Bitcoin RGB Protocol: The Ultimate Form of Smart Contracts?

TechFlow Selected TechFlow Selected

Bitcoin RGB Protocol: The Ultimate Form of Smart Contracts?

This article will unveil the world of Bitcoin smart contracts and discuss how they have evolved into a vast ecosystem built on top of the network.

This research report is jointly produced by Infinitas and LK Venture

Author: Echo | Infinitas; Leo | LK Venture

Supervisor: Hong Suning

Introduction

While most people associate Bitcoin with money, it has another lesser-known but significant use case — smart contracts. Smart contracts are foundational to Bitcoin and were first proposed by Nick Szabo in 1995. They refer to computer protocols designed to execute, verify, or enforce the negotiation or performance of a contract. At their core, they are contracts rather than intelligent code. Smart contracts enable trusted transactions without third parties, achieving automated trust and self-executing agreements without assistance from central authorities, thus offering a more secure and convenient way to execute contracts compared to traditional ones.

Before exploring Bitcoin's RGB protocol and its potential role in smart contracts, it's worth noting that the concept of "smart contracts" itself remains controversial. Vitalik Buterin, co-founder of Ethereum, expressed regret in 2018 about using the term “smart contracts” to describe Ethereum’s core functionality. Buterin suggested that a more technically accurate and mundane term—such as “persistent scripts”—would better reflect their nature as continuously running programs. This highlights that even among blockchain pioneers, there are differing views on how to define and understand smart contracts.

In this article, we will uncover the world of Bitcoin-based smart contracts and discuss how they have evolved into vast ecosystems built atop the network.

What Limits the Development of Smart Contracts?

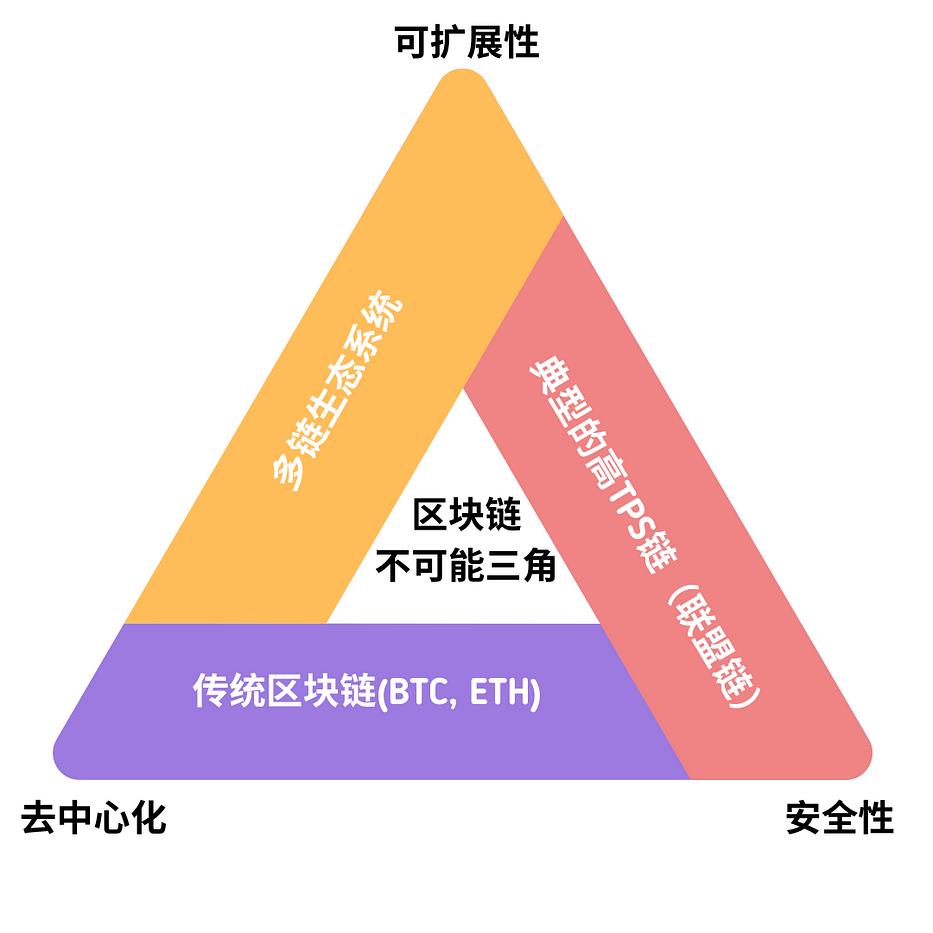

The concept of the blockchain trilemma was introduced by Ethereum founder Vitalik Buterin, referring to the idea that blockchains cannot simultaneously achieve all three of the following goals: decentralization, security, and scalability. Similarly, smart contracts face their own trilemma: decentralization, scalability, and Turing completeness. Although Bitcoin and Ethereum share many similarities, long-term vision differences and constraints have led them to become two distinct blockchain networks.

