4 Pillars Research Report: A Deep Dive into Next-Gen L1 Tokenomics Design through Berachain, Initia, and Injective

TechFlow Selected TechFlow Selected

4 Pillars Research Report: A Deep Dive into Next-Gen L1 Tokenomics Design through Berachain, Initia, and Injective

This article will focus on three key aspects that address the limitations of existing tokenomics and promote sustainable design, using Berachain, Initia, and Injective as examples.

Author: Eren

Translation: TechFlow

Key Takeaways

-

Currently, numerous L1 projects are pursuing specific missions—such as high-performance EVMs, optimized rollup execution environments, or IP tokenization—proposing and advancing new L1 solutions. Among these, which will achieve sustainable growth and become the next generation of L1 blockchains? This article explores tokenomics, a factor as critical to Layer 1 projects as technical capability and community.

-

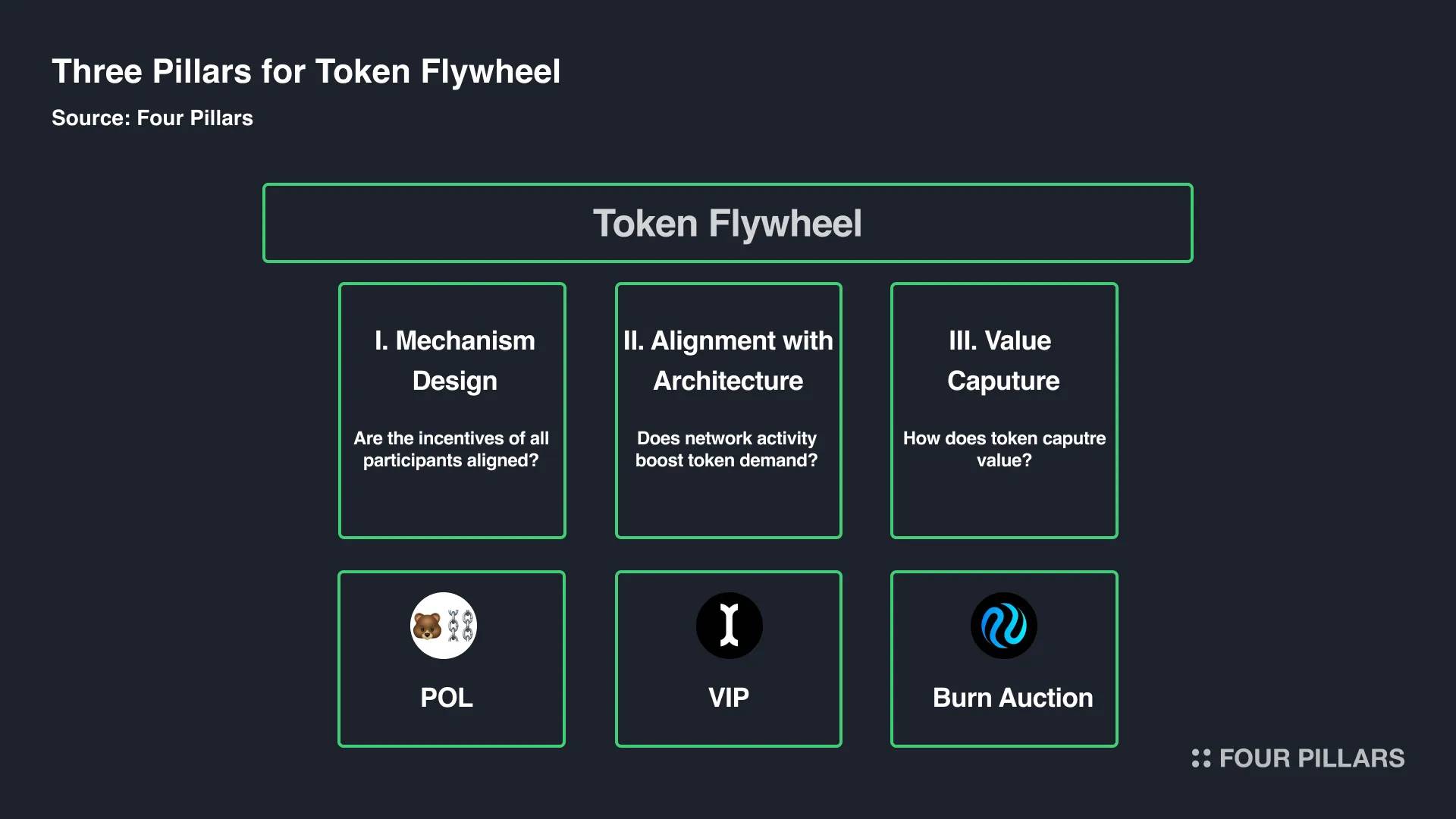

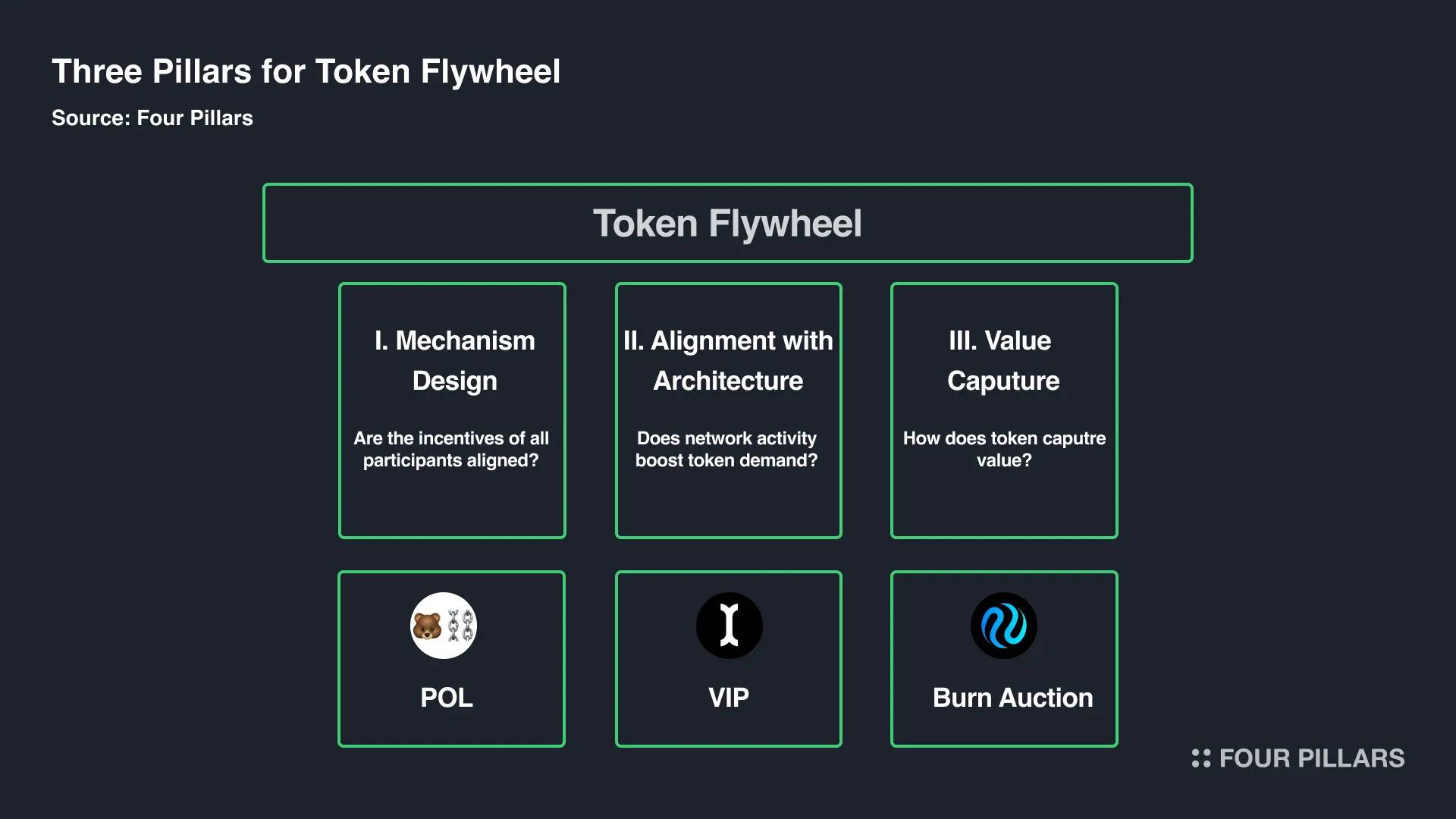

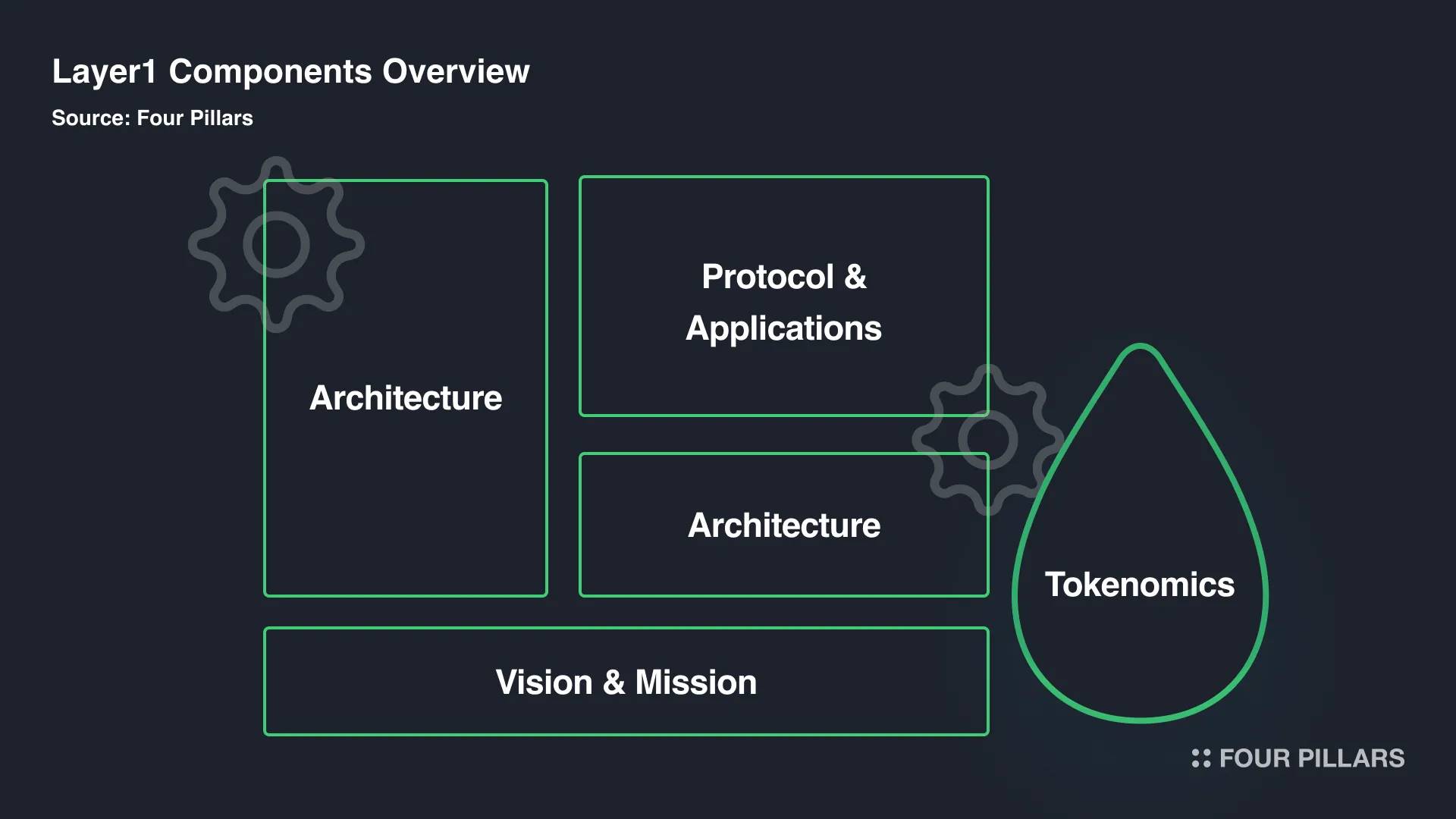

When designing L1 tokenomics, three key considerations are essential: 1) mechanism design, 2) alignment with architecture, and 3) value capture. Based on these principles, ecosystem participants should advance their own interests while collectively promoting network growth. The economic model must align with the unique technical architecture of the L1 and ensure that tokens accrue value as network activity increases.

