In-Depth Analysis of ERC-404: Pandora's Box or a Liquidity Revolution?

TechFlow Selected TechFlow Selected

In-Depth Analysis of ERC-404: Pandora's Box or a Liquidity Revolution?

Assets created based on 404 enable a corresponding exchange relationship between FTs and NFTs, achieving dual-sided liquidity by leveraging both ERC20 and ERC721.

Author: @0x_ethan_Crypto

Mentor: @CryptoScott_ETH, @Zou_Block

TL;DR

-

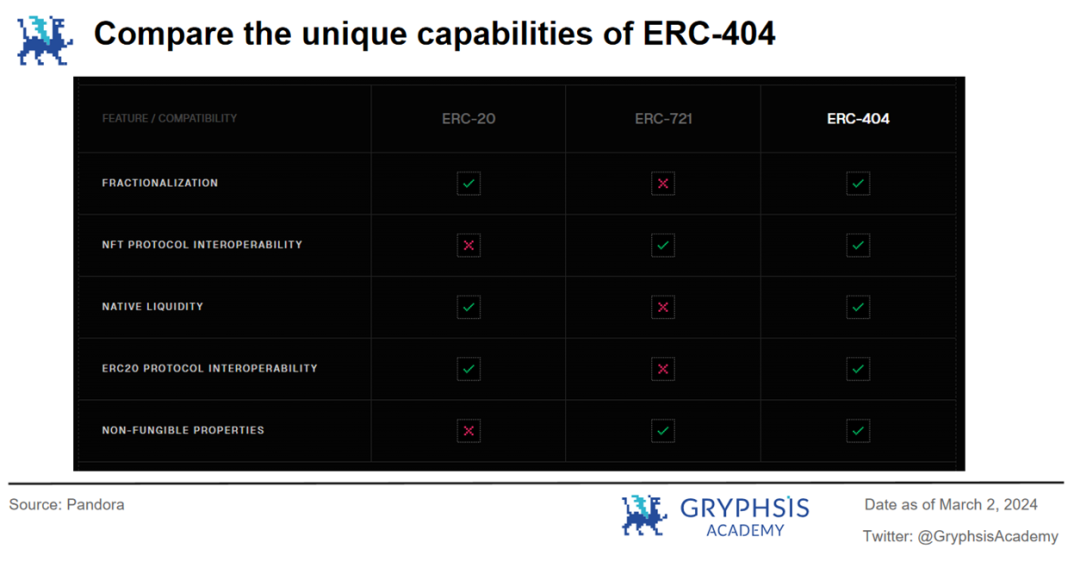

ERC404 establishes a bidirectional conversion relationship between NFTs and FTs through its protocol, enabling NFTs with dynamically changeable built-in attributes. It is defined as an experimental hybrid standard combining ERC20 and ERC721 features, offering native liquidity and semi-fungible token (SFT) fragmentation.

-

Unlike mainstream NFTFi business models, the 404 standard cleverly integrates existing NFT and FT infrastructure at the protocol layer to establish dual-sided liquidity. This introduces new characteristics such as "gacha mechanics," "native fragmentation," and "AMM liquidity." If widely adopted by future projects, it could unlock greater innovation potential, broader use cases, and expanded development opportunities.

-

ERC404 is still in early stages and has not undergone long-term validation. Currently, it suffers from a critical flaw where multiple NFTs may be uncontrollably destroyed during transactions and has not been formally submitted as an Ethereum EIP proposal.

-

Pandora is merely the first project launched under the ERC404 standard and cannot capture real value from the potential widespread adoption of ERC404 in the future. Its long-term success depends heavily on continued project team operations and roadmap execution.

1. Introduction

Each bull market in crypto brings new asset issuance methods and corresponding technical standards—from ERC20 fungible tokens (FTs) on Ethereum, to ERC721 non-fungible tokens (NFTs), and this cycle’s Bitcoin chain inscriptions. Among these, BRC20 is currently the most recognized inscription standard, recently referred to as semi-fungible tokens (SFTs).

This article introduces a new experimental standard on Ethereum—ERC-404—and its first asset, Pandora.

Assets created via ERC-404 enable a two-way conversion between FTs and NFTs, leveraging dual liquidity from both ERC20 and ERC721 protocols. Each full unit of FT automatically mints one corresponding NFT; fractional amounts below one FT do not trigger NFT minting.

When users trade or transfer FTs in quantities affecting whole units, the associated NFT is burned and reminted, with its properties automatically reprogrammed upon recreation. Users who wish to preserve their NFT can instead directly transfer or trade the NFT itself, leaving its attributes unchanged.

ERC404 is an experimental standard—technically it should be called EIP404—and the number 404 does not conform to official EIP submission guidelines. Whether it will be formally adopted by the Ethereum Foundation remains uncertain. Pandora is an early-stage project and, despite being the first ERC404 asset, carries significant risk. Please assess risks carefully.

