On the Eve of Runes Launch: A Review of the Three-Way Battle Among Bitcoin Layer-1 Protocols

TechFlow Selected TechFlow Selected

On the Eve of Runes Launch: A Review of the Three-Way Battle Among Bitcoin Layer-1 Protocols

Runes will attract Western retail investors' attention to the "meme coins on Bitcoin" sector, bringing more users and liquidity to the entire Bitcoin ecosystem.

By 0xSea.eth

At block height 840,000, Bitcoin will undergo its fourth halving, reducing the block reward from 6.25 BTC to 3.125 BTC—an event closely watched across the entire crypto industry. Within the Bitcoin ecosystem, nearly everyone is focused on the Runes protocol, which is set to launch simultaneously at block 840,000.

How will the Runes protocol reshape the landscape of Bitcoin's Layer 1 token ecosystem? What impact will it have on BRC-20, Atomicals, and other protocols? As an observer and participant, I’d like to share some reflections ahead of the halving and the Runes launch.

Key Takeaways

1/ The Bitcoin L1 token ecosystem will evolve into a three-way equilibrium among BRC-20, Atomicals, and Runes;

2/ Runes will draw Western retail attention toward the "shitcoins on Bitcoin" narrative, bringing more users and liquidity to the broader Bitcoin ecosystem;

3/ The industry is transitioning beyond mere asset issuance—DeFi will be the next unifying theme;

▵ Internal report from Franklin Templeton: We're still early!

Chapter I: BRC-20

In 2023, BRC-20 became synonymous with the "Bitcoin ecosystem." From Bitcoin’s perspective, BRC-20 acted as a growth hacker—its simple participation model and massive wealth effect attracted many people to create their first self-custodied Bitcoin wallet and purchase BTC for gas. Despite criticism over its imperfect technical implementation, BRC-20 defined the initial standard ("first is first") for issuing altcoins on Bitcoin, driving two major waves of BRC-20 mania. Two leading assets, $ordi and $sats, were listed on top-tier exchanges and maintained market caps exceeding $1 billion for extended periods.

BRC-20 functioned like a minimal viable product (MVP), inspiring mechanisms and token distribution designs in many other protocols—including Runes. Moreover, the surge in assets and network congestion caused by BRC-20 directly fueled interest in Bitcoin scaling and Layer 2 solutions.

After completing the first step of “asset issuance,” the BRC-20 ecosystem now needs richer applications and use cases. At the end of March, BRC-20 underwent a significant upgrade allowing developers to deploy five-character tickers, support project-led minting and burning—laying groundwork for DeFi. Notably, UniSat, one of the most influential players in the BRC-20 space, has deepened its collaboration with the protocol author @domodata.

Following two rounds of hype, BRC-20 primary launches have cooled significantly. Many users realized they’re sitting on worthless BRC-20 tokens and NFTs that can’t be sold. Over the past month, we’ve seen some BRC-20 projects begin migrating their assets onto Runes. It’s foreseeable that once Runes officially launches, BRC-20’s primary market will be severely drained.

Given this context, my focus going forward will be on the development of DeFi primitives within the BRC-20 ecosystem: when Unisat’s BRC-20 Swap will fully launch; whether credible stablecoins emerge; and when lending platforms supporting Ordinals and BRC-20 assets like @ShellFinance_ go live.

BRC-20 has passed the 0-to-1 phase and now needs to level up.

Chapter II: Atomicals

Long-time followers know I’m a supporter of @atomicalsxyz.

This is a critical moment for the Atomicals protocol—on-chain liquidity has declined, and there’s been considerable FUD recently. Fortunately, before Runes’ launch, Atomicals secured support from OKX Web3 Wallet/Marketplace and Binance Web3 Wallet/Marketplace, gaining full infrastructure backing that buys time for further development. However, while Binance originally committed to integration in February, actual rollout only began in early April—by which point the landscape had shifted dramatically.

Even during this downturn, I remain confident that Atomicals deserves a place in the Bitcoin ecosystem.

1/ ARC-20, built on colored coins and UTXO, achieves maximum compatibility with Bitcoin’s native network—an important exploration for enabling DeFi on Bitcoin L1, hence the name “atomic.”

2/ Among various L1 protocols, Atomicals has stood out by securing infrastructure support from top platforms like OKX and Binance—it’s no longer an infant.

3/ I believe in the two core visions of the Atomicals protocol—Bitwork and AVM—and deeply respect its founder.

4/ $atom dropped from a high of over $16 to a low of $3.5—a roughly 80% decline, which is actually a healthy pullback even in a bull market. There’s still room for recovery.

For Atomicals, here are what to watch next:

1/ AVM: The significance of AVM lies in enabling smart contracts directly on Bitcoin L1, supporting deposit, staking, and lending of ARC-20 tokens—unlocking basic DeFi capabilities. Of course, due to limitations of the Bitcoin L1 network, AVM faces constraints too. But its very existence marks a historic 0-to-1 breakthrough in Bitcoin’s 15-year history. For more details, see this thread.

2/ Splitting: Due to Bitcoin network constraints, splitting $atom below 546 units has long been a challenge. Now, a splitting solution has been finalized and is under testing, expected to roll out alongside AVM—increasing $atom’s liquidity and expanding its holder base as a protocol beta token.

3/ Ecosystem: Beyond listing on larger exchanges for better liquidity, another key challenge is attracting strong teams to build on Atomicals—launching high-quality assets that circulate widely and provide diverse collateral for AVM.

