Babylon Q1 2025 Report: BTC Staking Progresses Steadily, Ecosystem Reaches Initial Scale

TechFlow Selected TechFlow Selected

Babylon Q1 2025 Report: BTC Staking Progresses Steadily, Ecosystem Reaches Initial Scale

From its original vision to a three-phase deployment, ultimately forming a multi-chain security market, Babylon innovatively redefines how Bitcoin interacts with advanced blockchain ecosystems.

Author: Reflexivity Research

Translation: TechFlow

Introduction

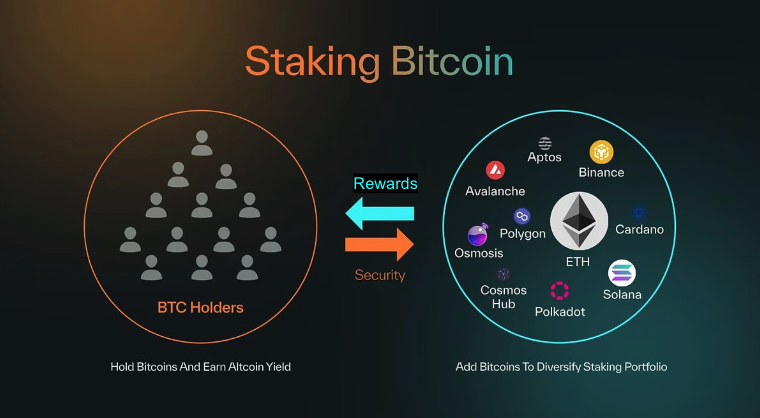

Over the past decade, Bitcoin has firmly held its position as the leading cryptocurrency globally due to its security and value. Its simple, tamper-resistant design combined with the PoW consensus mechanism has made it the frontrunner in the digital asset space. However, despite a market capitalization of approximately $2 trillion, Bitcoin's potential for more complex blockchain applications remains largely untapped.

In contrast, other cryptocurrencies utilizing PoS networks—such as Ethereum, Solana, and Cosmos-based chains—have demonstrated the economic potential of staking and smart contracts, fueling growth in decentralized applications (dApps), liquidity provision, and lending. Nevertheless, many PoS chains face funding challenges during launch, struggling to accumulate sufficient capital to build a robust validator set and resist attacks.

