The Middle Eastern "white knight" that acquired HiPhi turns out to be publicly raising funds through token issuance

TechFlow Selected TechFlow Selected

The Middle Eastern "white knight" that acquired HiPhi turns out to be publicly raising funds through token issuance

Just as Hiphi's restructuring was finalized, its new Middle Eastern owner has already placed its logo on the cryptocurrency promotion page.

Author: TechFlow

Remember HiPhi, the flashy-looking electric car company that unfortunately went bankrupt?

It has now found a white knight from the Middle East and may be brought back to life.

According to reports, an中东 electric vehicle company named EV Electra plans to invest $1 billion in HiPhi's restructuring and seeks controlling ownership.

Tianyancha data shows that on May 22, Jiangsu HiPhi Automobile Co., Ltd. was officially established with registered capital of $143.2665 million. The company is jointly funded by Lebanon-based EV Electra Ltd. and华人运通, the parent company of HiPhi, holding 69.8% and 30.2% stakes respectively.

The latest environmental impact assessment report disclosed by Yancheng Economic Development Zone indicates that the renovation project of Yueda Kia’s Plant No.1—formerly a contract manufacturer for HiPhi—has been initiated, aiming to produce three HiPhi models: HiPhi X, Y, and Z, with completion expected by October this year.

But who exactly is this中东electric vehicle company?

Public information reveals that EV Electra was founded in 2017 and is headquartered in Beirut, Lebanon.

The company's website states it is the first Arab-Canadian EV manufacturer to launch an electric vehicle; the first EV company in the Middle East and Arab world; operating in Canada, Italy, Germany, Turkey, and Asia.

Notably, EV Electra has been expanding globally in recent years: in 2021, it acquired majority equity in Detroit Electric, and in 2023 announced the purchase of NEVS Emily GT and Pons Robotaxi projects.

