Deep Dive into Ordinals: With Halving Approaching, How to Bet on the Bitcoin Ecosystem?

TechFlow Selected TechFlow Selected

Deep Dive into Ordinals: With Halving Approaching, How to Bet on the Bitcoin Ecosystem?

The Ordinals speculation frenzy has faded, but protocol and project innovations continue to emerge, with the ecosystem maintaining healthy growth.

Author: @JellyZhouishere

First published on | 2023.7.6

TL;DR

-

Ordinals is one of the most popular protocols in the Bitcoin ecosystem, with BTC NFTs and BRC20 being its primary applications.

-

While speculative excitement around Ordinals has cooled, protocol and project innovation continues to emerge, and the ecosystem continues healthy development.

-

Bitcoin has developed a unique culture distinct from Ethereum—emphasizing full on-chain data, fairness, and decentralization. BTC NFTs and BRC-20 are key expressions of Bitcoin's differentiation.

-

BTC NFTs and BRC-20 have grown amid controversy: behind bias lies opportunity, and controversy may be a positive signal indicating continued growth of the Ordinals ecosystem.

-

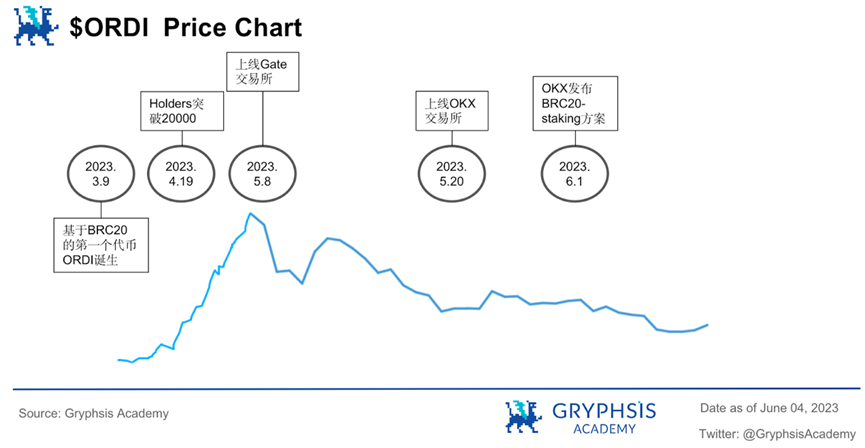

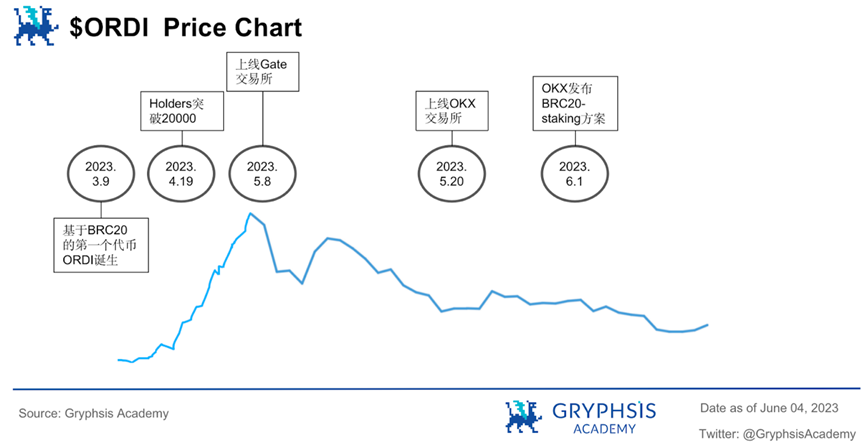

$ORDI is the first token based on BRC-20, carrying a narrative similar to Punk, and is the most widely recognized and consensus-driven BRC-20 token. The unique attributes of $ORDI have attracted numerous investors and community participants, frequently appearing across social media with broad reach.

-

$ORDI stands out through cultural identity, strong community, social virality, and capital support. Compared to other meme coins, it still holds growth potential, especially considering the upcoming Bitcoin halving cycle and the long-term evolution of the BRC20 and Ordinals ecosystems.

1.Ordinals Protocol: A Milestone for the Bitcoin Ecosystem

Despite countless narratives, innovations, and events throughout its turbulent 14-year history, the emergence and rapid development of BTC NFTs still came as somewhat unexpected. Below are some milestone moments for BTC NFTs over just a few short months:

(1) Launch of the Ordinals Protocol

Since late December 2022, Casey Rodarmor launched the Ordinals protocol, introducing NFTs to the Bitcoin network via "Ordinals" and "Inscriptions." This protocol enables arbitrary content—such as text, images, videos, or even applications—to be inscribed onto sequentially numbered satoshis (the smallest unit of Bitcoin), creating unique digital artifacts that can be transferred via the Bitcoin network.

