Blast L2 Operations Guide: Split Airdrop 50/50, I Want Both TVL and Developers

TechFlow Selected TechFlow Selected

Blast L2 Operations Guide: Split Airdrop 50/50, I Want Both TVL and Developers

In the world of crypto, Blast has truly mastered the art of incentives.

By TechFlow

Blast has recently re-entered the spotlight.

On January 17, Blast officially launched its testnet and a one-month "Big Bang" incentive program, encouraging developers to build applications within its ecosystem. Projects will compete under specific rules, with winners receiving token airdrops from Blast, as well as opportunities to connect and communicate with top-tier investors.

More importantly, this incentive campaign serves more like an audition or rehearsal—the real stage being the upcoming Blast mainnet. Meanwhile, seated in the audience are the users Blast has attracted over recent months, patiently waiting for new project launches and eager for the next liquidity bonanza.

This L2, launched by Blur founder Pacman, drew widespread attention when first announced last November. Its built-in yield features, backing from Paradigm, and lessons from Blur’s prior success made it both highly discussed and controversial.

The last time Blast sparked broad industry discussion was due to its rapid ability to attract users and liquidity.

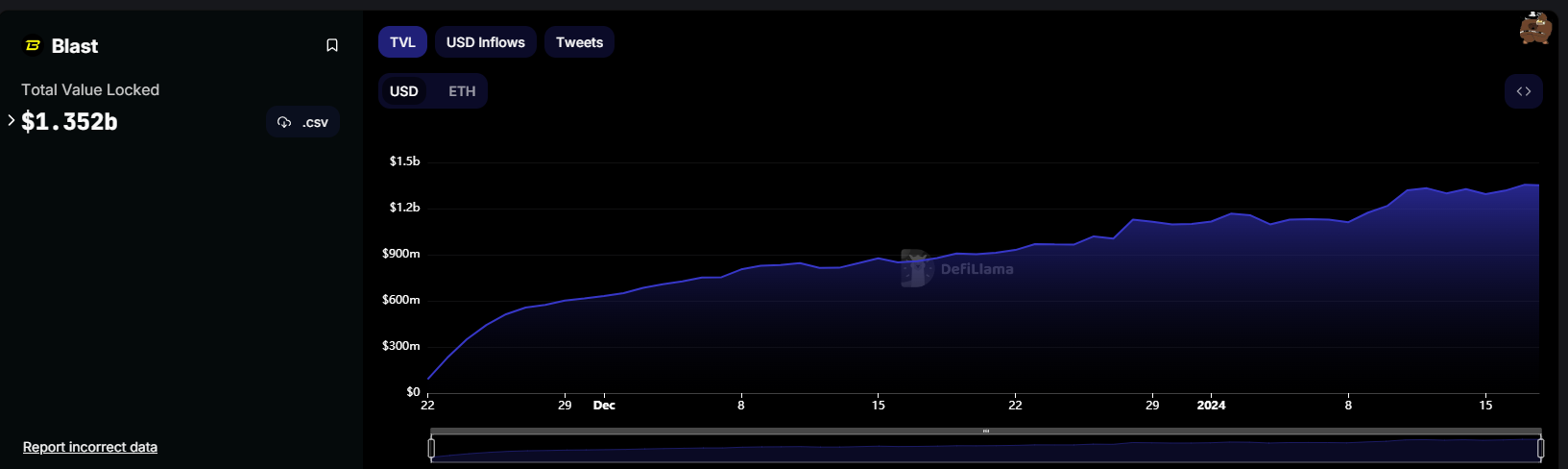

Just days after launching in November last year, Blast’s TVL surged past $500 million—making many competing L2s sweat. At the time, even the CEO of Arbitrum’s parent company tweeted, “We created this monster.”

Now, that monster has grown even bigger.

