Inscriptions, Ordinals, and BRC-20 have made Bitcoin interesting again

TechFlow Selected TechFlow Selected

Inscriptions, Ordinals, and BRC-20 have made Bitcoin interesting again

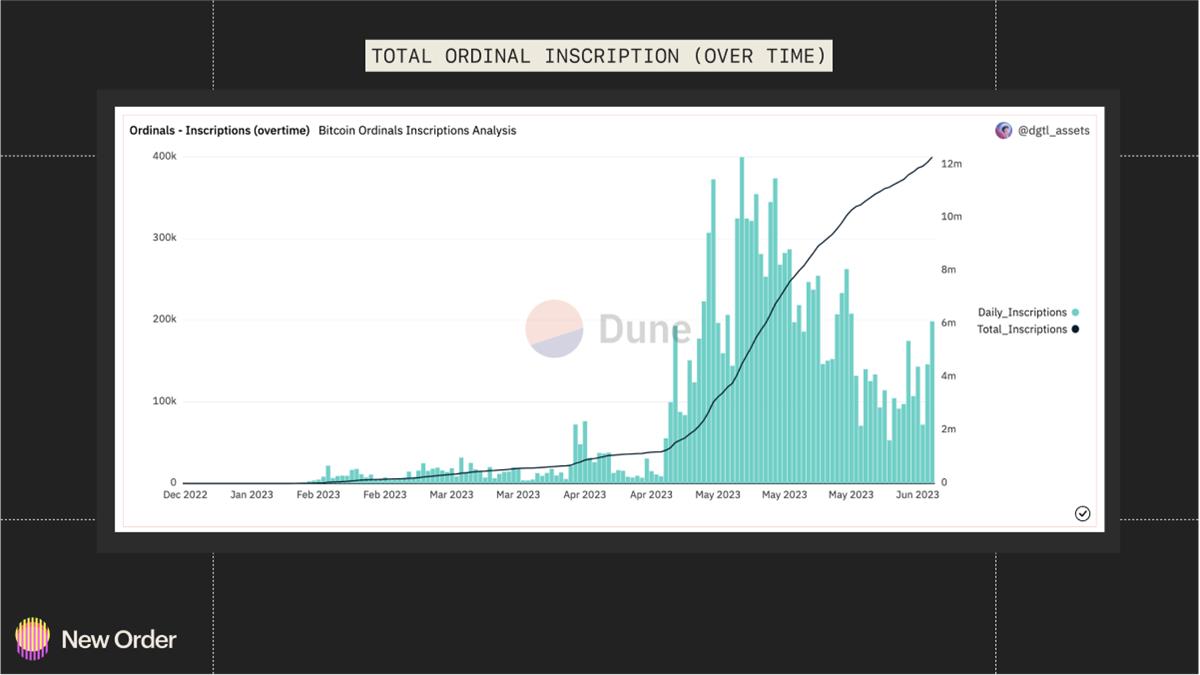

Bitcoin inscriptions have undergone a significant transformation, from "possibly nothing" in early 2023 to over 10 million inscriptions today.

Author: New Order

Translation: TechFlow

Ordinals and Inscriptions enable fungible tokens, non-fungible tokens, and other applications to be stored directly on the Bitcoin blockchain, sparking a wave of speculation comparable to the 2021 NFT bubble.

Bitcoin Inscriptions have undergone a remarkable transformation—from being dismissed as "possibly nothing" at the start of 2023 to surpassing 10 million inscriptions today. Notably, trading volume for Bitcoin Inscriptions has even exceeded that of prominent NFT platforms like Magic Eden. While comprehensive overviews of the evolving ecosystem of applications, NFTs, and tokenized assets on the Bitcoin network have been covered elsewhere, this article aims to explore the journey that brought us here and examine its potential future implications.

What Are Ordinals and Inscriptions?

Ordinals is a system that uniquely identifies and numbers individual satoshis (commonly referred to as "sats"). A satoshi is the smallest accounting unit in Bitcoin (100 million sats make up one bitcoin). The official Ordinals wallet software, called "ORD," functions as both a protocol client and wallet with unique capabilities. It assigns each satoshi an Ordinal based on specific details such as when, where, and how it was mined.

The ORD wallet is the canonical method for creating Inscriptions. This involves a two-step process—commit and reveal transactions—used to write data or metadata into the signature area of Taproot transactions. The purpose of this process is to create NFTs and, in some cases, fungible tokens.

