Ordinals transactions surge, clogging BTC network — how do they compare to NFTs in prospects?

TechFlow Selected TechFlow Selected

Ordinals transactions surge, clogging BTC network — how do they compare to NFTs in prospects?

Data is engraved on the blockchain, not just a link.

Elon Musk commented on The Joe Rogan Experience podcast on October 31, stating that NFTs do not actually store artwork on the blockchain. He said: "You should at least encode the JPEG into the blockchain. If the company hosting the image goes out of business, then you no longer own that image." While criticizing NFTs, Musk's remarks also highlighted the benefits of Bitcoin Ordinals (also known as Bitcoin NFTs). Ordinals permanently store image data directly on the Bitcoin blockchain, making them more decentralized and independent from third parties, thereby enhancing the anti-counterfeiting properties of NFTs.

Since the emergence of the Ordinals protocol in 2022, Bitcoin-based NFTs have divided the global blockchain user community. On one hand, proponents of the technology argue that no other blockchain platform offers the same on-chain capabilities, proven security, and active user base as Bitcoin, making it a natural home for NFTs. On the other hand, purists believe that Ordinals represent an unnecessary departure from Bitcoin’s original purpose, potentially clogging what was intended to be a lean payment network.

Bitcoin Network Congestion Caused by Ordinals

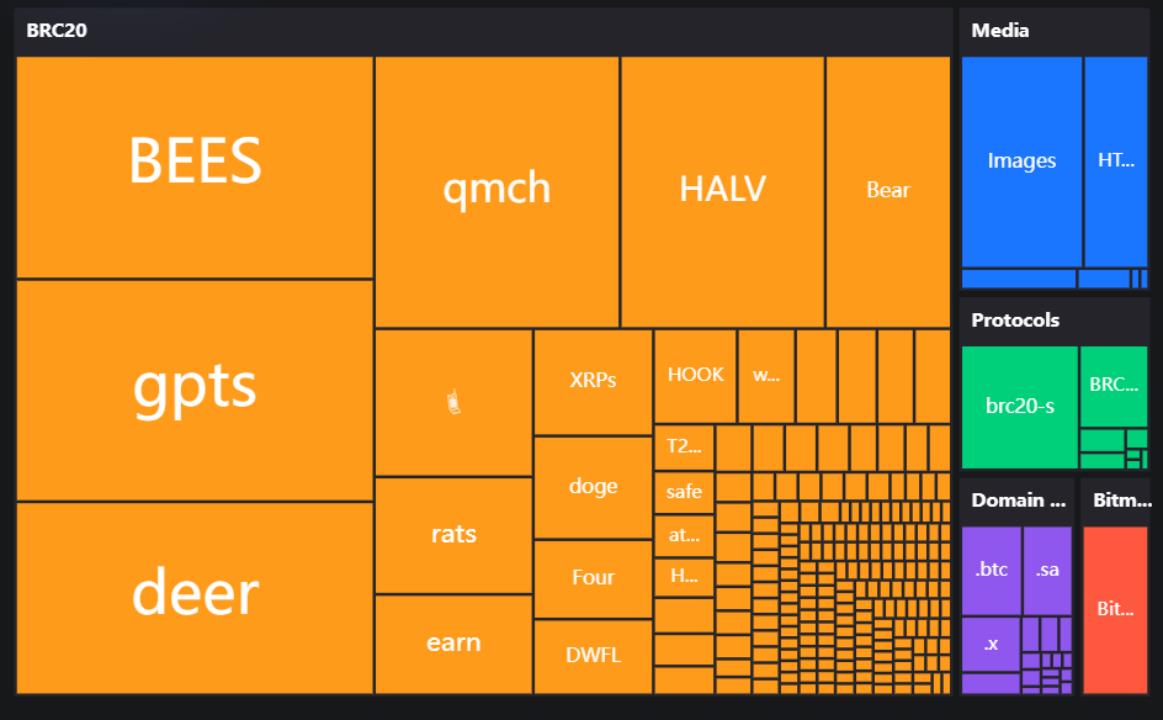

In October, the Bitcoin network recorded more Ordinals transactions than in any previous month. By the first week of November, the blockchain had already logged over 175,000 such transactions. Rising interest in NFT collections like Bitcoin Bees and OrdiRats—both BRP-20 tokens—has fueled a surge in activity recently.

Of course, compared to blockchains like Mythos, which are specifically built for NFTs, Ordinals transaction volumes still pale in comparison. Bitcoin Ordinals activity is also overshadowed by faster blockchains such as Ethereum and Polygon, which routinely record tens of thousands of NFT transactions daily. This disparity stems largely from a key difference between Bitcoin and later-generation blockchains—many of which were designed with data-intensive NFT transactions in mind.

Increased Ordinals Activity Drives Up Bitcoin Transaction Fees

Even under maximum load, Bitcoin’s processing speed is capped at just seven transactions per second (TPS). In contrast, faster and lighter blockchains can achieve TPS counts in the tens of thousands. For example, the TON network recently set a new record of 104,715 TPS, surpassing both Visa and Mastercard in speed.

