Blast's attack on Layer2 may not succeed, but it is certainly a blessing for the industry

TechFlow Selected TechFlow Selected

Blast's attack on Layer2 may not succeed, but it is certainly a blessing for the industry

Blast is simply poisoned by Paradigm's Web3 tokenomics economics; seeing the current lifeless state of the Layer2 ecosystem, it attempts to inject a strong stimulus.

Author: Haotian

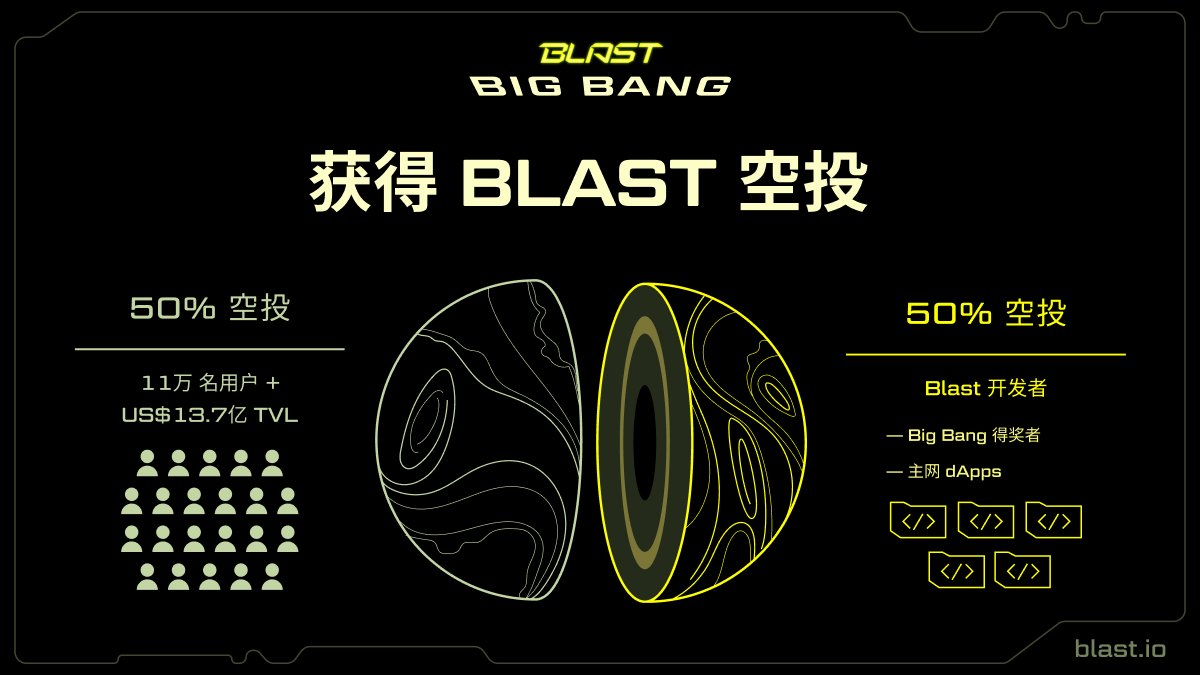

Blast's surge of over $200 million in TVL within just two days has genuinely sent shockwaves through the Layer2 market, which had been stagnant for months—creating a real "vampire attack" sensation. Task-based PUA, airdrop bait, and Vitalik-style hyper-competition: with Blast’s disruption, the last vestiges of modesty in the Layer2 space have been stripped away. My view: while Blast’s assault on Layer2 may not necessarily be its own success, it is undoubtedly a blessing for the broader Layer2 industry.

Why do I say that? A macro-level reflection on the current state of the Layer2 industry makes this clear.

1) According to L2beat data, there are now more than 60 diverse Layer2 projects spanning OP-rollups, ZK-rollups, Validium, Plasma, and other categories. However, most of these projects remain stuck at the stage of competing on technical architecture and narrative. The debates between OP-rollup and ZK-rollup rage on—technically, ZK-rollup has emerged victorious—and subsequently, a wave of new ZK-rollup solutions has followed, each touting unique features.

Starknet led the way by open-sourcing and decentralizing its Prover component, achieving a peak TPS exceeding 890,000. Scroll and Taiko gained favor for their higher EVM equivalence. zkSync earned praise for its stealth ERC4337 account abstraction experience. And most recently, zk+Plasma might spark yet another new narrative.

VCs are busy deploying capital; yield farmers are always ready for the next season. The Layer2 market appears to be experiencing unprecedented technical narrative prosperity—but is this truly the endgame for Ethereum scaling?