Rarity within the Ordinals system is arbitrary, meaning assets such as NFTs, security tokens, accounts, or stablecoins can be associated with Ordinals. Alternative rarity criteria have already been proposed, including recognizing "early" sats mined during Bitcoin’s first year or prioritizing sats with unique mathematical properties, such as prime numbers or other distinctive characteristics. Recently, a market has emerged specifically selling "rare" sats—particularly the first sat in regular blocks—currently priced at 0.03 BTC or $750.

Echoes Through Time

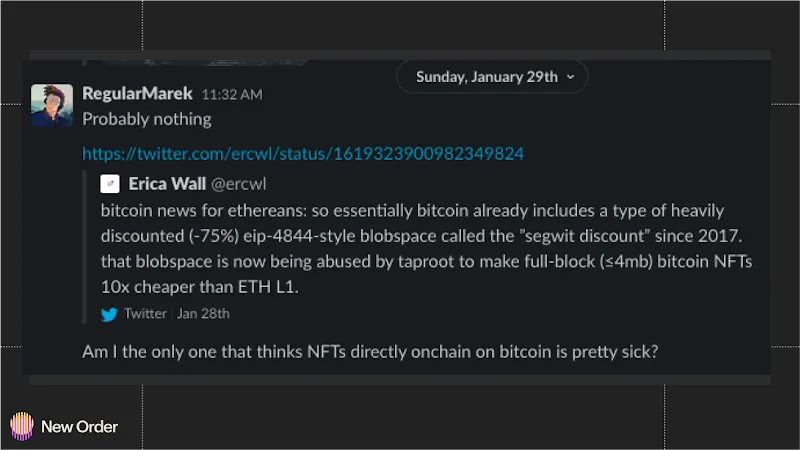

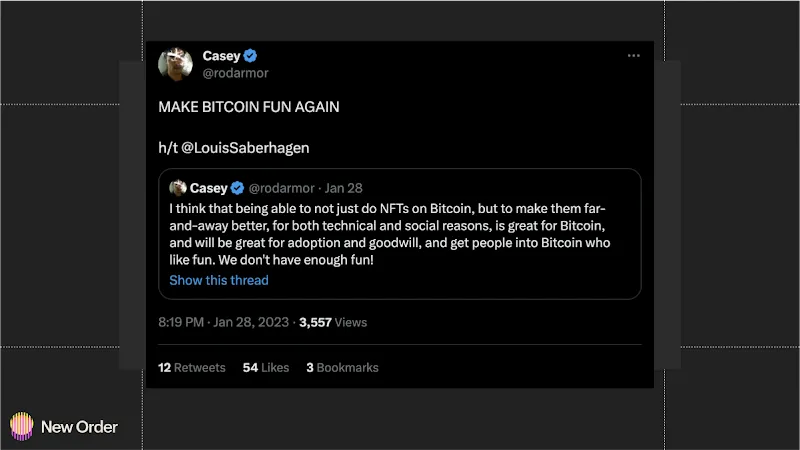

Despite their revolutionary nature, applications built directly on the Bitcoin blockchain had not been a focal point in recent memory—until late 2022, when Casey Rodarmor, inspired by prior work, numerology, and the fractal rhythm of the Bitcoin network, introduced the Ordinals theory. The official implementation via the "ORD" wallet suddenly enabled anyone running a Bitcoin node to create Ordinals Inscriptions. This represented a convergence of blockchain technology, digital artifacts, and digital identity, dramatically redefining the NFT landscape and ushering Bitcoin into a new era of utility and adaptability. Many Bitcoin supporters believe such innovation has made Bitcoin interesting again—including Casey himself.

Not all Bitcoin supporters are enthusiastic about applications on Bitcoin. Some view them negatively, arguing they could undermine Bitcoin’s core mission as a peer-to-peer electronic cash system. However, in recent months, Ordinals have gained significant momentum and attention within the space. Therefore, we believe it's essential—even from an observer’s perspective—to delve deeply into Ordinals.

