Four Pillars: A Snapshot of wBTC, Ordinals, and Runes

TechFlow Selected TechFlow Selected

Four Pillars: A Snapshot of wBTC, Ordinals, and Runes

Bridged BTC will face intense competition, and token protocols need to develop further.

Author: xparadigms & wowitsjun_ (hashed_official)

Translation: TechFlow

* This is the third part of a four-part series exploring current solutions for scaling the Bitcoin ecosystem.

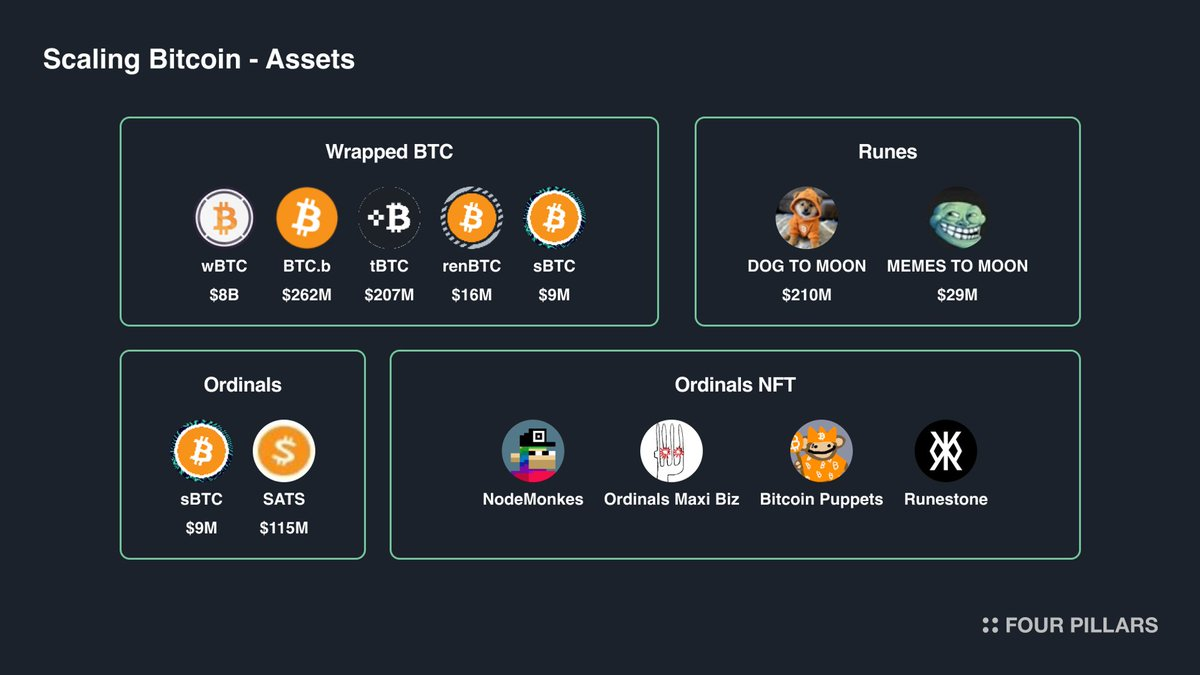

In the broader cryptocurrency market, Bitcoin holds the most valuable brand and asset, with its asset categories extending beyond native BTC. Bitcoin can not only be wrapped and sent to other blockchains for use but also includes Bitcoin-ordained assets such as Ordinals and Rune protocols. Additionally, Bitcoin has an expanding NFT market where NFTs are issued via the Ordinals protocol.

In this opinion piece, we will explore the asset classes within the Bitcoin ecosystem and the performance of each asset class.

1. Background – Bridged BTC and Bitcoin Token Protocols

1.1 Bridged BTC

As of 2024, Bitcoin remains the largest cryptocurrency by market capitalization, with a total value exceeding $1.3 trillion—accounting for 53% of the entire crypto market. However, due to the lack of use cases within its native ecosystem, Bitcoin is bridged to other smart contract-based blockchains, known as bridged BTC. Bridged BTC refers to Bitcoin that is wrapped or tokenized at a 1:1 ratio so it can be used in decentralized finance (DeFi) on other blockchain networks.