(2) Launch of Bitcoin Punks

Bitcoin Punks is an NFT project inspired by CryptoPunks on Ethereum, featuring 10,000 unique 8-bit pixel-style avatars, each with distinct traits and rarity. Bitcoin Punks were minted on the Ordinals protocol on February 9, 2023, and later traded on platforms like OpenSea.

(3) Bitcoin mines nearly 4M—the largest block in history

On February 1, 2023, Bitcoin mined its largest-ever block at nearly 4MB, containing the largest transaction ever recorded—also nearly 4MB. This massive transaction was initiated by Taproot Wizards, an obscure Bitcoin-based NFT project, primarily consisting of an NFT rather than a hash. It sparked widespread controversy.

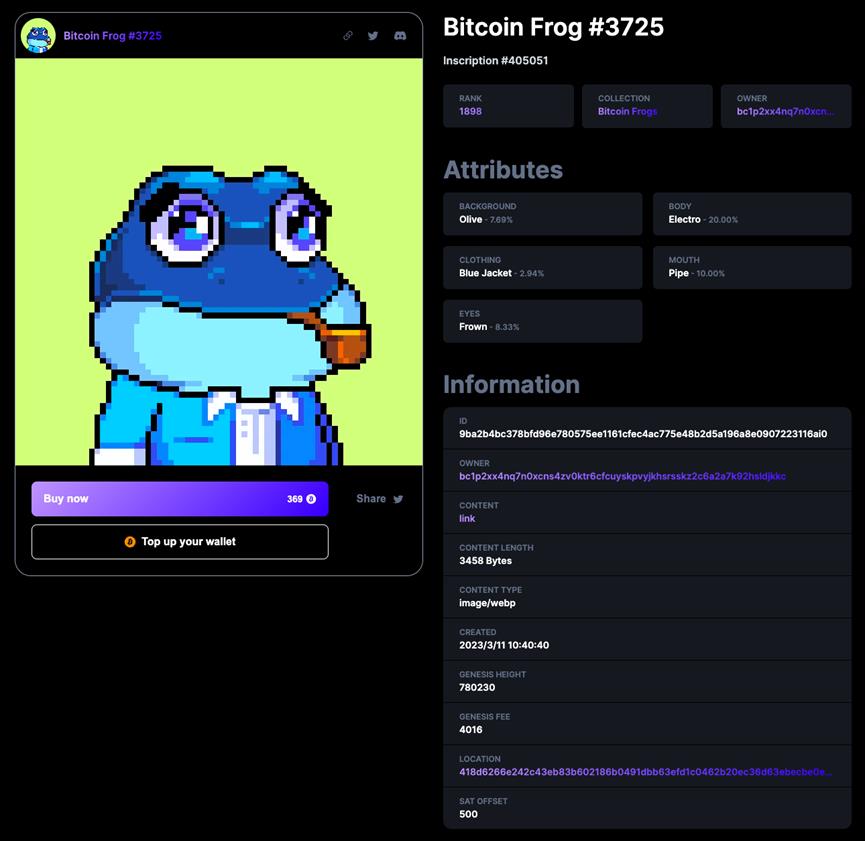

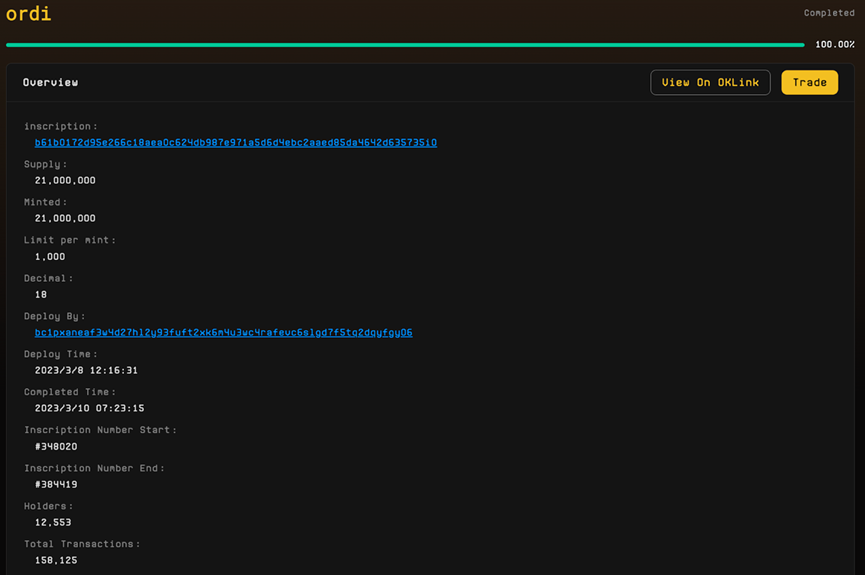

(4) Creation of the BRC-20 protocol and launch of the first token $ORDI

Twitter user @domodata created BRC-20 on March 8, 2023—an experimental fungible token standard leveraging Ordinal JSON data for minting and transferring tokens. The first BRC-20 token contract deployed was for "ORDI," limited to 1,000 tokens per mint, with a total supply of 21 million.

(5) Launch of ORC-20

ORC-20 is an improved protocol for BRC-20 developed by OrcDAO. On April 30, OrcDAO released "About ORC-20," describing it as an open standard for Ordinal Tokens designed to enhance the functionality of the popular BRC-20 standard.

(6) First ORC-20 Token $ORC

Based on ORC-20, OrcDAO deployed the first ORC-20 token, $ORC, on the Bitcoin network. Official data shows that as of May 4 at 1:29 AM, all $ORC tokens had been fully minted.