Looking Back

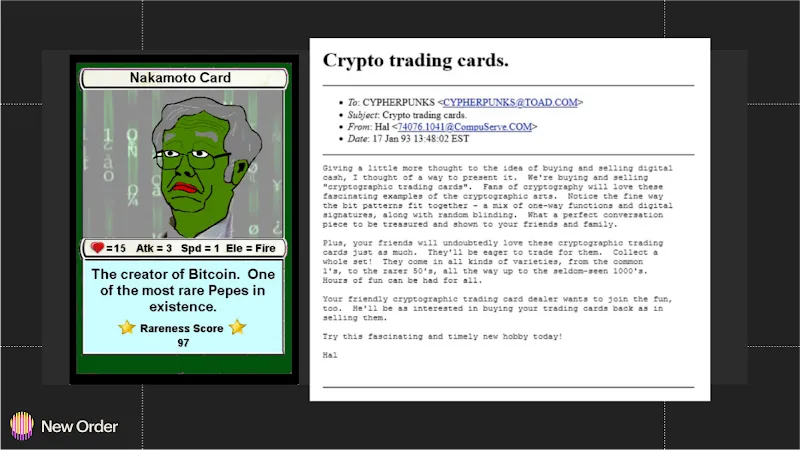

Although interest in Bitcoin-based applications surged culturally on crypto Twitter in early 2023, this enthusiasm did not originate then. Even before Bitcoin launched, the cypherpunk community showed interest in digital collectibles. In the screenshot below, legendary figure Hal Finney discusses the possibility of cryptography-related trading cards as early as January 1993:

Early Bitcoin clients themselves included applications from the outset, such as an initial version of a peer-to-peer poker game. In another notable case, Bitcoin pioneers Satoshi Nakamoto and Hal Finney were early advocates of BitDNS, a decentralized DNS application that eventually became a Bitcoin fork known as Namecoin. Namecoin itself played a role in the world of digital collectibles, as web archaeologists discovered the first instance of NFT art deployed on Namecoin back in 2014.

However, things changed with the introduction of the Counterparty Protocol (also known as XCP) in 2014. Built atop Bitcoin, this platform specialized in issuing both fungible and non-fungible tokens. Counterparty utilized a special non-spending transaction type called OP_RETURN to submit data onto the blockchain. XCP gained notable recognition later for releasing the famous Rare Pepes series—a satirical collection that didn’t take itself too seriously, fitting the fun-loving culture of early cryptocurrency. Centered around wizard characters, it featured poorly drawn mascots associated with the “Bitcoin Wizard” meme, when Bitcoin was affectionately called “magic internet money.”

Suddenly, resistance emerged from the developer community. It seemed Bitcoin wasn't ready for this—at least not at Layer 1—leading to what became known as the “OP_RETURN war.” XCP used 80 bytes to write state information, including hashes of its state, prompting Bitcoin developers—in what appeared to be a hostile move—to reduce the maximum size of OP_RETURN to 40 bytes, a restriction that lasted until 2016. Although XCP developers could work around the limitation, the reality of building applications on a platform facing developer hostility began to surface, ultimately halting further innovation.

Since Ethereum’s launch, most interest in decentralized or blockchain-based applications has shifted toward platforms offering supportive environments and official tooling. So what’s changed recently? Over the past few years, many average Bitcoin holders have adopted the attitude of “I don’t like many altcoins, but NFTs are cool,” often admitting to owning several of the latter.

Despite general sentiment within the Bitcoin community, ordinary Bitcoin users have experimented with digital collectibles on other platforms over the years. With the activation of SegWit (2017) and Taproot (2021)—two Bitcoin soft forks—the necessary enabling technologies were already in place. What followed next unfolded at an astonishing pace.

Inscriptions > Ordinals

More intriguing than the theoretical Ordinals system for enumerating satoshis is the phenomenon of Inscriptions—a gold rush-like scramble to claim digital property on the Bitcoin blockchain. To date, there have been over 11 million Inscriptions, with users storing videos, games, music, and books as on-chain entries. Much of the attention stems from the novelty of storing digital artifacts directly on-chain rather than linking to content hosted on centralized servers—the most common model for Ethereum NFTs.

Clearly, those who described Ordinals Inscriptions as “possibly nothing” were proven wrong, at least indicating that demand for activity on Bitcoin extends far beyond simple monetary transfers. Among the most prominent NFT Inscription collections are Taproot Wizards and Astral Babes.

