Bitget Research: Runes protocol launch causes surge in BTC network fees, BONK leads Solana meme coin rally

TechFlow Selected TechFlow Selected

Bitget Research: Runes protocol launch causes surge in BTC network fees, BONK leads Solana meme coin rally

Runes launch triggered a surge in BTC network fees, while BONK DAO's burn proposal led Solana memes to rise over the weekend.

Author: Bitget Research

In the past 24 hours, several new trending cryptocurrencies and topics have emerged in the market, potentially representing the next wealth-creation opportunities.

-

Sectors with strong wealth-generation potential: Solana Meme;

-

Sectors to watch closely going forward: Runes Protocol;

-

User-searched tokens & topics: MultiBit, GUMMY, TON;

-

Potential airdrop opportunities: LI.FI, Grass

Data collection time: April 22, 2024, 4:00 (UTC+0)

1. Market Environment

Last week, the Federal Reserve showed a more hawkish stance, further cooling market expectations for rate cuts. The Fed’s “one month hawkish, one month dovish” pattern has increased market uncertainty. BTC demonstrated strong resilience around the halving event—after a brief drop due to worsening Middle East tensions, it quickly rebounded and recovered losses, stabilizing over the weekend within the 63,000–65,000 range.

The BTC halving was successfully completed. On the same day, the Runes protocol launched on mainnet, causing a surge in BTC network transaction fees. Currently, SATOSHI•NAKAMOTO has reached 19,900 on-chain holders—the highest among all Runes assets—and also reflects the strongest market consensus so far. However, RuneStone's price crashed sharply two days after the protocol launch, indicating that the overall wealth effect of the Runes protocol has not met earlier high market expectations.

2. Wealth-Creation Sectors

1) Sector Movement: Solana Meme

Main Reason: As the market rebounded, the Meme sector—especially Solana Memes—surged significantly. On April 20, BONK DAO proposed burning over 278 billion BONK tokens, equivalent to all BONK tokens received since its end-2023 launch through revenue-sharing agreements with BonkBot. This announcement triggered a major rally in BONK, leading top-tier and long-tail Solana memes to rise collectively.

Price Performance: BONK surged +32% on April 20 alone; WIF broke above 3 USD again; long-tail memes like SOLAMA also saw significant gains over the weekend.

Factors Influencing Future Trends:

-

Ongoing growth in Solana ecosystem TVL and performance of leading projects will directly impact the entire meme sector. Key Solana platforms such as Jupiter and Backpack running meme-focused trading campaigns may spark individual high-return meme opportunities—for example, prior to Backpack’s WEN trading campaign, the WEN token price surged significantly.

-

The price movements and major developments of the most widely recognized Solana Memes—BONK, WIF, and BOME—will greatly influence the broader sector.

2) Sector to Watch Closely: Runes Protocol

Main Reasons:

-

Despite the initial wealth effect falling short of overheated market expectations, the sharp spike in BTC network fees has clearly demonstrated strong market interest in Runes. From a technical standpoint, the Runes protocol offers simpler and more manageable asset issuance, giving it the potential to surpass other inscription-based assets in popularity and market adoption.

-

However, it is important to note: many Runes projects reserved large amounts of tokens during issuance, meaning they lack the "fair launch" narrative common with BRC-20 tokens. This absence of fair distribution could reduce meme appeal and lead to investor skepticism or reluctance to participate.

Specific Token List:

-

SATOSHI•NAKAMOTO

3. User Search Trends

1) Popular Dapp

LI.FI Protocol:

LI.FI Protocol is an integrated service platform supporting cross-chain assets across multiple blockchains and aggregating transactions from multiple decentralized exchanges (DEXs). Recently, on-chain transactions involving LI.FI have surged rapidly, primarily driven by users seeking potential airdrops. The project has strong funding credentials, having raised $17.5 million in a Series A round in 2023. It has also been active recently at events such as Dubai Token 2049. Strong community anticipation for a token launch has led to widespread on-chain interactions. Investors who haven't yet interacted with the protocol may consider doing so to increase eligibility for a potential airdrop.

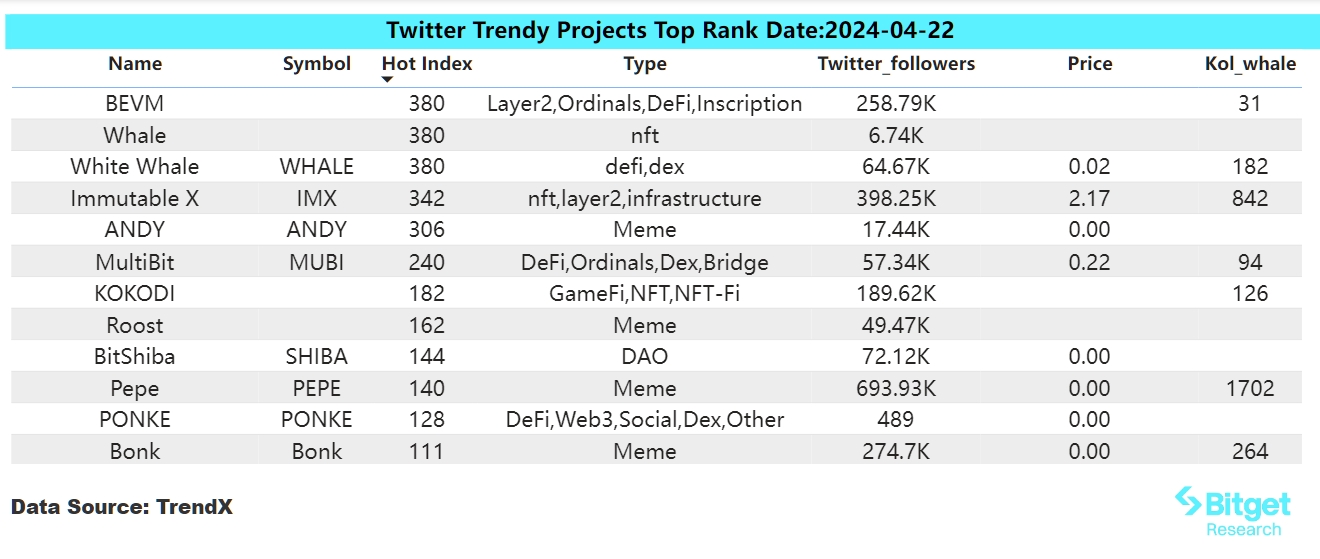

2) Twitter

MultiBit:

MultiBit is a cross-chain service enabling users to transfer BRC-20 tokens from Bitcoin to EVM-compatible chains. With the recent launch of the Runes protocol, MultiBit has officially announced support for Runes cross-chain transfers. Currently covering most Bitcoin ecosystem assets, MultiBit provides substantial off-Bitcoin-chain liquidity. As market attention grows toward Bitcoin’s ecosystem and related derivatives, demand for MultiBit is expected to rise steadily—making it a project worth continued monitoring.

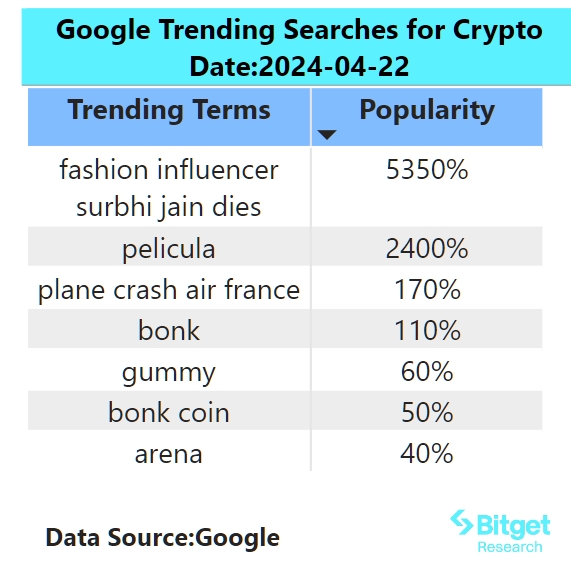

3) Google Search & Regional Trends

Global Overview:

Gummy:

Gummy is a recently popular meme coin on Solana, themed around gummy bears. The project conducted a large-scale airdrop and now has 44,000 token holders on-chain. After its token generation event (TGE), its price surged up to 50x, currently stabilizing around 40x, with a 24-hour trading volume reaching $40 million. After the intense meme season on Solana, few projects have matched this level of strong initial distribution, high trading volume, and price appreciation. Gummy stands out as a refreshing addition, with promising prospects for exchange listings and sustained momentum.

Regional Search Trends:

(1) English-speaking regions show growing interest in TON token and ecosystem:

The TON ecosystem is developing rapidly, with numerous new projects and meme coins emerging on the TON chain, beginning to generate noticeable wealth effects. Since participation in the TON ecosystem requires TON as native currency, demand for TON has increased, creating a positive feedback loop for ecosystem growth. Recently, Telegram founder Pavel Durov appeared at Token 2049, announcing the integration of USDT onto the TON blockchain and unveiling plans to tokenize Telegram stickers. Given TON’s robust infrastructure, Telegram’s massive user base, and the ecosystem’s openness and inclusivity, this space warrants close investor attention.

(2) Africa, Latin America, and CIS regions continue to show high interest in FLOKI:

FLOKI has repeatedly become a trending term in the Middle East, Latin America, and other regions, indicating widespread regional interest in meme coins. Additionally, as a major meme coin listed on local exchanges with available local trading pairs, FLOKI enjoys a large user base. During volatile market conditions, speculation around meme coins like FLOKI remains common.

4. Potential Airdrop Opportunities

LI.FI Protocol

LI.FI Protocol is an integrated multi-chain service supporting cross-chain asset transfers and aggregating liquidity from 33 decentralized exchanges across 20 blockchains and 14 cross-chain bridges.

The project has strong backing, having raised $17.5 million in a Series A round in 2023. The round was co-led by CoinFund and Superscrypt, with participation from Bloccelerate, L1 Digital, Circle, Factor, Perridon, and Theta Capital.

How to Participate: Users can visit the LI.FI Protocol website and perform cross-chain asset swaps across multiple networks to maintain on-chain activity and improve chances of qualifying for a potential airdrop.

Grass

Grass is the flagship product of Wynd Network, allowing users to monetize unused internet bandwidth. For individuals, it functions as a browser extension—downloaded, installed, and then left running in the background. It works silently to help others access public web data in exchange for rewards in the protocol’s native token. Grass focuses on transforming public web data into AI training datasets, making public internet data more accessible for open-source AI initiatives.

Wynd Network raised $3.5 million in a seed round led by Polychain Capital and Tribe Capital, with participation from Bitscale, Big Brain, Advisors Anonymous, Typhon V, and Mozaik. Total funding for Wynd now reaches $4.5 million.

How to Participate: Register on the Grass website, install the browser plugin, connect to the network, click “opendashboard,” and check your connection status on the control panel. Simply leave the service running to contribute bandwidth. Daily earnings in points and network status can be viewed directly on the dashboard.

[Disclaimer] The market involves risks; investment should be approached with caution. This article does not constitute investment advice. Readers should consider whether any opinions, viewpoints, or conclusions expressed herein are suitable for their individual circumstances. Investment decisions based on this information are made at the user’s own risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News