What Should the Bitcoin Ecosystem Look Like in the Post-Inscription Era?

TechFlow Selected TechFlow Selected

What Should the Bitcoin Ecosystem Look Like in the Post-Inscription Era?

Good projects can combine popular narratives with long-term value, and hyped bubble assets are not entirely worthless.

Written by: @xingpt,NP Hard

In the cryptocurrency industry, when it comes to technically oriented projects, we often need to distinguish between short-term narratives and long-term value—to identify which projects are bubble assets driven by hype, and which possess genuine technological value. Of course, great projects can combine both popular narratives and lasting value. That said, even hyped-up bubble assets aren't entirely without worth.

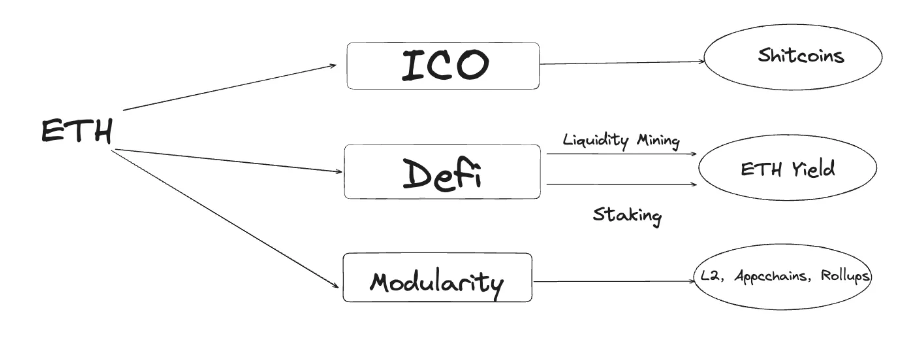

This article primarily discusses the future hype logic within the Bitcoin ecosystem. But first, let's learn from Ethereum—the project that has traveled furthest along the path of narrative building—on how it developed its own story.

ICO – Creating Fair but Useless Assets

When Ethereum first emerged, it needed a distinct identity separate from Bitcoin and its derivative coins—one centered on smart contract support enabling various applications. The first major application type was ICOs (Initial Coin Offerings), emphasizing fair token distribution: raising ETH and issuing ERC-20 tokens for new projects. Due to their low initial market caps, these new tokens often surged in price early on, sparking Ethereum’s first asset speculation frenzy—the ICO boom.

Looking back today, 99% of ICO projects have become worthless. However, the ICO craze solidified Ethereum’s positioning as an application launch platform, later rebranded with the more glamorous label of “world computer.”

DeFi and NFTs

After going through a slump in 2018–2019, Ethereum’s bull run from 2020 to 2022 was mainly driven by two waves of mainstream hype: first, DeFi assets. At the core of this model was using ETH—the native coin—as a **"shovel"**—providing liquidity in lending protocols, DEXs, derivatives, etc., in exchange for project tokens. Unlike ICOs where ETH served as investment capital, here ETH acted as collateral. This created a user experience of “getting free new tokens,” leveraging users’ desire to “free-mint” or “ape in” to rapidly acquire users.

However, the same model of selling essentially useless assets continued through NFT speculation. NFTs share several key traits: “uselessness”—which allows greater room for speculation; “low liquidity and low market cap”—enabling early participants to earn outsized returns; and “fairness”—everyone (except whitelisters) gets equal access. (Note: We’re not discussing cultural differences between NFTs and ICOs here, only their similarities in terms of asset speculation.)

Meme Coins

Although Shib and the animal-themed tokens kicked off the meme trend, it wasn’t until the emergence of the Pepe series that memes became a standalone category. However, the current issue is that meme coins struggle to sustain multiple large-cap projects—only one or two leaders can reach over $1B in market cap. As such, they haven’t provided enough momentum to significantly boost Ethereum’s overall valuation.

From this perspective, we can also understand why ETH underperformed in this cycle: there were no new low-liquidity assets like NFTs to sell, nor did ETH serve the **“shovel” function**. Rollups like Arbitrum, Optimism, and Starknet don’t offer opportunities to deposit ETH and mine Layer2-native tokens—exceptions being Manta and Blast. Meanwhile, restaking yields tokens whose total supply and value cannot match those of major Layer2 chains. Hence, ETH weakened in this cycle. In contrast, standout performers like Celestia maximized the “shovel” narrative through modular blockchain storytelling. On the “junk” asset front, Solana successfully launched high-performing memecoins like Bonk and Wif, while numerous airdrops across its ecosystem—including Pyth, Jupiter, and Jito—gave SOL some semblance of “shovel” utility.

