Deep Dive into ERC-3525: Opportunities, Current State, and Future of the New Protocol

TechFlow Selected TechFlow Selected

Deep Dive into ERC-3525: Opportunities, Current State, and Future of the New Protocol

A new token standard plus a new use case—can ERC-3525 also lead to the success of SFTs?

What's your first impression when you hear NFT?

A rare digital avatar? A collectible art piece? In fact, much of the perceived value stems from the meaning of NFT itself: Non-Fungible Token—unique and distinct, with no two being the same.

In cultural and digital collectibles, each NFT is unique and indivisible. This all traces back to that winter in 2017 with CryptoKitties, built on the ERC-721 standard:

A token standard + a smart contract created non-fungible tokens. At the same time, ERC-721 opened Pandora’s box, paving the way for today’s success of Bored Apes and other NFT assets.

But in finance, things are quietly changing.

A new asset form distinct from NFTs—SFT (Semi-Fungible Token)—is emerging, increasingly applied in Web3 financial scenarios. A dedicated standard protocol for these SFTs—ERC-3525—is also on the horizon.

Could a new token standard plus a new use case make SFTs successful, just as ERC-721 did for NFTs?

Before answering, let’s dive deep into ERC-3525 and SFTs. After all, understanding a trend correctly is the prerequisite for riding it.

Financial NFTs: The Hidden Blue Ocean Beneath the Surface

Before diving deeper, it's worth discussing why we need ERC-3525.

While ERC-721-based digital collectibles were booming, pioneers had already begun exploring NFTs in finance:

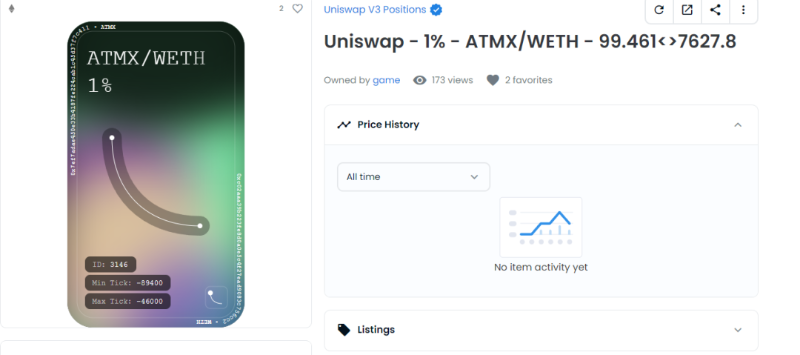

In May last year, Uniswap launched its V3 version, introducing LP NFTs—a “market-making certificate” acknowledging users’ provision of liquidity within a specific price range. Users retain ownership and redemption rights via their LP NFTs;

Meanwhile, Centrifuge, a platform focused on mapping real-world assets onto the blockchain, turns verified physical assets into NFT documents containing details like ID numbers, asset values, and maturity dates. Asset owners can use these NFTs as collateral to raise funds on-chain.

Figure 1: Financial NFT product implementations by Uni V3 and Centrifuge

In these examples, NFTs represent unique ownership of certain financial assets. Further, when financial rules are encoded via smart contracts and rights defined through NFTs, the concept of financial NFTs begins to take shape.

Beneath the surface lies even greater potential:

The possibility of using NFTs to represent more sophisticated financial instruments. For DeFi, traditional financial tools such as fixed deposits, bonds, options, and commercial paper are equally applicable—each governed by clear financial rules (holding conditions, redemption terms, etc.) and requiring a certificate to prove ownership or redemption rights, making them naturally suited for representation as financial NFTs. For example, a one-year bond issued as an NFT allows its holder to redeem principal and interest after one year.

This kind of representation imposes new demands on NFTs: When representing ownership of a financial product, we want it to be unique; but when transferring or calculating value, we want it to be divisible and computable—moving from fully non-fungible (NFT) toward semi-fungibility (SFT).

Fortunately, the financial NFT market isn’t yet as crowded as profile-picture NFTs, leaving vast room for innovation. But this potential requires appropriate standard protocols to support it—just as ERC-721 supported every unique CryptoKitty.

And the newly emerged ERC-3525 could become the seabed supporting this blue ocean of financial NFTs.

Figure 2: Blue ocean of NFT application scenarios and protocol support

ERC-3525: Enabling Advanced Financial Scenarios with SFTs

Let’s break down the requirements for financial NFTs mentioned above.

