Bitcoin's dormant capital has finally awakened

TechFlow Selected TechFlow Selected

Bitcoin's dormant capital has finally awakened

A new ecosystem is forming around Bitcoin, aiming to unlock all this "dormant capital."

Author: Vaidik Mandloi

Translation: Block unicorn

Introduction

Today, most people buy Bitcoin and then completely stop using it.

They hold Bitcoin, call it digital gold, and proudly declare they're "focused on long-term investment." There's nothing wrong with that—after all, Bitcoin has earned such a reputation.

But this massive holding has created one of the largest idle capital pools in today’s crypto ecosystem. About 61% of Bitcoin hasn't moved in over a year, and nearly 14% hasn't moved in more than ten years. Despite a market cap exceeding $2 trillion, only 0.8% of Bitcoin is currently involved in any form of decentralized finance (DeFi) activity.

In other words, Bitcoin is both the most valuable and the least used asset in cryptocurrency.

Now, let's compare this to other aspects of crypto:

-

Stablecoins are used for large-scale global payment settlements.

-

Ethereum powers smart contracts, decentralized autonomous organizations (DAOs), wallets, and entire economies.

-

Layer-2 networks run full ecosystems including lending, trading, gaming, and thousands of applications.

Meanwhile, Bitcoin—the largest, most secure, and most widely held asset—can do none of these things.

In contrast, it sits with trillions of dollars in value idle, generating no yield, creating no liquidity, and contributing nothing to the broader economy beyond security and price appreciation.

When people try to solve this problem, various solutions bring new issues. Wrapped BTC, while once popular, requires trusting custodians. Cross-chain bridges allow you to move Bitcoin to another chain but introduce security risks. Bitcoin holders want to use their Bitcoin, but the infrastructure has never provided a secure and native way to do so.

But that is finally changing. Over the past few years, an entirely new ecosystem has begun forming around Bitcoin, aiming to unlock all this "sleeping capital" without forcing people to wrap their Bitcoin, trust intermediaries, or transfer custody to others.

Why Bitcoin Ended Up This Way

Bitcoin becoming a passive asset was not accidental. Its entire architecture evolved in this direction. Long before DeFi emerged, Bitcoin made a clear trade-off: prioritize security above all else. This decision shaped its culture, developer environment, and ultimately the type of economic activity that could flourish around it.

The result is an extremely tamper-resistant blockchain—great for transferring funds, but severely limiting innovation. Most people only see the surface symptoms: low liquidity, high dormancy rates, and the dominance of wrapped Bitcoin—but the root causes go much deeper.