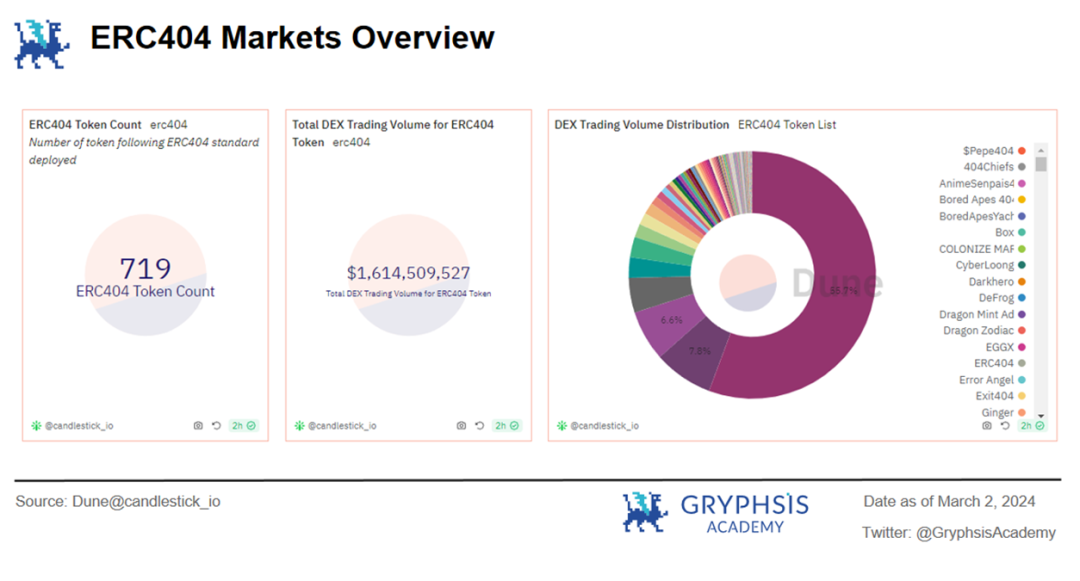

As of March 2, 2024, there are 719 token contracts based on the ERC404 standard, with a total trading volume of $1.6B. The majority of this volume comes from Pandora, which accounts for 55.7% of all trades.

2. Pandora Case Study

2.1 Pandora Overview

Pandora is the first project built on the ERC404 token standard, launched on February 2. For every 10,000 PANDORA ERC20 tokens, 10,000 NFTs ("Replicants") are generated. Pandora can be traded on Uniswap as well as NFT marketplaces like OpenSea.

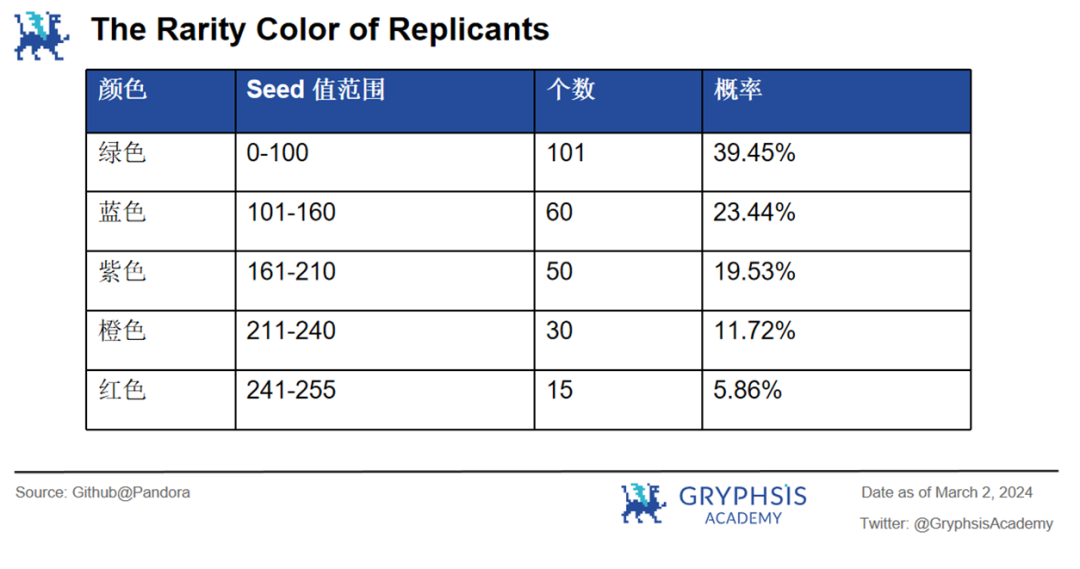

The collection features five rarity tiers distinguished by color. When users trade Pandora's FT tokens, Replicant NFTs are minted or burned according to the quantity held—for example, 1.3 Pandora results in one NFT being minted, while holdings below 1.0 generate no NFT. Each time a Replicant NFT is reminted, its rarity is randomized. However, transferring or trading the NFT directly preserves its original rarity.

Details about "unboxing" mechanics and future utility have not yet been disclosed by the team.

