AI Kills Miners: "Energy Run" Unveils a New Cycle—At What Crossroads Do Mining Companies Stand?

TechFlow Selected TechFlow Selected

AI Kills Miners: "Energy Run" Unveils a New Cycle—At What Crossroads Do Mining Companies Stand?

Miners are being forced to choose.

Author: Frank, MSX Research Institute

On November 18, as global financial markets fell into gloom, crypto once again faced a "Black Tuesday," with BTC breaking below the $90,000 psychological level during the day—down roughly 30% from its all-time high (126,000 USD) over a month earlier—entering a technical bear market.

At the same time, discussions around BTC shutdown prices, miner liquidations, and cyclical reshuffling have recently resurfaced. However, unlike in the past, the core assumption behind this round of discussion is no longer internal supply and demand within crypto, but rather a broader macro reality: AI and crypto are now competing for power from the same energy pool.

In fact, over the past year, every variable—from policy subsidies and preferential access to energy/land, to differences in marginal returns—has been forcing miners to undergo a fundamental shift in industry role: from "electricity consumers" to "electricity providers"——and when "using electricity to train models" becomes more certain and profitable than "using electricity to mine BTC," capital quickly realigns itself accordingly.

This means that in the coming years, miners must make real choices under new structural pressures: continue mining? Lease their power and facilities to AI? Or fully transform into general-purpose computing infrastructure providers?

This may well be a question far more valuable than predicting crypto market trends.

1. AI Accelerates the Squeeze on Crypto

What lies at the end of AI?

Electricity.

As early as 2024, Elon Musk pointed out incisively that the bottleneck for AI development isn't computing power or algorithms, but energy supply—especially high-quality, sustainable power capable of supporting ultra-high loads in data centers. In 2025, repeated warnings across the U.S. about shortages in electricity and transformer capacity have further reinforced this view in practice.

Thus, a real "energy run"—a scramble over electricity, land, and facilities—is already underway.

Upon closer inspection, it's easy to see that AI data centers and crypto mining farms share striking engineering similarities: both rely on dense arrays of computing units (NVIDIA GPUs / ASIC miners), require large expanses of scalable land and industrial infrastructure, need high-density, stable, long-term locked-in power supplies, and depend on massive cooling, heat dissipation, and redundancy systems.

In other words, "first comes power and facilities, then come computing units and customers"—a principle that applies equally to mining farms and AI data centers. The only difference is one uses electricity to train models and produce AI capabilities, while the other uses electricity to compute hashes and produce BTC.

This explains why mining companies have become key players in the AI arms race: Crypto mining farms have already secured abundant power supply, land, and infrastructure; compared to starting from scratch, tech giants can convert existing mining sites into usable AI infrastructure within months, giving them ready-made solutions that meet immediate needs.

Of course, this isn’t the first time crypto has deeply intersected with the “era of large-scale computing.” The last was the Ethereum mining boom of 2017–2018, which drove NVIDIA’s GPU sales through the roof (Jensen Huang even got a commemorative tattoo after NVIDIA’s stock first broke $100).

Only this time, the direction has reversed: instead of crypto driving the computing cycle, AI is now encroaching on the very energy space that miners rely on to survive.

