Will Bitcoin Core's New Proposal Awaken Inscriptions and Miners?

TechFlow Selected TechFlow Selected

Will Bitcoin Core's New Proposal Awaken Inscriptions and Miners?

The key to the future lies in community consensus.

Written by: TechFlow

2025 is already halfway through, and Bitcoin has broken new all-time highs.

Traditional financial giants like BlackRock and national strategic reserve funds have entered the market, treating Bitcoin as a safe-haven asset; major corporations are also following MicroStrategy’s lead in building strategic Bitcoin reserves.

However, this embrace from traditional finance hasn’t fully benefited Bitcoin's internal network.

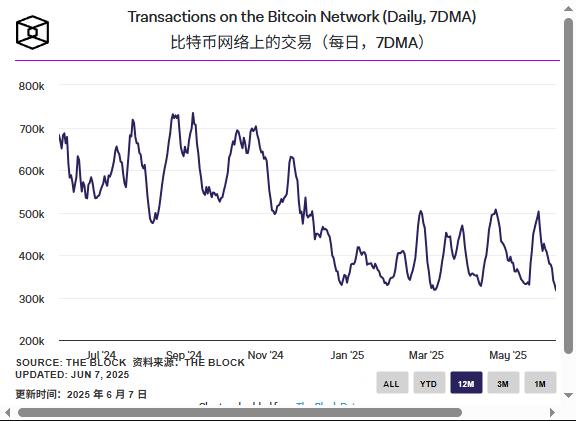

A ghost story persists: despite the external frenzy, Bitcoin’s on-chain transaction activity has entered an ice age.

According to the latest data from The Block, Bitcoin’s 7-day moving average transaction volume has dropped to $317,000—its lowest level in 19 months since October 2023. Back in October 2023, when Bitcoin was priced around $27,000, only about 270,000 transactions were confirmed per week. Today, with Bitcoin near $100,000, weekly on-chain transactions have fallen to just 250,000.

In short, while the price has surged, on-chain activity remains stagnant—a far cry from the peak levels seen during the Bitcoin inscription boom in early 2023.

You could argue that Bitcoin is increasingly resembling digital gold—with infrequent transactions. But don't forget: miners rely on transaction fees for survival.

The third halving in 2024 reduced block rewards to 3.125 BTC, making transaction fees their lifeline. Yet today’s low on-chain activity forces some miners to accept transactions below 1 sat/vB just to keep operations running.

Looking back at spring 2023, the Ordinals protocol sparked an explosion of ecosystem vitality. BRC-20 tokens like $Ordi drove transaction volumes skyward—sharply contrasting with today’s lull.

The frozen BTC network urgently needs revival.

In recent days, a new proposal within Bitcoin Core has stirred hopes of a thaw—a proposal aiming to adjust Bitcoin’s transaction rules, allowing more data on-chain, potentially breathing new life into struggling miners and cooling inscription markets.

The proposal has ignited heated debate online, amassing over 700,000 views and hundreds of comments at time of writing—yet received little coverage in Chinese media.

We’ve compiled and summarized the key points below.