Examples of bridged BTC include wBTC, tBTC, and BTC.b:

-

Wrapped Bitcoin (wBTC): Wrapped Bitcoin is an ERC-20 token on the Ethereum blockchain representing Bitcoin. Each wBTC is backed 1:1 by Bitcoin held in reserve and is currently operated by BitGlobal.

-

tBTC: It operates through a set of smart contracts and a decentralized network of signers who manage the minting and redemption processes. Users deposit Bitcoin into a multisig wallet and receive an equivalent amount of tBTC on Ethereum in return.

-

BTC.b: Another form of wrapped Bitcoin on Avalanche, serving as LayerZero’s cross-chain token standard.

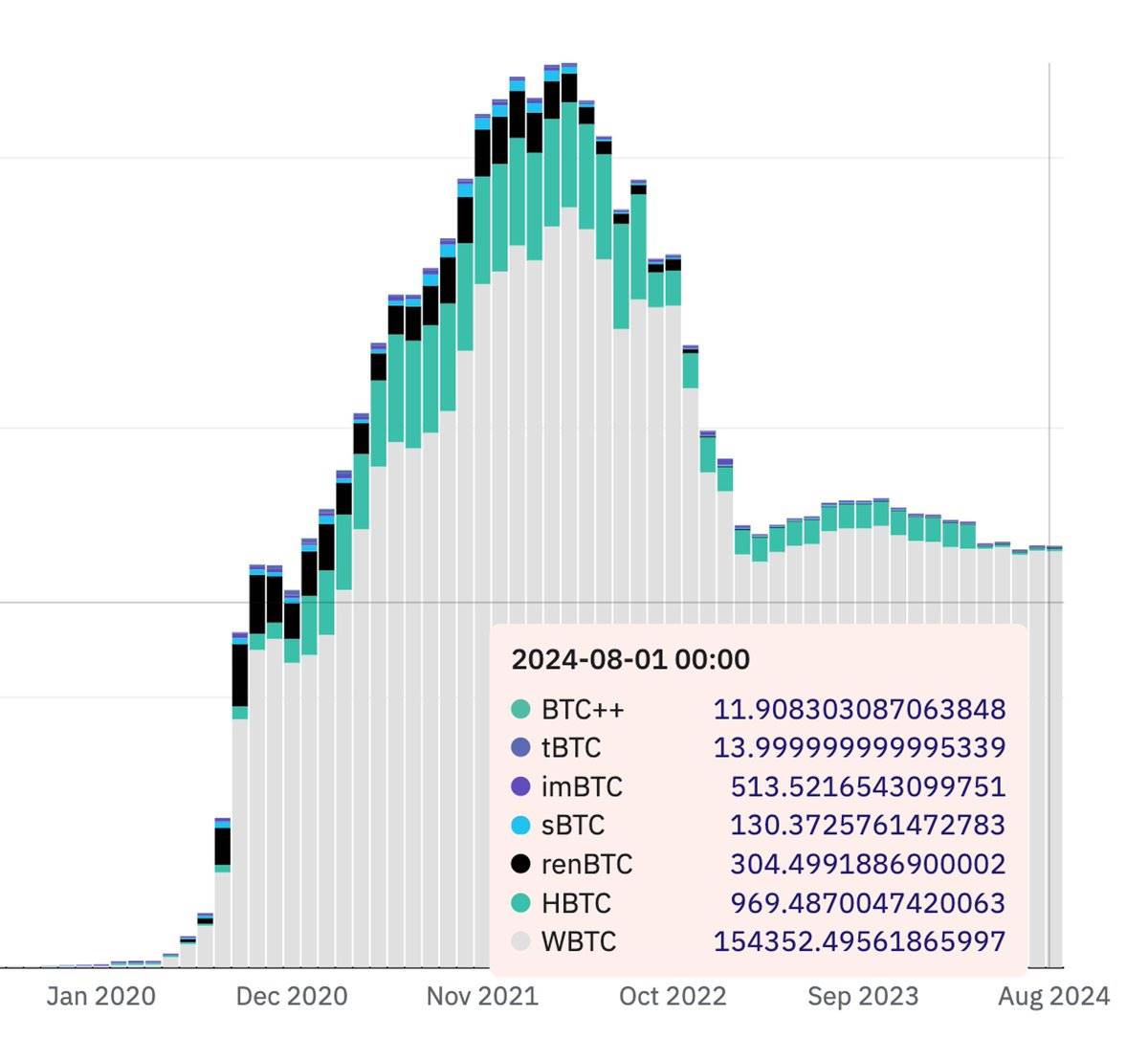

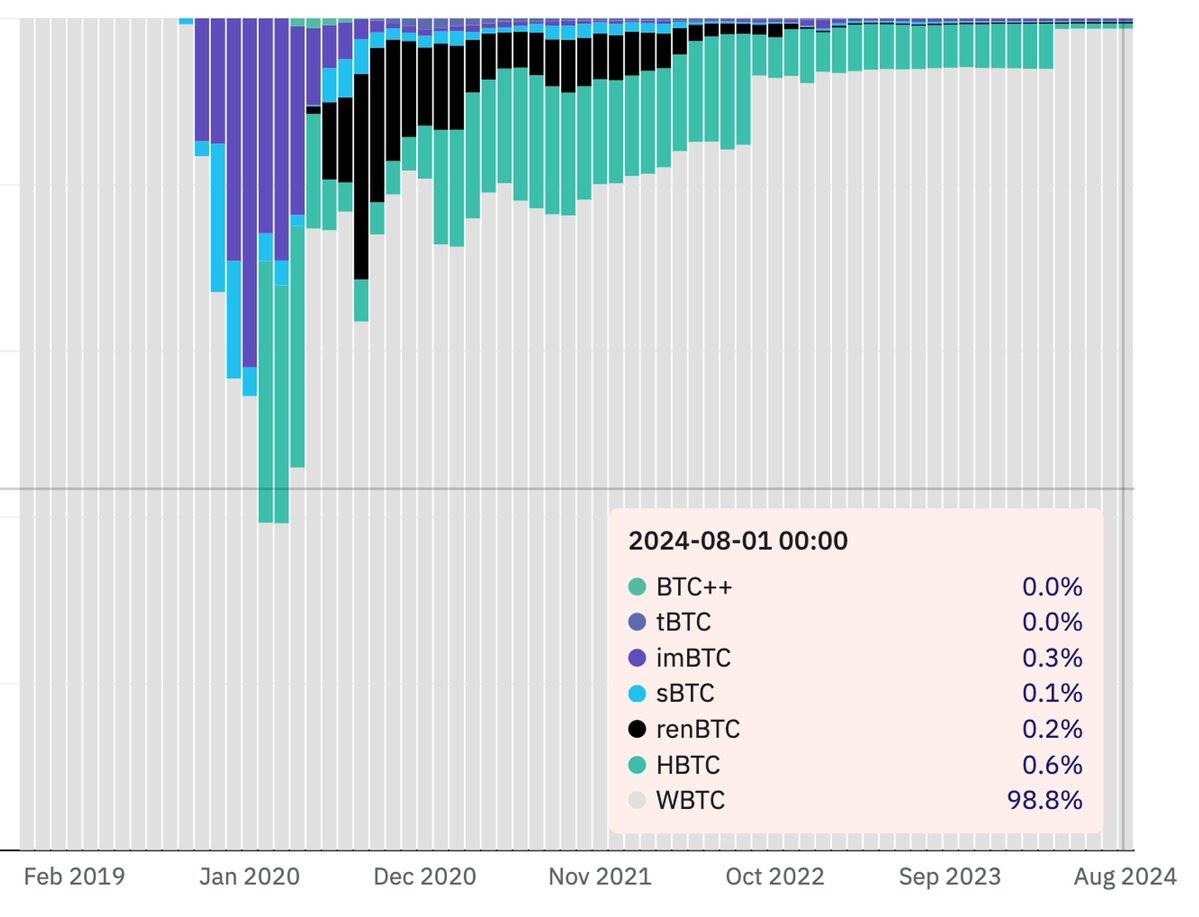

Among these bridged BTC variants, wBTC dominates supply and has become the de facto BTC asset within the Ethereum DeFi ecosystem. Recently, BitGo announced a joint venture with Bit Global in Hong Kong, planning to transfer control of some of the three multisig keys supporting WBTC to Bit Global in Hong Kong. This has sparked debate over the security of wBTC, prompting discussions and potential development of alternative solutions.

