In-Depth Analysis of BRC-20 Leading Projects $MUBI and $ORDI

TechFlow Selected TechFlow Selected

In-Depth Analysis of BRC-20 Leading Projects $MUBI and $ORDI

With the recent rise in Bitcoin's price, particularly in the Asian region, BRC-20 tokens and their Ordinals have seen a significant surge in popularity over the past six months.

Author: 0xGreythorn

What is BRC-20?

BRC-20 can be seen as Bitcoin's version of ERC-20 (very similar, yet with some differences). It was introduced in March 2023 by an anonymous developer named Domo. This technology stems from Bitcoin’s SegWit soft fork (2017) and the Taproot upgrade (November 2021).

How Are Ordinals Created?

Ordinals are created by inscribing a number onto the smallest unit of Bitcoin, the satoshi (or "sat"). This ordinal number and its associated data are embedded within the "witness signature" field of a Bitcoin transaction. This data confirms ownership of the spent funds and ensures they are not double-spent.

Unlike ERC-20, BRC-20 remains in a proposal stage, and trading of these tokens on decentralized exchanges is limited. In fact, most trading occurs primarily on centralized exchanges such as Binance, OKX, and Bybit. With the recent rise in Bitcoin's price—especially in Asia—the popularity of BRC-20 tokens and their Ordinals has grown significantly over the past six months.

Key Insights (Ordinals ≠ BRC-20)

Ordinals and Bitcoin “NFTs”

Ordinals is an NFT protocol built on the Bitcoin network. By assigning a unique and immutable identity to each satoshi (via ordinal numbering + inscription), Ordinals turns every otherwise fungible sat into a unique “NFT.” As a result, Ordinals adds higher collectible and trading value to individual sats. When the smallest Bitcoin unit becomes a new focal point, it can be viewed as a form of Bitcoin expansion.

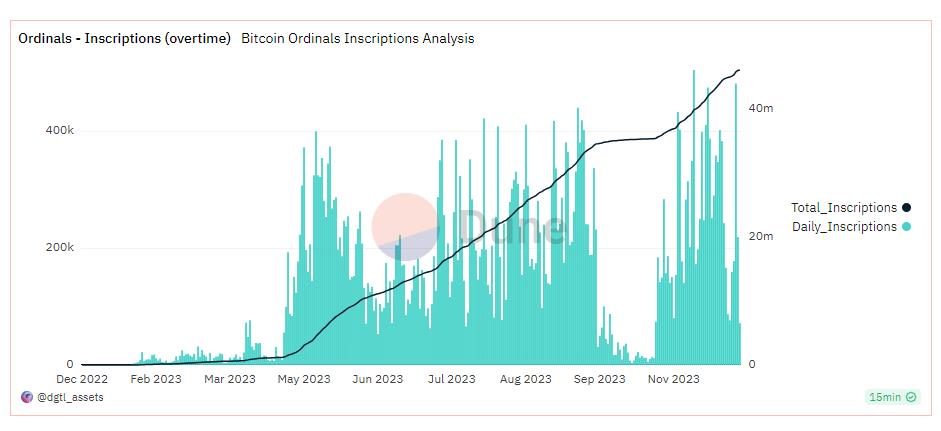

Since Ordinals were launched in December 2022, approximately 7.8 million NFTs and tokens had been minted by May 18, 2023, opening new doors for the Bitcoin ecosystem.