2) Setting aside technology and focusing instead on ecosystems, Arbitrum and Optimism—the twin titans of OP-rollup—have established a crushing lead. Arbitrum dominates with over 600 ecosystem protocols and a TVL exceeding $7 billion, while zkSync, often seen as the ultimate rollup solution, has managed only around $500 million in TVL after more than half a year of development.

Moreover, even after launching its native token, Arbitrum hasn’t shown any significant data growth. The meme-driven PEPE season didn’t take place on Layer2, and Bitcoin is attempting to rebuild its own Layer2 glory from scratch.

The entire Ethereum Layer2 ecosystem remains stuck at an awkward, stagnant level.

Rarely discussed is the core reason: Layer2 has yet to discover native applications with strong inherent appeal. Pure financial applications and DeFi (DEXs, lending, derivatives)—the three pillars—simply aren’t enough to drive meaningful ecosystem growth.

Layer2 should live up to its name by attracting long-tail, mass-adoption users who are sensitive to gas fees and user experience (UX) barriers. If Layer2 merely attempts to relocate already-established on-chain entities—miners, yield farmers, researchers, institutions—then it misses the point.

Sorry, but these established players care far more about “security” than performance improvements. Meanwhile, the much-criticized centralization of Layer2 sequencers has quietly become normalized. As for the technically favored ZK-rollups, they’ve only raised the development barrier via ZK circuits—without producing any killer apps that absolutely require ZK technology.

With such a weak foundational ecosystem and no influx of external capital from a bull market, Layer2 is inevitably trapped in an embarrassing situation: grand technical narratives paired with clumsy real-world adoption.

The market has silently waited for the Cancun upgrade, hoping it would bring a breakthrough. Perhaps. But unfortunately, EIP-4844 under Cancun only optimizes gas fees—it doesn’t directly catalyze ecosystem leapfrogging.

3) Now consider the so-called “Four Heavenly Kings” and their celebrated Stack strategies. In terms of long-term narrative building, modularizing core components like Sequencer and Prover, then leveraging shared infrastructure to expand Layer2 and Layer3 multi-chain ecosystems—isn’t inherently wrong. But it feels rushed.

Take zkSync: struggling to grow its own ecosystem, it launched the zkStack strategy. Suddenly, zkSync itself becomes just one application among many—an ingenious move. Everything gets outsourced to the developer community. The implicit message: if zkStack grows slowly, it’s not zkSync’s fault; after all, it already has a loyal base of users willing to pay gas… (one sarcastic sentence omitted here).

Optimism, meanwhile, uses Op-Stack to justify a centralized sequencer model. By sharing sequencers and adopting committee-based governance to build a Superchain, it somewhat plausibly compensates for shortcomings in decentralization.

So ultimately, the Stack strategy is a clever workaround—a premature, abstracted vision that sidesteps current technological and ecological weaknesses. Looking at various Stack initiatives today, beyond amplifying grand narratives and consolidating scarce developer resources, end-users see little immediate benefit.

Above is my analysis.

Back to the main point: saying that Blast’s entry into Layer2 is purely disruptive isn’t an exaggeration.

In the short term, it siphons away the already scarce liquidity that other Layer2s treasure. Long term, it encourages a Layer2 ecosystem desperate for builders to prematurely embrace a passive, earn-to-idle mentality. To put it bluntly, this completely contradicts the original purpose of Layer2 scaling.

Blast has clearly fallen victim to Paradigm’s Web3 tokenomics ideology—a toxic drug. Seeing how lifeless the Layer2 ecosystem has become, they’re trying to inject a powerful stimulant.

From a Layer2 construction standpoint, this starting point is flawed. No matter how high the TVL or user count, it’s still just internal consumption within a zero-sum market. Its individual success holds little significance. But from the perspective of industry disruption, we must applaud it.

Expectably, Blast’s disruption could bring two direct impacts:

1) A wave of Layer2 token launches: if Blast drains most of the market’s liquidity, what options do other already-niche ZK-rollup projects have besides issuing tokens to attract attention? Even if the teams aren’t eager, their deep-pocketed VC backers will surely push hard;

2) Layer2 market reshuffling: let’s be honest—there are too many Layer2s already. Once the curtain is pulled back, the industry will accelerate consolidation and natural selection. Especially those hastily assembled or superficial Layer2 projects will be exposed for what they are—clearing the path for a fresh new landscape.

In summary, Blast may not deliver a Compound-like governance token-fueled DeFi Summer for Layer2—but it will at least accelerate the industry’s arrival at the eve of summer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News