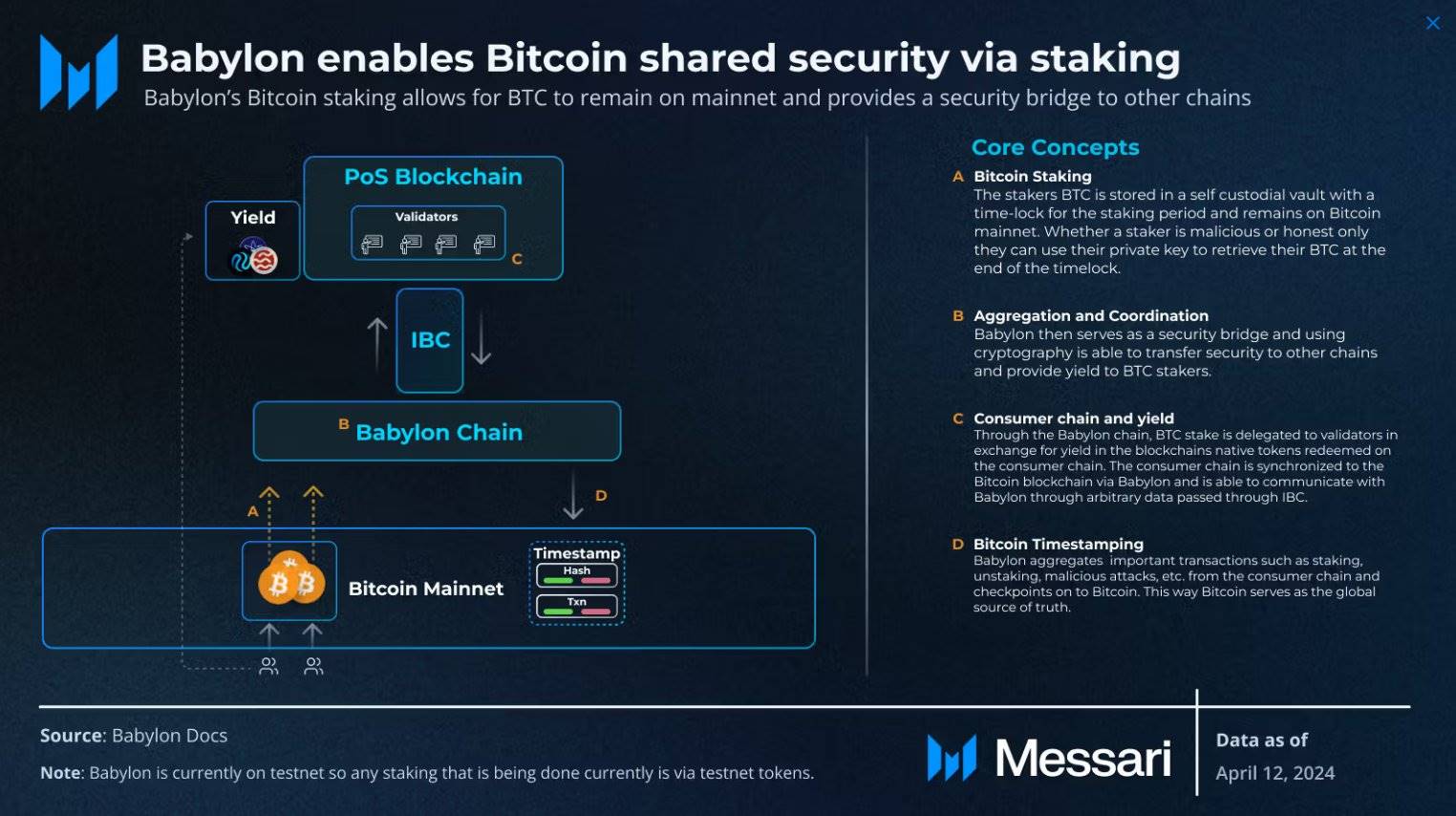

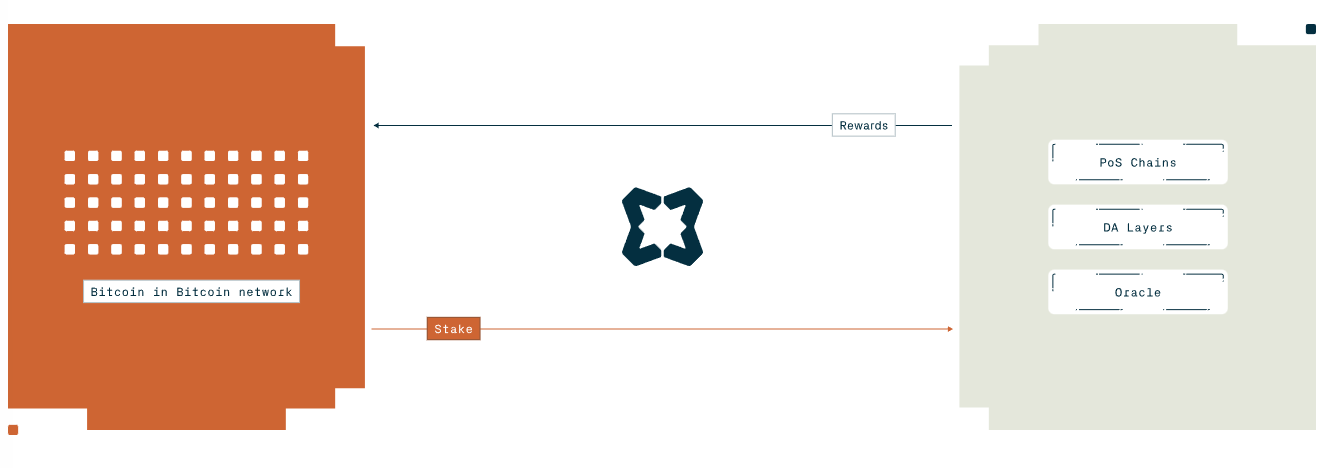

The Babylon protocol was created to combine the strengths of Bitcoin with various Layer1 PoS platforms, unlocking Bitcoin’s capital value through a trustless, direct anchoring to the Bitcoin blockchain. Babylon does not bridge BTC into wrapped assets nor rely on large custodians. Instead, it builds a unique Layer1 to serve as Bitcoin’s staking infrastructure.

In other words, Babylon is neither a "Bitcoin sidechain" nor an L2 solution dependent on bridges. It is a fully independent, feature-complete Layer1 built using the Cosmos-SDK. It can run its own dApps and support an entire ecosystem, while deriving economic security from Babylon’s Bitcoin staking protocol.

This report will deeply analyze the design of the Babylon protocol, focusing on its characteristics as a Layer1, its mission to bring practical utility to Bitcoin, and the emerging ecosystem around it.

Babylon as a Layer 1

Babylon's core goal is to enable Bitcoin staking, but the team positions Babylonchain as a Bitcoin-Secured Network (BSN), competing directly with major Layer1s like Ethereum, Solana, and Sui to attract developers, users, and capital into the Bitcoin ecosystem. Unlike solutions that rely solely on bridging or deploying smart contracts on other chains, Babylon creates a chain capable of:

-

Setting its own consensus rules and evolving independently.

