Exploring Notable DeFi Protocols, Catalysts, and Potential Airdrops in the Injective Ecosystem

TechFlow Selected TechFlow Selected

Exploring Notable DeFi Protocols, Catalysts, and Potential Airdrops in the Injective Ecosystem

This article will cover various aspects of the Injective ecosystem, including an overview of Injective, INJ token economics, comparative analysis with other projects, airdrop strategies, and the Volan upgrade.

Author: THOR HARTVIGSEN

Translation: TechFlow

INJ reached a low of $1.4 in January 2023 and surged to a record high of $45, with its market cap skyrocketing from $110 million to an astonishing $4.5 billion. This massive price increase has drawn significant market attention. This article provides an overview of the Injective ecosystem, INJ tokenomics, comparative analysis with other projects, airdrop strategies, and the Volan upgrade.

Introduction

Injective Protocol is an interoperable Layer 1 blockchain optimized for DeFi applications. It features out-of-the-box functionalities such as a fully decentralized order book, enabling the development of applications like exchanges and prediction markets. Built using the Cosmos SDK and leveraging Tendermint consensus, Injective achieves instant transaction finality and enables fast cross-chain transactions with major networks such as Ethereum and IBC-compatible chains.

Injective Hub serves as the platform and gateway to interact with Injective, offering wallet, governance, staking, and INJ burn auction functionalities. The native token INJ is used for governance, staking, and dApp value capture. With an initial supply of 100 million tokens, the deflationary mechanism is driven by burn auctions.

$INJ saw remarkable growth in 2023, increasing over 3000%. This surge was partly driven by growth in TVL and user numbers, but also undoubtedly fueled by increasing media coverage and narrative momentum around INJ.

Trading on Injective

Injective’s trading infrastructure supports the creation and trading of various spot and derivative markets. It offers on-chain limit order book management, trade execution, order matching, settlement, and incentive distribution—providing a comprehensive environment for decentralized trading. Developers can build dApps using CosmWasm (the smart contract platform within the Cosmos ecosystem), enabling seamless cross-chain migration of smart contracts.