Figure 1. Ordinals - Inscriptions (Over Time), Source: Dune Analytics

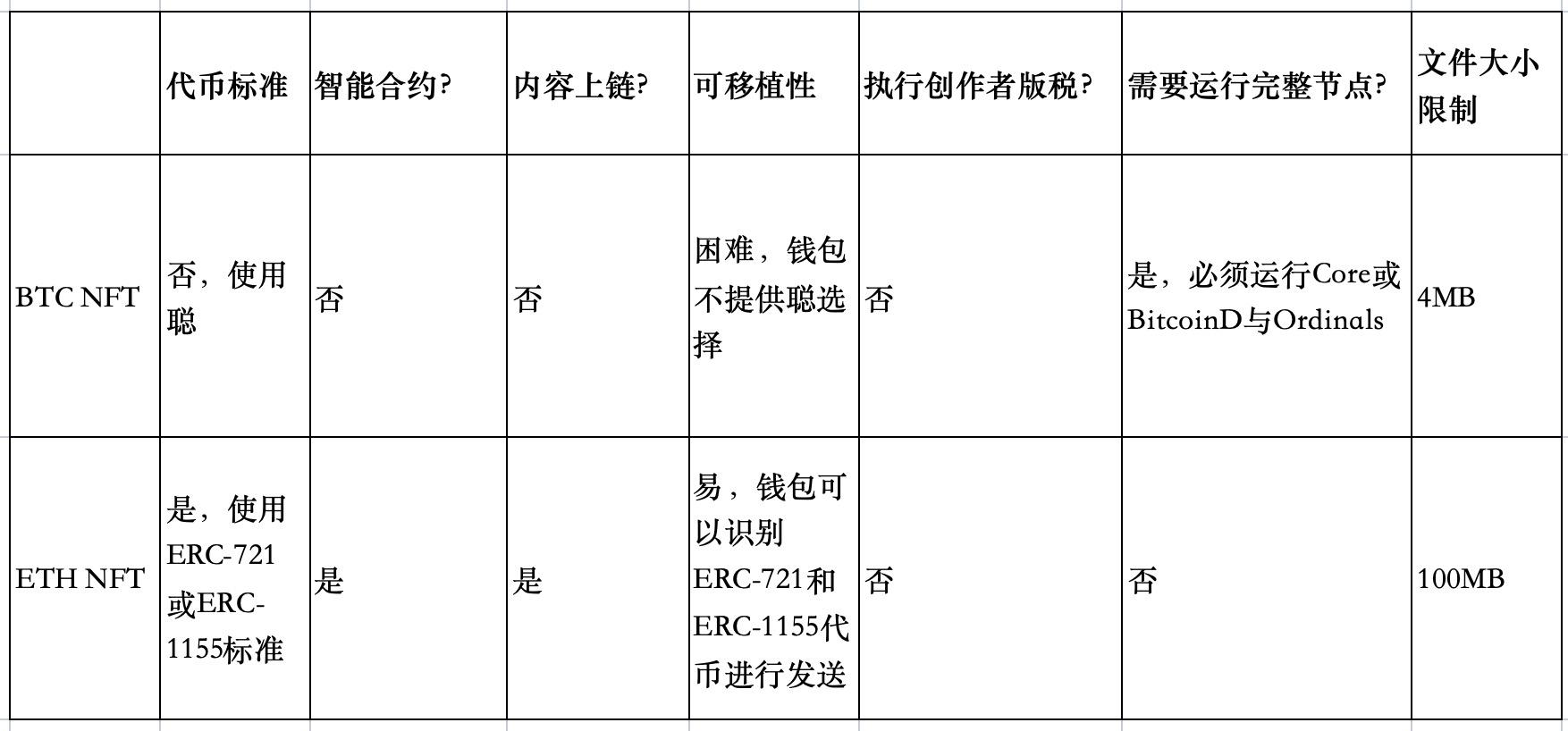

Unlike Ethereum-based ERC20 NFTs, Bitcoin NFTs minted via Ordinals are stored directly on the Bitcoin blockchain, making them closer to “true” NFTs—once published and verified on the network, their metadata cannot be altered. In contrast, ETH NFTs (ERC721 tokens) usually contain only an ID that points to a URL where metadata is retrieved, which may be changed at any time by teams controlling the smart contract keys or external parties.

Both methods of generating NFTs have their pros and cons, and the main differences between them are summarized in Figure 2 below.

Figure 2. Bitcoin NFT vs ETH NFT, Source: Galaxy Research

Although still in early stages, several notable NFT projects have entered the market. Yuga Labs’ “Twelvefold,” announced on February 27, 2023, received bids as high as 7.115 BTC. CryptoPunks also issued 10,000 Bitcoin Punks. Third-party nodes such as Ordinals Bot and Gamma help users mint Bitcoin NFTs without setting up full nodes themselves.

According to a report by Galaxy Digital, the Bitcoin NFT market could reach $4.5 billion by 2025. Additionally, infrastructure supporting Bitcoin NFTs is expected to mature in Q2 2023, reflected in various new bridging projects such as $VMPX and $MUBI, which we will introduce in this report.

BRC-20: The Evolution of Ordinals

It's worth noting that NFTs can be obtained by writing different information onto sats. So, what if we inscribe information following specific rules or standardized formats (i.e., deployment, minting, and transfer)? Could we generate fungible tokens (FTs) on Bitcoin? The answer is yes.

BRC-20 is a technology that leverages Ordinals to create and trade fungible tokens (FTs) on the Bitcoin blockchain. Simply put, BRC-20 can be considered a mutated form of Ordinals NFTs. While NFT inscriptions typically involve images, BRC-20 inscriptions use uniformly formatted JSON text data. In BRC-20, inscriptions also serve as the ledger for tracking token transfers. However, BRC-20 tokens cannot interact with smart contracts or execute automated operations.

$ORDI, the first token issued under the BRC-20 standard (March 9, 2023), allowed a maximum mint of 1,000 tokens per transaction, with a total supply capped at 21,000,000. Initially, $ORDI was free to claim—users only needed to pay miner fees. All 21 million $ORDI tokens were minted within less than 18 hours. As of May 22, 2023, the lowest secondary market price reached $11.48 per $ORDI. According to Dune Analytics, about 8.5 million $ORDI tokens were minted, generating 1,458 BTC in miner fees.

