With more and more projects preparing for TGE, how should I evaluate their quality?

TechFlow Selected TechFlow Selected

With more and more projects preparing for TGE, how should I evaluate their quality?

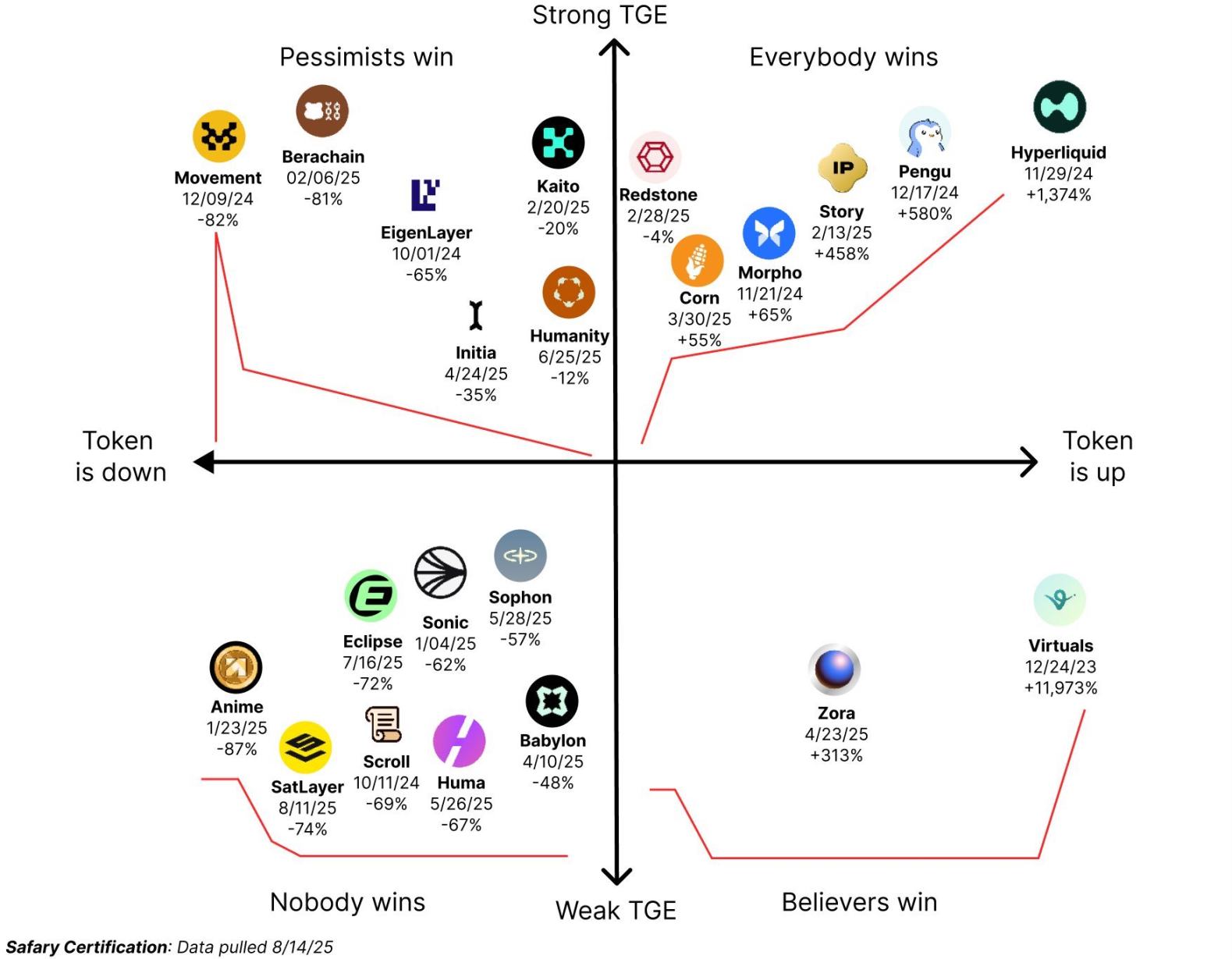

Token launches are like a high-stakes gamble; although they occasionally deliver 10x returns, such outcomes are the exception.