Source: btc on ethereum (WBTC, renBTC, etc)

1.2 Bitcoin Token Protocols – Ordinals and Runes

Bitcoin-inscribed assets like Ordinals and Runes are protocols inscribed directly onto the Bitcoin blockchain, leveraging its infrastructure for token creation and management. Both protocols were developed by Casey Rodarmor and highlight different use cases for the Bitcoin blockchain—Ordinals focusing on NFTs, while Runes enhance scalability for fungible tokens within the Bitcoin ecosystem.

-

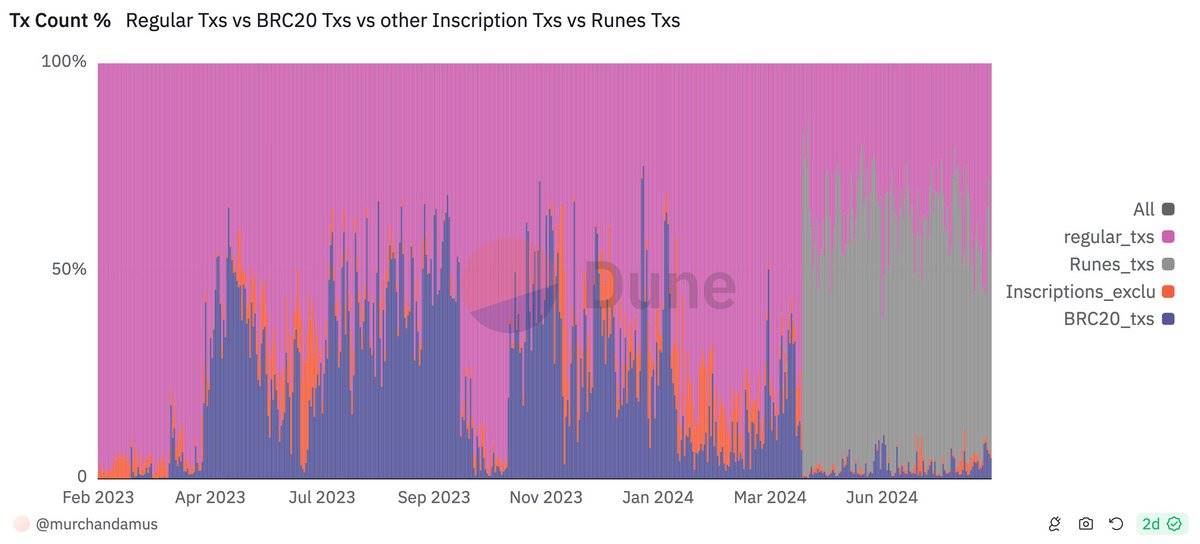

Ordinals Protocol: Launched in January 2023, the Ordinals protocol enables the creation of unique digital assets—NFTs or fungible tokens (BRC-20)—on the Bitcoin blockchain. The protocol allows users to inscribe data onto individual satoshis (the smallest unit of Bitcoin), creating a new form of digital collectibles. BRC-20 tokens are a token standard similar to Ethereum's ERC-20 but built on the Bitcoin blockchain, while Bitcoin Ordinals are generally considered a form of NFT.

-

Runes Protocol: A fungible token standard utilizing Bitcoin’s UTXO model. Unlike the BRC-20 standard, which caused network congestion due to a surge in “junk” UTXOs, Runes leverages Bitcoin’s native UTXO model to create tokens with minimal on-chain footprint. The protocol uses Bitcoin’s existing UTXO structure combined with a script that allows small amounts of data to be included without affecting transaction outputs. Special structures embedded in Bitcoin transaction outputs, called runestones, contain instructions for creating, minting, or transferring tokens. This approach enables more efficient data storage and reduces the potential risk of network bloat.