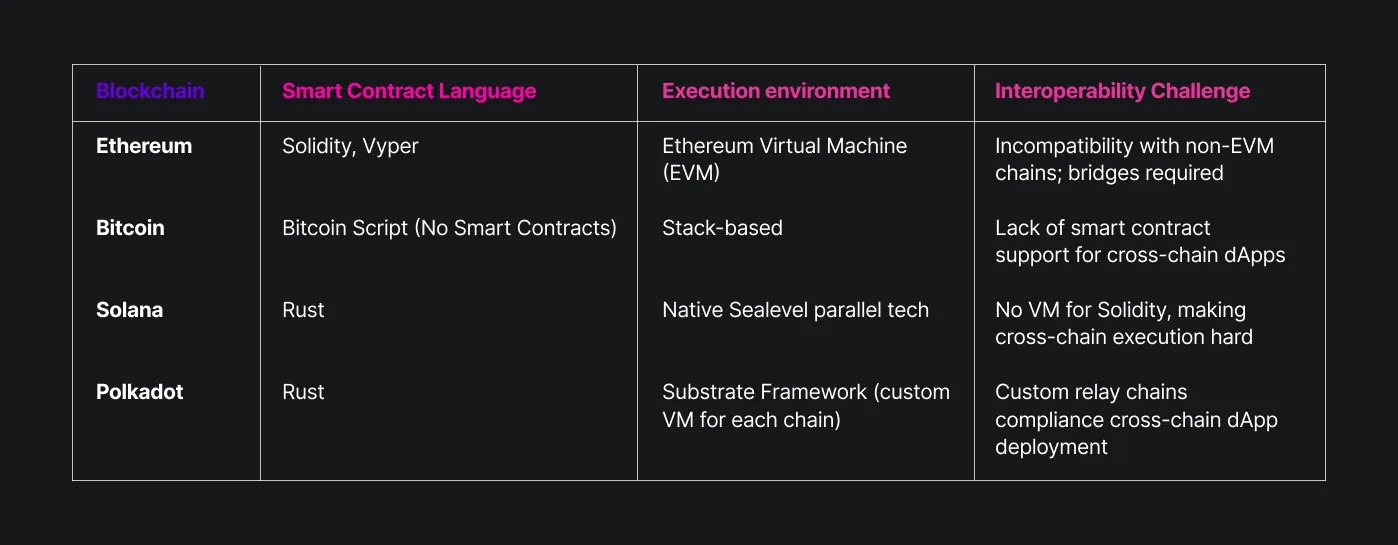

The first limitation is Bitcoin’s scripting model. It deliberately avoids complexity, keeping the base layer predictable and hard to exploit. This means no general-purpose computation, no native financial logic, no on-chain automation. Ethereum, Solana, and all modern L1s were built on the assumption that developers will build. Bitcoin was built on the assumption that developers should not build.

The second limitation lies in Bitcoin’s upgrade path. Any change, even minor feature updates, requires consensus across the entire ecosystem. Hard forks are socially almost impossible, and soft forks take years. While other cryptocurrencies iterate and overhaul entire design paradigms—like automated market makers, account abstraction, layer-2s, modular blockchains—Bitcoin remains largely stagnant. It became a settlement layer, never truly an execution layer.

The third limitation is cultural. Bitcoin’s developer ecosystem is inherently conservative. This conservatism protects the network but suppresses experimentation. Any proposal introducing complexity faces intense scrutiny. This mindset safeguards the base layer but ensures new financial infrastructure cannot emerge on Bitcoin as easily as elsewhere.

There’s also a structural constraint: Bitcoin’s value has grown faster than its surrounding infrastructure. Ethereum had smart contracts from day one; Solana was designed for high throughput from the start. Bitcoin’s value inflated into an asset class before its “applicability scope” could expand. As a result, the ecosystem faces a paradox: trillions in capital with almost nowhere to deploy it.

The final limitation is interoperability. Bitcoin is uniquely isolated—it cannot interoperate with other blockchains nor has native bridging. Until recently, there was no minimally trusted way to connect Bitcoin to external execution environments. Thus, any attempt to make Bitcoin usable required abandoning Bitcoin’s security model entirely—via wrapping, bridging, custodial minting, multisig, or federated systems. For an asset built on distrust of intermediaries, this approach can never scale.

The First Workarounds: Wrappers, Sidechains, and Bridges

When it became obvious that Bitcoin’s base layer couldn’t support meaningful activity, the industry responded as usual—by building workarounds. Initially, these seemed like progress, enabling Bitcoin to enter spaces where DeFi thrives. But upon closer inspection, they all share a critical flaw: using them requires giving up part of Bitcoin’s trust model.