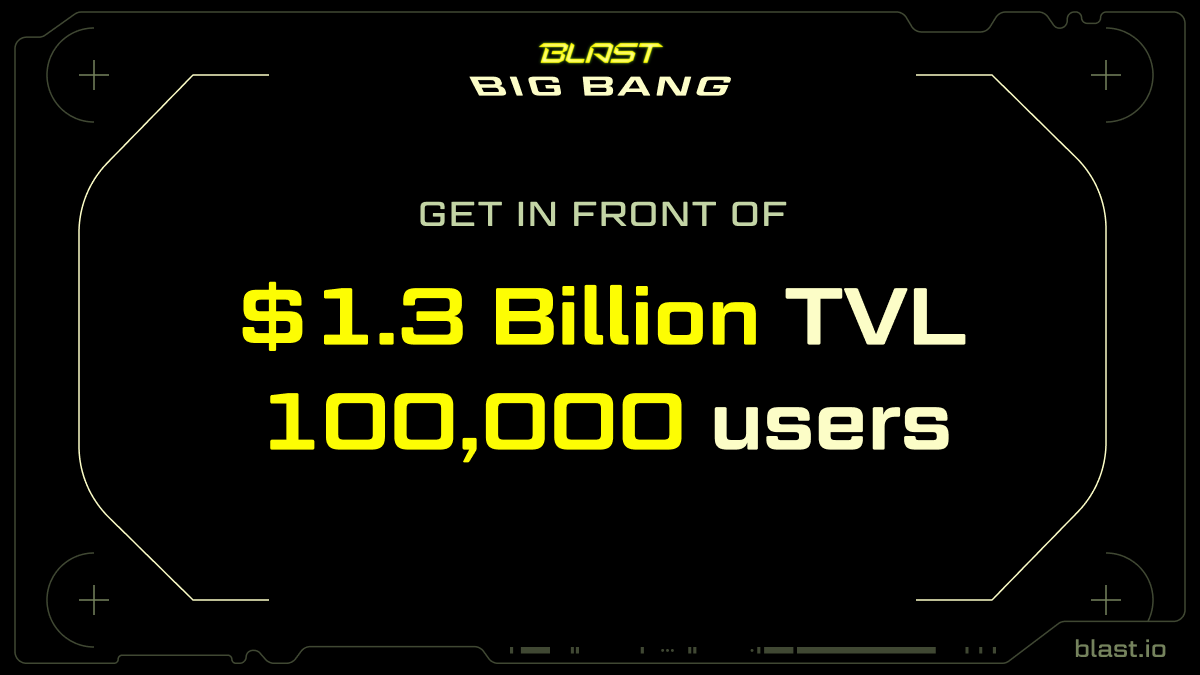

Within just about two months, Blast has successfully absorbed a total TVL of $1.3 billion and over 100,000 users. Considering Blast hasn’t officially launched yet and has been operating only briefly, this is remarkable—especially compared to the mature Arbitrum, which has a TVL of $2.6 billion, only double that of Blast.

Not only attracting users, Blast is now extending an olive branch to developers.

With its Big Bang testnet initiative, Blast offers projects help finding users, funding, and connections—an offer some new projects may find hard to refuse.

In the world of crypto, incentive mechanisms have clearly been mastered by Blast.

A Testnet Where Airdrops Are Split in Half

Let’s take a closer look at the details of this Big Bang testnet incentive program.

Think of an L2 as a stage: users watch, while projects perform.

For the stage organizer, Blast, there are two interrelated challenges:

Promising performers there will be an audience, and promising the audience there will be performances.

This is also the fundamental dilemma faced by any platform project: how to pull resources away when both sides—or even both sides’ competitors—are already established elsewhere.

Blast’s solution is blunt, primitive, yet effective—yield, yield, and more yield.

Even though the L2 mainnet isn’t live yet, Blast openly promises users that depositing assets will earn ETH staking yields and stablecoin interest—enough on its own to draw in profit-driven crypto users en masse, not to mention the added incentive of earning points redeemable for future airdrop expectations.

On the other side, Blast can confidently attract builders by showcasing real, tangible TVL, and directly stating that developers will receive airdrop rewards.

One testnet, yield split in half.