-

L1 tokenomics that meet these criteria include Berachain (PoL), Initia (VIP), and Injective (Burn Auction). These projects actively refine tokenomics at the network level—adjusting supply and demand dynamics, balancing participant incentives, or designing novel economic models for their technical architectures—offering distinct and innovative tokenomic frameworks.

1. Introduction: The Evolution of Layer 1 Tokenomics

Recently spotlighted projects attracting significant investment—such as Berachain, Monad, Story Protocol, Initia, and Movement—share a common trait: they are upcoming Layer 1 (L1) blockchains. Rather than building on Ethereum as Layer 2 (L2) solutions or developing standalone protocols, these projects have chosen to build their own L1s. This strategy allows them to establish unique ecosystems through specialized functionalities and economic models. Each project enters the market with a defined mission—be it a high-performance EVM, an optimized rollup environment, or IP tokenization—thereby advancing novel L1 paradigms.

The question is: among these initiatives, which will achieve sustainable growth and emerge as the next generation of L1 blockchains? In such evaluations, the robustness of their tokenomics is just as crucial as technical capabilities and community engagement.

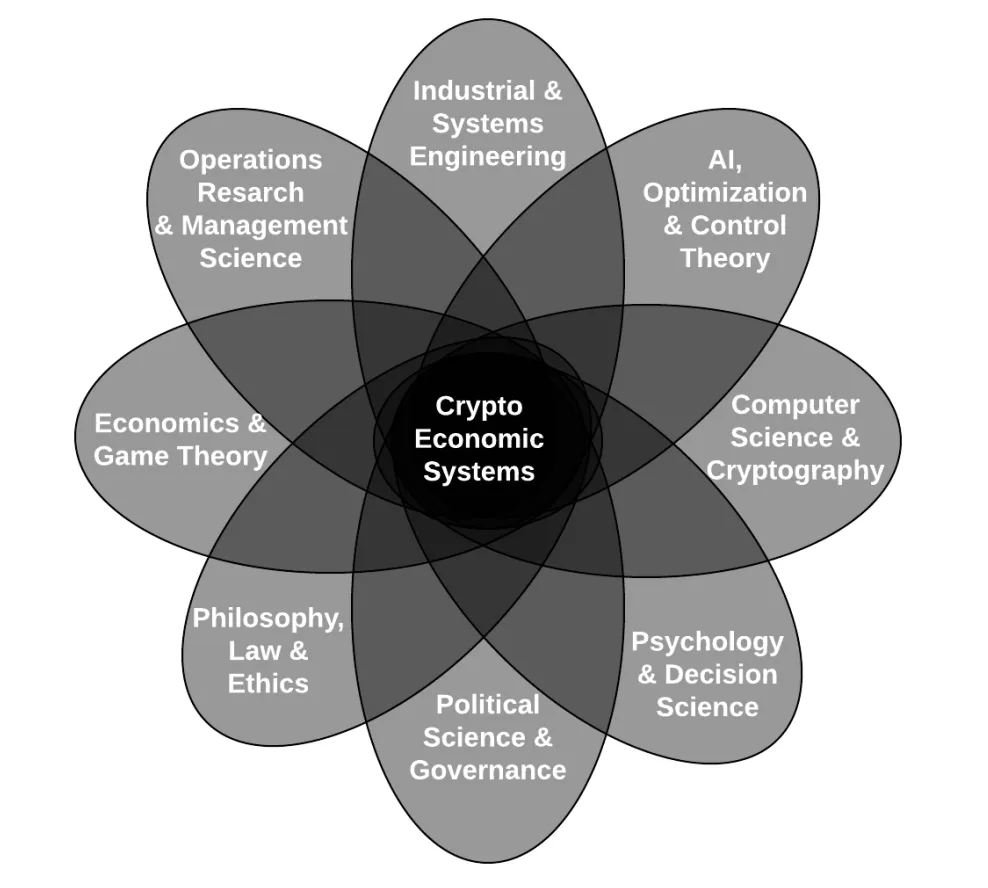

Source: Foundations of Cryptoeconomic Systems

An L1 blockchain can be likened to a nation. The L1 network acts as the country, its ecosystem protocols form local economies, and users or communities represent participating entities. Within this framework, the native token functions both as an economic incentive and as a reserve currency, organically connecting various economic units.

In this context, what role does tokenomics play within the "nation" of an L1 blockchain? Tokenomics serves as an economic system that incentivizes network participants to engage actively, ensuring smooth network operations. Simultaneously, it maintains stable token value by regulating supply and demand dynamics.

Thus, designing tokenomics resembles crafting a national economy. When designing a national economy, governments consider geography, industrial structure, political systems, and culture. Similarly, the tokenomics of an L1 blockchain must reflect its technical architecture, Dapp ecosystem, governance model, and community characteristics.

However, many L1 blockchains born during the 2017–2019 ICO boom adopted generic tokenomic models without accounting for their unique network traits. This led to the emergence of "billion-dollar zombie chains"—blockchains with high valuations but minimal real-world impact.

In contrast, recent trends in tokenomics reveal more sophisticated approaches. These include directly modulating token supply and demand at the network level, introducing architecture-specific tokenomic designs, and establishing clearer role definitions to align the interests of validators, protocols, and users. This article examines Berachain, Initia, and Injective as case studies, focusing on three core aspects that address limitations of traditional tokenomics and promote sustainable design.

2. Flaws in the Token Flywheel and Its Three Pillars of Resolution

2.1 A Basic Overview of Tokens and Tokenomics

2.1.1 The Role of Layer 1 Tokens

"Why do we need tokens?" While tokens are effective tools for blockchain projects, the answer isn't always obvious. For L1 networks, however, the need is clearer: tokens are used at the core level to reward validators and pay network fees. Native L1 tokens primarily serve three functions:

-

Reserve Currency: Users must pay network fees in the native token when using blockspace. For blockchains with embedded L2s, when L2s use the main chain as a data availability (DA) layer, the native token also pays for storage costs.

-

Incentive Tool: Validators receive block rewards in the native token for honestly verifying transactions. Additionally, unique L1 features like unified liquidity may be incentivized through native token rewards.

-

Unit of Value: The native token issued by the L1 directly or indirectly represents the value created by the network. Market participants trade tokens like $ETH based on assessments of Ethereum’s business performance and market position.

2.1.2 The Role of Layer 1 Tokenomics

While tokens have specific roles, tokenomics governs the flow of those tokens. This concept is often narrowly understood as adjusting supply via mechanisms like burning or through specific distribution methods (e.g., max supply, allocation ratios, unlock schedules). However, in our discussion, tokenomics encompasses not only these mechanisms but also incentive systems that align participant interests, practical token utilities, and revenue distribution models—essentially forming a full-fledged token-based economic system.

Within this context, the core function of tokenomics is to establish a system that incentivizes participants to behave in ways that ensure the healthy operation of the L1 network. Specifically, it designs reward structures to encourage beneficial behaviors such as enhancing security or providing liquidity. For such rewards to be effective, they must hold sufficient value to attract contributors. Therefore, tokenomics must also incorporate mechanisms that regulate token supply and demand to preserve reward value.

2.2 The Circular Growth Structure Built by Tokenomics: The Token Flywheel as the Ultimate Goal

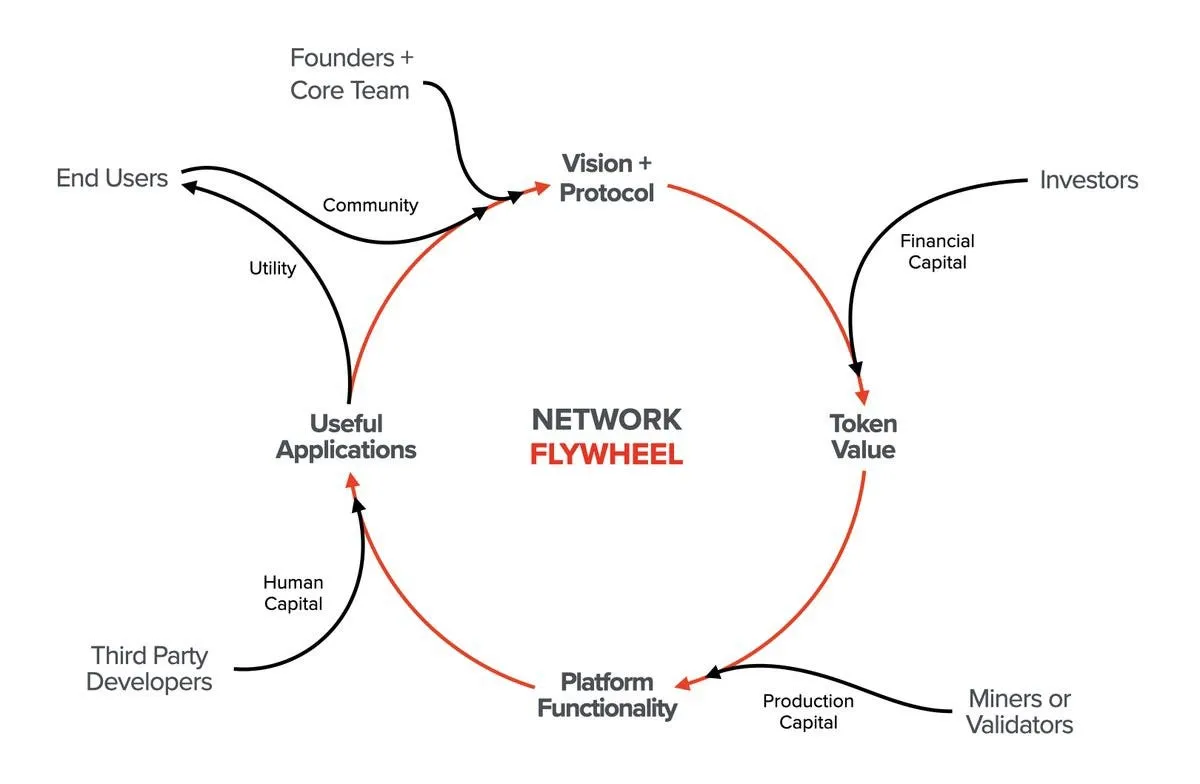

Source: X(@alive_eth)

Well-designed tokenomics can generate a flywheel effect, enabling value to circulate within the network and drive organic growth. This model assumes that interactions between validators (ensuring security), developers (building applications), and users (forming the community) create a self-reinforcing cycle. Through "network effects," this interaction achieves economies of scale, accelerating network expansion. Let's trace how this flywheel effect unfolds from the ground up:

-

After the core team presents a new vision to the market, initial capital funds the infrastructure development of the L1 network, creating early token value in private or public markets.

-

As token value rises, validators support the network’s supply side in exchange for token rewards. For example, they earn block rewards for validating transactions, thereby providing security and functionality.

-

Once the L1 network achieves functional stability and security, developers begin to join and build valuable applications.

-

These applications deliver tangible value to end users, increasing demand for the token. During this process, the user base gradually becomes a supportive community for the L1 network.

-

With increased network activity and a growing community, demand for the token rises. The token serves not only as a reserve currency for paying fees but also as a unit representing network value. Consequently, market demand for the token increases.

-

As token demand grows, validators are further motivated to support network security and functionality. This enhances network security and the developer environment, encouraging the creation of more useful applications and delivering greater value to users. This loop reinforces itself—increasing token demand strengthens incentives, improves security and functionality, drives app development, activates the community, and ultimately creates a flywheel effect.

Once the flywheel effect is initiated, the L1 network can achieve self-sustaining growth. At this stage, development no longer depends entirely on the core team but accelerates autonomously through token incentives. This flywheel fully unlocks the potential of tokenomics and is widely regarded as the ultimate goal of all tokenomic designs.