-

Using the Cosmos SDK and integrating the Inter-Blockchain Communication (IBC) protocol.

-

Supporting native dApps, enabling developers to build freely within a Turing-complete environment while being linked to Bitcoin's security.

-

Managing real BTC staking on the Bitcoin mainnet via dedicated on-chain logic.

Babylon aims to rival Layer1s like Solana or Sui by achieving high throughput, fostering an active developer community, and building a large user base. Its key advantage lies in incorporating staked BTC into Babylonchain’s architecture for security, rather than relying solely on the market value of newly issued tokens.

Babylon L1 itself is a PoS-based blockchain that runs consensus by selecting validators and Finality Providers (FPs) based on the amount of BTC delegated. Users do not need to bridge BTC onto the chain; instead, they lock BTC directly on the Bitcoin blockchain into a specific script and delegate voting rights to FPs on Babylon. This means no third-party custodian holds the BTC—stakers remain self-custodial, which is central to Babylonchain’s security model.

Babylonchain’s Security Model

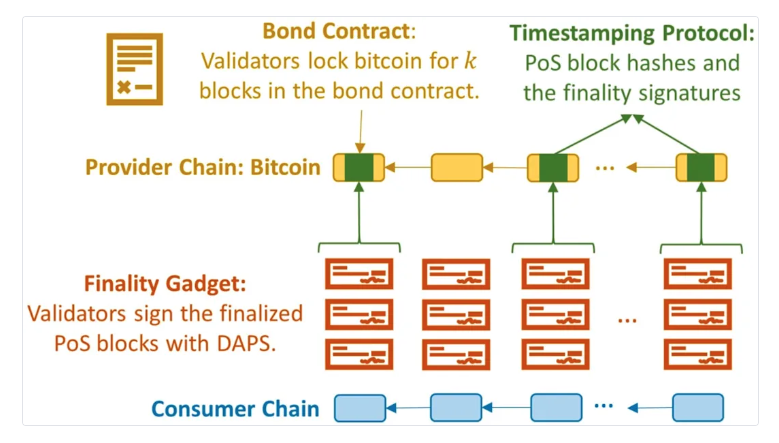

Both Babylon’s BTC staking infrastructure and Babylonchain employ multi-layered cryptographic security mechanisms, placing it at the forefront of the BTC staking ecosystem. Here’s how it works:

-

BTC Locked on Bitcoin Mainnet: Through a specialized script called a “bond contract,” funds are secured and cannot be moved until the staker unbonds or the staking period expires.

-

Use of Extractable One-Time Signatures (EOTS): Thanks to Bitcoin-native Schnorr signatures, if a validator double-signs a block, their private key can be extracted, allowing anyone to broadcast a transaction on Bitcoin to burn part of the staked BTC.

-

Block Finality Signatures: Validators sign blocks on Babylonchain with special keys. Signing contradictory final states results in punishable losses.

-

Regular Anchoring to Bitcoin: Chain data is periodically embedded into the Bitcoin blockchain, preventing long-range attacks or state rollbacks without detection. For Babylon, however, timestamps are only one component of its security framework.

This layered design means any malicious attack on Babylonchain or other BSNs would be deterred by the risk of actual BTC loss. This is why Bitcoin is considered the ultimate security foundation—the destroyed BTC cannot be easily recovered.

Why Build a Standalone Layer1?

Why build a new chain from scratch instead of leveraging existing infrastructure? Simply put, advanced staking functionality requires fine-grained control over staking logic, slashing mechanisms, and cross-chain coordination—beyond what traditional bridges or contract-based solutions can offer.

What makes Babylonchain unique:

-

Manage Staking and Slashing: As a Layer1, Babylonchain ensures Bitcoin staking security is trustless, enforceable, and self-custodial. It implements slashing by cryptographically extracting private keys upon double-signing, incentivizing honest behavior and deterring malicious actors—without needing complex bridge contracts or sidechains on Bitcoin.

-

Empower Developer Ecosystem: Provides a Turing-complete environment where developers can build dApps leveraging Bitcoin capital.

-

Serve as an Optional Hub: Other PoS chains (or even specific L2s, oracles, or data availability layers) can choose to "buy security" from the aggregated staked BTC on Babylon, making Babylonchain the control center for these interactions.

Babylon not only solves technical security challenges but also aims to bring Bitcoin’s user base and brand influence into a new ecosystem. By attracting significant liquidity and providing comprehensive developer tools, Babylon is determined to challenge existing Layer1s and has a clear path toward achieving this goal.

Specifically, Babylonchain’s success depends on creating real utility for BTC:

-

Support Native dApps: The ultimate goal is to create DeFi protocols that accept BTC as collateral while letting users retain control of their funds. However, as of Q1 2025, staked BTC cannot yet be used directly in DeFi on Babylonchain and currently relies on custodial liquid staking tokens (LSTs). LST services stake BTC on behalf of users and mint tokens representing staking positions on PoS chains.

