Rumors suggest payments giant Stripe is entering the L1 space—what new applications are worth watching?

TechFlow Selected TechFlow Selected

Rumors suggest payments giant Stripe is entering the L1 space—what new applications are worth watching?

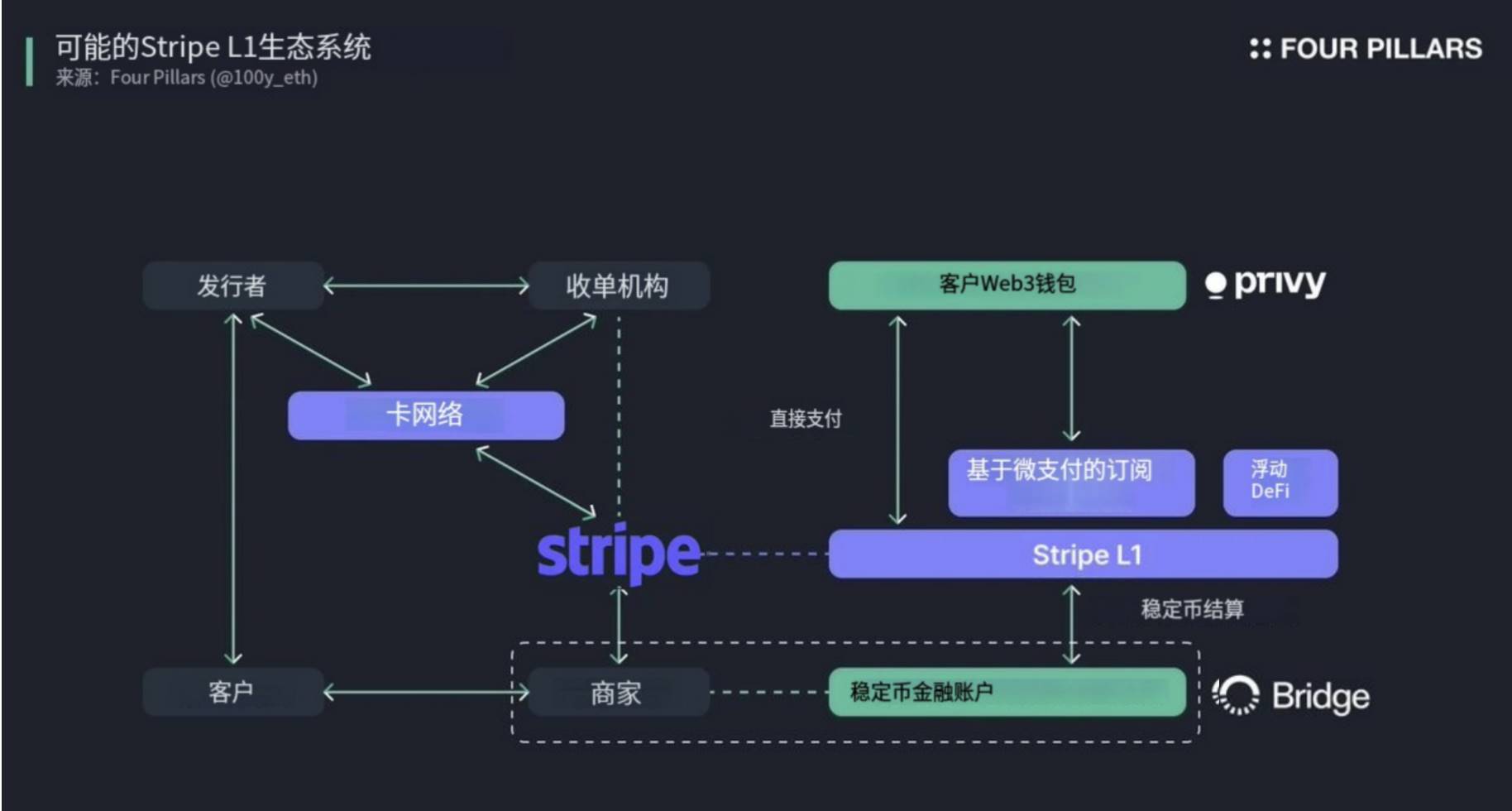

Stripe has always played the role of a payment gateway or acquiring institution, but the introduction of Stripe L1 could enable it to simultaneously assume the functions of a card network and issuing bank.