2.3 Three Challenges to the Token Flywheel: No, the Flywheel Is Just a Conceptual Label

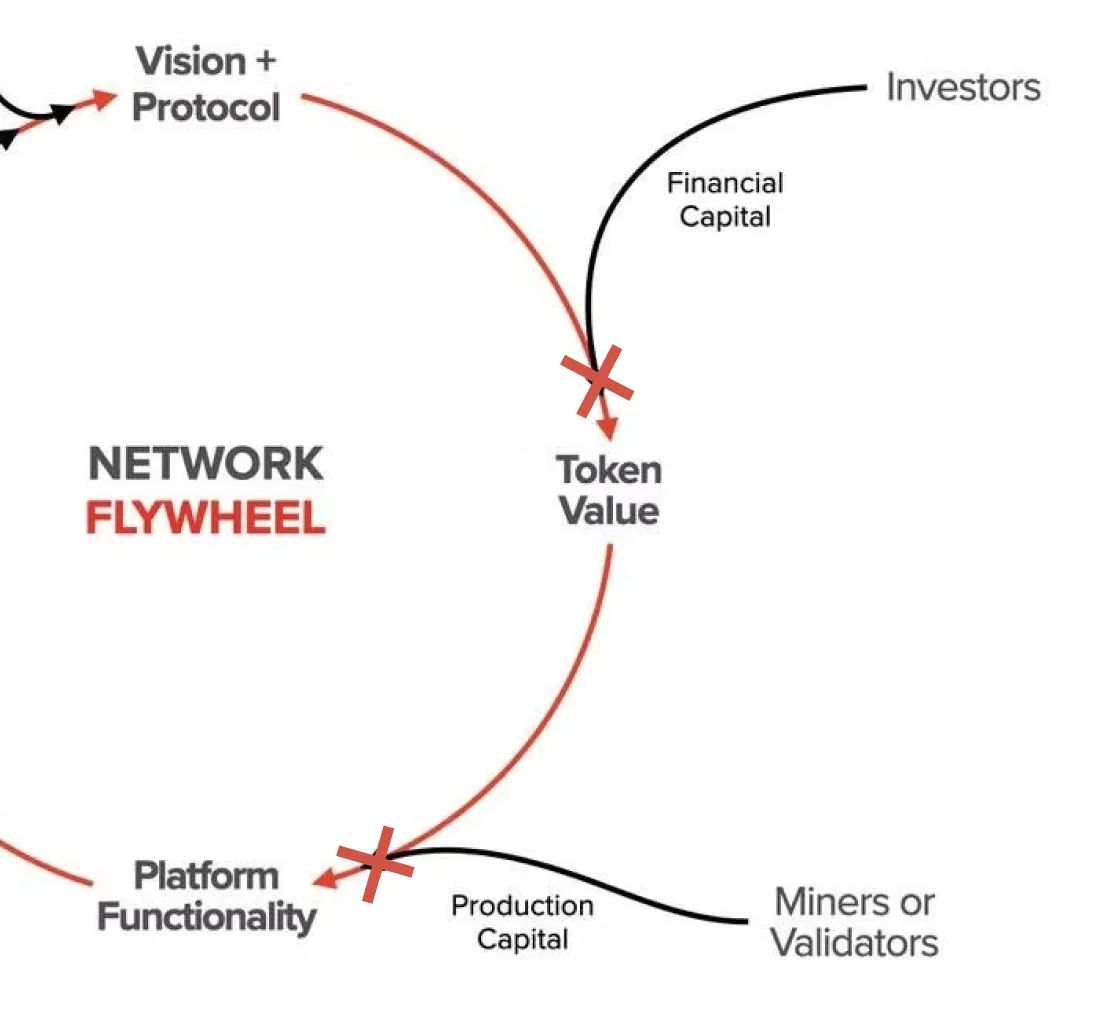

Source: X(@alive_eth)

The flywheel model relies on certain assumptions when constructing a circular growth structure. It assumes that as network activity increases, so does token demand—laying the foundation for stronger incentives for ecosystem contributors. It also assumes higher incentives will motivate validators to contribute to the ecosystem in diverse ways, creating an environment conducive to building more useful applications. These seemingly obvious assumptions deserve scrutiny. Many existing L1 networks struggle to build sustainable tokenomics due to missing key elements in three critical areas:

2.3.1 Are incentives truly aligned across all participants?

L1 networks host various types of participants with differing interests. If the structure coordinating these complex interests breaks down, the flywheel effect stalls. Specifically, we must question whether validators really contribute to the ecosystem in the ways described by the flywheel model when token demand increases and participant incentives strengthen.

Validators’ interests are tied to ecosystem growth. Their block rewards are paid in the L1’s native token, so rising token demand and value benefit them directly. Moreover, as the application ecosystem attracts more users and transaction volume increases, network congestion may rise, boosting validator incentives. Most L1 networks, like Ethereum’s PoS, use gas fee mechanisms where validators earn higher fees during congestion. However, there is typically no direct mechanism at the network level requiring validators to actively contribute to the broader ecosystem. This results in a loose relationship between validators and protocols or users. Because enhanced validator incentives aren’t directly linked to ecosystem vitality, motivation to contribute remains weak. Conversely, when solo stakers receive insignificant rewards, users or protocols lack clear methods or motivations to enhance economic security. Widespread low governance participation rates across L1 ecosystems indicate that individual users lack strong incentives to actively engage in network consensus. In short, there is no direct alignment between validator incentives and those of other ecosystem participants.

2.3.2 Does increased network activity lead to higher token demand?

It's difficult to assert that rising application count and user numbers necessarily translate into increased token demand. Without an intrinsic or strong structural link between network activity and native token demand, these two metrics may diverge. As discussed later, Ethereum currently faces rising L2 activity, yet factors driving $ETH demand remain limited. Like Ethereum, each blockchain has a unique technical architecture, meaning tokenomics should closely reflect these architectural traits.

2.3.3 How does the token capture value?

Though similar to the previous point, this question can be approached differently: how exactly does the token capture value? Suppose the flywheel operates ideally, and token demand grows with network activity. Does this necessarily increase token value? Clearly, rising demand doesn’t automatically mean rising value. Setting aside market speculation—which often decouples from fundamental ecosystem growth—basic math shows that demand must exceed newly issued supply for value to increase. Thus, a mechanism must exist to either increase token demand or reduce supply when the network is active. Yet such mechanisms are sometimes overlooked or ineffective, preventing the feedback loop of “network activation → increased token demand → increased token value.”

2.4 The Three Pillars for Correcting the Token Flywheel

To summarize: L1 tokens act as a reserve currency, an incentive tool, and a unit representing network-created value. By constructing tokenomics as an economic system, L1s can coordinate participant incentives through tokens and rewards, ensuring smooth network operation. Well-designed tokenomics holds the potential to foster self-sustaining growth by circulating value through token incentives.

However, our idealized token flywheel often fails to match real-world phenomena in actual L1 networks. This is because positive feedback loops fail to activate effectively during participant behavior guidance or value linkage. Specifically, insufficient attention is paid to whether participant incentives are truly aligned, whether network activity drives token demand, and whether value accumulates in the token.

These limitations often undermine the sustainability of tokenomics in existing L1 networks. Therefore, when exploring the future direction of next-generation L1 tokenomics, we must analyze these past shortcomings more carefully. To do so, we can transform our skepticism about the token flywheel into three key design principles: I. Mechanism Design, II. Alignment with Architecture, III. Value Capture. In the following section, we’ll examine case studies to illustrate the limitations of current tokenomics and clarify these guiding principles.

I. Are all participants’ incentives truly aligned? → Mechanism Design

II. Does increased network activity lead to higher token demand? → Alignment with Architecture

III. How does the token capture value? → Value Capture

3. Lessons from Millennial-Era L1 Networks

Due to the complexity of tokenomics, analyzing individual cases through a single lens risks oversimplification. Nevertheless, identifying limitations in existing models and learning from them is a valid approach to exploring sustainable tokenomics. We can concretize the three pillars supporting the flywheel by examining: 1) Bitcoin’s challenges in mechanism design, 2) Ethereum’s misalignment between architecture and tokenomics, and 3) Arbitrum’s structural inability to effectively capture network value.

3.1 Pillar I – Mechanism Design: Bitcoin

Since the advent of blockchain, Bitcoin has been one of the most innovative inventions and has become a significant asset in traditional financial markets. However, a notable gap exists between Bitcoin’s original intent and its current role. As Bitcoin evolves into a store of value, its initial incentive design no longer fits its present function, raising concerns about insufficient incentives to maintain long-term security. This reality is reshaping Bitcoin’s roadmap. Let’s delve into Bitcoin’s case, focusing on mechanism design—specifically, “how much reward is provided, how it is delivered, and what behaviors it aims to incentivize.”

3.1.1 Bitcoin Tokenomics: The Premise of Halving

Bitcoin’s mechanism can be summarized as linking network security with node incentives through rewarding miners who generate valid blocks under the PoW (Proof-of-Work) consensus algorithm. Network nodes compete to compute hash values, consuming computational power to earn block rewards and add valid blocks to the longest chain. For malicious actors, attacking the network requires controlling over half of the total PoW computing power—an extremely difficult feat. Even if successful, attackers lose motivation because an attack would devalue Bitcoin, harming themselves. Through this mechanism, Bitcoin achieves Byzantine Fault Tolerance (BFT), operating as a decentralized monetary system without relying on third-party trust.

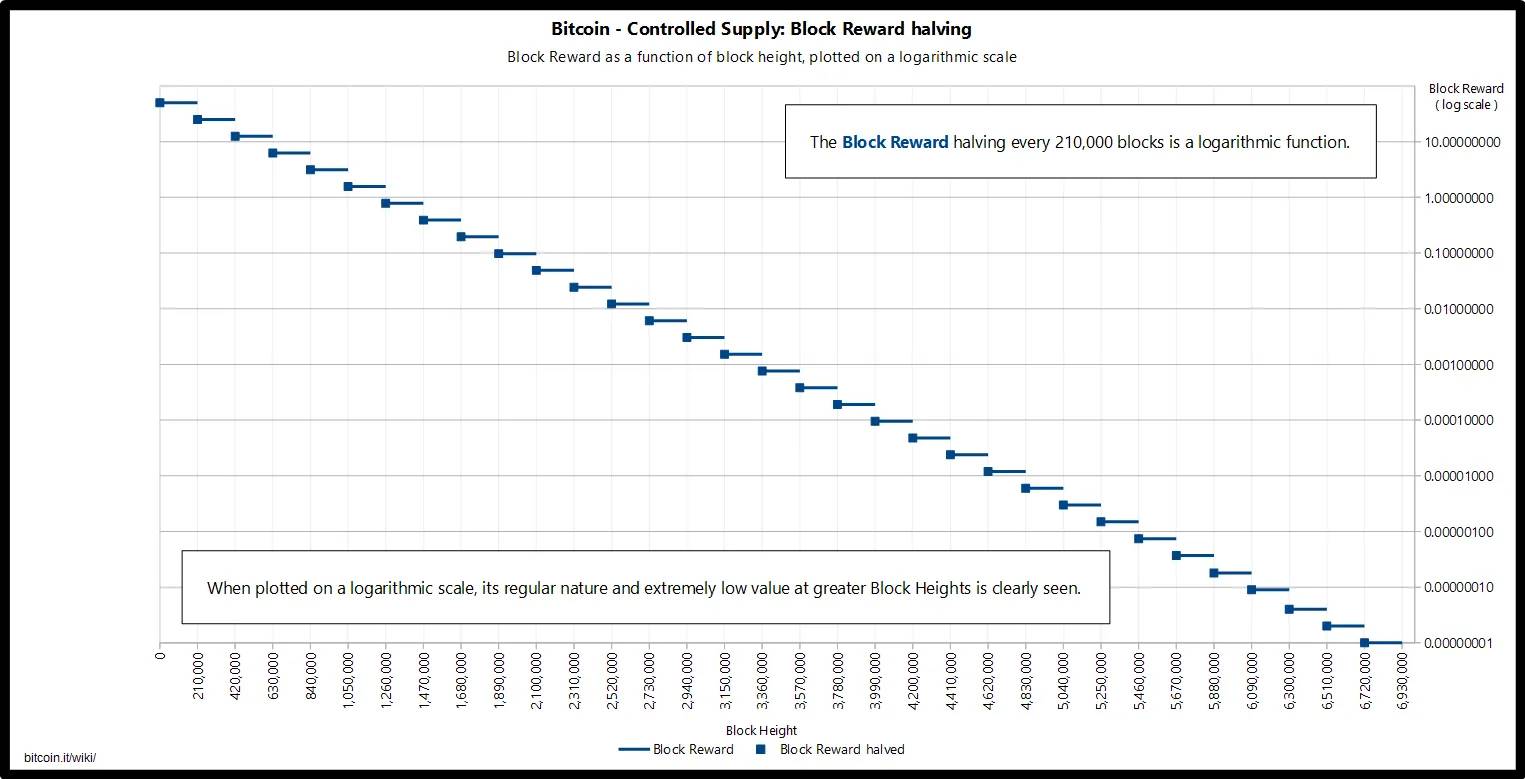

Source: Bitcoin Wiki

Thus, block rewards for miner nodes are crucial for maintaining Bitcoin’s decentralization and security, as they incentivize honest participation in the PoW process. However, a deeper look reveals that block rewards halve approximately every four years to curb inflation, eventually ceasing altogether. Miners will then increasingly rely on transaction fees rather than inflationary block rewards.