1. What Are SFTs (Semi-Fungible Tokens) and ERC-3525?

In financial applications, we need IDs to uniquely identify NFTs while allowing similar NFTs to have quantifiable values that can be split, merged, and calculated (e.g., splitting financial assets).

Put simply, I want my $100 NFT bond to belong only to me, but I also want the face value of $100 to be split into two $50 units for easier transfer and management.

Notice the nuance? This bond sits between NFT and FT: It maintains individual uniqueness while allowing division of its monetary value.

Technically, this middle ground is known as a "Semi-Fungible Token" (SFT): Each bond is different, yet two $50 bonds have equal value.

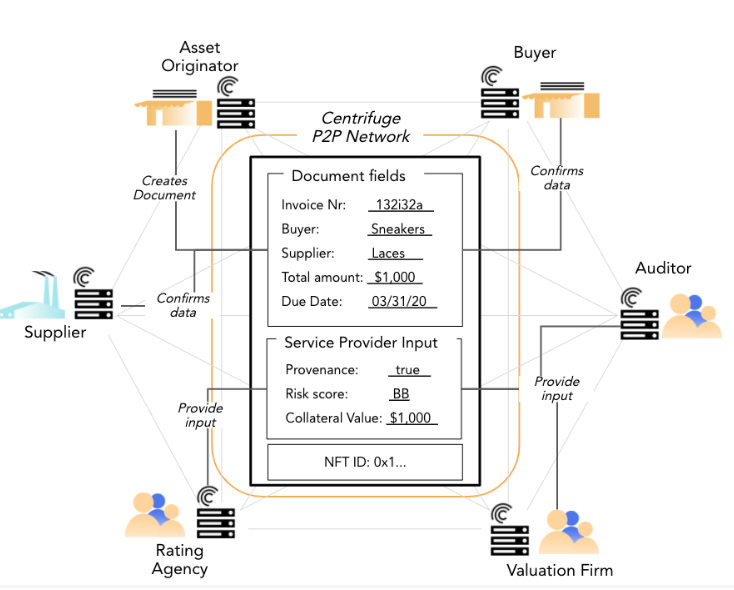

Commonly used ERC standards lack dedicated design for “semi-fungibility,” making them poorly suited for such bonds:

-

ERC-20: Tokens under this protocol are divisible but identical. For instance, one ETH in your wallet is indistinguishable from mine, failing to meet the needs for personalization and unique ownership in financial products;

-

ERC-721: Each token is unique (like 100 different Bored Apes), but lacks quantity attributes (each defaults to one unit) and cannot be split or transferred partially. Imagine trying to cut Bored Ape #001 in half and give one side to Bored Ape #002—it’s impossible;

-

ERC-1155: Each token represents a class of NFTs with quantity attributes. However, objects sharing the same token ID cannot be distinguished. For example, in a game, token #001 might represent magic potions—you could own 100 potions, but they’re all identical, with no difference between 50 in your left hand and 50 in your right. Moreover, the quantity concept in ERC-1155 refers mostly to discrete “counts,” lacking financial precision (e.g., decimals, fractional calculations).

For financial use cases, we still need a dedicated protocol that supports both unique ownership and divisibility, enabling transfers and computations among tokens.

ERC-3525 was designed exactly for this purpose. The table below illustrates how ERC-3525 outperforms other protocols in financial scenarios:

Table 1: Comparison of various ERC protocols across features, use cases, and supported asset types

As shown, ERC-3525 better supports Semi-Fungible Tokens (SFTs), aligning closely with financial NFT use cases.

To understand how ERC-3525 achieves this, some technical explanation is unavoidable. We’ll keep it simple to help you quickly grasp the core design of ERC-3525 and how it enables SFTs.

2. Design Philosophy and Applications of ERC-3525

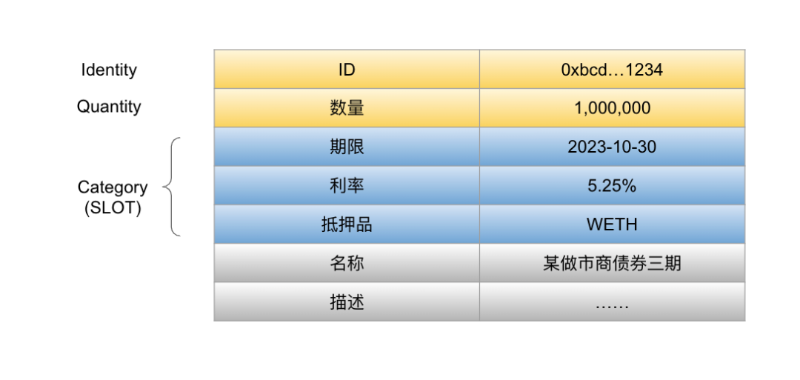

Take our one-year $100 bond again. Technically, ERC-3525 isn't complicated—it uses an “id-slot-value” structure to support semi-fungible assets:

-

id: Asset ID, uniquely identifying ownership. For example, your bond is ID 001, mine is 002—different ownerships, yours vs. mine;

-

slot: An innovative classification method distinguishing asset types and enabling inter-token transfers. For example, a one-year bond issued on August 5, 2021, maturing August 5, 2022, with a 1% interest rate. As long as issuance/maturity dates and interest rates match, your $100 bond and my $200 bond are fundamentally the same type of NFT asset and can be split, transferred, or merged;

-

value: Asset amount/quantity, used for numerical calculations. For instance, your $100 bond can be split into two $50 bonds; I can merge my $20 and $30 bonds into one $50 bond.

Figure 3: Illustration of id-slot-value design

Through the core “id-slot-value” design, ERC-3525 uses IDs to ensure each NFT asset has a unique identifier, while slots and values allow assets with identical business rules to be transferred and calculated—ideal for splitting, merging, stacking, and transferring financial assets. More broadly, ERC-3525 fits any scenario involving smart contract conditions, quantity attributes, and computational needs.

Notably, ERC-3525 is backward compatible with ERC-721. This means ERC-3525 can directly leverage all existing NFT infrastructure, allowing products built on it without additional development costs—highly developer-friendly.

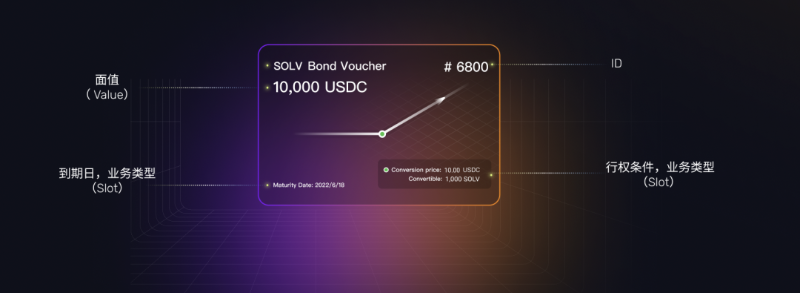

Additionally, under ERC-3525, token metadata gains enhanced visualization capabilities, enabling complex financial logic to be presented more intuitively and flexibly. For example, Solv Protocol—the proposer of ERC-3525—launched a bond product based on ERC-3525 in its financial NFT marketplace:

The #4 in the top-right corner indicates the note’s ID; the 3,000 USDC in the top-left represents the bond’s face value; the conversion price and maturity date at the bottom define the business type (slot), indicating the bond matures on Feb 1, 2023, with a call option where 1SOLV = 3.00 USDC at maturity.

Figure 4: Example of Solv Protocol’s bond product design

This is clearly a Web3 financial innovation. Projects needing funding can issue ERC-3525-based notes. Investors buy them, with token unlocking rules governed by smart contracts—tokens released only at agreed times, avoiding early sell-off pressure. These notes can also be split in value, allowing partial transfers—a key SFT feature mentioned earlier.

Yet this innovation proceeds quietly.

Solv Protocol submitted the ERC-3525 standard to Ethereum in July last year and passed initial review in October. Over the past year, Solv has iteratively developed financial NFT products based on ERC-3525, refining the original proposal. Only now is ERC-3525 emerging into public view.

By launching products before ecosystem adoption, gradually increasing market awareness of financial NFTs, the final release of ERC-3525 avoids being just an abstract, obscure technical document.

The lengthy protocol creation process inevitably involved trial, error, and trade-offs, while opening doors for other applications.

Beyond Finance: The Synergy Between ERC-3525 and SBTs

The role of foundational protocols is to generalize commonalities and support diverse use cases. Beyond financial NFTs, ERC-3525 may also support new applications—one of which is SBT (Soulbound Token).

In May, a paper co-authored by Vitalik Buterin titled “Decentralized Society: Finding Web3’s Soul” introduced Soulbound Tokens (SBTs), sparking widespread interest.

