Who Caused ORDI's Rollercoaster Ride? It Turns Out the Exchanges Hold All the Chips

TechFlow Selected TechFlow Selected

Who Caused ORDI's Rollercoaster Ride? It Turns Out the Exchanges Hold All the Chips

This article will reveal the two main reasons behind ORDI's roller-coaster price movements and analyze its subsequent market outlook.

Author: Metaer,特邀作者 at Meta Era

Over the past week, a Bitcoin-based BRC-20 meme coin called "ORDI" has drawn significant attention from the crypto community due to its extreme price volatility.

According to data from Coingecko shown in the chart above, ORDI, which had been hovering around $20 for over a month, began rising steadily and entered the $40 range on November 5—nearly doubling. But the market wasn't satisfied. Just one day later, it broke through $60, reaching an all-time high of $61 on November 6 with a single-day gain exceeding 50%. However, this rally didn't last long. From November 7 to 8, ORDI's price fell sharply below $50, dropping more than 25%.

Two Key Reasons Behind ORDI’s Rollercoaster Ride

1. Potential Bull Market Signal Fuels ORDI Surge

Frankly speaking, many users in the crypto community mistakenly believe ORDI—the meme coin built on Bitcoin—is the native token of the Ordinals protocol. Although this misconception was quickly corrected, ORDI’s price remained stagnant for quite some time. If you compare the two market trend charts below, you’ll notice that ORDI started gaining momentum in early November, coinciding almost exactly with Bitcoin’s recovery and entry into the next bull cycle. In recent days, as Bitcoin surged past $44,000, ORDI’s price increase has been striking.

2. Bitcoin Core Developer Luke Dashjr’s Criticism Triggers ORDI Sell-off

On December 6, Bitcoin core developer Luke Dashjr claimed on social media that “inscriptions” are exploiting a vulnerability in Bitcoin Core—the main Bitcoin client software—to flood the blockchain with spam data. Since 2013, Bitcoin Core has allowed users to set limits on the size of extra data included when relaying or mining transactions. By disguising their data as executable code, inscriptions bypass this restriction. If this loophole is patched, both Ordinals and BRC-20 tokens could cease to exist.

Currently, the Bitcoin ecosystem is divided into two major camps: core developers and miners. Developers focus on maintaining the software, while miners operate the network—similar to how Vitalik Buterin and the Ethereum Foundation represent developers in Ethereum, while miners run the network.

Developers and miners sometimes disagree, but in most cases, core developers hold greater influence over the direction of the network. Generally speaking, rising ORDI prices benefit Bitcoin miners, especially given the limited use cases in today’s Bitcoin ecosystem, as they can earn higher transaction fees during an ORDI-driven “bull run.” In contrast, developers tend to be purists—technically driven individuals focused on preserving the integrity and long-term vision of the protocol. For example, at the end of 2022, Vitalik Buterin and the Ethereum Foundation executed the Ethereum 2.0 “Shanghai” upgrade, which effectively phased out all Ethereum miners. Therefore, when Luke Dashjr voiced his opposition, the outcome was predictable: from November 7 to 8, ORDI’s price plummeted below $50, falling over 25%.

Are ORDI Tokens Concentrated in Exchanges?

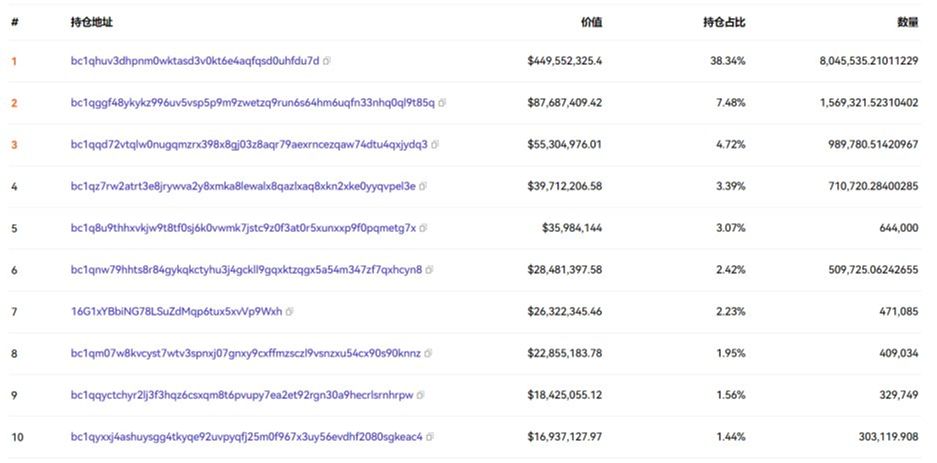

On December 7, media reports revealed that the top 30 ORDI holders collectively own 16.78 million ORDI (approximately $950 million), accounting for 79.94% of the total supply. However, the reality may be different. Analysis of the top ten ORDI addresses shows that five of them belong to centralized exchanges such as Binance, OKX, and Gate, indicating a shift in ORDI market dynamics—from being primarily driven by minting activity toward exchange-dominated trading. This suggests that ORDI’s token distribution has largely consolidated within exchanges.