For the Bitcoin ecosystem, the biggest change in this market cycle has been inscriptions—the first time “junk” assets were directly issued on Bitcoin, possessing characteristics of low circulation, fair distribution, and low market cap. The question is: what comes next for Bitcoin after the inscription era?

Following the above logic of positioning Bitcoin as a “shovel,” here are several hypotheses.

Staking Bitcoin for Yield

Babylon, one of the leading projects in the Bitcoin ecosystem, offers BTC staking by introducing slashing mechanisms on Bitcoin to allow permissionless staking that secures Cosmos-based chains. Both narratives—using Bitcoin as a yield-generating base asset and leveraging the Bitcoin network to enhance chain security—are highly compelling. Consequently, Babylon dominated the primary market and attracted strong VC interest. However, for Bitcoin to truly act as a “shovel,” two conditions must be met: first, the PoS tokens generated via the Babylon protocol must be sufficiently valuable and abundant; second, the amount of Bitcoin staked through Babylon must reach significant scale. A low TVL would undermine the credibility of the “securing other chains” narrative. Meeting both requirements demands top-tier business development resources and coordinated efforts across both the Bitcoin and Cosmos ecosystems—an extremely challenging task. Projects looking to emulate Babylon should carefully assess whether they have the capability to raise over $100 million in funding.

Staking Bitcoin to Mine New Tokens

Staking Bitcoin to mine new tokens is a common cold-start strategy adopted by many emerging Bitcoin Layer2s, such as BSquare and MerlinChain. However, Bitcoin holders face two major issues: First, security—depositing Bitcoin into Layer2 networks via bridges requires trusting the security of Layer2 smart contracts and validators, representing a clear downgrade compared to Bitcoin’s native security. Second, usability—unlike Celestia, which is inherently part of the Cosmos ecosystem (where staking TIA once grants access to multiple project airdrops), Bitcoin Layer2 mining forces users to constantly shift funds across different protocols, resulting in poor user experience and increased operational risk.

Another challenge lies in yield. The intrinsic value of the chains being mined must be seriously considered. Without annualized returns exceeding 10%, let alone 20%, it will be difficult to attract large Bitcoin holders willing to take on such risks.

Therefore, projects adopting this model must move quickly to capture early adopters among the limited pool of high-risk-tolerant Bitcoin whales (a small minority). They must also aggressively increase the value of their native tokens—through exchange listings, ecosystem growth, and marketing—all of which favor teams with prior crypto startup or asset management experience.

Using Bitcoin to Fund and Issue "Junk" Assets

The reason seemingly “useless” junk assets still find buyers is due to innovative storytelling. Inscriptions tell the narrative of Bitcoin’s revival; NFTs focus on cultural breakout moments. Currently, Runes (Ordinals-based fungible tokens) appear best positioned—created by Casey from Ordinals, with community-driven initiatives like RSIC gaining traction. Merlin’s RCSV team previously launched BRC420 Blue Box, a prime example of starting with new asset issuance, centering on asset speculation, and eventually evolving into a broader infrastructure narrative.

Other emerging Bitcoin Layer2s and cross-chain interoperability projects akin to Babylon may need to go beyond merely building more decentralized and secure Layer2 solutions (the traditional legitimacy narrative). Before launching a chain, they should plan how to create new asset classes and implement more innovative, fair distribution mechanisms—not just simple airdrops to existing Bitcoin holders.

How to “Package” a Perfect Bitcoin Ecosystem Infrastructure Project?

First, we want Bitcoin users to be able to stake within our protocol trustlessly—without needing to touch cold wallet funds or initiate transfers—leveraging native Bitcoin validation logic such as Bitcoin Covenants or DLCs;

Second, the yield or new assets obtained through staking should either be redeemable for Bitcoin or generate a highly attractive annualized return from a Bitcoin-denominated perspective;

For degens, newly issued assets should offer relatively fair participation, limiting whale dominance while rewarding early community members and core contributors. I discussed this topic in detail in my previous article (The Best Time to Invest in Web3 Has Arrived—What Kind of DApp Do We Need?).

Finally, actively contribute to open-source community development—building foundational tools, documentation, offering grants, etc. Giving back to the community is a crucial non-technical way to gain legitimacy, perhaps even more important than technical achievements themselves.

In my next article on the Bitcoin ecosystem, I’ll discuss from a technical pathway perspective how the Bitcoin ecosystem can evolve and how to find the right ecological positioning for Bitcoin projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News