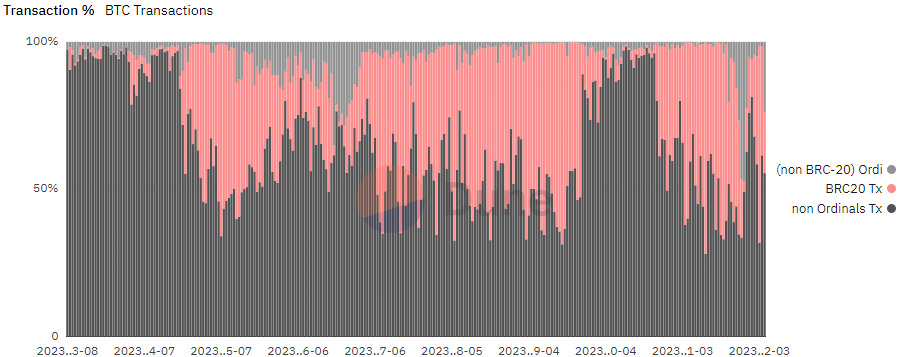

As reported by ordspace.org, as of May 19, 2023, there were over 18,000 BRC-20 token projects, with a total market cap of approximately $420 million. Over the past few months, BRC-20 protocol transactions have dominated activity on the Bitcoin network, sometimes exceeding 50% of total Bitcoin transaction volume.

Figure 4. Percentage of Bitcoin Transactions, Source: Dune Analytics

How Does BRC-20 Affect Bitcoin and Its Ecosystem?

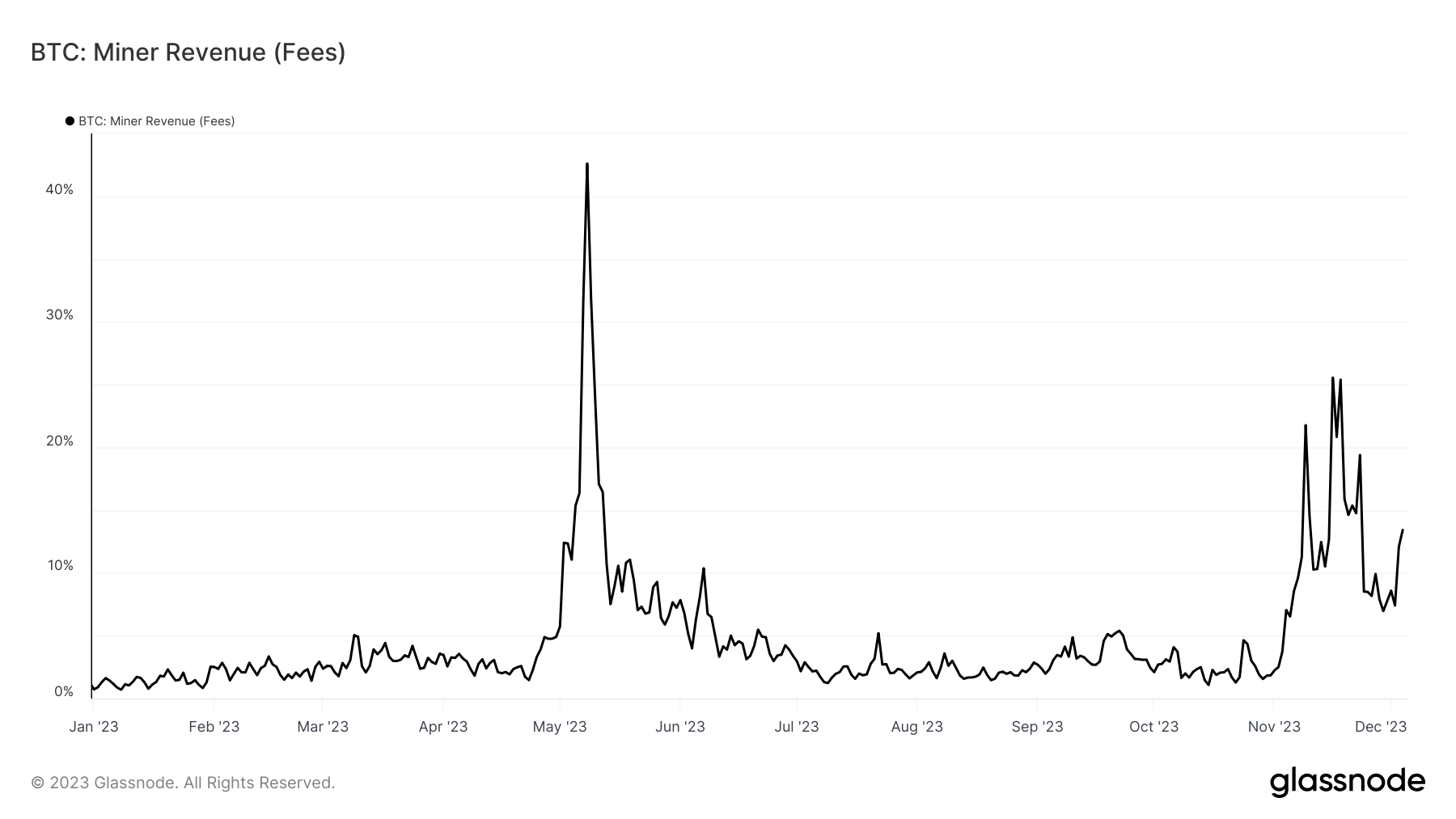

BRC-20 impacts Bitcoin miner fees and transaction dynamics. Because minting and transferring BRC-20 tokens require more blockchain space due to their complex design, competition for block space may lead users seeking fast confirmations to face higher transaction fees.