Author: Stacy Muur

Translation: TechFlow

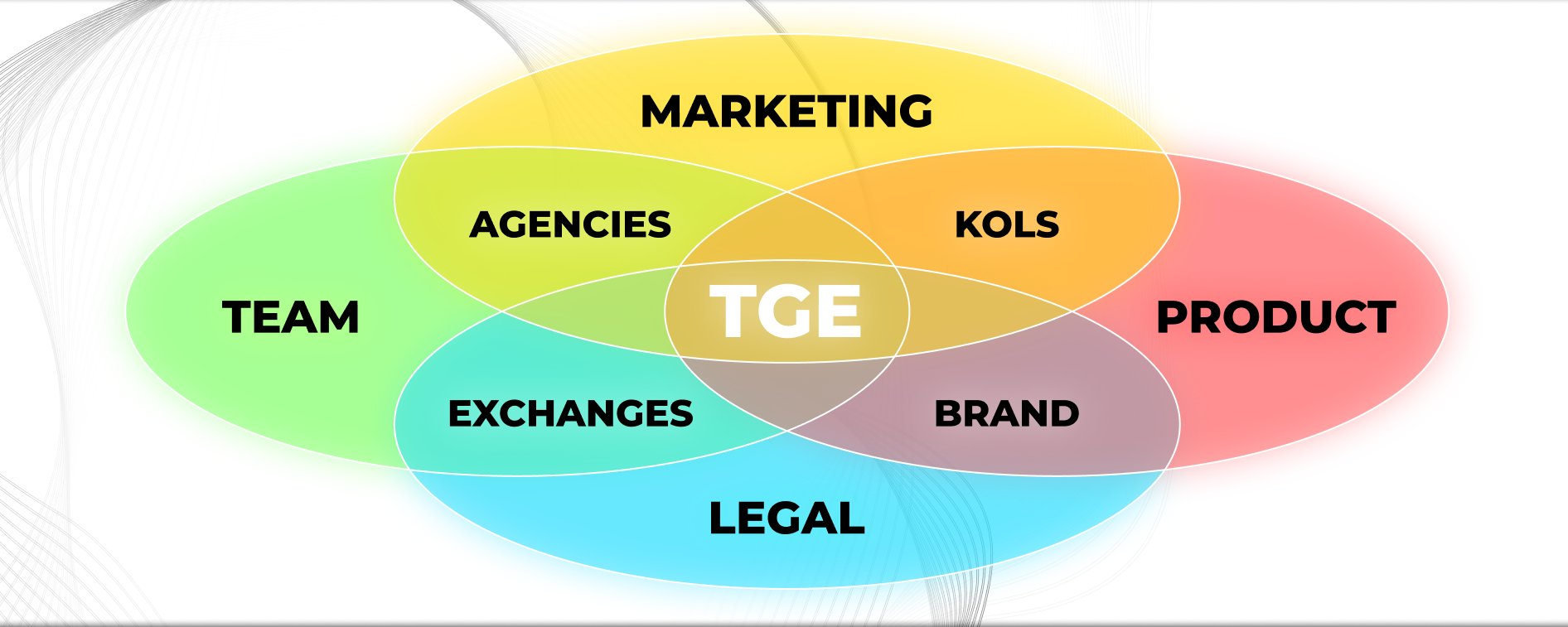

We are in the midst of a wave of token launches and TGEs (Token Generation Events), but not every launch is worth participating in. So how do you determine whether a project deserves attention? I'll use @KintoXYZ as an example to share my analytical framework.

Looking back, token launches in 2016 offered tremendous investment opportunities. By 2017, the ICO boom reached peak market expectations—similar to the surge in AI agents last December.

Today, token launches resemble more of a gamble. While occasional 10x returns happen, they're exceptions. According to Cryptorank data, only 30% of token launches this January achieved positive returns. Within that 30%, however, some hidden-value projects do exist.

So how can you judge whether a token launch is worth your attention? In this article, I’ll walk through my analysis method using Kinto as a case study.

Step 1: Analyze the Product

In short, when analyzing a token launch, break down the protocol into multiple components and evaluate them across three dimensions: maturity, demand, and innovation.

For product analysis, I focus on the following aspects:

-

Narrative

-

Product status

-

Metrics and market performance

-

Competitive advantage

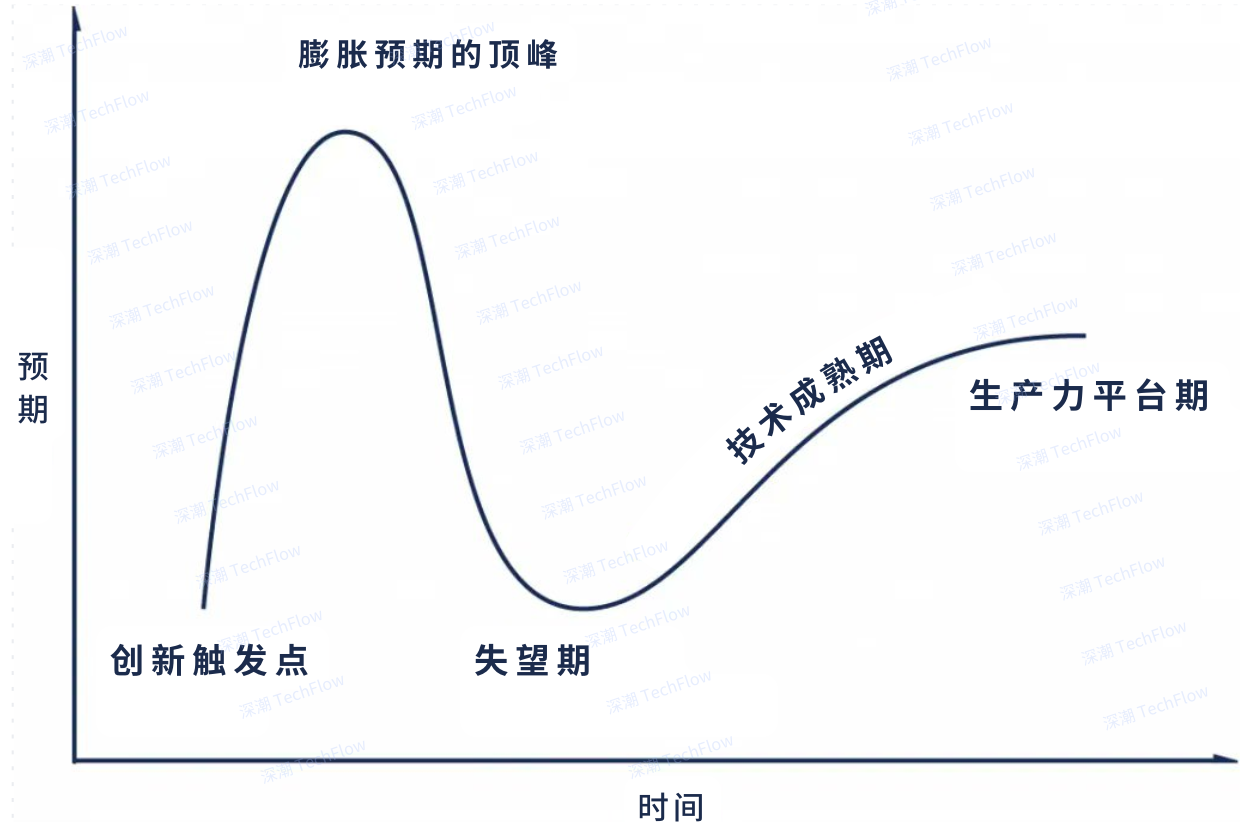

When analyzing narrative, refer to the Gartner Hype Cycle:

(Original image by Stacy Muur, translated by TechFlow)

If the protocol is at one of these stages:

-

Near the innovation trigger point: 5 points (e.g., BNB memes this week)

-

Near peak of inflated expectations: 0 points (e.g., new AI agents or AI agent launch platforms on new chains)

-

Near the trough of disillusionment: 1 point (e.g., many current DePIN/GameFi protocols)

-

Technology maturity phase: 3 points (e.g., many RWA protocols are now here)

-

Plateau of productivity: 1 point (e.g., most DeFi protocols are currently here)

Why do protocols in the trough of disillusionment and plateau of productivity score only 1 point? Because when a concept enters disillusionment, it either fades away or revives in a new form (e.g., ERC404). During the plateau phase, concepts become neutral and offer limited virality for the protocol.

Likewise, we score the following parameters (0–5 points):

-

Is the protocol already the TVL leader in its category? 5 points.

-

Is it still on testnet? 2 points.

-

Are there many competitors with clear, well-known leaders? 1 point.

You can add more questions based on your needs, but make sure to document all questions and answers to calculate an average score later.

Case Study: Kinto

As mentioned, I’ll use Kinto to demonstrate how to analyze a token launch.

Here’s a quick overview of the product to help you understand its core features.

Kinto is an institutional-grade modular exchange, positioned as a middleware layer between traditional bank accounts and Web3 wallets, focused on providing secure on-chain financial services.

Kinto is an institutional-grade modular exchange, sitting between traditional bank accounts and Web3 wallets, committed to enabling secure access to on-chain finance.

In simple terms, Kinto bridges traditional finance and blockchain with key features including:

-

KYC, AML, and fraud monitoring implemented at the blockchain level;

-

KYC is more private and secure than centralized exchanges (CEX) because no user data is stored, and users can freely choose their KYC provider;

-

Only verified participants can execute transactions, enabling Sybil resistance;

-

Each user has a smart contract wallet powered by account abstraction, which operates seamlessly and invisibly;

-

Misubi chain abstraction layer:

-

Kinto is the first protocol to launch chain-abstracted swaps, lending, and perpetual contracts, enabled via @HyperliquidX;

-

-

As a 100% KYC-compliant Ethereum Layer 2 protocol with built-in insurance, Kinto significantly reduces regulatory and financial risks.

Note that despite implementing KYC, Kinto remains decentralized, user-owned, and non-custodial.

In short, Kinto is a product combining on-chain wallet and exchange functions, with built-in KYC, AML, and support for traditional financial assets.

You might assume Kinto competes with Hyperliquid, but that's not the case. Instead, Kinto provides direct access to Hyperliquid, supports cross-chain lending on Aave, and enables asset swaps across any AMM on Ethereum, Arbitrum, Base, and other chains. It positions itself as an abstraction layer for DeFi.

For end users, Kinto functions like a wallet with CEX-like features, such as fiat on-ramps. Yet it operates fully on-chain, is decentralized, permissionless, and gas-free—all features already live.

