Blast 9-Day TVL Breaks $600 Million: Rational Reflections Behind the Frenzy

TechFlow Selected TechFlow Selected

Blast 9-Day TVL Breaks $600 Million: Rational Reflections Behind the Frenzy

From a marketing perspective, this incident is undoubtedly a market battle between a technically strong Layer2 and a consensus-strong Layer2.

Author: YBB Capital Researcher Ac-Core

Preface

Recently, with the launch of Layer2 network Blast by Blur’s founder, market sentiment has been mixed amid strong expectations for airdrop rewards. According to official announcements, Blast's mainnet will go live in February next year, continuing Blur’s previous model of distributing airdrops based on accumulated points. Within days of this news, Blast’s TVL growth has been nothing short of astonishing. However, this sudden move by Blur into the Layer2 narrative inevitably leads to three possible outcomes: triggering a new market trend; planting another potential bubble; or prompting related projects to “copy homework.” From a marketing perspective, this event represents a clear battle between technically robust Layer2s and those driven by strong community consensus.

Reviewing the Basic Structure of Ethereum Layer2

Image source: Top Ethereum Layer 2 Networks

Before evaluating Blur’s newly introduced “Stake Layer2” narrative, let us first understand the current fundamental types of Ethereum Layer2 architectures. Layer2 solutions are scalability mechanisms designed to increase transaction throughput and reduce costs by introducing secondary protocols atop the Ethereum blockchain. These can be broadly categorized as follows:

State Channels

Definition: State channels are off-chain solutions where participants directly exchange signed transactions without recording each one on the blockchain. The basic idea is to create an off-chain environment between parties, allowing multiple transactions to occur off-chain, only submitting the final state to the blockchain when necessary. This significantly improves efficiency and throughput.

Mechanism: In a state channel, participants open a channel, conduct numerous transactions off-chain, and only submit the final state upon closing. Only the opening and closing require on-chain transactions, reducing cost and latency associated with every individual step.

Examples: The Lightning Network is Bitcoin’s implementation of state channels, enabling fast, low-cost microtransactions off-chain, with final settlement recorded only when the channel closes. On Ethereum, Raiden Network offers a similar solution through a multi-party channel network, achieving high scalability.

Sidechains

Definition: Sidechains are independent blockchains compatible with the main chain but operating under their own consensus rules. Users lock assets on the main chain and use them on the sidechain, later relaying results back. This increases overall throughput by shifting computation off the mainnet. Common bridge methods include:

Pegged Bridge: Assets are mapped between two chains via locking on one chain and issuing equivalent tokens on the other. This typically involves trusted intermediaries to manage locking and release;

Lock-and-Mint Bridge: Assets are locked on the source chain, and corresponding tokens are minted on the target chain. Security often relies on trusted entities or multi-sig contracts;

Cross-Chain Atomic Swap: A decentralized method enabling atomic exchanges across chains—either both sides complete or neither does. Uses smart contracts and hash time locks, eliminating need for trust but requiring complex logic;

Proxy Bridge: Relies on intermediary agents that receive assets on one chain and execute operations on another. Multi-signature contracts often serve as proxies;

Light Client Bridge: Employs lightweight clients to verify state from the source chain and reflect it on the destination. No asset locking required—security comes from cross-chain validation. Commonly used in some Ethereum Layer2 designs.

Plasma

Definition: Plasma is a Layer2 framework initially proposed by Vitalik Buterin. Inspired by tree structures, it consists of multiple child chains processing transactions independently, only submitting final states to the main chain in case of disputes. Each child chain functions like a separate sidechain, offering lower costs and higher throughput.

Mechanism: By decentralizing transaction processing across sub-chains, Plasma reduces load on the mainnet, enhancing scalability while preserving security. However, challenges remain, particularly around exit procedures and dispute resolution.

Hybrid Solutions:

Definition: Some Layer2 systems combine advantages of state channels and sidechains, providing flexible options depending on use cases.

