What innovative gameplay can emerge in the semi-fungible token (SFT) asset track?

TechFlow Selected TechFlow Selected

What innovative gameplay can emerge in the semi-fungible token (SFT) asset track?

Won't you pay attention to the SFT sector in this bull market?

Author: Bobo Bobo

After the explosive popularity of Move smart inscriptions, is the Semi-Fungible Token (SFT) asset sector poised for a bull market breakout? What innovative applications can SFT-type assets enable?

How can SFT unlock new innovation across various sectors? Why must you pay attention to the SFT sector in this bull cycle?

Let’s dive into what exactly SFT is and explore the potential opportunities within the SFT asset space amid the Move inscription craze.

Following my previous theoretical demonstration of "10,000x returns" using Move smart inscription SFTs, the MoveScriptions team quickly launched its official marketplace.

The project chose to sort listings by unit price based on “amount” rather than the inscription itself—an approach ideally suited for SFT trading, avoiding the awkwardness inherent in NFT transaction logic.

Meanwhile, many people have been asking: What exactly is an SFT?

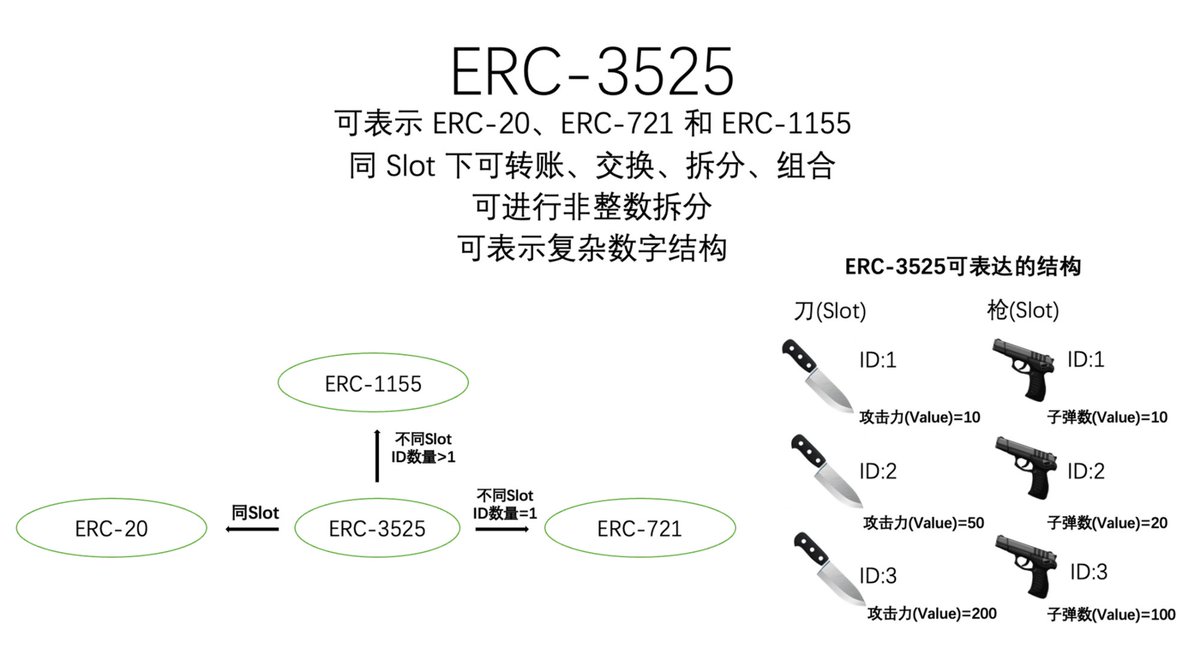

SFT (Semi-Fungible Token), originated from Ethereum's ERC-3525 standard, was officially adopted as a new Ethereum token standard in September 2022. It immediately drew significant attention—not only because it represents foundational-level innovation but also because it was led by Solv Protocol, a Chinese team.

However, since it emerged during a bear market, its vast potential has remained largely underexplored—making it a highly promising area!

Simply put, think of SFT as a hybrid between NFTs and FTs—a kind of supercharged NFT that supports splitting and merging, yet offers greater composability and innovation potential than either NFTs or FTs. It also possesses unique features such as “container” properties and cash flow programmability.

For deeper technical insights, check out my earlier articles. In short, SFT enables complex asset structures, making it especially suitable for finance and gaming applications.