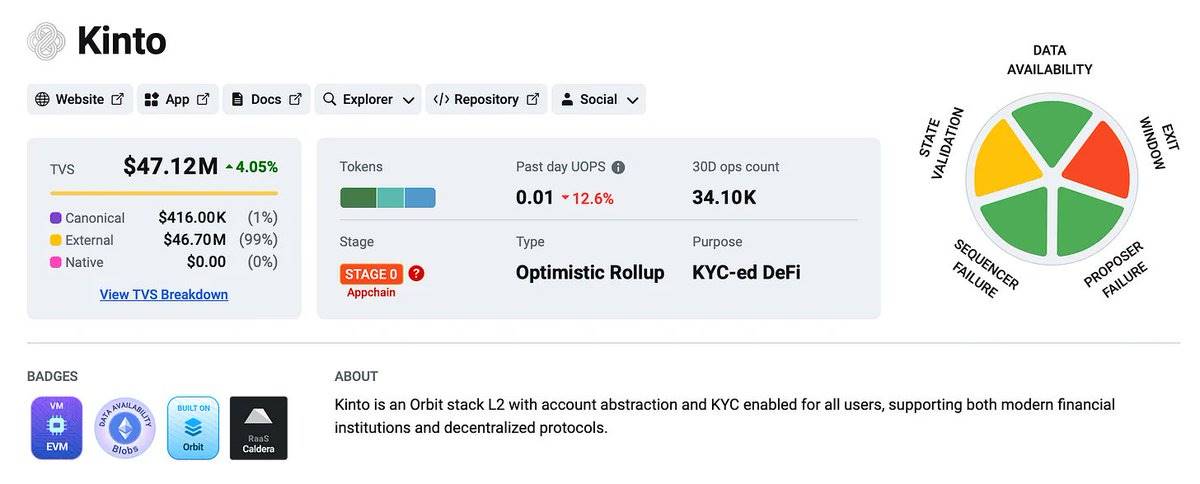

(Original image by Stacy Muur, translated by TechFlow)

Now, let’s apply our framework to answer several key questions:

-

What is Kinto’s positioning?

Kinto sits at the intersection of infrastructure and trading, with core narratives around “institutional-grade,” “financial ecosystem,” “chain abstraction,” and “aggregator.” This positioning is indeed novel—aside from Kinto, I haven’t seen another product attempting to build a KYC-enabled DeFi chain. But how strong is the demand compared to centralized alternatives? Can it outcompete Particle’s Universal Accounts (also rapidly evolving) in chain abstraction? These remain to be seen. Therefore, I give Kinto 3 points, potentially increasing as activity grows.

-

What stage of development is Kinto in?

Since launching mainnet in March 2024, Kinto has been operational for some time. According to L2Beat, its TVS (Total Value Secured) stands at $47 million. However, recent 30-day operations are modest at 34K, with a total wallet count of 147K. For this, I give Kinto 4 points.

-

How does Kinto perform in trading functionality?

Beyond traditional Web3 assets, Kinto offers broad support for popular traditional financial assets—a feature distinguishing it from both CEXs and DEXs. Supported assets include Nvidia, Meta, Uber, and S&P 500. This diversity attracts specific user types, earning Kinto a high score of 5 points in this category.

The more specific your questions, the more accurate your final product score will be. Ensure each question carries similar weight to avoid skewing the final result.

In Kinto’s case, my final product score is 3.6.

Step 2: Evaluate Expertise

When evaluating expertise, I assess all factors that could impact product success from human resources, technical strength, and business development (BD) perspectives. Key areas to watch include:

-

Team: Evaluate team members’ past experience, transparency, social media presence, and developer engagement.

-

Venture Capital (VC): VCs are not just funding sources—they’re vital for networking with other projects and industry influencers.

-

Funding amount: Adequate funding is crucial for hiring and product development.

-

Partnerships: A broad partner network can significantly boost user onboarding efficiency.

