Wormhole releases airdrop details, while another dark horse Axelar is no less impressive—the battle for leadership may have already concluded.

TechFlow Selected TechFlow Selected

Wormhole releases airdrop details, while another dark horse Axelar is no less impressive—the battle for leadership may have already concluded.

Axelar is highly likely to ignite the market this summer and become another phenomenal project.

Author: Snow Brother, Crypto Enthusiast

Recent news: Wormhole, the universal cross-chain messaging protocol, has secured $225 million in funding at a $2.5 billion valuation and announced its token airdrop details on Twitter. The token's opening price on Whale Market is expected to surge sharply, drawing widespread attention. With Wormhole launching its token, competition among cross-chain interoperability leaders like LayerZero and Axelar intensifies, heating up the entire cross-chain interoperability sector.

On the broader market front, after a long wait of 27 months, BTC finally broke through the $60,000 mark and continued rising, briefly touching $70,000 on March 9—setting a new all-time high—and signaling the return of a new crypto bull market. Driven by this bullish momentum, market participation and trading volumes have surged, significantly increasing demand for cross-chain operations and elevating discussions around multi-chain ecosystems to new heights.

As another major frontrunner in the cross-chain interoperability space, Axelar has also drawn substantial attention. Following its recent announcement supporting Blast, Axelar now connects 60 public blockchains and has processed over $7 billion in transaction volume. As the sector heats up, analyses and discussions about Axelar are multiplying rapidly.

Today, we’ll provide a comprehensive analysis of Axelar—can it emerge as the new leader in the cross-chain interoperability race?

The Superstar of the Cross-Chain Ecosystem: Key Facts About Axelar You Should Know

After the DeFi boom in 2020, multi-chain and cross-chain demands quickly became foundational infrastructure in the crypto market. Benefiting from the rapid adoption and innovation of DeFi, cross-chain interoperability protocols have evolved into one of the most promising sectors in blockchain technology.

Compared to earlier cycles of innovation, today’s cross-chain technologies and ecosystems are more mature and robust, giving rise to several strong platforms. Among them, Axelar Network stands out as a leading contender.

Axelar is a decentralized Web3 interoperability platform designed to enhance connectivity across heterogeneous blockchains, enabling seamless asset transfers and composability for developers and end users. At its core, Axelar operates as a permissionless network that delivers Turing-complete cross-chain communication via proof-of-stake and open protocols.

According to research by Binance Research tracking support for over 60 major networks among leading cross-chain interoperability protocols, Axelar leads the pack by supporting 53 public chains. In contrast, Wormhole supports only 29 chains including Solana, Terra, Avalanche, and Ethereum.

Following its latest announcement of support for Blast, Axelar has broken its own record, now connecting 60 public chains—far surpassing competitors like LayerZero—and becoming the most widely connected cross-chain network today. This includes mainstream EVM chains such as Ethereum, BNB Chain, and Polygon; Layer 2s like Base, Arbitrum, and Optimism; and non-EVM chains like Cosmos.

Not Just Competitive—But Leading: Why More People Are Bullish on Axelar

Since 2023, Axelar has entered a phase of rapid growth, with increasing market penetration, rising transaction counts, and growing user activity laying a solid foundation for future expansion. As the crypto market roars back in 2024, the battle among multi-chain ecosystem giants is entering an intensely competitive stage. So how does Axelar compare against rivals like Wormhole and LayerZero? What gives it the edge? And why do so many view it as the emerging leader in cross-chain interoperability?