This halving mechanism assumes Bitcoin will ultimately become a payment currency, with transaction fees fully replacing mining rewards. Unlike its current role as a “store of value” (SoV), Bitcoin was originally intended to replace centralized electronic payment systems. However, Bitcoin’s scalability issues for payments are well-known, and alternatives like USDC or USDT have emerged as effective digital payment instruments.

To address these challenges, it has been proposed that Bitcoin adjust its strategy, with possible solutions for mining incentives including: as Bitcoin supply dwindles, its scarcity naturally increases, potentially resolving incentive issues. Eventually, as Bitcoin solidifies its role as a store of value, its value could rise so significantly that even without mining rewards, block production remains sufficiently incentivized. Another solution involves evolving Bitcoin into a programmable asset and network via BTCFi or Bitcoin L2 projects. This approach aims to make Bitcoin more productive.

3.1.2 What Bitcoin Reveals About Mechanism Design

Despite ongoing debates about Bitcoin’s scalability, the potential future lack of miner incentives contradicts its original tokenomic design, raising critical questions about sustainability. If mining rewards eventually stop, no one may be willing to expend computational power to produce blocks, risking the recording of Bitcoin transactions. Hence, the market is beginning to focus on gradually increasing transaction fees to replace mining rewards, transforming Bitcoin into a more productive asset. This task has become a key driver for attracting developers and expanding the Bitcoin ecosystem.

Bitcoin’s case highlights the importance of mechanism design in tokenomics—“how rewards are delivered, how much is given, and what behaviors are encouraged.” Here, mechanism design refers to structuring incentives so that participants maximize personal gain while collectively achieving network goals. Often called “reverse game theory,” it differs from traditional game theory, which predicts strategic decisions based on self-interest. Instead, mechanism design creates optimal systems where individuals pursuing self-interest collectively achieve a desired outcome—ensuring that validators, protocols, and users, while maximizing personal benefits, simultaneously uphold the L1 network’s stability and long-term viability.

3.2 Pillar II – Alignment with Architecture: The Case of Ethereum

Architectural alignment refers to whether a blockchain’s technical structure is compatible with its underlying economic model. L1 networks employ diverse technical architectures—from consensus algorithms to transaction computation models and the presence of L2s. For instance, some L1s target specific goals: Monad Blockchain aims for high-performance EVM via parallel transaction processing, while Story Network focuses on IP tokenization—both requiring unique technical architectures. But is adjusting architecture alone sufficient? As architecture evolves, so do participant types and their incentives, necessitating optimized economic models. From this perspective, we can assess whether architecture and tokenomics are aligned. Ethereum’s recent struggles with tokenomic sustainability offer a multidimensional case study.

3.2.1 Ethereum’s Tokenomics: L2 Dependence on Ethereum

Source: X(@glxyresearch)

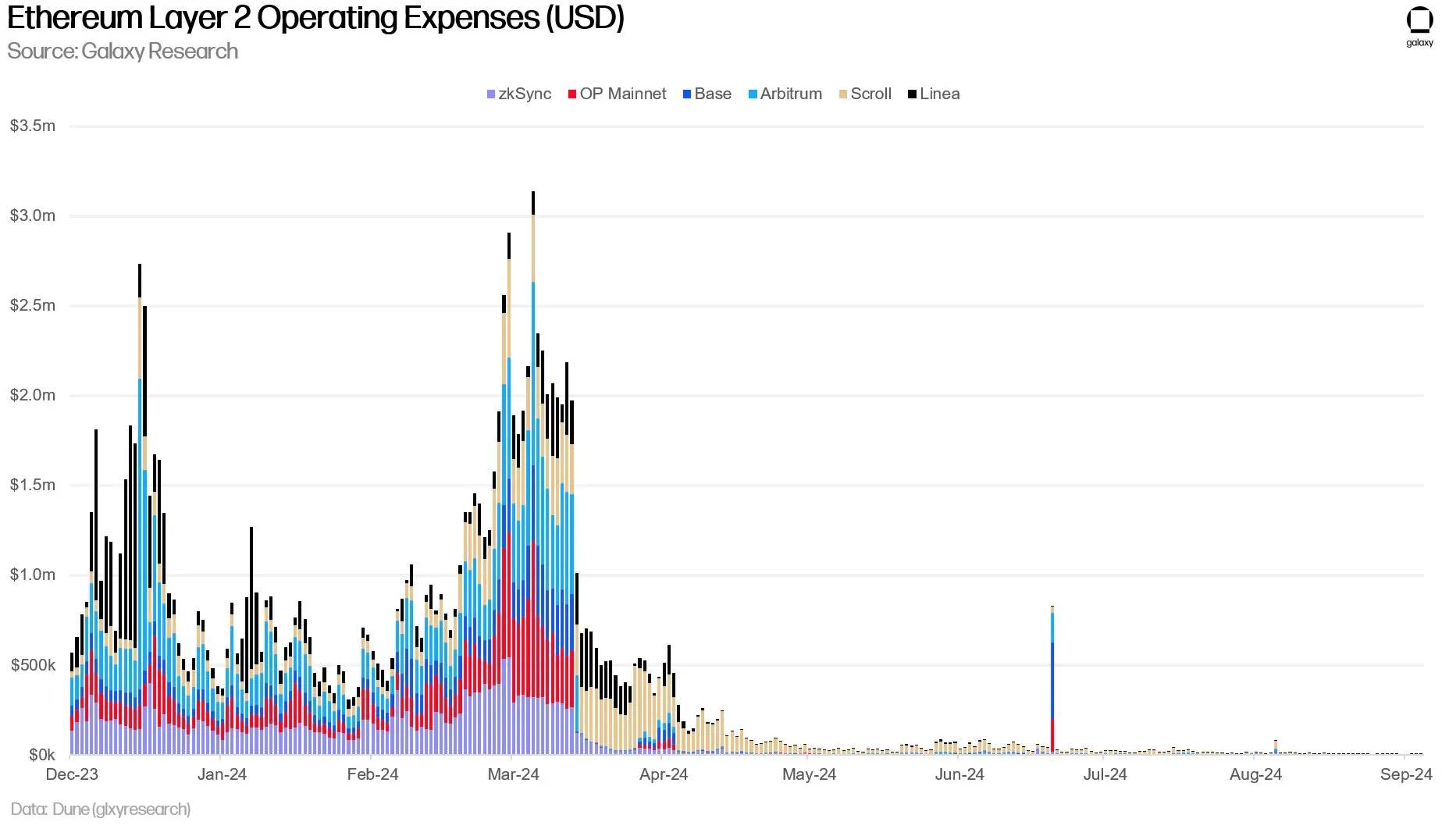

Ethereum has built the largest blockchain ecosystem thanks to its strong liquidity and vibrant developer community. However, recent concerns have emerged about its economic model, particularly because L2 value isn’t reflected on Ethereum’s mainnet or $ETH. The root cause lies in the EIP-4844 upgrade, which drastically reduced DA (data availability) fees that L2s pay when uploading transaction data to Ethereum. This reduced demand for $ETH as a gas token. In other words, as L2s pay less to Ethereum, Ethereum’s revenue declines, and a major source of $ETH demand disappears—leading to the critique that “L2s are economically parasitic on Ethereum.”

Source: Dune(@blockworks_research)

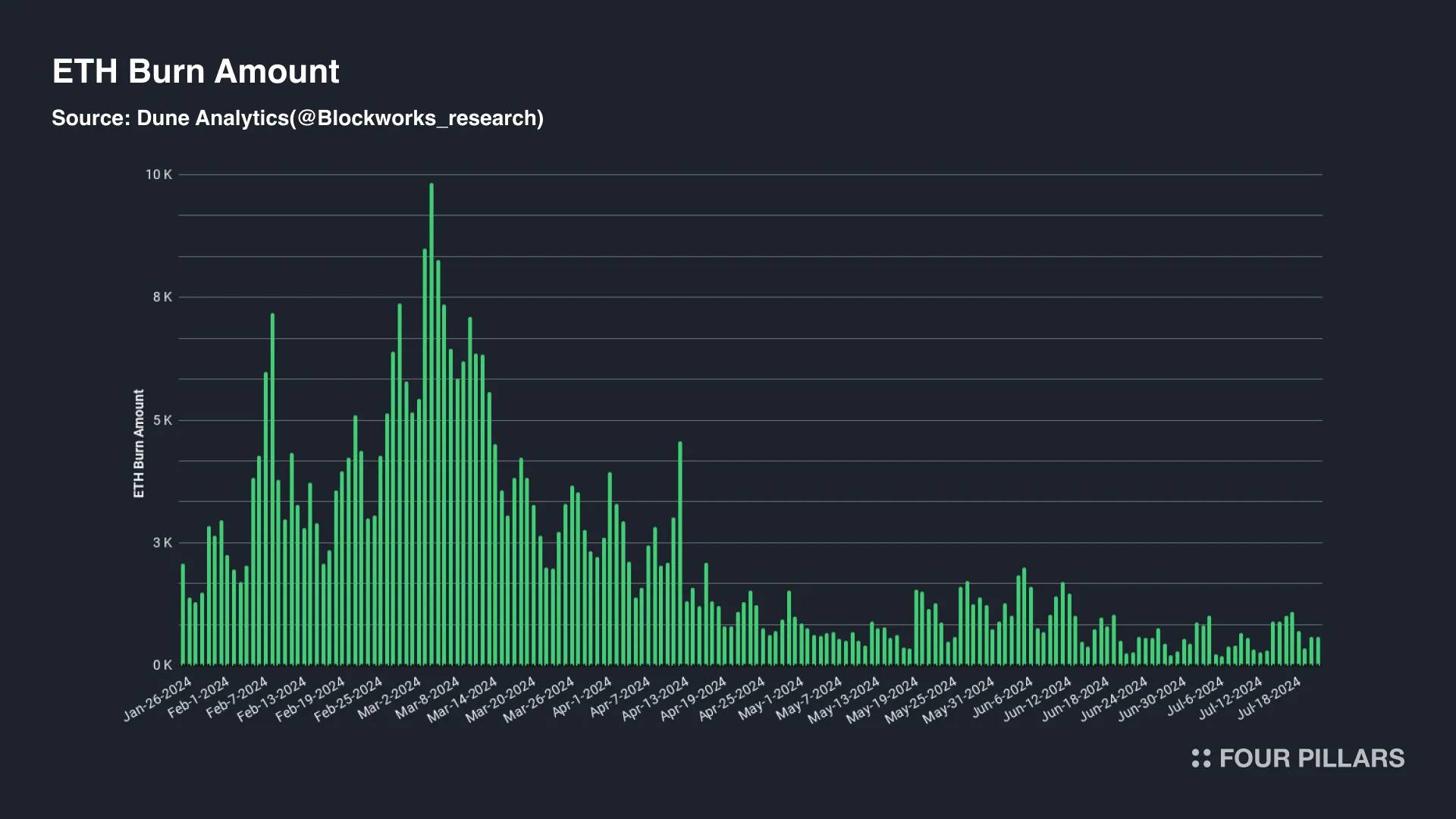

To understand the background: Ethereum splits gas fees into a base fee (determined by network congestion) and a priority fee (set by users). Priority fees go to validators; base fees are burned. When total base fees exceed new block rewards, enough $ETH is burned to keep the overall supply deflationary. A shrinking circulating supply of $ETH is seen as foundational for sustained demand.

