Behind Injective's data surge: a flash in the pan or a comeback of the king?

TechFlow Selected TechFlow Selected

Behind Injective's data surge: a flash in the pan or a comeback of the king?

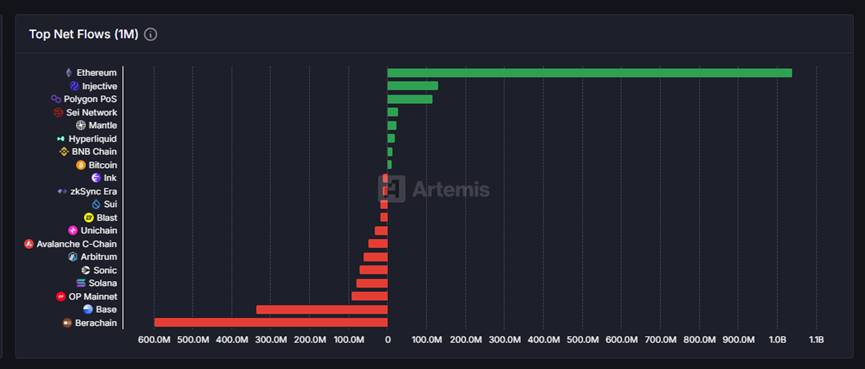

According to Artemis data, Injective has seen a net inflow of approximately $142 million over the past 30 days, second only to Ethereum.

Author: Frank, PANews

Within the past month, veteran blockchain Injective has returned to public attention by ranking second in net capital inflows. According to data from Artemis, Injective recorded approximately $142 million in net inflows over the last 30 days—second only to Ethereum.

PANews' further analysis of other Injective metrics reveals this capital inflow is not an isolated event. There have been notable improvements in on-chain fees, active users, and token trading volume. After a long period of dormancy, is this former rising-star blockchain poised for an ecosystem resurgence—or merely experiencing a fleeting moment in the spotlight?

$142M Monthly Inflow: Sweet Honey or Flare Signal?

As of June 4, Injective achieved $142 million in net capital inflow over the past month. While this amount isn't exceptionally high, it still ranked second among all blockchains during this period. A closer look shows that this significant net inflow stems from two factors: substantial new capital entering Injective, coupled with minimal outflows—only $11 million. Therefore, Injective’s high ranking in net inflows does not result from abnormally active overall capital movement (i.e., massive simultaneous inflows and outflows). In fact, its absolute inflow volume ranks around tenth when compared horizontally across chains. Its standout performance in the 'net inflow' metric primarily results from negligible outflows during the same period.

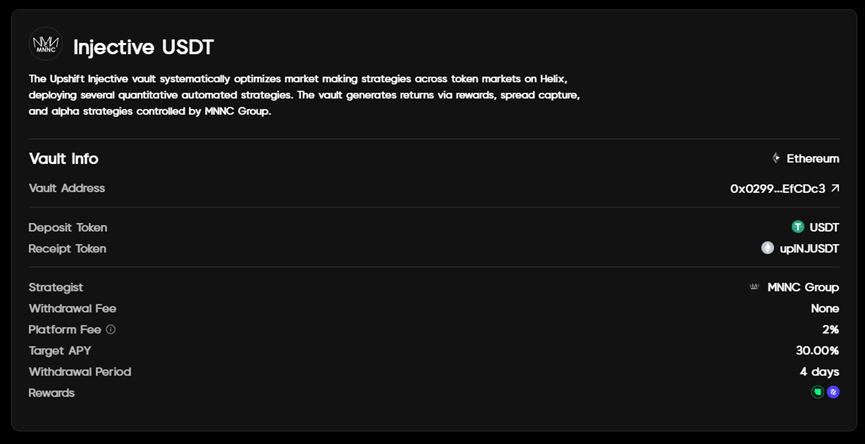

However, such on-chain capital movements are rare for the Injective network. Of the $142 million inflow, $140 million was transferred via the Peggy cross-chain bridge, accounting for 98.5% of the total. Market research firm Keyrock, in its May 26 report titled “Key Insights, Bond Appetit,” pointed out that this large-scale capital inflow was mainly driven by the launch of Upshift—an institutional-grade yield platform—on Injective. Reports indicate that Upshift’s treasury on Injective offers an APY of up to 30%, which could indeed be a key incentive attracting capital to move assets onto Injective.

However, PANews’ investigation found that the hard cap for Upshift’s treasury on Injective is only $5 million, insufficient to fully absorb and utilize the incoming capital. The excess funds unable to participate in this treasury may potentially exit again in the short term.

From Derivatives Setbacks to RWA Hopes: Can Injective Forge a New Path?

Beyond capital inflows, Injective has recently seen meaningful ecological developments. On April 22, Lyora Mainnet officially launched—an important milestone in Injective’s evolution. This upgrade introduced technical optimizations like dynamic fee structures and a smart mempool. Official materials describe post-upgrade Injective as “faster,” claiming lower latency and higher throughput.

Additionally, Injective launched iAssets, a dedicated oracle framework for RWA (real-world assets), with Upshift’s treasury being an example of an RWA DeFi vault. On May 29, Injective announced the launch of on-chain foreign exchange markets for the euro and pound sterling using the iAsset framework. From this perspective, Injective’s new narrative appears inseparable from RWA.

As a veteran blockchain, Injective’s original core narrative centered on decentralized derivatives exchanges. Indeed, Injective originated as a decentralized derivatives exchange before evolving into a full-fledged blockchain—a path strikingly similar to today’s rising star Hyperliquid.

However, Injective’s current derivatives trading has failed to meet expectations. Data from June 4 shows that the most traded BTC contract pair on Injective generated about $39.75 million in 24-hour volume, with total chain-wide derivatives trading reaching roughly $90 million. By comparison, Hyperliquid’s daily volume reached approximately $7 billion—about 77 times higher.