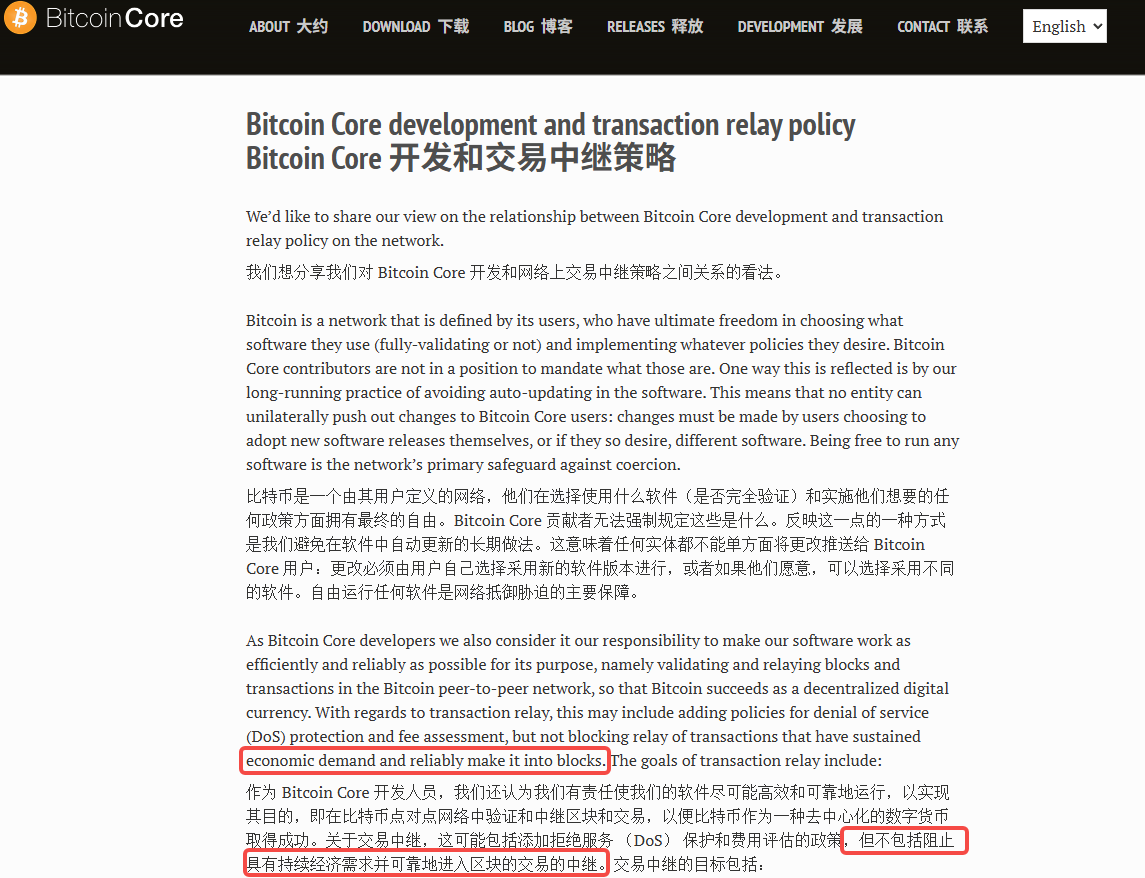

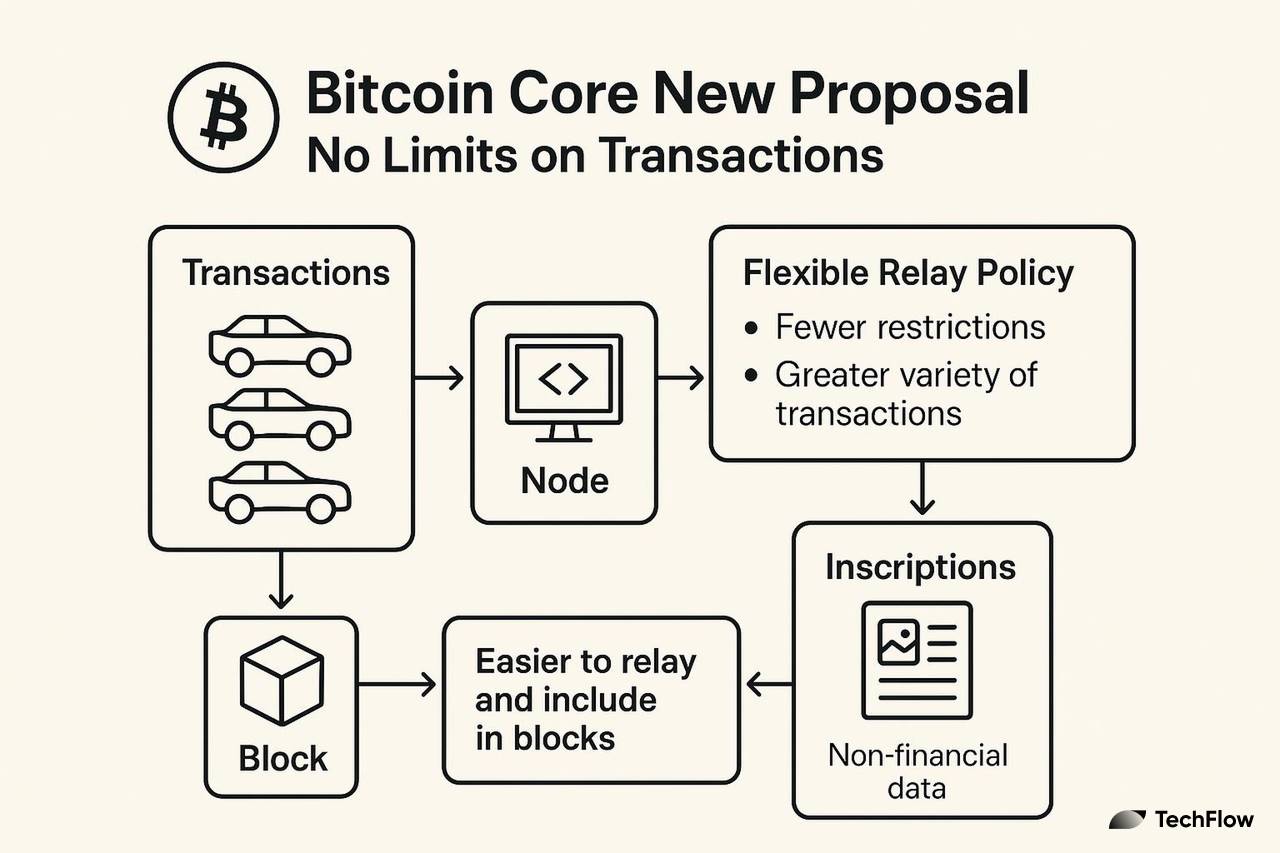

Bitcoin Core’s New Proposal: No Limits on Transactions

This Bitcoin Core proposal is a joint statement on transaction relay policy, co-signed by 31 developers.

Its core idea: Bitcoin node software should minimize intervention in transactions, allowing more economically motivated transactions to be relayed and included in blocks.

The reason this proposal has drawn widespread attention is that while it sounds like a technical tweak, it could profoundly impact on-chain activity, miner revenues, and the inscription ecosystem.

First, you need to understand what “transaction relay” means.

In simple terms, transaction relay refers to how nodes propagate transactions across the Bitcoin network.

Think of it as traffic controllers on a highway, directing vehicles (transactions) so they reach miners’ “construction sites” (block-building zones) smoothly.

During this process, nodes apply certain rules to decide which transactions get propagated and which are filtered out.

Historically, Bitcoin node relay rules have been relatively strict—especially for transactions carrying large amounts of data (like inscriptions), which may be rejected due to high block space usage or low fees.

This Bitcoin Core proposal introduces a key principle: as long as a transaction has economic demand and can be accepted by miners, nodes should not hinder its propagation.

This "flexible relay" philosophy would allow freer flow across Bitcoin’s network “highway.” Specifically, nodes would reduce restrictions on transaction size and fees, enabling more transactions to reach miners successfully.

Transaction diversity would increase—especially for non-financial data transactions such as inscriptions and BRC-20 tokens—which could become easier to propagate and confirm.

What Does This Have to Do With Inscriptions and Miners?