-

Aggregate Security: For emerging blockchains or L2s seeking strong security quickly, Babylon can act as an anchor, offering "Bitcoin-grade economic security" while allowing stakers to earn multiple rewards.

-

Bitcoin-First Developer Experience: Many developers want to build on Bitcoin but are limited by its scripting language or bridging constraints. Babylonchain’s approach simplifies this process.

Three Phases of Mainnet Deployment

Babylonchain’s mainnet deployment is divided into three phases, each focused on different objectives. This phased strategy ensures core subsystems are thoroughly tested, allowing users, developers, and external PoS chains to evolve alongside the network.

Phase One – Supply-Side Bootstrapping

Phase One focuses on acquiring and organizing the supply side of Bitcoin staking, laying the foundation for Babylonchain. Users stake real BTC on the Bitcoin mainnet via a dedicated script, locking funds in a self-custodial manner. In the future, these stakers will assume PoS voting responsibilities (or delegate to FPs) once the Babylon blockchain is fully launched. However, in Phase One, the primary goal is to validate user interest and test the staking infrastructure.

Stakers lock BTC into timelock scripts on-chain, typically with a lock-up period of about 15 months. To reduce complexity and allow participants to freely experiment with staking and unbonding, the slashing mechanism is deliberately disabled in Phase One—stakers face no penalties for misbehavior.