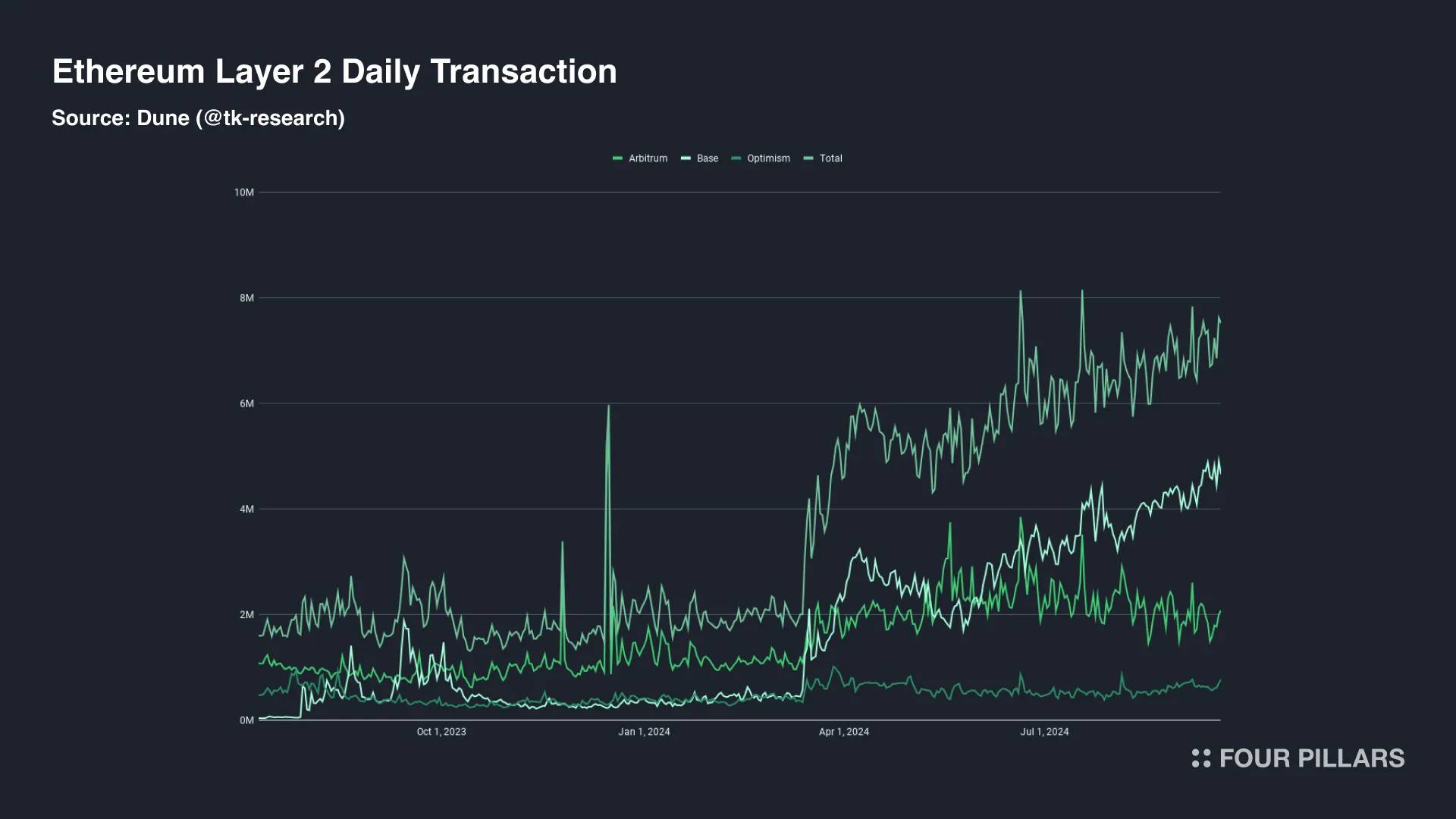

Source: Dune(@tk-research)

Yet Ethereum’s long-term vision centers on L2s, prompting EIP-4844 to lower sequencing costs and improve L2 scalability. Since this update, conditions have shifted. Significant increases in L2 transactions and active addresses show end users now transact via L2 apps at lower fees, bypassing Ethereum. Meanwhile, structurally, Ethereum is at a “disadvantage” compared to L2s. Despite L2 activity, Ethereum’s average gas price has dropped to 1 Gwei, pushing $ETH into inflation—fueling criticism of L2s’ economic parasitism.

3.2.2 What Ethereum Reveals About Architectural and Economic Model Alignment

Ethereum continuously upgrades its architecture, leveraging L2s to overcome mainnet scalability limits. This raises a question: hasn’t Ethereum already succeeded, given its improved scalability and rising L2 activity? Ethereum has declared a rollup-centric roadmap to achieve high scalability while preserving decentralization. Thus, post-EIP-4844 reductions in L2 operational costs and improved user convenience may align with its architectural goals.

However, Ethereum’s case shows problems arise when technical architecture and economic models mismatch—even during a transition to an L2-centric model. While the L1 improves architecturally to meet its goals and enhances UX and activity, the value generated by this activity fails to connect with the economic model. L2 scalability hasn’t translated into economic gains for Ethereum. Proposals like EIP-7762, suggesting higher blob fees for L2s, risk undermining L2 scalability—revealing a misalignment between architectural and economic growth curves.

This demonstrates that tokenomics cannot be separated from L1 architecture. If an L1 has a clear problem to solve and a goal to achieve, its technical architecture should be designed as a methodology to accomplish that goal—and its tokenomics must align accordingly. This issue is especially pronounced in modular blockchains prone to economic fragmentation. Beyond Ethereum, the Cosmos IBC ecosystem hosts diverse app chains based on unique architectures, yet remains fragmented, lacking a value chain integrating these app chains into a unified economic system. In short, as architecture evolves and participants develop unique interests, a tailored economic model becomes essential.

3.3 Pillar III – Value Capture: Arbitrum

Value capture refers to how a token accrues value from the network. Even with high network activity, a mechanism directly adjusting token supply and demand is needed to boost fundamental token demand. The weak link between Arbitrum and $ARB illustrates the importance of value capture—without it, tokens fail to effectively capture value.

3.3.1 Arbitrum’s Tokenomics: L2 Tokens as Meme Tokens

Arbitrum is currently the most active L2 network, hosting around 700 protocols and processing ~5 million weekly transactions. Yet despite high activity, $ARB is criticized as a meme-like token due to its lack of utility beyond governance. It lacks fundamental demand drivers recognized by the market. Although many variables influence token prices—making volatility hard to explain—the mechanisms that encourage long-term holding or buying play a vital role in valuation. In practice, $ARB’s price has trended downward, dropping 66% year-to-date. According to IntoTheBlock, 95% of $ARB holders are currently underwater.

To address this, Arbitrum DAO recently passed a proposal to introduce $ARB staking. The core idea is delegating governance rights via $ARB staking and strengthening the staking rewards system. Staking $ARB yields returns from multiple income streams, such as sequencer fees, MEV fees, and validator fees. Additionally, liquid staking enables $stARB interoperability with other DeFi protocols while maintaining staked status.

This tokenomic update is expected to yield multiple benefits. Arbitrum DAO’s treasury holds $45M in $ETH, yet circulating $ARB used for governance is less than 10%. Enhancing governance delegation via staking could improve governance security. Another key benefit is incentivizing long-term $ARB holding.

3.3.2 What Arbitrum Reveals About Value Capture

Value capture means accumulating network value through the token—via distributing network revenue to contributors or directly/indirectly adjusting token supply. As Arbitrum’s case shows, value capture is crucial not only for L2s or DeFi protocols but also for L1 tokenomics. Especially for L1 native tokens used as incentives, the token must be perceived as a valuable reward to motivate ecosystem contributions.

Token value capture works by linking network demand with token supply-demand dynamics. For example, using network revenue to buy and burn tokens reduces circulating supply. Alternatively, revenue can be distributed directly to stakers. Such mechanisms create fundamental demand or adjust circulating supply, forming a virtuous cycle: increased L1 activity → higher token value → stronger contributor incentives → further L1 growth.

4. Sustainable Tokenomics for the Next Generation of Layer 1

By studying existing tokenomic cases, we’ve identified three key points for building a token flywheel. While Bitcoin’s complete block reward phaseout remains distant, it’s not yet urgent. Ethereum and Arbitrum are actively discussing solutions, leaving room for improvement. Nevertheless, the limitations encountered offer valuable lessons: when ecosystems lack incentives, economic models misalign with architecture, or network activity fails to translate into token value growth, tokenomic sustainability is threatened.

Meeting these standards isn’t as simple as it seems. Berachain, Initia, and Injective propose a shared solution: intervening directly at the network level to align participant incentives or designing tokenomics tightly coupled with technical architecture. They experiment with unique mechanisms to adjust token supply and demand, overcoming prior limitations. This deep integration of tokenomics at the network level could effectively fill gaps in existing flywheel models. Next, we’ll explore how Berachain uses its complex PoL mechanism to resolve incentive misalignment, how Initia plans to unify fragmented rollup ecosystems via VIP economics, and why Injective can sustain long-term token deflation.

4.1 Mechanism Design: Berachain’s Proof of Liquidity

Mechanism design involves creating a system where L1 participants, while pursuing self-interest, actively promote network operation and sustainability. Berachain excels here, introducing PoL (Proof of Liquidity) as a consensus algorithm that aligns ecosystem participant incentives and rewards to resolve misalignment.

4.1.1 Berachain Overview

Berachain is an EVM-compatible L1 blockchain built on BeaconKit, a modified version of the Cosmos SDK. Similar to Ethereum’s beacon chain, Berachain uses BeaconKit to separate execution and consensus layers, employing CometBFT for consensus and EVM for execution—ensuring high compatibility with EVM environments. With strong technical capabilities, Berachain has cultivated its community and dev environment since launching the NFT project Bong Bears. Though still on testnet, multiple protocols are live, showing high community engagement.

4.1.2 Berachain Tokenomics

Berachain’s uniqueness lies in its PoL mechanism, which aligns participant incentives at the network level. PoL is a custom consensus algorithm designed to ensure stable liquidity and security while enhancing validators’ ecosystem roles. Focused on mechanism design, it fosters interdependence so that each participant promotes network growth while pursuing self-interest. Next, we examine how Berachain unifies the interests of users, validators, and protocols around a shared growth objective.

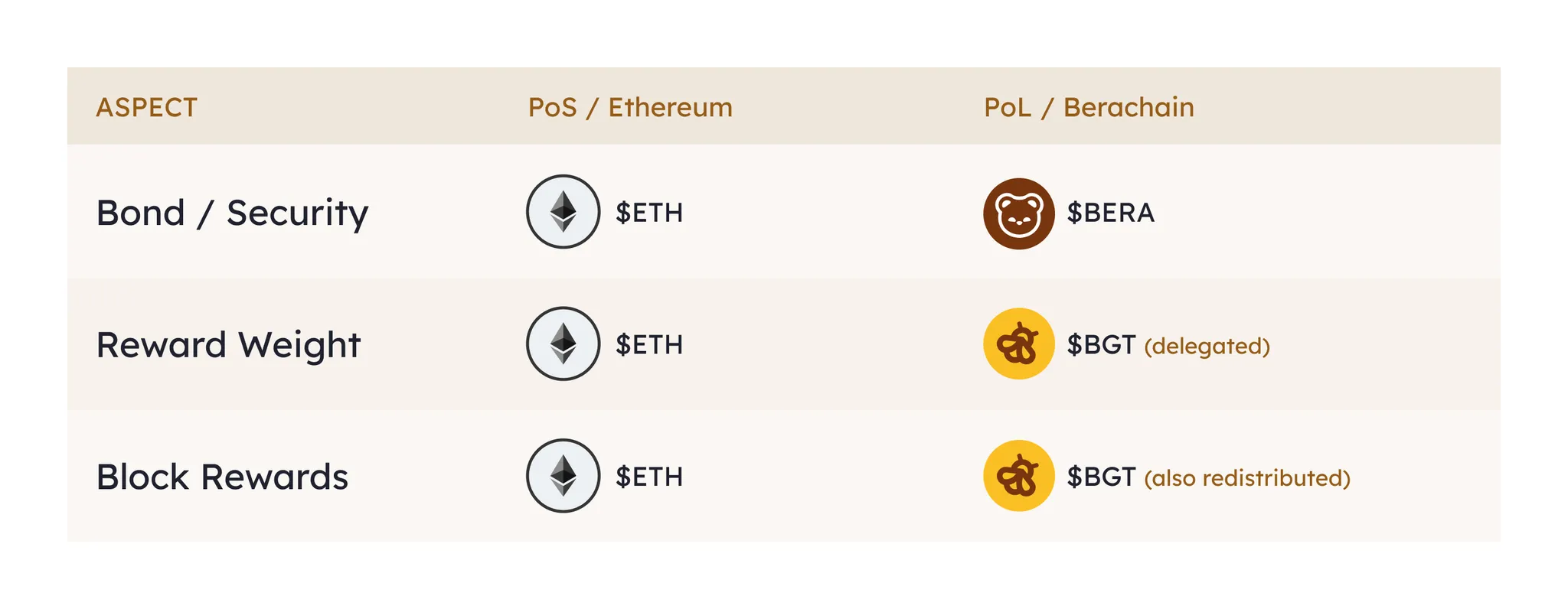

Source: Berachain Docs

Berachain uses three tokens: $BERA, $BGT, and $HONEY, each playing distinct roles in PoL. $BERA serves as the gas token for network fees, $BGT (Bera Governance Token) acts as both a liquidity provision reward and a governance token determining reward allocations. $HONEY is Berachain’s native stablecoin, pegged 1:1 to $USDC. Though Berachain employs a triple-token model, we’ll focus on $BERA and $BGT to simplify the discussion of PoL participation. Understanding Berachain’s mechanism design hinges on grasping $BGT’s unique properties.

$BGT is a reward token earned by providing liquidity to whitelisted pools (Whitelist Reward Vaults), decided by governance. $BGT is held in non-tradable form in accounts. While earned $BGT can be redeemed 1:1 for $BERA, reverse conversion ($BERA → $BGT) is impossible. Thus, liquidity provision is the sole way to obtain $BGT.