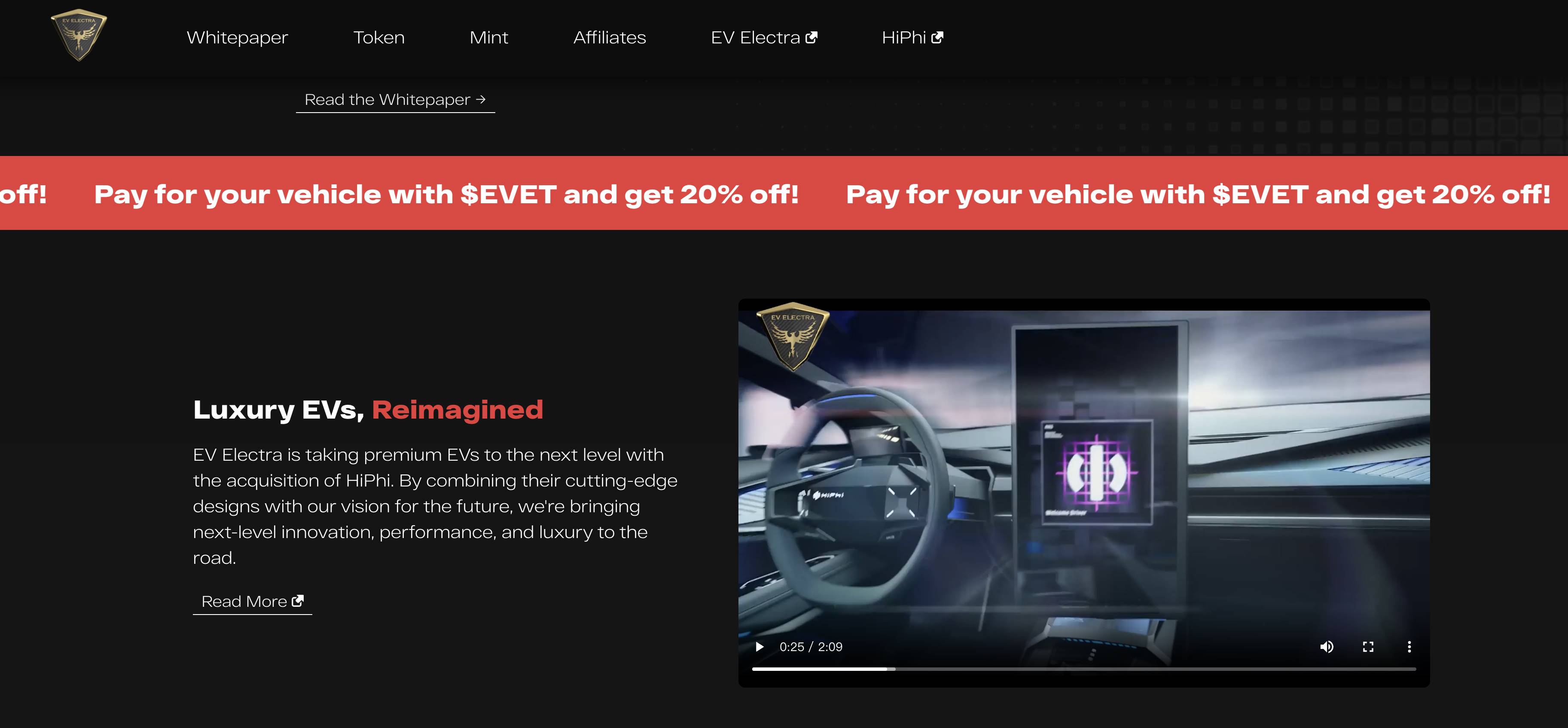

Currently, HiPhi’s logo and three models already appear on EV Electra’s official homepage.

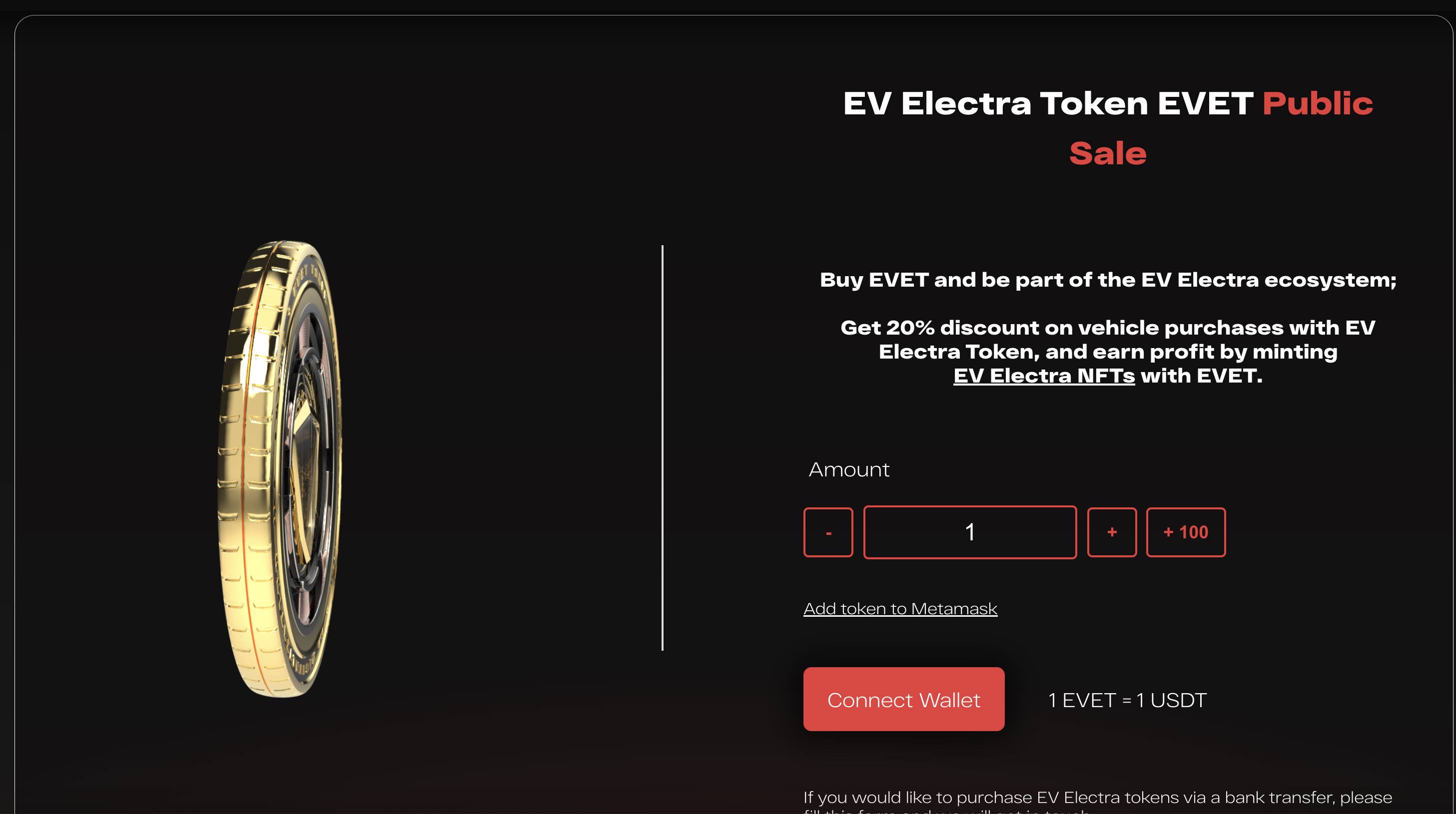

Surprisingly, we discovered that this中东EV company is conducting a token public sale directly through its website.