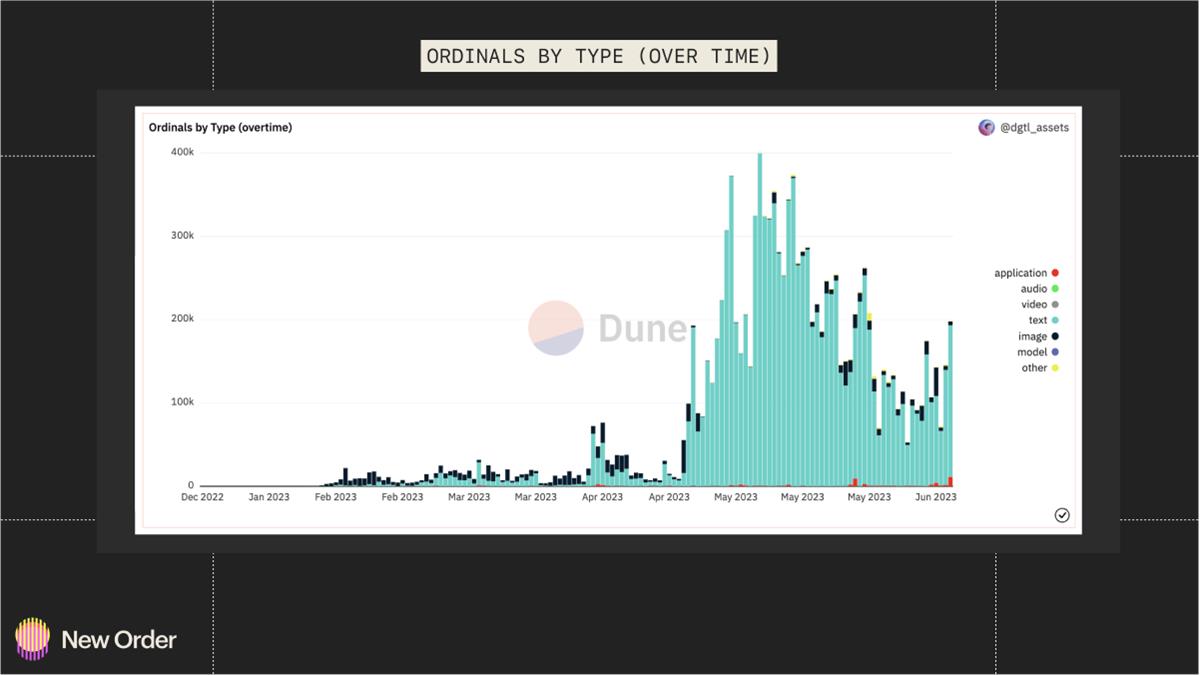

Bitcoin Ordinals initially gained popularity as a means of creating Bitcoin NFTs, digital artifacts, and collectibles. However, interestingly, recent observations show that since April 2023, the majority of Bitcoin Inscription transactions have primarily consisted of text-based Inscriptions rather than images. What is driving this shift in usage patterns within the Bitcoin Inscriptions ecosystem?

The Arrival of the BRC-20 Standard

On March 8, the BRC-20 standard was introduced, named after the well-known ERC-20 fungible token standard. However, it's important to note that BRC-20 tokens differ fundamentally from ERC-20 tokens in several ways. BRC-20 tokens are essentially Ordinals Inscriptions that embed a specific type of text, providing a set of rules and specifications for creating and managing fungible (or semi-fungible, technically) tokens. Unlike popular token standards on EVM blockchains, BRC-20 tokens do not use smart contracts. Instead, they allow users to store Ordinals Inscriptions of JSON (JavaScript Object Notation) transactions to deploy token contracts, mint, and transfer tokens. The blockchain is used for ordering and timestamping transactions. Client software interprets the transactions themselves and rejects any invalid ones according to protocol rules (e.g., minting more than the maximum supply).

As of June 14, the total market cap of all BRC-20 tokens has exceeded $404 million. While initial excitement centered on NFT Inscriptions, since the meme coin frenzy, the capitalization of fungible tokens on Bitcoin has grown exponentially. The current highest-market-cap token, ORDI, has a market cap exceeding $200 million at the time of writing. Just weeks ago, Bitcoin NFT trading volume briefly surpassed that of platforms like Ethereum.

