The narrative around modular blockchains is gaining momentum, and settlement layer projects will hold higher value.

TechFlow Selected TechFlow Selected

The narrative around modular blockchains is gaining momentum, and settlement layer projects will hold higher value.

Order of value accumulation in a modular stack: Settlement → Execution → DA + Consensus.

Author: IMAJINL

Translation: TechFlow

Modular blockchains have been receiving significant attention, yet one often overlooked aspect is that they fragment value. In a world where we have a single massive blockchain, all value would accumulate within that blockchain’s ecosystem—but this is not the case with modular blockchains.

This stems from the inherent design of modular blockchains. Modularity relates to core blockchain components—data availability and consensus, execution, and settlement—and refers to specialization across different layers (each doing what it does best). The most suitable layers for data availability and consensus, settlement, and execution are integrated into individual blockchains, allowing end users to access better products at lower costs.

To elaborate further, the primary benefit of modular stacks is enabling users to access blockspace at lower costs while enjoying improved performance and stronger security. This specialization allows total blockspace to scale exponentially. As more blockchains emerge, entirely new applications—ones we haven't even imagined yet—will be unlocked, much like how broadband internet enabled social media. Application developers no longer need to spend excessive time determining the ideal stack; they can simply plug in and deploy their applications. So, when the functions of all these core components are carried out by different blockchains, where exactly does value accumulate?