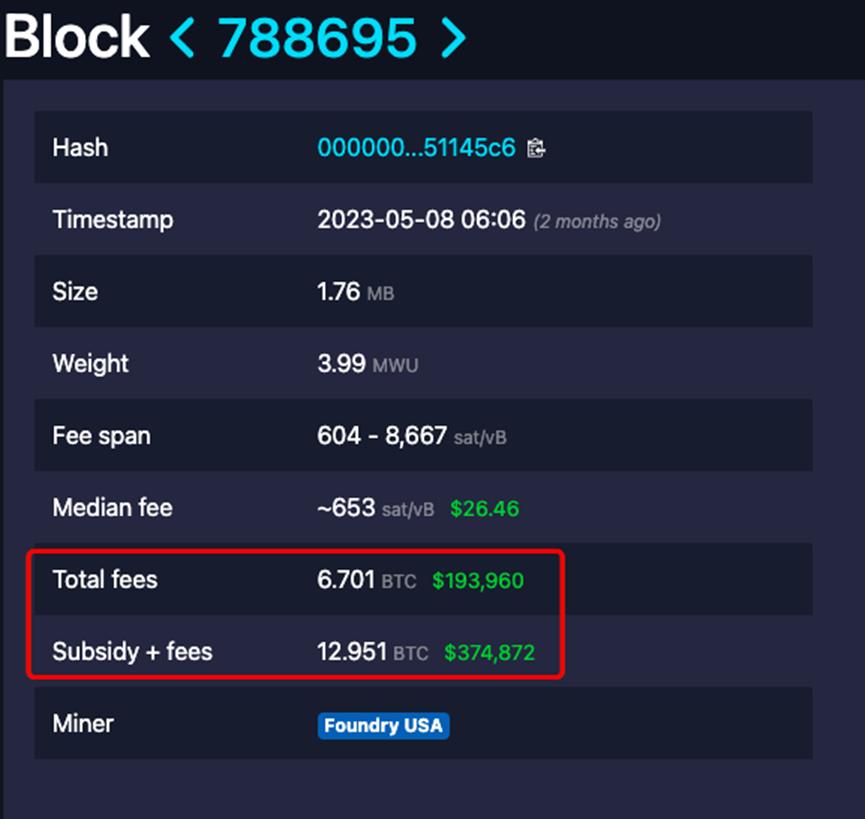

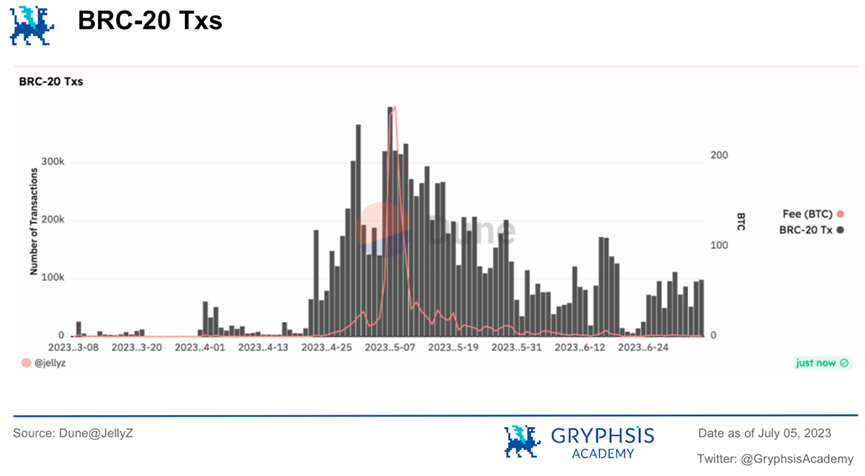

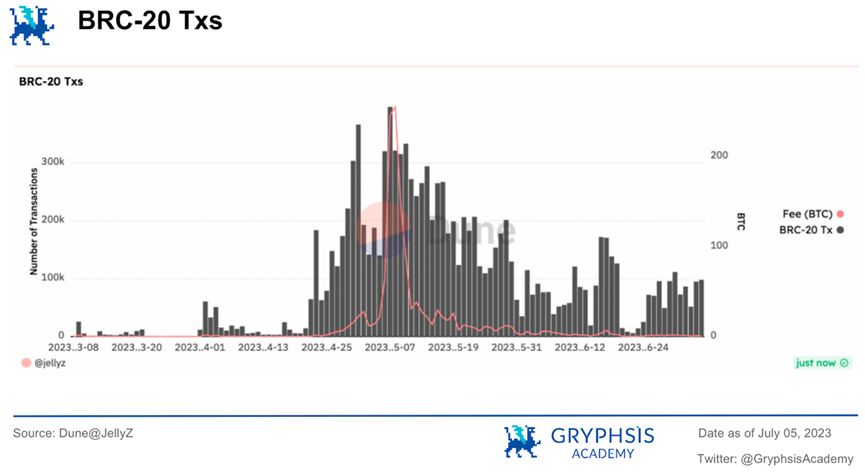

(7) Bitcoin transaction fees exceed block rewards for the first time since 2017

During a recent surge in Bitcoin transaction fees, block 788695 marked a significant milestone for miners. For the first time since 2017, transaction fees in a single block exceeded the block subsidy allocated to miners. In this particular block, transaction fees reached 6.7 BTC, surpassing the 6.25 BTC block reward.

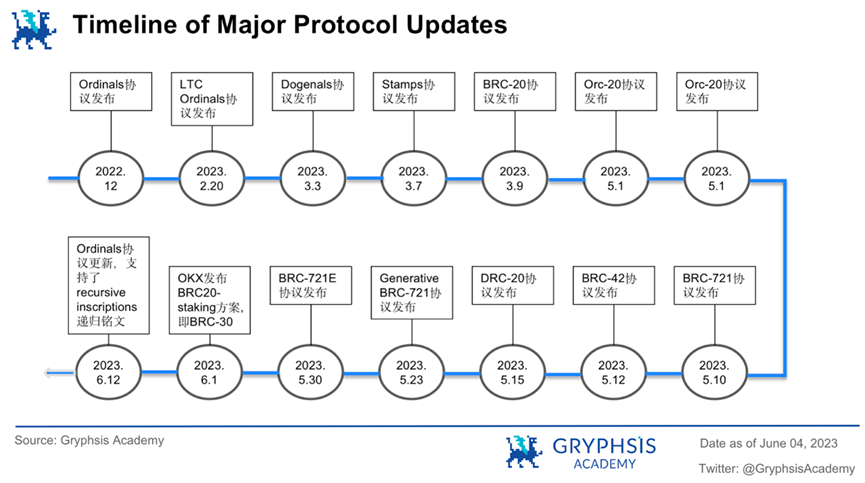

After this initial wave peaked, the BRC-20 and Ordinals sectors gradually cooled over the following month. However, numerous new localized hotspots continued to emerge, further demonstrating the field’s sustained vitality:

Brief descriptions of various protocols are shown in the table below:

