Why is BTC the biggest alpha in this cycle?

TechFlow Selected TechFlow Selected

Why is BTC the biggest alpha in this cycle?

Bitcoin, favored by the wealthy, is bound to become increasingly expensive.

Author: armonio, AC Capital

2024 has been a wild year for the digital crypto market. Among all assets, BTC's "elephant dance" stands out as the most extreme. In the past month alone, BTC surged over 50%. What drives such an explosive performance? And can this frenzy continue? Let’s dive deep to explore.

Any asset price rise stems from reduced supply and increased demand. Let’s break it down into supply and demand sides for separate analysis.

As BTC continues its halving cycle, the impact of supply-side factors on BTC prices is weakening. Still, we must formally monitor potential selling pressure:

Supply Side

On the supply side, consensus indicates less than 2 million new BTC will ever be created. The issuance rate is about to halve again, further reducing new selling pressure post-halving. Looking at miner wallets, balances have long remained above 1.8 million BTC. This trend suggests miners show no inclination to sell.

On the other hand, long-term holder wallets continue accumulating BTC, now holding around 14.9 million BTC. The truly liquid supply of BTC is extremely limited—less than $350 billion in market cap. This explains why sustained daily inflows of just $500 million can drive BTC’s explosive growth.

Demand Side

Increased demand comes from multiple sources:

-

1. Liquidity brought by ETFs;

-

2. Wealth growth among the rich;

-

3. Financial business models are more attractive than short-term speculation;

-

4. For funds, it’s acceptable to buy BTC at the wrong time—but unforgivable to miss it entirely;

-

5. BTC is the core of traffic.

ETF Approval Is the Irreplicable Scarcity Driving This BTC Cycle

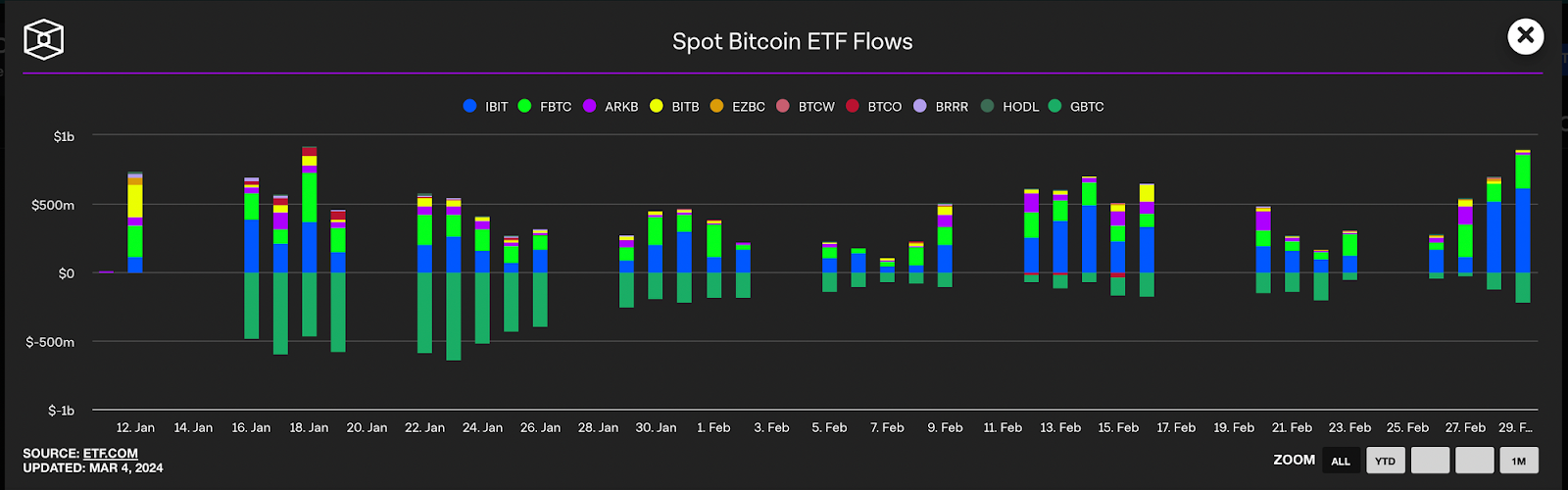

BTC’s SEC-approved ETF grants it access to traditional financial markets. Compliant capital can now flow into BTC—and within the crypto world, traditional finance money flows only into BTC.

