$SOLV to launch on Hyperliquid — how will Solv Protocol unlock Bitcoin's potential?

TechFlow Selected TechFlow Selected

$SOLV to launch on Hyperliquid — how will Solv Protocol unlock Bitcoin's potential?

Solv Protocol = HyperSolv

Author: Bitcoin Ecosystem

Translation: TechFlow

@SolvProtocol recently announced a surprising update: "$SOLV is coming to Hyperliquid."

What happens when the leading BTCFi protocol with 25,000 BTC in reserves partners with @HyperliquidX, known as the "on-chain Binance"? Let's explore.

Solv has recently unveiled its highly anticipated TGE (Token Generation Event) and the launch of its native token $SOLV. For a high-profile project like Solv, the typical path would be listing on top centralized exchanges (CEXs). Yet, Solv has chosen Hyperliquid as the primary platform for its token launch. What makes this unconventional choice so significant?

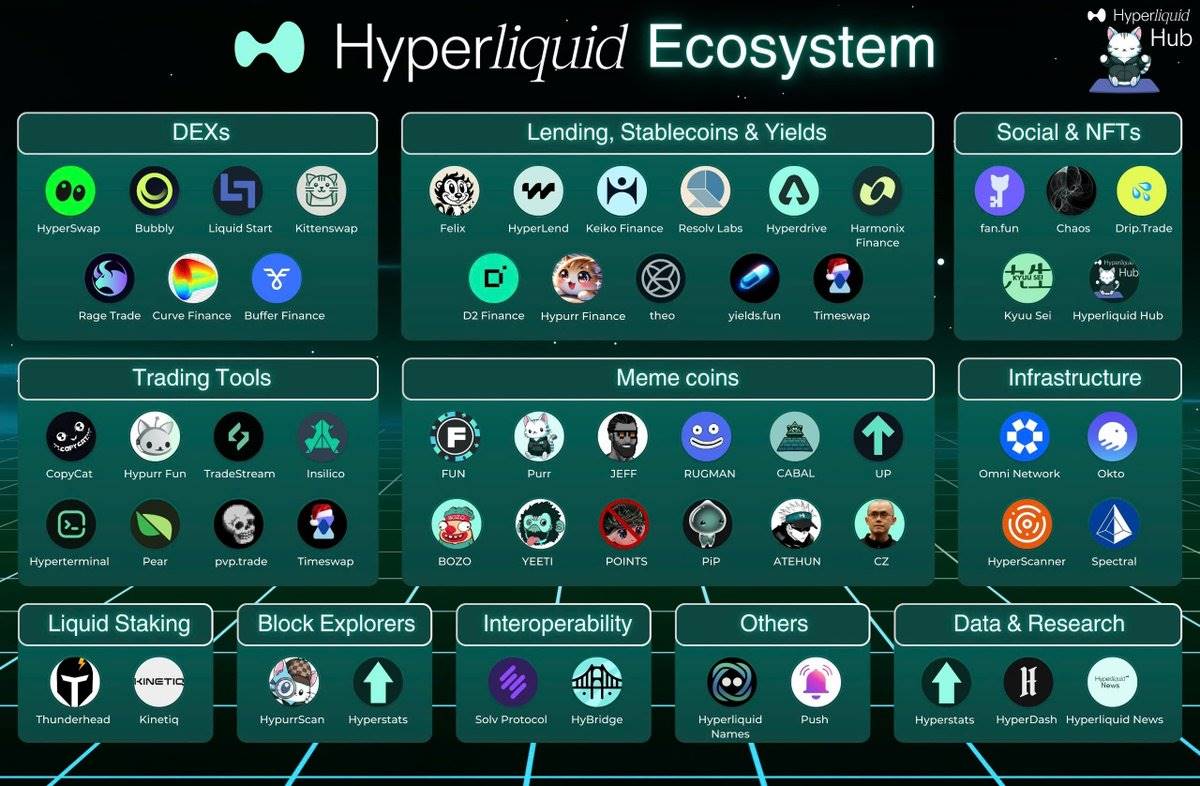

Hyperliquid is an on-chain exchange renowned for user experience, transaction speed, and transparency, already gaining substantial traction within the blockchain community. However, most tokens currently listed on the platform are memecoins—cryptocurrencies driven by social trends.