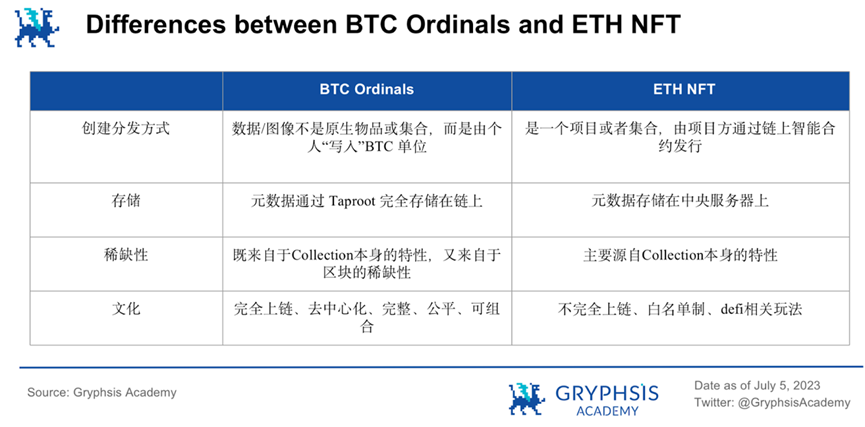

2. Cultural Differences and the Value of BTC NFTs and BRC-20

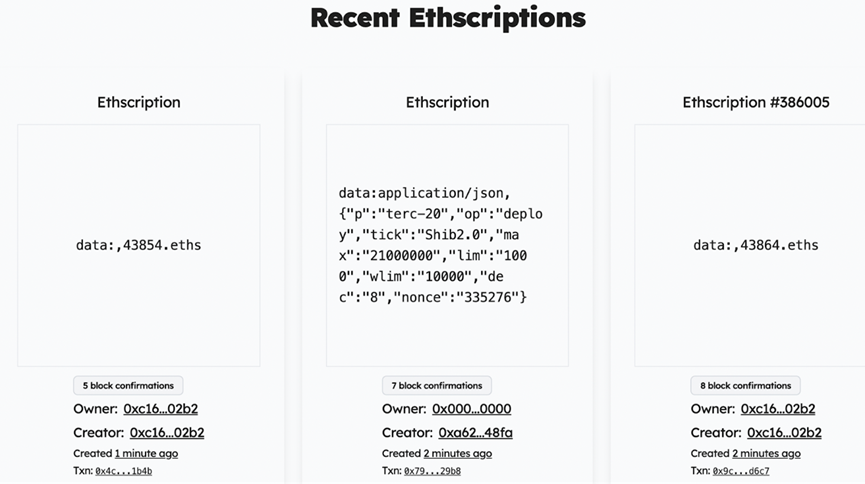

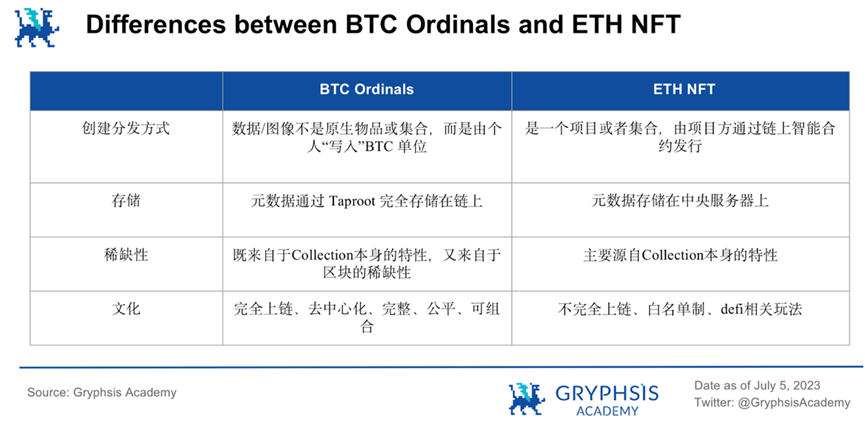

Regarding BTC NFTs and BRC-20, there are still many doubts today. For example, some argue that BTC NFTs store all data on-chain while Ethereum NFTs do not—typically hosting images or multimedia off-chain. But in fact, Ethereum NFTs could also adopt BTC NFT-like models; recent examples like Ethscriptions and ERC-20 have borrowed ideas from Ordinals and seen over 100x gains on Ethereum.

Ethscription

Moreover, BTC NFTs are costly. While they’ve gained popularity due to wealth effects, can this be sustainable? Some question whether BRC-20 is merely a fleeting trend destined to fade quickly. What long-term value do BTC NFTs and BRC-20 bring to the industry? Do they truly matter?

Existence implies meaning—though value varies. Those making such judgments may not understand the cultural differences between Bitcoin and Ethereum chains. Why bring up culture now?