Deflationary BTC naturally forms a Ponzi-like, FOMO-prone structure. As long as funds keep buying BTC, its price rises. Funds holding BTC deliver top-tier returns, enabling them to raise more capital and buy even more BTC. Meanwhile, funds not owning BTC face underperformance pressure and potential redemptions. Wall Street has played this game for decades in real estate.

BTC is especially suited for this dynamic. Over the past month, average net daily inflows were under $500 million—yet that drove over 50% market gains. Such volume is negligible in traditional finance.

ETFs also enhance BTC’s value through liquidity. Global traditional finance, including real estate, reached ~$560 trillion in 2023—demonstrating ample liquidity to support massive financial assets. BTC’s liquidity pales in comparison to traditional assets. Integrating with traditional finance injects compliant liquidity, boosting BTC’s valuation. Crucially, this compliant liquidity flows only into BTC—not into other digital assets. BTC no longer shares a liquidity pool with other cryptocurrencies.

Higher liquidity increases an asset’s investment value. Only instantly liquid assets can carry large wealth. Which leads us to the next point:

BTC, Favored by the Rich, Will Naturally Become More Expensive

I conducted small-scale field research. According to my findings, crypto billionaires typically hold large BTC positions during bull markets, while those at my wealth level—middle class or below—rarely allocate more than 25% of their portfolio to BTC. Currently, BTC dominance stands at 54.8%. Ask yourself: if people in your social circle hold far less BTC than that, who actually holds it?

BTC is in the hands of the wealthy and institutions.

This introduces a phenomenon: the Matthew Effect—assets held by the rich keep rising; assets held by ordinary people keep falling. Without government intervention, free markets inevitably generate the Matthew Effect. The rich get richer, the poor poorer. This isn’t just because the rich may be smarter or more capable—they inherently control resources. Talent and useful information naturally gravitate toward the wealthy seeking collaboration. Unless wealth is purely luck-based, it compounds, making the rich richer. Thus, things favored by the wealthy become more valuable, while those favored by the poor depreciate.

In crypto, the wealthy and institutions use altcoins to extract wealth from retail investors, while treating highly liquid major tokens like BTC as stores of value. Wealth flows from retail chasing memecoins, gets harvested by the rich or institutions, then reinvested into BTC and other blue-chips. As BTC’s liquidity improves, it becomes even more attractive to the wealthy and institutions.

BTC’s Price Is Trivial—What Matters Is Capturing Financial Market Share

After the SEC approved spot BTC ETFs, fierce competition emerged across multiple levels. Institutions like BlackRock, Goldman Sachs, and Blackstone are vying for leadership in the U.S. ETF space. Globally, financial hubs including Singapore, Switzerland, and Hong Kong are following suit. Institutional dumping is theoretically possible. But if early BTC holders dump small amounts into the market, whether they can repurchase them later—without triggering liquidity shortages in the global environment—is uncertain.

Moreover, without BTC spot backing, ETF issuers lose not only fees but also pricing power over BTC. Their financial markets forfeit control over BTC—the “digital gold” and future financial anchor—as well as BTC spot derivatives. For any nation or financial center, this would be a strategic failure.

Therefore, I believe global traditional financial capital is unlikely to collude on dumping. Instead, they’ll compete to accumulate, fueling FOMO.

BTC Is Wall Street’s “Inscription”