The container capability of SFT is vividly demonstrated in Move inscriptions: each inscription mints and locks an equivalent amount of SUI as minting fees. This locked value can be reclaimed at any time by burning the inscription, effectively allowing early participants to recoup their costs. Burning also creates deflationary pressure.

This mechanism ensures that first-tier participants almost never lose money—only negligible gas fees are incurred, while still offering access to potentially high returns. The non-zero-risk nature of participation motivates broad user engagement.

Seeing @jolestar's Move inscription protocol built on SFT architecture gain such massive traction made me incredibly excited. I’ve since published two threads highlighting the technical advantages of SFT. Of course, I’m not encouraging anyone to speculate on Move inscriptions—this is not investment advice. Do your own research (DYOR).

Using this moment, let’s discuss: What other innovative use cases could SFT unlock? Are there new narratives emerging? And what’s the current state of the SFT ecosystem?

First, a brief overview of the current SFT ecosystem: In real-world applications, our official initiatives include three central bank collaborations utilizing ERC-3525, with plans to continue advancing Web3 technology adoption in practical scenarios alongside these authoritative institutions.

In the crypto space, Solv—the DeFi player pioneering on-chain fund products via SFT—has become the leader in decentralized asset management, surpassing $100 million in issued assets.

In GameFi, several projects have leveraged ERC-3525 for novel designs—such as integrating AI so NPCs can interact with players’ assets, or enabling cross-game point sharing through SFT’s composability.

In DePIN and SocialFi, multiple teams are leveraging ERC-3525 to enhance competitiveness. Moreover, combining SFT with modern cryptography has sparked some fascinating synergies.

Of course, the possibilities go far beyond this. Here are a few speculative SFT applications I’d like to propose:

1. Fully Automated Dividend Protocols

One of SFT’s most powerful features is cash flow programmability—in simple terms, managing monetary flows entirely within a smart contract. For example, a project could sell future revenue streams upfront to raise capital, allowing users to share risks and rewards with the team.

This model already exists in traditional Chinese finance—like “Ditongguan,” which securitizes future cash flows of SMEs. But on-chain execution offers clear advantages: everything runs automatically via smart contracts.

By linking a dividend contract with the main project contract—or manually funding it—the SFT contract can autonomously distribute payouts to all holders based on ownership share, regardless of how those shares circulate.

Such forward-looking financing models may shine brightly in this bull market—perhaps even inspiring wild experiments, like someone issuing an SFT to crowdfund futures trading profits and sharing gains with investors.

2. Web3 Fan / Creator Economy

The success of FriendTech has drawn renewed interest in SocialFi innovations—and SFT offers a more flexible asset framework.

Tokenizing fan relationships has long been a core goal of SocialFi. While NFTs and FTs are technically viable, implementing certain functions increases complexity significantly.

For instance, every creator or room currently needs a separate NFT contract to distribute tokens to fans. Coordinating joint campaigns or shared rewards across creators becomes technically cumbersome.

Since SFT can represent both NFT-like and FT-like assets, and allows multiple types of “NFTs” under one contract—with optional interoperability between types—it offers tremendous design flexibility. This eliminates redundant contract deployments and makes it easier to implement an “Open Loyalty” model, where different organizations can share loyalty programs and co-create value.

Combined with automatic dividend distribution, SFTs can dynamically allocate benefits based on fans’ contribution levels—an enormous advantage.

3. A New DAO Governance Paradigm

Pure speculation here: Much conflict in current DAO governance stems from flawed incentive and reward distribution mechanisms. Could the fair launch and auto-dividend mechanics of inscriptions give rise to an entirely new governance model?

For example, launching a DAO via smart inscription crowdfunding, where early contributors receive proportional rewards based on capital input, while future contributors are incentivized through dynamic mechanisms. This idea is just food for thought—open for discussion.

4. Nested Asset Composability

Thanks to its “container” property, SFT theoretically supports multi-layered nesting—like Russian dolls, infinitely embeddable.

Imagine an SFT containing ETH, or an SFT holding another SFT—or an SFT inside an SFT inside an SFT? Or an SFT that requires burning another SFT to unlock its contents? The possibilities are vast—left to your imagination.

In summary, there’s a widespread belief that this bull market lacks innovation and compelling narratives. But the potential of SFT goes far beyond what we've seen. Isn’t it time you started paying attention to the SFT sector?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News