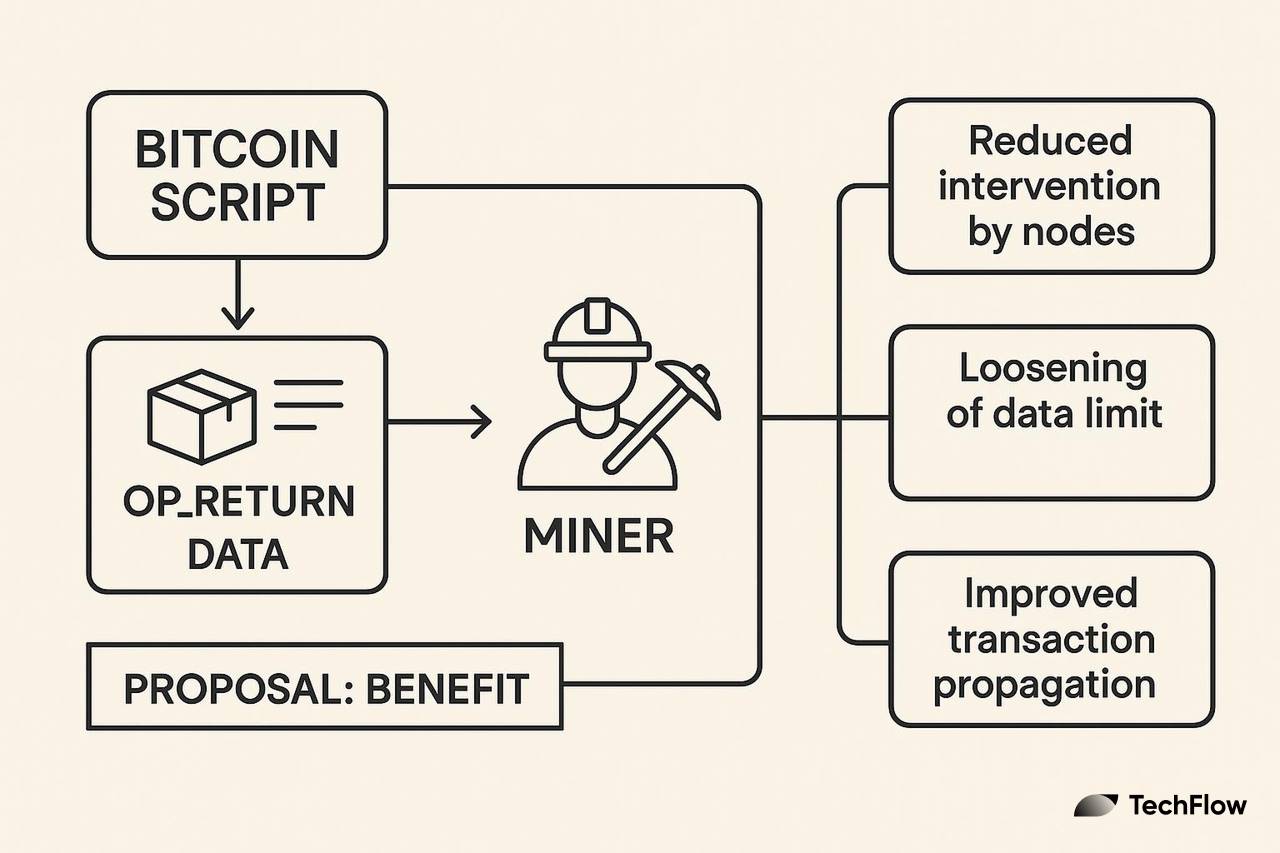

Clearly, this shift toward “flexible relay” naturally brings to mind a critical feature in Bitcoin’s scripting system: OP_RETURN. It is precisely this function that directly enabled the rise of inscriptions.

OP_RETURN is an opcode in Bitcoin script that allows users to attach small amounts of data within a transaction.

Currently limited to 80 bytes, this data isn’t treated as valid Bitcoin output and cannot be spent. Think of it as a “small package” on a truck—it doesn’t participate directly in the value transfer but can carry information such as:

-

File hashes (for proof-of-existence)

-

NFT metadata

-

BRC-20 token data

Originally designed for simple use cases like on-chain messages, the 80-byte limit was too small for complex content. Yet developers leveraged it to create something big.