Which liquidity pool receives $BGT distribution? Users earning $BGT have two choices: redeem $BGT for $BERA to cash out, or delegate $BGT to validators to earn extra rewards. These additional rewards stem from incentives flowing from protocols to users via validators, explained below.

Berachain separates gas and governance tokens into $BERA and $BGT to simultaneously ensure liquidity and security. In single-token L1s, staking tokens for PoS security reduces liquidity available in the ecosystem. Berachain solves this by requiring users to provide liquidity to earn $BGT for security purposes. Furthermore, allowing validators to allocate $BGT issuance ratios strengthens incentive alignment, increasing interdependence among validators, protocols, and users.

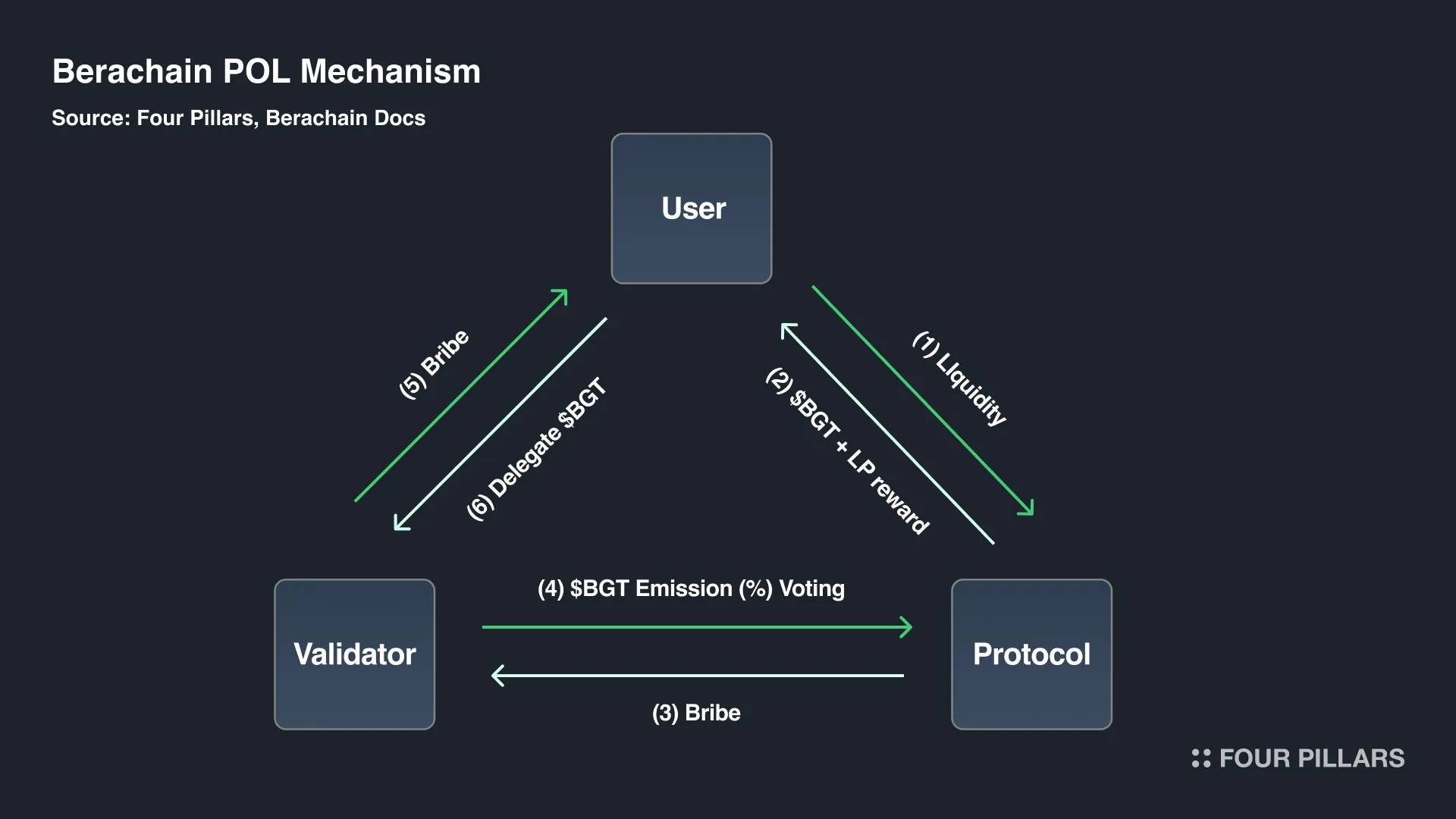

Having covered PoL basics and the roles of $BERA and $BGT, let’s now examine how ecosystem participants interact. Follow the flow of $BGT, liquidity, and incentives from step (1) to (6) to understand how participants engage under aligned incentives.

User ↔ Protocol

(1) Liquidity: Users deposit funds into their chosen whitelisted liquidity pool. Protocols use these pools to provide users with seamless trading experiences.

(2) $BGT + LP Rewards: When users provide liquidity to whitelisted pools, protocols grant $BGT rewards plus standard liquidity provider rewards. To attract users, protocols compete to secure higher $BGT issuance allocations.

Protocol ↔ Validator

(3) Incentives: Validators hold governance power to decide $BGT issuance ratios for liquidity pools. Protocols therefore offer incentives to validators to vote for their pools.

(4) $BGT Issuance Vote: Unlike other L1s, Berachain validators don’t receive L1 tokens as network validation rewards based on inflation rates. Instead, they earn validation income from protocol-provided incentives (excluding occasional priority fees). To receive sufficient incentives, validators must accumulate more $BGT to strengthen their governance influence.

Validator ↔ User

(5) Incentives: To gain stronger governance power, validators need users to delegate their $BGT—earned via liquidity provision—to them. To attract delegations, validators must share back protocol incentives or offer additional rewards.

(6) Delegate $BGT: Users delegate $BGT to validators in exchange for offered incentives.

4.1.3 The Direction of Berachain’s Mechanism-Driven Tokenomics

In summary, Berachain’s PoL mechanism aims to simultaneously ensure ecosystem liquidity and security while resolving validator interest misalignment. Unlike traditional single-token models, Berachain separates $BERA (for liquidity) and $BGT (for governance), solving the liquidity-security trade-off. By having validators earn rewards through incentives and granting them power over $BGT issuance, Berachain strengthens interdependence among validators, protocols, and users.

Certainly, increased mechanism complexity steepens the user learning curve. Close monitoring will be needed post-mainnet launch to see if PoL interactions unfold smoothly. Nevertheless, Berachain’s intricate mechanism design—resolving incentive misalignment—points toward a significant advancement in L1 tokenomics.

4.2 Alignment with Architecture: INITIA and VIP

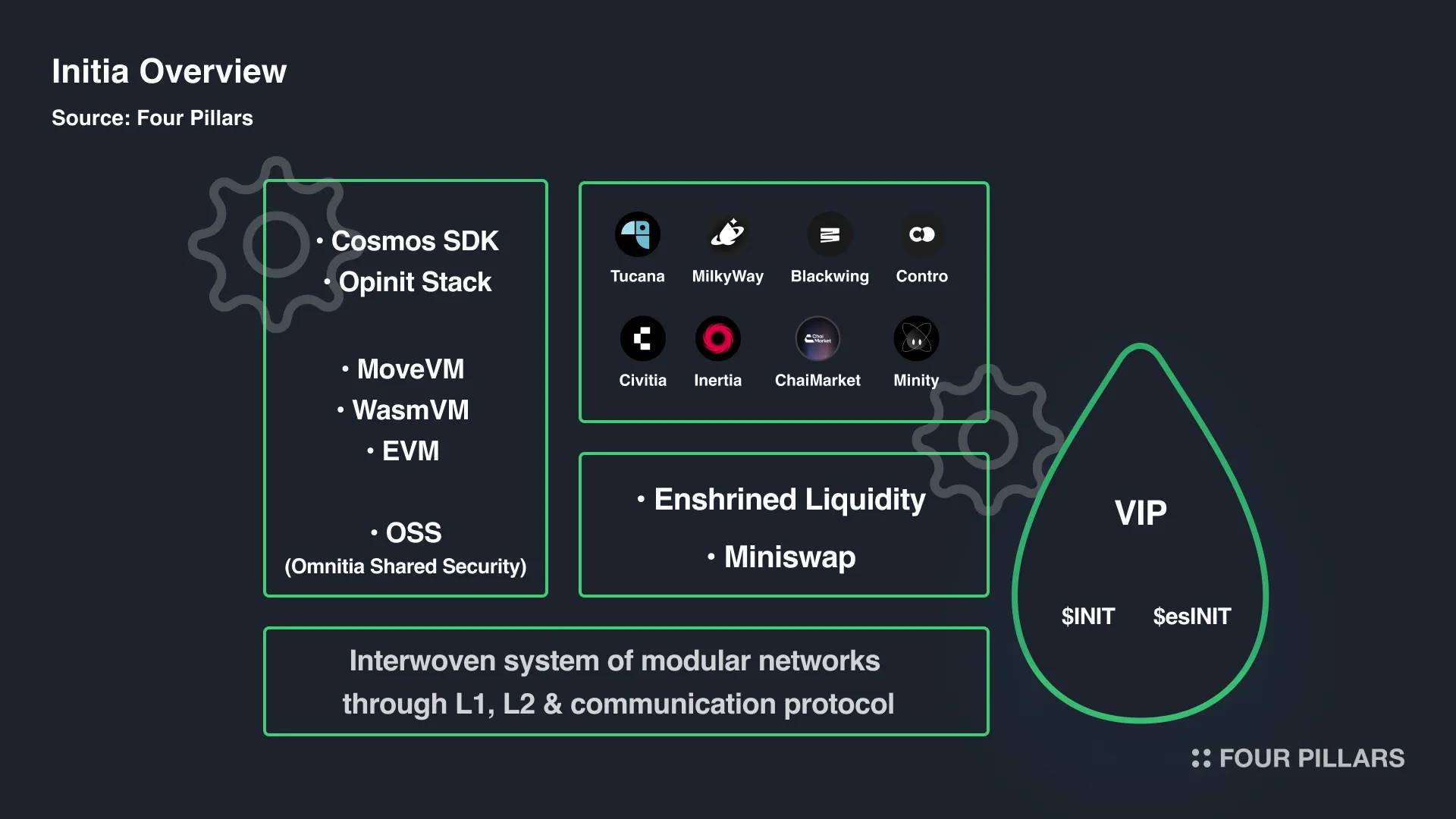

Initia addresses the potential misalignment between architecture and economic model when architecture evolves. It targets fragmentation challenges in existing rollup ecosystems. Guided by the mission of “interwoven rollups,” Initia aims to build an ecosystem where L2 Minitias orbit Initia, tightly connected economically and securely. To achieve this, Initia leverages its unique VIP tokenomics to link potentially fragmented rollup economies.

4.2.1 Initia Overview

Initia is a Cosmos-based L1 blockchain powered by MoveVM, designed as a settlement layer for L2 rollups called Minitia. Initia (L1) and Minitia (L2) are interconnected economically and securely, forming an integrated ecosystem called Omnitia. Thus, Initia’s features are engineered to strengthen connections with Minitia L2s. For security, if fraud occurs in a Minitia, Initia’s validators collaborate with Celestia to resolve disputes and reconstruct the last valid state. For liquidity, Initia operates Enshrined Liquidity—a liquidity hub at the L1 level—allowing Minitias to leverage routing for seamless cross-Minitia asset transfers and swaps.