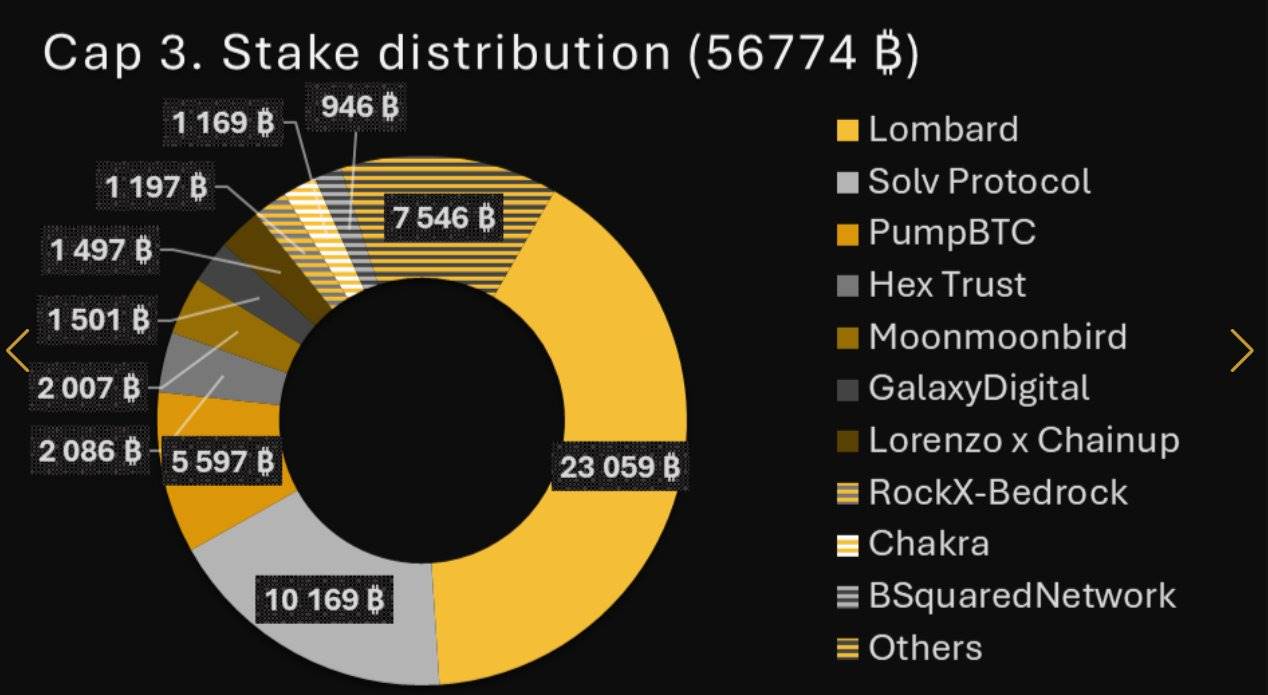

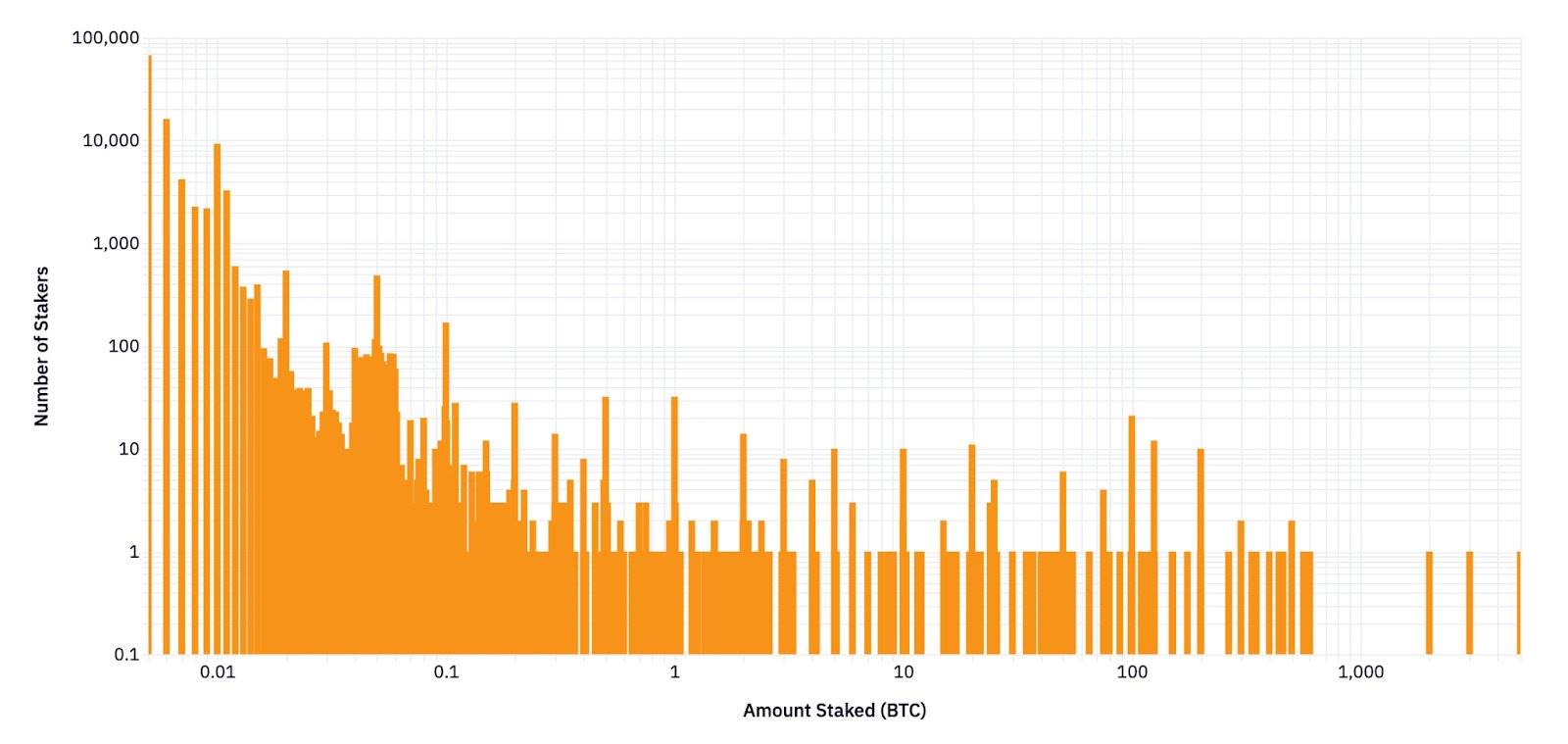

Initially, the protocol set a cap of 1,000 BTC to test interest and infrastructure. Subsequently, additional windows (Cap-2 and Cap-3) were opened, allowing more BTC inflow. By the end of Phase One, over 56,000 BTC had been staked by more than 135,000 participants. In December, a prominent entity staked 10,000 BTC, signaling strong confidence in its trustless design. These caps validated diverse holders’ demand for and trust in a self-custodial BTC staking model.

Additionally, the protocol uses a points system rather than direct token rewards to track staker participation, measuring the amount and duration of staked BTC and associated FPs to assess user activity without prematurely distributing native tokens.

Phase Two – Babylonchain Activation

Building on the success of Phase One, Phase Two transitions Babylon from mere staking to a fully operational blockchain executing large-scale Bitcoin-staking security. The locked BTC shifts from placeholder status to actively securing assets. FPs receiving sufficient BTC delegation will directly participate in Babylonchain’s on-chain consensus.

The BTC locked in Phase One becomes the economic backbone of Babylonchain’s PoS consensus. FPs (and self-delegating stakers running their own nodes) are responsible for block finalization and validation, with malicious actions resulting in real financial losses. Once slashing is enabled, any violation of consensus rules triggers the burning of staked BTC on the Bitcoin mainnet.