Comparison between Bitcoin and Ethereum

Ethereum has long struggled with scalability. Its low throughput and slow processing speed stem from prioritizing decentralization and security over scalability (the scalability trilemma). Precisely because Ethereum faces bottlenecks in scalability, despite being Turing-complete, it still falls short of representing the ultimate form of smart contracts.

How Does Bitcoin Overcome the Scalability Challenge of Smart Contracts?

Bitcoin’s on-chain scalability has always been a persistent challenge. To implement smart contract solutions on Bitcoin, they must either be created directly on the main chain or built upon layer-two scaling solutions. In recent years, layered scalability solutions such as the RGB protocol have enabled rapid iteration of Bitcoin’s smart contract capabilities, effectively addressing the scalability constraint within the trilemma.

The Blockchain Trilemma

Smart Contracts on the Bitcoin Main Chain

Bitcoin’s scripting language, Script, is overly simplistic, making it difficult to deploy complex smart contracts at the base layer. Since its inception, Bitcoin has been designed to be simple and relatively immutable to ensure the integrity and longevity of the blockchain. While protocol upgrades occur periodically, they do not imply fundamental changes to the blockchain but rather provide minor improvements at the margins.

Nevertheless, Bitcoin’s underlying layer retains several fundamental smart contract functionalities.

• Pay-to-Public-Key-Hash (P2PKH)

Pay-to-Public-Key-Hash is a common contract used in Bitcoin transactions. This script creates a contract executed by a public key and signed by the corresponding private key.

• Multi-signature (Multisig)

A multi-signature address requires approval from multiple parties before a transaction can be completed. It is commonly used to enforce agreements between parties, where a predefined number of signatures must be collected to release funds or perform certain operations.

• Hash Time-Locked Contracts (HTLC)

Hash time-locked contracts are conditional Bitcoin transactions with time-bound contingencies. These time limits are hard-coded; BTC is only released at specific times, dates, or blocks. If certain conditions in the contract are not met before the preset deadline, the transaction is canceled.

• Discreet Log Contracts (DLC)

DLCs leverage oracles to enable trustless peer-to-peer transactions. These oracles assess real-world event outcomes and provide off-chain information for Bitcoin smart contracts. DLCs are most often used when two counterparties commit to a financial agreement based on future results.

• Pay-to-Taproot (P2TR)

Pay-to-Taproot is a script for sending Bitcoin that introduces Merkle trees and Schnorr signatures. These transactions offer enhanced security, lower fees, and greater flexibility. This type of contract was recently implemented due to the Taproot upgrade.

Advantages of Layered Execution for Bitcoin Smart Contracts

The uniqueness of Bitcoin layers lies in their ability to introduce new functionalities to the network without modifying the main chain. Innovations and experimental developments can be introduced without altering Bitcoin’s core code, allowing Bitcoin’s foundation to remain simple and unaffected by what is built on top.

All Bitcoin layer transactions are ultimately settled on Bitcoin’s base layer, meaning the history of every transaction is recorded on Bitcoin’s ledger. The degree of validation distinguishes blockchains from other networks—altering a layer transaction requires changing the main chain transaction.

Layered execution of Bitcoin smart contracts offers several key advantages.

• Enhanced programmability: Layered smart contracts overcome the limitations of Bitcoin’s scripting language by accessing their own global state, expanding the possibilities of what can be built atop Bitcoin.

• Higher scalability: Deploying smart contracts on scalable solutions significantly accelerates transaction processing. Currently, the base layer handles only about 5–7 transactions per second. Layered solutions can batch transactions before settling them on the main chain, greatly increasing Bitcoin’s throughput and viability as a scalable network capable of supporting millions of daily transactions.

• Improved efficiency: Enhanced scalability goes hand-in-hand with faster transactions and lower costs. Shorter block intervals accelerate confirmations, while transaction fees on layers are significantly reduced compared to the main chain. Additionally, layer transactions reduce congestion on the base layer, improving overall network performance.

Looking at the Bitcoin ecosystem, after completing SegWit, efforts have focused heavily on developing Layer 2 solutions such as the Lightning Network and sidechains. Due to the high complexity of Layer 1 scaling proposals, the community favors building new Layer 2 systems atop Bitcoin’s Layer 1—ensuring compatibility and avoiding impact on the core system while solving on-chain congestion. Thus, the imagination for Bitcoin smart contracts now centers on achieving Turing completeness.

Why the RGB Protocol Could Be the Ultimate Form of Smart Contracts?