Because sometimes why something is done one way versus another isn't always driven by logic—it's simply because people believe their way is right. That’s it.

On Ethereum, people are accustomed to storing assets on Arweave or IPFS—or even just a server—and including only a link. There's nothing inherently wrong with that. Even if someone says your image changed or disappeared, so how is this decentralized? People often don’t care because they see it as sufficient—a link is enough. Who would store everything on-chain? It seems pointless. This mindset has solidified into a cultural norm.

On Bitcoin, however, a different cultural atmosphere exists. If something isn't stored fully on-chain—if it's just a link pointing to your own server, which might go offline—then doing so feels dishonest, violating Bitcoin’s unique ethos.

On Bitcoin, everything must be fully on-chain—like engraving gold without defilement. Different cultures lead to different mindsets. On Bitcoin, users won't tolerate compromised integrity—they'd rather pay more than accept compromises.

Extending this idea, although BRC-20 differs from ERC-20 by just one letter, its underlying logic is fundamentally different. After deployment, creators must manually mint tokens themselves. From the user perspective, everyone starts on equal footing—an aspect of fairness absent on Ethereum. This reflects cultural difference. It's hard to say which approach is right or wrong. Is storing everything on-chain absolutely correct? I wouldn’t say so. This is more about difference than correctness.

3. Moving Forward Amid Controversy, Breaking Through Amid Bias

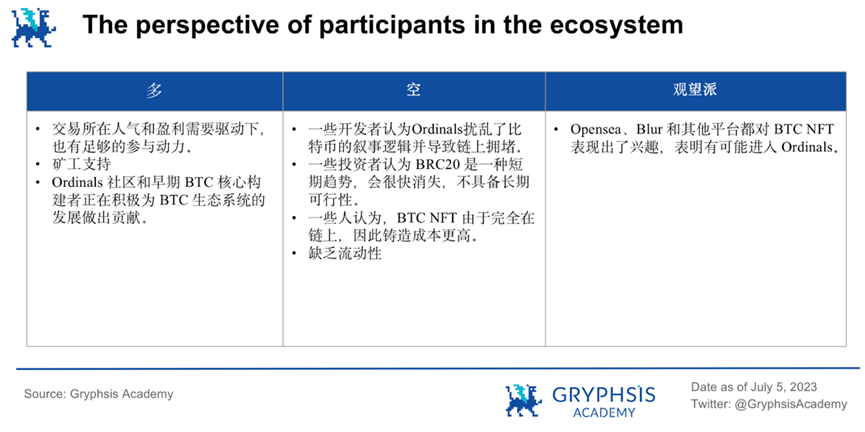

From the perspective of ecosystem participants, we can broadly categorize them into bulls, bears, and observers:

Bullish:

-

Exchanges: Major exchanges like Binance and OKX generally aim not to miss out on new opportunities. They proceed cautiously while advancing—OKX taking more action by partnering with Unisat to launch BRC-20 and Ordinals NFT markets; Binance has also launched a BTC NFT marketplace and published multiple reports on BRC-20, signaling interest. Smaller exchanges, needing traffic and profit, also have strong incentives to participate.

-

Miners: Early miners largely overlooked Ordinals, but now recognize their profitability—both through increased transaction fees alongside block rewards, and through ecosystem growth. Miners also see potential for greater influence—for instance, f2pool actively entering the Ordinals space.

-

Developers: One group includes core builders from the Ordinals and early Bitcoin communities—represented by Unisat, Xverse, Ordinals Wallet, and protocol creators—who actively support the BTC ecosystem. The other group consists of developers from other ecosystems (e.g., Ethereum, Solana) seeking to capitalize on BRC-20’s momentum.

Bearish:

-

Bitcoin Developers: Some believe Ordinals disrupt Bitcoin’s original narrative and cause network congestion. Lightning Network and sidechain developers view Ordinals as clutter clogging the main chain.

-

Fleeting Trend Camp: Some investors and even exchanges believe BRC-20 is a short-lived phenomenon with no staying power.

-

Valueless BTC NFT Theory: Critics argue BTC NFTs store all data on-chain unlike Ethereum NFTs, which mostly host media off-chain. But Ethereum NFTs could adopt BTC-style storage—if they haven’t, perhaps users don’t care much. Moreover, BTC NFTs are expensive. Despite current popularity driven by wealth effects, they may lack long-term industry value.

-

Liquidity Concerns: Without large-scale external capital inflow, BTC NFTs may face the same liquidity challenges as NFTs on other chains.

