Axelar: Blockchain connector, one of the largest drivers of liquidity in the Cosmos ecosystem

TechFlow Selected TechFlow Selected

Axelar: Blockchain connector, one of the largest drivers of liquidity in the Cosmos ecosystem

One of the biggest drivers of liquidity growth in the Cosmos ecosystem.

Author: Emperor Osmo

Translated by: TechFlow

Over the past six months, one chain has been instrumental to the development of Cosmos—Axelar, powering the cross-chain future.

Today, Axelar has made solid progress. Let’s take a look.

Axelar is an application chain designed to connect all blockchains, enabling true interoperability.

Their goals are:

-

To become a plug-and-play communication solution;

-

To provide cross-chain operability;

-

To allow users to interact across multiple ecosystems;

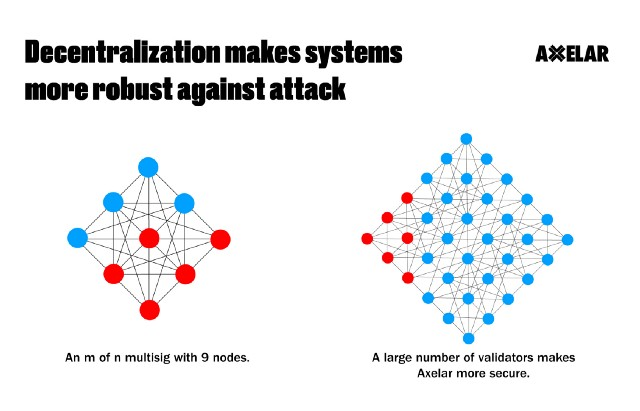

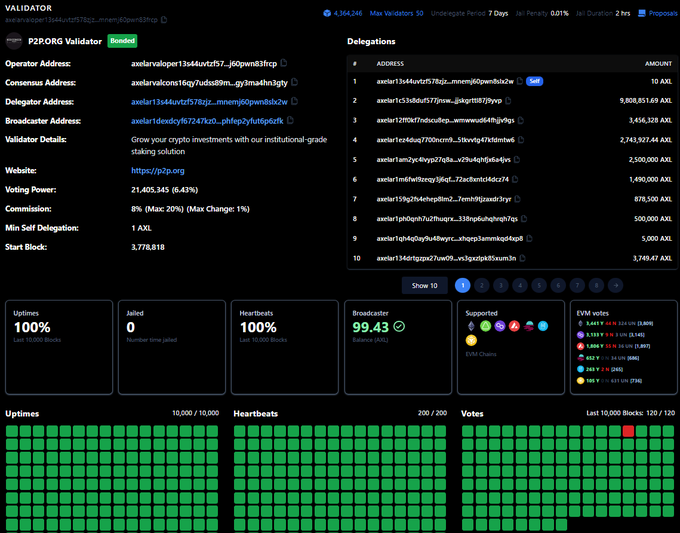

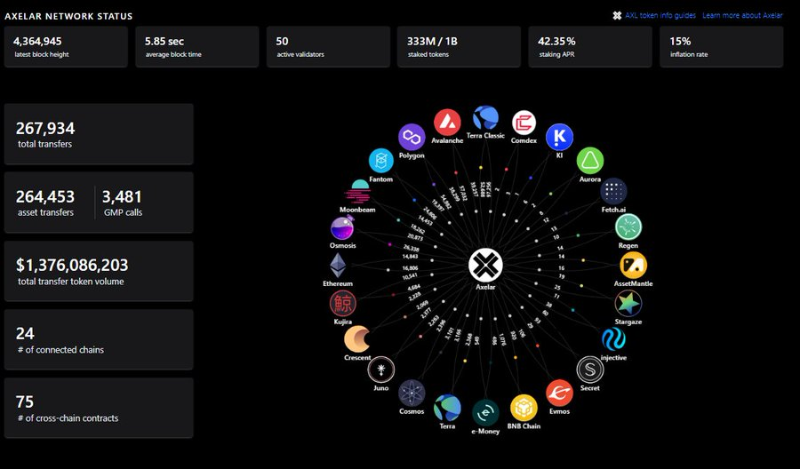

Axelar is secured by a total of 50 validators, divided into three roles based on different functions:

- Maintaining the network;