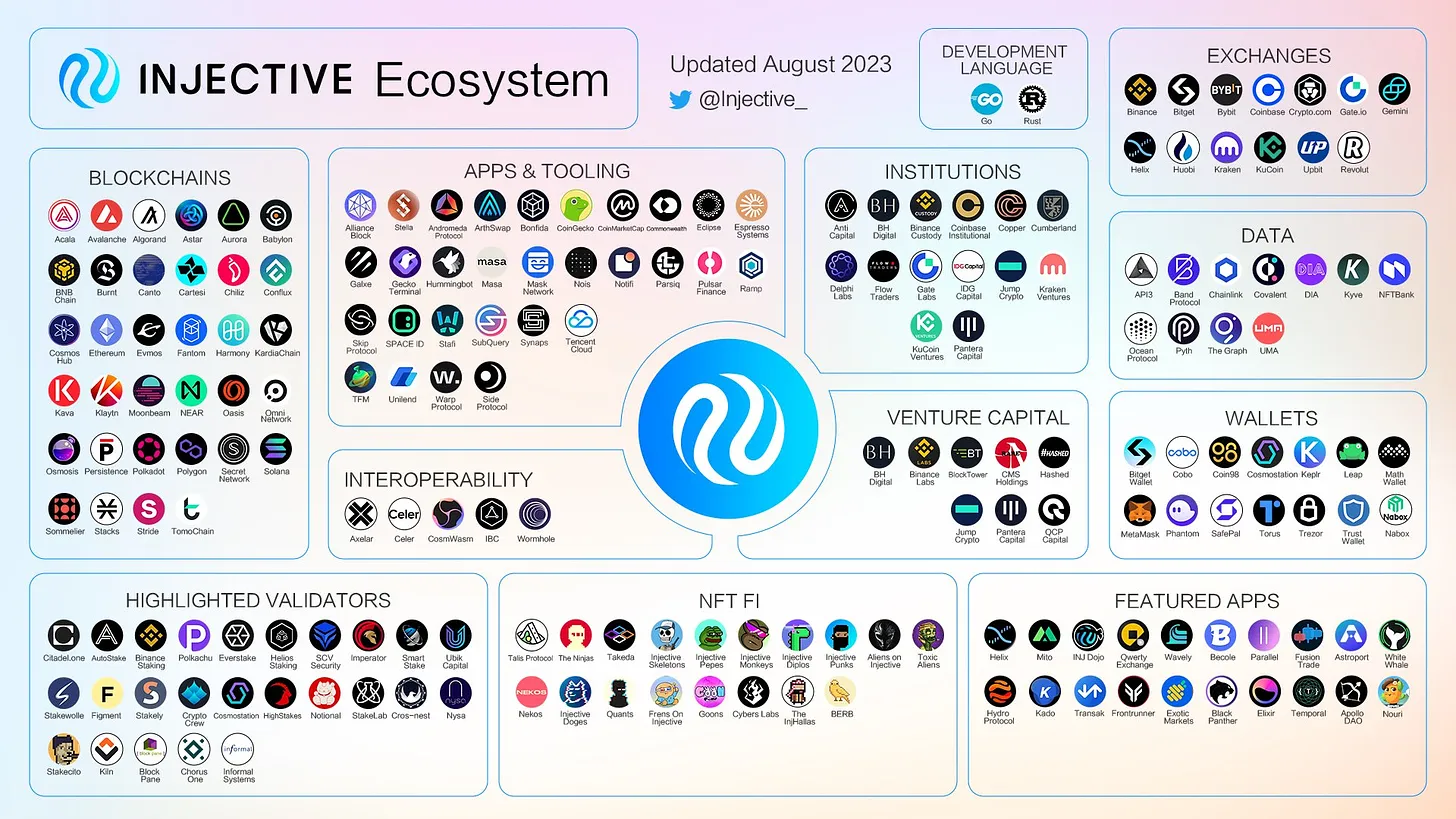

Ecosystem Overview

The Injective ecosystem is characterized by its focus on DeFi dApps, primarily centered on spot and derivatives trading and asset management. This overview highlights several notable dApps within the ecosystem:

Helix

Helix is the most well-known protocol in the Injective ecosystem and the largest perpetual DEX (Perp DEX). It facilitates cross-chain trading of crypto assets and perpetual markets, offering leading rebates. Helix operates with zero gas fees, low taker fees, and competitive maker fee rebates, ensuring a cost-effective trading experience.

With over $16 billion in total trading volume and $10 million in TVL, it is currently the largest dApp in the ecosystem. For context, dYdX Chain—now part of the Cosmos ecosystem—has a TVL of $349 million and cumulative trading volume exceeding $1 trillion (combined V3+V4). While direct comparison with the largest Perp DEX may seem ambitious, Helix still has a long way to go in the competition.

Black Panther

Black Panther is a decentralized asset management protocol designed to deliver superior returns through smart vaults. These vaults utilize active trading strategies such as grid trading, providing unique alpha sources that differentiate Black Panther Finance from typical auto-compounding yield protocols. As of January 5, 2024, the protocol has $3.6 million in TVL, employing strategies including grid trading, trend following, and real yield. Vaults have generated APYs as high as 100–600%.

Dojoswap

Inspired by Uniswap, Dojoswap is an automated market maker (AMM) protocol on the Injective blockchain. It enables decentralized on-chain swaps of various assets within the ecosystem.

Astroport

Astroport is a decentralized, permissionless, open-source DEX. Governed by its community of token holders through Astral Assembly—the Astroport DAO—it supports permissionless listing, multiple pool types, and robust incentive structures. It features programmable liquidity, a new Rust codebase, oracle integration, easy dApp integration, diverse liquidity pools, and a data-rich user interface. Astroport is live on Terra, Sei, Injective, and Neutron.

Talis

Talis is similar to Blur on Ethereum, offering an NFT marketplace, launchpad, and tools for artists. It enables buying, selling, and trading NFTs within the Injective ecosystem. A $TALIS token has been confirmed for issuance; users must interact with the platform—such as by buying or selling NFTs—to qualify.

INJ Tokenomics

INJ Token Overview

-

Initial supply of 100 million INJ tokens at launch

-

Inflation rate: Initially set at 7%, scheduled to decrease over time to 2% to control supply growth

Governance

-

Token utility: INJ serves as the governance token of the Injective chain, allowing holders to participate in key ecosystem decisions

-

DAO participation: INJ holders can propose new market listings and participate in other governance decisions, contributing to decentralized protocol management

-

Community-driven governance: The Injective Labs team has relinquished voting rights to ensure governance remains in the hands of the community, promoting a democratic and decentralized structure

Deflationary Mechanism

-

Buyback and burn: A buyback and burn mechanism has been implemented where 60% of fees collected by the ecosystem are used to purchase and then burn INJ tokens