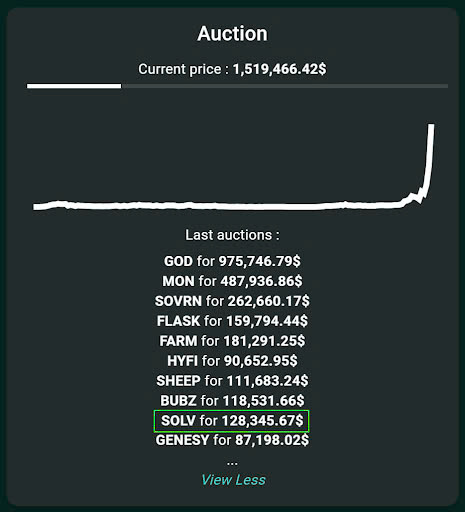

Solv is the first project to place a six-figure bid on Hyperliquid, initially offering $128,345.67. That auction price has since surged to $500,000—and at its peak, reached $1.5 million.

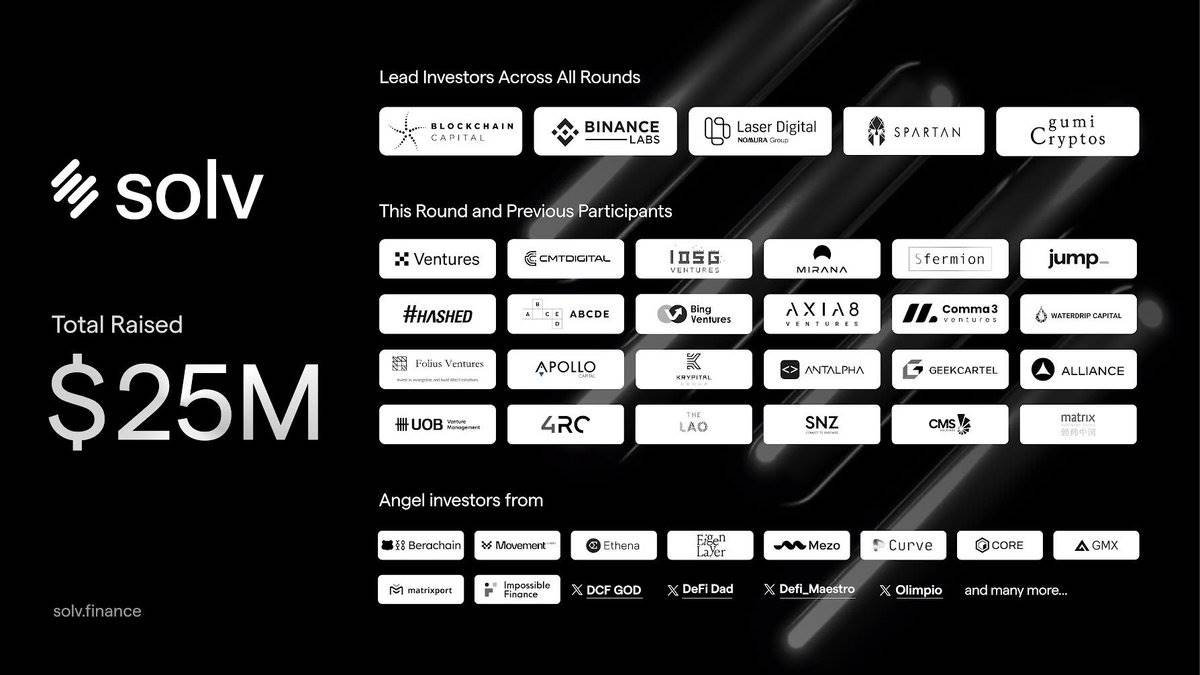

Solv raised $25 million from top-tier investors and strategically selected Hyperliquid as the launchpad for $SOLV. As the first high-profile project on Hyperliquid, Solv not only gains first-mover advantage but also successfully positions its flagship product, SolvBTC, onto the upcoming Hyperliquid L1 network.