- Processing transactions;

- Running the cross-chain gateway protocol

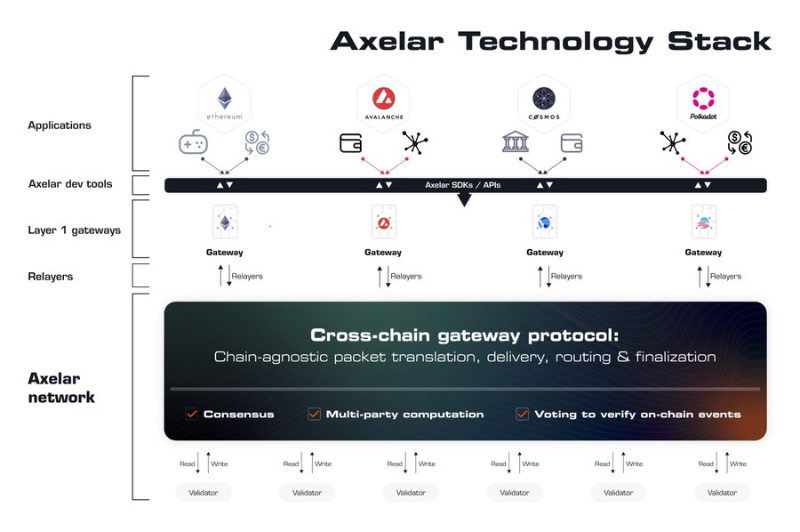

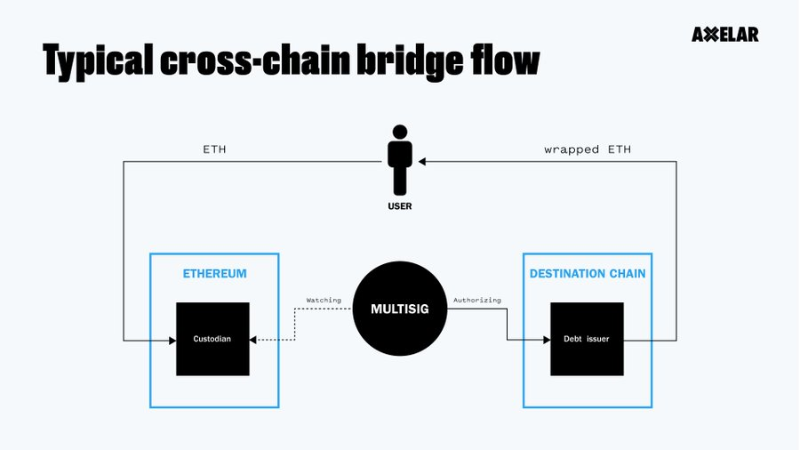

The cross-chain gateway protocol is a multi-party cryptographic overlay layer sitting atop connected chains, responsible for reading and writing between smart contracts to verify transactions.

Gateway Protocol: Axelar operates via gateways that connect the network and individual chains.

- Validators read transactions;

- Write down destinations;

- Execute transactions;

Developer Tools: Located on validator nodes, these tools enable developers to access the Axelar network. This also enables interoperability between blockchains and subsequent applications.

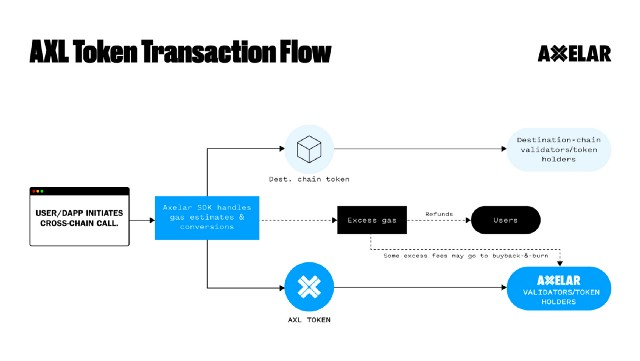

The $AXL token plays an interesting role in connecting Web3.

