After Bitcoin's plunge, are miners still doing well?

TechFlow Selected TechFlow Selected

After Bitcoin's plunge, are miners still doing well?

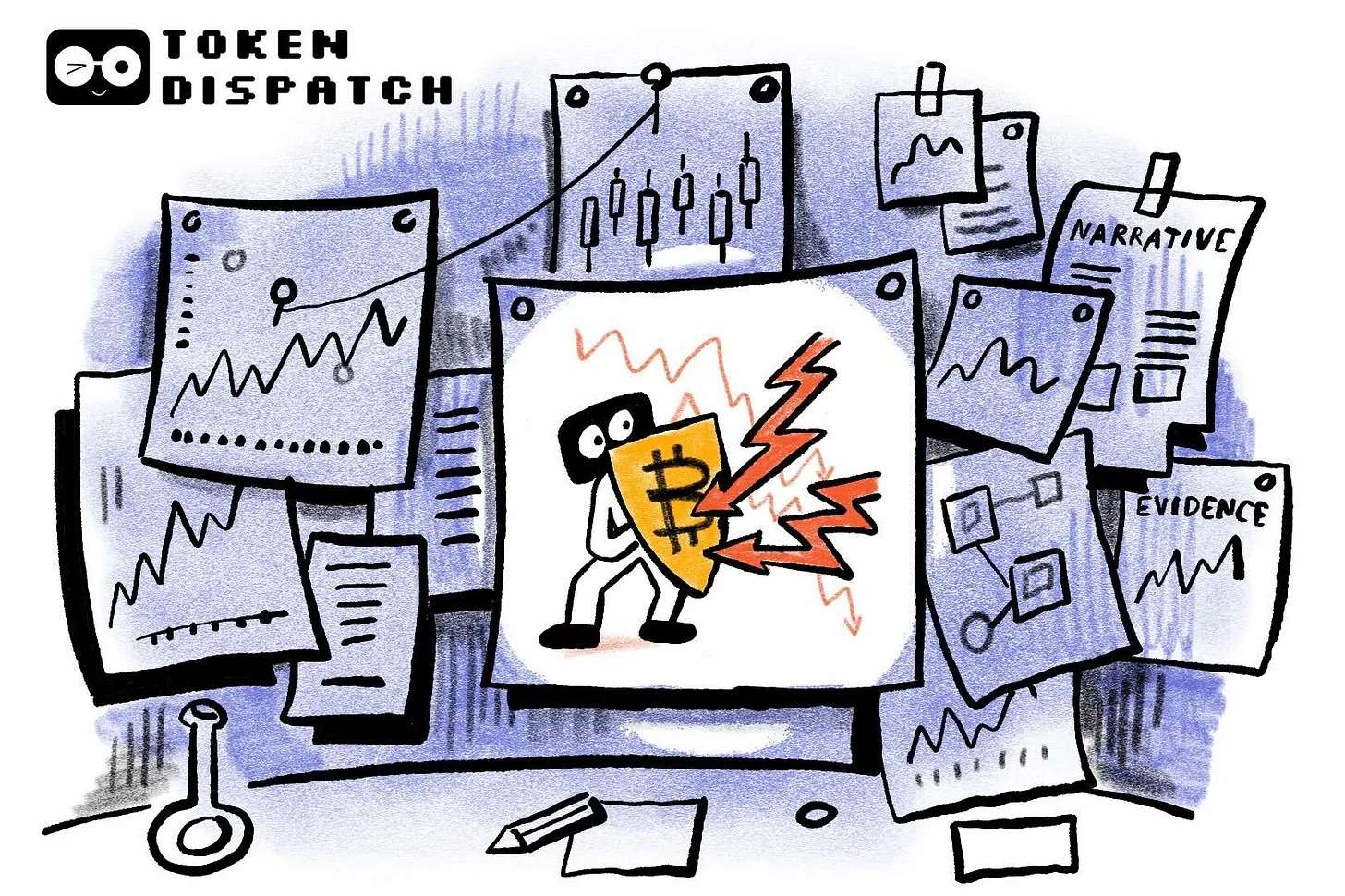

Over the past two months, miners' 7-day average revenue has declined by 35% from $60 million to $40 million.

Author: Prathik Desai

Translator: Chopper

The financial logic for Bitcoin miners is quite simple: they rely on fixed protocol revenue to survive, yet face fluctuating real-world expenses. When market volatility strikes, they are the first to feel balance sheet pressure. Miners earn income from selling mined Bitcoin, while their operating costs are primarily electricity for running the heavy computers required for mining.

This week, I tracked several key metrics for Bitcoin miners: network payments to miners, the cost of earning this revenue, remaining profit after cash expenses, and final net profit after accounting.

At current Bitcoin prices below $90,000, miners are under pressure. Over the past two months, the 7-day average miner revenue has dropped 35% from $60 million to $40 million.

Let me break down the key mechanics.