2.2 FT Token Information, Market Conditions, and Liquidity Analysis

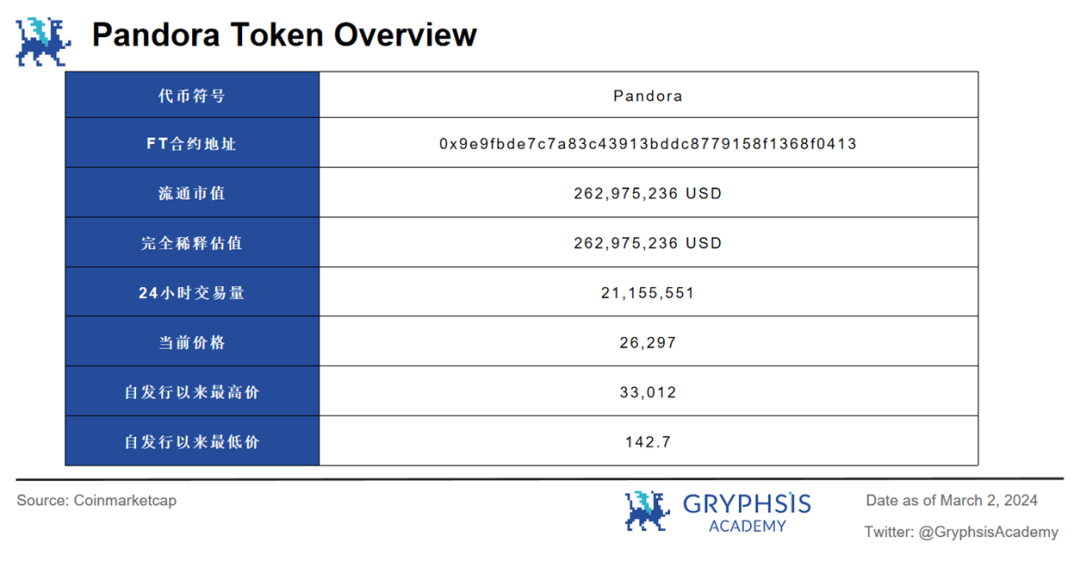

As of March 2, 2024, key metrics are as follows:

Approximately 67% of daily trading volume occurs on Uni v3, with the remainder distributed across CEXs including Bitmart, Lbank, and Gate. OKX and Binance wallets already support ERC404, but Pandora has not yet been listed on either exchange.

Uni v3 currently holds $26M in WETH liquidity, with a total TVL of $44M and approximately $90M in 7-day trading volume, indicating high turnover and active price discovery.

2.3 Comparison of FT and NFT Trading Volumes

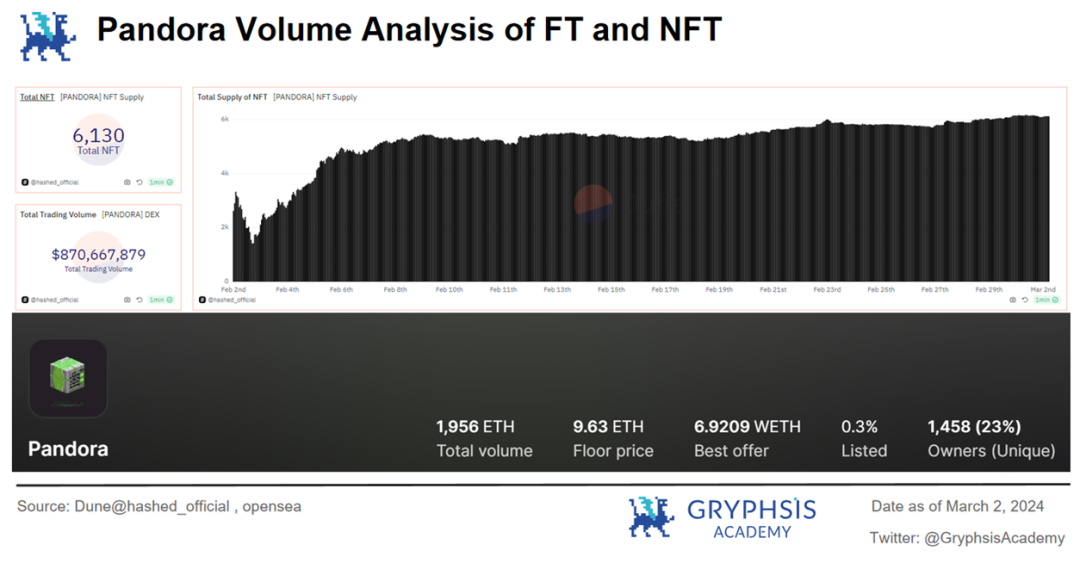

As of March 2, 2024, DEX trading volume totals $870M. A total of 6,130 NFTs have been minted. On OpenSea, cumulative trading volume stands at 1,956 ETH. At an approximate ETH price of $3,400 on that date, this equates to roughly $6.6M—only 0.7% of the FT trading volume. The core liquidity of the Pandora series is almost entirely driven by AMM pricing on Uni v3. Besides the immediate availability of AMM liquidity, another likely reason is the lack of clear utility for Pandora NFTs at this stage.