It has three main uses:

-

Security;

-

Governance;

-

Fees;

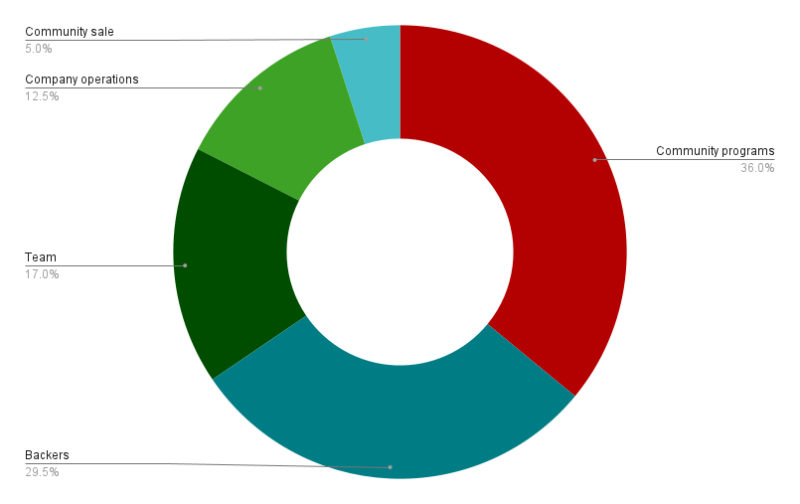

At genesis, a total of 1 billion AXL tokens were minted and distributed as follows:

-

Community programs: 35.96%;

-

Community sale: 5%;

-

Supporters: 29.54%;

-

Core team: 17%;

-

Company operations: 12.5%;

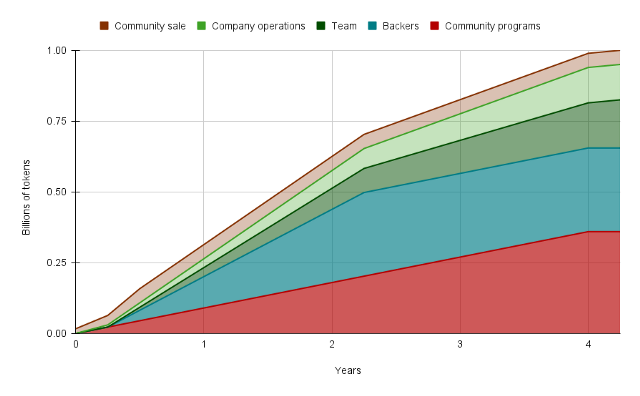

At genesis, all $AXL tokens are locked but eligible for staking:

-

All tokens are staked and earn 15% APY;

-

Tokens allocated to company operations and community programs are released over four years;

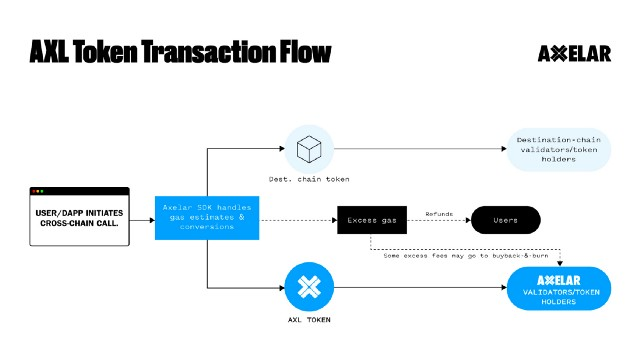

Currently, transacting on the network does not require $AXL tokens, meaning fees paid in other tokens will be converted into:

-

$AXL used to pay stakers and validators;

-

Gas fees required to reach the destination chain;

Any excess $AXL from payments made on Axelar can be:

-

Refunded to users;

-

Used to buy back AXL tokens;

-

Burned;

If implemented, this would create a positive cycle: transaction volume ➡ fees ➡ surplus ➡ $AXL token value.