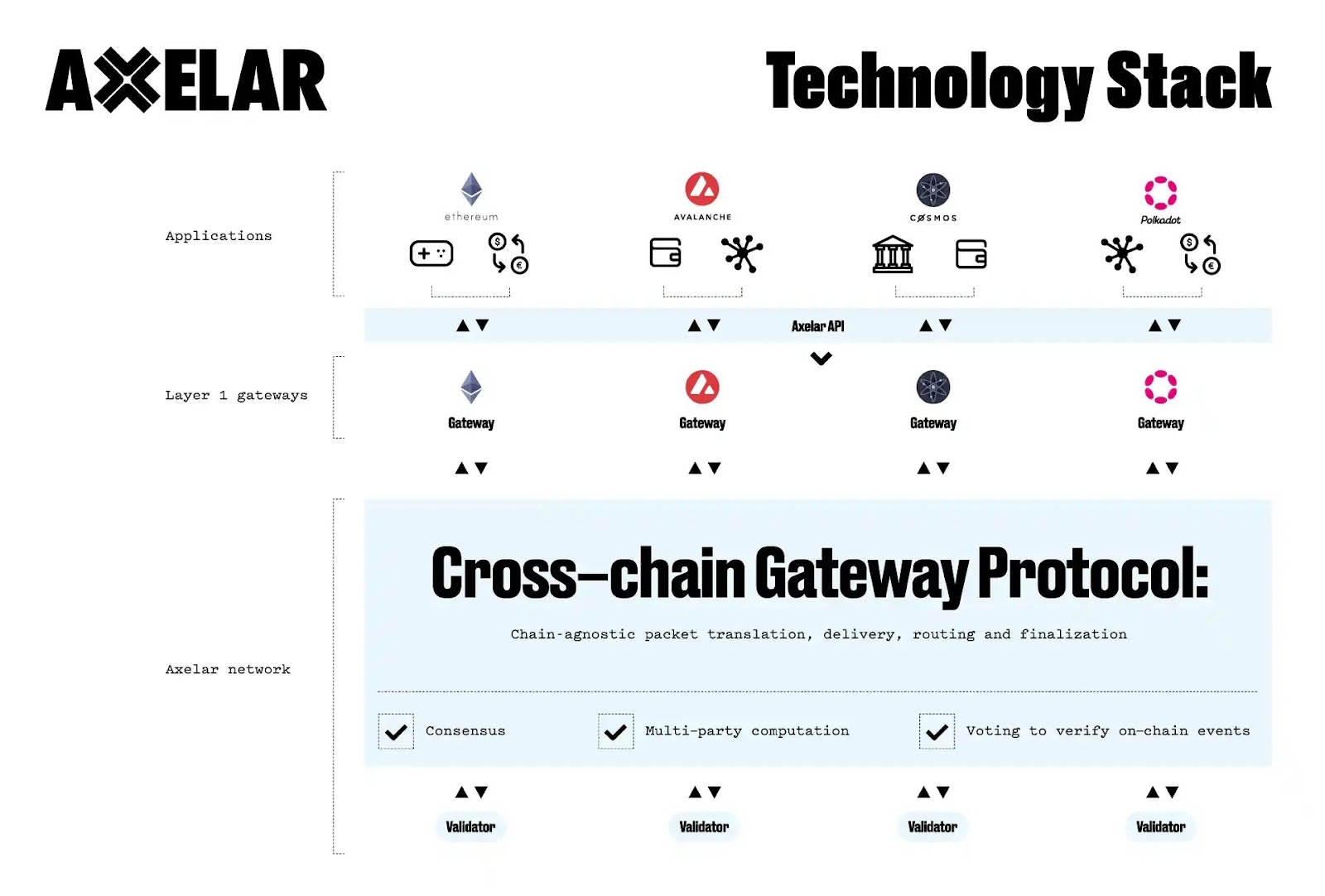

Technically, Axelar is built on the Cosmos SDK and fully compatible with all EVM chains. It functions as an application-specific chain designed to connect all blockchains, achieving true interoperability with the ability to bridge any type of data or asset.

Both Wormhole and Axelar have received strong backing from top-tier institutions like Coinbase, making them standout projects in the sector. However, when closely compared across key metrics, Axelar clearly holds several advantages.

