9 Data Charts Analysis: How Is Blast Doing?

TechFlow Selected TechFlow Selected

9 Data Charts Analysis: How Is Blast Doing?

Blast is the fastest chain to reach $2 billion in TVL.

Author: 1912212.eth, Foresight News

Blast arrived late—originally scheduled for an airdrop at the end of May, it only recently announced its governance token plan. The total supply is 100 billion tokens, with 50% allocated for community airdrops and an initial distribution of 17 billion. Additionally, 25.5% is assigned to core contributors, 16.5% to investors, and 8% to the Blast Foundation. As part of the transition toward decentralized governance, the official team stated that control over the project’s Twitter account, website, and Blast protocol governance will shift to the foundation.

Optimism (OP) and Arbitrum gained attention due to their airdrops, while ZKsync became a "negative example." Since opening its airdrop claims, Blast has also received lukewarm community feedback. According to Bitget market data, BLAST is currently trading at $0.025.

From being highly anticipated at launch to now facing dwindling enthusiasm, how exactly has Blast evolved? Here are nine data charts to break it down.

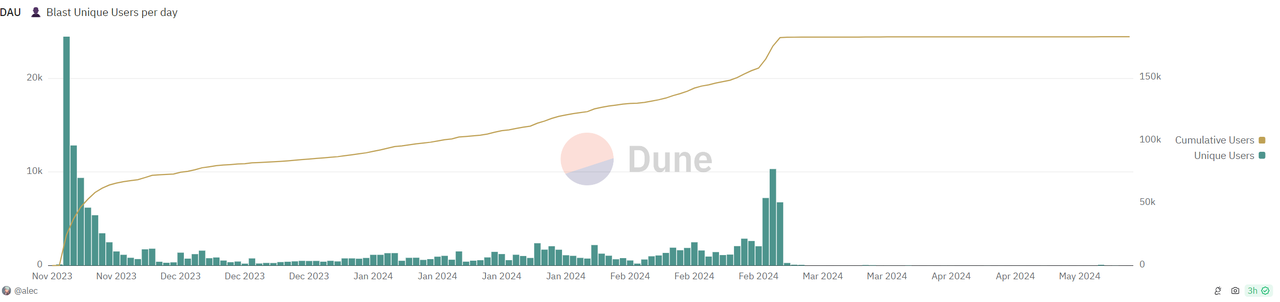

Total Participants Exceed 1.56 Million, Daily Active Users Surpass 150,000

Blast launched its testnet in mid-January this year and officially went live on mainnet on March 1. According to data from its official website, the total number of users has reached 1.56 million.

On the day of mainnet launch, daily active users exceeded 70,000 but quickly dropped afterward. However, driven by various incentive programs such as points campaigns, activity rebounded steadily. By June 24, daily active users had reached 150,000—more than double the level seen at mainnet launch.

Total TVL Hits Record High of $3.46 Billion

Although the Blast testnet launched in January this year, its staking functionality opened as early as November 21 last year. The next day, Total Value Locked (TVL) surpassed $100 million; by November 24, it reached $400 million. On December 2, it exceeded $667 million, making Blast the third-largest Ethereum L2 after Arbitrum and OP. On December 26, TVL crossed the $1 billion mark.

Notably, on February 25 this year, TVL surpassed $2 billion, making Blast the fastest blockchain to reach that milestone. In May, it peaked at over $3.4 billion.

Over 479,000 ETH Bridged to Blast

According to Dune analytics, since mainnet launch, the amount of ETH bridged via cross-chain bridges totals 479,709, accounting for 62.25% of all bridged assets. stETH accounts for 26.81%, while USDC, USDT, and DAI together make up 10.94%.

Highest User Activity Seen During Ethereum Staking Launch and Mainnet Go-Live

Significant increases in active and new users occurred around the time of opening Ethereum staking last year and the mainnet launch in February 2024.

After the mainnet launch, cumulative new user growth quickly plateaued.

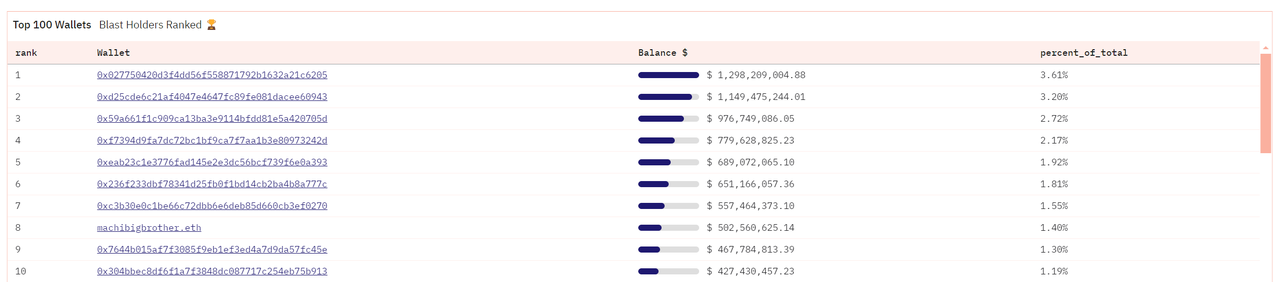

Top 10 Wallet Addresses Hold 20.87% of Total Funds

In crypto, major airdrops always attract large holders. The top Blast whale holds 3.61% of all funds held by Blast users in a single wallet address. Collectively, the top 10 Blast holders possess 20.87% of the total holder balance.