-

Supply reduction: This deflationary process aims to reduce the total supply of INJ tokens over time, potentially increasing scarcity and value

-

To date, a total of 5.8 million $INJ tokens worth $241 million have been burned via auctions

INJ Burn 2.0 Upgrade

-

Enhanced token burn: The INJ Burn 2.0 upgrade allows all dApps built on Injective to participate in INJ burn auctions, with no limits on the amount they can burn

-

Economic impact: This upgrade aims to strengthen the on-chain economy by capturing value from all dApps within the Injective ecosystem, further aligning stakeholder incentives

The structure of INJ tokenomics is designed to balance the initial token supply with mechanisms that incentivize development, reward users, and maintain a deflationary supply to support token value. The governance model ensures the community plays a significant role in the protocol's direction, while the burn mechanism aims to create a sustainable economic model for the Injective ecosystem.

INJ Price Performance

INJ reached a low of $1.4 in January 2023 and climbed to a record high of $45, with market cap surging from $110 million to an astonishing $4.5 billion.

Comparative Analysis

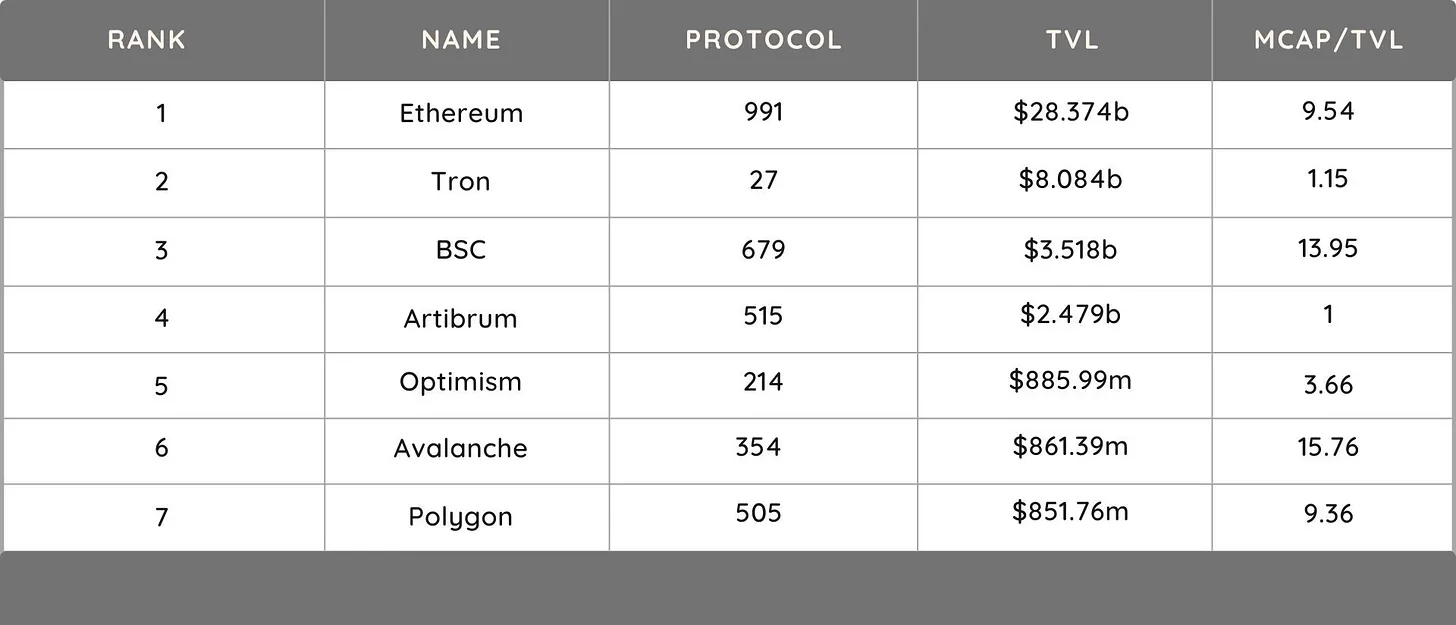

Despite impressive price action and market cap growth, TVL has not seen significant expansion, making it difficult to justify such a dramatic valuation increase based on fundamentals alone. Let’s compare INJ’s valuation against popular ecosystems within Cosmos using DefiLlama’s simple Mcap/TVL ratio.

Injective has an Mcap/TVL ratio of 155, nearly higher than any other ecosystem.