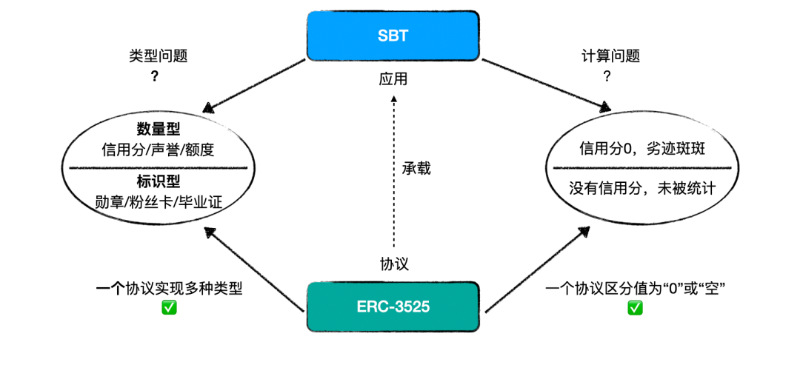

When considering how to use SBTs to verify social identity, a more fundamental question arises: Which protocol should carry SBTs?

If we naively treat SBTs as non-transferable, indivisible NFTs, then ERC-721 could suffice. But SBT types may be far more complex. Consider a credit-score-like SBT measuring a wallet address’s reputation. Under ERC-721, lacking a quantity attribute, how do we represent changes in credit scores?

Numerically, a user with 0 points differs from one with no score at all—the former may have a poor record, the latter may never have been issued a score.

Figure 5: Vision of ERC-3525 supporting various SBT applications

For numeric, calculable, and manageable SBTs, ERC-3525 appears to solve the problem almost serendipitously.

With its built-in value attribute, ERC-3525 easily adapts to “credit score” scenarios; and since NFTs of the same type (slot) can undergo quantitative operations, increases and decreases in credit scores become naturally feasible.

However, SBTs are still in early stages, and Vitalik’s vision of a decentralized society remains unrealized.

Still, looking ahead, realizing that ERC-3525 can seamlessly support SBTs reveals broader possibilities:

A product solves one problem; a protocol solves a category. SBTs are a new species—but恰好 fall within the scope of problems ERC-3525 can address.

ERC-3525 came first, SBTs later—a seemingly prescient coincidence, but actually reflecting the inevitable breadth of foundational protocols.

Looking Ahead: Solv Market’s Role in the Web3 World

Ultimately, the value of a foundational protocol must manifest in applications.

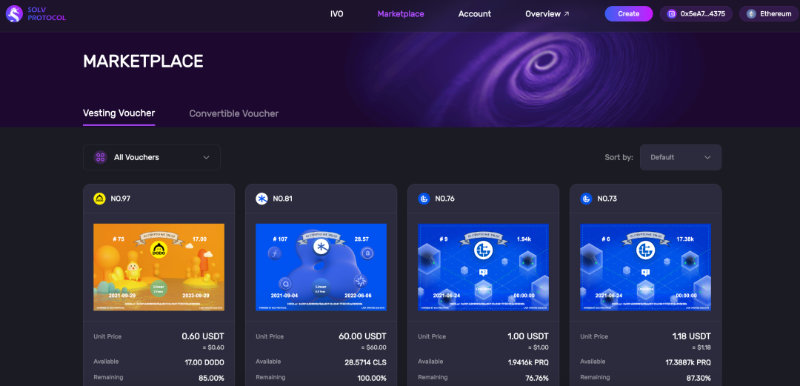

Solv Protocol, the creator of ERC-3525, has also built Solv Market—a platform for creating, displaying, and trading financial NFTs.

Here, you can find various financial NFTs created by DeFi protocols and DAOs, including lock-up vouchers, convertible bonds, call options, and more.

Figure 6: Product examples from Solv Marketplace

All these financial NFTs are built on ERC-3525. Currently, Solv Market serves as a foundational infrastructure platform offering rules and tools, helping Web3 projects fundraise and innovate financially.

In future scenarios involving SBTs and decentralized societies, Solv Market could act as a transparent third party, issuing SBTs to participants based on business needs—to showcase project or user reputations. Conversely, it could benefit from SBTs issued by other third parties to assess credit risks of potential projects or users.

All of this stems from Solv Protocol naturally introducing the ERC-3525 standard while building DeFi products.

From a micro perspective, combining product and protocol strengthens competitive advantage and ecosystem integration; from a macro view, open-sourcing and promoting the protocol positions Solv as a powerful enabler and continuous contributor to industry progress.

Great buildings rise from the ground—one small step like ERC-3525 at a time, eventually sketching the grand landscape of Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News