Crypto Morning Brief: U.S. August PPI data below expectations, Meteora to launch TGE in October

TechFlow Selected TechFlow Selected

Crypto Morning Brief: U.S. August PPI data below expectations, Meteora to launch TGE in October

Oracle co-founder Ellison surpasses Musk to become the world's richest person.

Author: TechFlow

Yesterday's Market Dynamics

U.S. August PPI MoM -0.1%, U.S. August PPI YoY 2.6%

According to Jin10 News, the U.S. Producer Price Index (PPI) for August showed a month-over-month decline of 0.1%, compared to an expected increase of 0.30% and a previous reading of 0.90%.

The annual PPI rate for August was 2.6%, below the forecast of 3.3% and the prior value of 3.30%.

U.S. SEC Chair: Will Ensure Entrepreneurs Can Raise Funds on Chain Without Facing Legal Uncertainty

According to official news from the U.S. Securities and Exchange Commission (SEC), SEC Chair Paul Atkins delivered a keynote speech at the OECD Global Financial Markets Roundtable in Paris, announcing the launch of Project Crypto aimed at comprehensively modernizing securities regulations to support the development of on-chain markets.

Atkins stated that the SEC will no longer set policy through ad hoc enforcement actions but instead provide clear and predictable regulatory rules. He emphasized that "most crypto tokens are not securities" and that the SEC will clearly define boundaries to ensure entrepreneurs can raise capital on chain without facing legal uncertainty.

The initiative supports innovation in "super app" trading platforms, allowing them to offer trading, lending, and staking services under a single regulatory framework. Atkins noted that regulators should apply the "minimum effective dose" of oversight necessary to protect investors while avoiding excessive regulatory burdens.

In his speech, Atkins also mentioned that the convergence of artificial intelligence and blockchain will drive the development of "agent finance," and said the U.S. will collaborate with international partners such as the European Union to advance the modernization of digital asset regulation.

Oracle Co-Founder Ellison Surpasses Musk to Become World’s Richest Person

According to Jin10 News, Oracle co-founder Larry Ellison's net worth has reached $393 billion, surpassing Elon Musk to become the world's richest person.

Earlier reports indicated that Oracle (ORCL.N) surged approximately 32% today, hitting a new all-time high in share price with its market capitalization nearing $900 billion. The surge follows expectations of cloud orders valued at $500 billion.

Gemini to Allocate 30% of IPO Shares to Retail Investors

According to Bloomberg, Gemini Space Station Inc., founded by Cameron and Tyler Winklevoss, will list on U.S. stock markets this Friday (September 13). The company plans to allocate up to 30% of shares in its initial public offering (IPO) to retail investors.

As updated in filings on Tuesday, these shares will be made available to small investors via online brokerage platforms such as Robinhood, Moomoo, and Webull, offering ordinary investors a rare opportunity to participate in pre-IPO investment in the billionaire-backed cryptocurrency exchange.

VanEck Plans to File for HYPE Spot Staking ETF in the U.S.

According to Blockworks, VanEck plans to file for a Hyperliquid (HYPE) spot staking ETF in the United States and launch an exchange-traded product (ETP) in Europe. This ETF would provide U.S. investors access to HYPE and could prompt exchanges to consider listing the token. VanEck is also considering using a portion of the fund's net profits for HYPE buybacks.