Mechanism: High-frequency transactions may use state channels, while larger or less frequent ones leverage sidechains. This hybrid approach optimizes performance and adaptability.

Rollups

Currently the most popular scaling solution, Rollups move computation and data storage off-chain. According to a recent Chainstack report [1], without Optimism and Arbitrum, Ethereum gas fees would be four times higher. There are two primary types: Optimistic Rollup and ZK Rollup.

● Optimistic Rollup: Operates under the assumption that transactions are valid unless challenged. Reduces mainnet burden and boosts throughput, but requires effective fraud-proof mechanisms to ensure security;

● ZK Rollup: Uses zero-knowledge proofs to validate off-chain transactions before submitting compact proofs to the main chain. Ensures validity and security while maintaining privacy and efficiency.

Validium Chains

Validium combines features of sidechains and state channels, executing transactions off-chain while using zero-knowledge proofs for validity. Data availability remains off-chain, avoiding mainnet execution costs while ensuring verifiability—a novel blend of high performance and privacy protection.

State Rent

Note: State Rent is not a Layer2 solution, but rather a mainnet optimization. It introduces a fee mechanism to incentivize users to free up unused storage space, alleviating on-chain bloat. While it doesn’t directly boost throughput, it enhances resource efficiency across the network.

Back to Blast Itself

Image source: Season 3 Rewards & Loyalty

Each of these Layer2 approaches aims to solve blockchain scalability issues, with unique strengths and ideal use cases. The right choice depends on application needs, security requirements, and user experience considerations. Regarding Blast, it has been confirmed that it uses a 3/5 multi-sig to control deposit addresses—a common practice among many Layer2s (see Further Reading [2]). Despite unresolved centralization concerns regarding rollup sequencers, Blast has achieved significant short-term success in terms of community consensus.

Potential Risks Associated with Lido:

Image source: ASIA ARYPTO

Lido is a decentralized staking service on Ethereum, allowing users to stake ETH into Ethereum 2.0’s PoS mechanism. Blast’s staking model essentially takes user ETH and stakes it via Lido and RWA platforms, redistributing yield to users and developers, supplemented by native token incentives. Concentrating large amounts of capital within Lido increases exposure to financial risk due to growing centralization in staking practices. Key risk factors affecting Lido include:

Liquidity Risk: Liquidity is critical to Lido’s operational success. Insufficient liquidity could hinder users attempting to unstake or withdraw funds, influenced by market volatility or network congestion. Mitigation strategies may involve more flexible withdrawal policies, increasing participant numbers, or integrating with other DeFi protocols to enhance liquidity.

Technology Upgrade and Evolution Risk: As Ethereum and broader blockchain tech rapidly evolve, Lido must continuously adapt its infrastructure to maintain compatibility, security, and functionality.

Excessive Centralization Risk:

● Node Centralization: Although Lido aims for decentralization, actual validators are operated by specific organizations or individuals. If these actors collude or are compromised, systemic centralization risks emerge;

● Social Engineering and Malicious Behavior: Validator operators may fall victim to social engineering attacks or malicious interference, leading to node compromise, downtime, or manipulation;

● Technical Centralization: Core protocol functions and key infrastructure might be controlled by a small number of technical entities, risking centralized control—especially if upgrades are overly concentrated;