Another notable point is that none of the top ten ORDI holding addresses are linked to minting activity. The largest minter-held address ranks only between 19th and 27th. Back in May, nearly half of the top 20 ORDI holdings were held by minters. This clearly indicates a shifting battlefield for ORDI.

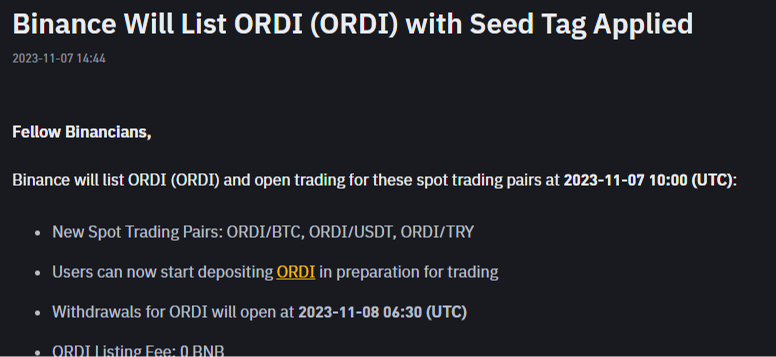

In fact, major exchanges anticipated this trend early on and began positioning themselves strategically. For instance, OKX announced support for ORDI deposits as early as May, followed by Binance listing ORDI on November 7—about a month before ORDI’s explosive price surge.

According to available data, Binance currently holds the largest share of ORDI tokens, owning at least 38.4%, making it the single largest holder. OKX follows with at least 12.2%, while other exchanges like Gate, Bybit, and MEXC collectively hold around 10%. (Note: Due to the lack of labeling on the Bitcoin network, there may be some uncertainty regarding specific addresses.)

What Impact Will the ORDI Craze Have on the Bitcoin Ecosystem?

Undeniably, ORDI’s price fluctuations have sparked massive interest across the crypto community and brought wider attention to the Bitcoin ecosystem. So, what impact could the ORDI phenomenon have on Bitcoin?

First, ORDI’s emergence enhances Bitcoin’s value proposition, transforming it from merely a store of value into a platform capable of supporting broader applications. It injects new vitality into the Bitcoin ecosystem and promotes further development.

Second, ORDI has accelerated the growth of the inscription sector and may even catalyze the development of Layer 2 networks on Bitcoin. Users could leverage Layer 2 solutions to create off-chain transaction channels, processing transactions off-chain to improve scalability and throughput while reducing costs.

Currently, inscription protocols utilize Bitcoin’s Layer 1 to mint NFTs, allowing users to embed data directly onto the Bitcoin blockchain—including Ordinals (numbering of satoshis) and Inscriptions (engraving arbitrary content onto satoshis). These effectively create native non-fungible tokens (NFTs) on Bitcoin. While this increases transaction volume on the network, it also risks imposing additional strain. To address these challenges, Layer 2 networks built atop Bitcoin’s main chain may begin to emerge.

Notably, Binance announced integration with the Bitcoin Lightning Network back in July, enabling users to deposit and withdraw Bitcoin directly using this Layer 2 scaling solution. Looking back, this move appears to have been a strategic preparation for supporting ORDI-related transactions. The ORDI craze will undoubtedly attract more development teams to build foundational infrastructure on Bitcoin L2. Combined with the upcoming Bitcoin block reward halving, the growth of Bitcoin’s Layer 2 networks is poised to draw increasing attention.

Of course, for any emerging project or protocol, sustainability and market acceptance remain uncertain. In the current market environment marked by strong early-bull momentum, volatility is common, and participants should proceed with caution. Nevertheless, the ORDI surge has successfully drawn more attention to Bitcoin ecosystem development. If innovative and compelling narratives—such as advanced Layer 2 solutions or new application forms—can emerge, it would undoubtedly benefit the entire crypto industry. Let’s wait and see!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News