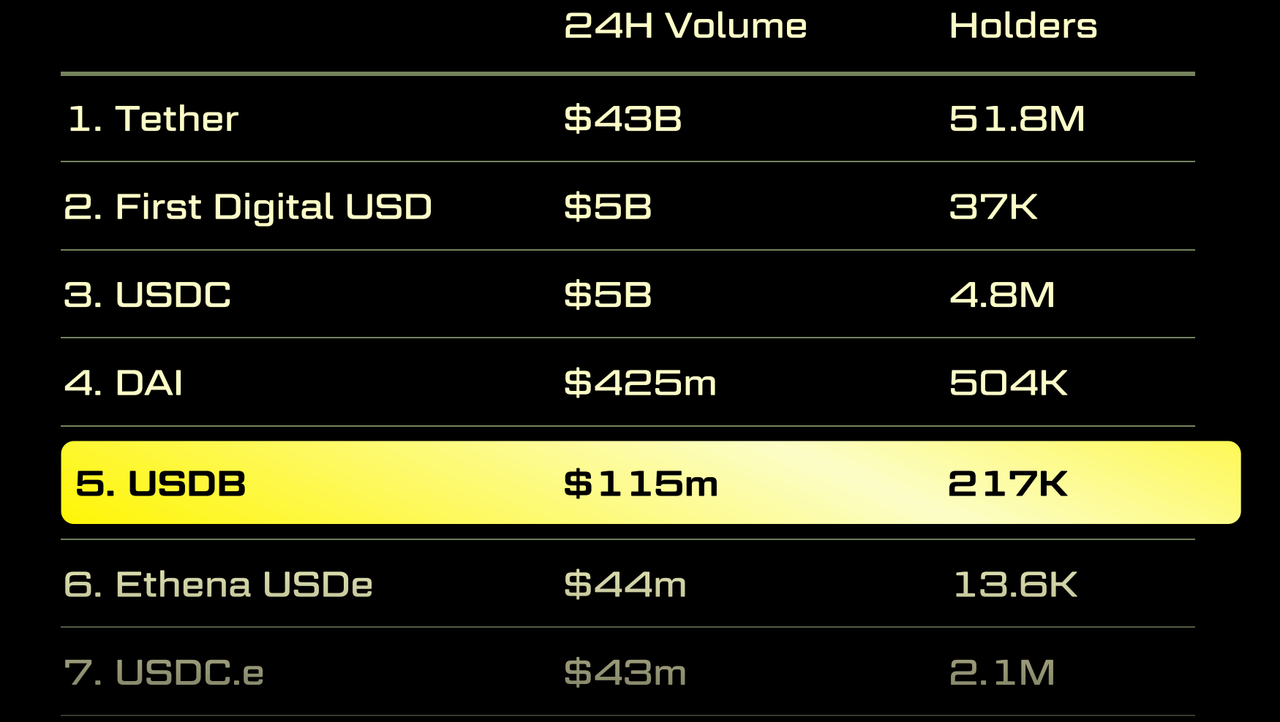

USDB Ranks Fifth in Usage, Fourth in Holder Count Among Stablecoins

Blast is a chain with a native stablecoin. Data from June 21 shows that USDB achieved a 24-hour trading volume of $115 million, is held by 217,000 users, ranks fifth in activity, and has a market cap exceeding $400 million.

USDB and WETH Rank Among Top Three in Yield

Among liquidity pools with over $40 million in assets, USDB offers yields between 17.3% and 32.6% on Blast. WETH provides yields ranging from 7.6% to 10.5%.