2.4 Holder Distribution

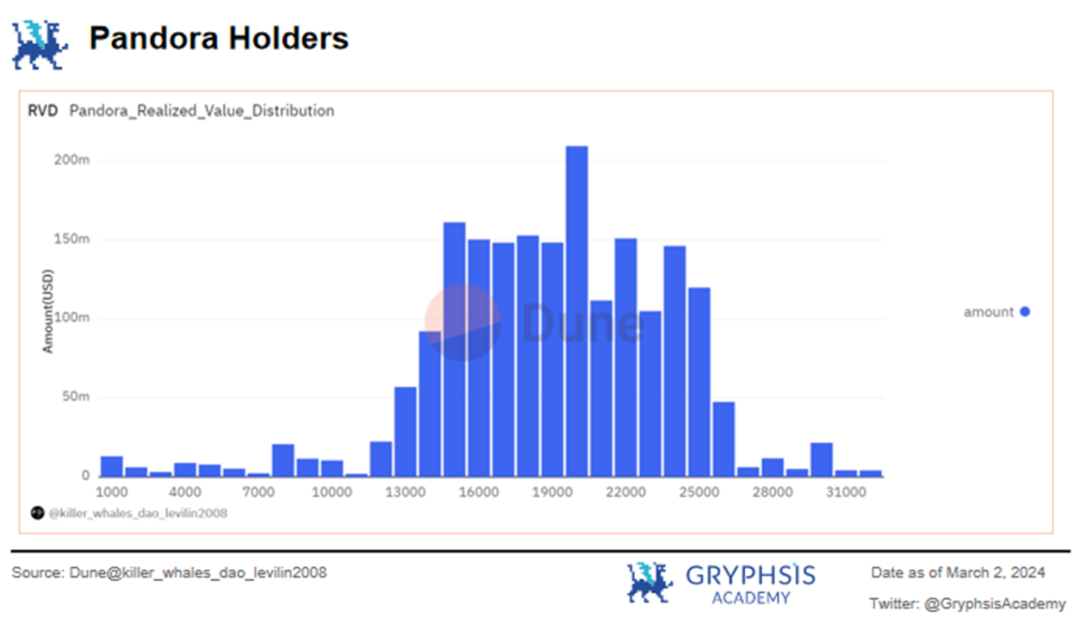

There are 10 addresses holding 100 or more tokens. The top three are the project’s multisig wallet, Uniswap v3 LP position, and the Sablier V2 LockupLinea contract address. Overall, token distribution appears relatively decentralized, with most holdings concentrated between 19,000 and 27,000 tokens.

3. Historical Context and Team Background

The concept behind Pandora and the technical design of ERC404 are not entirely novel. In my view, similar attempts can be divided into two historical branches: third-party fragmentation protocols on Ethereum and blockchain standards introducing the so-called "image-token duality"—notably BTC inscriptions and Solana's DN.

3.1 Third-Party Fragmentation Protocols

After the emergence of ERC721 NFTs on Ethereum, various protocol-level solutions were developed to address poor liquidity—one of which was "fragmentation." Examples include:

NFTX, launched around late 2020, pools similar-valued NFTs into vaults and issues vTokens. Holding enough vTokens allows users to randomly redeem an NFT from the vault.

Fractional, a later high-profile project that raised $28M, introduced curators who earn revenue from auctions, while token holders vote on auction terms and pricing for vault-held NFTs.

Flooring Protocol, launched last year, allows users to deposit NFTs into a vault and receive 1 million μTokens. Users can either forfeit ownership to randomly redeem an NFT or retain a key to reclaim their specific NFT later.

In summary, third-party fragmentation protocols allow NFT holders to stake individual or collections of NFTs and receive new ERC20 tokens issued by the protocol. These protocols aim to increase NFT liquidity through mechanisms like token incentives, curator roles, utility assignment, and proportional redemption. Post-launch, most deposited NFTs in these protocols have been blue-chip assets.

3.2 Origin of the Term “Image-Token Duality”

The concept of "image-token exchange," "image-token unity," or "image-token duality" emerged from BTC inscription protocols and Solana's Deez Nuts (DN) protocol.

Starting with Bitcoin inscriptions—the new asset class driving this bull run—UTXO structure combined with Ordinals and Inscriptions enabled BRC20 tokens. Users can inscribe arbitrary data onto sats, giving them unique traits. This mechanism abstractly represents an image-token correspondence: adding "uniqueness" to fungible tokens or "fungibility" to NFTs. Practically, when minting an inscription, you create "one item"—which is fully an NFT—but it can also be split, distributing fungible tokens within it. Hence, they are also known as semi-fungible tokens (SFTs).

Then in January this year, Solana's Tiny SPL—a new token standard aimed at solving network rent issues—launched an AMM mechanism on its website. Its token DN (Deez Nuts) sparked market speculation. DN supports splitting and merging, and holders can add NUTS to AMM pools as LPs. To degens, this resembled another form of "image-token swapping" akin to inscriptions.

Thus, the concept of image-token duality entered mainstream awareness. Given differing technical environments and levels of NFT infrastructure maturity across chains, SFTs evolved uniquely on each chain—BTC inscriptions, then Solana’s image-token swaps. So what emerges on Ethereum, the current leader in DeFi and NFT ecosystems?

3.3 ERC-404

In early February, another early attempt at achieving "image-token duality" appeared on Ethereum: Uniswap Emerald, a project aiming to build NFT liquidity on Uniswap. However, due to smart contract vulnerabilities, it suffered attacks and repeatedly changed token contracts. The team is still working on fixes. Members of the Pandora team drew inspiration from Emerald.

The ERC-404 standard and Pandora asset were co-developed by a four-person team, though only three have public Twitter profiles:

-

@maybectrlfreak (ctrl): Self-described startup investor and angel investor in Syndicate. Syndicate's first tweet was on January 22, announcing an early investment in BeFi Labs, a BRC20 and Ordinals trading terminal.

-

@searnseele (Searn): No detailed information available on Twitter.

-

@0xacme (Acme): Published the ERC404 standard on GitHub and formerly worked as an engineer at Coinbase.

4. Implementation Mechanism

According to the ERC404 documentation, it is an experimental hybrid standard combining ERC20 and ERC721, featuring native liquidity and semi-fungible token fragmentation.

4.1 Lossy Encoding Scheme

First, understand the operation flows of ERC20 and ERC721:

User A holds 11.11 units of token B. During transfers, the smart contract deducts the amount from A’s balance and credits it to the recipient. The contract only needs to track balances.

User A owns NFT #1234 from collection C. When transferring, the contract removes the NFT from A and adds it to the recipient’s account.

Under normal circumstances, these are clearly distinct asset types, requiring the contract to determine the type before processing.