According to Glassnode data, miner revenue from fees peaked at 42.595% and rose again due to the popularity of $ORDI and new BRC-20 mints (e.g., initiated by $VMPR and $MUBI).

Figure 5. Bitcoin: Miner Revenue from Fees (%), Source: Glassnode

Advantages and Disadvantages of BRC-20 and Ordinals

Why the Hype?

- Compared to ERC-20

BRC-20 cannot interact with smart contracts (i.e., no burn or lock functions), meaning BRC-20 tokens cannot be hoarded by project teams or VCs. Everyone truly participates equally within the ecosystem.

BRC-20 is backed by Bitcoin, ensuring these tokens do not carry the risk of dropping to zero like many ERC-20 or sidechain ERC-20 tokens.

- The minting and trading of BRC-20 significantly increase transaction fees. High fees combined with block rewards generate substantial profits for miners.

- New narrative within a proven consensus: BRC-20 standards and the Bitcoin ecosystem represent novel concepts in the industry, easily attracting market sentiment and capital inflows. Leading institutions such as Yuga Labs and CryptoPunks have already entered the space.

- Bitcoin Beta Play: BRC-20 tokens are inherently created within the Bitcoin network and are currently treated by traders as a beta play for speculative investment, especially given Bitcoin’s sustained price increase over the past 12 months.

- Low market liquidity: For many BRC-20 tokens, both buyer and seller liquidity is low, leading to high volatility. Considering bullish sentiment toward Bitcoin, we believe industry trends will continue growing as Bitcoin gains broader adoption.

Potential Concerns

High barrier to user participation:

The BRC-20 standard is relatively complex, requiring additional data storage and transaction steps. Specifically, when users mint Ordinals, they must run a full node. Both the cumbersome node setup and expensive Bitcoin gas fees (for inscription and transfer) may deter retail investors from entering the market.

Security issues:

- There is no AMM on the Bitcoin chain, necessitating secure secondary market trading.

- As BRC-20 introduces more complex asset management mechanisms, it requires additional tools or platforms, which may be vulnerable to malicious attacks and contradict Bitcoin’s core principle—decentralization.

- Due to excessive transaction volume, Binance suspended withdrawals twice on May 7 and May 8. On May 8, 2023, no blocks were produced for one hour, leaving 350k transactions unconfirmed. When fee income consistently exceeds block rewards, time-bandit attacks may occur. Miners may prioritize high-fee transactions while ignoring lower-fee ones.

Most BRC-20 tokens are meme coins without real value or utility.