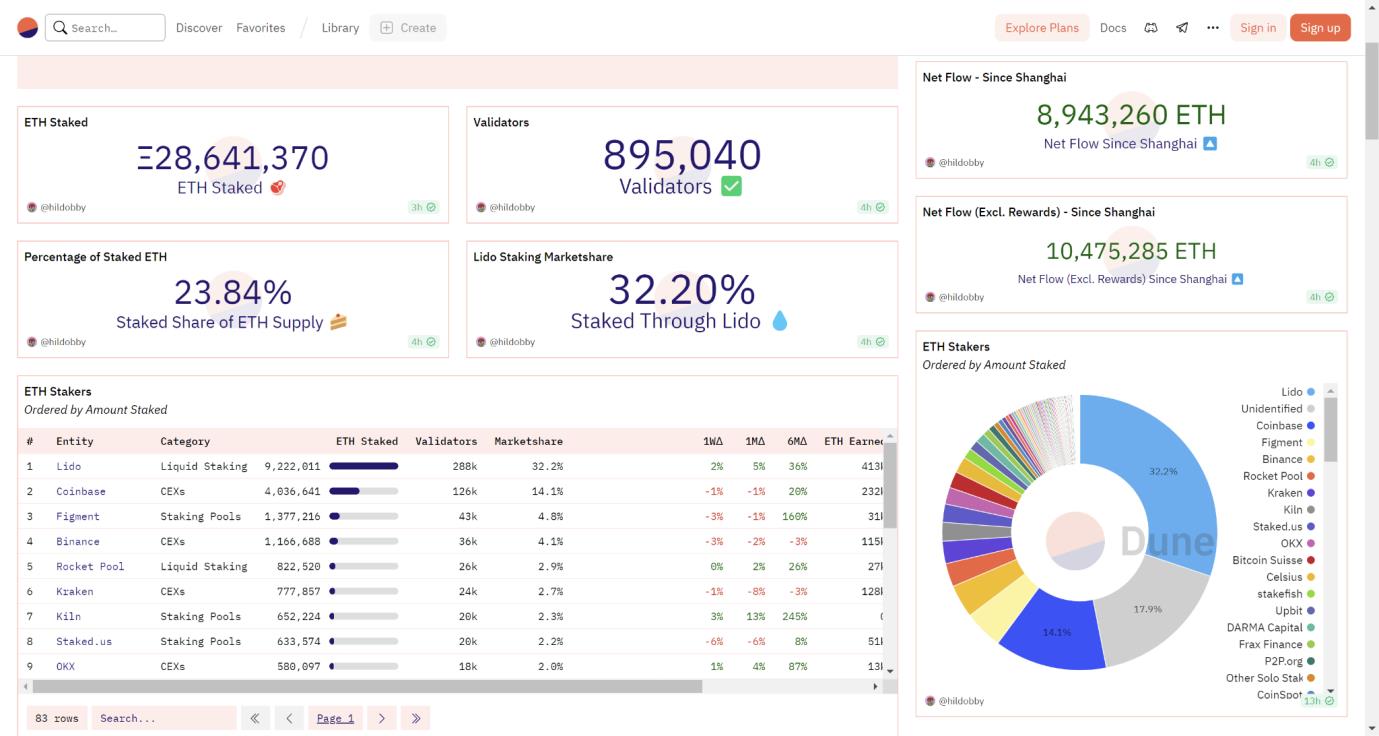

● Capital Centralization: Token issuance and staking may be dominated by large holders who exert disproportionate influence over the protocol. As shown in Dune data below, as of November 29, total staked ETH on the Ethereum Beacon Chain exceeded 28.64 million, with Lido holding a 32.20% market share;

● Governance Centralization: If governance mechanisms are too centralized, decision-making power may rest with a few entities, marginalizing broader community input;

Data source: Dune

Economic Contract Risk: Incentive models must be carefully designed to protect long-term interests of users and the ecosystem. Poorly structured incentives may lead to capital flight or instability. Continuous evaluation and refinement are essential to respond to changing market dynamics;

Smart Contract Audit Risk: Smart contract security is foundational to Lido’s viability. Vulnerabilities could result in loss of user funds. Comprehensive, regular audits are crucial, along with prompt response to findings from the security community;

Community Governance Risk: Governance design impacts project direction and decision-making. Ineffective governance can stall progress. Close collaboration with the community and transparent processes are vital;

Black Swan Events: Unpredictable events could severely impact Lido. Flexible risk management frameworks and resilient system architecture are needed to absorb shocks.