-

Observers: Platforms like OpenSea and Blur have expressed interest in BTC NFTs and may enter the Ordinals space. OpenSea published an article introducing Ordinals on May 5.

Ordinals and BRC-20 involve many stakeholders. They've grown amidst controversy and nurtured valuable consensus despite bias. Months later, we’re surprised to see continuous development and user influx. Earlier controversies indicate early-stage consensus—behind prejudice lies opportunity. Controversy may actually be a positive sign for the continued evolution of the Ordinals ecosystem. During paradigm shifts, breakthrough innovators across generations are often isolated—with no path dependency.

4. Consensus Leader: $ORDI

@domodata, creator of the BRC-20 protocol, described it at launch as merely an interesting experiment, believing better designs and optimizations would likely follow. Thus, it remains a highly dynamic experiment encouraging the Bitcoin community to iterate on standards until best practices gain broad consensus—or until the idea is deemed fundamentally flawed.

$ORDI is the first token built on BRC-20, lacking utility and best viewed as a meme coin.

Currently, $ORDI’s price serves as a confidence anchor for the entire BRC-20 sector and even the broader Ordinals ecosystem, showing correlation with on-chain minting activity.

At the protocol level, founders and various Ordinals builders, creators, and enthusiasts continue generating fresh ideas, injecting new momentum into the space. Currently, people care less about roadmaps or utility and more about community, coolness, historical significance, and rarity—all unfolding within the Bitcoin community.

