2023 will be the breakout year for the SFT ecosystem—here's a quick overview of SFT ecosystem projects and their development potential

TechFlow Selected TechFlow Selected

2023 will be the breakout year for the SFT ecosystem—here's a quick overview of SFT ecosystem projects and their development potential

In September 2022, the Ethereum community approved the EIP-3525 proposal, listing it as an ERC standard.

Author: SFT Labs

In September 2022, the Ethereum community approved EIP-3525 and adopted it as an ERC standard.

The semi-fungible tokens (SFTs) defined by ERC-3525 combine the advantages of both fungible tokens and NFTs, offering rich functionality, strong self-descriptive capabilities, visualizability, and programmability. Together with the previously released ERC-1155, ERC-3525 has established SFTs as a promising new category of digital assets, attracting growing attention from Web3 users and investors, while rapidly drawing developers and entrepreneurs to explore its potential.

Now, nearly half a year later, how have SFT applications evolved across various fields? Have these applications addressed real-world problems and created tangible value? Has the potential of SFTs been preliminarily validated? Could ERC-3525 become a mainstream asset standard on par with ERC-20 and ERC-721? This article introduces nine representative projects within the SFT ecosystem to offer insights into the latest developments across different sectors and provide reference points for innovators in the Web3 space.

Top SFT Applications to Watch in 2023

SFT Token Standard Comparison: ERC-1155, ERC-3525, and ERC-3475

Top SFT Applications to Watch in 2023

Use Cases Based on ERC-3525

1. Web3 Gift Cards: CodeFox

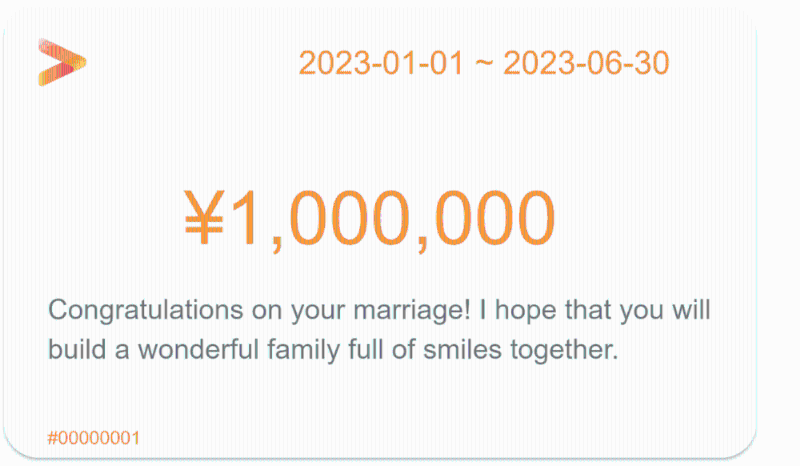

In the familiar Web2 world, brands issue membership cards, game currencies, or point systems to price and manage entitlements—such as Amazon gift cards or Starbucks cards. Yet such commonplace features remain underdeveloped in Web3. CodeFox is developing prepaid SFTs based on ERC-3525 that can store arbitrary token amounts for use in various scenarios. Similar to traditional gift cards, these prepaid SFTs embed images, expiration dates (including start and end), and any additional text messages within their metadata. "Since neither ERC-20 nor NFTs can express or manage membership card expiry dates, we chose SFT technology and developed our product based on ERC-3525," noted CodeFox's founder. "Regulatory policies toward ERC-20 tokens in Japan will continue to inspire innovation based on SFTs."

Figure: Gift cards issued by CodeFox

2. RWA Tokenization: InVar Finance

InVar Finance, a protocol focused on tokenizing real-world assets (RWA), leverages SFTs to bridge traditional finance and Web3, launching on-chain use cases for RWAs. The InVar Finance team stated that ERC-3525 SFTs meet many critical requirements for bringing RWAs on-chain, including visualizability, asset storage, value transfer, and efficient attribution of assets or identities—leading them to adopt SFTs as the tool for RWA tokenization and NFT financialization. Kenji, co-founder of InVar Finance, said: "Highly flexible and interoperable SFTs will be key infrastructure for the next stage of NFT development."

Figure: InVar Finance Product

InVar Finance’s public demo is now live; interested users can try it out here.