Reflections and Impacts of Blast:

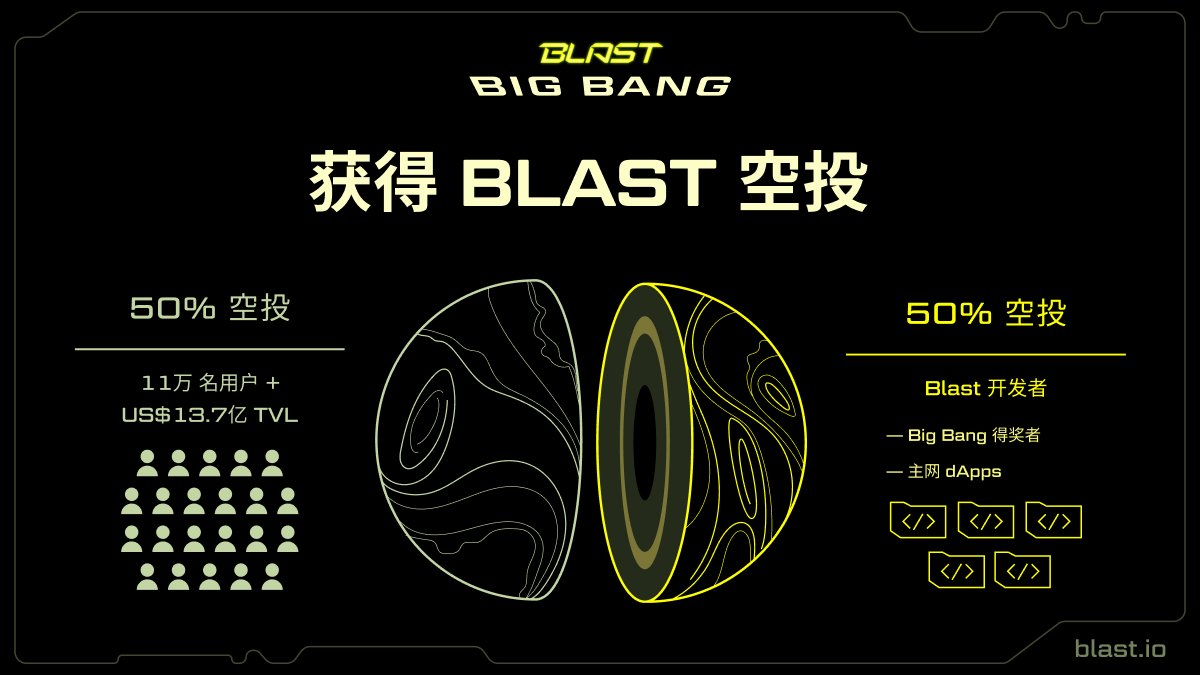

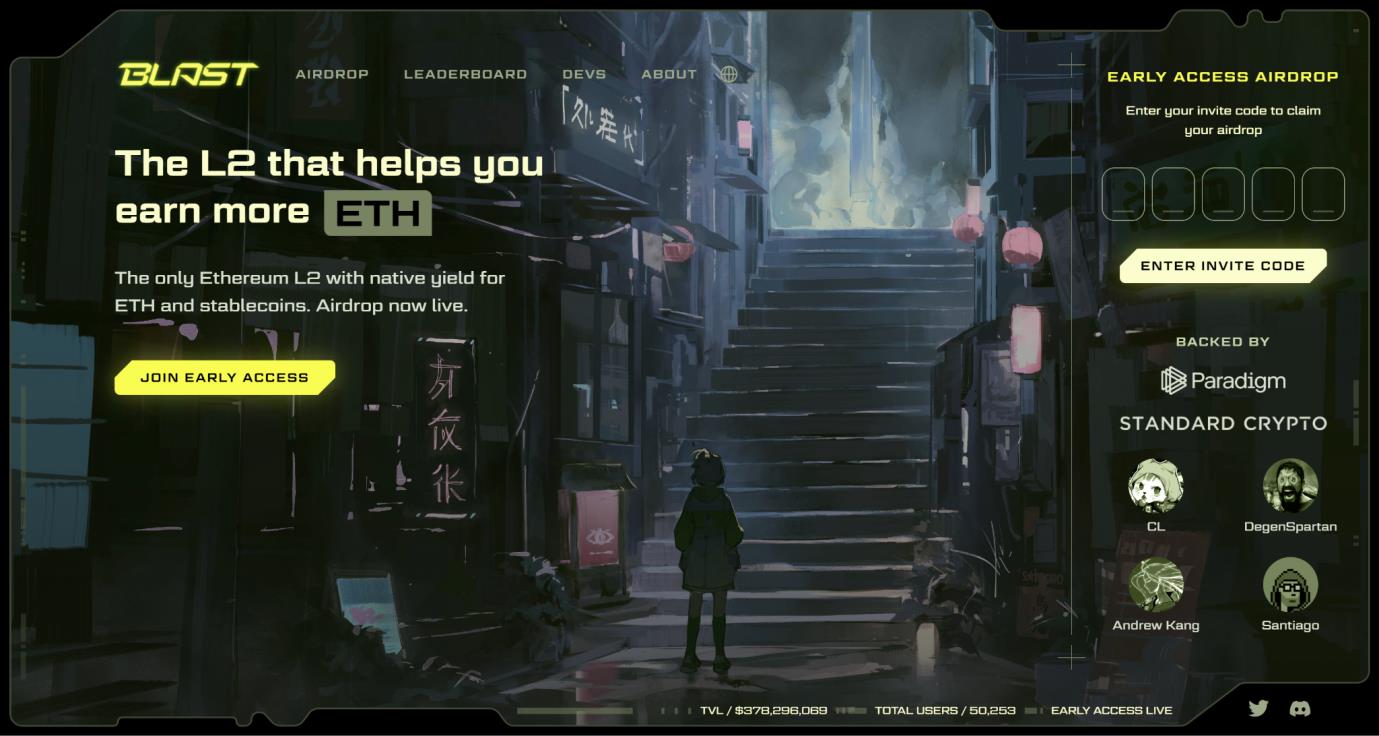

Image source: Official Blast

Pacman announced raising $40 million for the Blur ecosystem from Paradigm, Standard Crypto Investment, and angel investors including Lido advisor Hasu and The Block CEO Larry. Backed by Blur’s reputation and Paradigm’s funding, Blast captured immediate attention. Recent developments under its new narrative invite deeper reflection.

1. Where Does Blast’s Native Yield Come From?

When users deposit tokens into the Blast (L2) network, their equivalent value is locked and redeployed by Blast into Lido and RWA staking. Returns are shared with users alongside original point allocations, raising two immediate concerns:

● Concentrating deposits in Lido further exacerbates centralization in the staking sector. Users must now assess not only Blast’s security but also Lido’s. Assuming both are secure, continued TVL growth combined with secondary market price fluctuations introduces greater uncertainty to the entire Ethereum ecosystem;

● Viewing Blast as a novel “Stake Layer2,” locking large volumes of ETH for yield simultaneously locks liquidity. This raises questions about how Blast’s dApps will access liquidity and sustain new token emission narratives.

2. Technology vs. Consensus: Which Layer2 Direction Will Markets Favor?

Blockchain’s core goal is solving trust and security in transactions. Once confirmed and added to the chain, data becomes immutable unless over 51% of nodes are compromised. Technological advancement drives industry growth. From a technical standpoint, Blast brings no innovation—it charts a new path, though strictly speaking, it does not qualify as a true Layer2.

Yet blockchain remains fundamentally financial at its core. Technology rests on math and code, whereas finance hinges on psychological expectations. Blast’s greatest strength lies in leveraging its and Paradigm’s massive visibility to directly tap into user anticipation for airdrops. Compared to technically advanced rollups that profit from gas arbitrage, Blast redistributes returns via staking yields. Liquidity is the lifeblood of any public chain, and Blast has generated powerful short-term consensus through anticipated airdrops. In the near term, strong consensus will attract market adoption, but sustaining it long-term requires additional catalysts.