ERC404 introduces a lossy encoding scheme, allowing ERC20 token quantities and ERC721 token IDs to share the same data structure—“AmountOrId”—in contract storage.

Solidity records ERC20 balances in smallest units (decimals). For example, 2.3 Pandora becomes 230000000000000000 (18 decimals), a number much larger than typical NFT token IDs. The contract compares this “amountOrId” parameter against the current “Minted” value (total NFTs minted). If “amountOrId” ≤ “Minted,” it triggers ERC721 operations; otherwise, it processes ERC20 actions. This allows the contract to distinguish between ERC20 and ERC721 during calls.

After identifying the type via lossy encoding, mapping functions track account states. When users transfer ERC20 tokens via the “transfer” function, the corresponding ERC721 NFT is burned and reminted. In the “mint” function, each new NFT increases the “minted” variable, which becomes the new token ID. Thus, each newly minted NFT receives a unique, sequentially increasing ID starting from 1.

4.2 Two Key Flaws: Uncontrolled NFT Destruction and Higher Gas Costs

When a user holds multiple FTs and corresponding NFTs, transferring FTs causes the smart contract to burn NFTs without user control. The burn function uses a minimalist approach, always destroying the highest-numbered (most recently acquired) NFT ID—a Last-In, First-Out (LIFO) mechanism. This could inadvertently destroy a user’s preferred NFT, representing a current design flaw in ERC404.

Pandora mitigates this issue through rarity mechanics, encouraging users to manually separate desired FTs into different wallets. Users can move less desirable NFTs to another wallet or sell them on secondary markets before operating on their main FT balance—effectively using economic incentives to partially offset protocol limitations.

The second issue—higher gas fees—stems from ERC404’s need to store and monitor multiple balances and NFT ownerships, resulting in more complex contract logic, increased computational load, and higher gas consumption.

4.3 Pseudo-Random Design Based on Sequential IDs (Pandora Rarity System)

Due to image-token correspondence, converting tokens triggers automatic burning and reminting of NFTs using sequential global IDs. Projects can leverage these IDs as sources of pseudo-randomness to assign dynamic attributes—enabling “pseudo-gacha” mechanics with varying visual and functional traits.

Pandora determines rarity by applying the keccak256 hash function to the first byte of the NFT’s ID and encoding the result to generate a pseudo-random value. Each ID maps to a unique seed, producing a number between 0 and 255, which determines rarity tiers.

In practice, because IDs are sequential, users globally reshuffling NFTs simply receive pre-determined seeds based on minting order—like drawing cards from a fixed deck in sequence. The timing of on-chain transactions determines which card (rarity) they draw.

From the table above, red Pandora boxes only appear when the seed value falls between 241 and 255. Since low-frequency random numbers occur less often after hashing, rarity can be seen as a mix of “luck” and repeated effort.

This rarity system explains why red and other high-rarity boxes command large premiums on OpenSea and Blur—far exceeding the price of one FT unit. As some players say, “Got another orange box—so addictive.”

What actual utility these rare NFTs will offer remains to be seen and awaits further announcements from the team.

In the initial version, it was theoretically possible to eventually convert all NFTs into red-tier rarities through infinite resummoning—a logical consequence of the current pseudorandom mechanism. The team has acknowledged this and plans to fix it in a recent v2 update.

4.4 Recent Update v2.0

-

ERC-721 token IDs are now stored in an FIFO (First In, First Out) queue and reused instead of incrementing indefinitely upon mint/burn. This creates predictable NFT IDs similar to traditional NFT collections.

-

This change limits the possibility of infinite rarity upgrades. With finite token IDs, there will be a capped number of red-tier NFTs. Once all IDs are sequentially assigned up to the cap, subsequent remints won’t increase high-rarity counts unless accidental burns occur. High-rarity NFTs will naturally persist, reducing incentive for continuous resummoning.

-

Transferring full ERC-20 tokens now directly transfers corresponding ERC-721 NFTs from sender to receiver. For example, sending 3 full tokens moves 3 NFTs directly, avoiding burn-and-remint cycles.

-

Predictable events are emitted during transfers, approvals, and other operations, clearly indicating whether they relate to ERC-20 or ERC-721 activity.

-

Removed fixed supply cap in contract, allowing optional implementation of supply limits as needed.

-

Simplified and centralized transfer logic, with extensive optimizations leading to significant gas savings.

-

Added support for EIP-2612, EIP-165, and others.

5. Differences from ERC721-NFTs

I believe ERC404-based assets skillfully blend the previously distinct ERC20 and ERC721 standards into a hybrid model whose nature is hard to define—it could be described as “Ethereum’s version of inscriptions,” “natively fragmented mutable NFTs,” or “meme coins with embedded NFTs.” The refreshable attribute enabled by its technical mechanism represents another unique value proposition.

-

Native fragmentation and liquidity at the standard level: 404 FTs provide native liquidity on DEXs like Uniswap while auto-generating NFTs. Leveraging Ethereum’s mature DeFi infrastructure, 404 FTs could eventually integrate with lending platforms, perpetual contracts, and other advanced DeFi protocols.

-

Inherent gacha mechanics and interchangeability within NFT series: With limited token IDs, each can be programmatically assigned unique attributes and visuals. 404 NFTs gain programmability and pseudo-randomness, enabling low-friction, gas-efficient “gacha loops” on-chain to obtain entries from a predefined sequence. Compared to static 721 NFTs, this offers more dynamic and engaging experiences. However, since rarity is effectively predetermined, calling it “pseudo-random” is accurate. Once high-rarity NFTs are revealed, repeated resummoning loses meaning. Pandora isn't designed for constant rarity farming.