The website shows that EV Electra has launched its ecosystem token EVET, which can currently be purchased by connecting a wallet, at a fixed rate of 1 EVET = 1 USDT. Even bank transfers are supported for those unfamiliar with cryptocurrency.

According to their description, customers using EV Electra tokens to purchase vehicles will enjoy a 20% discount, and EVET can also be used for minting.

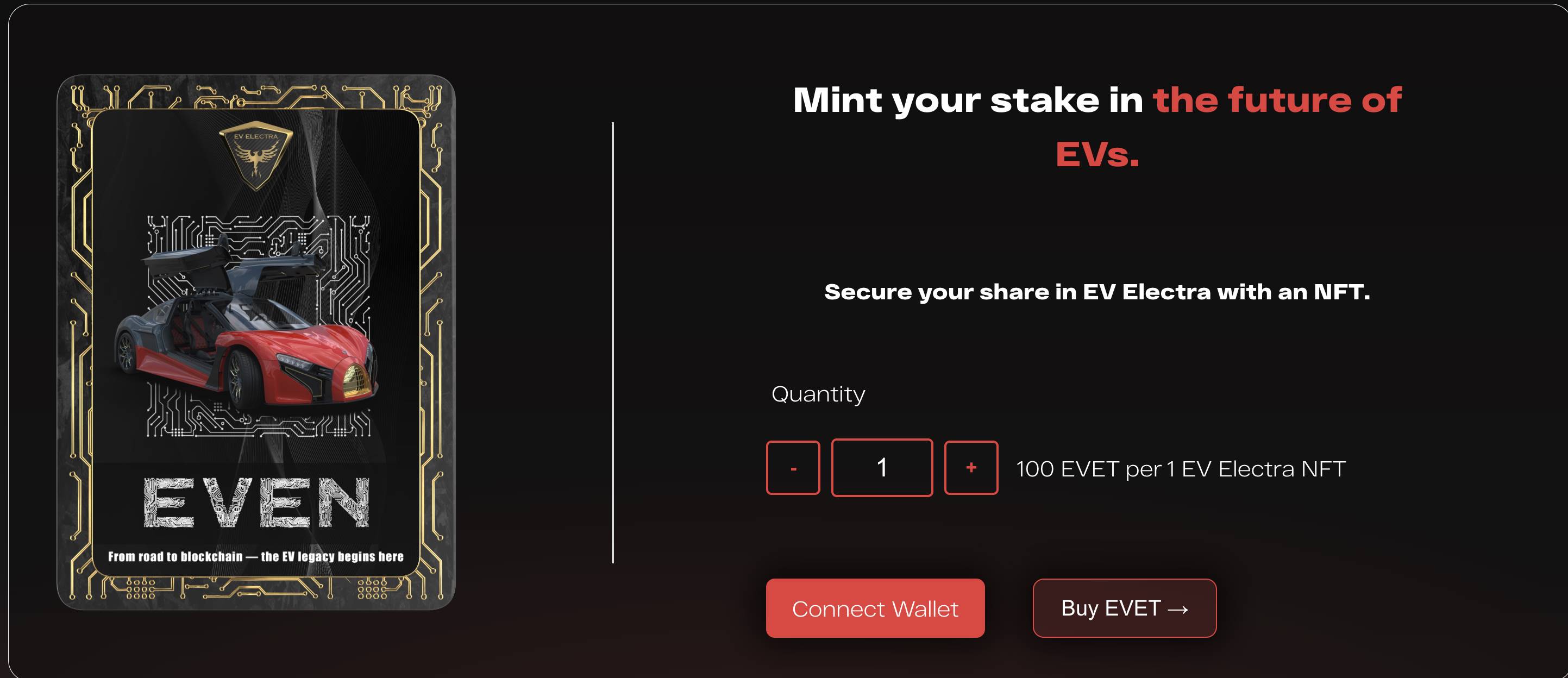

EV Electra NFTs function as virtual shares, entitling holders to company profits—though these claims remain purely promotional at this stage.

Looking into the whitepaper released in April 2025, EV Electra employs a dual-token system.

EVET is a utility token with a total supply of 1.2 billion: 28.33% private sale, 41.6% public sale, and 30% allocated to the team. With a pricing of 1 EVET = 1 USDT, the project aims to raise $840 million—an ambitious target. Its utility includes a 20% discount when paying with EVET.

EVEN is an ERC-721 format NFT with a total supply of 12 million, primarily used for profit-sharing and governance. EV Electra promises to convert 10% of net profits into USDT and distribute them to NFT holders.