In spring 2023, the Ordinals protocol combined Bitcoin’s Taproot upgrade with OP_RETURN to enable users to mint inscriptions and tokens directly on-chain. By embedding data into transactions, Ordinals achieved NFT-like functionality, while BRC-20 expanded programmable token use cases.

This innovation briefly ignited on-chain activity, causing transaction congestion and soaring miner fees—an era known as the “Inscription Spring.”

However, the 80-byte cap severely limits OP_RETURN’s potential. Users cannot upload richer content (e.g., larger images or videos), constraining Bitcoin’s role as a decentralized data storage platform.

Although the current proposal does not explicitly mention OP_RETURN, its “flexible relay” principle could indirectly loosen constraints on its use:

-

Reduced node interference: The proposal advocates against rejecting transactions with economic demand. If adopted, nodes will be more likely to relay OP_RETURN-containing transactions instead of filtering them based on size or type.

-

Paving the way for higher data limits: The spirit of the proposal may lay the groundwork for future increases to OP_RETURN’s 80-byte limit. As relay policies evolve, the community might explore expanding OP_RETURN’s data capacity.

-

Improved transaction propagation efficiency: Even if the 80-byte cap stays unchanged, the proposal would significantly improve propagation success rates for OP_RETURN transactions, reducing failures caused by node filtering.

The boom in inscriptions and BRC-20 once brought record-breaking fee income to Bitcoin miners. If OP_RETURN limits are lifted, more users may pay higher fees to upload richer data. This could ease post-halving revenue pressure on miners and incentivize their support for the new relay policy.

Another important point: this proposal is relatively easy to adopt technically.

The change applies only to transaction relay policy, not Bitcoin’s consensus rules.

Relay policies determine whether nodes propagate certain transactions—they affect propagation efficiency but do not alter transaction validity. Therefore, implementation is straightforward: Bitcoin Core simply releases a new version, and users and miners can choose whether to upgrade.

