How important is timing for TGE?

TechFlow Selected TechFlow Selected

How important is timing for TGE?

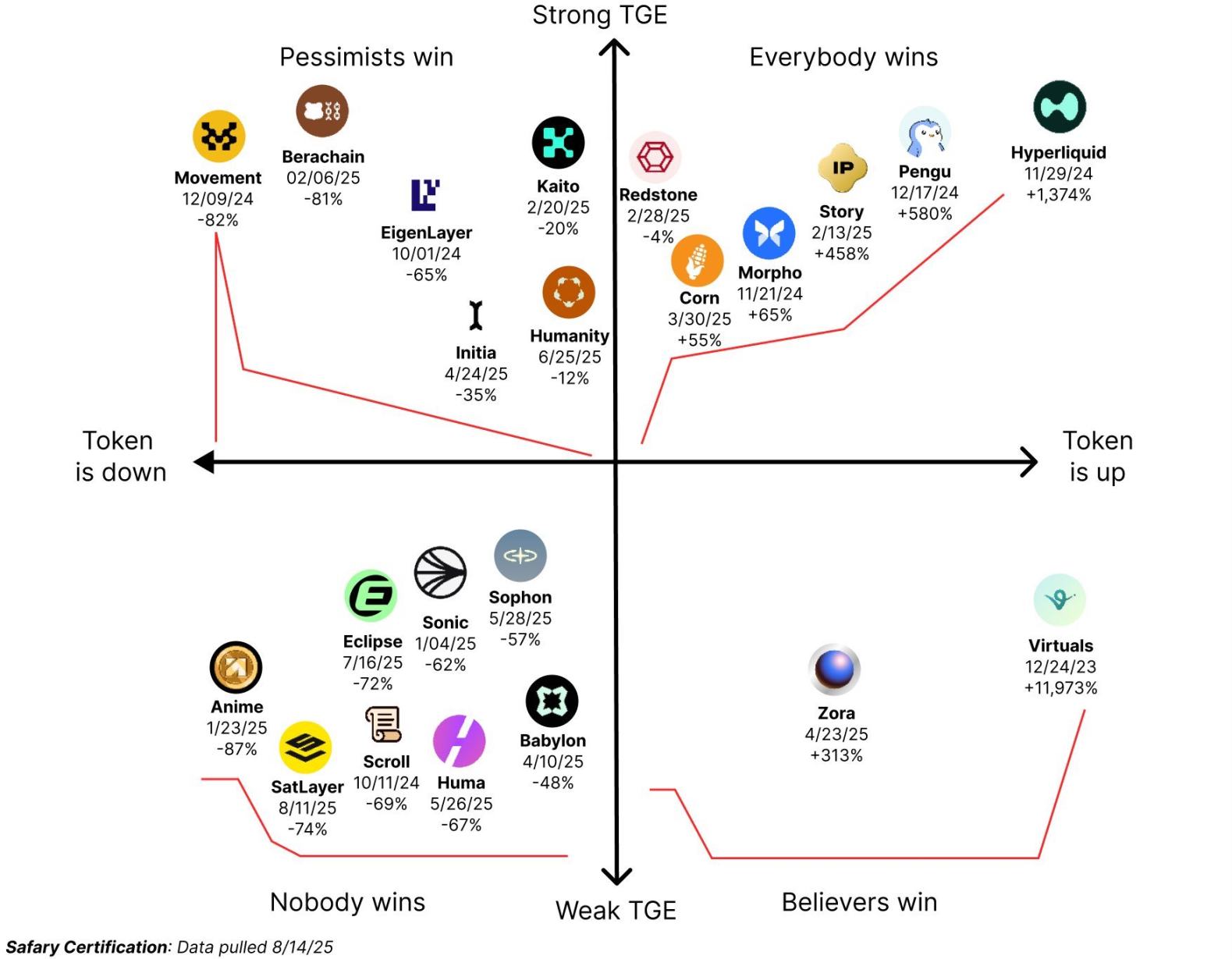

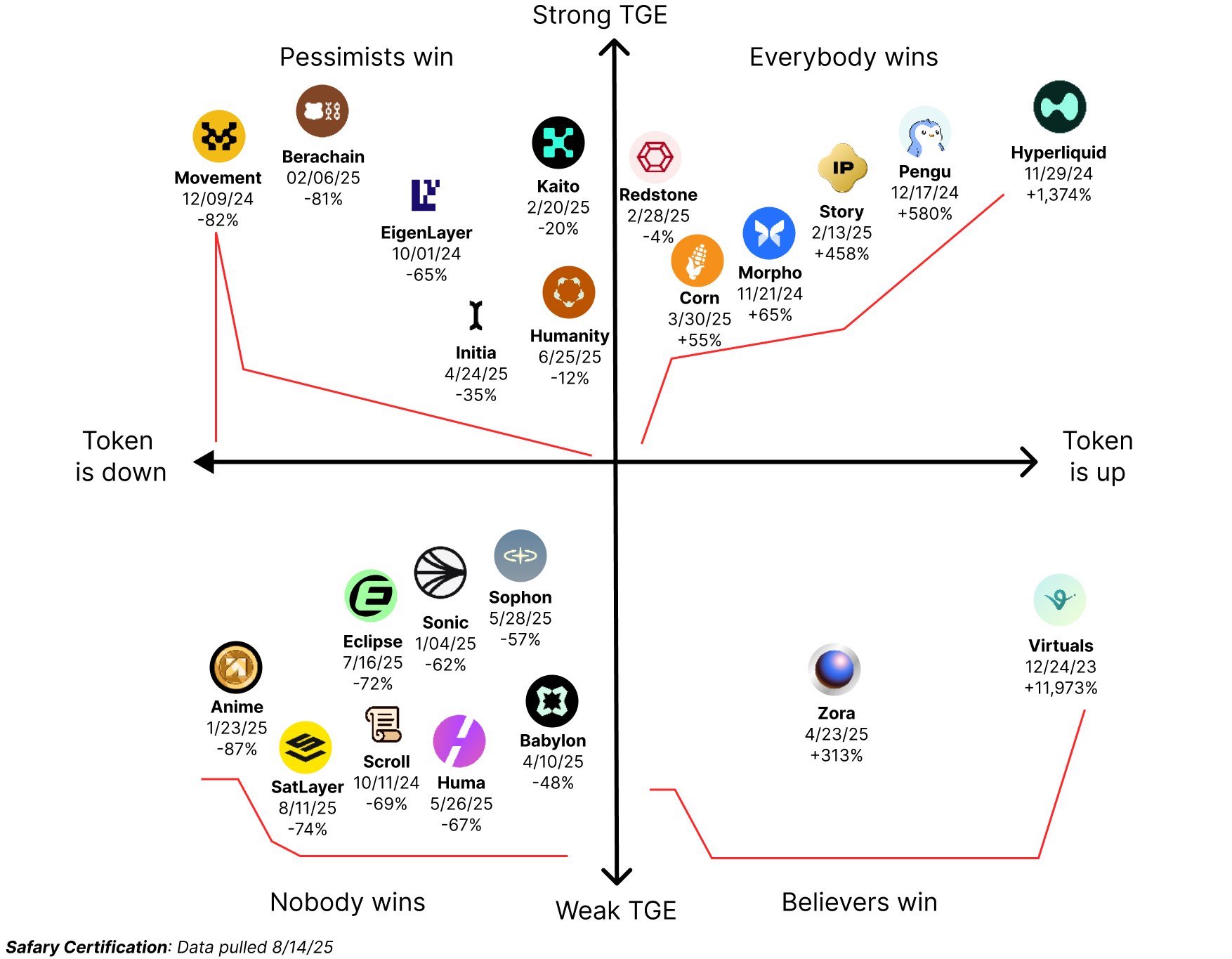

Choosing a TGE during a period of ample liquidity is important, so important that it can overshadow the project's fundamentals.

By: Haotian

Caught a post this morning that sparked some thoughts—sharing them here:

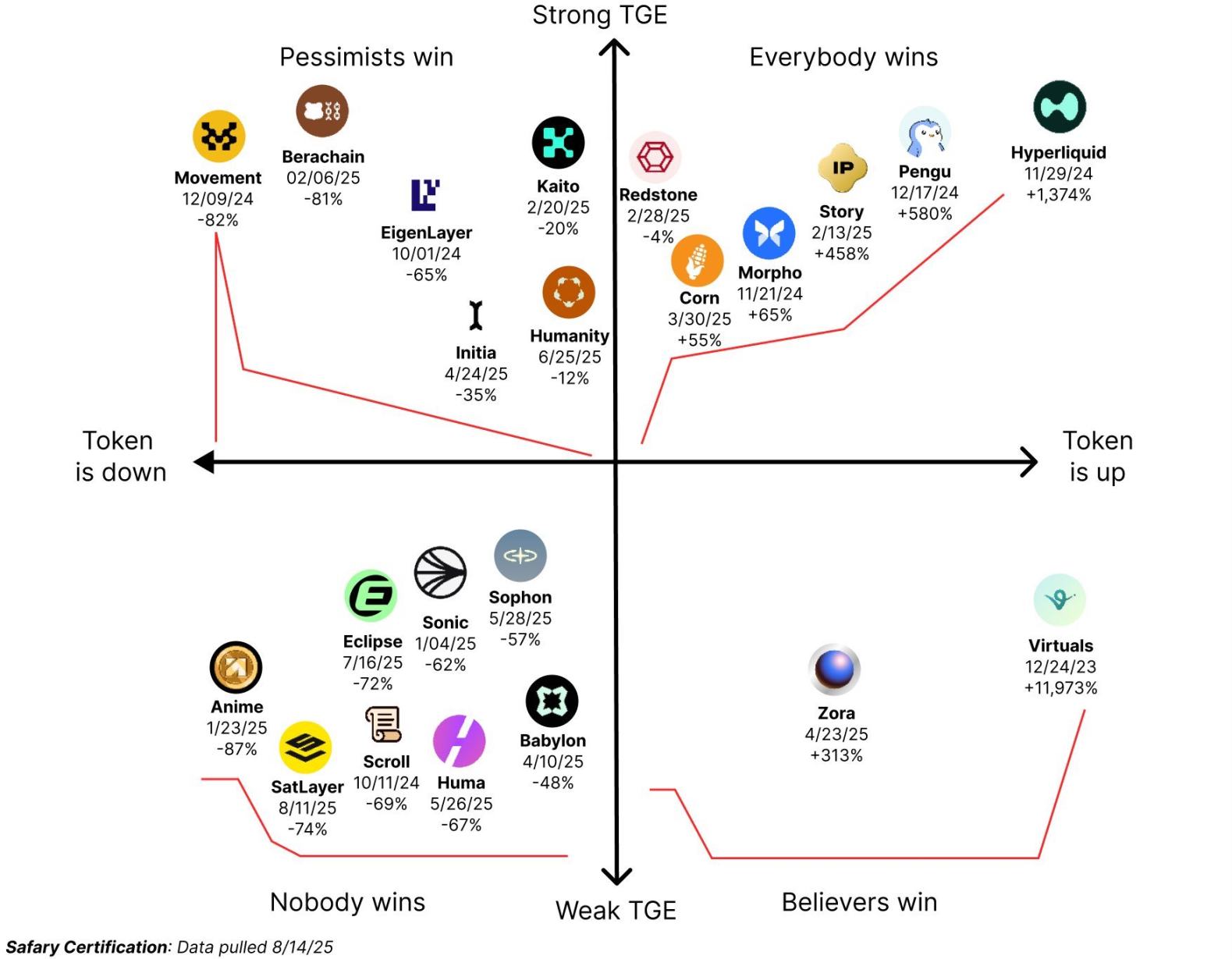

1) Choosing the right time window for TGE when liquidity is abundant is crucial—so crucial that it can overshadow a project’s fundamentals.

For example, $Pengu, an NFT community MEME token, launched on December 17 last year during a period of strong market liquidity and outperformed most other projects. In contrast, $BABY and $HUMA—projects with solid technical narratives and VC backing—launched in April–May this year when liquidity was relatively dry, and both performed poorly.

2) Projects tend to cluster at similar launch times, but one must consider whether market liquidity can absorb them all.

For instance, between November and December last year, Hyperliquid, Movement, Pengu, and Morpho all launched in quick succession. Despite mixed performance, most managed to exit successfully thanks to ample liquidity. Conversely, in April–May this year, Babylon, Initia, Zora, Huma, and Sophon crowded the same window amid tightening liquidity, resulting in generally disappointing outcomes.

3) Even during favorable TGE windows, some projects may experience “peak at launch” syndrome.

Certain projects take advantage of periods of high liquidity and retail FOMO to launch despite weak fundamentals. For example, Movement and Berachain saw explosive initial interest, but ultimately collapsed into endless downtrends. This shows that without solid fundamentals, liquidity-driven market booms can actually accelerate a project’s decline.

4) Launching during a weak TGE window can paradoxically present golden opportunities to discover value in fundamentally sound but overlooked projects.

$ZORA is a classic case—it launched when the market was at its quietest and liquidity at its lowest, yet emerged as the only winner among its cohort. Similarly, $Virtual launched during one of the darkest periods but consistently delivered strong fundamentals, leading successive waves of Solana AI agent enthusiasm and rewarding long-term believers in the end.

5) Regardless of whether they launch during strong or weak market cycles, fundamentally strong projects will eventually succeed.

For example, Hyperliquid built a massive community of supporters and led the narrative wave for Perp Dexes, with $HYPE climbing steadily in a staircase-like pattern; @flock_io

Despite launching at the peak of TRUMP’s massive liquidity drain last year—when $FLOCK’s circulating market cap briefly crashed below $3 million—the project succeeded due to outstanding fundamentals, achieving near-universal exchange listings and ultimately rewarding its believers. In short, for most retail investors, understanding the importance of TGE timing and adopting differentiated strategies—avoiding FOMO and taking quick profits during strong TGE phases; focusing on research and identifying undervalued quality assets for long-term holds during weak TGE phases—can still lead to success, even if the path is tough.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News