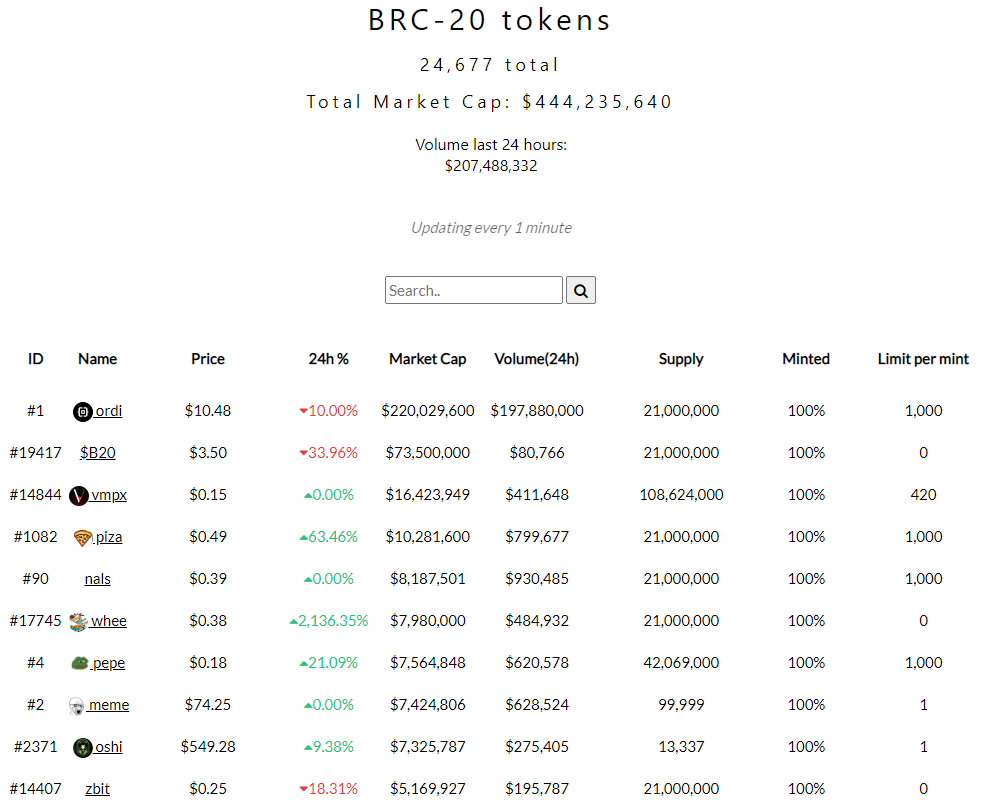

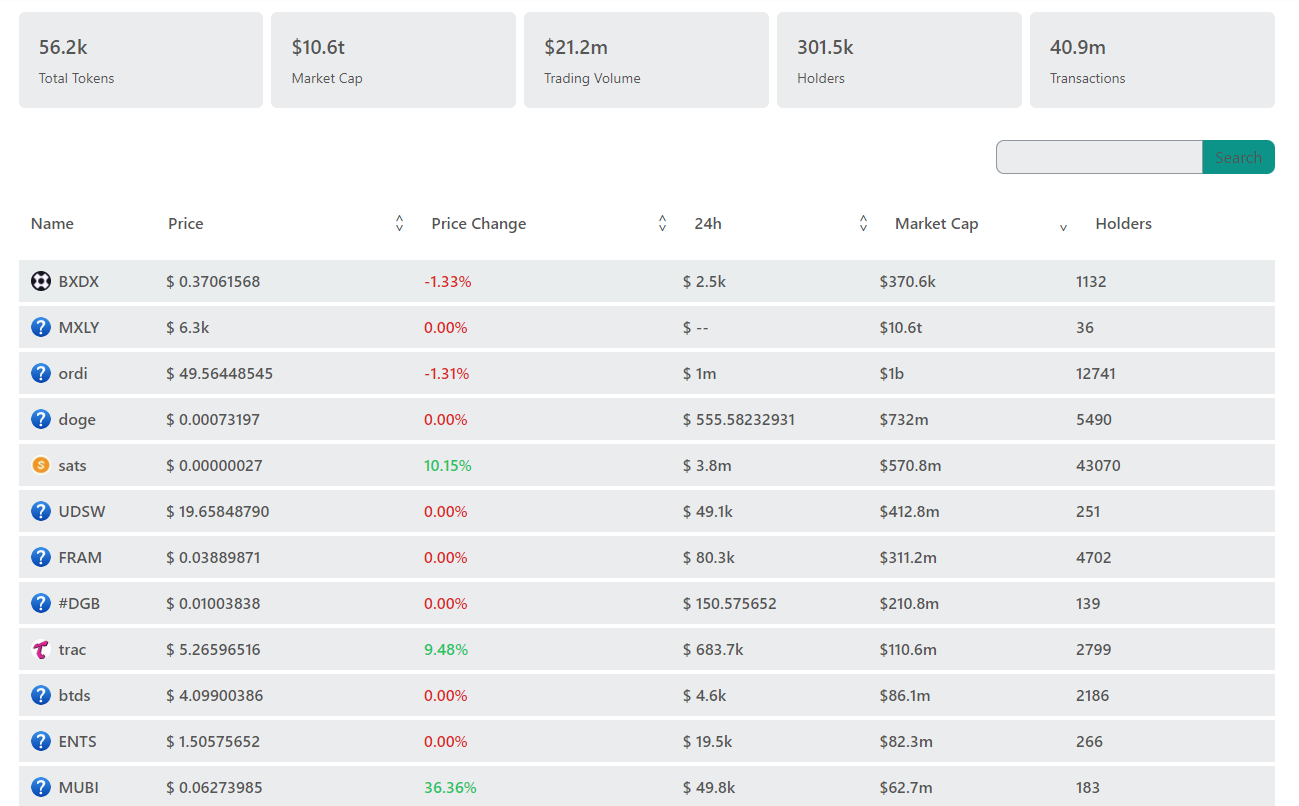

Comparing snapshots from May and December, we observe a “Cambrian explosion” of new BRC-20 projects within the ecosystem. However, only a few well-known projects have stood the test of time, including $ORDI, $MUBI, and $VMPX, some of which are now listed on tier-three exchanges. Excluding these, we note that the total market cap of BRC-20 tokens has grown from $444 million to over $2 billion today, as shown below (excluding MXLY, a scam token valued at $10.6 trillion).