Source: Regular transactions vs BRC20 transactions vs other inscription transactions vs Runes transactions

1.3 Ordinals NFTs

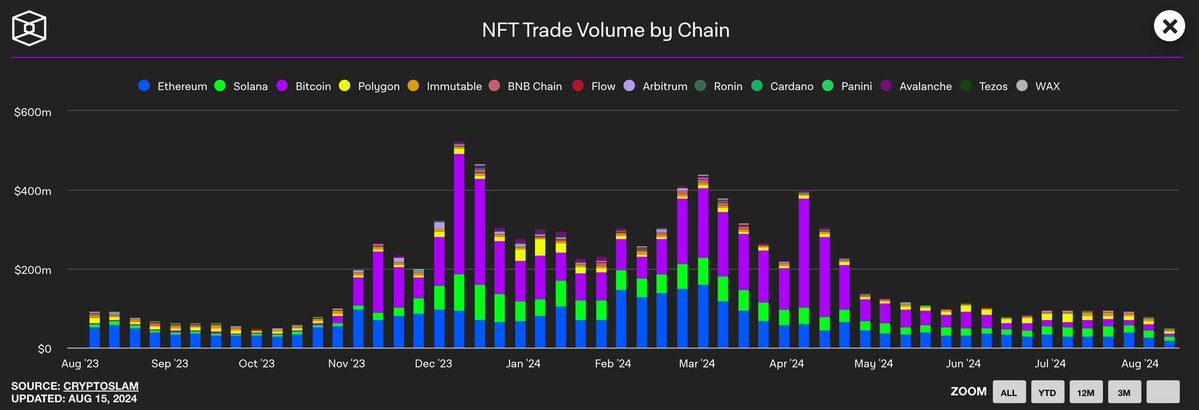

Over the past year, the Bitcoin NFT market has experienced significant growth despite a broader contraction in the overall NFT market. This sector is emerging as a notable asset class within the Bitcoin ecosystem, forming a tight-knit community.

The expansion of the Bitcoin NFT market stems from growing interest in Bitcoin-based NFTs. According to CryptoSlam data, Bitcoin ranks third in historical NFT trading volume by blockchain, behind only Ethereum and Solana.

Source: NFT Trade Volume by Chain

2. Summary – Bridged BTC Will Face Intense Competition; Token Protocols Need Further Development

Author: xparadigms, from Four Pillars

2.1 On Bridged BTC (e.g., wBTC) – New Bridged BTC Solutions Will Face Fierce Competition

Beyond serving as digital gold for price appreciation, Bitcoin is often sent to other blockchains as bridged BTC to be used as collateral or to earn yield in DeFi protocols, especially on Ethereum. This gives DeFi users easy exposure to BTC.

This week, the operator of wBTC announced plans to transfer partial control to Bit Global, a joint venture co-founded by Justin Sun. Out of the three multisig keys, two would be managed by Bit Global and one by BitGo. Given Justin Sun’s history of opacity in previous projects (such as TUSD and stUSDT), public concern has arisen over “custody risk” stemming from his “reputational risk.” Since wBTC accounts for over 95% of Bitcoin assets on Ethereum, mishandling could negatively impact the ecosystem, potentially leading to wBTC trading at a discount compared to other bridged BTC variants.

Now that this issue has been identified, more projects may launch marketing efforts (e.g., tBTC, BTC.b) and introduce new wrapped Bitcoin versions (e.g., Coinbase’s cbBTC).

Source: btc on ethereum (WBTC, renBTC, more)

2.2 Bitcoin Token Protocols – “Currently, This Relies Entirely on Community Momentum”

Most Bitcoin-inscribed assets, such as meme coins, lack mechanisms for generating revenue or intrinsic value, making them highly dependent on community interest. This means the overall market could collapse if sentiment sours. For example, ORDI does not generate traditional revenue; its value primarily stems from market speculation and attention toward the Ordinals protocol and BRC-20 tokens. While increased usage of Ordinals raises transaction fees—benefiting Bitcoin miners—it does not directly generate income for ORDI itself. This reliance on community enthusiasm makes these assets highly volatile; their value could plummet rapidly if community interest fades.

As Bitcoin Layer 2 (L2) technologies evolve, improving the user experience for creating and trading Bitcoin tokens may attract renewed attention—similar to launching a Bitcoin version of pump.fun. For these Bitcoin token protocols to truly thrive, further development remains essential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News