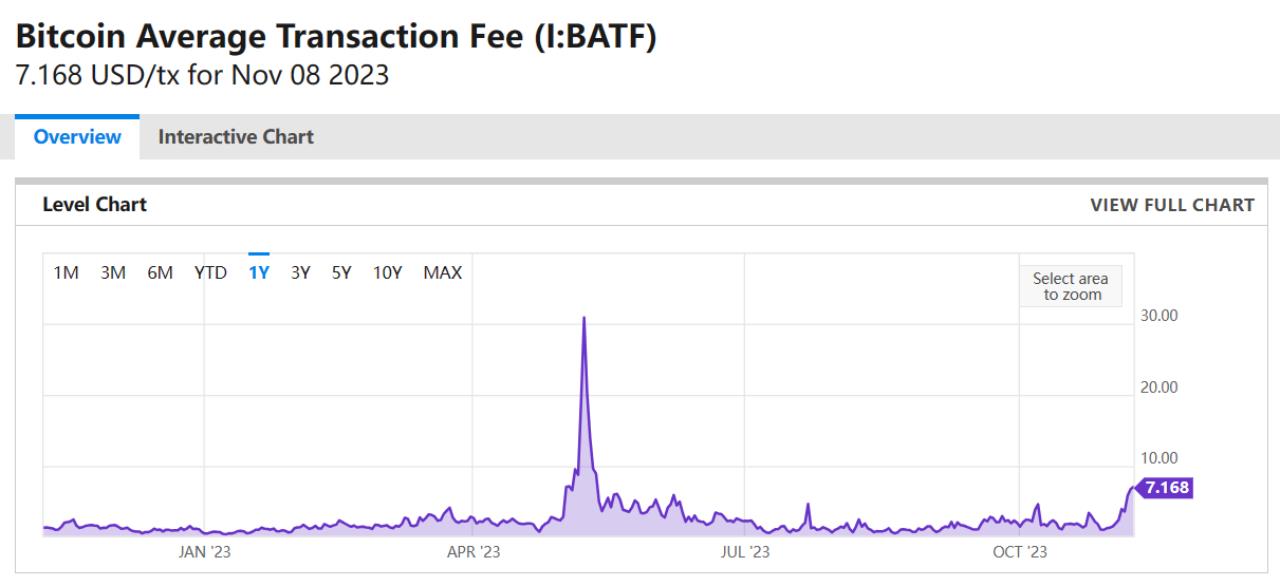

Clearly, compared to younger and more agile counterparts, Bitcoin appears slow in transaction processing. As a result, skeptics of Ordinals warned that the protocol would cause network congestion—and their concerns were validated when Bitcoin transaction fees began rising in October. During the summer, average Bitcoin transaction fees fluctuated within 20% of $1, but on November 8, the average fee climbed to $7.168, reaching a six-month high.

When Ordinals transactions previously clogged the Bitcoin network in May, some members of the community proposed modifying the underlying protocol to limit such activity. As one developer put it, “valueless” BRP-20 tokens “threaten the smooth and normal use of the Bitcoin network as a peer-to-peer digital currency.”

However, Bitcoin purists may never succeed in restricting Ordinals, as achieving the necessary consensus to force changes to Bitcoin’s core codebase is notoriously difficult. Likewise, persuading miners to support upgrades that could negatively impact their transaction fee revenues is an almost impossible task—especially with the upcoming Bitcoin halving on the horizon.

Bitcoin Ordinals and NFTs

The Ordinals protocol was created by Casey Rodarmor in December 2022, enabled by the prior Taproot upgrade that allowed complex smart contracts on Bitcoin. According to data from Dune, approximately 38 million Ordinals inscriptions are now permanently etched onto the Bitcoin blockchain. In early May, the number of Bitcoin Ordinals surged dramatically, overwhelming the network. On May 7 and 8, daily inscriptions peaked at 400,000, causing Bitcoin fees to spike and filling the mempool with pending transactions.

On the other hand, NFTs were first conceived in 2014. Their creation made it possible for the first time to trade digital art, collectibles, and gaming items as if they were as scarce as physical objects. It is well known that since their launch years ago, NFTs have rapidly grown into a multi-billion-dollar market and become a cultural phenomenon. Yet, it took many years before NFTs truly gained traction. By 2021, celebrities like Justin Bieber and Madonna were proudly showcasing their Bored Apes, and seemingly everyone had an opinion about the infamous “expensive JPEGs.” The market finally reached its peak on January 19, 2022—nearly eight years after its inception.

Bitcoin Ordinals differ from traditional NFTs in two key aspects. NFTs on platforms like Ethereum typically store only links to off-chain artwork rather than encoding the actual artwork on the blockchain itself. As Musk pointed out, this means that if the link breaks, the NFT loses its associated artwork and thus its value. Additionally, NFTs usually embed creator royalties into smart contracts, allowing artists to receive a percentage of resale proceeds. Bitcoin Ordinals lack such royalty mechanisms—or at least lack native ones—since data inscribed on Bitcoin cannot be altered once written.

Digital Artifact

Bitcoin Ordinals encode artwork directly onto the Bitcoin blockchain, ensuring that the artwork will exist as long as Bitcoin exists. For this reason, some argue that Ordinals more purely reflect the original vision of NFTs as immutable proof of ownership and provenance. Because of this, their creator Casey prefers the term “digital artifact” over “Bitcoin NFT.”

Conclusion

Looking ahead, we may see a split in the non-fungible market: one branch being NFTs that allow more complex and evolving functionalities, and the other being Bitcoin Ordinals, which guarantee immutable ownership and provenance. The “digital artifacts” created by Casey might evolve into more durable digital collectibles than the NFTs we know today—data engraved on the blockchain, not merely a link.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News