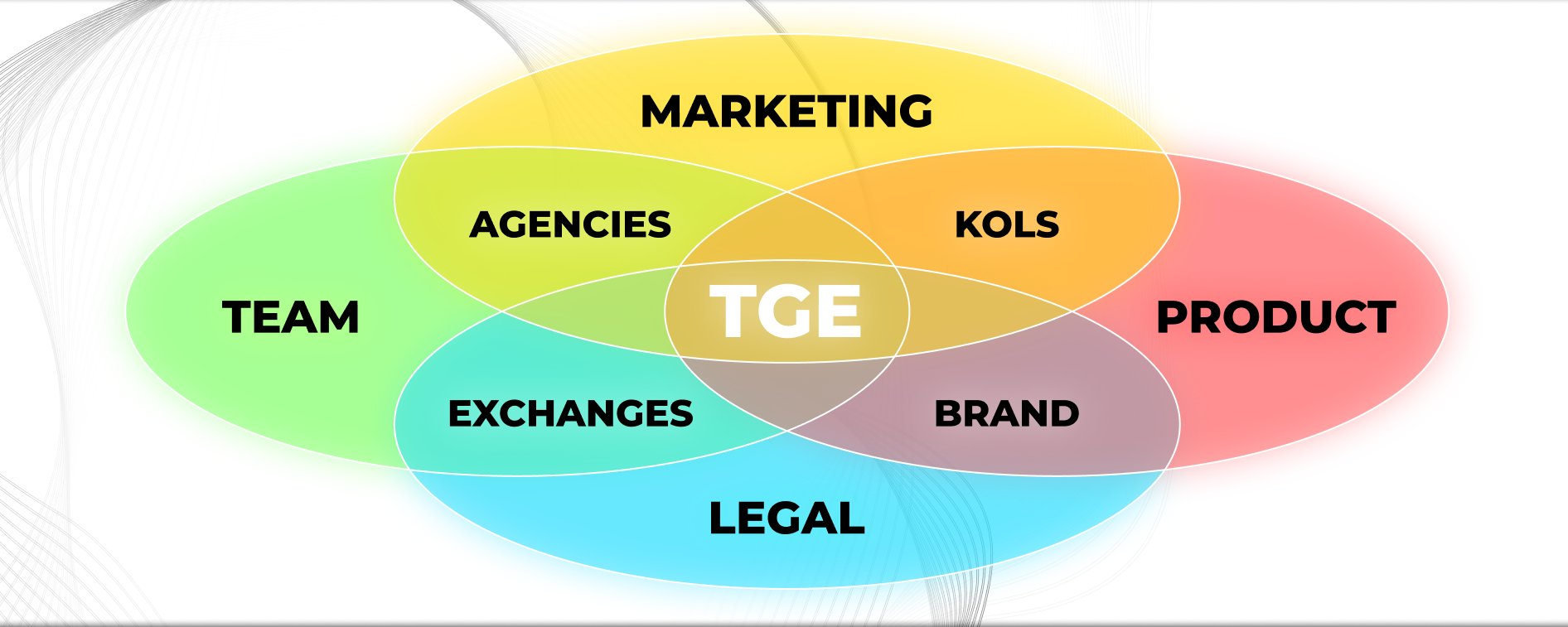

Meteora: TGE Scheduled for October

According to an official announcement, Solana-based liquidity protocol Meteora has announced it will conduct its Token Generation Event (TGE) in October.

Falcon Finance Announces FF Token Community Sale via Buidlpad

According to Chainwire, Falcon Finance, a subsidiary of DWF Labs, has announced it will conduct an FF token community sale through the Buidlpad platform.

Binance to Partner with Franklin Templeton to Launch Digital Asset Products

According to CoinDesk, Binance and Franklin Templeton have announced a collaboration to develop blockchain-based investment products, aiming to bridge traditional markets and the cryptocurrency sector.

As stated in a release on Tuesday, the partnership will combine Franklin Templeton’s expertise in security tokenization with Binance’s trading infrastructure and global investor base. The goal is to create products offering efficient settlement, transparent pricing, and competitive yields for a broad range of investors.

Sandy Kaul, Head of Innovation at Franklin Templeton, said blockchain is not a threat to traditional systems but an opportunity to reimagine them. Catherine Chen, Head of VIP and Institutional Clients at Binance, said the collaboration reflects Binance’s commitment to bridging crypto and traditional finance.

Specific products are expected to be unveiled later this year.

a16z Reportedly Accumulating Large Amounts of $HYPE via Anchorage, Holdings Reach $91 Million

According to monitoring by @mlmabc, venture capital giant Andreessen Horowitz (a16z) is suspected of acquiring large amounts of $HYPE tokens through Anchorage Digital. Recent transactions show Anchorage withdrew approximately 455,000 $HYPE (worth $25.3 million) from Bybit and transferred 210,000 (valued at $11.7 million) to a newly created wallet believed to belong to a16z.

a16z now holds around 1.638 million $HYPE across multiple wallets, with a total value of approximately $91 million. Last week, Anchorage had already purchased 1.428 million $HYPE (worth $79 million) on behalf of a16z.

BitMine Accumulates 46,255 ETH, Worth ~$201 Million

According to on-chain analyst Onchain Lens (@OnchainLens), BitMine has received 46,255 ETH from BitGo, valued at approximately $201 million. It now holds a total of 2,126,018 ETH, worth $9.24 billion.

Ant Digital Launches Full-Stack Tokenization Solution Supporting Real-World Asset Digitization

According to the SCMP, Ant Digital recently launched its "DT Tokenization Suite (full-stack tokenization solution)," providing institutions with end-to-end digital services covering the entire lifecycle of physical assets. The solution aims to promote standardization and scalability in real-world asset tokenization (RWA).

The solution is built on AntChain technology, integrating Web2 and Web3 capabilities. Its blockchain platform Jovay supports up to 100,000 transactions per second with response times within 300 milliseconds, making it suitable for financial transaction scenarios.

The system employs TEE and zero-knowledge proof (ZK) mechanisms to ensure transaction security, with average daily call volume reaching 2 billion, supporting cross-chain asset transfers. The platform offers services including asset tokenization, token issuance, on-chain circulation, risk management, and investor ecosystem integration, with related financial services provided by licensed financial institutions.

Market Movements

Suggested Reading

From Tenant to Broker: The Crypto Business Inside Trump Tower

This article tells the story of Dominari Holdings transforming from a tenant to a broker after moving into Trump Tower and establishing close ties with the Trump family, successfully becoming a key player and "super connector" in the cryptocurrency space. The company converted political capital into business opportunities, leveraging the Trump family's influence to expand its crypto operations and grow its market valuation.

After the iPhone 17 Launch, I Realized the Biggest 'Apple Mindset' in Crypto Is Holding Tokens

This article explores two mindsets in the crypto space—"Android mindset" and "Apple mindset"—drawing analogies to cryptocurrency investment strategies. The "Android mindset" emphasizes high-risk, high-return short-term opportunities, while the "Apple mindset" focuses on long-term holding and steady growth. By analyzing the core logic, advantages, disadvantages, and manifestations of both approaches in crypto, the author presents a key insight: the real choice lies in understanding oneself rather than blindly following others' advice.

This article discusses Sahara AI's innovations and developments in the fields of Web3 and AI, highlighting its sustainable business model, user participation mechanisms, and future strategy. Sahara AI is committed to addressing value distribution issues in the AI industry through Web3 technology, ensuring both individual users and enterprises can benefit.

Battle for Hyperliquid: Who Will Win the $5.6 Billion Treasury?

This article focuses on the upcoming contest for the issuance rights of the USDH stablecoin on the Hyperliquid platform, analyzing proposals from various candidates and their respective strengths and weaknesses, while also exploring the significance of this on-chain vote and its impact on DeFi governance.

DAT Sector Continues: More Players Preparing for Q4

This article serves as an investment guide for decentralized autonomous treasury (DAT) companies focused on altcoin treasuries, analyzing the current state, future trends, and key investment strategies in the DAT market. It provides detailed discussion on DAT funding methods, market dynamics, structural design, and future direction, along with recommendations and cautions for investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News