Interpreting MetaDAO: A New Governance Experiment Based on the Concept of "Future System"

TechFlow Selected TechFlow Selected

Interpreting MetaDAO: A New Governance Experiment Based on the Concept of "Future System"

The crypto market always pays for belief.

By TechFlow

Although the crypto market always follows the basic principle of "chasing new, not old," old concepts repackaged can become new hotspots in today's market.

For example, MetaDAO, which has seen a surge in discussions over the past two days.

Unlike mainstream sectors such as AI, DePIN, and L2 that are currently trending, new projects related to DAOs often intertwine with human narratives like social experiments, governance optimization, and egalitarianism—narratives that are hard to falsify yet deeply resonate with people, making them easy targets for capital speculation.

Around the 18th, its token META deployed on Solana surged rapidly, reaching a peak of around $1,600, achieving nearly a 20x increase within just one day.

Although its price has pulled back somewhat by the time of writing, discussions about MetaDAO on social media continue to escalate.

Solana co-founder Toly commented that MetaDAO is "the coolest experiment in governance" and has repeatedly retweeted content related to the project; overseas crypto Twitter sees increasing posts using "MetaDAO" as a keyword.

Even more FOMO-inducing, well-known crypto VC Pantera reportedly sent a $50,000 investment offer for the project’s tokens, seemingly backing this “DAO governance experiment” with real action.

What exactly makes MetaDAO so special that it captures widespread attention? Are its product and token worth further attention?

"Futarchy": A New Practice of an Old Concept

For a DAO project, a compelling vision is often more valuable than actual governance mechanisms.

At its core, MetaDAO remains a DAO project—essentially making decisions democratically and decentralizedly—but its conceptual foundation sounds particularly attractive, providing ample reason for many in the industry to rally behind it:

Futarchy—the rule of the future.

This slightly sophisticated concept isn’t newly invented. As early as 2000, Professor Robin Hanson from George Mason University first introduced the idea of Futarchy in a paper titled “Shall We Vote on Values, but Bet on Beliefs?”

Later, in 2008, Futarchy was named a buzzword of the year by The New York Times.

What gives it legitimacy among crypto enthusiasts is that Vitalik also published a comprehensive long-form article introducing the concept of Futarchy on the Ethereum forum back in 2014.

Everything seems traceable—historical foundations, celebrity endorsements. But what does this concept actually mean?