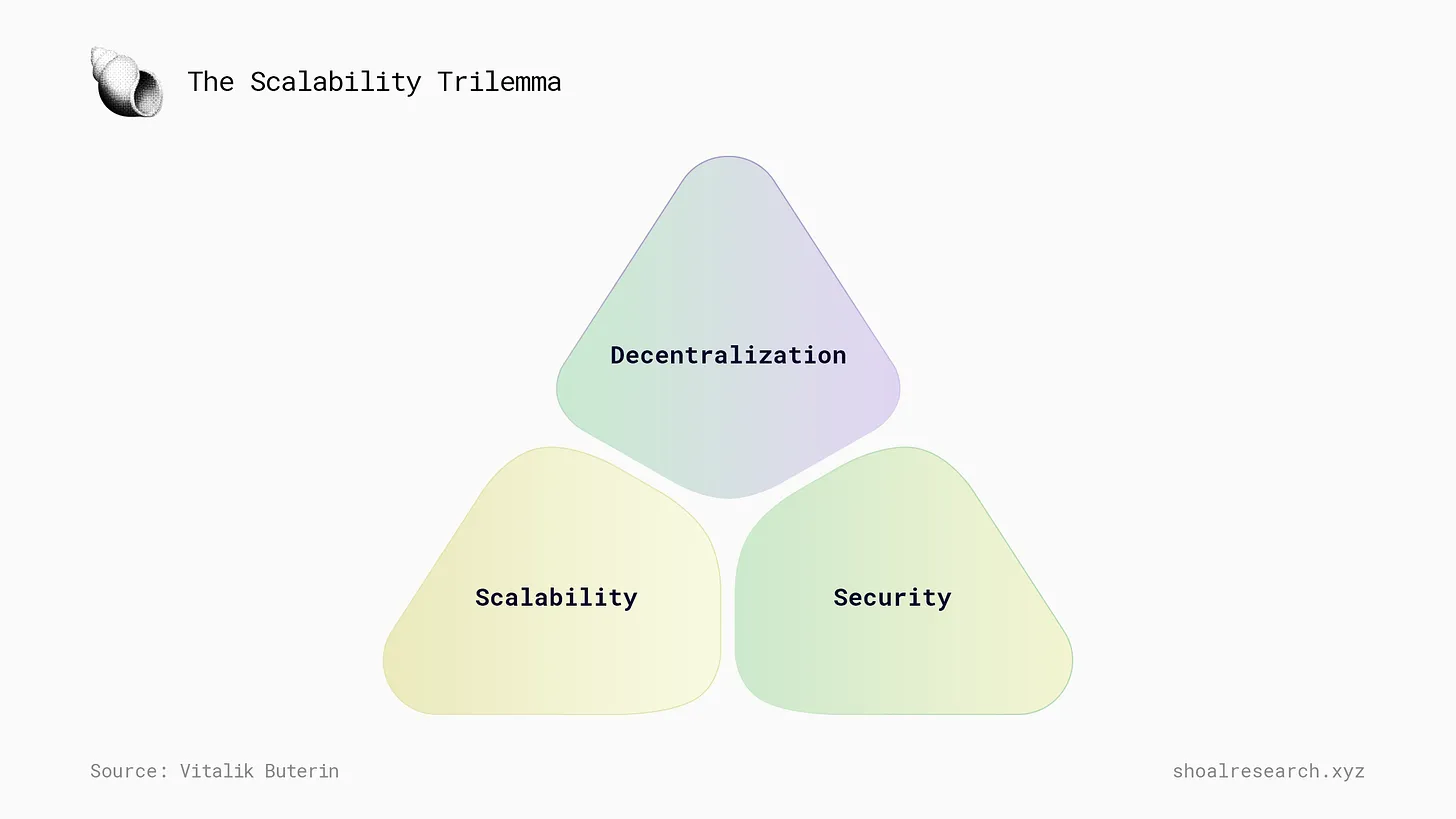

But before answering that question, let’s dive deeper into modular blockchains. The narrative around modular blockchains will help drive a paradigm shift in blockchain technology and Web3. It enables us to scale bandwidth without compromising on key properties of blockchains—namely censorship resistance, validity, and credible neutrality.

Scalability of Modular Blockchains

At its core, modular blockchains allow us to make optimal trade-offs within the blockchain trilemma (as shown in the diagram above) through layered scaling. Take Ethereum as an example. With modular blockchains, Ethereum can serve as a settlement layer due to having the largest number of validators, the most geographically distributed validator set, many individual stakers, and relatively low cloud concentration (see here). Objectively, Ethereum is the second-best cryptocurrency after Bitcoin. In practice, Ethereum is exceptionally well-suited to function as a settlement layer—this would make it the home of canonical bridges and enable dispute resolution capabilities such as fraud or validity proofs.

Now, regarding scalability, we build layers atop Ethereum similar to how traditional finance operates—for instance, products like Stripe or PayPal are built atop multiple financial layers. Banks typically use Fedwire (the Federal Reserve's settlement system) approximately every other week to settle transactions. Notably, TradFi has an advantage because it uses centralized databases to record transfers, whereas blockchains are distributed ledgers requiring cooperation among thousands of nodes to add and verify data. This takes the form of rollups (and other scaling solutions, with rollups being the primary one), which specialize in execution (execution essentially means running code within an execution environment—in the case of Ethereum and Ethereum rollups, this is the EVM). Thus, some trade-offs in decentralization and security are made. Rollups also require data availability, and by extension, consensus, to function. While Ethereum can provide these, they can also be outsourced to blockchains specialized in these tasks, such as Celestia.

An example of a project embracing modularity is Eclipse, which uses Ethereum as the settlement layer and Celestia for DA+consensus, while executing independently using SVM (Solana Virtual Machine) as its execution environment. SVM has recently attracted significant attention because it is currently the only multithreaded virtual machine, enabling parallelization (essentially processing transactions simultaneously), unlike Ethereum’s single-threaded virtual machine, where sequential transaction processing is standard and parallelization is not possible.

Modular vs. Monolithic?

I should clarify here that Ethereum itself is not a modular blockchain in the sense that it can perform all functions independently (data availability, consensus, execution, and settlement). However, it can be used by other blockchains and modular stack layers (such as execution layers like rollups) for functions like settlement, making Ethereum a component within another project’s modular stack. Jon Charb has written excellent pieces on Ethereum’s roadmap and Ethereum rollup layers, which is the origin of Jon Charb’s meme below. This meme can be interpreted as follows: everything can be seen as both a modular blockchain and a monolithic blockchain (performing all functions at the base layer, like Solana), depending on your perspective. If I build a rollup on Solana, is Solana itself a monolithic or modular blockchain? The same applies to Ethereum. Even Celestia could perform execution and settlement, but if it is used solely for data availability and consensus, then it becomes a modular blockchain.

By adopting modular blockchains, you can have different blockchains dedicated to fulfilling the "optimized" requirements of blockchains, as I outlined earlier.

