Is TVL the Only Metric for the Restaking Sector, Judging by Babylon Cap2's TVL Growth?

TechFlow Selected TechFlow Selected

Is TVL the Only Metric for the Restaking Sector, Judging by Babylon Cap2's TVL Growth?

Under the "points game" rules of Restaking, should we still adhere strictly to "TVL" as the key metric?

Written by: DeFiMaximalist, Jiamigou

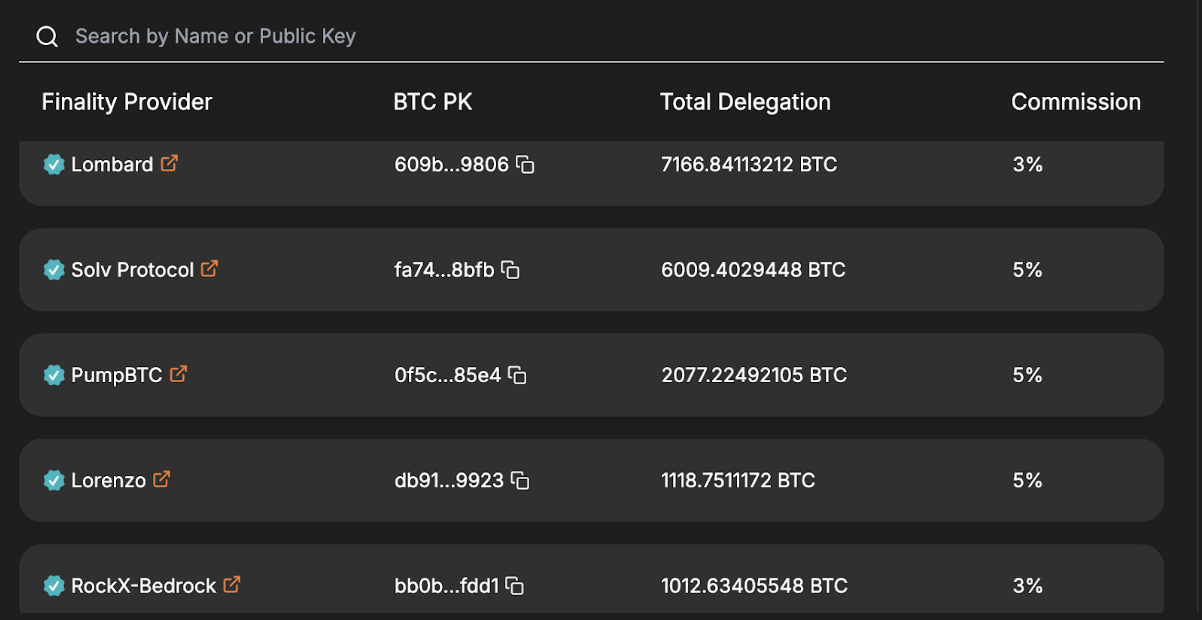

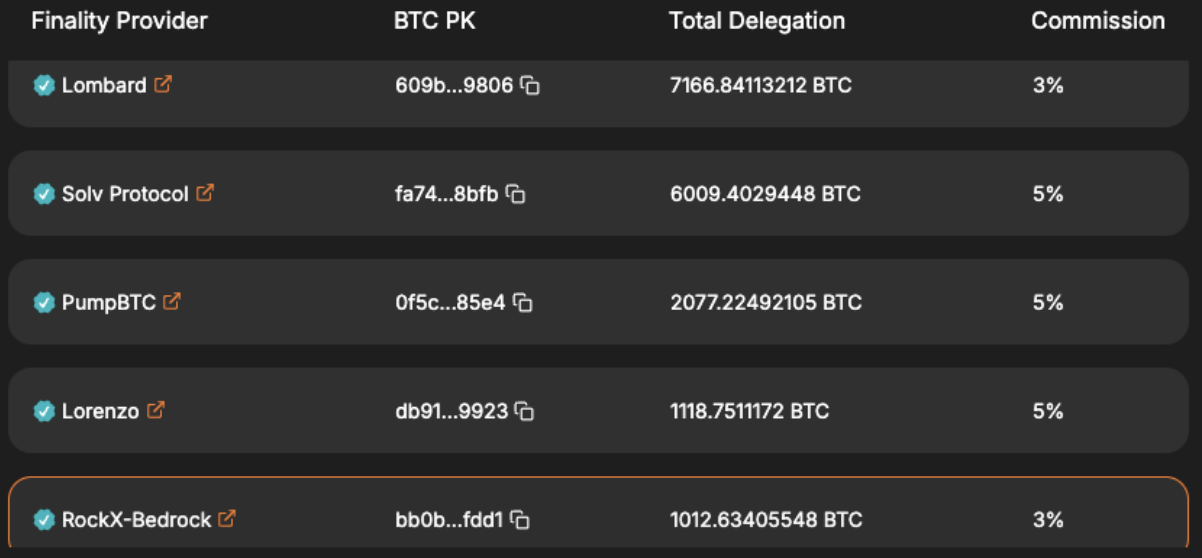

Babylon Phase-1 Cap-2 concluded at 03:08 AM (UTC+8) on October 9 (block height 864799). A total of 22,891 BTC were deposited into Babylon, with over 12,000 stakers participating. Gas fees surged from 60 satoshis to a peak of 5,281 satoshis, consuming 1.56 BTC in total. The performance of major players in the BTC restaking赛道 is as follows:

(source: https://btcstaking.babylonlabs.io/, https://x.com/babylonlabs_io/status/1843795315721416722,

https://mempool.space/zh/block/000000000000000000001e14e2e02b7ecd370f30e9e6d32042b569dc8cf0f597 )

At this moment that should have been one for celebration, I urge everyone to pause and reflect: under the "points race" rules of restaking, should we still blindly worship TVL?

1. Beware the "Too Big to Fail" Illusion of TVL

Less than 10 days ago, EigenLayer—the creator of restaking and the force behind popularizing the points game—unlocked transfers for its $EIGEN token after a 5-month lock-up period. It peaked at $4.5 and now trades around $3.78, with a circulating market cap of approximately $700 million and a fully diluted valuation (FDM) of about $6.35 billion. Compare this to EigenLayer’s peak TVL exceeding $20 billion, and current TVL of $11,726,166,528.30 (~$11 billion). The vast gap between EigenLayer's massive TVL and the current market value of $EIGEN leaves ambitious restakers only able to sigh: “It's like drinking water—only you know if it's hot or cold.”

(source: https://coinmarketcap.com/currencies/eigenlayer/, https://defillama.com/protocol/eigenlayer#information)