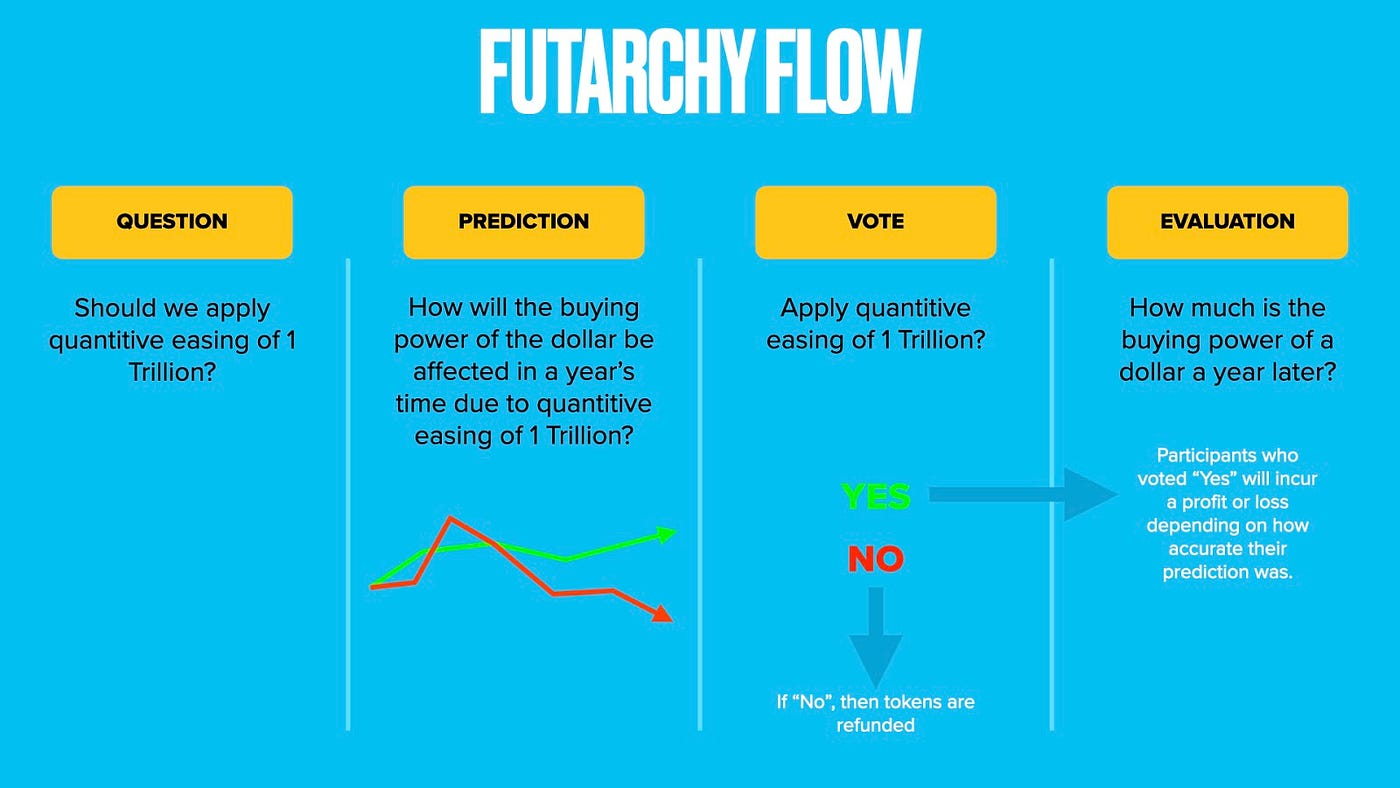

According to Wikipedia, “Futarchy is a form of government where elected officials define measures of national welfare and use prediction markets to determine which policies will produce the most positive outcomes.”

In the context of crypto, you can think of Futarchy as a decision-making mechanism based on the price movements of crypto assets.

When voting in a DAO, each proposal passes or fails based on market pricing; market prices reflect the collective probability assigned by participants to the outcome—if you believe an event is highly likely and back it financially, the corresponding token price rises accordingly.

If you’re still struggling to grasp the concept, consider a more accessible example described by MetaDAO’s founder in the project blog:

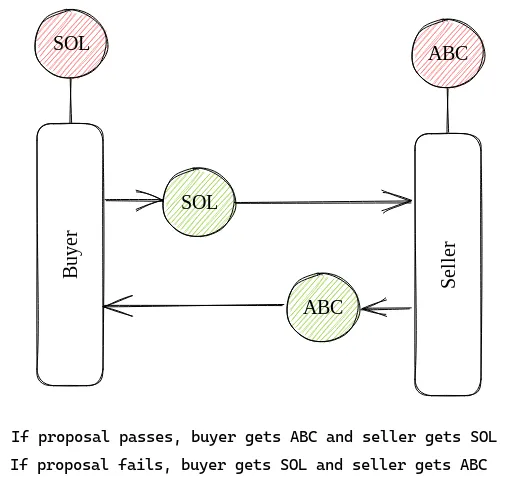

Suppose there’s a proposal, and investors believe its passage would positively impact member token ABC. Investors could act as follows:

-

Lock SOL tokens: The investor first locks 9 SOL.

-

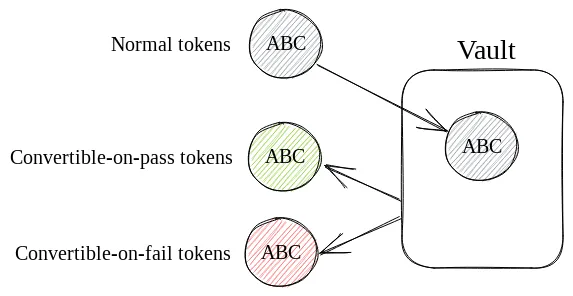

Receive convertible instruments: By locking these SOL, the investor receives equivalent convertible instruments—in this case, tools redeemable for SOL if the proposal passes (let’s call them “convert-if-passed-SOL”).

-

Trade conversion instruments: The investor exchanges these 9 “convert-if-passed-SOL” for 1 “convert-if-passed-ABC” instrument. This trade reflects their prediction that if the proposal passes, ABC’s value will rise to 10 SOL.