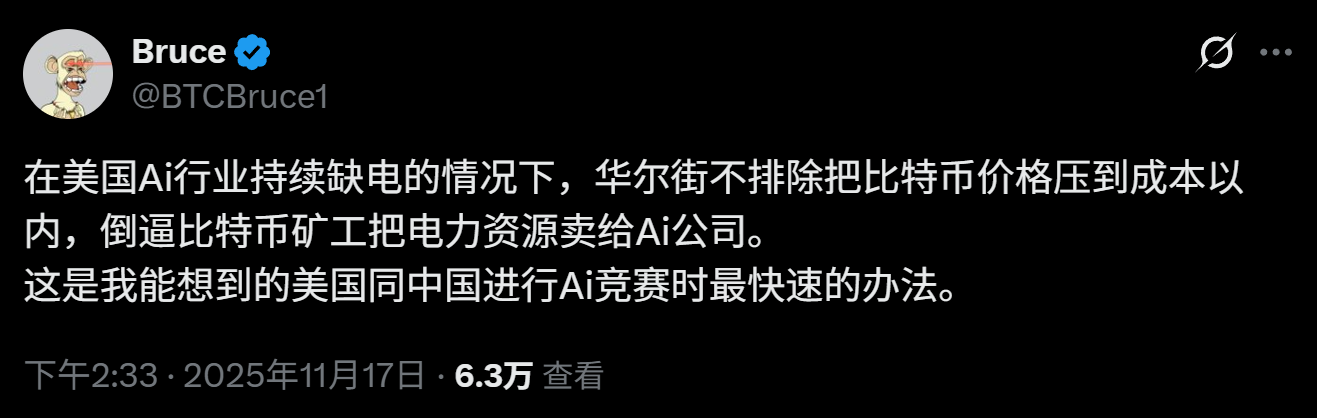

Source: Xueqiu

According to Morgan Stanley estimates, if a mining company repurposes a 100 MW mining facility into a "powered shell" data center (providing site, power, and cooling, but not chips or servers) and leases it long-term, it could generate equity value of approximately $5.19–7.81 per watt—far above current trading levels for many Bitcoin mining stocks.

More critically, beyond market forces, policy priorities are also shifting: The U.S. now treats AI energy as a strategic battleground, with subsidies, tax incentives, land allocations, and power planning clearly prioritized for AI data centers over crypto mining.

Overall, miners now find themselves caught in a deadly "sandwich" position:

-

Above: AI’s downward pressure: Tech giants wielding hundreds of billions—or even trillions—of dollars are willing to pay premiums multiple times higher than miners to secure power contracts and transformer capacity, pushing miners toward transformation with strong profit incentives;

-

Below: BTC’s own deflationary mechanism: Halving cycles continuously compress revenue in BTC terms, network difficulty keeps rising, output per unit of hashpower declines steadily, and price volatility adds selling pressure, further squeezing survival space for small and medium-sized mining farms;

Under such multi-layered AI-driven pressure, whether miners can find a new path to survival is becoming a fundamental issue of cycle resilience—and has led to three distinct development paths:

-

Dig in and keep mining: Continue mining BTC, aggressively reduce electricity costs and improve miner efficiency, fighting for survival amid halving and increasing difficulty;

-

Become a "sub-landlord": Lease owned power, facilities, and cooling systems to AI firms or computing service providers, transforming into an "energy intermediary + data center service provider," earning stable rental and service fees;

-

Complete role transformation: Evolve directly from single-purpose mining operations into general-purpose computing providers, offering long-term computing power and hosting services for AI, cloud computing, and high-performance computing (HPC) data centers—effectively becoming a new type of "digital infrastructure company";

Going forward, the valuations and fates of U.S.-listed mining companies will largely depend on which path they choose.

2. A New Valuation Logic for Miners: Forget EH/s, Focus on GW/MW

As noted above, miners today appear to face a forced three-way choice: keep mining, sell power to AI, or fully transform?

But in reality, under the冲击 of the AI-driven infrastructure boom, there is only one ultimate solution for survival: No matter which path they take, miners must complete a shift from "electricity consumers" to "electricity providers" within the next few years, or risk being eliminated before the next cycle begins.

The reason is simple—over the next three years, the power deficit is absolute. Morgan Stanley’s model shows that between 2025 and 2028, U.S. data centers will demand 65GW of power, yet current grid capacity offers only 15GW of near-term connectivity, plus another ~6GW from projects under construction—leaving a massive shortfall of about 45GW.

Against the backdrop of sharply rising AI energy consumption, control over power directly determines life or death.