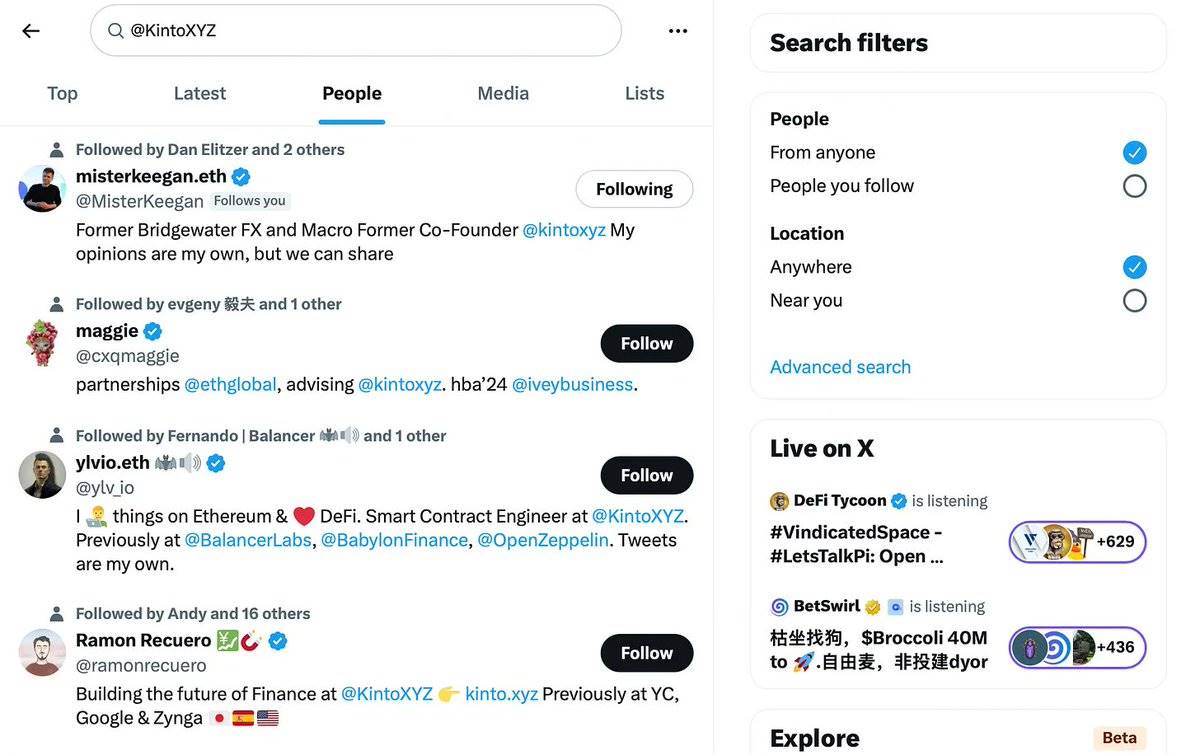

Using Kinto as an example, I want to highlight key evaluation points. Many struggle to find team information, but it’s simple: search the brand name on X (Twitter) and LinkedIn to browse team profiles and assess their expertise.

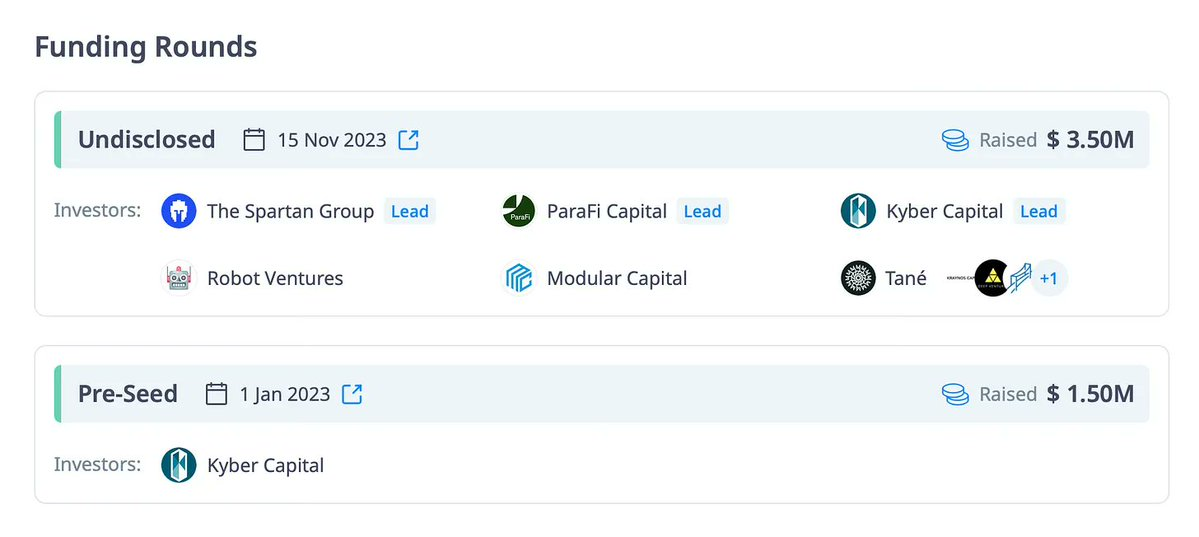

When evaluating funding rounds, note these key points:

-

Whether lead VCs continue participating in follow-on rounds (e.g., Kyber Capital) signals investor confidence.

-

On Cryptorank, VCs are ranked by activity level. You can also review their portfolio performance for reference.

The more projects you analyze this way, the more efficient your research becomes, allowing you to quickly identify potential risks and opportunities.

Kinto’s partners include notable protocols such as Caldera, Socket, and Arbitrum.

My scoring for Kinto:

-

Team: 5 points

-

VCs: 4 points

-

Funding: 4 points

-

Partnerships: 4 points

Average: 4.25

Step 3: Tokenomics

Tokenomics is one of the most challenging parts of project analysis, especially after many disappointing launches featuring low float and high fully diluted valuations (FDV).