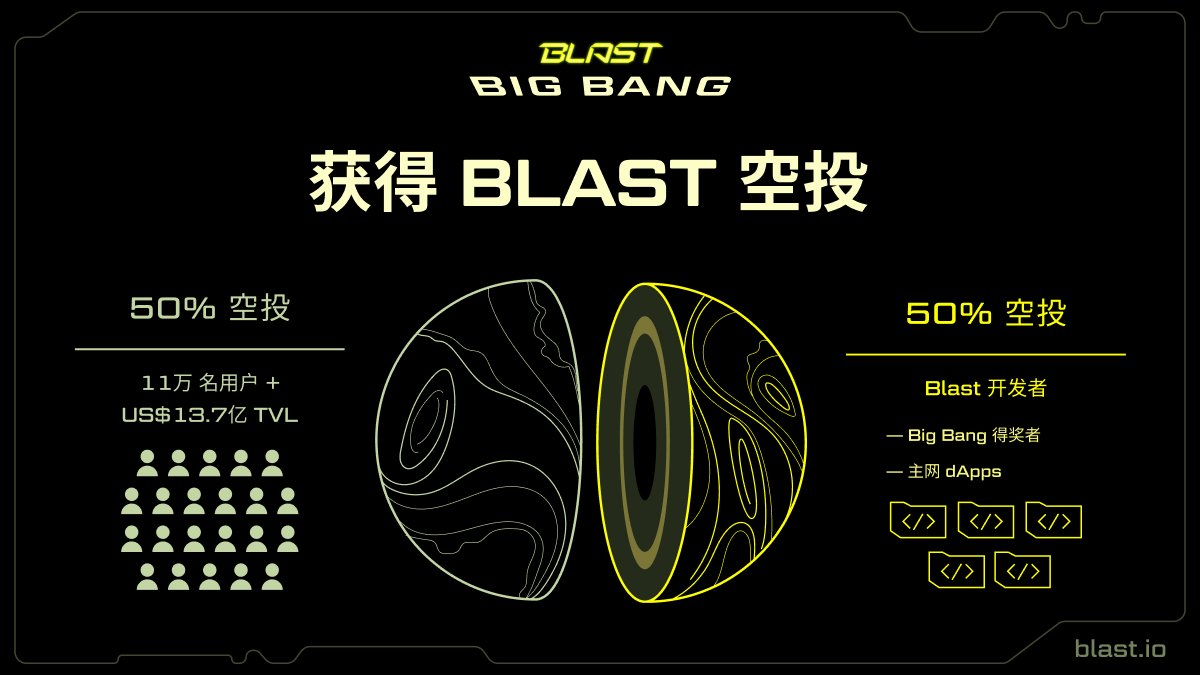

All Blast airdrops will be split evenly: half going to winning projects and mainnet application developers, the other half to users who deposited liquidity on Blast.

Typically, airdrops are aimed at retail users, and direct airdrops to developers are rare. But as the saying goes, big rewards bring brave men. Especially in an environment where other L2 ecosystems are becoming rigid and dominated by top players, building on Blast offers three key advantages: airdrop incentives, ready users, and uncharted territory—why wouldn't you?