Phase Two continues to leverage Bitcoin for anchoring, with an upgraded timestamp protocol embedding key Babylon events regularly into Bitcoin blocks, preventing malicious rollbacks.

Transitioning from Placeholder to Real Security

In Phase One, stakers “pre-positioned” BTC; now, this capital actively supports Babylonchain’s consensus. This shift gives the network a strong security budget from day one—an extreme rarity for new chains. Phase Two also positions Babylon as a direct competitor to existing Layer1s, standing out by relying on slashable BTC rather than just native token economics.

Impacts on the Babylon ecosystem include:

-

Increased Validator Accountability: With slashing enabled, FPs and validators must maintain flawless key management and behavior, or risk permanent loss of staked BTC.

-

Developer Onboarding: High security and on-chain operation (permissioned) of CosmWasm supporting BTC LST attract dApp developers eager to reach Bitcoin users.

-

Enabling Multi-Staking: After stabilizing under its own PoS consensus, attention turns to providing cross-chain security for other networks. Success in Phase Two is crucial for building confidence in multi-staking.

Phase Three – Multi-Staking and Broad Adoption

Phase Three realizes Babylonchain’s vision of creating a multi-chain security market, where each unit of staked BTC can simultaneously protect multiple PoS systems. Babylon aims to become the preferred hub for BSNs, opening its BTC reserves to blockchains wishing to rent secure validation capacity.

Specifically, users (or FPs) can allocate their BTC stakes across multiple PoS networks, each offering native token rewards. This creates an ecosystem where stakers earn叠加 returns, and consumer chains gain robust protection from Bitcoin’s economic power. Any PoS chain, L2, oracle, or data availability project can opt to join Babylonchain’s security layer. These chains are known as “Bitcoin-Secured Networks” (BSNs), outsourcing part of their consensus security to Babylon’s staked BTC and paying stable rewards or fees to participants.

Babylonchain oversees the cross-chain staking process, verifying delegations, collecting evidence of malfeasance, and enforcing slashing when necessary, ensuring consistent security standards across all participating networks.

Impact on BTC Holders

Stakers can decide how to distribute their BTC across consumer chains, earning diversified tokens and rewards. This overturns Bitcoin’s traditional narrative as a static store of value, transforming it into an active asset with multiple yield opportunities—without sacrificing Bitcoin’s trustless security on the mainnet.

As more chains compete for Bitcoin’s security and offer competitive APRs, demand for holding and staking BTC may rise, potentially reshaping mainstream investors’ perception of Bitcoin’s utility over the long term.