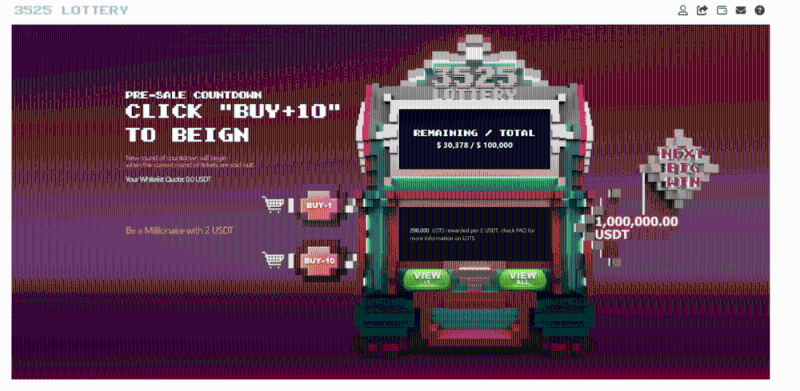

3. Gambling Games: 3525 Lottery

3525 Lottery is the first blockchain lottery application built on ERC-3525, aiming to address issues like potential fraud caused by centralized management in traditional lotteries, enhance game transparency, and return governance rights to users. They mint protocol shares as SFTs and distribute them 100% to users. Users can become protocol shareholders by purchasing lottery tickets and later withdraw funds corresponding to their share value by burning SFTs—or simply transfer their SFTs to exit the game.

4. Carbon Credit Market: Carbonable.io

Carbonable is a carbon-offset NFT project connecting blockchain, DeFi, and environmental efforts. It allows DeFi investors to fund decarbonization projects worldwide by purchasing project-related NFTs and earn returns through holding those NFTs.

When decarbonization projects receive funding, investors receive a certain amount of “carbon credits.” Each carbon credit represents the removal of one metric ton of greenhouse gases. By holding NFTs, investors continuously earn returns from the decarbonization projects (paid in stablecoins) and Carbonable’s utility token $CARBZ.

The Carbonable team believes that ERC-3525 tokens—with their high descriptive power and divisibility—are ideal for creating carbon credit certificates. Their recent Cairo implementation announces the deployment of ERC-3525 SFTs on StarkNet, laying the foundation for using SFTs to drive the next generation of carbon credit markets.

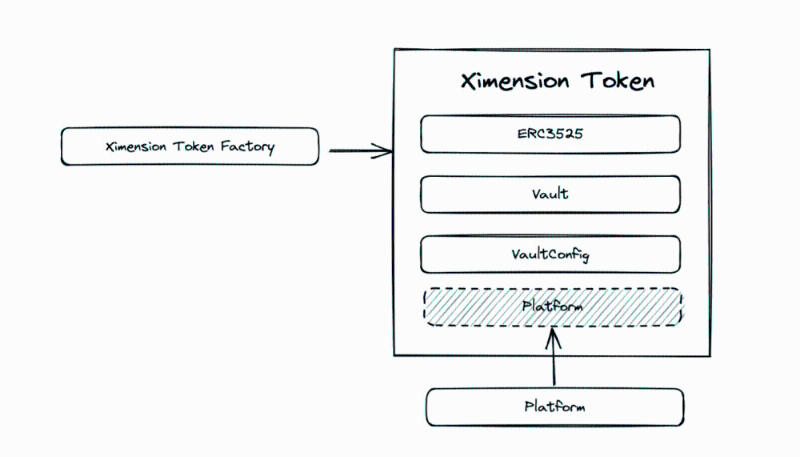

5. Future Cash Flow Certificates: Ximension

Royalties are a major incentive for artists to issue NFTs, allowing them to earn a share of profits when their artwork is resold on the blockchain. In other words, artists hold two types of assets: the NFT artwork itself and the royalty rights associated with it. However, existing crypto applications only support the transfer of NFTs, not the trading of royalty rights, resulting in significant liquidity opportunity costs—for example, being unable to use royalty rights as loan collateral.

Ximension uses ERC-3525 to create so-called future cash flow certificates, representing rights to future income streams such as NFT royalties. Ximension co-founder Naoer pointed out that the team will build more foundational products using ERC-3525 to help both traditional and blockchain companies manage equity stakes and facilitate entirely new ways of trading NFT collectibles and derivatives.

To learn more about Ximension’s future cash flow certificates, see the Ethereum Magicians proposal.

