ERC-3525 Countdown: Can Semi-Fungible Tokens (SFTs) Become the Third Pole of On-Chain Assets?

TechFlow Selected TechFlow Selected

ERC-3525 Countdown: Can Semi-Fungible Tokens (SFTs) Become the Third Pole of On-Chain Assets?

What is SFT?

By Solv Research Group

On September 3, 2022, the last call period for the semi-fungible token standard ERC-3525 draft ended, meaning that ERC-3525 will soon be officially adopted as an industry standard within weeks. This is expected to be the first token standard approved after Ethereum's Merge upgrade.

Tokens are one of the key innovation areas in blockchain technology. There are now dozens of token standards named under the ERC designation, with new ones constantly emerging. What makes ERC-3525 special?

Unlike most recently emerged specialized "small standards," ERC-3525 is a universal "major standard." Proposed and designed by the Solv Protocol team, it has received support from several core Ethereum developers. It took 20 months from initiation to finalization, undergoing repeated refinements and multiple revisions—an unusually meticulous process in the fast-moving blockchain industry.

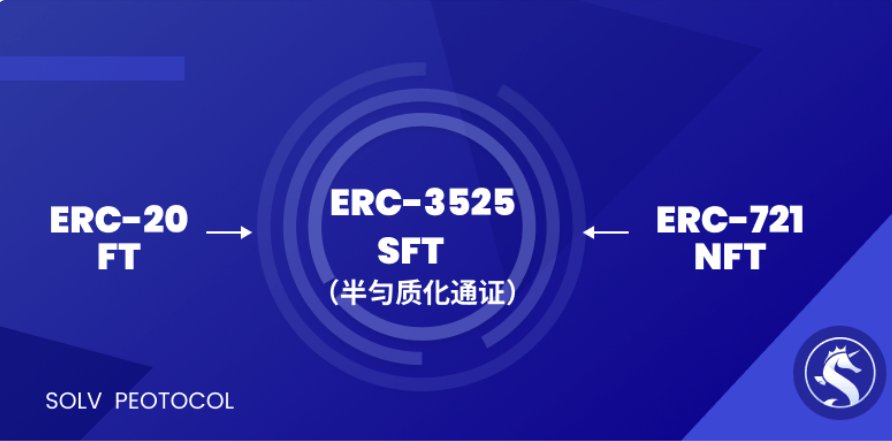

ERC-3525 defines a new asset class—the Semi-Fungible Token (SFT)—placing it on equal footing with ERC-20 and ERC-721. Previously, ERC-20 opened the fungible token (FT) market in 2016, which now represents thousands of billions of dollars in assets. ERC-721 launched the non-fungible token (NFT) market in 2018, currently valued at hundreds of billions of dollars. Can ERC-3525 open a new market? And what might its potential be?

To answer these questions, we must first understand what SFTs are—and to do so, we need to start with FTs and NFTs.

What Is an SFT? — Starting from FT and NFT

Fungible tokens (FTs) are digital assets where each unit is identical and interchangeable. The term "fungible" means "mutually replaceable." As the name suggests, any two units of an FT are exactly the same and can substitute for one another, making them "homogeneous." Because FTs directly correspond to real-world value units such as currency, common stock, or loyalty points—and because they support arithmetic operations like addition and subtraction—they are intuitive and were among the earliest forms of digital tokens. As early as 2015, shortly after Ethereum’s launch, Vitalik Buterin proposed implementing FTs via smart contracts. This led to Fabian Vogelsteller introducing the ERC-20 standard proposal in November 2015. Since 2016, ERC-20 has become the most widely used and best-known digital token standard, spawning a multi-hundred-billion-dollar industry.

Non-fungible tokens (NFTs), in contrast, are the opposite of FTs in nearly every way. While all units of an FT are identical and interchangeable, each NFT is unique, one-of-a-kind, irreplaceable, and cannot be subjected to mathematical operations. Whereas FTs represent abstract quantities, NFTs represent specific digital items—such as digital art, domain names, music, or gaming gear. To express their uniqueness, each NFT has its own distinct ID (determined by the contract address and serial number) and metadata. The primary standard for NFTs is ERC-721, introduced in January 2018 by William Entriken and two others. For its first three years, NFTs remained relatively obscure. However, in 2021, fueled by the explosion of crypto art, the NFT industry suddenly surged. In the first five months of 2022 alone, newly created NFT assets reached $36 billion in value. Today, NFTs are considered one of the most important infrastructures for Web3 and the metaverse.

So, what exactly is an SFT?

An SFT, or Semi-Fungible Token, is a new type of token—positioned alongside FTs and NFTs as the third general-purpose category of digital assets. As the name implies, it sits between FTs and NFTs: it supports divisibility and calculation like an FT, yet retains individual identity and uniqueness like an NFT.

We’ve seen that FTs are ideal for representing abstract quantities, while NFTs suit unique, concrete items. So what kinds of things are best represented by SFTs?

What New On-Chain Assets Can SFTs Bring?

In fact, SFTs are well-suited for expressing digital items that have quantitative attributes and may require merging or splitting operations. Typical examples include financial instruments, advanced financial contracts, land parcels, and any standardized goods with intrinsic quantity. For instance, two bonds with identical terms and face values of 500 yuan each are equivalent to one bond with the same terms and a face value of 1,000 yuan. Similarly, two virtual land plots can, under certain conditions, be merged into one. In the physical economy, two solar panels of the same model, each with an effective area of 20 square meters, can be treated as a single 40-square-meter panel for management and accounting purposes. Likewise, two railcars of the same type of coal can be aggregated by tonnage into a single batch. Such items are widespread across Web3, DeFi, and the real economy—especially in management, statistics, and financialization scenarios—representing massive scale and significance. These are precisely the types of assets best expressed using SFTs.