The Babylon Ecosystem

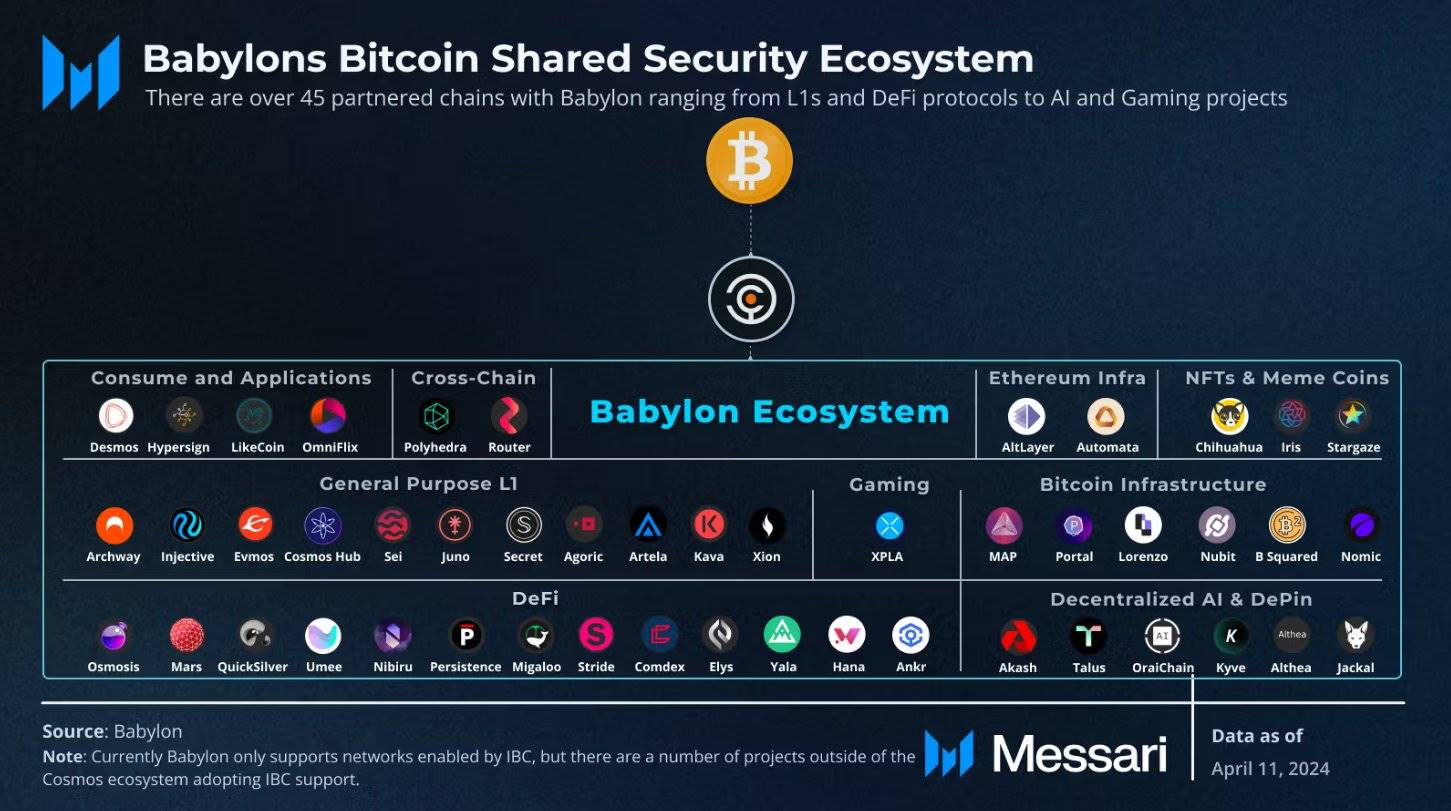

One notable outcome of the successful first phase of the Babylon Bitcoin staking protocol is the emergence of new collaborations. Over 150 Finality Providers (FPs)—including well-known institutions such as P2P, Galaxy Digital, and InfStones—have registered to receive BTC delegations. Major custodians like Anchorage Digital and Hex Trust have also integrated with the protocol, enabling institutional clients to natively stake BTC.

Additionally, a wave of Liquid Staking Token (LST) protocols has emerged around Phase One, allowing users to easily lock BTC and hold derivative tokens representing staking positions. Projects like Lombard, PumpBTC, and Lorenzo have launched targeted campaigns, managing tens of thousands of BTC.

These developments demonstrate widespread demand for BTC yields and hint at greater potential once the Babylon Layer1 launches:

-

DeFi Protocols: BTC can secure underlying chains while also serving as collateral in lending pools or decentralized stablecoins.

-

Data Availability and Oracle Services: Projects relying on cross-chain data can leverage Babylonchain’s aggregated security.

-

Innovative dApps: Through CosmWasm, developers can build advanced financial and social applications, all backed by real BTC collateral.

Lombard is a key partner of Babylonchain, dedicated to integrating Bitcoin into yield-generating activities while maintaining self-custody. Recently supported, Lombard’s “liquid bitcoin” approach is closely tied to Babylon’s staking foundation.

LBTC (Liquid Bitcoin) Token

At the heart of Lombard is the LBTC token, serving as a tradable on-chain receipt for staked BTC within the Babylon protocol. Users deposit BTC into addresses controlled by Lombard, which then stakes on their behalf and mints LBTC. Users can deploy LBTC in lending protocols, decentralized exchanges, or other yield strategies, while their staked BTC contributes to Babylonchain’s security market. This partnership creates a “win-win”: Lombard helps users maintain liquidity, while Babylon gains more BTC staking, strengthening both ecosystems in the process.

PumpBTC is a user-centric liquid staking platform helping BTC holders maximize on-chain yield potential. It is rooted in Babylon’s native staking model.

PumpBTC simplifies the staking process by issuing transferable assets after users stake BTC via self-custodial scripts in the Babylon protocol. These assets act as “tickets” into various DeFi strategies, allowing users to maintain liquidity while their BTC is locked. The PumpBTC platform actively seeks opportunities across multiple PoS chains integrated with Babylon. As more networks become Bitcoin-Secured Networks, PumpBTC can direct stakers’ capital to the highest-yielding environments—amplifying the expanding market for BTC-based returns.

Because PumpBTC inherits Babylonchain’s trustless and slashable security, participants are protected from typical cross-chain risks. In cases of validator misbehavior, slashable stakes ensure bad actors face real economic penalties—reducing the likelihood of network-level exploits.

Lorenzo is an L2 infrastructure extending Bitcoin’s utility into sophisticated yield operations. It connects directly to Babylon’s staking mechanism, enabling its BTC holders to participate in advanced DeFi scenarios without relinquishing control. At the same time, Lorenzo offers structured financial products such as automated market-making or derivatives positions, all yields backed by Babylon’s security baseline. The project provides native rollups that manage complexity off-chain while periodically settling back to Bitcoin for reliability. By partnering with Babylon, Lorenzo ensures rollup finality and validator honesty are secured by slashable BTC, minimizing reliance on external trust.