Author: 100y.eth

Translation: TechFlow

Key Takeaways:

-

Rumors are circulating in the crypto community that Stripe might be preparing to launch its own Layer 1 blockchain (L1). Combined with its recent acquisitions of Bridge and Privy, launching a proprietary blockchain could be a logical next step.

-

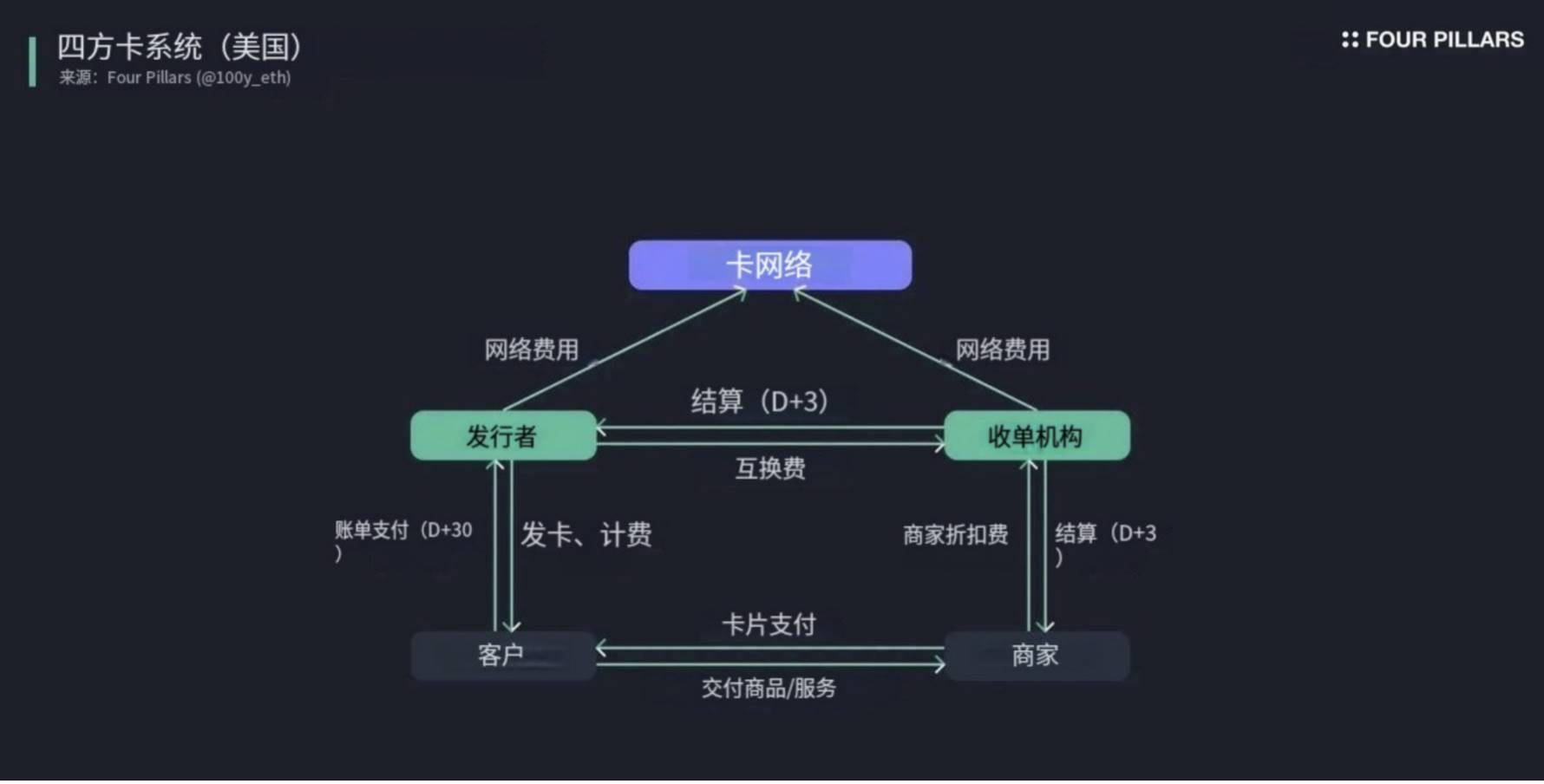

As a leading global payment service provider (PSP), Stripe technically connects merchants, acquirers, card networks, and issuing banks to ensure smooth and secure transactions.