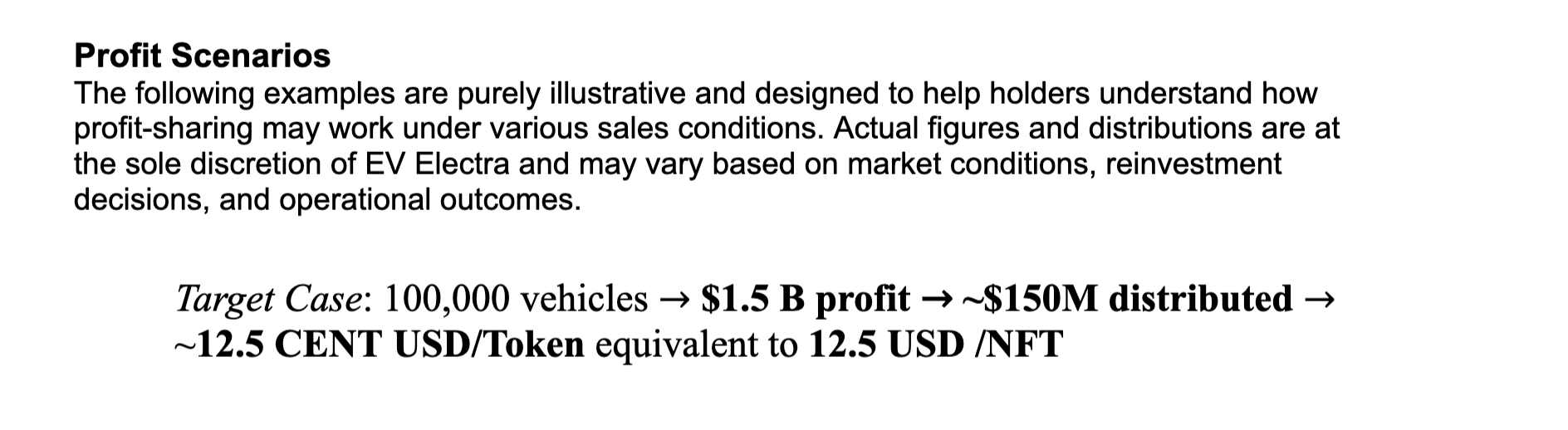

In the whitepaper, EV Electra paints a future vision (promissory pie): selling 100,000 vehicles, generating $1.5 billion in profit, and distributing $150 million to NFT holders.

According to its roadmap, EV Electra plans to complete token issuance and exchange listing in Q2 2025, establish a governance framework and begin production reservations in Q3, complete the first USDT profit distribution in 2026, and achieve a target production volume of 500,000 electric vehicles between 2027 and 2030.

Why issue a token?

Jihad M. Mohammad, founder of EV Electra, stated on his personal social media that the company originally planned to list on Nasdaq but changed course due to "Trump's crazy actions," opting instead for a "hybrid model"—digitizing part of the company's equity as NFTs that carry dividend rights, while also planning a reverse merger listing on the Hong Kong Stock Exchange.

Regarding fund usage, Jihad openly admitted that part of the funds will support Palestine, while another portion will establish a fund, emphasizing they are the first company with pure Arab and Muslim heritage adopting this model.

However, both EV Electra and its founder Jihad have faced significant controversy.

In 2023, EV Electra was accused of involvement in a cryptocurrency scam, using car manufacturing as a front to defraud investors. Later, Jihad responded that the software developer, Swedish businessman Anthony Norman, had been detained and convicted of multiple fraud charges, and had since been fired, with investors receiving refunds.

At the end of 2023, automotive media reported that EV Electra used images of cars from other manufacturers on its website, presenting them as its own designs—including the Skywell ET5 SUV and a K-1 Attack kit car—with EV Electra badges photoshopped onto the vehicles. After exposure, these concept images were removed from the website.

Currently, the newly established joint company between HiPhi and EV Electra requires the中东partner to contribute $100 million in registered capital according to shareholding ratio, with the payment deadline set for December 31, 2025.

On EV Electra's token sale website, HiPhi's materials have already been integrated, stating: “After acquiring HiPhi, EV Electra will elevate premium electric vehicles to a new level.”

These moves have sparked widespread skepticism within the industry: Can a中东EV firm with a controversial history genuinely deliver on its $1 billion promise to restructure HiPhi while simultaneously raising $840 million via tokens? Its true intentions and financial credibility warrant serious scrutiny.

More concerning is that HiPhi’s brand and product imagery are being directly used for token marketing—was this authorized by华人运通?

From car manufacturing to token issuance, from Nasdaq listing plans to NFT-based virtual equity, from pledges to support Palestine to claims of pure Arab lineage, EV Electra’s business model and fundraising strategy seem riddled with contradictions and uncertainties.

We welcome and support HiPhi’s revival, but also urge HiPhi to carefully assess its partner’s qualifications and motives, avoiding getting lost in a fog of capital speculation—and above all, ensuring this Chinese brand does not become a pawn for foreign companies to hype cryptocurrencies.

After all, a true "white knight" should bring real funding, technology, and market access—not empty promises and speculative token blueprints.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News