Figure 6. Market Cap of BRC-20 Tokens, Source: brc-20.io (May 2023)

Figure 7. BRC-20 Token Market Cap Ranking, Source: brc-20.io (December 2023)

BRC-20 Infrastructure Is Still in Early Stages:

With only a few established projects and numerous scams/Ponzi schemes in the ecosystem, it is difficult to identify stable new projects suitable for retail markets. Although more mature projects like ORDI are emerging.

Regulatory Risks:

Bitcoin is more akin to a commodity, but BRC-20 tokens may facilitate an unregistered securities market on the Bitcoin blockchain.

Deep Dive: $MUBI and $ORDI

As mentioned above, several projects have emerged as leaders in the BRC-20 narrative. Within this ecosystem, we focus on Multibit, a project offering bridging solutions for compatibility between EVM chains, the Bitcoin network, and BRC-20/ERC721 assets. We also conduct an in-depth analysis of $ORDI, the primary driver behind the BRC-20 narrative.

MUBI: Multibit

Project Name: Multibit (Project Link)

Project Type: BRC-20 Token & Ecosystem Bridge

Blockchains: Bitcoin, Ethereum, BSC & Polygon

Token Ticker: MUBI

Crypto Rank: N/A

Max Supply: 903,586,439

Circulating Supply: 903,586,439

Market Cap / USD: $61,850,759

Fully Diluted Valuation / USD: $61,850,759

What is Multibit?

Multibit is the first bidirectional cross-chain bridge enabling transfers between BRC-20 and ERC-20 tokens. By facilitating easier mobility of these tokens, Multibit enhances cross-chain interoperability. Our mission is simple: securely and user-friendlily promote liquidity and accessibility for BRC and ERC tokens.

Investor and Fundraising Information

Funds Raised in Fundraising Round:

Initially freely mintable as a BRC-20 token on Bitcoin, the Multibit team reserved a portion of tokens for fundraising via the following link:

https://app.bounce.finance/launchpad/multibit

On Ethereum, Multibit’s initial fully diluted valuation (FDV) was $400,000 for 387.5 million $MUBI, allocated as follows:

- KOL Whitelist Sale: 11.25%

- Public Sale: 78.75%

- DEX Liquidity (indefinitely locked): 5%

- Team (6-month lock initially, followed by 2-year vesting): 5%

The fundraiser ultimately raised $196,075 at a price of $0.000506 per MUBI.

This means early investors achieved a 135x return on investment.

Tokenomics

In addition to the above fundraising allocation, all other MUBI tokens have been minted and are available as circulating tokens across the BRC-20 and EVM ecosystems.

Liquidity Channels

Centralized Exchanges (CEX):

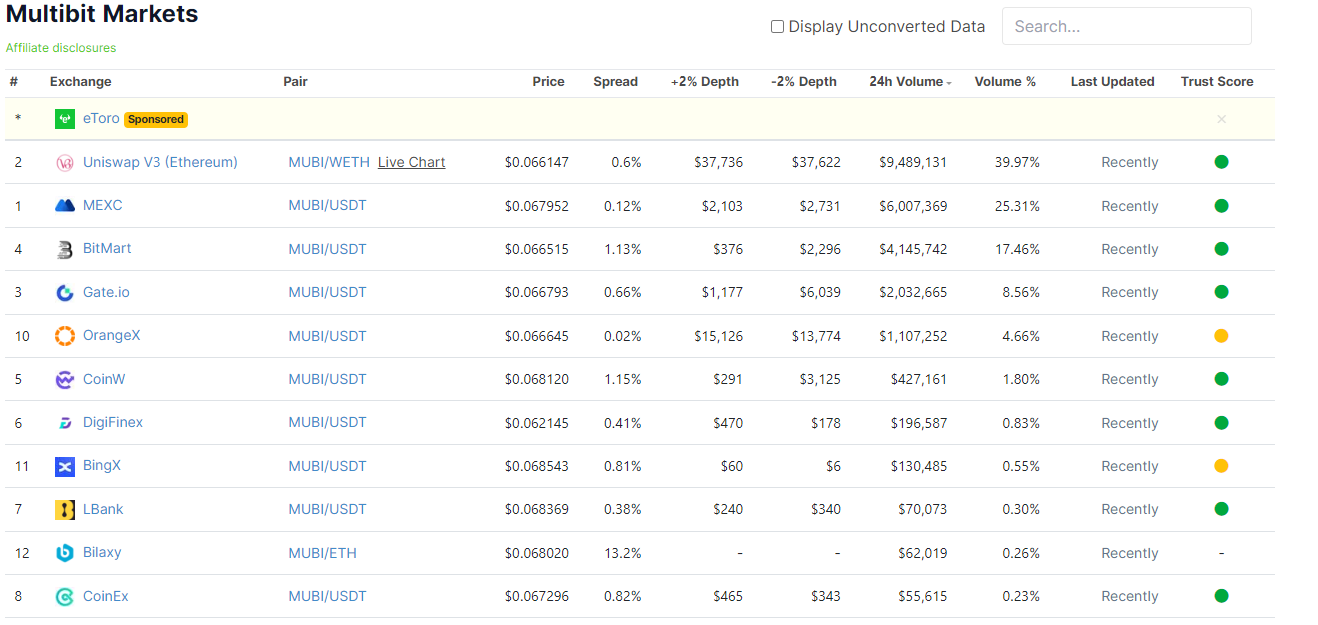

$MUBI is listed on major tier-two and tier-three exchanges, with primary trading activity concentrated on MEXC, Gate, and Bitmart.