Bitcoin’s revenue mechanism is fixed and coded into the protocol. Each block’s mining reward is 3.125 BTC, with an average block time of 10 minutes—around 144 blocks per day, yielding approximately 450 BTC daily across the network. Over 30 days, global Bitcoin miners collectively mine about 13,500 BTC. At the current Bitcoin price of around $88,000, that amounts to roughly $1.2 billion in value. But when distributed across a record-high 1,078 EH/s (exahashes per second) of network hash rate, each TH/s (terahash per second) generates only 3.6 cents per day—this is the entire economic foundation supporting the security of a $1.7 trillion network. (Note: 1 EH/s = 10¹⁸ H/s; 1 TH/s = 10¹² H/s)

On the cost side, electricity is the most critical variable, varying by mining location and miner efficiency.

Miners using modern S21-class machines (17 joules per terahash) with access to cheap power can still achieve cash profitability. However, those relying on older equipment or paying high electricity rates see every hash computation add to their costs. At current hash prices—affected by network difficulty, Bitcoin price, block subsidy, and transaction fees—a S19 miner paying $0.06 per kWh can barely break even. Any increase in network difficulty, slight drop in Bitcoin price, or spike in electricity costs worsens their economics.

Let me analyze with specific data.

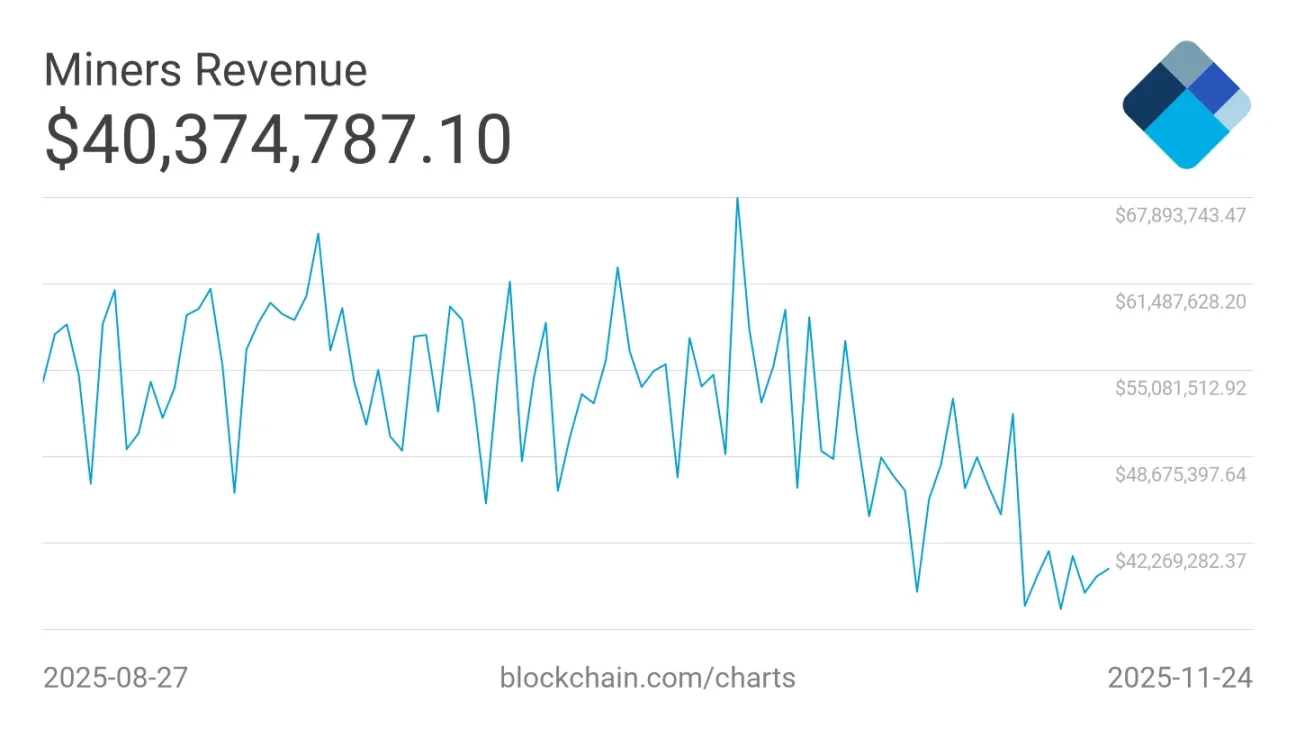

In December 2024, CoinShares estimated that public mining companies had a cash cost of approximately $55,950 to mine one Bitcoin in Q3 2024. Today, Cambridge University estimates this cost has risen to about $58,500. Actual mining costs vary among miners: Marathon Digital (NASDAQ: MARA), the world’s largest publicly traded Bitcoin miner, reported an average energy cost of $39,235 per Bitcoin mined in Q3 2025; Riot Platforms (NASDAQ: RIOT), the second-largest, reported $46,324. Despite Bitcoin prices falling 30% from peak levels to $86,000, these firms remain profitable—but that’s not the full picture.

Miners must also account for non-cash expenses such as depreciation, impairments, and stock-based compensation—factors that make mining a capital-intensive industry. Once these are included, the total cost to mine one Bitcoin easily exceeds $100,000.