-

Clear separation of valuation for different asset attributes: Each FT unit corresponds to one NFT, grounding each NFT’s base value at exactly 1. This eliminates cognitive barriers and enables fuller pricing and liquidity via AMMs. Meanwhile, because 404 NFTs can change randomness via transfers, early holders enjoy repeated “unboxing” moments similar to 721 NFTs. Consequently, rare NFTs trade at significant premiums on NFT marketplaces, reflecting market valuation of “luck and repeated refreshes”—i.e., rarity as a probabilistic trait.

Summary: The FT represents the “floor price” of the entire 404 NFT series, while different rarity tiers represent “floor price + random value premium.” This differs significantly from how users typically value PFP-style 721 NFTs—such as preferences for clothing, accessories, or cultural significance.

6. Discussion on NFTFi Evolution

I argue that if 404 NFTs are considered a subclass of broader NFTs, then ERC404 represents a unique NFTFi framework for this category.

During Pandora’s launch, many KOLs suggested that if this issuance paradigm gains widespread adoption, it could render parts of the current NFTFi ecosystem obsolete. Below is my analysis:

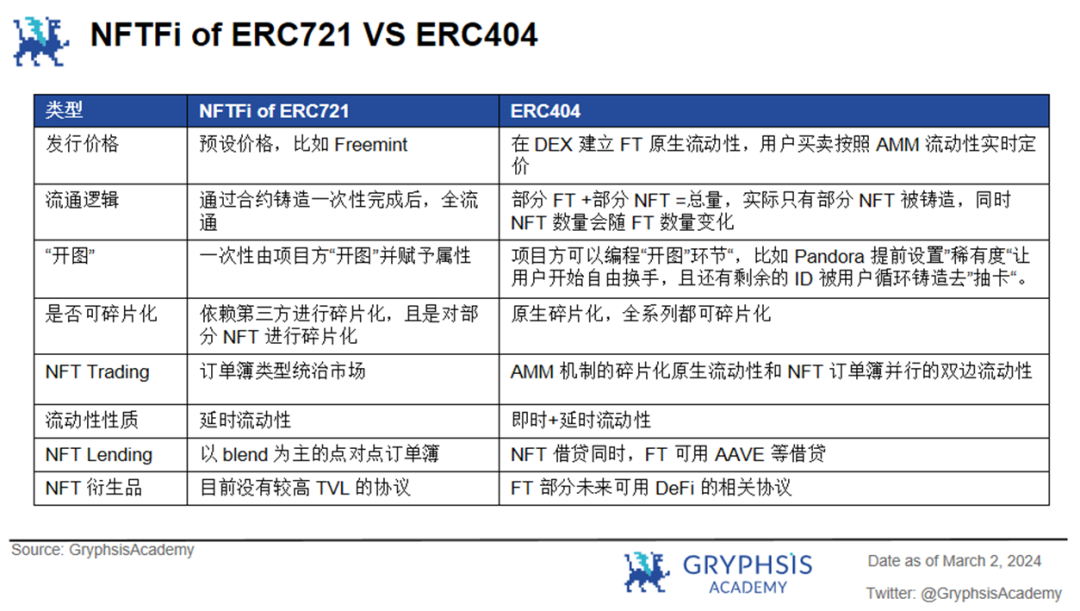

We can categorize NFTFi by use case: Trading, Lending, and Derivatives.

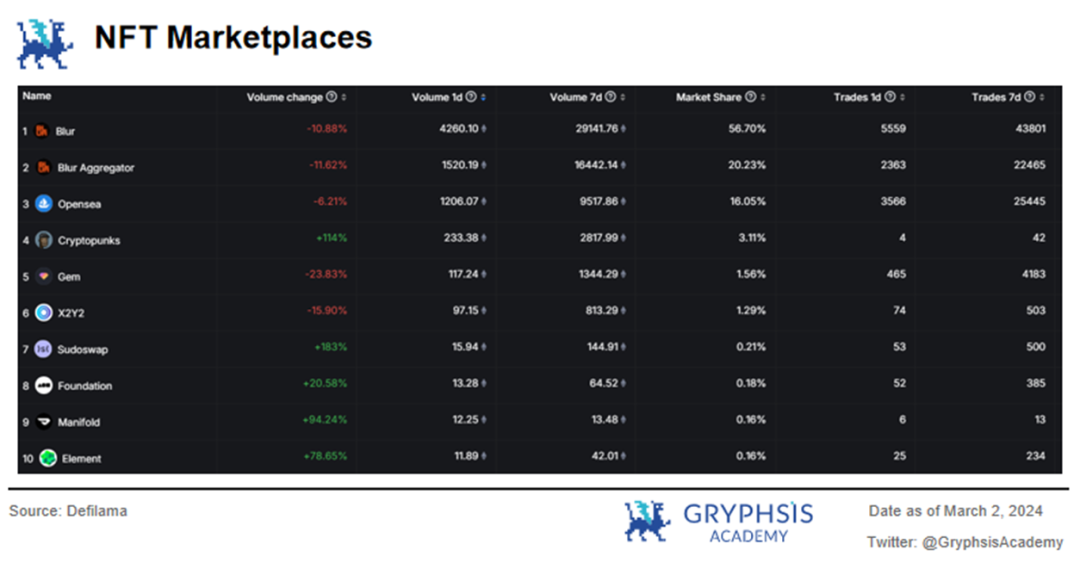

NFT Trading currently includes four models: order books, aggregators, fragmentation protocols, and AMMs—exemplified by Opensea, Blur, NFTX, and Sudoswap respectively.