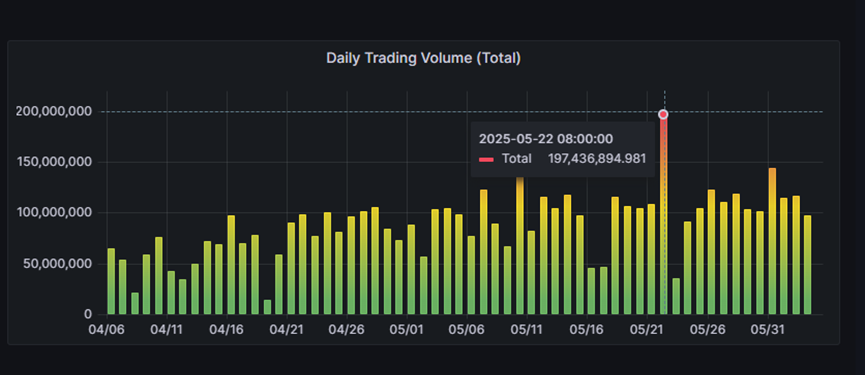

Perhaps due to difficulties gaining traction in crypto derivatives, Injective has pivoted toward integrating RWA. Judging from internal ecosystem comparisons, this shift seems to have had some effect: on May 22, Injective’s derivatives trading peaked at $1.97 billion—significantly exceeding other periods—and has shown an upward trend recently.

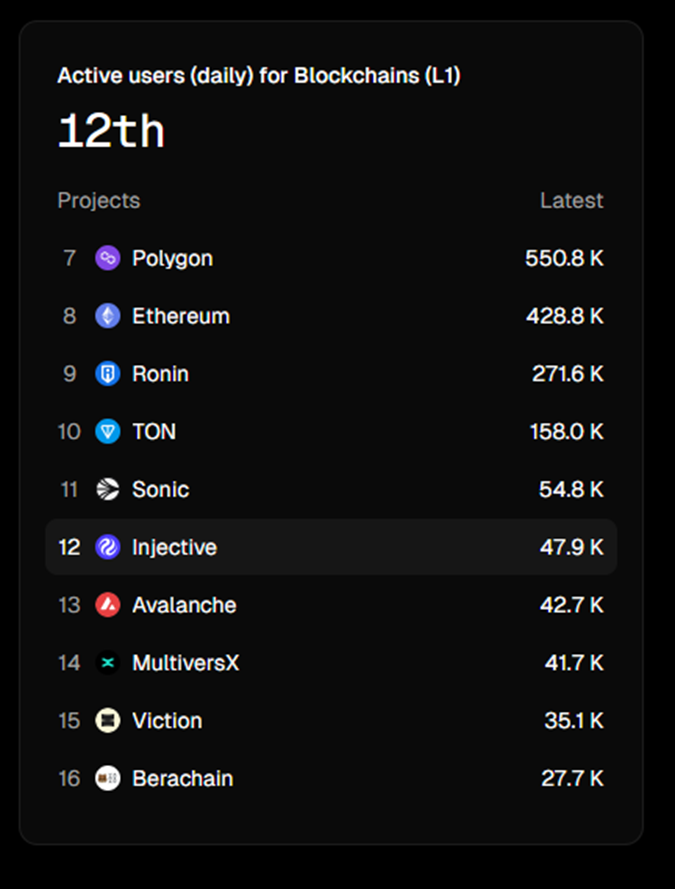

Moreover, daily active addresses surged from a low of 6,300 in February to 47,900 recently—an increase of about 7.6 times. Although this figure ranks only 12th among all blockchains, considering the rapid growth within a short timeframe and surpassing chains like Avalanche and Berachain, it represents a relatively clear breakthrough.

Nonetheless, despite the noticeable rise in daily activity, Injective’s TVL has shown no significant change. It has declined steadily since March 2024 and currently stands at just $26.33 million. At least for now, DeFi projects on Injective remain unattractive to capital.

Short-Term Token Rally Shines, Yet Still Lags 4x Behind All-Time High

Economically, its governance token INJ currently has a market cap of about $1.26 billion, ranking 82nd. Compared to its peak market cap of $5.3 billion, this reflects a 76% drop. However, from a low of $6.34 in April, INJ rebounded to a high of $15.48—a 144% gain—performing notably well among veteran blockchains. Still, how long this momentum can last remains uncertain.

Of course, Injective’s recent activities extend beyond these examples. It has recently attracted prominent institutions such as Republic, Google Cloud, and Deutsche Telekom MMS to join its validator set, while also launching several AI-related products and initiatives. Overall, over the past year, Injective has actively embraced emerging narratives like AI and RWA to drive transformation. As of June data, these efforts have indeed yielded certain growth over recent months. But in terms of scale, it still lags significantly behind leading blockchains.

Injective is not alone in this pursuit—many once-prominent blockchains from the previous cycle now face similar challenges. Numerous projects are attempting rebranding, renaming, or brand upgrades to re-enter the public eye. But will these "new bottles holding old wine" truly offer the market a fresh taste, or merely deliver superficial renewal?

Currently, Injective’s ecosystem transformation and revival efforts remain in their early stages. The capital inflow triggered by Upshift resembles more of a critical market sentiment test and demonstration of ecosystem potential than a fundamental reshaping of its position. Whether its strategic pivot toward RWA can genuinely establish differentiated competitive advantages and translate into sustained ecosystem vitality and value capture remains to be seen, facing numerous challenges and requiring long-term market validation.

Whether the short-term data rebound is a flash in the pan or a positive signal marking the beginning of a prolonged recovery journey—only time will provide the final answer. For Injective, the real test has only just begun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News