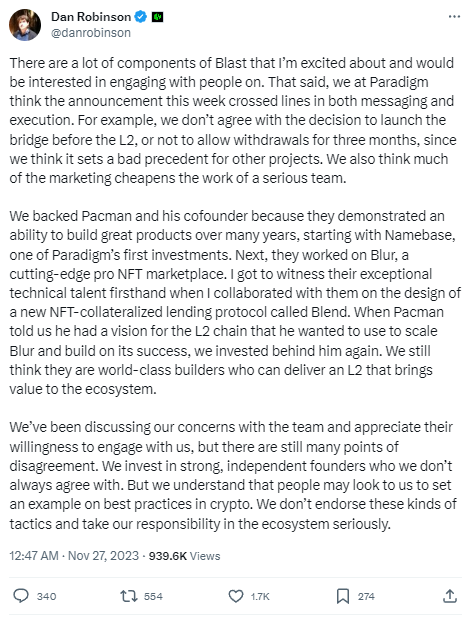

3. What Did Paradigm Research Director Dan Robinson Hint At?

Image source: X (Twitter) @danrobinson

Disagreement with Project Decisions:

● Bridge Before L2 Launch: Paradigm expressed disagreement with launching the bridge before the L2 is ready, suggesting it poses risks to stability and security;

● No Withdrawals for Three Months: Similarly, prohibiting withdrawals for three months sets a precedent that may concern or frustrate users.

Concerns Over Marketing Tactics:

Paradigm criticized Blast’s marketing methods, noting they could damage the credibility of a serious team—possibly referring to exaggerated or misleading claims.

Support for Pacman and Team’s Past Work:

Paradigm highlighted its support for Pacman and partners across previous ventures—from Namebase to Blur to Blend—indicating trust built on years of demonstrated technical ability and product excellence.

Support for the L2 Vision:

Paradigm invested because Pacman presented a compelling vision for an L2 chain aimed at extending Blur’s success—an indication that Paradigm believes the team can deliver valuable contributions to the ecosystem.

Engagement with the Team:

Paradigm emphasized ongoing dialogue with the Blast team, expressing concerns and receiving openness in return—showing willingness to resolve differences through communication.

Responsibility and Example Setting:

Paradigm stressed its sense of responsibility in the crypto space, acknowledging that others look to its actions as a benchmark. They clearly stated opposition to certain tactics, underscoring their commitment to ethical standards within the ecosystem.

Overall, this statement reflects Paradigm’s specific objections to certain Blast decisions, while reaffirming support for the team’s past achievements and emphasizing responsible behavior in the ecosystem. Subsequently, according to Wu Blockchain, Pacman issued clarifications:

● Blast’s high yield is not a Ponzi scheme—the returns come from Lido and MakerDAO, based on Ethereum staking yields and on-chain T-Bills, which are integral parts of on- and off-chain economies and inherently sustainable;

● Go-to-market (GTM) strategy is unrelated to Paradigm. While Paradigm provides technical L2 design advice, GTM decisions are entirely internal to Blast;

● The referral system isn't new—it has existed for years. Designed to reward users contributing to the L2 ecosystem, it serves as回馈 to community supporters, justifying the existence of referral rewards.

Note: This analysis reflects solely the author’s personal views, not intended as guidance. Disagreements may be disregarded.