-

If Stripe does launch an L1, in a base scenario it would likely support stablecoin payments and integrate Stripe L1 for customer payments and merchant settlements; in a bullish scenario, it could revolutionize the payment system through features such as:

-

Enabling direct payments bypassing issuing banks and card networks;

-

Supporting micropayment streaming subscriptions not feasible in traditional systems;

-

Earning yield on short-term deposit balances held on Stripe L1.

-

-

Stripe currently operates primarily as a payment gateway and acquirer. But launching a Stripe L1 could allow it to assume roles traditionally held by issuing banks and card networks—marking a historic milestone in the payments industry.

Will Stripe Really Launch Its Own Blockchain Network?

Recently, rumors have spread across the crypto community that global payments infrastructure company @Stripe may be gearing up to launch a Layer 1 blockchain. Another rumor ties into Paradigm’s recent confidential hiring efforts, which some speculate could be related to Stripe’s potential L1 project.

While no one outside internal circles knows for sure whether Stripe will launch an L1, the speculation has quickly gained traction—especially given surging interest from traditional U.S. financial players in blockchain and stablecoins, increasing blockchain integrations by card network companies like Visa and Mastercard, and Robinhood’s announcement of plans to tokenize stocks via Arbitrum.

Stripe’s mission is to “increase the GDP of the internet.” The company focuses on building economic infrastructure for the internet, helping businesses—from startups to large enterprises—manage payments, operations, and growth online. From this perspective, blockchain technology is highly aligned with Stripe’s vision.

In fact, Stripe has been actively expanding its blockchain-related initiatives in recent years. In February 2025, Stripe acquired Bridge (@Stablecoin), a stablecoin infrastructure firm, for approximately $1.1 billion, strategically strengthening its position in stablecoin-based financial infrastructure. Building on this, at its May 2025 Stripe Sessions event, Stripe launched its Stablecoin Financial Accounts service.

Stripe’s Stablecoin Financial Accounts are now available in 101 countries and offer businesses the following capabilities:

-

Holding USDC issued by Circle and USDB issued by Bridge;

-

Funding and withdrawing stablecoins using USD transfers via ACH/wire or EUR via SEPA;

-

Depositing and withdrawing USDC across multiple blockchains including Arbitrum, Avalanche C-Chain, Base, Ethereum, Optimism, Polygon, Solana, and Stellar.

This means businesses in 101 countries can now easily access USD-backed stablecoins through Stripe and seamlessly integrate them with traditional banking systems for convenient deposits, withdrawals, and payments.

Additionally, in June 2025, Stripe acquired Web3 wallet infrastructure startup @privy_io. The company offers key services such as wallet creation via email or single sign-on (SSO), transaction signing, key management, and gas abstraction.

Given these strategic moves, the rumors about Stripe launching a Layer 1 blockchain don’t seem far-fetched. Stripe now possesses both stablecoin and wallet infrastructure—launching a blockchain network that synergizes with these assets could be the natural evolution of its blockchain strategy.

What Could Be Possible If Stripe Launches a Layer 1 (L1)?

Of course, there is currently no concrete evidence that Stripe will launch an L1—this remains speculative. However, we can explore what new possibilities might emerge if Stripe did launch its own L1: how it might be used, and what services could be enabled that aren’t possible in traditional payment systems. The ideas below are purely hypothetical and meant to spark imagination—think of them as food for thought on “how blockchain could transform payment services.”

2.1 Stripe’s Role as a Payment Service Provider (PSP)

To understand where blockchain could bring improvements, we must first examine the services Stripe provides. As one of the world’s most prominent payment service providers (PSPs), Stripe acts as a technical bridge between merchants, acquirers, card networks, and issuing banks, ensuring secure and seamless payment flows. Specifically, Stripe performs the following functions:

-

Payment Gateway: When customers pay online or offline using cards, Stripe securely collects card information, encrypts it, and transmits it to card networks and issuing banks.

-

Multi-Payment Support: Integrates various payment methods including credit cards, digital wallets, bank transfers, and local payment options to enhance convenience for customers and merchants.

-

Fraud Detection & Security: Employs machine learning-based fraud detection and PCI-DSS compliant security measures to prevent fraudulent transactions.

-

Multi-Currency & International Payments: Offers automatic currency conversion and supports multi-currency transactions, enabling cross-border commerce.