Axelar uses a Hub & Spoke network topology, which contrasts sharply with LayerZero’s peer-to-peer architecture. This design resembles centralized airline networks, reducing the number of required connections and simplifying monitoring processes, thereby greatly improving efficiency and manageability.

In terms of security—the most critical factor—Axelar differs significantly from Wormhole. Wormhole relies on a limited set of "Guardians" for validation authority, whereas Axelar leverages the Cosmos SDK’s delegated proof-of-stake (PoS) mechanism. It implements three key measures: full use of open-source technology, a hub-and-spoke connection model instead of traditional point-to-point links, and a decentralized network of 75 dynamic validators. These features enhance not only security but also stability and reliability.

Another major advantage of Axelar is its Virtual Machine (AVM), built on Cosmwasm, which enables permissionless integration of new chains and offers flexibility for developing cross-chain dApps. Developers can write smart contracts directly on Axelar, making cross-chain tasks fully programmable.

The launch of Wormhole Gateway reflects the foresight behind Axelar’s architectural choices. Wormhole’s new design incorporates the Cosmos SDK and IBC light clients—approaches very similar to those used by Axelar. This indicates strong market demand and recognition for Axelar’s methodology, while also signaling that competition in this space is intensifying.

On the ecosystem front, Axelar currently provides scalable cross-chain solutions for partners ranging from Uniswap to Microsoft. Developers can build across multiple blockchains with an experience nearly as smooth as building on a single chain—thanks to simple APIs and an open, permissionless ecosystem of tools and service providers. Within the crypto space, Axelar enjoys strong support from major players such as Binance, Coinbase, Dragonfly, Galaxy, and Polychain.

An interesting development recently occurred: despite heavy anticipation around Wormhole’s token launch, Binance still decisively listed AXL, even launching futures pairs on the same day. This strong endorsement signals clear confidence from top-tier exchanges in Axelar’s potential—making the question of who leads the sector fairly obvious. Moreover, Binance Research has repeatedly published in-depth technical analyses of Axelar. Notably, since its listing on March 1, AXL has performed impressively, repeatedly hitting new highs and peaking at 2.2 USDT, sparking wave after wave of community engagement.

In Progrmd Capital’s latest valuation forecast for Axelar based on P/E ratios, even under conservative assumptions—such as Axelar capturing just 25% market share in the cross-chain segment and estimating gas fees alone—the annual revenue could reach $309 million. At a 30x P/E ratio, this implies a conservative valuation potential of $9.3 billion. If market share reaches 50%, especially amid bull market conditions, the valuation could soar to $114 billion—revealing the immense upside potential of Axelar.

Conclusion:

-

From a sector perspective, cross-chain interoperability is largely driven by major North American funds and offers vast growth potential. Additionally, Axelar sits at the intersection of the Cosmos ecosystem, serving as the liquidity gateway between Cosmos and EVM chains. It will directly benefit from any surge in Cosmos-based activity. This dual positioning strongly favors Axelar’s long-term development.

-

In terms of timing, AXL has just been listed on Binance and undergone initial market consolidation. Widespread awareness and consensus are still forming. With Wormhole and LayerZero nearing their token launches, and on the eve of a multi-chain ecosystem explosion, now presents an excellent entry opportunity.

-

Regarding AXL trading strategies, analysts suggest taking partial profits gradually based on overall market trends or Wormhole’s token release cycle. Another key metric to watch is Axelar’s gas burn rate, which can serve as a strategic indicator for trading decisions.

-

Finally, looking ahead at industry trends, the arrival of Wormhole’s airdrop hype will undoubtedly place multi-chain ecosystems at the center of the crypto spotlight, sparking broad discussion. As a project that technically, experientially, and prospectively outperforms Wormhole, Axelar is highly likely to ignite the market this summer and become another breakout phenomenon.

References

1. https://twitter.com/sonyasunkim/status/1747660794253500820

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News