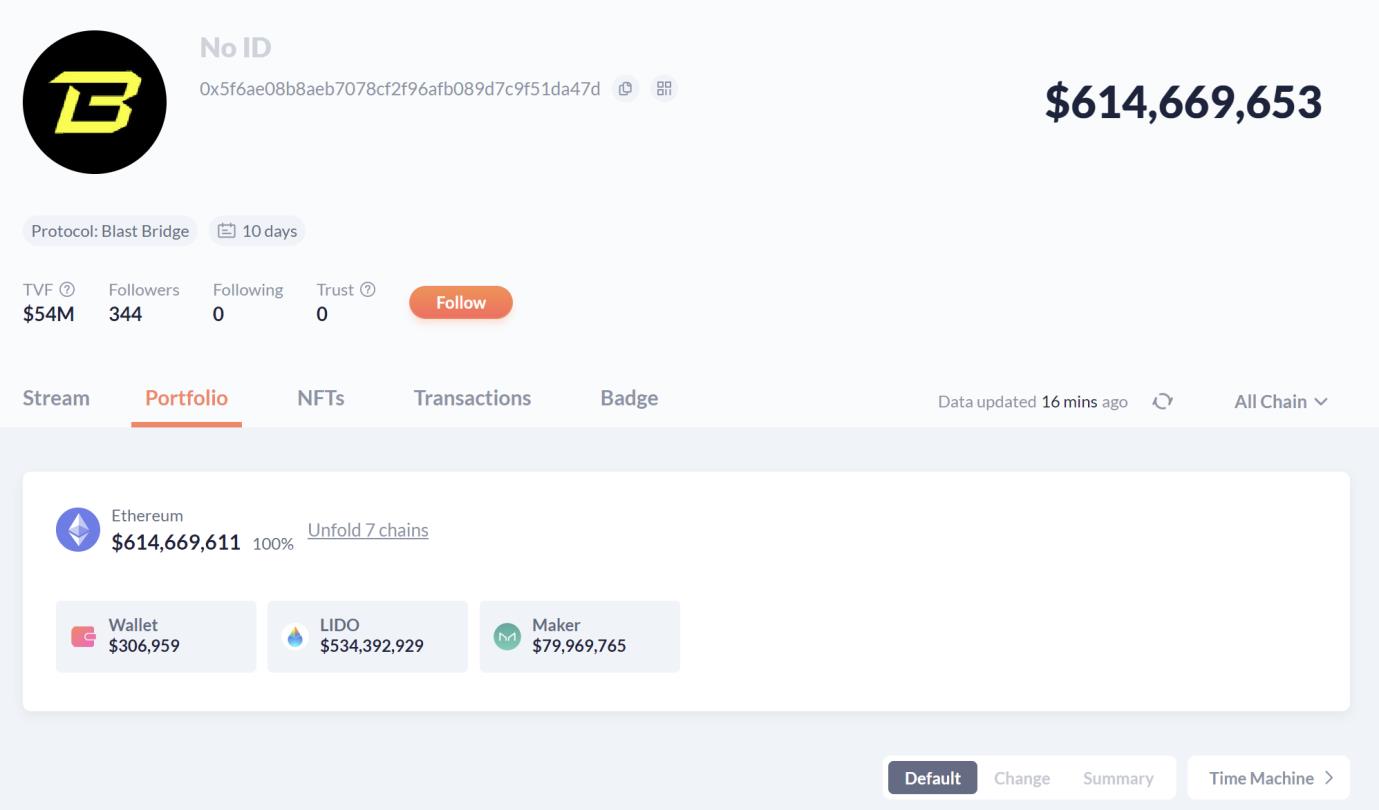

4. Rapid Surge in TVL Exceeding $600 Million

Data source: DeBank

Since Pacman, founder of Blur, announced the launch of Blast on November 21, by November 29, Blast’s total value locked (TVL) reached $614 million in just one week, sparking widespread discussion in the industry. This “Stake-centric Layer2” narrative has clearly achieved major success in capturing market consensus.