4.2.2 Initia Tokenomics

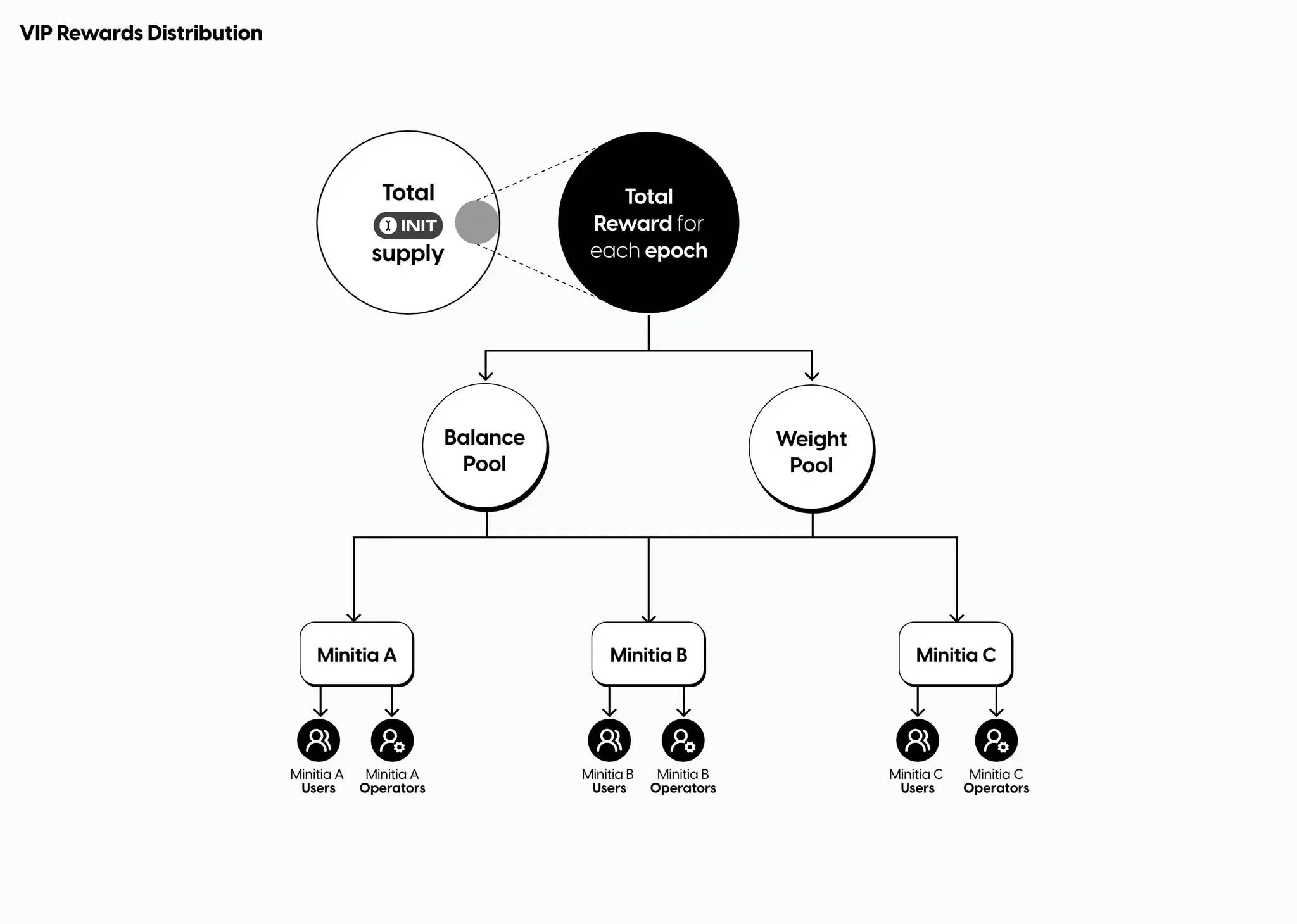

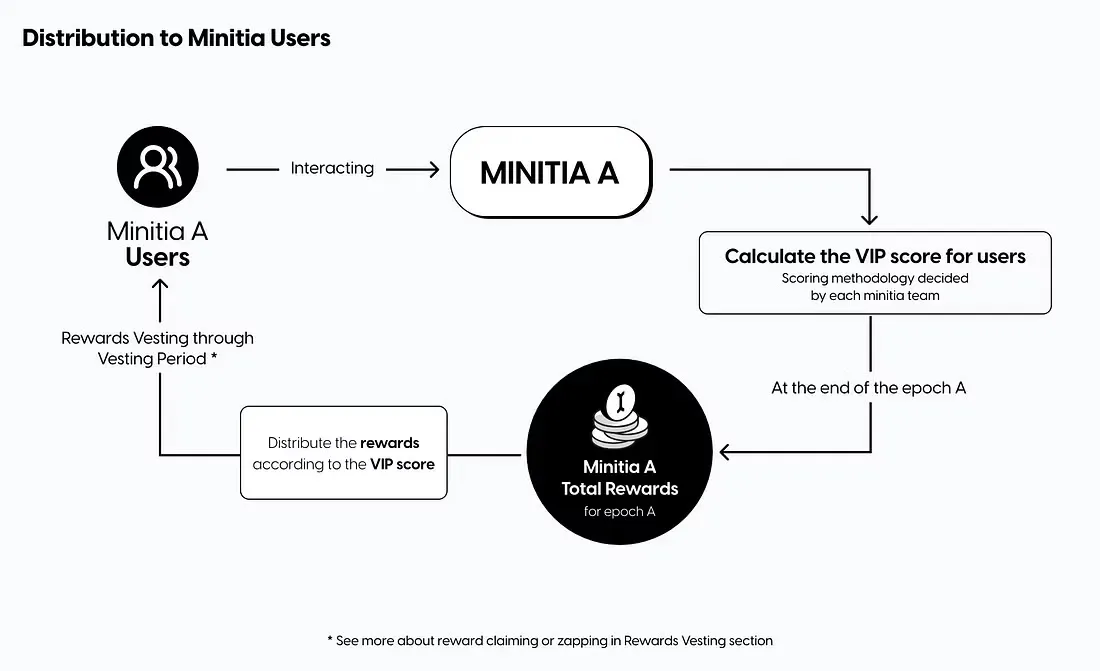

Designed for tight integration with Minitia L2s, Initia introduces the VIP (Vested Interest Program) to forge economic ties. VIP aims to make $INIT the foundational currency of the Initia ecosystem and a core component of all L2s. This mechanism uses $INIT as an economic bridge between Initia and Minitia, continually expanding $INIT’s utility. The VIP process has three stages: 1) Allocation, 2) Distribution, 3) Unlocking.

1) Allocation

Source: Introducing VIP

First, 10% of $INIT’s genesis supply is allocated to the VIP fund. Every two weeks, this fund distributes rewards to qualifying Minitias and users. Rewards are split between two pools: the Balance Pool and the Weight Pool. The Balance Pool allocates rewards proportionally based on the amount of $INIT held by each Minitia. The Weight Pool allocates rewards based on weights set through metric voting in L1 governance. In other words, L1 stakers determine each Minitia’s reward share via metric voting. Thus, the Balance Pool encourages Minitias to hold more $INIT and expand its use in applications, while the Weight Pool creates new utility for $INIT via voting and incentivizes validators, users, and bribe protocols like Votium and Hidden Hand to participate in L1 governance.

2) Distribution

Source: Introducing VIP

Rewards allocated to Minitias are distributed as $esINIT (escrowed INIT), initially non-transferable. Recipients fall into two categories: operators and users. Operators are project teams running Minitias. They can use $esINIT in various ways—e.g., as development funding, redistributing to active users, or staking on Initia L1 to vote for themselves in future metric votes.

Meanwhile, $esINIT distributed to users as rewards is allocated directly based on their VIP score. The VIP score is calculated using KPIs set by Minitias to encourage user engagement. For example, a Minitia might define VIP score criteria based on a user’s transaction count, volume, or borrowing size within a given period to incentivize specific behaviors.

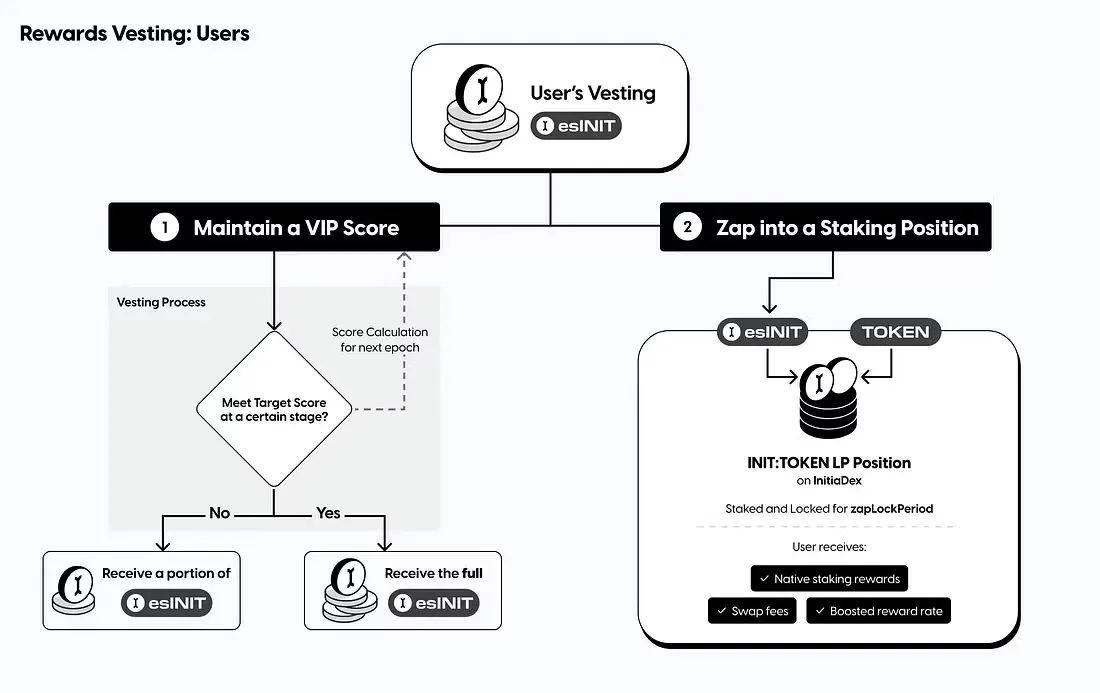

3) Unlocking

Source: Introducing VIP

As noted, $esINIT is granted as a non-transferable escrowed token based on VIP scores. Users must unlock it to realize value. During unlocking, users can choose two paths to maximize returns. First, maintain their VIP score over multiple cycles to unlock $esINIT into tradable $INIT. Maintaining scores helps users accumulate more, improving retention for Minitias. Second, deposit $esINIT as a liquidity pair into Enshrined Liquidity to earn staking rewards.

4.2.3 The Direction of Initia’s VIP-Based Tokenomics

In sum, VIP is Initia’s tokenomic strategy to economically link L1 and L2 and create sustained demand for $INIT. In 1) Allocation, mechanisms like the dual-pool system broaden $INIT’s utility and encourage governance participation to energize the ecosystem. In 2) Distribution, allowing Minitias to use VIP scores to guide user behavior aligns Minitia and user incentives. Finally, 3) Unlocking promotes user retention or direct contributions to the Initia ecosystem via liquidity provision.

Through this process, Initia aims to prevent economic fragmentation of the Minitia ecosystem while generating multiple use cases for $INIT, stimulating fundamental token demand. As modular blockchain infrastructure spreads, economic fragmentation poses a long-term challenge—balancing modularity’s advantages against its drawbacks. In this context, Initia’s VIP offers a meaningful blueprint for tokenomic design in future modular ecosystems.

4.3 Value Capture: Injective and the Burn Auction

Unlike Berachain and Initia, which haven’t launched mainnets, Injective has been active since 2018. Yet through updates like INJ 3.0 and Altaris, it has refined its tokenomics to build a unique deflationary model centered on burning. Thus, when discussing value capture in L1 tokenomics, Injective stands out as a noteworthy case.

4.3.1 Injective Overview

Injective is a Cosmos SDK- and TendermintBFT-based L1 blockchain with a custom consensus mechanism, optimized for financial applications ranging from spot trading to perpetual futures and RWA. As a finance-focused L1, it delivers a high-performance environment exceeding 25,000 TPS to support HFT, and employs on-chain order matching models like FBA (Frequent Batch Auctions) to mitigate MEV in capital-efficient trading. Additionally, Injective provides plug-and-play modules as development resources. Notably, its trading module simplifies order book management, execution, and matching, enabling developers to build financial services instantly using Injective’s shared liquidity—no need to bootstrap liquidity separately.