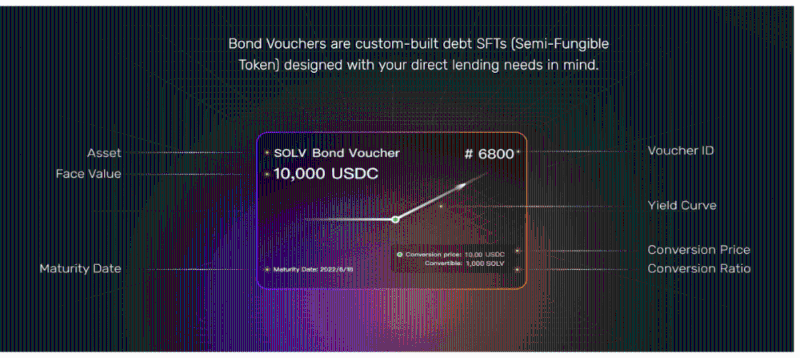

6. SFT Minting, Issuance, and Trading Infrastructure: Solv Protocol

Founded in Singapore in 2020, Solv Protocol aims to build infrastructure for SFT asset creation, issuance, and trading. As the original team behind ERC-3525 and the proposers of the “SFT” concept, Solv is a rare team in the crypto industry in recent years that combines both technical and product innovation—and has secured investments from top-tier backers including Binance Labs, Blockchain Capital, and Sfermion.

Solv Protocol is an infrastructure protocol centered around ERC-3525, aiming to provide a full suite of development and runtime frameworks for quickly building SFT applications. Beyond offering a standard implementation of ERC-3525, it provides plug-and-play capabilities such as digital asset containers, smart contract visualization, business logic for common financial products (bonds, equity shares, vesting schedules, funds, etc.), and SFT data services—significantly lowering the barrier for ERC-3525-based application development and enabling any team to easily build their own SFT applications.

Solv’s first application is an all-in-one fund issuance, management, and trading platform. It enables institutions or individuals with professional investment expertise to define and issue fund shares, offering a wide range of diversified asset management options—including fixed-income, secondary market investments, primary investments, and money markets—to the broader crypto investor community. SFTs are naturally ideal carriers for advanced financial assets like bonds and funds. Even during the bear market of 2022, Solv successfully raised $88 million for over 60 blockchain projects.

Figure: Solv Bond SFT

Use Cases Based on ERC-1155

1. Gaming Infrastructure: Enjin

Enjin is a platform for game developers, making it easier to build on-chain games and manage, transfer, and trade in-game assets. The Enjin team pioneered the ERC-1155 token standard and provides infrastructure for ERC-1155 SFTs, allowing developers to create unlimited numbers of FTs, NFTs, or SFTs via a single smart contract, thereby reducing gas and transaction costs.

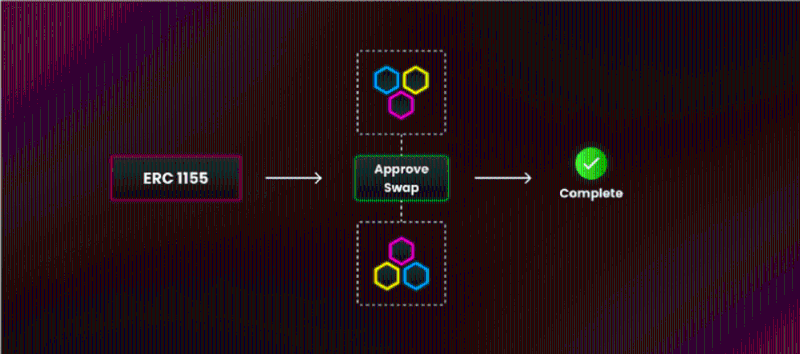

2. DeFi Aggregator: Fuji DAO

Fuji DAO is a lending aggregator that integrates with decentralized lending protocols such as Compound and AAVE to offer competitive borrowing and lending rates. To map lending positions efficiently, Fuji DAO initially experimented with AAVE debt tokens (ERC-20) on testnets. However, this approach introduced challenges such as high gas fees and excessive contract deployments. Therefore, they adopted ERC-1155, leveraging its batch transfer capability to reduce gas costs and minimize the number of required smart contracts.