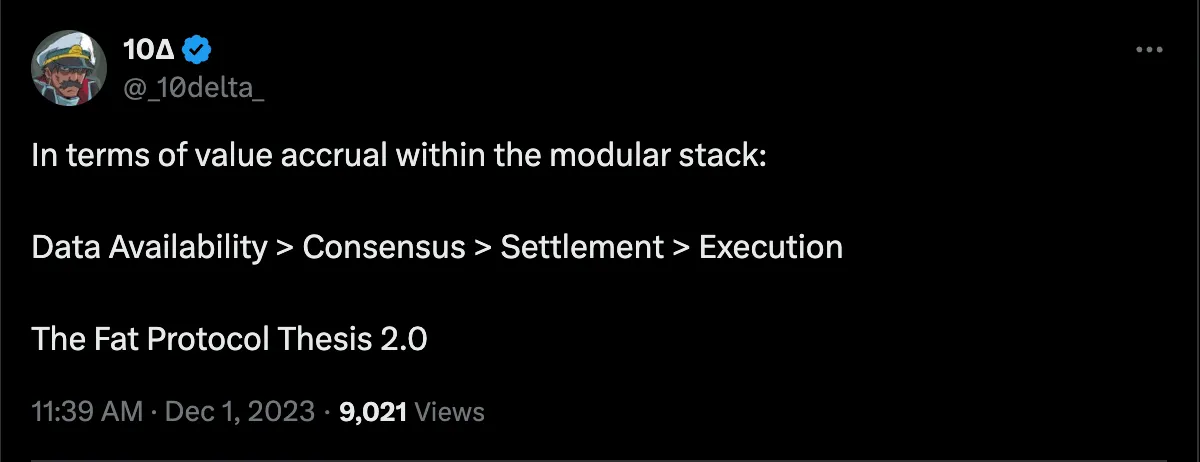

But this raises a critical question: Which of these layers—data availability, consensus, settlement, or execution—will capture the most value (i.e., experience the greatest value accumulation)?

This article was inspired by this tweet, from which I derived my conclusions and framework (spoiler: I disagree with the content of the tweet).

A clearer articulation of my thinking:

1) For a DA layer to function properly, you need some form of ordering on that layer (thus, DA layers have their own consensus mechanism, i.e., an ordering protocol). Therefore, in such a modular stack, data availability and consensus are not two separate things. Imagine using available data on one chain to create proofs, but that data (because it exists on a blockchain) gets ordered differently by another chain—this would be chaotic.