DEX:

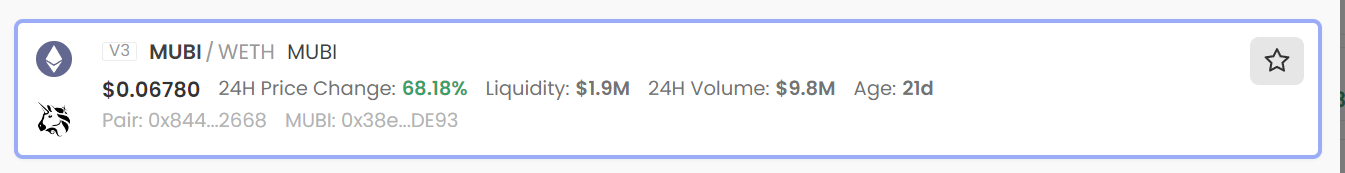

MUBI liquidity pools (LP) are primarily on Uniswap, with a total value locked (TVL) of $1.9 million on Ethereum L1.

Investment Opportunity (Market Potential)

- Bitcoin Beta Play - BRC20

As part of the BRC-20 token ecosystem, MUBI represents a low-market-cap Bitcoin beta play, ideal for market participants interested in investing in BRC-20 areas focused on bridging infrastructure and cross-chain liquidity.

- First BRC-20 Bridge & Market Leader in Bridging

As the first stable bridge connecting Bitcoin and other EVM chains, Multibit leads in bridging liquidity between ecosystems and bringing BRC-20 tokens to new chains.

Their bridging workflow is as follows:

Deposit Tokens

Your journey begins by depositing your Bitcoin RC-20 tokens (BRC20s) into a unique address provided by the Multibit protocol. Multibit verifies the token deposit transaction.

Mint Tokens

Upon successful verification, the Multibit protocol springs into action, minting an equivalent amount of tokens on Ethereum or the BNB Chain.

Security

The Multibit protocol periodically aggregates tokens from all assigned unique addresses. These tokens are securely transferred to a unified cold wallet.

Withdraw Tokens

When you're ready to withdraw, the Multibit protocol removes (“burns”) the corresponding amount of tokens from the EVM chain. Then, it sends an equivalent amount of tokens back to you from the secure cold wallet.

Surge in BRC-20 Adoption on EVMs

In recent days, transaction volumes across all EVMs have surged. Detailed analysis of input data in transaction hashes across each EVM indicates this growth is attributable to the introduction of Ordinals inscriptions. These protocols allow the minting of tokens inspired by Bitcoin Ordinals (BRC-20).

Notably, Ordinals on the Polygon network have gained significant attention and maintained dominance in daily transactions.

Conclusion

As the first project to bridge BRC-20 tokens between Bitcoin and EVM chains, Multibit has established itself as a market leader in infrastructure. As a Bitcoin beta play, MUBI is currently popular among the masses and serves as a potential asset for users to gain exposure to the BRC-20 token ecosystem.

Although early investors enjoyed relatively high returns, new investors should proceed cautiously, as supply is concentrated among early adopters of the bridge. Nevertheless, as long as Bitcoin continues to grow, $MUBI—as one of the few projects consistently increasing in total value locked,热度, and usage—will likely continue to appreciate alongside Bitcoin’s growth.

ORDI: Ordinals

https://www.coingecko.com/en/coins/ordi

Project Name: ORDI

Project Type: BRC-20

Blockchain: Bitcoin

Token Ticker: ORDI

Crypto Rank: 61

Max Supply: 21,000,000

Circulating Supply: 21,000,000

Market Cap / USD: $1,048,995,165

Fully Diluted Valuation / USD: $1,048,995,165

What is ORDI?

Ordi (ORDI) is the first BRC-20 token on Bitcoin, leveraging the Ordinals protocol to inscribe data onto sats. With a fixed supply of 21 million coins, Ordi introduces innovative possibilities for NFTs and tokens by assigning ordinals based on mining and transfer order.

Open-source initiatives on GitHub include the BIP for the ordinal scheme, sat tracking index, wallets supporting ordinal transactions, and block explorers. Despite lacking intrinsic value as a meme coin, Ordi’s novelty and innovation have driven significant market capitalization, marking it as a symbol of cryptocurrency innovation.

Investor and Fundraising Information

None; ORDI was freely mintable at launch, with effectively zero cost aside from the Bitcoin network gas fee paid by minter.