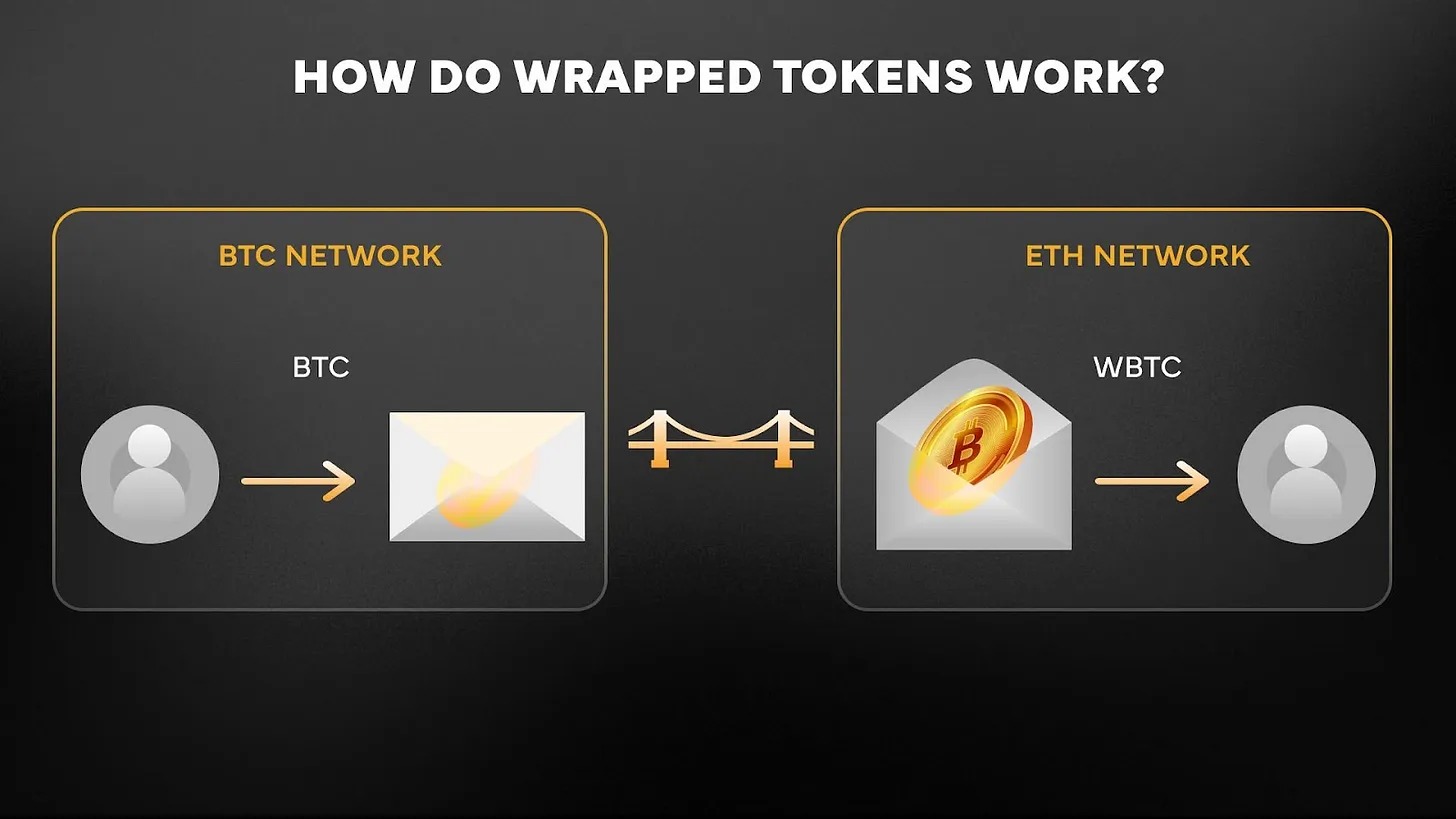

The most prominent example is Wrapped Bitcoin. It briefly became the default bridge between Bitcoin and Ethereum, and for a time, it appeared effective. It unlocked liquidity, allowing Bitcoin to be used as collateral, traded in AMMs, lent, cycled, re-collateralized—essentially doing everything Bitcoin itself couldn’t. But the cost was that wBTC relies on real Bitcoin being held by someone else. This means custody, dependence on external entities, operational risk, and a guarantee system detached from Bitcoin’s underlying security.

Federated systems attempted to reduce this trust burden by distributing control among multiple parties. Instead of a single custodian, a group jointly holds the Bitcoin backing the wrapped assets. This is an improvement, but far from eliminating trust. Users still depend on a coordinated set of operators, and the strength of the peg depends entirely on their incentives and integrity. For communities preferring trustless systems, this isn’t a perfect solution.