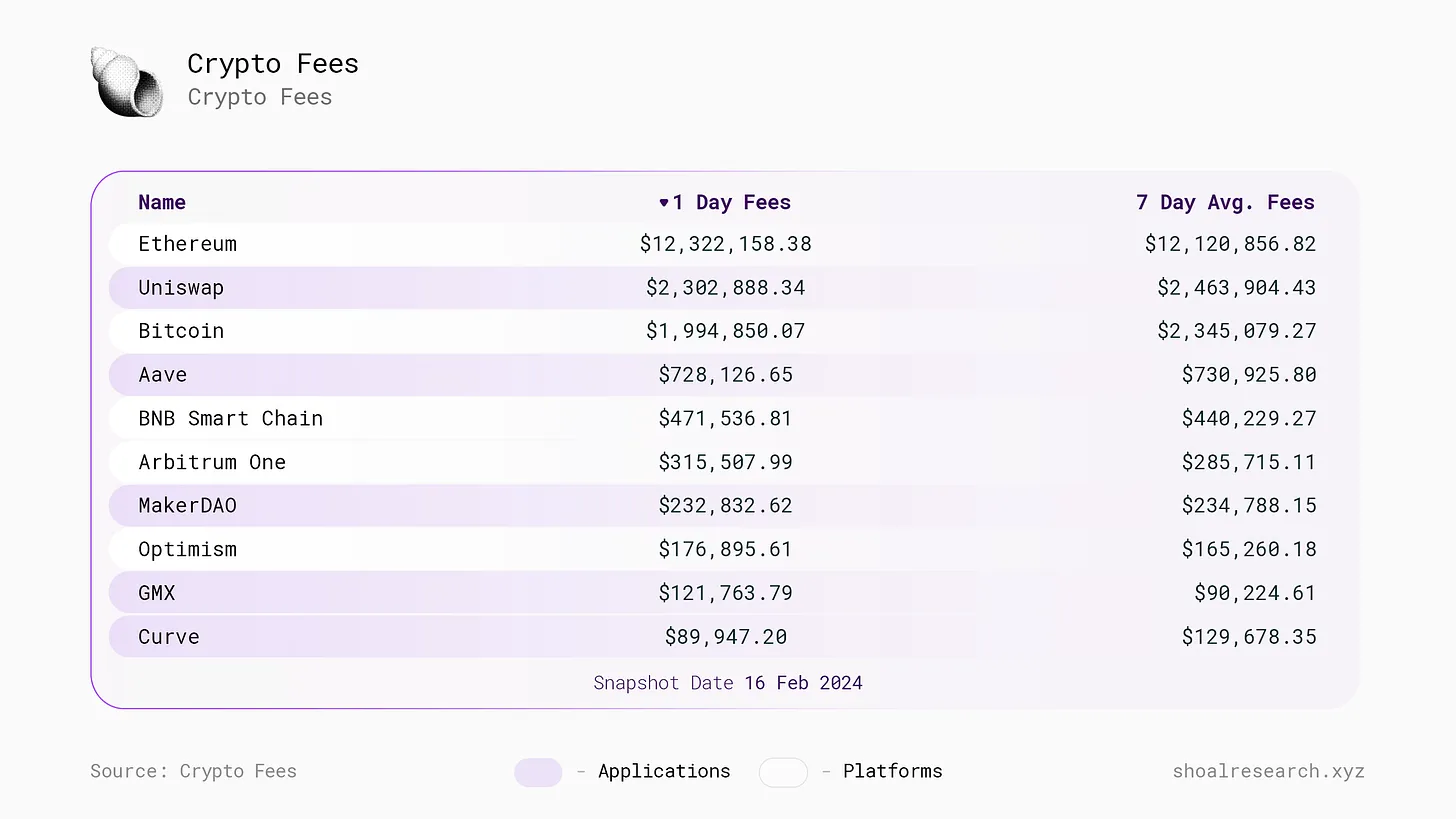

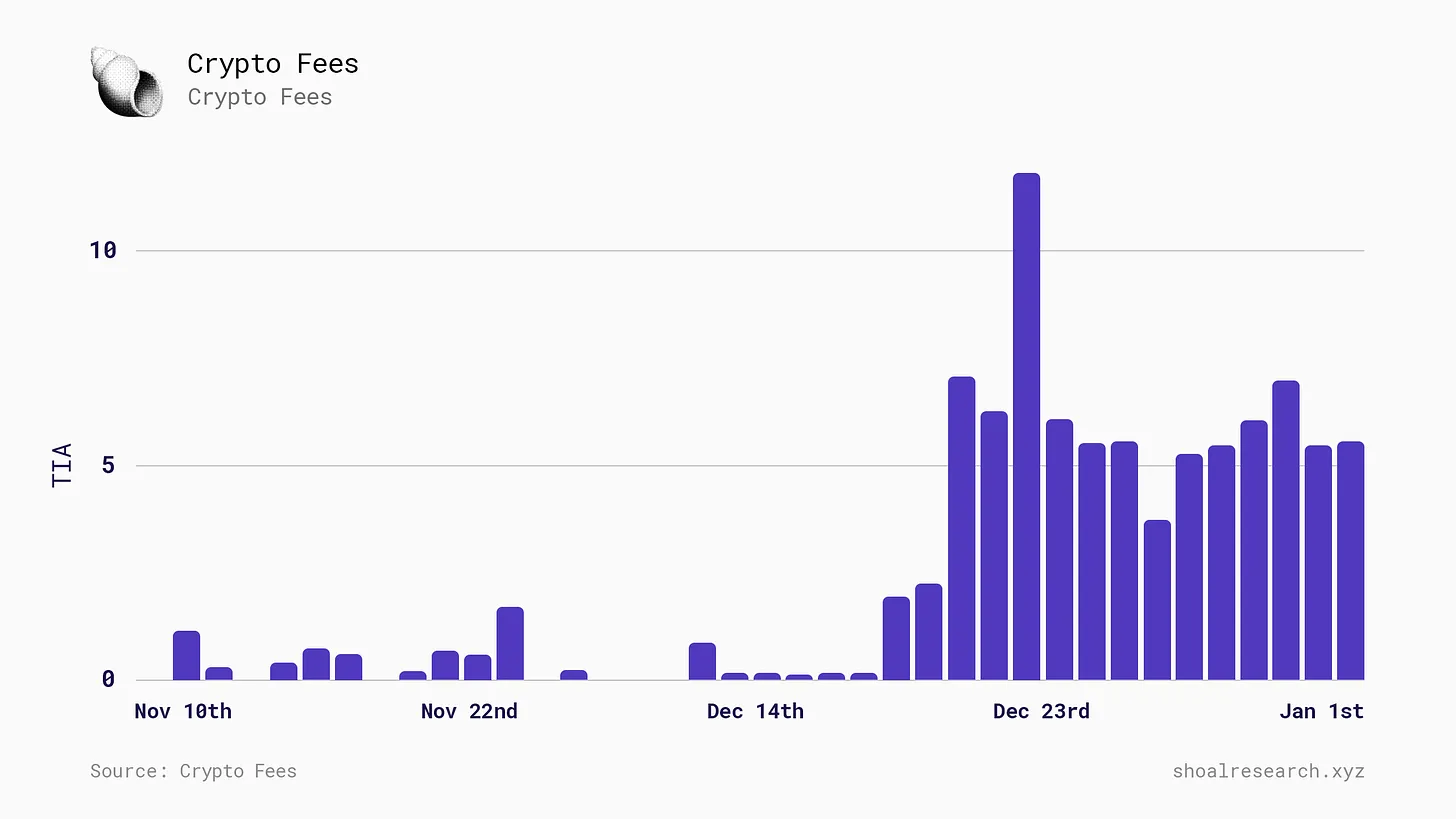

2) Execution layers like Arbitrum possess pricing (discriminatory) power, whereas DA layers like Celestia do not. This is because Celestia provides a commoditized service (data availability), while Arbitrum (and other rollups like Optimism) offers unique execution environments hosting some of the best crypto applications unavailable elsewhere—this is precisely why Arbitrum earns substantial revenue (hundreds of thousands of dollars per day), whereas Celestia’s fees are far lower (less than $100 per day), as illustrated in the chart below. Due to its sequencing monopoly (the foundation runs the sole sequencer), Arbitrum is also closer to end users. Although this may change in the future (e.g., with adoption of shared sequencing), the Arbitrum protocol (sequencer, builder, searcher) remains the only one charging user fees. Most importantly, part of the MEV revenue will flow through rollups and execution environments down to the DA layer, since rollups and execution environments still write data to Celestia! Remember, if the DA layer captured most of the value, today’s rollups and protocols would charge users less than the cost of publishing/writing data to the DA layer.

Solana co-founder Anatoly Yakovenko elaborated deeply on this phenomenon during the Lightspeed Podcast.