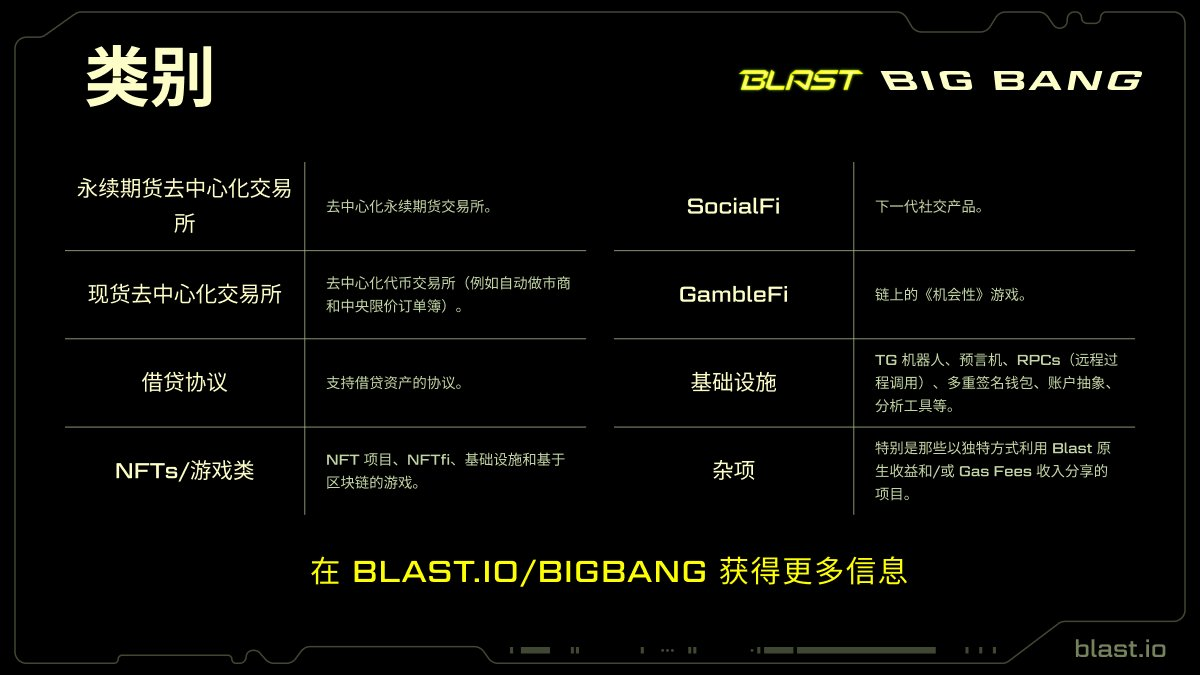

According to official information from Blast, the types of projects they encourage include DeFi, NFTs, social, gaming, infrastructure, and five other major categories—essentially covering all areas most favored by liquidity in the crypto market. With such strong incentives, it's only a matter of time before standout projects emerge.

We can see Blast’s eagerness to attract talent, while also maximizing the value of its team and brand. Winning projects will also gain opportunities to interact with core members from the Blur team. While a single conversation might not solve practical issues, the networking and community effects—whether for project development, business development, or insider insights—are overwhelmingly beneficial.

Maximizing both token and resource incentives, openly throwing out the invitation—Blast seems to deeply understand what truly motivates developers and users in the crypto space.

Technical Homogenization, Operational Big Bang

Blast’s testnet incentive campaign is named “Big Bang,” but in my view, what’s truly exploding is the operational mindset.

Setting aside Blast for a moment, how did previous L2s attract users and developers?

They offered airdrops, but with vague, fluctuating rules—not upfront clarity. They provided developer incentives, but these didn’t immediately engage retail users; instead, they later manifested as equivalent token emissions to attract participation.

More importantly, earlier L2s focused almost entirely on technical narratives—how far their OP/ZK tech could go, how low gas fees could get, how fast performance could be.

This matters, but it’s not decisive.

When dozens of L2s in the crypto market have technically homogenized foundations, users and developers have already made their calculations:

I don’t care much how good your tech is—I care more about how much benefit you can give me.

From Blast’s operational approach, we’re seeing a different model: I’m not asking you to come because you think the tech is amazing—I’m getting you here purely through yield.

Straightforward, efficient, and practical.

First, attract users and liquidity with predictable returns (ETH staking and stablecoin interest), then use that liquidity as leverage to attract developers.

No user will resist tangible yield incentives, and no developer will turn down the lure of “a large user base.”

Using yield as a lever on both sides effectively drives behavior, at least enabling rapid momentum and achieving cold start success for a latecomer L2.

Of course, there’s always skepticism in the market—that users acquired purely through yield and incentives aren’t sustainable, legitimate, or technically grounded. But in crypto, it’s winner-takes-all. If stacking incentives leads to successful business outcomes, users get paid, projects acquire users, and the L2 earns transaction fees from volume, everyone else tends to stay quiet.

Those still complaining later will inevitably be competitors or those who didn’t make money. This logic closely mirrors Blur’s earlier challenge against OpenSea.

Blur once executed a classic case of a late-mover dominating the NFT platform space, and now, repackaging the same formula, Blast appears to be using a similar operational playbook to eat into the L2 market share:

Incentives as matchmakers, offering benefits to both sides.

Moreover, the broader impact of Blast’s current testnet campaign is that it positions itself as an L2 with built-in Launchpad functionality.

Want liquidity? I’ve got it. Want incentives? I’ve got those too. Want users? I’ve got even more of those.

For a new project, what reason is there not to launch on Blast? Conversely, when “launching on Blast” becomes a consensus, Blast effectively turns into a Launchpad, making it easier to attract future projects eager to try their luck.

In this new cycle, lofty technical narratives seem to be losing effectiveness. Users increasingly favor projects that are straightforward, easy to understand, and offer direct incentives. Thus, we’ve seen the rise of inscriptions, growing anxiety among VC-backed projects, and a pragmatic shift where many projects, unable to beat the trend, choose instead to join the inscription or Bitcoin ecosystem bandwagon.

Is the L2 sector undergoing a similar shift toward more grounded, practical thinking in both philosophy and operations? At the very least, Blast has set the precedent.

Interestingly, you can always sense that narratives change, teams change, strategies change in crypto—but beneath it all, the understanding of human nature remains constant.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News