Key areas to focus on:

-

Is the FDV at TGE (Token Generation Event) reasonable? (Prior analysis of product and team is critical here.)

-

Circulating supply of tokens.

-

Token distribution model.

-

Lock-up and vesting schedule design.

-

Supply-demand utility.

-

Short- and mid-term inflation.

-

Token issuance mechanism.

Our core task is answering three key questions:

-

Did the project launch at an FDV supportive of short-term growth?

-

Are there factors likely to cause sell pressure post-listing (e.g., airdrops, public or whitelist presales, advisor or ambassador tokens)?

-

Given the token’s actual utility, does holding it make sense in the medium term?

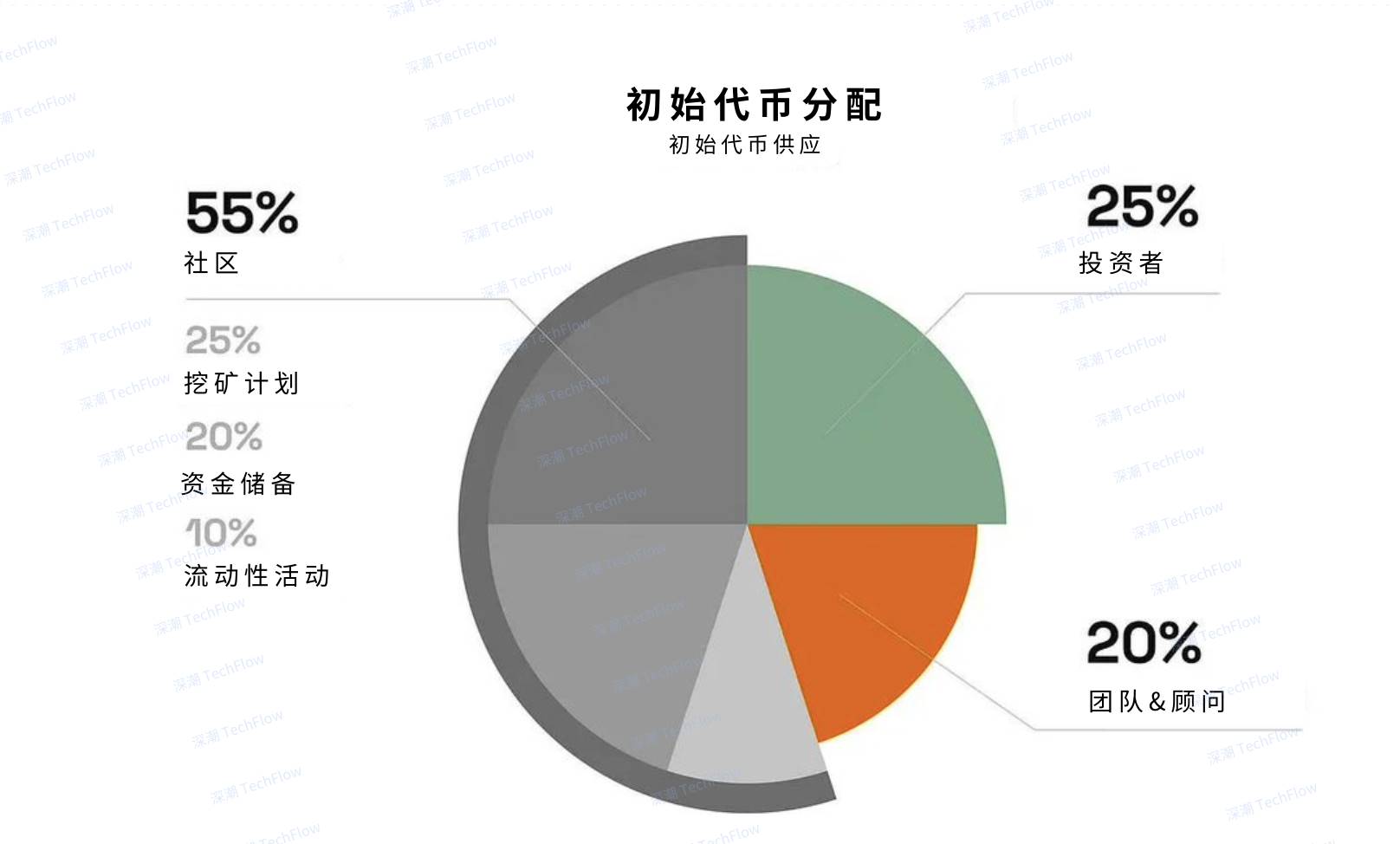

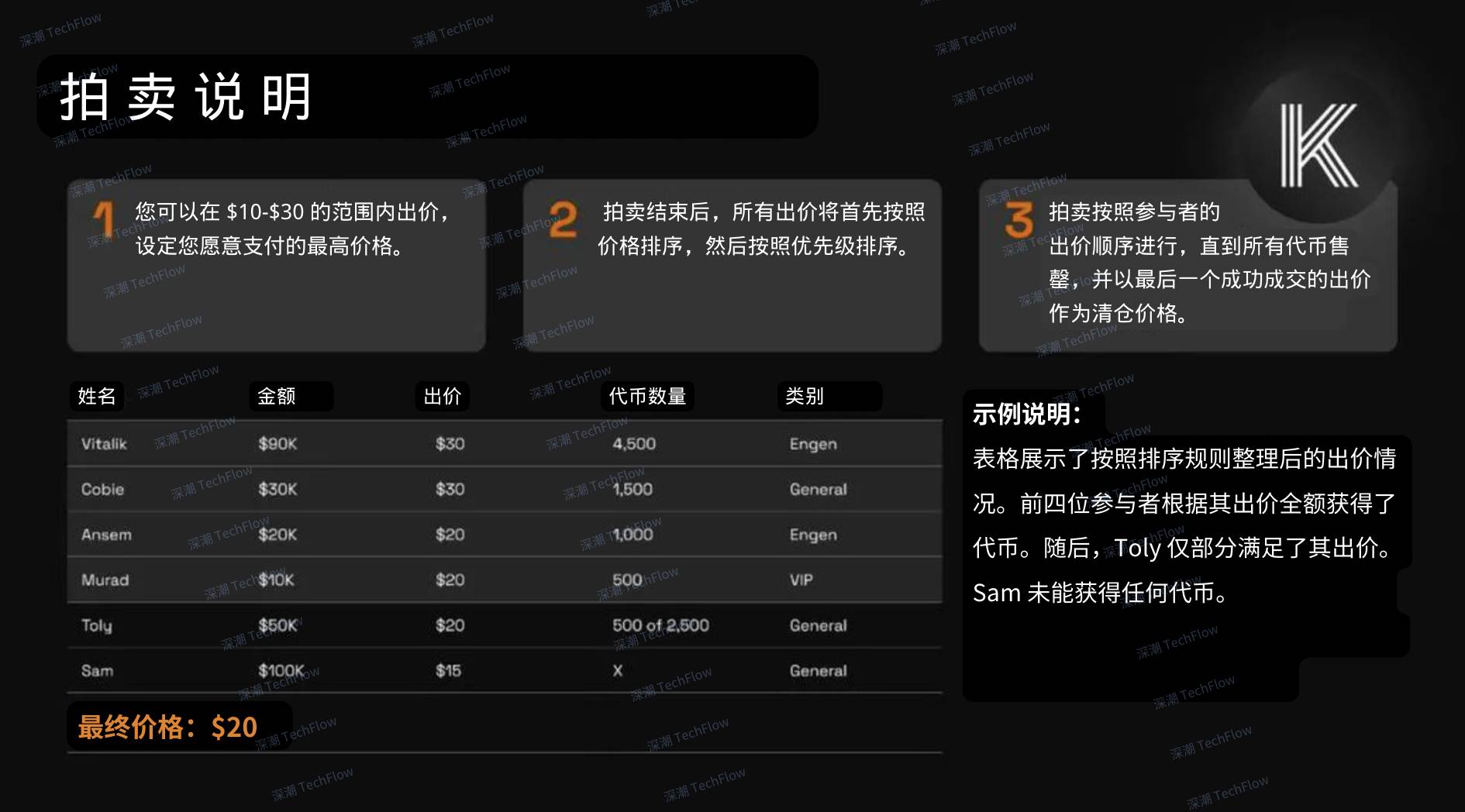

Below is my analysis of Kinto’s tokenomics, split into two parts.

(Original image by Stacy Muur, translated by TechFlow)

Positive factors:

-

The auction mechanism allows users to set preferred purchase prices, aiding fairer FDV discovery.

-

70% of the total token supply is allocated to the community, signaling strong commitment to decentralization.

-

Team tokens have a 3–4 year vesting period, reducing short-term sell pressure.

-

No lock-up for auction participants increases token liquidity.

-

High VC round transparency: Kinto’s latest funding priced tokens at $10 ($100M FDV).

-

Based on market expectations, auction prices may range from $20–$30, resulting in a $200M–$300M FDV—relatively reasonable.

-

$K is more than a governance token—it’s used to pay for account recovery and wallet insurance expansion. All protocol revenue flows into the treasury, managed by token holders via on-chain governance.

Concerns:

-

The auction pricing mechanism may cap post-TGE price upside.

-

Airdrops could increase sell pressure.

-

Tokens aren’t immediately transferable; to achieve transferability before March 31, at least two of the following three conditions must be met:

-

At least 20% circulating supply: To prevent low-float, high-FDV launches, at least 20% of tokens must be fully unlocked and distributed.

-

Governance Phase 2 achieved: The first Nios election has taken place, and the Roll-up has reached Stage 1 (nearly complete, expected before March 31).

-

$100M TVL: Network TVL must exceed $100M for over four weeks.

-

(Original image by Stacy Muur, translated by TechFlow)

My tokenomics score for Kinto: 3.25.