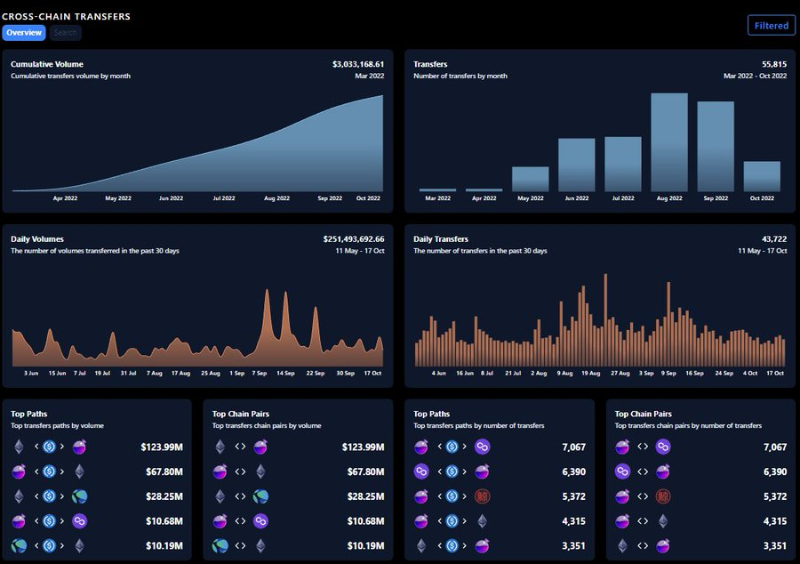

So, how successful has Axelar been since its launch this year? Here are some key metrics:

-

Second highest IBC transaction volume;

-

$204 million transferred in 30 days;

-

Average monthly users: 7,274;

-

TVL: $127 million;

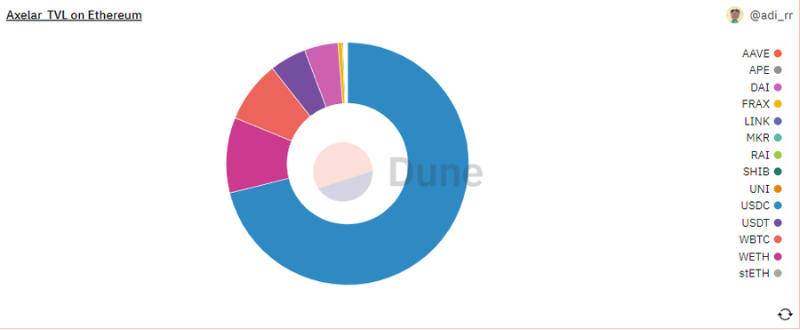

Meanwhile, Axelar has consistently been the largest provider of USDC liquidity in the Cosmos ecosystem.

Within its $127 million TVL, 53% comes from USDC trading volume.

Since January 2021, over $300 million worth of USDC transactions have been completed in the Cosmos ecosystem thanks to Axelar.

It is one of the biggest drivers of liquidity growth in the Cosmos ecosystem.

What about within the ecosystem?

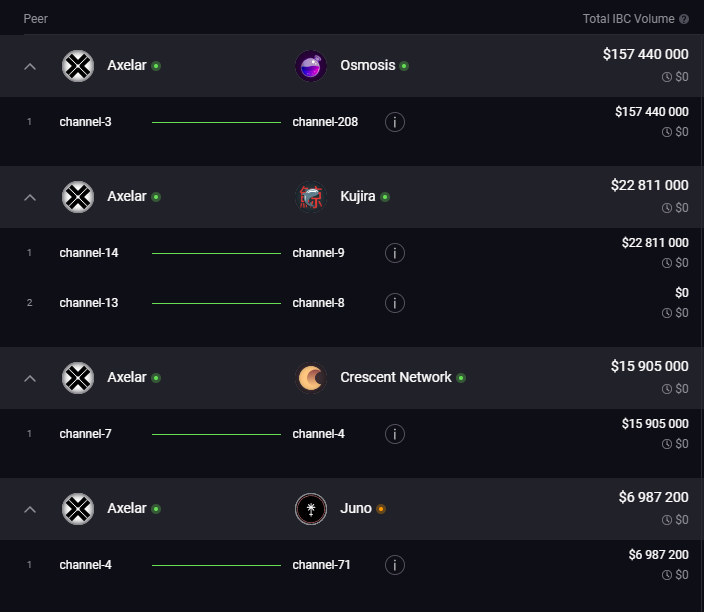

Below are the IBC transaction volumes through Axelar over the past 30 days:

-

Osmosis: 39.9%;

-

Kujira: 79.8%;

-

JunoNetwork: 22.6%;

-

Crescent: 57.4%;

Axelar is positioned as a neutral communication layer enabling commercialization on Web3, extending security and interoperability through Tendermint consensus, with every node securing the network while avoiding the risks and clunkiness of traditional cross-chain bridges.

Their story has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News