Funds Raised in Fundraising Round:

None

Tokenomics

A total of 21,000,000 ORDI were minted. In line with Bitcoin’s vision, ORDI is an idea and experiment by Domo on the Bitcoin network. All tokens were minted at genesis, so no new ORDI will ever enter circulation.

Detailed Info:

https://domo-2.gitbook.io/brc-20-experiment/

Liquidity Channels

Centralized Exchanges (CEX):

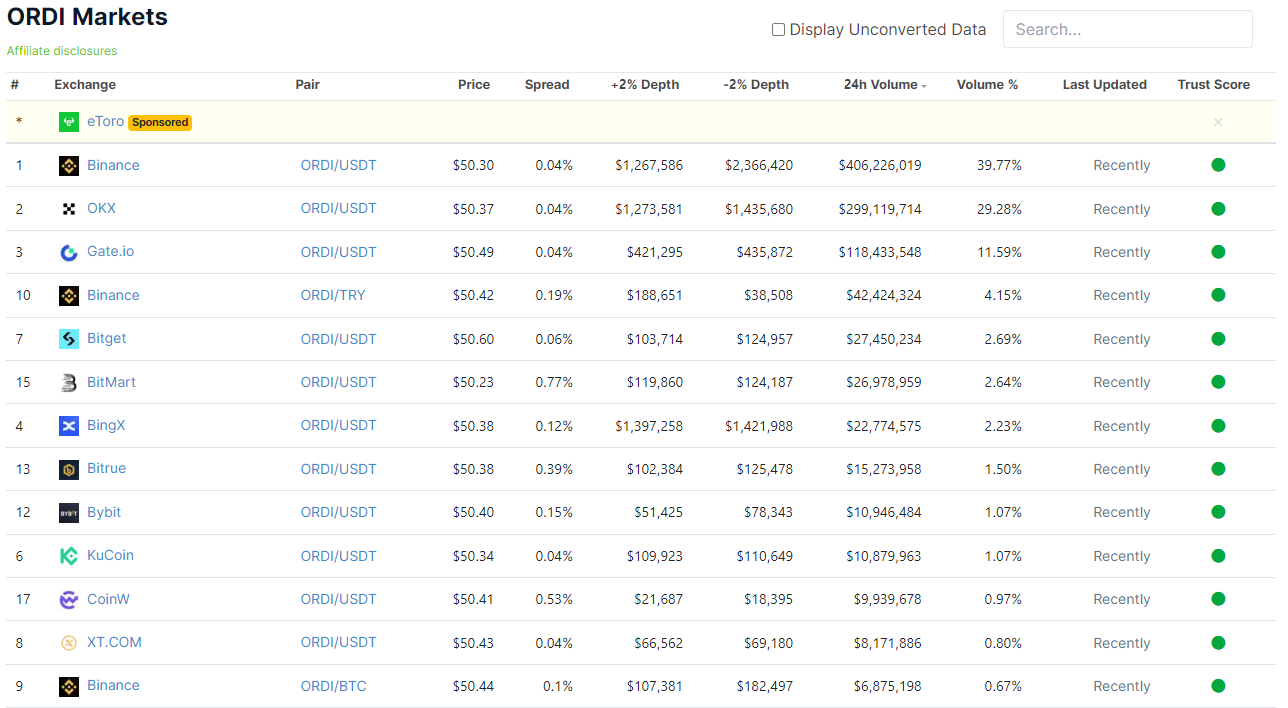

ORDI is listed on all major centralized exchanges, with primary trading activity on tier-one and tier-two exchanges such as Binance, OKX, Bybit, etc.

DEX: None

Investment Opportunity (Market Potential)

- BRC-20 Market Leader

As the first BRC-20 token and key infrastructure for other BRC-20 tokens on the Bitcoin network, $ORDI stands out in the market as the leading and oldest BRC-20 token.

- Bitcoin Beta Play - BRC20

As the #1 BRC-20 token and the most decentralized BRC-20 in the market, ORDI serves as a Bitcoin beta play for market participants interested in investing in deflationary assets within the Bitcoin ecosystem.

- Deflationary Narrative

With only 21 million tokens available and some already lost due to private key loss or transaction errors, a deflationary narrative dominates ORDI. Due to its limited supply, ORDI will experience net deflation over time, potentially increasing its value.

- Surge in BRC-20 Adoption on EVMs

Similar to $MUBI’s narrative, $ORDI also receives increased attention due to rising BRC-20 adoption on other chains (see previous $MUBI chart).

Conclusion

As the market-leading BRC-20 with limited supply and surging demand from centralized exchanges and on-chain token holders, ORDI has become a popular holding for investors bullish on Bitcoin who seek higher Bitcoin beta exposure.

Despite its popularity, due to its limited supply and current listing only on centralized exchanges, investors should exercise caution when investing in ORDI due to its highly volatile nature. Nonetheless, it remains the simplest asset for investors to gain exposure to the Bitcoin network and BRC-20 ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News