is Believe, which allows anyone to issue a token in seconds. The process is simple:

-

Tweet a token ($TICKER + name)

-

A bonding curve and liquidity pool are instantly generated

-

Earn 50% of all trading fees

-

Once the token hits a market cap threshold ($100K), deeper liquidity unlocks

Builders no longer need to raise funds the traditional way. But therein lies the problem.

When revenue is front-loaded before any product exists, the line between builder and speculator blurs.

While projects like $DUPE and $GIGGLES show some traction, others feel more like memes. The infrastructure is impressive, but tools don’t fulfill purpose.

Two Stories of Vision

There’s a fundamental split in how people view ICM:

-

Idealists see it as Web3’s endgame: on-chain IPOs, decentralized equity, and a transparent, always-open financial layer for internet-native companies.

-

Realists see it as a speculative playground for tokenized minimum viable products (MVPs)—no roadmap, no moat, no accountability.

Both narratives are circulating. Whichever side gains stronger builder momentum may eventually overshadow the other.

Potential and Pitfalls

Undeniably, ICM taps into real truths: the desire to back ideas early, the fun of funding culture, and the instinct to speculate on what might go viral.

But this same convenience brings the risk of dilution. Without discipline or long-term alignment, ICM could devolve into another pump-and-dump arena—where meme coins wear the disguise of productivity, and liquidity masks a lack of substance.

While some see ICM as the future of startup financing, others treat it purely as a profit tool. This duality makes it hard to separate signal from noise.

Future Directions

For ICM to mature beyond the hype cycle, it needs:

-

Durable builders: Projects must deliver and retain users, not just raise quickly. Teams achieving product-market fit must lead.

-

Credible metrics: Dashboards and screens should highlight actual adoption, not just trading volume or volatility.

-

Progressive regulation: If tokenized startups want lasting value, they may eventually need legal frameworks blending utility and compliance.

-

Narrative integrity: Not every tradable idea is “ICM.” The term must retain its meaning to have long-term value.

ICM isn’t the enemy—but it’s not the solution either. It’s a canvas; the final outcome depends on what gets painted on it.

Though new in concept, its mechanics aren’t unfamiliar. The key question is whether this can evolve into something structurally meaningful, or fade like so many prior crypto fads. Time and trajectory will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News