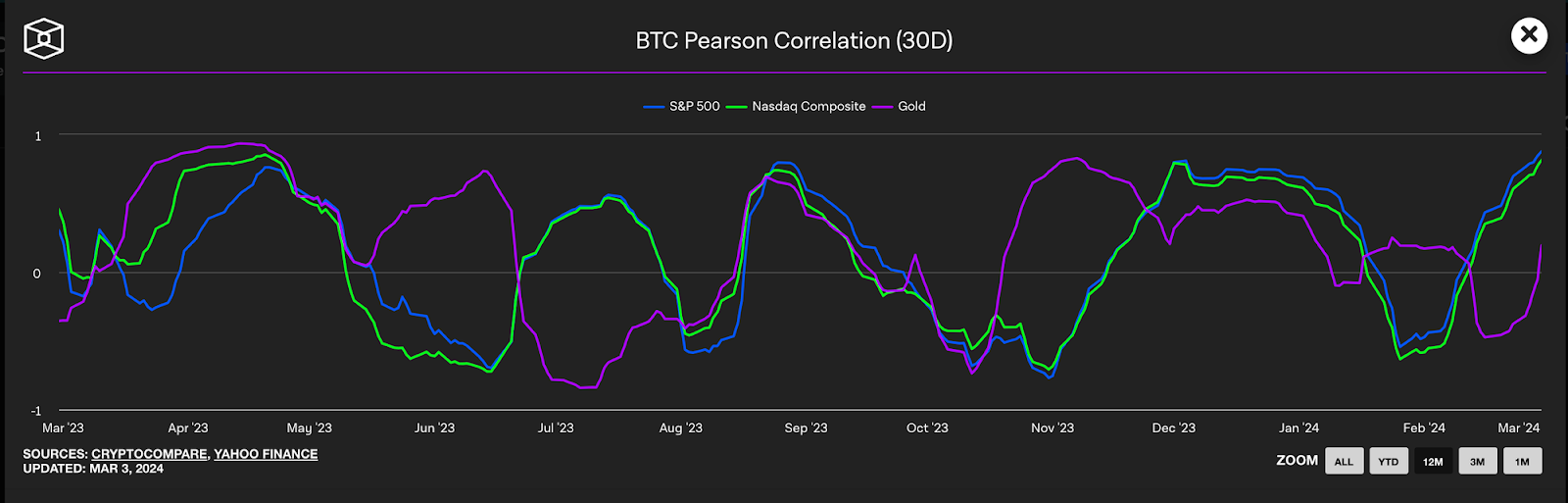

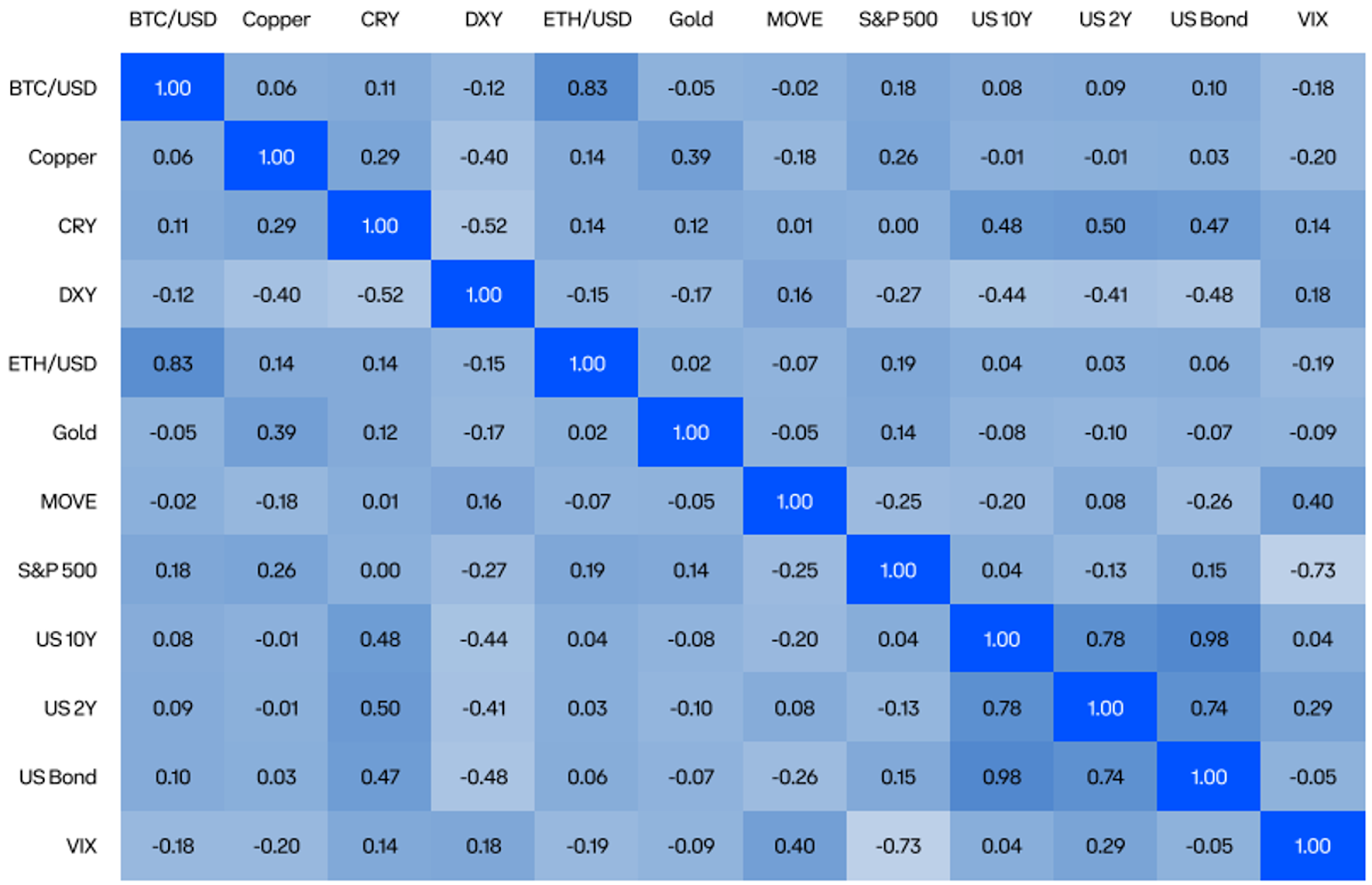

For Chinese-speaking investors, the concept of “inscriptions” may resonate. These are low-cost, high-upside assets. Allocating a small amount can significantly boost portfolio returns without risking catastrophic losses. BTC’s current valuation remains negligible within traditional finance. Its correlation with mainstream assets is also still low (though not as negatively correlated as before). So isn’t holding some BTC a natural move for mainstream funds?

Even more so, imagine BTC becoming the top-performing asset in traditional finance in 2024. How would a fund manager who missed it explain that to LPs? Conversely, holding 1–2% in BTC—even if unprofitable—won’t materially hurt performance. It’s easier to report to investors.

BTC’s price has low correlation with mainstream assets

BTC Is the Natural “Piggy Fund” for Wall Street Fund Managers

Earlier, we discussed why Wall Street fund managers reluctantly buy BTC. Now let’s examine why they might actually enjoy doing so.

We know BTC operates as a semi-anonymous network. I believe the SEC cannot conduct the same level of穿透监管 (penetration regulation) on fund managers’ BTC spot holdings as it does with equities. Yes, exchanges like Coinbase and Binance require KYC for deposits, withdrawals, and OTC trades. But offline OTC transactions still occur. Regulators lack sufficient tools to monitor financial professionals’ spot holdings.