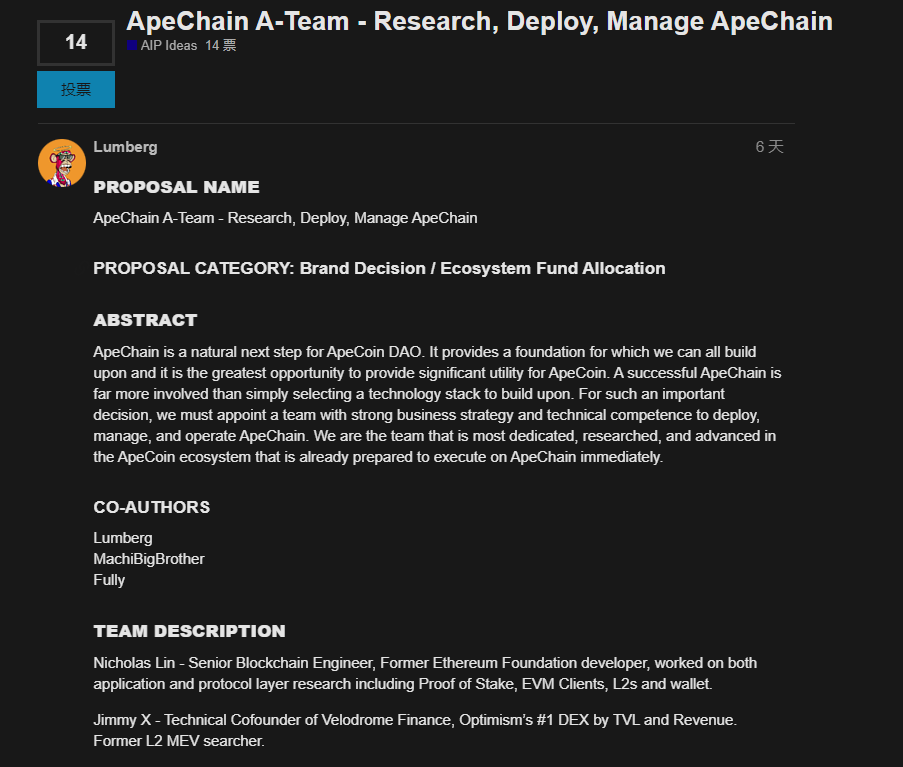

5. ApeCoin’s “New Homework”

Image source: ApeCoin Official

The document references a proposal called "ApeChain," aiming to research, deploy, and manage ApeChain within the ApeCoin DAO ecosystem (original text in Extended Link [3]). The team reportedly met with various technical partners, assessing pros and cons to gain support. After careful consideration, the team chose to back Layer2 Rollups to better attract developers to build on ApeChain.

This naturally raises the question: Is ApeCoin trying to ride Blast’s momentum immediately?

Future development will be compatible with the Optimism Superchain ecosystem, with commitments to provide foundational token grants to enable ApeCoin DAO participation in Superchain governance. Does this suggest Ape is leveraging Blast’s TVL suction effect to catch a quick wave of hype? DAO funding includes infrastructure, operations, developer relations, and ecosystem development.

Infrastructure includes:

● Block explorers such as Blockscout, Etherscan, or open-source alternatives like Otterscan;

● Oracles: Chainlink, Pyth, or Redstone;

● Layer 1 data publication costs in ETH;

● Sequencer operation.

Two discussed fee models:

● Direct launch of ApeChain (AC) token, freeing DAO from bearing costs;

● Fundraising to support ApeChain operations and development, with future governance tokens distributed to ApeCoin supporters.

In conclusion, Blur’s launch of Blast was a massive marketing success—leveraging existing industry influence to clearly communicate its points-based airdrop mechanics, attracting vast sums of staked capital in a short time and reigniting market enthusiasm for staking. Its rapid accumulation of over $600 million in TVL has drawn attention from other Layer2s and the Ape community alike. However, given its inherent uncertainties and risks, caution remains warranted.

Extended Links:

[1]https://blockworks.co/news/ethereum-rollups-save-gas-fees

[2]https://twitter.com/eternal1997L/status/1729128004239216863

[3]https://forum.apecoin.com/t/apechain-a-team-research-deploy-manage-apechain/20163

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News