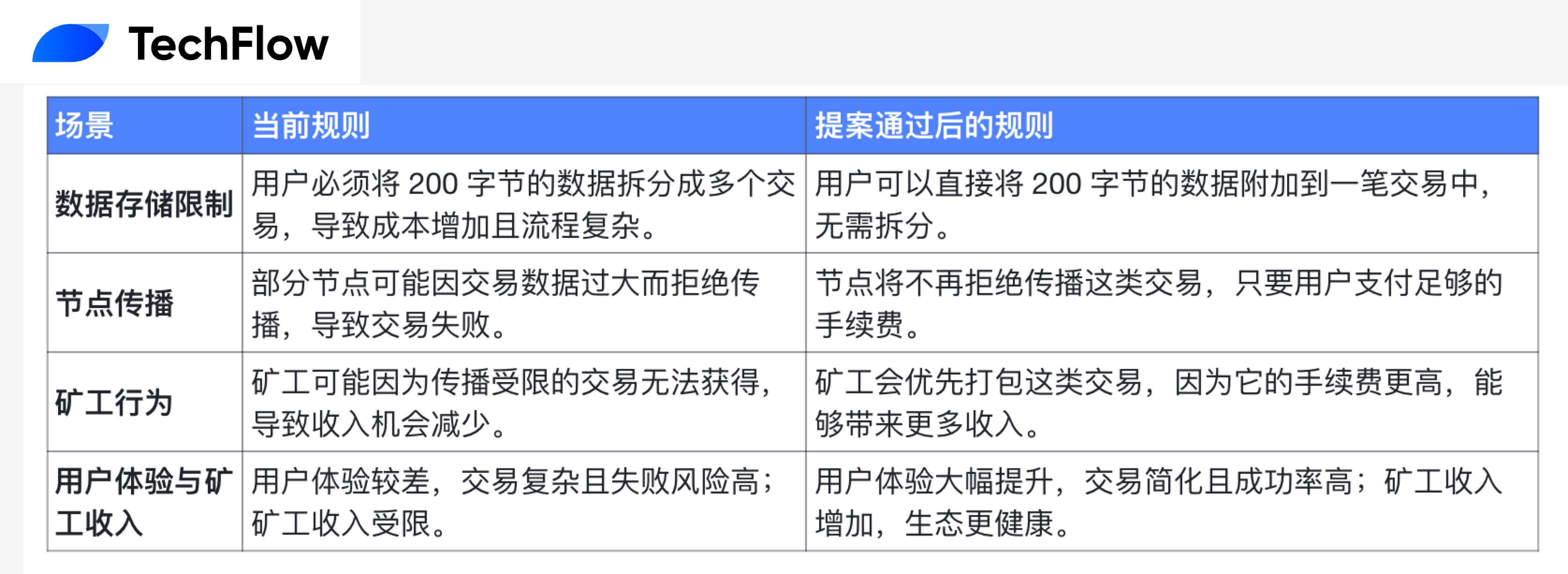

With this understanding, let’s look at a real-world example to illustrate the potential impact.

Suppose a user wants to mint a high-resolution NFT image on Bitcoin, requiring 200 bytes of metadata storage. Here’s how the experience differs under current rules versus after the proposed changes:

Ultimately, user experience improves dramatically—and miner revenue increases too.

While seemingly a minor adjustment to relay policy, this Bitcoin Core proposal could mark a crucial first step toward “thawing” Bitcoin’s frozen on-chain activity.

More importantly, it opens the door to relaxing OP_RETURN limits and enables enterprises to store critical file hashes on Bitcoin, ensuring immutability. Bitcoin’s non-financial use cases gain exciting new possibilities.

Community Reactions

The new Bitcoin Core proposal is like a pebble tossed into a pond—sending ripples across the ecosystem. Both support and opposition are strong.

For instance, crypto influencer 0xTodd argues that flexible relay returns to Satoshi Nakamoto’s vision of unrestricted transactions, giving miners more earning opportunities. He rejects the notion that these are “spam,” noting inscriptions pay fees proportionally to their data size.

Bitcoin will never become a storage chain—but without altering the base layer, using it occasionally for data storage is harmless.

If physical gold can be engraved to preserve records, why shouldn’t BTC—the so-called “electronic gold”—allow the same?

But opponents worry about a surge in on-chain data leading to broader issues.

Under the original Bitcoin Core post, critics accuse the team of “ignoring Bitcoin’s purity” and turning the network into a “Swiss Army knife,” sacrificing volunteer node operators and regular users.

Many fear flexible relay will unleash a flood of “junk transactions,” crowding out valuable ones.

Luke Dashjr, a hardline figure among core developers, responded with a direct “NACK” (rejection), arguing the proposal inverts priorities. Predicting which transactions will be mined amounts to censorship, he says—violating anti-censorship principles.

Glassnode data shows the blockchain has already reached 500GB. A data explosion could drastically raise full-node operating costs, potentially reducing the number of decentralized nodes and pushing the network toward centralization.

Opponents maintain that Bitcoin should focus solely on being money—not a storage layer.

This divide is reflected in node distribution. CoinDance data shows 93% of nodes run Bitcoin Core, while 7% use alternative clients like Bitcoin Knots.

Knots, known for its “spam filters” that reject inscription transactions, has become a stronghold for dissenters. If the proposal passes, Knots users may continue resisting—raising risks of client fragmentation.

History offers a cautionary tale: the 2017 SegWit2x controversy nearly split the network. Could this debate replay a similar scenario?

The key lies in community consensus.

This debate is far from over. Supporters see hope for miner revenue and ecosystem innovation; opponents defend decentralization and monetary purity.

The proposal’s fate hinges on code reviews on GitHub and willingness of nodes to upgrade. If consensus forms, flexible relay could go live within months—perhaps reviving another “Inscription Spring.” But if divisions deepen, Bitcoin’s ice age may persist, possibly triggering a client fork.

This is a battle unrelated to Bitcoin’s price. The thawing of Bitcoin’s internal ecosystem still awaits its spring.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News