With all the arguments above, fund managers can easily draft comprehensive reports justifying BTC investments. Given BTC’s historically low liquidity, even small capital can move its price. So when objective rationale exists, what stops a fund manager from using public funds to enrich their personal holdings?

Traffic Bootstrapping by Projects

Traffic bootstrapping is a unique crypto phenomenon—and BTC has long benefited from it.

“BTC traffic bootstrapping” refers to other projects leveraging BTC’s popularity—they elevate BTC’s image to gain attention, inadvertently channeling their generated traffic back to BTC.

Recall every altcoin launch: they all invoke BTC’s legend, extol Satoshi’s mystery and greatness, then claim to be “the next BTC.” BTC requires no marketing—it gets passively promoted and brand-built by imitators.

Today’s project competition is fiercer than ever. Dozens of Layer2s and tens of millions of inscriptions on BTC are attempting to ride BTC’s coattails, collectively pushing BTC toward massive adoption. Never before has the BTC ecosystem seen so many projects promoting BTC. This year’s traffic bootstrapping effect will be stronger than ever.

Conclusion

Compared to last year, the biggest market variable is the approval of BTC ETFs. Our analysis shows all forces are pumping BTC’s price—shrinking supply, surging demand.

In summary, I believe: BTC is the largest alpha of 2024.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News