Through interoperability with the Cosmos ecosystem and other IBC-enabled networks, Lorenzo’s L2 can seamlessly transfer data and value across different chains. BTC holders thus gain access to a wide range of dApps, liquidity pools, and staking markets.

Bitcoin-Secured Networks (BSNs)

With Phase Three approaching, several PoS chains have announced plans to become BSNs on Babylonchain, including Corn. Becoming a BSN means these chains formally integrate with Babylonchain, gaining several strategic advantages:

-

On-Demand Security: Each chain can pay rewards to Bitcoin (BTC) stakers to "borrow" shared security.

-

IBC and Interoperability: Built on the Cosmos SDK and the Inter-Blockchain Communication (IBC) protocol, integrated networks can communicate seamlessly with Babylonchain. This creates a fluid environment where tokens, data, and security can flow freely and trustlessly between chains.

-

Multi-Chain Staking Economy: A single staker’s BTC might earn small yields from five different networks, but collectively these could exceed returns from traditional BTC bridging or lending markets, offering strong incentives to stakers.

This layered security model aims to bring to Bitcoin an effect similar to Ethereum’s “restaking,” but using BTC as the ultimate capital base, fully operating on Babylonchain.

Developer Empowerment and dApp Potential

For an emerging native Layer1 chain, attracting and supporting an active developer community is a critical element of growth. Babylon achieves this through thoughtful initiatives, such as offering highly flexible smart contracts via CosmWasm, supporting upgradable logic, and accommodating a broad range of DeFi and NFT use cases. Additionally, Babylonchain supports Inter-Blockchain Communication (IBC), enabling direct interoperability with the broader Cosmos ecosystem. dApps on Babylonchain can therefore tap into vast liquidity pools and even share user bases across multiple IBC-enabled chains.

These two features are highly attractive to dApp developers, but Babylonchain believes its native access to Bitcoin is the true differentiator against other Layer-1 ecosystems. While it does not replicate Bitcoin’s PoW environment, it offers “remote staking” integrable at the contract level. Developers can build applications leveraging slashable staked BTC for finance, gaming, and more—minimizing reliance on trust.

Bringing Utility to Bitcoin

To understand the profound significance of the Babylon protocol, consider its implications for Bitcoin as an asset. Historically, Bitcoin has had two undeniable native uses:

-

Holding (store of value)

-

Spending/transferring (medium of exchange)

Beyond these, everything from bridging to wrapped tokens, and lending on centralized platforms, requires reliance on external entities or custodians. Babylon introduces staking as a new native use case for Bitcoin, allowing BTC holders to secure PoS networks without intermediaries or wrapped assets, while offering these unique advantages:

-

No Custody: Stakers do not hand over BTC to third parties; they lock it into a dedicated script on the Bitcoin chain.

-

Slashable: If a staker’s key signs blocks maliciously (e.g., double-signing to attack a PoS chain), the key can be cryptographically exposed, allowing the corresponding BTC to be burned.

-

Self-Custodial: Users can unbond and withdraw BTC from the staking script at any time, subject only to the unbonding schedule. After the unbonding period, users regain possession of standard BTC UTXOs.

The impact on Bitcoin is profound. For the first time, BTC holders can earn staking rewards through a minimally trusted process while preserving the principle of Bitcoin self-sovereignty. Meanwhile, the broader ecosystem gains unprecedented access to the largest crypto asset in a slashable form—a novel injection of capital.

Conclusion

From initial vision to a three-phase rollout culminating in a multi-chain security market, Babylon innovatively redefines how Bitcoin interacts with advanced blockchain ecosystems. Rather than focusing merely on bridging or timestamping, Babylon Labs has built a full Layer1 environment harnessing Bitcoin’s economic power. This approach has already been validated in Phase One by tens of thousands of BTC stakers, reflecting strong user demand to transform BTC into a yield-generating, chain-securing asset.

Looking ahead, Babylonchain’s trajectory will reshape the conversation around “using Bitcoin.” For the first time, BTC holders have a truly native way to earn yield, while decentralized networks gain a reliable source of security. As the Babylonchain Layer1 matures, developers can build dApps that merge Bitcoin’s sound monetary properties with the expressiveness and scalability of PoS blockchains.

Disclaimer: This report was commissioned by Babylon Labs. This research report is purely informational. It is not intended as financial advice, and you should not blindly assume any information presented here is accurate without conducting your own verification. Bitcoin, cryptocurrencies, and other digital assets involve significant risks. Nothing in this report should be interpreted as an endorsement to buy or sell any asset. Never invest more than you can afford to lose, and understand the risks you are taking. Conduct your own research. All information in this report is for educational purposes only and should not serve as the basis for any investment decision.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News