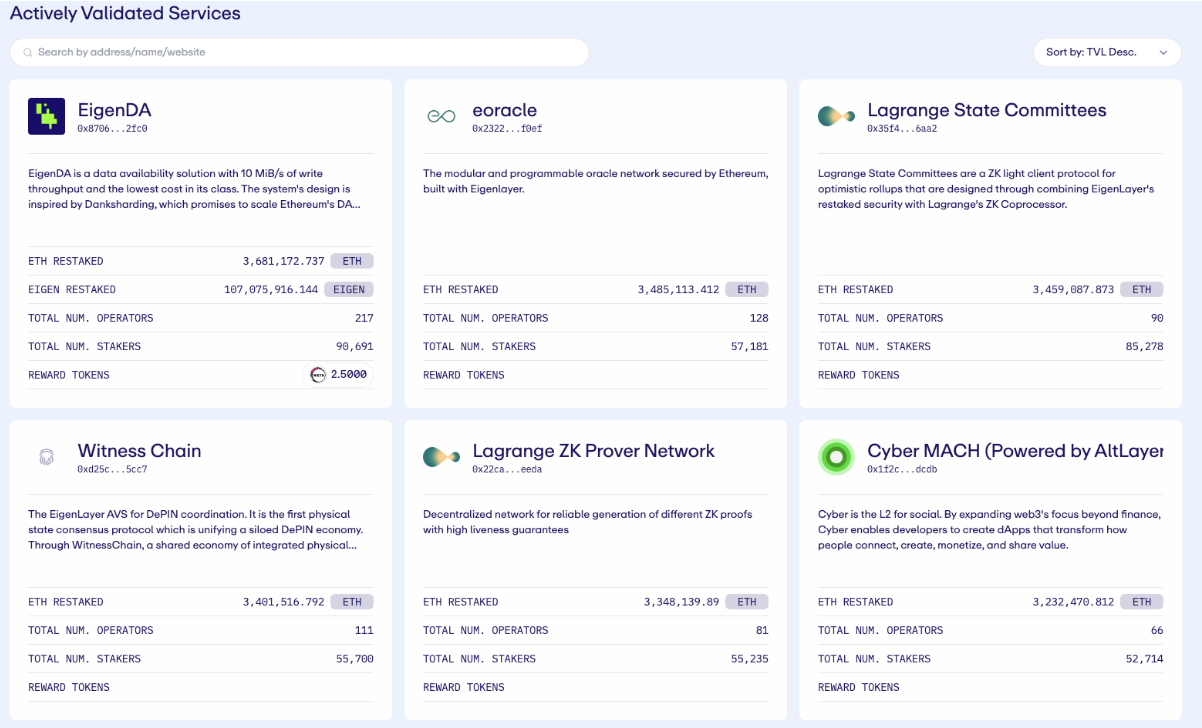

2. Excessively High TVL Only Dilutes Rewards

EigenLayer has implemented several measures to protect smaller restakers: minimum balance protections, a 5-month post-launch token lock-up, and additional airdrops before circulation. These helped prevent a massive sell-off, especially during the 5-month lock-up intended to buy time for AVSs (Actively Validated Services) to grow—but results have been minimal. Even when some AVSs begin gaining traction, EigenLayer’s TVL is now far beyond what AVSs can absorb. Among 17 launched AVSs, 15 have delegated ETH TVL exceeding $1.5 billion. How many of these services can actually justify securing $1.5 billion? Could this be the core bottleneck to AVS development? EigenLayer’s oversized TVL renders AVS rewards nearly negligible. For example, EigenDA currently offers weekly rewards of just 2.5 ETH, despite having over $900 million worth of delegated ETH and EIGEN tokens.

(source: https://app.eigenlayer.xyz/avs/0x870679e138bcdf293b7ff14dd44b70fc97e12fc0)

3. In Today’s Points Race, Restaking Needs New Metrics

I won’t delve into how to improve EigenLayer’s yields—after all, “Render unto Caesar the things which are Caesar’s.” The “Caesars” will deal with their own issues. For us regular restakers, what matters most is real yield—no one wants to wake up early and stay up late chasing early mining rewards only to realize they’re just working for miners. Let’s revisit the good old days of DeFi Summer, when APR was our compass. As an intuitive measure of return, APR once drove frenzied behavior: “With 100% profit, capital dares to defy death; with 300%, it tramples all laws of humanity”—from Das Kapital. But in today’s points era, we cannot directly compare EigenLayer points with Babylon points because points, by definition, lack liquidity and pricing. However, within the same ecosystem, we can calculate how many points the same value of assets earns. Thus, we propose a new metric for the points era: PPC—Points Per Coin!

