$875 Airdrop for Low-Income Users: ether.fi Airdrop Distribution and Eligibility Overview

TechFlow Selected TechFlow Selected

$875 Airdrop for Low-Income Users: ether.fi Airdrop Distribution and Eligibility Overview

$2,875 per capita, $875 for minimum living standard.

By Karen, Foresight News

The ether.fi airdrop distribution has become the focus of community discussion today. After Justin Sun deposited a massive 120,000 ETH (worth up to $480 million) into ether.fi last week, users widely expressed concerns about potential dilution of their airdrop shares. Today, ether.fi adjusted its token allocation based on community feedback to better balance interests between whales and smaller participants. However, its linear distribution model still faces skepticism from some members of the community.

How is the airdrop distributed?

According to the data released, Q1 airdrop allocations account for 6.8% of the total token supply, with the snapshot timestamp set at 08:01 on March 15, 2024.

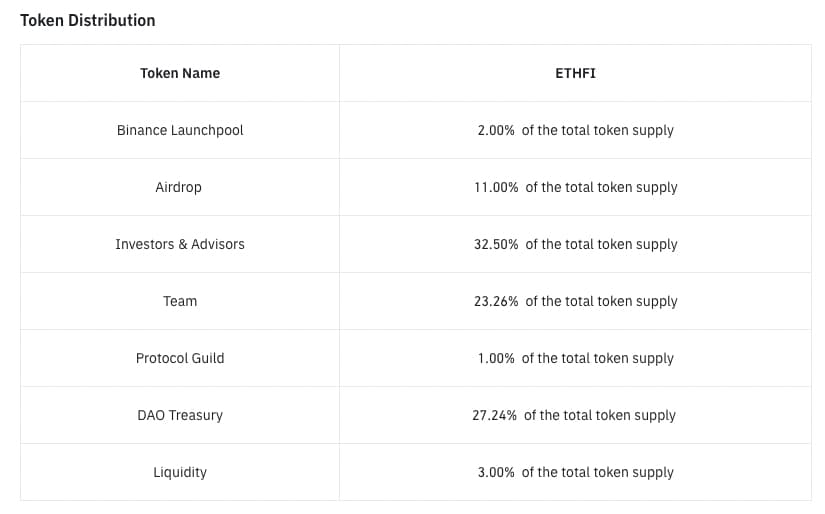

Per the ETHFI tokenomics, the total supply is 1 billion tokens, with a circulating supply of 115.2 million. The token distribution includes 2% allocated to Binance Launchpool, 11% to airdrops, 32.5% to investors and advisors, 23.26% to the team, 1% to Protocol Guild, 27.24% to the DAO Treasury, and 3% for liquidity provision.

This airdrop ratio reflects the project's emphasis on early contributors. In response to community feedback, ether.fi has additionally allocated 12 million ETHFI (1.2% of total supply) specifically to small stakers, and this portion will not dilute the allocations of large holders (whales).

The average airdrop per user is 575 tokens—valued at $2,875 based on the lowest asking price in Whale Market’s pre-launch marketplace—with a median of 175 tokens ($875). According to community reports, the minimum airdrop amount also appears to be 175 ETHFI.

The address receiving the largest airdrop allocation—approximately 3 million tokens—belongs to Justin Sun, who deposited assets worth $480 million during the Final Countdown campaign. However, ether.fi previously clarified that whale wallets will be subject to a 3-month vesting period. The Final Countdown event ran from March 5 to March 15 and used a matching model: every 50,000 ETH staked earned 0.125% of the tokens, with existing stakers receiving the same 0.125% matching rate. This campaign enabled the community to receive an additional 7.7 million tokens in distribution.

Regarding specific distributions to stakers, 90% (61 million tokens) were allocated proportionally based on contributions. ether.fi adopted a linear distribution model, which benefits smaller stakers.

In terms of deposit value, the bottom 50% of wallets contributed 1.8% of the total staked value but are eligible to receive 18% of the token distribution. In contrast, the top 10% of wallets contributed 88% of the TVL but can only claim 65% of the tokens. This indicates a clear tilt toward smaller participants to encourage broader engagement.

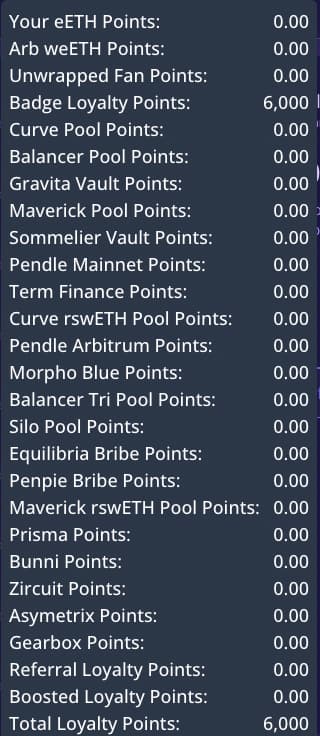

ether.fi explained that it chose a linear model over a tiered one because tiered airdrops are highly susceptible to manipulation and Sybil attacks. Nevertheless, the linear distribution model has sparked some criticism within the community. Some users pointed out that both depositing 0.1 ETH and 1 ETH result in the same 175-token reward. Others noted that they deposited 0.5 ETH in one address and 0.2 ETH in another in early January, yet both addresses received 175 tokens. There are also reports indicating identical airdrop amounts for users with 30,000 versus 200,000 loyalty points.

Who qualifies for the airdrop?

In the first-quarter token distribution, 90% goes to stakers, 6% to partners, and 4% to early adopters (holders of fan NFTs and EAP participants).

For stakers, the minimum airdrop threshold requires earning over 1,000 loyalty points through staking—for example, staking 1 ETH for one day or 0.1 ETH for ten days. This means even with smaller ETH deposits, users can qualify for the minimum airdrop as long as they stake for a sufficient duration; even depositing 0.01 ETH can qualify if staked for 100 days.

Additionally, each fan NFT holder receives 430 tokens, while individual Solo Staker addresses receive 4,200 tokens. Badge holders and referrers may receive further allocations.

Notably, ether.fi offers 26 different ways to accumulate loyalty points. However, for this airdrop, only addresses that earned more than 1,000 points through staking are eligible. Users holding only badge points without staking points do not qualify for the airdrop.

In summary, ether.fi’s linear distribution approach aims to balance the interests of whales and small participants, promoting broad community involvement and sustainable growth. However, the specifics of this linear model remain somewhat unclear and await further clarification from the official team to fully address community concerns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News