-

Reporting & Analytics: Provides merchants with detailed transaction histories, success rates, and customer behavior insights to optimize operations.

-

Technical Integration & Operational Support: Enables easy integration via APIs and SDKs while handling customer support, regulatory compliance, refunds, and billing management.

-

Enhanced Customer Experience: Delivers fast, frictionless checkout experiences and supports use cases like subscription billing, installment payments, and refunds.

-

Merchant Settlement Intermediary: Works with acquirers or acts as one itself to settle funds collected from issuing banks to merchants.

Without PSPs, merchants would need to individually support various payment methods and negotiate complex contracts directly with acquirers. This would significantly increase technical and operational burdens and degrade the payment experience for both merchants and customers.

2.2 What Changes Could a Stripe L1 Bring?

If Stripe were to launch a Layer 1 blockchain, how might it improve existing services and unlock new functionalities? Here are some possibilities:

2.2.1 Base Case Scenario

Integration of Merchant Stablecoin Financial Accounts with Stripe L1

Currently, Stripe offers stablecoin financial accounts to merchants in 101 countries, allowing them to hold USDC and USDB and fund/withdraw via traditional banking rails (e.g., ACH, SEPA) and multiple blockchain networks.

If Stripe L1 launches, the stablecoin financial account service would likely support deposits and withdrawals via Stripe L1. Merchants could also leverage their stablecoin balances on Stripe L1 for various financial activities.

Stablecoin Settlement Options for Merchants

As a PSP, Stripe typically partners with or acts as an acquirer to settle merchant revenues. With Stripe L1, merchants might choose to receive settlements in USD-pegged stablecoins—a major advantage for those in regions with high dollar demand but limited access.

Customer Wallet Services

Stripe’s acquisition of Privy, a wallet infrastructure provider, enables easy wallet creation and usage. While Stripe currently serves businesses rather than individual users, leveraging Privy’s tech on Stripe L1 could allow individuals to easily create Web3 wallets, make stablecoin payments, and participate in financial activities within the Stripe L1 ecosystem.

Stablecoin Payment Options for Customers

Currently, when customers pay online via Stripe, they’re limited to traditional methods like cards and bank accounts. If Stripe L1 launches, users might connect Web3 wallets (provided by Stripe or third parties) and select stablecoins as a payment method.

2.2.2 Bull Case Scenario

Direct Customer-to-Merchant Payments

Traditional payment systems like credit cards rely on legacy financial networks such as card schemes and banks. If Stripe L1 allows customers to pay merchants directly using stablecoins, it could eliminate the need for issuing banks and card networks—dramatically speeding up settlement and reducing fees. Of course, given the irreversible nature of blockchain transactions, appropriate safeguards would be needed to ensure security around chargebacks and refunds.

Micropayment-Based Subscription Services

Blockchain enables micropayments and streaming subscriptions impossible in traditional systems. Most Stripe subscriptions today follow monthly or annual billing cycles. With Stripe L1, however, per-minute or real-time usage-based subscriptions could become feasible. Users would pay precisely for what they consume, with all payments automatically executed via smart contracts. This new model could unlock innovative business models built atop the system.

DeFi Use of Short-Term Deposits

One reason for settlement delays in traditional systems is to allow time for handling fraud, cancellations, or refunds. Even if Stripe L1 supports direct stablecoin payments from customers to merchants, funds might still be temporarily held before release to merchants.

These short-term deposits could accumulate into a massive liquidity pool on Stripe L1. For example, they could be supplied as liquidity to DeFi protocols, deployed in lending markets, or invested in low-risk bonds to earn yield—greatly improving capital efficiency.

Final Thoughts

After extensive research into stablecoins and observing industry trends, the rumors around Stripe L1 are genuinely intriguing. To date, companies like Visa, Mastercard, and PayPal have treated blockchain and stablecoins as supplementary features. If Stripe actually launches its own Layer 1 blockchain, it could mark a historic turning point in the payments landscape—signaling the beginning of a paradigm shift.

Stripe has long operated as a payment gateway or acquirer. But with Stripe L1, it could take on the roles of card network and issuing bank as well. Leveraging blockchain, it could dramatically improve payment efficiency and enable previously impossible innovations—such as micro-streaming subscriptions and automated management of short-term deposits.

We are entering an era of blockchain-driven innovation in payments. Whether Stripe will follow through on these rumors and launch an L1 remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News