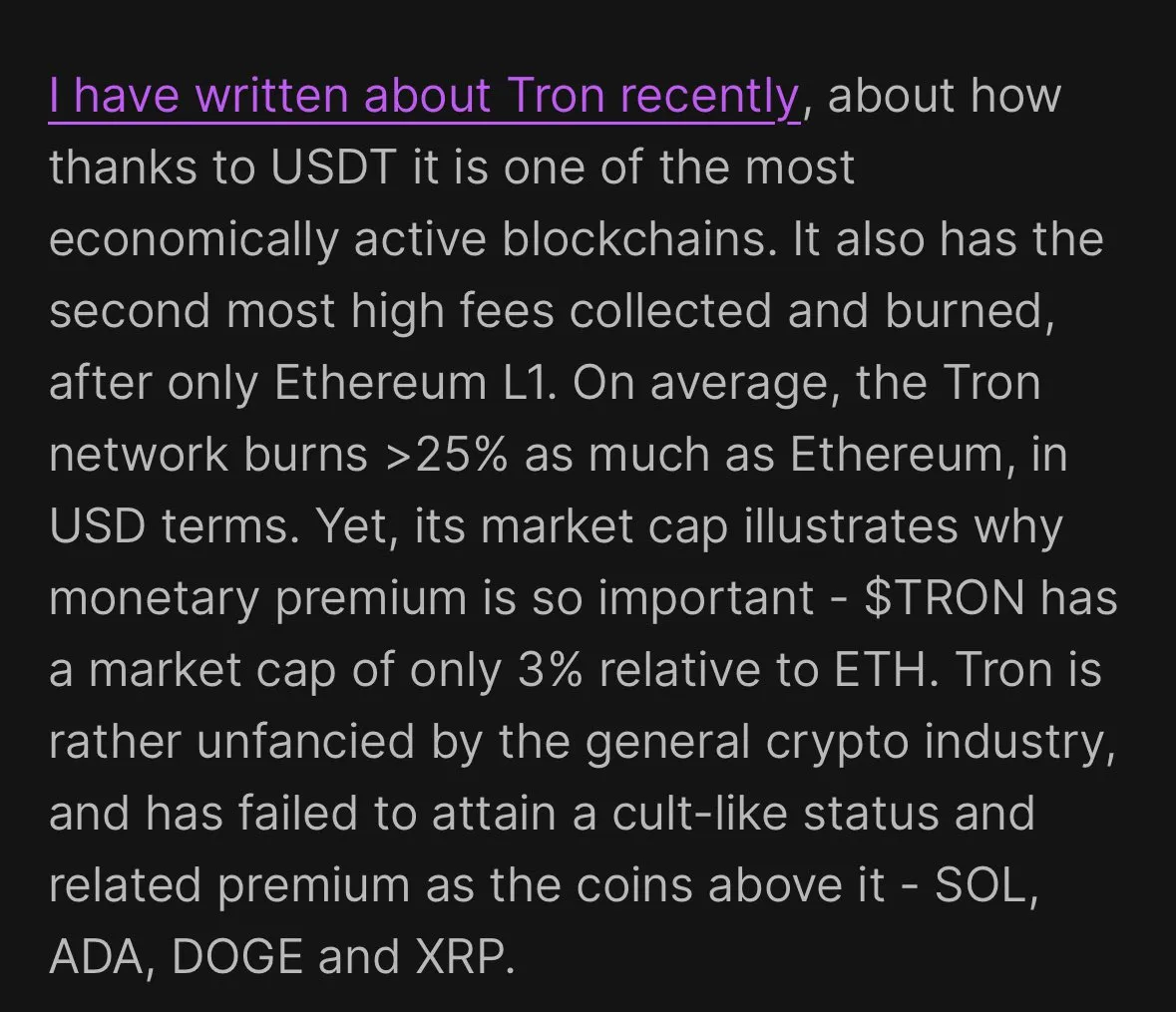

3) The settlement layer is more valuable than the DA+consensus layer (and I believe also more valuable than the execution layer) because the settlement layer will be secured by the largest amount of capital / monetary-like crypto assets, just as Ethereum—the most credibly neutral settlement layer today—is secured by $ETH. Compared to the settlement layer, inevitably more activity/traffic will pass through the DA+consensus layer, yet the assets on the settlement layer remain more valuable despite doing “less.” Consider the comparison between $TRX and $ETH: the former’s blockchain processes more transactions and burns more native tokens than Ethereum, yet its market value remains lower than ETH’s. Why? Precisely due to monetary premium.

In short, monetary premium refers to the multiple at which an asset trades relative to its fundamentals due to its “monetary properties.” Gold is a perfect example—it isn’t heavily used in production processes economically, and while gold looks beautiful, most of its value comes from its hard money characteristics. On this point, Polynya explains it better than I can, as shown below.

So what’s the conclusion?

I believe the most valuable part of the stack is settlement, followed by execution, then DA+consensus, for the reasons stated above (which is also why I don’t distinguish between DA and consensus).

My view can be summarized as follows: the settlement layer is the most valuable due to monetary premium; the execution layer is more valuable than the DA+consensus layer because the latter provides a highly competitive, commoditized service whose costs (and thus revenues for DA+consensus layers) will trend toward zero, while execution layers can build network effects faster and solidify them through massive liquidity! They are also closer to users and do not compete aggressively on fees.

Let me explain this further. Currently, rollup protocols like Optimism and Arbitrum pay over 90% of the cost (ultimately borne by users) for DA expenses and actively seek to minimize this fee. Hence, they might switch to Celestia for DA (and thereby consensus), drastically reducing costs (and consequently their revenue). Today, rollup data costs on Celestia are just a few cents; if Arbitrum were to write as much data to Ethereum as it does now, plus additional data to Celestia, it would cost only a few thousand dollars—Dan Smith conducted excellent research on this. But users don’t care about minor fee differences between rollups. Users don’t mind paying $0.01 for a swap on Rollup A instead of $0.007 on Rollup B, simply because they don’t swap frequently, and bridging assets carries security risks! However, for rollups, publishing terabytes of data to the DA layer is their core business, so these incremental costs matter significantly because they add up. Fundamentally, rollups are price-elastic. But rollup users largely are not.

Finally

Moving from fat protocols to fat applications, building models of value accumulation in blockchain is nothing new. The emergence of modularity introduces new components into the public blockchain landscape, bringing with it new economic and value dynamics. Modular blockchains represent a paradigm shift in the blockchain stack: moving away from building powerful, fully integrated networks capable of delivering all four blockchain functions at the base layer, toward constructing networks that leverage specialized layers to optimally deliver these functions.

To reiterate, I believe the settlement layer is the most valuable component in the stack, grounded in the monetary premium associated with its base asset. The execution layer comes next. In contrast, although the DA+consensus layer provides essential functionality, due to its commodity-like nature, it faces increasingly fierce competition and diminishing revenue potential.

In short, the order of value accumulation in a modular stack: Settlement > Execution > DA + Consensus.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News