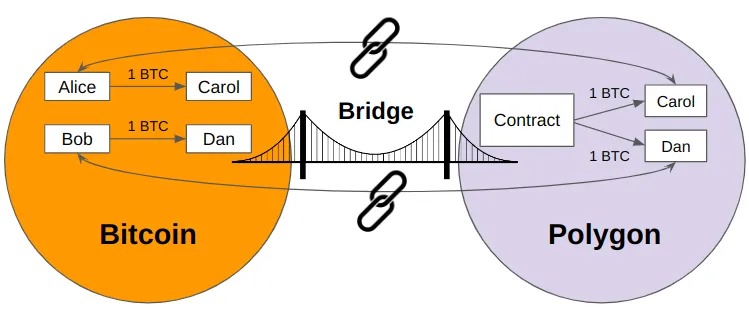

Cross-chain bridges introduced a new set of problems. Instead of relying on custodians, users now depend on external validators whose collective security is often weaker than the chain they’re leaving. Bridges made cross-chain Bitcoin transfers possible, but also became one of the biggest security vulnerabilities in crypto. Analyses consistently show bridge exploits as one of the largest sources of fund losses in the space.

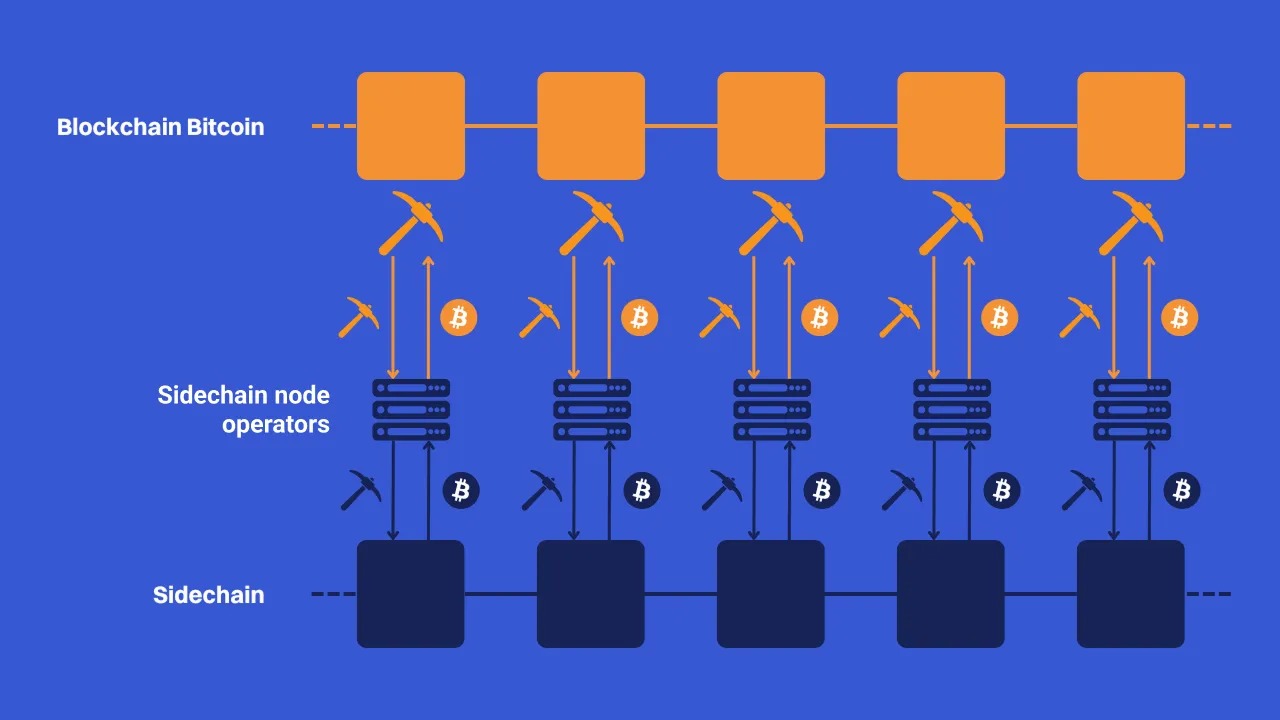

Sidechains added further complexity. They are independent chains connected to Bitcoin via various anchoring mechanisms. Some use multisig controls, others rely on SPV proofs. But none inherit Bitcoin’s security. They run their own consensus, validator sets, and risk models. The label “Bitcoin sidechain” is often more marketing than reality. Liquidity flows, but security doesn’t.