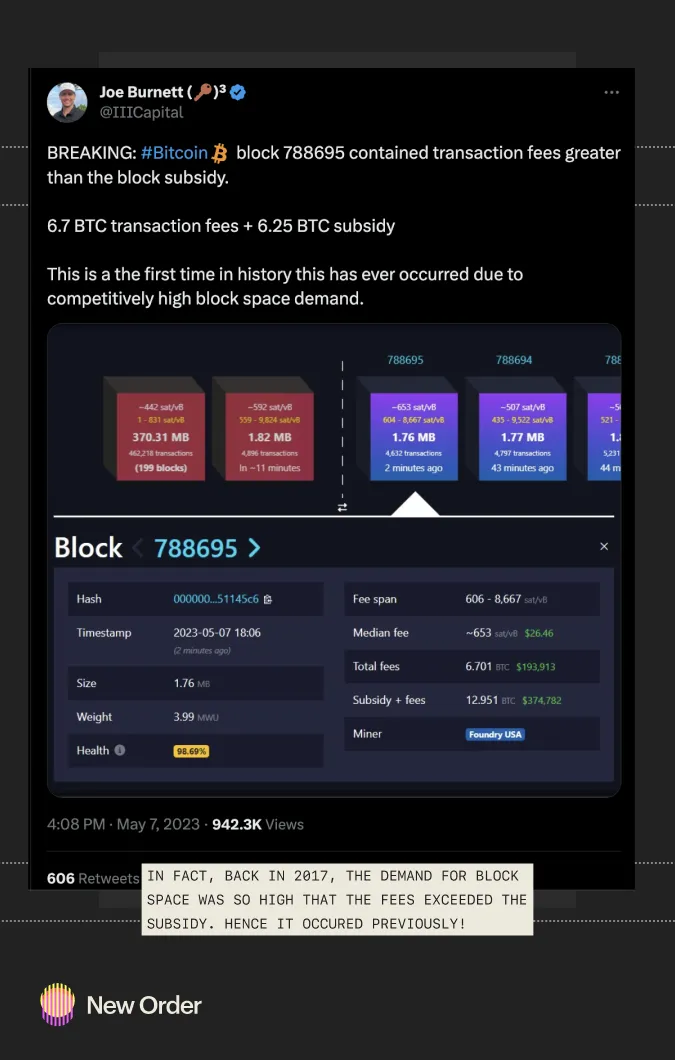

While not all Bitcoin supporters are pleased with this development, critics have leveled accusations ranging from spam to scams. However, one group of stakeholders—the miners—who secure the PoW chain, may be very happy due to the surge in transaction fees driven by the Ordinals phenomenon. Since April 25, miner revenues have significantly increased thanks to rising Bitcoin Inscription activity. This is a significant development, as transaction fees have begun to exceed inflationary block rewards—a rare occurrence in Bitcoin’s history.

On the other hand, not everything is smooth sailing. Due to this surge in activity, the Bitcoin network has started experiencing noticeable congestion. This influx has caused transaction fees to rise sharply, posing challenges for certain users and applications reliant on low-cost transactions. Transaction efficiency and affordability have been impacted, casting a shadow over what was otherwise a promising development.

Challenges Ahead

So far, the application ecosystem is rapidly expanding, with new projects emerging daily—building wallets, tools, marketplaces, launchpads, DAOs, and governance systems.

Like any nascent ecosystem, numerous challenges remain. Support for Inscriptions wallets is limited, and even when available, documentation is often sparse and error-prone. Notably, at the time of writing, the original ORD wallet does not fully support sending BRC-20 tokens. These factors make it easy to accidentally burn inscriptions, especially when wallet support is absent or undocumented. Managing Inscriptions with basic tools requires expertise in handling Bitcoin UTXOs. Fortunately, common BIP-39 seed phrases allow for easy key migration between wallets.

Open Questions

Key questions remain unanswered:

Is this the beginning of a revival for Bitcoin network applications?

Clearly, there is demand for digital collectibles or artifacts—key value drivers during the last bull run. However, in terms of expressiveness, smart contract functionality on the Bitcoin platform remains limited. A soft fork expected this year or next, introducing covenants, could upgrade smart contract capabilities. Meanwhile, Layer 2 solutions such as RGB or BIP-300 might offer additional functionality and improve scalability.

If Bitcoin developers attempt to ban Ordinals, will miners resist?

Growing concerns exist around Bitcoin’s security budget, particularly as it shrinks with each halving. The new on-chain activity from Ordinals shows that demand for block space can support mining. It would be difficult to justify completely blocking this activity, especially with the next inflationary block reward halving expected in 2024.

Will another standard replace BRC-20—or even Ordinals/Inscriptions altogether?

As noted in this article, several competing standards are being introduced. However, as with the ERC-20 standard itself, the best technical solution does not always gain market adoption or dominance.

Will interest in on-chain Bitcoin digital collectibles last?

This remains speculative. Certainly, awareness of digital collectibles grew during the last cycle, although the term “NFT” has become somewhat tainted among consumers.

If Inscriptions fade away, their legacy might include:

-

Increased understanding of the UTXO model among ordinary users;

-

More people running Bitcoin nodes;

-

Greater recognition of satoshis (sats) as an accounting unit;

-

Progress toward addressing Bitcoin’s long-term security budget at the base layer.

-

Only time will tell.

Warning: This is still early stage. As highlighted in this article, support for these nascent protocols is not universal. The technology is new, and if you're not an expert, it's easy to make mistakes—such as burning Inscriptions. Proceed with caution and beware of scams. This article does not constitute financial advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News