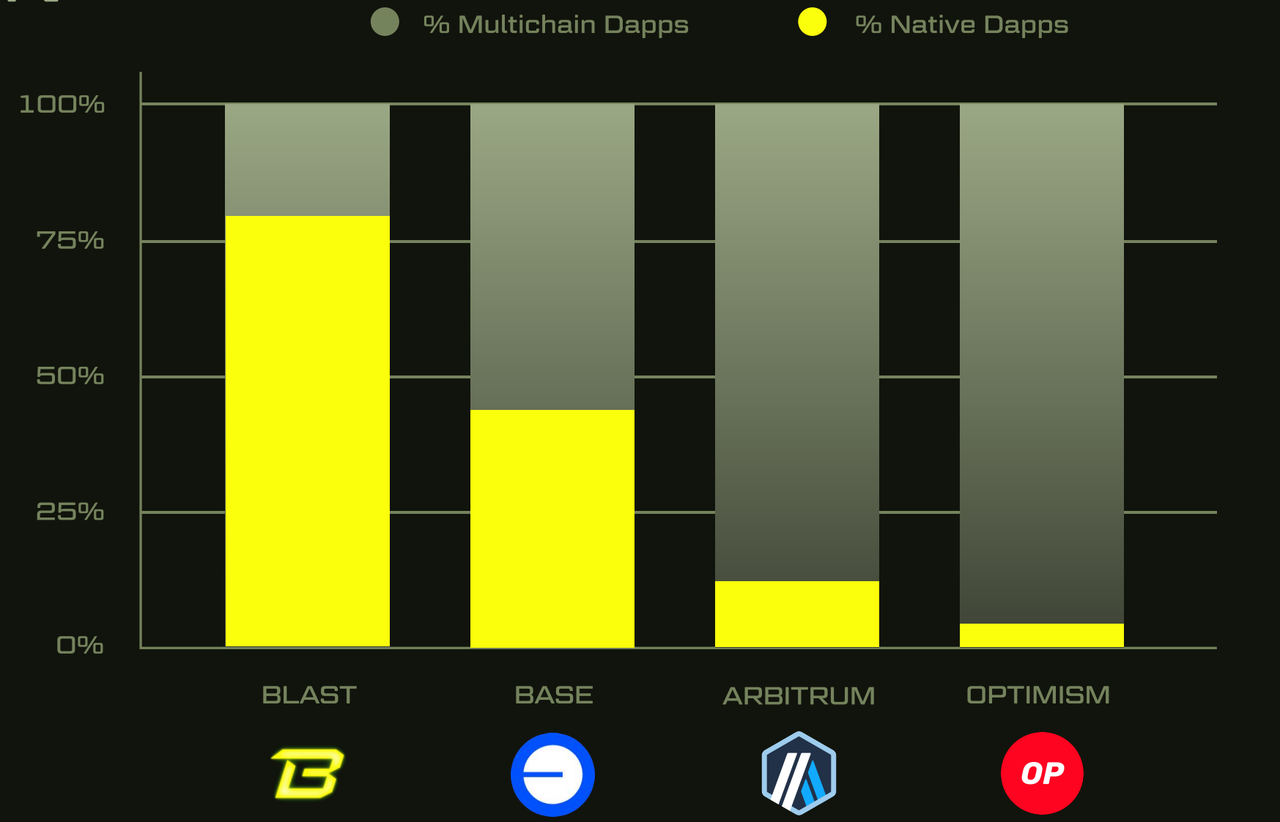

Native DApps Account for Over 75% of All DApp Volume

Most EVM chains host similar applications, but thanks to its native yield mechanism and gas fee revenue sharing, Blast sees over 75% of DApp activity coming from native applications—far surpassing other major L2s.

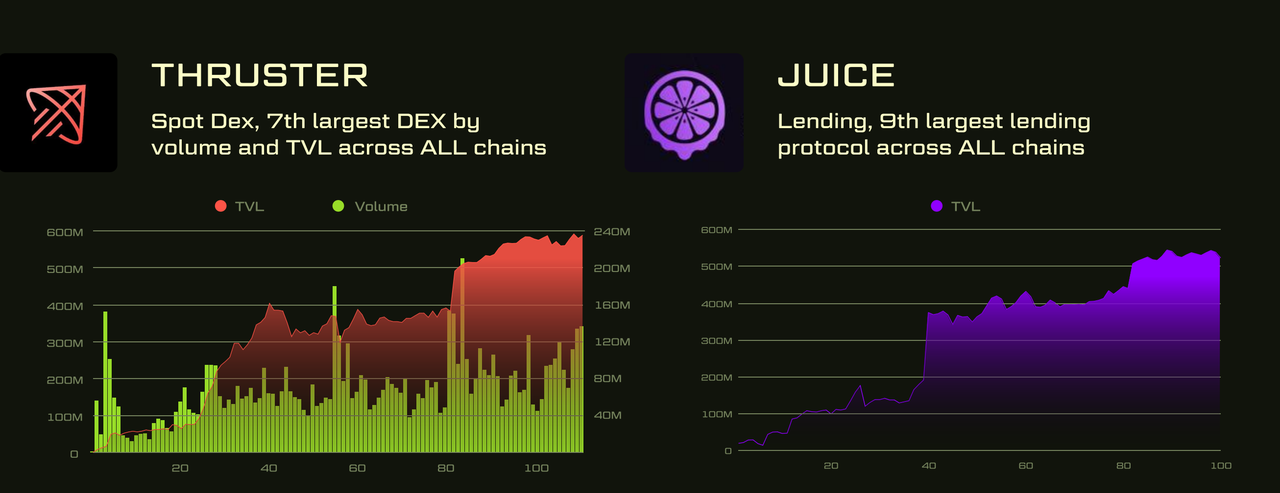

Lending and Spot Trading Products Reach $500 Million TVL Within Four Months

The spot trading protocol Thruster has become the seventh-largest DEX. Around 80 days after mainnet launch, its TVL surpassed $500 million. Similarly, the lending product Juice reached $500 million in TVL within the same timeframe and is now the ninth-largest lending protocol.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News