All these approaches have one thing in common: they push Bitcoin outward, removing it from the base layer into environments where rules are enforced by others. This solved usability in the short term but created a bigger problem: Bitcoin suddenly began operating under the very trust models it was designed to avoid.

The flaws are evident:

-

Wrapped BTC grew only because people tolerated custodians as a temporary fix.

-

Sidechains exist but remain niche due to failing to inherit Bitcoin’s security.

-

Bridges connect Bitcoin to other chains but open new attack vectors.

Each workaround solved one problem but created another.

The Breakthrough: Bitcoin Finally Gains New Primitives

For years, Bitcoin’s limitations were considered irreversible. The base layer wouldn’t change, upgrades were slow, and any proposal to enhance expressiveness was dismissed as unnecessary risk.

But over the past few years, that assumption has started to crumble.

1. Bitcoin gained the ability to “verify without executing”: The key breakthrough is a new class of verification models enabling Bitcoin to check computations done elsewhere without running them itself.

This is what makes BitVM and later BitVM-like systems possible. These systems don’t alter Bitcoin’s functionality but leverage its ability to enforce results via fraud proofs.

This means you can build logic, apps, and even full execution environments outside Bitcoin, while Bitcoin still ensures correctness. This is fundamentally different from Ethereum’s “execute everything on L1” philosophy. Bitcoin can now act as a judge. This is precisely what opens the door to:

-

Bitcoin-secured rollups

-

Trust-minimized bridges

-

Programmable Bitcoin vaults

-

Off-chain computation, on-chain verification

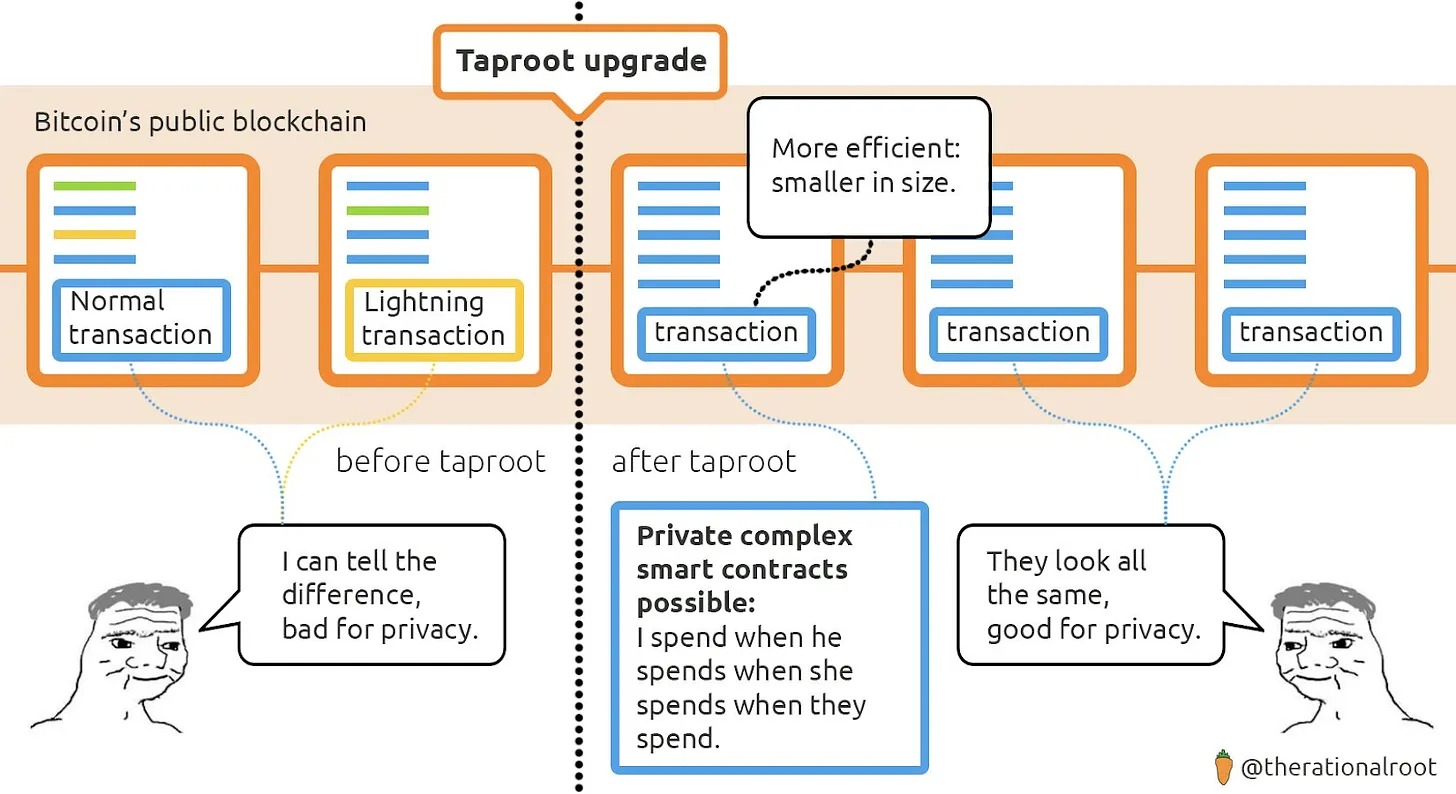

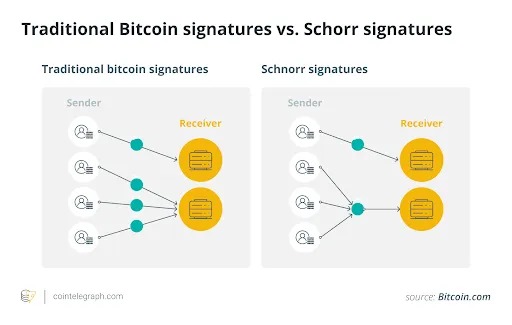

2. Upgrades like Taproot quietly expanded Bitcoin’s utility: Taproot wasn’t marketed as a DeFi upgrade, but it provided the cryptographic foundation BTCFi needed—cheaper multisig, flexible key-path spending, better privacy. More importantly, it enabled architectures like Taproot Assets (for stablecoins) and advanced vault systems.

3. Native Bitcoin assets emerged: With Taproot and newer proof systems, projects began launching assets based on Bitcoin or secured by Bitcoin—without wrapping BTC.

Combining Taproot, Schnorr signatures, and new off-chain verification techniques, developers can now build assets on Bitcoin itself or ones that directly inherit Bitcoin’s security.

This includes:

-

Taproot Assets (Tether minting USDT directly on Bitcoin / Lightning Network stack)

-

Bitcoin-native stablecoins not reliant on Ethereum, Solana, or Cosmos

-

Synthetic assets backed by BTC without custodial pegs

-

Programmable vaults and multisig structures previously impossible

Assets issued via Bitcoin can now be used without ever leaving Bitcoin—and without requiring Bitcoin to leave self-custody.

4. Bitcoin yield becomes possible: Bitcoin itself never had yield. Historically, the only ways for Bitcoin to “earn” yield were wrapping it, sending it to custodians, lending it on centralized platforms, or bridging it to other blockchains—all risky and fully脱离 Bitcoin’s security model.

BTCFi introduces a completely new way to earn yield on Bitcoin. How? By creating systems where Bitcoin contributes to network security. This gives rise to three types:

Bitcoin staking (for other networks): BTC can now secure PoS networks or app chains without leaving Bitcoin.

Bitcoin restaking: Similar to how Ethereum can protect multiple protocols via shared security, Bitcoin can now serve as collateral to secure external chains, oracles, DA layers, etc.

Lightning-based yield systems: Protocols like Stroom allow BTC used in Lightning channels to earn yield by providing liquidity—again, without wrapping or relying on custodial bridges.

All of this was impossible before BTCFi.