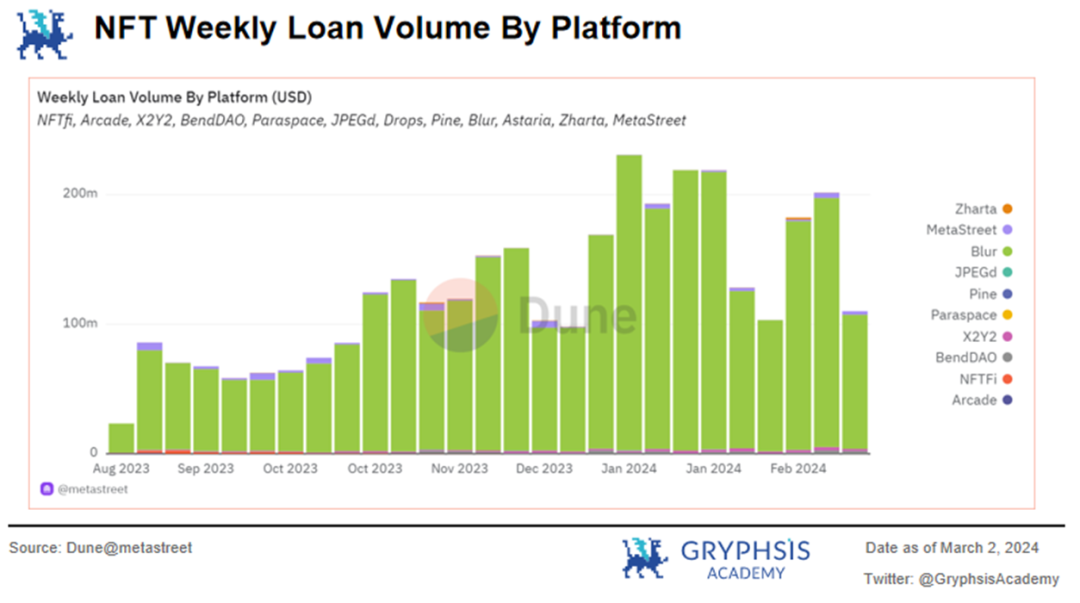

NFT Lending includes peer-to-peer, pool-based, and buy-now-pay-later models, with few successful projects like Blend and BendDAO emerging.

NFT Derivatives lack strong TVL performers, suggesting derivative protocols requiring high liquidity may still be too early.

Reviewing these NFTFi projects reveals two preliminary observations:

First, most NFT series rely on order book models for liquidity and pricing. Instant liquidity solutions like AMMs and fragmentation barely hold market share—Sudoswap captures only 0.12% of trading volume, indicating near-zero adoption.

Second, in NFT Lending, Blend dominates via peer-to-peer lending. Common traits among lending protocols include reliance on token incentives to attract external capital, complex game-theoretic designs or third-party price feeds, and high trust/security barriers for users. Except for Blend integrated with Blur, most protocols suffer from layered filters that progressively reduce circulating NFTs and external liquidity.

Comparing 404’s issuance logic and commercial path to mainstream NFTFi reveals stark differences:

Based on this comparison, I conclude that 404, as a new asset class, diverges significantly from mainstream 721NFT-based NFTFi models. By cleverly leveraging existing NFT and FT infrastructures to establish dual liquidity, it introduces novel features like “gacha mechanics,” “native fragmentation,” and “AMM liquidity.” If matured, it could enable richer innovations, broader imagination, and greater growth potential.

7. Risk Analysis

Both ERC404 and its flagship project Pandora remain in early stages, carrying risks at both the standard and project levels:

-

The ERC404 standard currently has flaws: uncontrolled NFT destruction and higher-than-average gas costs due to complex logic.

-

ERC404 is complex and未经long-term validation, potentially harboring unknown security vulnerabilities susceptible to hacking or unexpected failures.

-

ERC404 is an experimental standard—technically it should be named EIP404—and the number 404 violates EIP naming conventions. Monitor responses from the Ethereum Foundation closely.

-

Pandora is only the first project on ERC404 and cannot capture tangible value from any future widespread adoption of the standard, though it may benefit sentimentally.

-

Pandora has not yet “unboxed”; as an NFT series, it requires ongoing team operation and faces risks of being overtaken by other ERC404-based projects.

8. Other 404-like Standards

Following the rise of ERC404, similar standards have emerged. Their futures may depend—like Ordi meme assets—on first-mover advantage and wealth effects, or—like Bored Apes—on community strength and operational strategy. Below is a brief overview of comparable standards.

8.1 DN-404

Unlike ERC404, which merges ERC-20 and ERC-721 into a single contract, DN-404 uses two separate but linked contracts: a base ERC-20 contract and a mirrored ERC-721 contract for unique NFTs.