Step 4: Community

The final aspect to analyze when researching a token launch is the protocol’s community—its activity, loyalty, and size. A loyal and active community, combined with a solid product, can yield exceptional results, as seen with Hyperliquid. This area therefore deserves close attention.

We should examine:

-

Number of high-quality users: How many truly influential and contributing members are in the community?

-

Community activity: Engagement, discussions, and participation levels.

-

Product usage: Assess post-TGE user retention and token demand by analyzing real product usage.

-

Demand related to launch platform: Some launch platforms (e.g., CoinList) have highly active investor communities, directly impacting token demand.

How to track this information?

-

Analyze authenticity of engagement data: For example, if a tweet has high retweets but nearly identical likes, it may indicate fake activity or Galxe-style campaign participation. Typically, retweet-to-like ratios shouldn’t exceed 1:5.

-

Use analytics tools: Tools like Moni Discover, TweetScout, or Kaito help track community attention and high-quality user counts, offering efficient insights into real community vitality and potential.

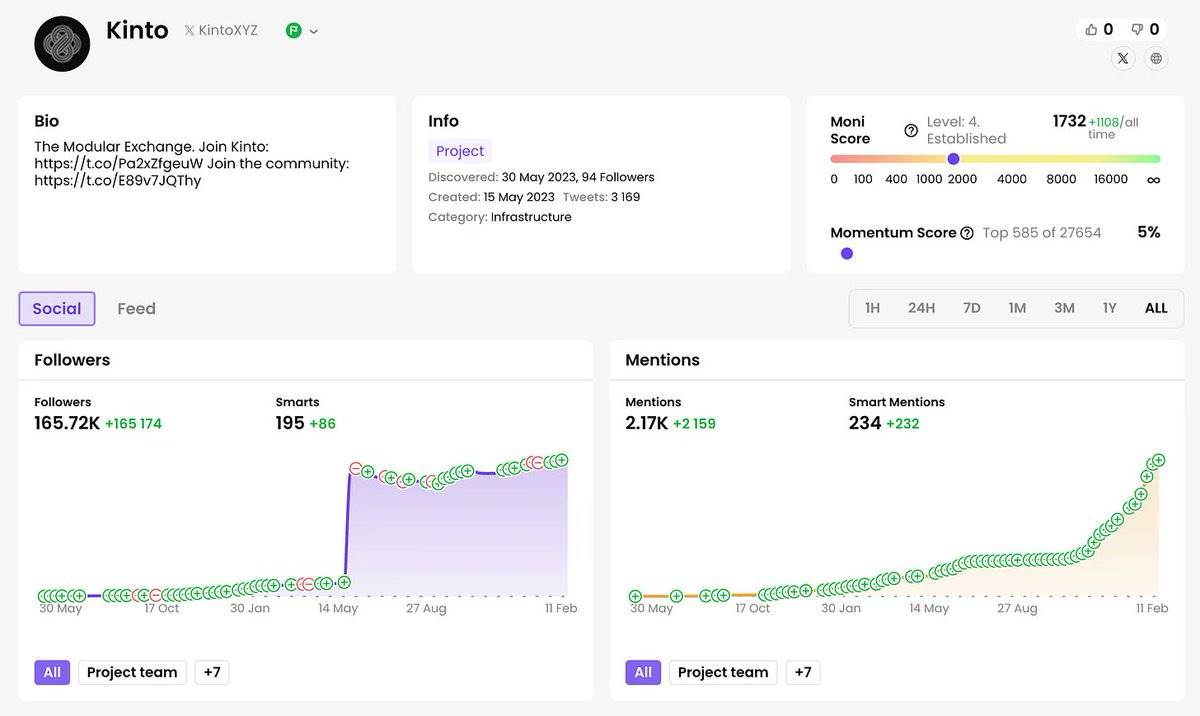

Kinto’s follower count on Moni shows significant growth. This usually correlates with one of two scenarios:

-

Fake followers (bots)

-

Promotions or giveaways resembling Galxe or Zealy campaigns

Therefore, we estimate Kinto’s genuine, active X followers to be around 35,000—a number consistent with other metrics.

The “Smart Mentions” chart looks strong. Thus, my final community score for Kinto is 3.75.

What’s Next?

The analysis so far is critical for assessing the reasonableness of a project’s launch FDV, evaluating growth potential, and deciding whether to engage.

Next, calculate the final average score for the protocol and make your decision accordingly. Below is my typical scoring guide:

-

Below 2.5: Skip entirely; not recommended.

-

2.5–3: Consider only if the project has distinct advantages (e.g., innovation trigger point or high Kaito platform attention with active community).

-

3–3.5: If participating, commit only small capital due to high risk.

-

3.5–4: Likely a tier-3 protocol; could be a decent opportunity if multiple favorable factors align, but don’t over-allocate.

-

4–4.5: High-quality product, worth participating in the token launch.

-

4.5–5: Rare, high-potential gem—definitely worth watching.

My average score for Kinto is 3.71.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News