5. Bitcoin finally gains an execution layer: Recent advances in off-chain verification enable Bitcoin to enforce computational outcomes it does not execute itself. This allows developers to build rollups, bridges, and contract systems around Bitcoin that rely on it for validation, not computation. The base layer stays unchanged, while external layers run logic and prove correctness to Bitcoin when needed.

This gives Bitcoin unprecedented capability: supporting applications, contract-like behavior, and new financial primitives—without moving Bitcoin into custodial systems or rewriting the protocol. It’s not “smart contracts on Bitcoin,” but a verification model that preserves Bitcoin’s simplicity while enabling more complex systems around it.

BTCFi Overview: What’s Being Built

With mature underlying verification and portability tools, the Bitcoin ecosystem is finally expanding in ways that no longer rely on custodians or wrapped assets. What’s emerging isn’t a single product or category, but a stack of interconnected layers—giving Bitcoin, for the first time, a fully functional economic system. The easiest way to understand this is to see how these components complement each other.

Infrastructure Layer: The first major shift is the emergence of secure execution environments for Bitcoin. These aren’t L1 competitors or attempts to turn Bitcoin into a smart contract platform. They are external systems handling computation, relying only on Bitcoin for verification. This separation is crucial. It creates space where lending, trading, collateral management, and even complex primitives can exist—without changing Bitcoin’s base layer. It also avoids the flaws of old models, where using Bitcoin meant handing it to custodians or trusting multisig. Now, Bitcoin stays the same; computation happens around it.

Assets & Custody Layer: Meanwhile, a new generation of Bitcoin bridges is forming—not the custodial, trust-heavy bridges of the last cycle, but ones built around verifiable outcomes. These systems no longer require users to trust a set of operators. Instead, they use challenge mechanisms and fraud proofs to automatically reject incorrect state transitions. The result is safer movement of Bitcoin into external environments without relying on fragile trust assumptions. More importantly, these bridges align with Bitcoin holders’ innate sense of security: minimal trust, minimal reliance.

Protocol Layer: With asset movement becoming safer, the next wave of innovation focuses on what Bitcoin can do within these environments. Yield markets and security markets emerge here. For most of Bitcoin’s history, earning yield required giving up custody or wrapping into other chains. Now, staking and restaking models let Bitcoin contribute to external network security without leaving user control. Yield isn’t derived from credit risk or rehypothecation, but from the economic value of maintaining consensus or verifying computation.

At the same time, native Bitcoin assets are emerging. Developers are no longer wrapping Bitcoin or migrating to Ethereum. Using Taproot, Schnorr signatures, and off-chain verification, they’re issuing assets on Bitcoin or anchoring them to Bitcoin’s security. This includes stablecoins minted directly on Bitcoin’s infrastructure, synthetic assets without custodians, and vault structures with flexible spending conditions. All expand Bitcoin’s utility without importing foreign trust models.

Each of these developments is interesting on its own. Together, they mark the birth of the first coherent Bitcoin financial system. Computation happens off-chain and is enforced on Bitcoin. Bitcoin moves securely without custody. It earns yield without leaving self-custody. Assets exist natively, secured by Bitcoin without relying on other ecosystems. Each advancement solves a different piece of the decade-long liquidity trap that has plagued Bitcoin.

My Take?

I think the simplest way to view BTCFi is this: Bitcoin finally has an ecosystem matching its scale. For years, people tried building Bitcoin’s ecosystem using tools never meant to support trillion-dollar liquidity. No serious Bitcoin holder would stake their BTC on custodial pegs, unproven bridges, or makeshift sidechains—and they didn’t.

This wave is different because it meets Bitcoin on its own terms. The security model remains intact, self-custody remains intact, and the surrounding systems are finally robust enough to carry meaningful capital. Even if a small fraction of dormant BTC starts moving because the infrastructure has finally caught up, the impact will be profound.

This new wave is different because it addresses the challenge on Bitcoin’s own terms. The security model stays unchanged, self-custody remains intact, and the systems around Bitcoin are finally strong enough to handle significant capital flow. Even if just a small portion of sleeping Bitcoin begins to move as infrastructure matures, the implications will be substantial.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News