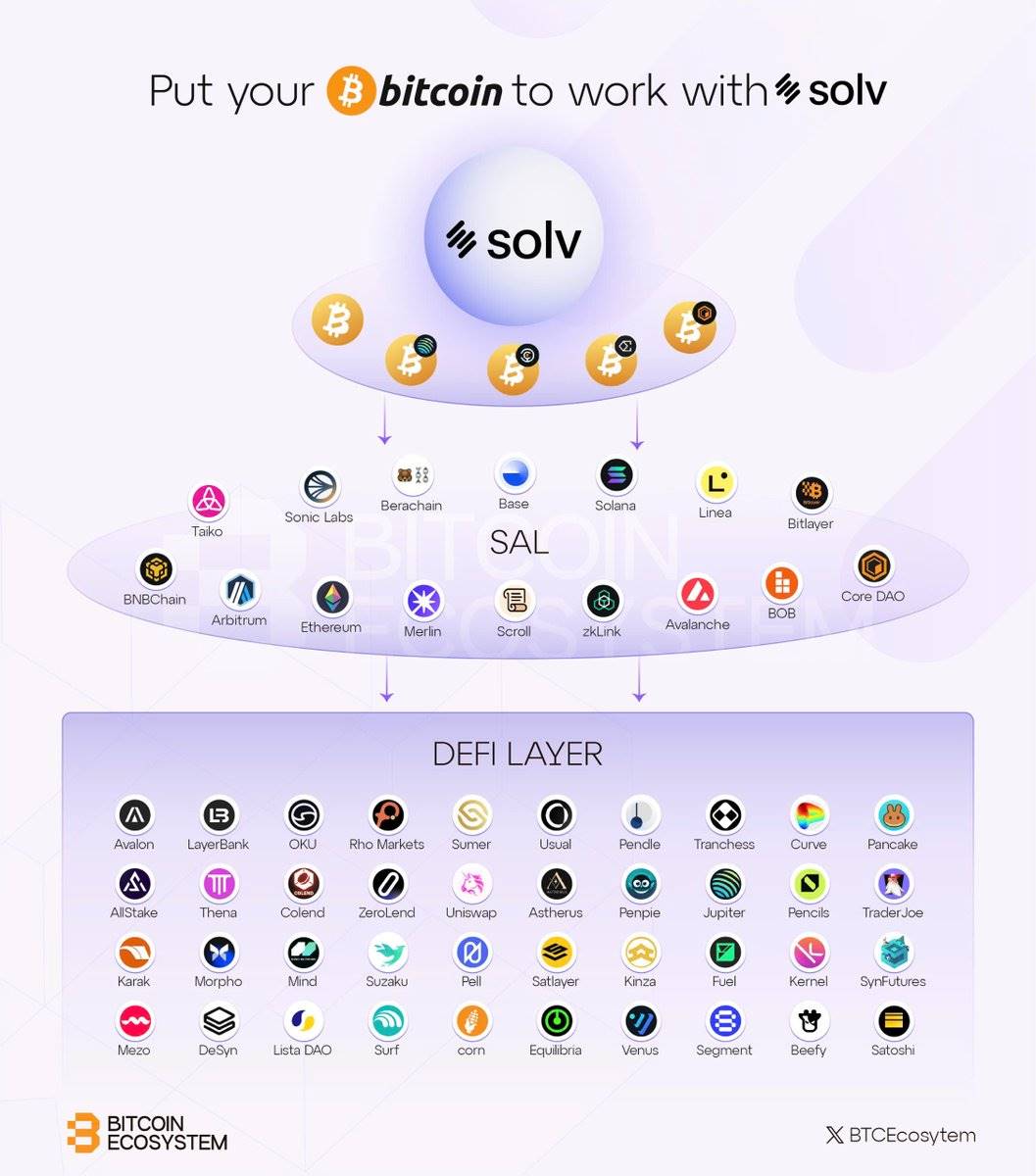

Currently, Solv holds over 25,000 BTC in reserves—the largest decentralized Bitcoin reserve globally—powered by its innovative product, SolvBTC.

Through its Staking Abstraction Layer, Solv provides a unified framework enabling seamless interoperability across more than 15 blockchains, laying the foundation for deep integration with the Hyperliquid ecosystem.

Hyperliquid is still in early development. In the future, the platform may expand beyond its current dollar-denominated contracts to include:

-

BTC-based contracts: trading contracts priced in Bitcoin.

-

Unified margin model: allowing users to post Bitcoin as collateral for USD-denominated contracts.

-

BTC spot pairs: enabling direct trading between Bitcoin and other cryptocurrencies.

To enable these expansions, Hyperliquid will require substantial Bitcoin inflows into its ecosystem—necessitating a reliable cross-chain Bitcoin solution.

Moreover, Hyperliquid’s upcoming HyperEVM—an Ethereum Virtual Machine-compatible network—will transform it into a full-fledged L1 blockchain. This evolution, combined with Hyperliquid’s growing DeFi ecosystem and increasing demand for Bitcoin derivatives on its DEX, further solidifies SolvBTC as the preferred Bitcoin asset on the Hyperliquid network.

With SolvBTC, Bitcoin holders can earn up to 20% APY through innovative yield strategies.

Deep integration with the Hyperliquid ecosystem maximizes Bitcoin’s potential. Users can leverage SolvBTC not only as collateral for trading contracts but also within DeFi protocols—all while earning consistent yields.

Unlike traditional Bitcoin held on exchanges, SolvBTC on Hyperliquid is a secure, yield-generating asset, significantly enhancing the overall value of the Hyperliquid network.

As a pioneer of yield-bearing Bitcoin, Solv has already brought SolvBTC to emerging ecosystems such as Base, Sonic, and Berachain via its staking abstraction layer. Hyperliquid will be Solv’s next frontier—offering Bitcoin holders a new platform to unlock Bitcoin’s full potential.

Summary:

@SolvProtocol = HyperSolv

Bullish on the future of BTCFi? Choose Solv!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News