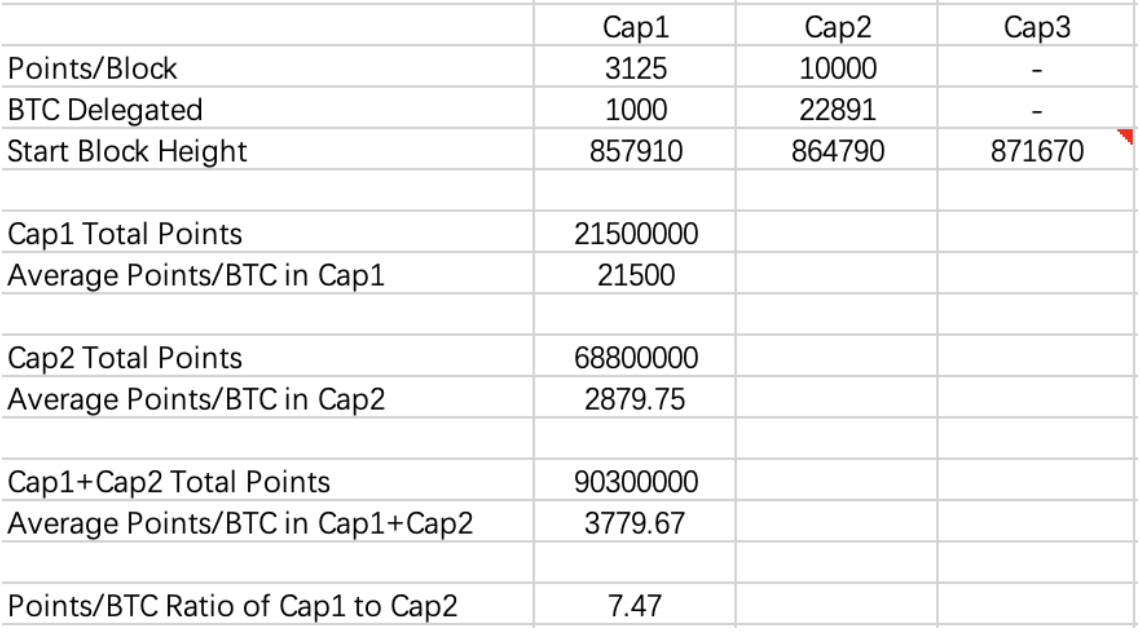

4. How to Calculate PPC—Points Per Coin

Take Babylon as an example. It opened two caps: Cap1 with 1,000 BTC and Cap2 with 22,891 BTC. The point generation rules differ between phases: 3,125 points per block in Cap1, and 10,000 points per block in Cap2. Assuming the block interval from Cap2 to Cap3 equals that from Cap1 to Cap2, we can estimate that each BTC in Cap1 earned an average of 21,500 Babylon Points, while each BTC in Cap2 earned only 2,879.75 points—a difference of over 7x! Clearly, Cap1 offered exceptional value.

5. Comparing Participants in the Babylon Restaking Ecosystem

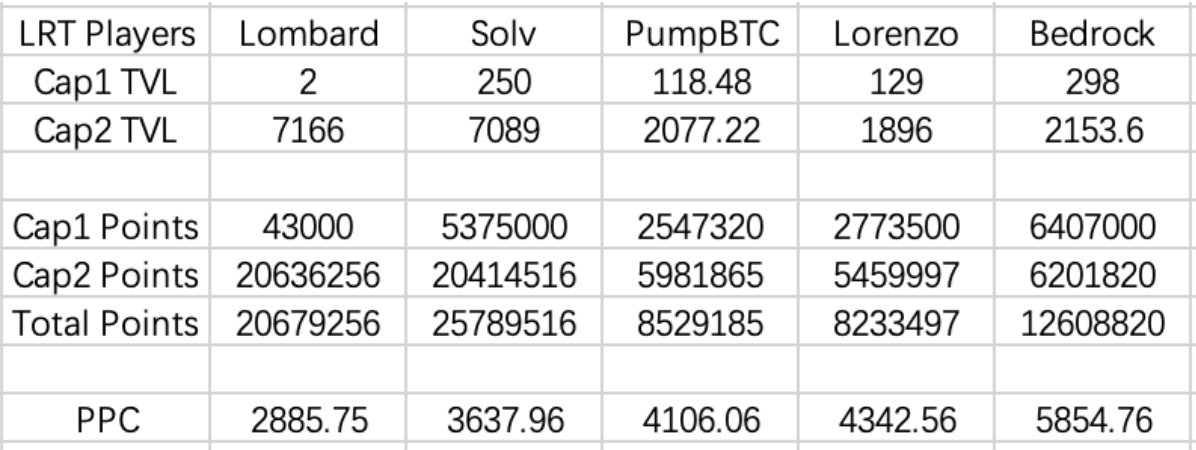

Now let’s calculate the PPC for major participants (top 5 Finality Providers on Babylon’s official site post-Cap2):

PS: Staked BTC data is taken as the highest value among Babylon’s official website, project social media, and project websites.

As shown:

-

Ranked by TVL: Lombard, Solv, Bedrock, PumpBTC, Lorenzo;

-

Ranked by PPC: Bedrock, Lorenzo, PumpBTC, Solv, Lombard.

Considering both TVL and yield, Bedrock scores the highest overall.

6. For Both Babylon and the BTC Ecosystem, This Is Just the Beginning

The 22,000+ BTC staked last night may seem substantial, but valued in USD it’s roughly $1.5 billion—only about 14% of EigenLayer’s TVL. Comparing Babylon to EigenLayer now might seem unfair, but the crypto market needs Babylon even more urgently than it needed EigenLayer:

1. From a holder’s perspective, BTC holders need decentralized platforms to generate staking yields more desperately than ETH holders;

2. From a Layer2 standpoint, BTC L2s need Validators-as-a-Service more acutely than ETH L2s. Unlike AVSs, multiple BTC L2s already have higher TVL than Babylon itself—though conversely, one could argue Babylon is intentionally limiting its TVL growth;

3. From infrastructure needs, BTC’s demand for Babylon is far greater than ETH’s demand for EigenLayer. Ethereum already has abundant developer tools and infrastructure. In contrast, in the BTC ecosystem, a single innovation like Ordinals caused massive market excitement. Imagine the transformation once Babylon matures—BTC’s ecosystem could undergo a revolutionary shift.

Don’t forget: BTC’s market cap represents much more than half of the entire crypto market. Everything has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News