4.3.2 Injective Tokenomics

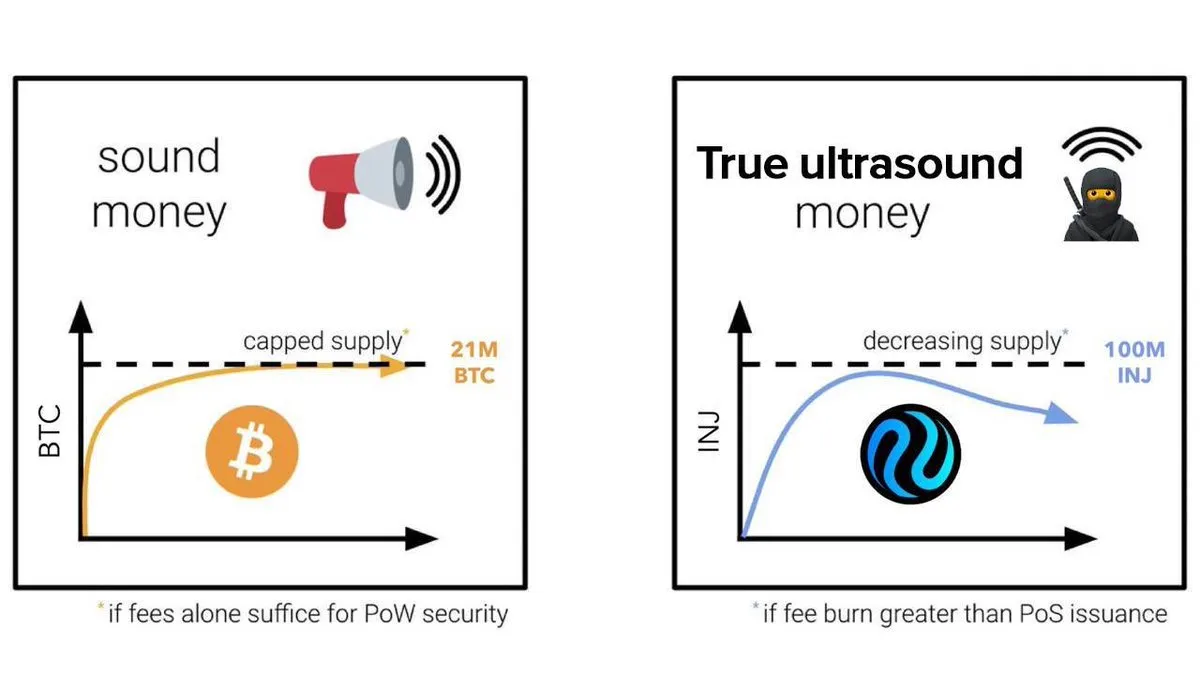

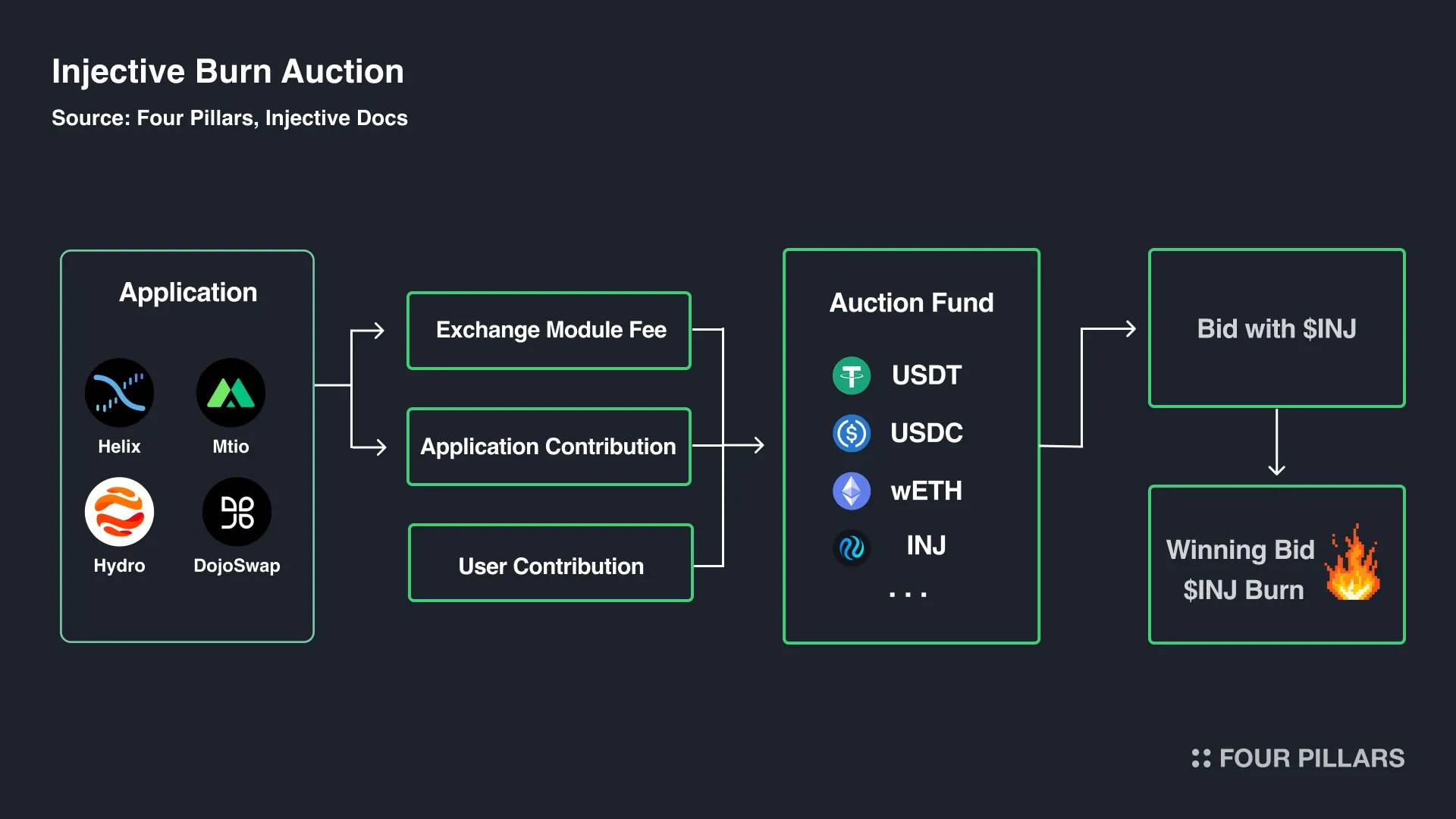

Source: X(@Injective)

Injective is known for its deflationary token model powered by burn auctions, which reduce circulating $INJ supply. The burn auction works as follows: when assets accumulate in the auction fund—via partial revenues from Injective apps or direct contributions from users—they are auctioned off, with bidders using $INJ. After the auction, the winning bidder exchanges their $INJ for tokens in the fund, while the bid $INJ is burned, reducing total supply. Injective conducts these auctions weekly—by October 2024, 6,231,217 $INJ (~$142M) had been burned.

The auction process runs via an auction module handling bidding, winner selection, and $INJ burning, working alongside the trading module. Auction fund assets are collected through three channels: first, apps using the trading module route part of their revenue to the fund; second, apps not using the module can contribute fixed amounts or percentages; third, individual users can directly donate.

Auction fund assets accumulate mainly as USDT, USDC, or $INJ. Anyone can bid using $INJ. Bidders can win slightly discounted assets—e.g., using $95 worth of $INJ to win $100 in fund assets—naturally sparking competitive bidding. Ultimately, the winner exchanges their $INJ for fund tokens, and the bid $INJ is burned.

4.3.3 The Direction of Injective’s Burn Auction Tokenomics

Injective’s burn auction uses fees generated by the trading module to fund auctions, creating a mechanism where higher trading volume leads to greater $INJ burns. Thus, as Injective’s trading activity grows, circulating supply shrinks, enabling the token to capture network value. Injective tightly couples ecosystem growth with tokenomic value appreciation and plans to further strengthen this growth-driven burn mechanism.

While most blockchains have mechanisms to burn a portion of network fees, few L1s adjust supply as visibly as Injective. Given that most blockchains (except Bitcoin and Ethereum mainnet) are built on low-gas-fee assumptions, fee-based burn mechanisms face limitations in large-scale supply reduction. Injective also aims for near-zero fees, averaging $0.0003 per transaction. In this context, the burn auction’s ability to conduct massive burns while maintaining ultra-low fees aligns with the user experience sought by future L1s—making Injective a highly compelling case study.

5. Looking Ahead: Why We Should Care About Next-Gen Layer 1 Tokenomics

5.1 Shifting Perspectives: What Defines an Ideal Layer 1?

So far, we’ve analyzed limitations of existing tokenomics and reviewed improvements, identifying potential directions for next-gen models. Notably, Berachain, Initia, and Injective share a trend: they enhance tokenomics through unique network-level mechanisms. Each leverages strengths in mechanism design, architectural alignment, or value capture to build distinctive tokenomic frameworks.

What then defines ideal L1 tokenomics? Is there a universal framework to power the token flywheel? To answer, we treat tokenomics as a holistic system encompassing not just the token, but the L1’s mission, technical architecture, and participant behavior patterns. This reveals a key insight: tokenomics is merely a concept. Its value emerges from real interactions among the L1 network and its participants.

Thus, we must shift from asking “what is ideal tokenomics?” to “what makes an ideal L1, and what role does tokenomics play?” From this view, a high-potential L1 is one where mission, architecture, protocols, and tokenomics integrate synergistically.

-

Clear mission

-

Technical architecture designed to faithfully fulfill that mission

-

An ecosystem of protocols and apps optimized for the network’s environment or architecture—so-called “only-on-[this-chain]” use cases

-

Delivering differentiated value to users

Tokenomics—though not listed—is the lubricant enabling smooth operation of architecture and protocols. Applying this framework to today’s discussed L1s yields the following insights:

5.2 Overview of Berachain, Initia, and Injective

Berachain developed PoL, a unique consensus algorithm for an EVM-compatible L1 that turns liquidity into security, along with Polaris, an EVM-compatible framework. On this foundation, projects like Infrared—which clears non-tradable $BGT—Smilee Finance, which hedges impermanent loss to reduce PoL liquidity risks, and Yeet Bonds, which lets protocols raise liquidity independently via bond sales (protocol-owned liquidity)—minimize resource needs for liquidity bootstrapping (e.g., liquidity mining, bribes) and enable autonomous voting for $BGT issuance. When combined with Berachain’s PoL goals, triple-token model ($BERA, $BGT, $HONEY), and supporting infrastructure, we can expect a unique ecosystem where validators, protocols, and users co-develop and grow together.

Initia is an L1 designed for “interwoven rollups,” tackling fragmentation in modular blockchains. It builds multiple architectural components to strengthen Initia-Minitia links: Opinit Stack (a framework for building Minitias on Initia), Enshrined Liquidity for securing Minitia liquidity, and OSS (Omnitia Shared Security), a shared fraud-proof framework. On this foundation, modular-infrastructure-focused Minitias are emerging—like Tucana, an intent-driven DEX aggregating modular network liquidity, and Milkyway, offering restaking services on Initia. Here, VIP tokenomics could create a virtuous economic cycle: Minitias accumulate value in Initia, while Initia boosts Minitia activity.

Injective’s tech stack is perfectly tailored for financial applications, embodying its “blockchain built for finance” ethos. It offers a high-performance environment for HFT and plug-and-play modules—like Exchange Module (shared order book and liquidity), Auction, Oracle, Insurance, and RWA modules—for financial app development. Numerous financial products leverage these modules. For example, the on-chain order book exchange Helix uses Exchange Module to deliver CEX-like trading, while tokenizing Blackrock’s BUIDL fund index via Injective’s RWA oracle exemplifies the “only-on-Injective” principle. Against this backdrop, Injective’s tokenomics—via burn auctions—links ecosystem growth with token value appreciation, fostering more innovative applications.

The above analysis shows these projects possess the conditions for synergistic evolution across L1 and tokenomic components. Of course, since Berachain and Initia haven’t launched, long-term monitoring of ecosystem interactions is essential. Both chains feature complex tokenomics, requiring careful evaluation from multiple angles to reduce user learning barriers and ensure real-world execution matches expectations.

Meanwhile, Injective’s tokenomics critically depend on application ecosystem activation. Currently, Injective averages 2–3 million daily trades, with cumulative volume reaching $39.2B, showing high activity and steady $INJ burn rates. Going forward, driving active usage of financial products—especially those leveraging Injective’s unique capabilities, like the BUIDL index or 2024ELECTION perpetual market—will remain vital to sustaining its unique deflationary model.

5.3 Fundamentals First: The Importance of Tokenomics

Has the crypto industry moved beyond being just a “narrative game” devoid of substance? Recent market trends suggest yes. With RWA markets reaching $12B, driven by institutions like BlackRock and Franklin Templeton, traditional finance participation is accelerating. Market participants are shifting focus from short-term narratives to fundamentals—such as Uniswap and Aave’s profitability and revenue distribution.

As fundamentals gain importance, tokenomics clearly emerges as a core criterion for evaluating L1 fundamentals. As discussed, we can assess tokenomics by asking: does network activity drive token demand? Do ecosystem participants actively engage around the token? Do these interactions fuel network growth? Moreover, tokenomics must not just exist conceptually but deliver tangible utility through synergy with network components—becoming a key framework for judging L1s’ intrinsic value.

In this context, our focus on Berachain, Initia, and Injective lies in their attempts to transcend existing models by directly embedding tokenomics into the network fabric. Injective’s def

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News