Chapter III: Runes

Compared to BRC-20, Runes is essentially an improved and enhanced version.

Where is it improved?

1/ Technical: Like Atomicals, Runes is based on the UTXO model, avoiding the network strain caused by BRC-20 and reducing both time and cost for users transferring assets.

2/ Mechanism: Building on BRC-20, Runes introduces more flexible issuance models such as pre-mining and time-limited uncapped mints.

Where is it enhanced?

1/ Marketing: While Atomicals spent seven months (Feb–Sep last year) quietly developing, Runes has spent the past seven months (since Sept) building momentum through strategic marketing. Like a dam蓄water for seven months, a small ecosystem has already formed. When the floodgates open, the unleashed energy will nourish downstream ecosystems.

2/ Infrastructure: Thanks to seven months of pre-launch buzz and its “canonical” origin, Runes gained immediate support from numerous wallets and trading platforms on day one. In contrast, Atomicals took seven months—from launch in September—to gradually secure backing from major players like Unisat, OKX Web3, and Binance Web3.

3/ Influence: @rodarmor holds immense influence in the Ordinals ecosystem. Projects like Runestone, RSIC, and other creative NFT teams have rallied around Runes, heating up the scene.

I’ve followed Runes closely since Casey published his article last September, even preparing infrastructure (full node + ord indexing) to avoid missing out. While I still believe Atomicals offers greater technical innovation and stronger technical consensus, the popularity of Runes has made me rethink competition and differentiation among protocols. I acknowledge Runes’ innovations are limited, yet it has clearly become the market’s top consensus. Much like Ethereum wasn’t the first blockchain to support smart contracts nor necessarily the best technically, but its thriving developer ecosystem made it the leading smart contract platform.

On the asset issuance side, there are three camps within the Runes ecosystem:

1/ Pre-Runes frontrunners, represented by RSIC and Runestone, both with market caps above $500M—already priced in, offering little alpha;

2/ Fair launches similar to BRC-20, where projects have no pre-mine;

3/ Projects reserving part of supply while opening minting to the community;

Successful projects will emerge from all three groups. However, Runes has received unprecedented attention—the information asymmetry from earlier weeks has largely disappeared. Going forward, success will depend on execution and gas wars. Expect fierce on-chain competition. It may be hard to replicate last year’s $ordi miracle—rising from obscurity to 10,000x—but double or triple-digit gains should still be abundant.

My key areas of focus for Runes:

1/ It’s often said that Western users dominate Ordinals NFTs while Eastern capital drives BRC-20—with little crossover. Runes, inheriting resources from the Ordinals ecosystem, could attract Western users to engage with “altcoins on BTC,” bridging East and West. Increased user inflow and liquidity may also spill over to benefit BRC-20 and Atomicals ecosystems.

2/ Bold hypothesis: Could a Runes token with stronger Western adoption be the first to list on Coinbase? Consider projects like Runestone, whose airdrop deliberately excluded BRC-20 addresses—worth pondering.

3/ Beyond asset issuance, does Runes hold undisclosed innovations? Can “Light Pools,” mentioned by Casey, materialize and help transition Runes from asset issuance into DeFi?

— END —

From the quiet launch of BRC-20 on March 8, 2023, to Atomicals emerging on September 21, 2023, and now Runes shining brightly on April 20, 2024—these 13 months mark the infancy of the Bitcoin ecosystem.

Now, on the eve of the fourth halving, we’re witnessing Bitcoin’s evolution from simple asset issuance toward the next frontier—DeFi—amidst the chaos of ongoing protocol wars.

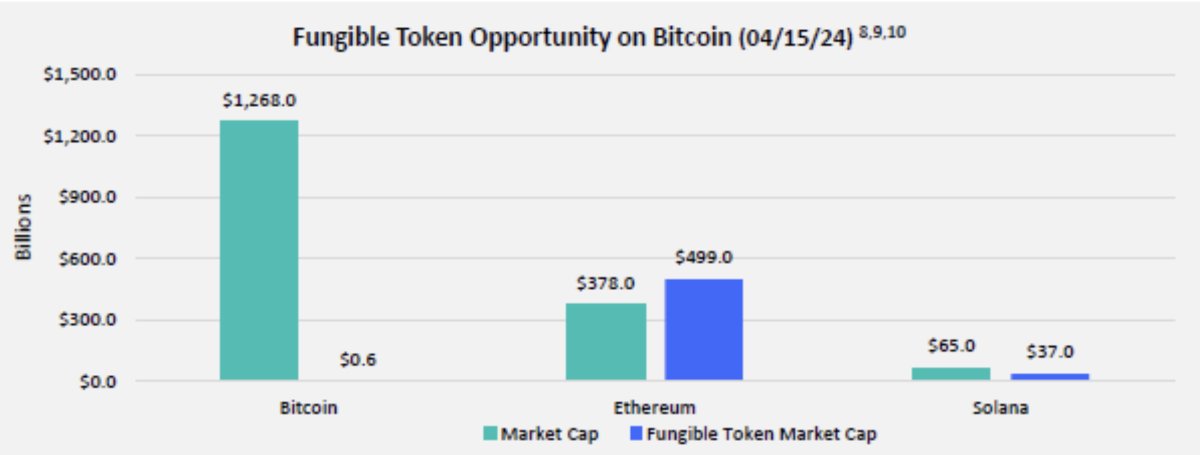

As shown in the first image above, the total market cap of the entire BTC ecosystem is still just several billion dollars—there’s enormous room to grow. We’re still early!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News