3. Yield Farming: Alpha Homora V2

Alpha Homora is a protocol enabling users to perform high-leverage yield farming. It adopts ERC-1155 primarily to avoid high gas fees and the burden of deploying numerous contracts. On Homora V2, farm rewards depend on staked amount and duration. Due to varying leverage levels, users who initially stake equal LP shares may ultimately receive unequal rewards—resulting in differentiated LP attributes. Using ERC-1155, users with the same staking period can be tagged with different leverage attributes, simplifying the reward distribution process.

Why SFT?

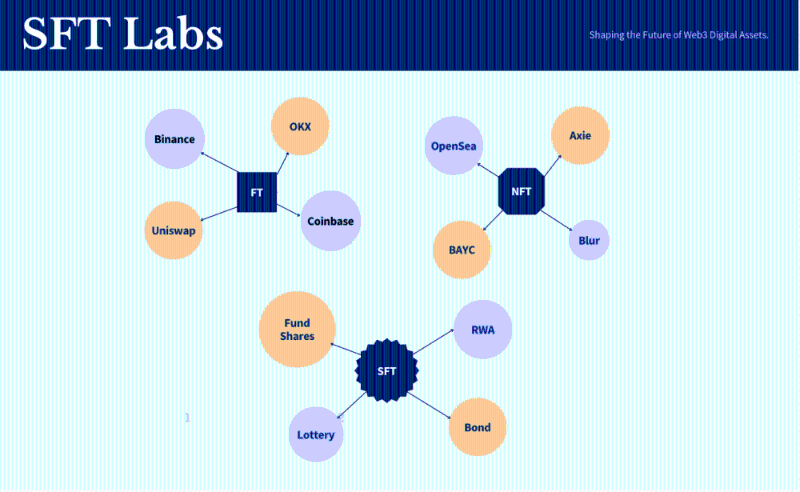

So far, the blockchain world has seen waves of enthusiasm around FTs and NFTs, each triggering explosive growth in new infrastructure and applications: The emergence of FTs fueled the rise of centralized exchanges like Binance, OKX, and Coinbase, and sparked the explosion of decentralized exchanges like Uniswap and Sushiswap, leading to the DeFi Summer boom. The arrival of NFTs created highly consensus-driven, unique PFP assets like BAYC, Azuki, and Punk. Opensea began building its platform as early as 2017 and once dominated 85% of the NFT trading market, reaching a valuation of billions of dollars. Axie Infinity ignited the gaming NFT wave, and various NFTfi platforms emerged rapidly.

The emergence of FTs and NFTs, along with the infrastructure, applications, and assets built around them, undoubtedly served as engines for the previous bull market. The vast potential of SFTs is equally worth anticipating.

FT, or Fungible Token, refers to interchangeable units—by definition, any two FTs are identical and mutually substitutable. FTs represent the most basic and simple form of digital assets in the blockchain world. Most widely circulated FTs today are based on ERC-20, such as BTC and ETH.

-

Characteristics of FTs: Regardless of their features or structure, each token holds equal value.

-

Use Cases for FTs: Currency, common stock, loyalty points, etc.

NFT, or Non-Fungible Token, is in many ways the antithesis of FTs. While every unit of an FT is identical and interchangeable, each NFT is unique and non-substitutable. With rich metadata and a unique ID, NFTs perfectly meet the demand for personalized expression among artists and younger generations. NFTs based on ERC-721 exploded in popularity in 2021.

-

Characteristics of NFTs: Each NFT is unique and visually represents its distinct features or structure.

-

Use Cases for NFTs: Collectibles, in-game items, etc.