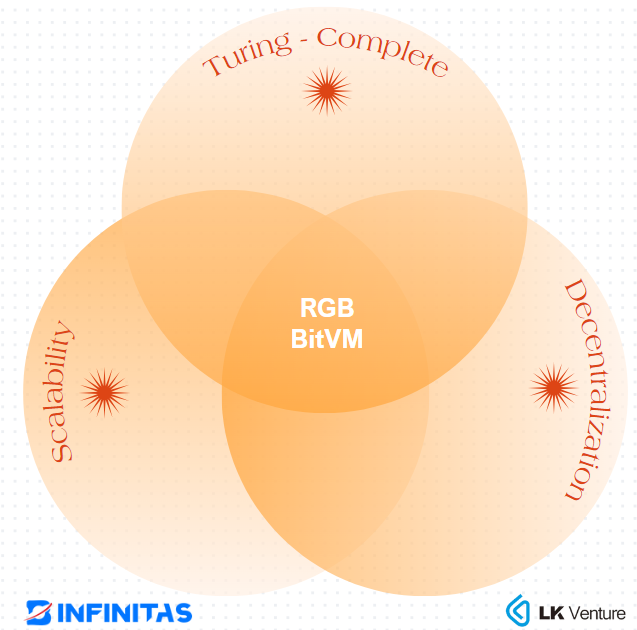

As a form of Bitcoin layer solution, the RGB protocol demonstrates immense potential for enabling large-scale future applications in the field of smart contracts. Among Bitcoin’s layer solutions, RGB and BitVM are currently the only two capable of balancing “scalability,” “Turing completeness,” and “decentralization.”

RGB is an open-source protocol based on Bitcoin, leveraging the Lightning Network (LN) to execute smart contracts. It operates atop Bitcoin’s Proof-of-Work (PoW) consensus layer. RGB utilizes the Lightning Network without requiring modifications to the protocol itself and enables the issuance and management of programmable and private assets. RGB addresses scalability by executing private smart contracts between two parties (e.g., LN channels). It was developed to improve upon colored coins and tokenize digital assets on the Bitcoin blockchain.

Client-Side Validation

One of RGB’s core features is client-side validation, a concept proposed by Peter Todd. Client-side validation is supported through RGB schemas—the method users employ to create smart contract agreements among parties. This validation approach leverages the strength and security of Bitcoin’s blockchain consensus mechanism while moving RGB’s smart contract code and data off-chain. Given Bitcoin’s limited capacity to support smart contract execution environments, RGB moves execution and verification off-chain. Notably, RGB transactions are not included in Bitcoin or Lightning transactions, allowing participants to benefit from the security of Bitcoin’s consensus layer while gaining increased flexibility and scalability.

In addition to storing transaction data off-chain, RGB transactions are assigned to UTXO sets secured with one-time seals to lock Bitcoin transaction outputs—a further security measure. Seals prevent different parties from presenting conflicting versions of the same data, thereby enabling authorized parties to verify the historical state of a smart contract.

RGB Smart Contracts, Architecture, and Validation

An RGB smart contract consists of states, owners, and operations that participants can execute to update the state. The schema in RGB defines each state validation rule at the genesis level, ensuring that each subsequent state owner uses the same schema to validate history. This guarantees social consensus, verification, and the validity of the smart contract state.

The core validation logic uses Rust—an algorithmically deterministic smart contract language equivalent to a Turing machine. All contract-specific validation logic runs on the AluVM (Algorithm & Logical Unit Virtual Machine), a highly deterministic and fault-resistant virtual machine providing a platform-independent instruction set.

Other approaches enabling Turing-complete Bitcoin smart contracts:

• BitVM: Released in October 2023, BitVM adopts a Rollup-like approach by executing complex programs off-chain and submitting critical proofs on-chain. Like RGB, BitVM aims to bring Turing-complete smart contracts to Bitcoin. However, BitVM demands extremely high computational power, rendering it theoretically feasible but practically challenging. Its scalability and commercial viability require further exploration.

RGB and BitVM overcoming the smart contract “impossible trinity”

Conclusion

Bitcoin is a decentralized “digital gold,” but it is also a platform for executing smart contracts. Currently, a large amount of Bitcoin remains idle. Approximately 76% of the Bitcoin supply is illiquid and lacks transaction history. Through smart contract expansion, there is an opportunity to elevate Bitcoin’s productivity to new levels. With Bitcoin-layer protocols like RGB that integrate Turing-complete smart contract capabilities, developers can program more smart contracts onto the network, accelerating Bitcoin’s mainstream adoption as both a store of value and a financial services layer.

As a highly decentralized, secure, and durable blockchain, Bitcoin could serve as the foundation for a broader range of on-chain economic activities in the future. We believe Bitcoin may soon emerge as a leading ecosystem for smart contracts, decentralized applications, and Web3 infrastructure. In this evolving landscape, Bitcoin’s role and capabilities may surpass our current imagination—just as our understanding of the term “smart contract” continues to evolve and deepen over time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News