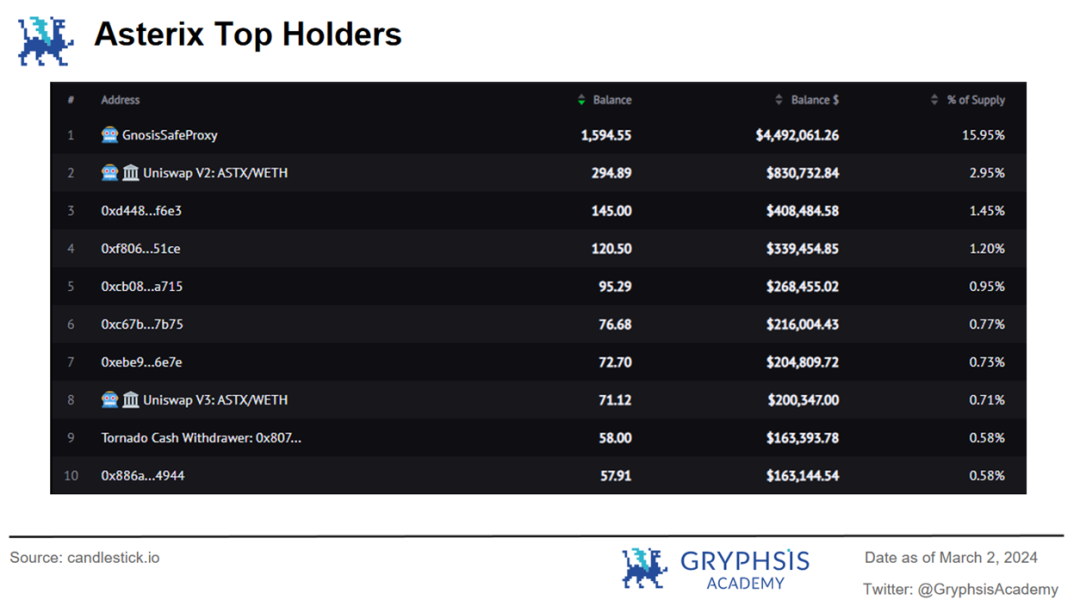

The highest-traded DN-404 asset is Asterix, a 10,000-PFP collection. Operational details remain unclear. The team mentions snapshots ahead of future “unboxing.” Current FDV is $26M.

8.2 ERC-1111

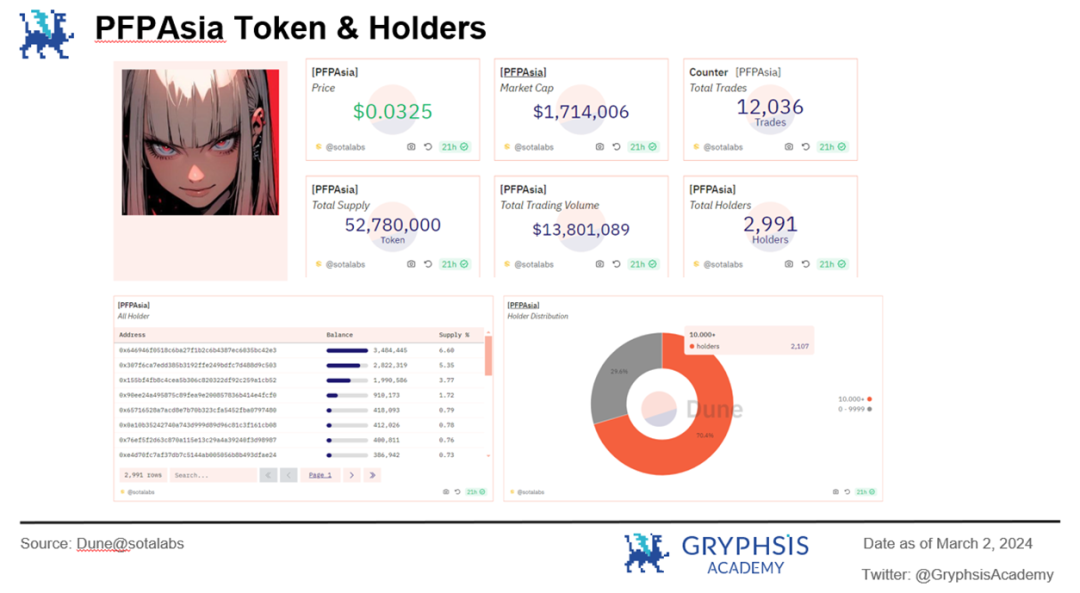

A new token standard developed by PFPAsia team, also known as REDT. It enables user-controlled state transitions between FTs and NFTs and allows customizable FT-to-NFT ratios.

Using ERC-1111, PFPAsia launched a 10,000-piece PFP collection blending Korean and Chinese aesthetics. The FT-to-NFT ratio is 1:10,000. Marketing began in January, FT public sale in February, and NFT freemint is currently underway via whitelist. As of March 2, FDV is $1.7M. Image-token conversion is not yet enabled, and “unboxing” hasn’t occurred.

In August last year, HashKeyNFT collaborated with NFTAsia and PFPAsia to release a commemorative SBT honoring HashKey Exchange becoming Hong Kong’s first licensed retail crypto exchange.

8.3 ERC-X

Supports multiple standards (ERC-20, ERC-404, ERC-721, ERC-721A, ERC-721Psi, ERC-1155, ERC-1155Delta) within one framework, supporting both ERC-1155 and ERC-721 tokens with improved gas efficiency.

Built on this standard is MINER, aiming to create a cross-chain hybrid volatility mining protocol via LayerZero. It wraps on-chain NFT assets with MINER tokens and shares fees with token holders.

Launched with a contract vulnerability, fixed and relaunched on February 19. As of March 2, FDV is $3M.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News

Add to FavoritesShare to Social Media

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News