-

Post-proposal actions:

-

If the proposal passes, the investor redeems 1 “convert-if-passed-ABC” for 1 actual ABC token and sells it on the market for 10 SOL, realizing a profit of 1 SOL.

-

If the proposal fails, the investor uses their 9 “convert-if-failed-SOL” instruments (received upon failure) to reclaim the originally locked 9 SOL.

-

How should we evaluate MetaDAO’s design?

-

Role of prediction markets: By allowing investors to trade convertible instruments, MetaDAO captures market predictions regarding a proposal’s impact. The market prices of these instruments reflect the community’s consensus forecast on potential outcomes depending on whether the proposal passes or fails.

-

Estimating proposal impact: By comparing the prices of convertible instruments under pass vs. fail conditions, MetaDAO can estimate how a proposal affects member token valuations. If the market believes passage increases token value, then “convert-if-passed” instruments will trade higher than “convert-if-failed” ones.

-

Decision mechanism: This market-driven decision framework enables MetaDAO to make decentralized choices that maximize overall member wealth.

Put even more simply, we can summarize MetaDAO’s Futarchy concept in one sentence:

“Quantify a proposal’s economic impact via prediction markets, and automatically execute decisions that maximize member wealth based on these quantified outcomes.”

FDV Skyrocketing on Narrative Alone?

In current social media discourse, most believe MetaDAO may be the first proposal attempting DAO governance based on the Futarchy ideal—where all proposals pass or fail based on final trading valuations.

Being first brings attention and hype. Backed by Solana and endorsed by Toly, MetaDAO’s momentum is likely to persist for some time.

But that doesn't mean the project is without issues.

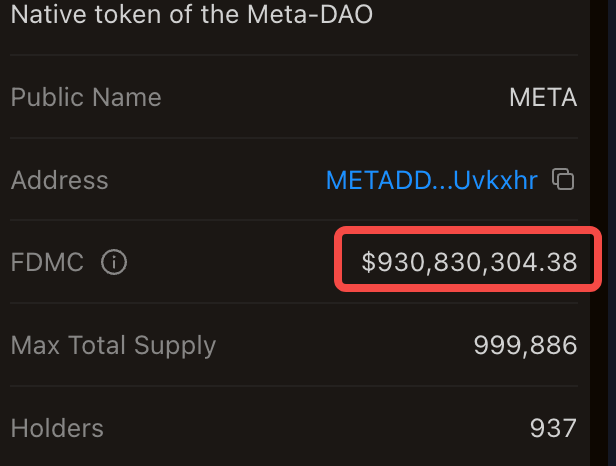

Looking at the most obvious metric—the token valuation—its FDV based on current price approaches $1 billion, driven purely by the Futarchy concept or governance narrative alone.

While speculation often outweighs fundamentals in bull markets, FDV still serves as a useful gauge for assessing whether a project is overvalued or undervalued. For reference, the well-known AI project Fetch.ai also has an FDV around $1 billion, yet the AI narrative clearly carries broader appeal and influence than on-chain governance. Meanwhile, Bonk—one of Solana’s breakout meme projects—has an FDV of approximately $1.2 billion.

Therefore, rather than positioning itself primarily as a DAO governance solution, MetaDAO arguably resembles more of a meme infused with the “Futarchy” governance idea.

People are buying into this sexy concept—what exactly is being governed, or what needs governing, seems less important. Additionally, the project’s smart contracts have not yet been publicly audited, and current token holder count remains under 1,000.

Conclusion

Although MetaDAO’s governance design aims to reduce manipulation risks, prediction markets may still be influenced by small interest groups when liquidity is low or participation limited. Moreover, if certain participants possess superior information compared to others, they could exploit this asymmetry for unfair gains, potentially distorting market predictions.

Futarchy and its implementation in MetaDAO represent relatively novel ideas whose long-term effectiveness and unforeseen consequences require further observation.

Yet an interesting point lies in the title of the original paper introducing Futarchy: “Should We Vote on Values, But Bet on Beliefs?”

The crypto market always bets on beliefs.

Where there’s a concept, there’s an audience; where there’s belief, there’s community consensus.

How far belief alone can carry MetaDAO and its token price—only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News