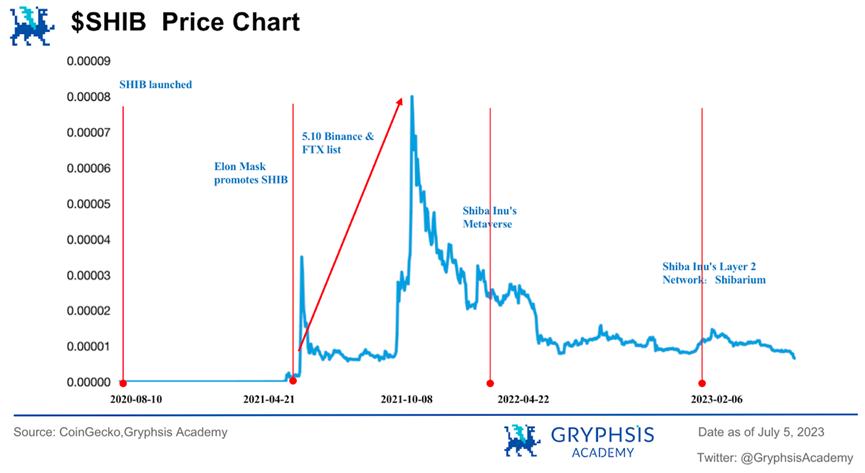

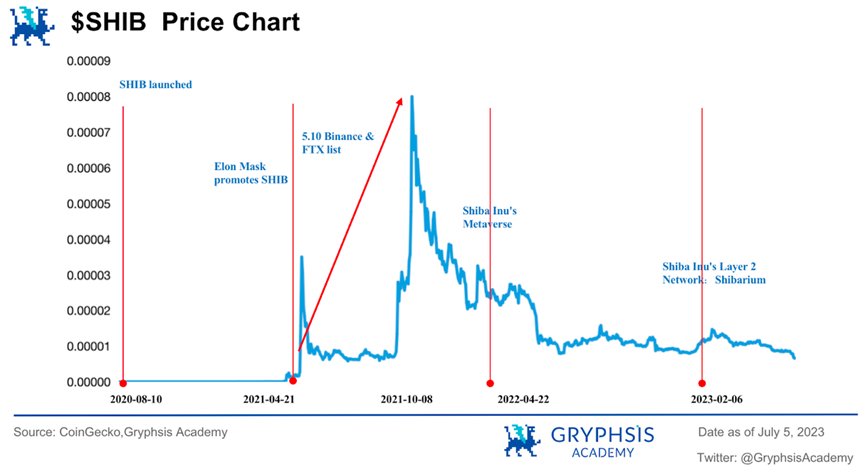

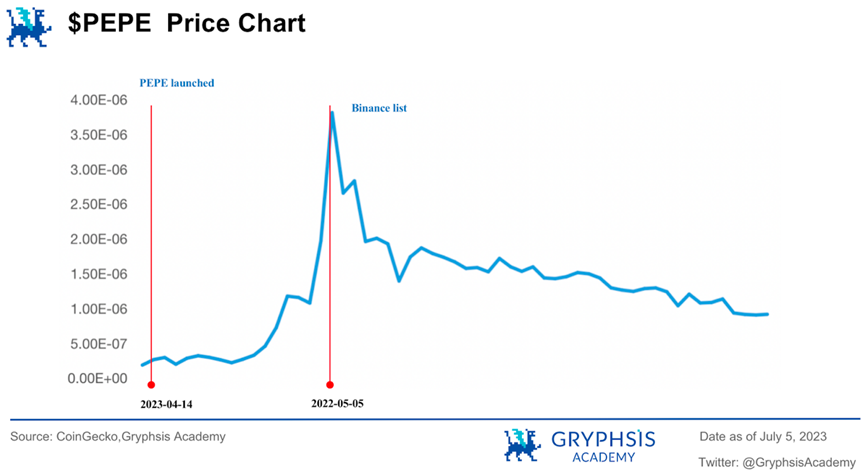

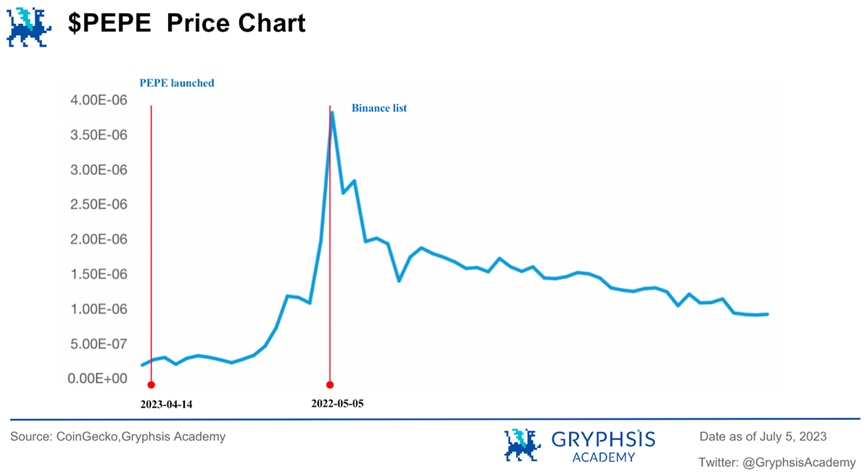

Looking back at $SHIB, $PEOPLE, and recently $PEPE, these meme coins generated powerful wealth effects and peaked after listing on top-tier exchanges like Binance. Meme coins have become one of the most watched investment opportunities in crypto.

For $ORDI specifically, it features the following characteristics:

(1) Cultural Identity: As the first BRC-20 token, it carries a Punk-like narrative and is the most widely recognized and consensus-backed BRC-20 token.

(2) Community Building: $ORDI’s unique attributes attracted many investors and community members. Early holders’ substantial profits foster shared interests, views, and beliefs, forming a consensus system amplified through social media, forums, and other channels—providing strong momentum for $ORDI.

(3) Social Virality: Observations show $ORDI appears frequently across social media with wide reach.

(4) Capital Support: Centralized exchanges like OKX and investment institutions deeply involved in BTC ecosystem development have fueled sector growth, further benefiting $ORDI.

$ORDI has currently consolidated the greatest consensus across the sector and is listed on exchanges like OKX. As the leading meme coin in the BRC-20 space, we see strong potential for future listing on Binance.

Looking at past cases like $SHIB, $People, and $PePe, all saw significant post-Binance-listing rallies (early investors holding until listing achieved over 10x returns). Compared to these meme coins, $ORDI has a relatively smaller market cap. Considering the current bear market context, we believe $ORDI has not yet reached its peak valuation.

Furthermore, combined with the narrative of the upcoming Bitcoin halving cycle and the long-term development of the BRC-20 and Ordinals ecosystems, $ORDI still holds vast room for imagination.

In summary, as a recent innovative narrative in Bitcoin and the broader crypto space, BRC-20 and BTC NFTs have drawn significant attention and generated substantial wealth effects amid short-term speculation.

For investors, opportunities lie in monitoring future developments in protocol standards like BRC-20 and BTC NFTs, particularly the rebound potential of the leading token $ORDI after a correction.

As wealth effects grow and user numbers increase, competition among ecosystem products will drive gradual improvement in infrastructure. Next year, under the major narrative of the Bitcoin halving event, BRC-20 and BTC NFTs are expected to occupy a critically important position across the entire crypto landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News