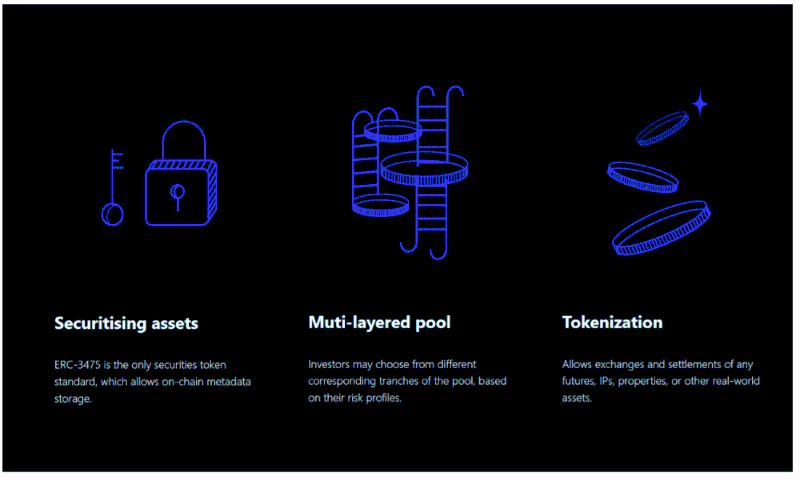

SFT, or Semi-Fungible Token, is a new type of crypto asset combining the quantifiability of FTs with the descriptive richness of NFTs. Currently, the main SFT standards in the market include ERC-1155, ERC-3525, and ERC-3475.

-

Characteristics of SFTs: Semi-fungibility—tokens with different IDs can either be fungible (allowing quantity operations) or non-fungible (distinguishable from one another).

-

Use Cases for SFTs: Financial assets like bonds and fund shares, RWAs, loyalty cards, lottery tickets, etc.

As a new token type, SFTs expand the functional boundaries of asset standards, enhancing product performance. Token standards like ERC-3525 also enable intelligence and external interaction—meaning not only JPEGs and other file formats can be embedded into SFTs, but even full smart contracts can be included, capable of storing, receiving, or sending assets when needed.

SFT Token Standard Comparison: ERC-1155, ERC-3525, and ERC-3475

There are three dominant SFT token standards in the industry: ERC-1155, ERC-3525, and ERC-3475.

ERC-1155 Multi-Token Standard

Developed by the Enjin team, ERC-1155 was designed to streamline blockchain game development. It allows multiple types of tokens (e.g., in-game items) to be issued via a single smart contract. The core idea is to bundle multiple tokens together, saving on contract deployment costs and gas fees for token transfers. Notably, ERC-1155’s notion of quantity refers to discrete "units"—it cannot represent fractional values or precise decimal calculations, limiting its financial applicability.

For technical details on how ERC-1155 works, refer to EIP-1155.

ERC-3525 Semi-Fungible Token Standard

Developed by Solv Protocol, ERC-3525 was designed to represent advanced financial products, using a two-layer structure to simultaneously support quantity and unique ID identification. Compared to ERC-1155, it offers higher numerical precision—supporting transactions of any 256-bit unsigned integer, matching ERC-20’s quantitative capability. The ERC-3525 standard also provides multiple transfer methods and optimizes gas consumption.

From the outset, ERC-3525 was intended to represent complex financial assets such as on-chain bonds and funds. The Solv team believed that the simplicity of DeFi financial products would hinder large-scale adoption by traditional capital. Advanced financial instruments require multidimensional descriptions—including maturity, interest rates, and quantities—to meet diverse user needs. Since neither ERC-20 nor ERC-721 could express such assets, Solv chose to design their own standard, refining it into a general-purpose industry specification. With superior quantification and rich attribute expressiveness, ERC-3525 has broad applicability. Currently, over 30 teams are building products across DeFi, gaming, RWA, and SBT domains based on ERC-3525.

For technical details on how ERC-3525 works, refer to EIP-3525.

ERC-3475 Bond Template Standard

Developed by the eBond team, ERC-3475 is a standard specifically designed for contracts. It is highly customizable and supports the representation of nearly any kind of information. Its main advantages lie in optimizations for gas efficiency and batch transfers.

For technical details on how ERC-3475 works, refer to EIP-3475.

Conclusion

SFTs remain an emerging asset class, yet their commercial potential is already being proven by innovators in the crypto space. They are driving innovation in areas such as RWA tokenization, gaming, financial instruments, DeFi, and environmental sustainability. A multi-billion-dollar on-chain market is opening up.

2023 will be the breakout year for the SFT ecosystem. The infrastructure, application markets, and assets built around SFTs will continue to generate real yield for the crypto world. We look forward to the SFT ecosystem becoming a key engine for the next bull market!

If you enjoyed this article and wish to join the SFT community, please reach out. Join our Telegram group (English) or Telegram group (Chinese) to engage deeply with SFT builders.

SFTLabs is an alliance of SFT innovators, fostering collaboration and knowledge sharing among SFT entrepreneurs, developers, and learners, pooling resources to accelerate SFT adoption and development in Web3.

If you know of projects building or considering using SFTs, please contact us: Website, Twitter

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News