For a quick comparison with major ecosystems outside Cosmos, refer to the table below:

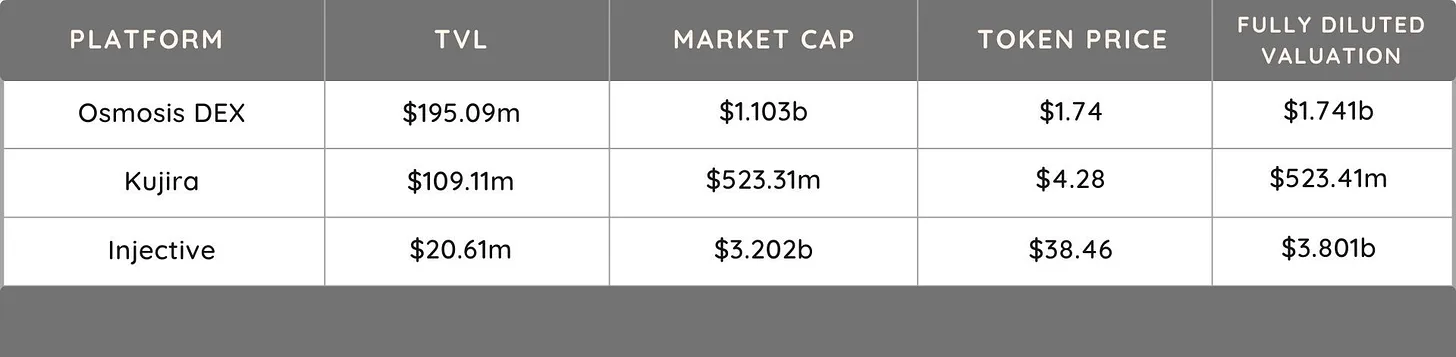

Comparing Injective with Kujira and Osmosis

Osmosis DEX and Kujira are two distinct and popular app-chains/DeFi applications operating within the Cosmos ecosystem, each offering unique features and products. Osmosis is an AMM-powered spot DEX that allows the creation of liquidity pools and facilitates trading of IBC-enabled tokens. Currently, the exchange supports 92 tokens and 329 trading pairs.

Kujira is a Cosmos L1 blockchain platform that prioritizes community-vetted projects. It operates on a semi-permissioned basis, requiring governance approval to deploy contracts, ensuring network quality and sustainability. Kujira features an on-chain scheduler that reduces reliance on bots, minimizing wasteful transactions and improving protocol efficiency. The platform supports native token generation, simplifying smart contract development as every token becomes a native Cosmos token.

Airdrop Strategy

The price surge and rising popularity have attracted considerable attention, especially regarding token airdrops. Several projects have already confirmed airdrops to INJ holders. With a strong $150 million ecosystem fund, new projects will likely use airdrops to attract users and generate traction. Below are some potential airdrops and how to qualify for them.

Wallet

-

Get a Keplr wallet - https://www.keplr.app/

-

Send INJ from a CEX to your Keplr wallet, or swap assets for INJ on Osmosis or Astroport

Helix

Swap or trade on the Helix application.

Talis

Stake $INJ through the Talis protocol, click here for details.

Black Panther

Stake $INJ through a Black Panther validator or deposit into one of its vaults.

Volan Mainnet Upgrade

The Injective Volan mainnet upgrade, known as Proposal 314, is a planned update to the Injective blockchain network. This upgrade is significant because it will temporarily halt the blockchain at a specific block height before restarting it with new software version 1.12.0. Key improvements include:

-

Real World Assets (RWA) module, introducing a new way to create and manage assets representing real-world financial products (e.g., tokenized fiat or credit instruments) in a compliant manner

-

Enhanced cross-chain functionality via IBC Hooks and packet forwarding middleware, enabling more complex transactions across different blockchain networks

-

Reduced on-chain inflation parameters, expected to make INJ tokens scarcer and potentially more valuable over time

-

Improved scalability through new enterprise APIs aimed at reducing latency, particularly for institutional participants

-

Introduction of a novel oracle design, enabling integration of off-chain price feeds and facilitating the launch of unique assets and markets on Injective

-

Expanded capabilities for burning bank tokens generated on Injective, along with EIP712 V2 integration for improved Ethereum wallet compatibility and developer experience

In summary, there is a lot happening within the Injective ecosystem. While recent price movements are driven more by narrative than fundamental improvements, it is clear that the ecosystem has several catalysts ahead this year—including broader ecosystem growth, technical upgrades, and airdrop marketing campaigns by protocols.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News