Fred Thiel, CEO of MARA Holdings (MARA), put it bluntly: "By 2028, you’ll either be your own power generator, get acquired by one, or form deep partnerships with one. Miners relying solely on the grid are already on a countdown to extinction."

In short, future miner value will no longer hinge primarily on computing scale (EH/s) or miner/BTC reserves, but instead anchor on their ownership of energy infrastructure (GW/MW). Whoever controls power can control costs—and thus determine future business direction—whether continuing to mine or powering AI.

The market has already responded to this shift in valuation logic. Take Iris Energy (IREN), a flagship example of miner-to-AI transition—its stock surged from around $6 to as high as $76.87 within the year, gaining over 1200%.

The key factor was reaping early rewards from strategic transformation. While traditional miners were still expanding ASIC capacity in 2023, IREN began diverting its owned power away from mining, gradually upgrading its campuses into AI/HPC data centers. In 2024, it became one of the first preferred partners of NVIDIA, securing stable GPU allocations, locking in key clients early, and positioning itself upstream in the AI energy market.

This month, IREN signed a five-year, $9.7 billion AI cloud computing contract with Microsoft, taking its transformation story to new heights. Under the agreement, Microsoft will prepay about 20%, implying annualized revenue of $1.94 billion—a massive leap for IREN’s existing revenue base.

Still, while IREN’s ideal transformation path may seem enviable, it’s not replicable for all miners—not every miner has bet everything on AI like IREN. Ultimately, not every miner qualifies to transform—or surrender—because the prerequisite for transformation isn’t willingness, but foundational infrastructure assets like owned power, scalable land, and campus facilities.

Miners without these resources, even if they wish to surrender to AI, cannot become valuable suppliers of computing infrastructure. In a sense, it may appear that "miners are choosing AI," but in reality, it's closer to "AI choosing miners."

This is the most fundamental change across the entire mining sector.

3. The Transformation Arms Race: Ambition, Bets, and Giving Up

This article also briefly reviews the basic situations of eight U.S.-listed mining companies—IREN, CIFR, RIOT, CORZ, MARA, HUT, CLSK, BTDR, HIVE—in order to illustrate the diverse choices and challenges different miners face in transitioning to AI infrastructure.

Judging from their transformation paths, the "arms race" among U.S.-listed miners is accelerating. Whether it’s IREN leading the shift from traditional mining to AI data centers, or CORZ, CIFR, and MARA making major investments in owned power and land, these companies are striving to become digital infrastructure providers.

Meanwhile, miners like CIFR and BTDR are gradually expanding their power and computing resources, extending their business into the AI sector. Yet not all companies are advancing at the same pace.

For instance, HUT and HIVE, due to insufficient power infrastructure, lack of transformation resolve, or inadequate resource accumulation, are following more conservative paths, still relying heavily on traditional Bitcoin mining. As a result, miner fates are clearly stratifying:

-

Resource-rich miners: Have the potential to evolve into "quasi-energy companies" or "AI data centers";

-

Light-asset miners: Can at best become "sub-landlords," leasing power or facilities to AI firms and earning service fees;

-

Small-scale miners highly dependent on the grid: Will likely be the first to be wiped out in the next upcycle due to rising electricity costs and increasing difficulty;

The historic wave of AI, vast and powerful, has not only reshaped the direction and power structure of the global internet but also triggered a new round of reshuffling in the global energy industry. The battle for miner transformation is precisely a microcosm of this macro trend.

Indeed, when AI giants begin directly seizing resources like power and land, the valuation logic for miners has already been permanently altered: Mining farms are no longer mirror assets of BTC, but are being repriced as part of AI energy infrastructure. Their market cap elasticity is no longer directly tied to computing scale or BTC price, but determined by the scale of GW/MW they control.

In the coming years, as power demand continues to rise and competition for data center resources intensifies, miners must find their place in this war for power and computing.

This is true competitiveness in the cycles ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News