ERC-3525 was specifically designed to represent SFTs, combining the strengths of both FTs and NFTs. Like NFTs, it supports rich metadata and visualization capabilities; like FTs, it has quantitative properties enabling flexible splitting, merging, and mathematical computation. With ERC-3525, developers can easily implement the use cases listed above—not only serving as infrastructure for Web3 and the metaverse but also acting as a vital bridge connecting blockchain with the real economy. Its application potential is virtually limitless. In the long run, SFTs are destined to grow into a multi-trillion-dollar industry.

Beyond this, ERC-3525 offers strong extensibility, allowing many advanced features. For example, the creators of ERC-3525—the official Solv Protocol team—have extended it with a powerful capability: enabling SFTs to hold unlimited types and amounts of other digital assets. These assets can include FTs, NFTs, or even other SFTs. This extension also allows dynamic depositing and withdrawing of assets into and from an SFT, turning it into a flexible, dynamic container capable of representing various advanced Web3 digital assets, financial instruments, and contracts—with enormous application potential.

Clearly, ERC-3525 represents a broadly applicable digital asset class (SFTs), while also offering robust extensibility that leaves ample room for innovation.

What Is ERC-3525 Good For?

How can ERC-3525 be applied in Web3? Here are several key directions:

First, use ERC-3525 to build various advanced digital financial assets, such as certificates of deposit, bills of exchange, bonds, options, futures, swaps, insurance contracts, fund shares, and asset-backed securities (ABS). On one hand, ERC-3525 SFTs can be freely split, merged, and calculated—offering flexibility comparable to ERC-20 fungible tokens. On the other hand, advanced financial assets often involve complex conditional logic requiring strong expressive power. Building upon ERC-721, ERC-3525 greatly enhances metadata and visualization capabilities, enabling richer, structured data representation with unprecedented transparency and auditability compared to traditional systems. For example, if fund shares are represented as ERC-3525 SFTs, users could easily inspect the fund’s current portfolio composition and asset status, eliminating the information opacity and asymmetry common in traditional finance.

Second, develop advanced virtual items and equipment for Web3 or the metaverse based on ERC-3525. For instance, representing virtual land as an NFT makes merging or subdividing plots difficult, whereas doing so with SFTs becomes effortless. Similarly, upgradable or combinable gaming gear can leverage the computational and compositional features of SFTs to significantly reduce development complexity and enhance trading liquidity. Additionally, creating membership cards, gift vouchers, or lottery tickets using ERC-3525 enables entirely new functionalities, enriching user experiences in Web3 applications.

Third, use ERC-3525 to enable real-world asset tokenization. ERC-3525 SFTs can carry and lock legally binding contractual documents from the real world (typically in PDF format) and, through programming oracle services, monitor the real-time status of associated assets. Therefore, once coordinated with relevant institutions and government agencies, ERC-3525 can serve as a powerful tool for bringing real-world assets on-chain. For example, land or solar panels can be represented as ERC-3525 SFTs, with area as the unit of measurement, managed on blockchain. These assets can then be freely combined, split, and transferred. When integrated with management systems, their actual status can be queried instantly—offering advantages over traditional technologies in supply chain collaboration and financialization.

Fourth, treat extended ERC-3525 SFTs as transferable, splittable digital asset wallets. By leveraging Solv Protocol’s dynamic container extension, an ERC-3525 SFT can function like a wallet, holding multiple types and unlimited quantities of digital assets—for example, bundling 2 BTC, 10 ETH, 2 BAYC NFTs, and another SFT into a single ERC-3525 SFT. But unlike a traditional wallet, this SFT can itself be transferred—or even split—making it far more flexible.

Finally, and perhaps most generally, ERC-3525 SFTs can act as visualized, tokenized smart contracts. Since an ERC-3525 SFT can embed one or more smart contracts with custom execution logic and trigger conditions, and also has the ability to receive and send tokens, it can effectively function as a transferable, splittable, and visualized advanced smart contract. In theory, any functionality achievable with a smart contract can be implemented via ERC-3525—often with greater flexibility. Given that smart contracts are central to blockchain technology, ERC-3525 stands out as one of the most versatile and representative blockchain innovations. For example, a supply chain tracking and management platform could use SFTs to represent batches of goods, splitting them during distribution. Or trade agreements, lease contracts, or mortgage loans could be encoded as SFTs, leveraging the precision, automation, and efficiency of smart contracts to dramatically improve contract creation and enforcement, laying a solid foundation for supply chain finance.

In short, the upcoming ERC-3525 is one of the most advanced, versatile, and feature-rich token standards for digital assets and digital objects available today.

But does such power come with high usage costs and technical barriers?

Surprisingly, the average gas consumption of ERC-3525 is comparable to that of ERC-721, and in some common functions, it is even significantly lower than popular ERC-721 implementations—a result of careful design and prolonged optimization. Moreover, to lower adoption barriers, ERC-3525 is designed to be compatible with ERC-721. As a result, nearly all existing wallets, DeFi protocols, NFT tools, and marketplaces can support ERC-3525 without any modifications. Furthermore, the reference implementation of ERC-3525 is fully open-source and freely available, with proven success cases. Solv Protocol has already built the largest bond issuance and trading market using ERC-3525, and FujiDAO is developing an options market based on it—validating the standard’s technological maturity.

We believe ERC-3525 will become one of the leading token standards in blockchain, opening new frontiers for Web3, digital finance, and real-world blockchain applications—and unlocking a trillion-dollar-scale market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News