Mining costs for top miners Marathon and Riot

MARA operates both its own rigs and mines through third-party hosting arrangements, incurring electricity, depreciation, and hosting fees. Rough calculations suggest its total cost per Bitcoin exceeds $110,000. Even CoinShares’ December 2024 estimate placed MARA’s total mining cost at around $106,000.

On the surface, the Bitcoin mining industry appears stable—healthy cash margins, potential for accounting profits, and large-scale operations capable of raising capital freely. Yet deeper analysis reveals why an increasing number of miners are choosing to hold onto mined Bitcoin and even accumulate more from the market rather than sell immediately.

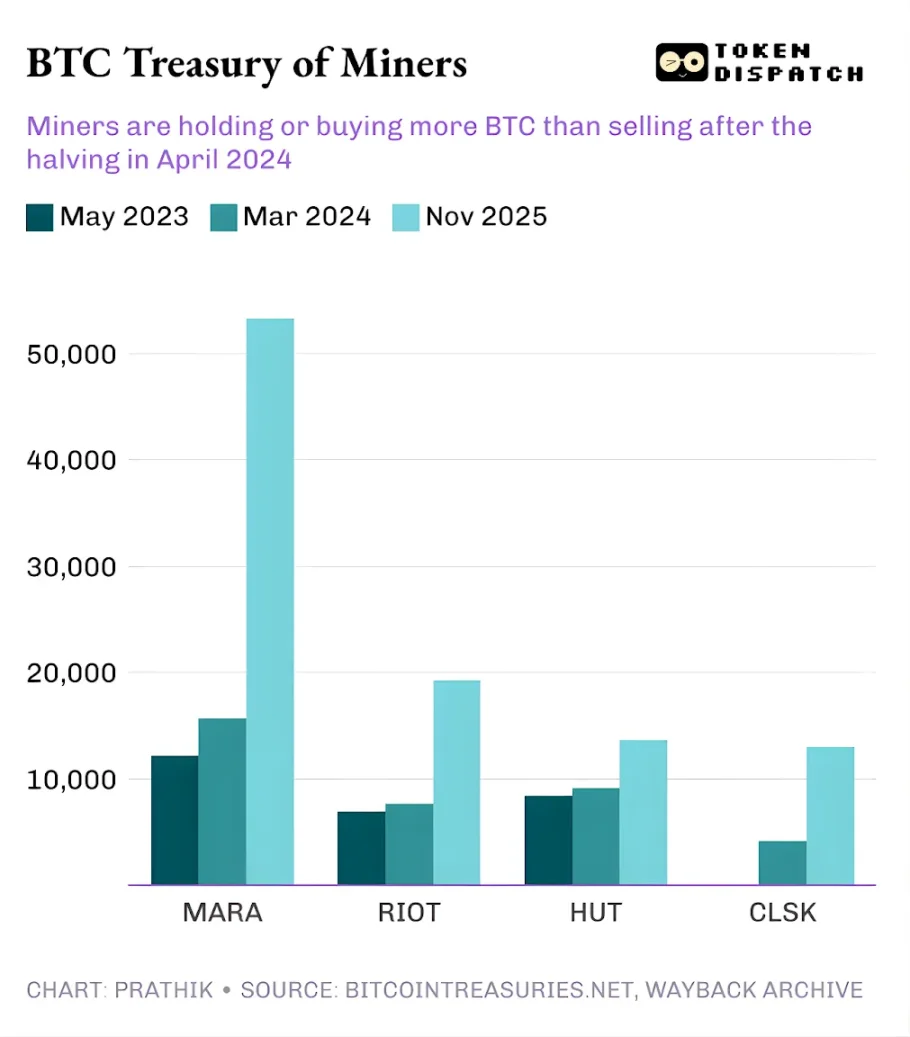

Bitcoin reserves held by leading mining firms

Strong players like MARA can cover costs due to diversified business lines and access to capital markets. However, many other miners would fall into losses with just one more rise in network difficulty.

Overall, the mining industry presents two coexisting breakeven scenarios:

The first involves large industrial-scale miners with efficient hardware, low-cost power, and lean capital structures. For them, daily cash flow turns negative only if Bitcoin drops from $86,000 to $50,000. Currently, they generate over $40,000 in cash profit per Bitcoin mined, though whether they achieve accounting profitability depends on the individual miner.

The second group includes all other miners who struggle to break even once depreciation, impairments, and stock-based compensation are factored in.

Even conservative estimates placing the all-in cost between $90,000 and $110,000 per Bitcoin imply many miners have already fallen below economic breakeven. They continue mining because cash costs remain covered, but accounting costs are exceeded. This may push more miners toward holding Bitcoin instead of selling now.

As long as cash flow remains positive, miners will keep mining. At $88,000, the system appears stable—but only if miners refrain from selling Bitcoin. If prices fall further or miners are forced to liquidate holdings, they will approach their breakeven threshold.

Thus, while sharp price declines continue to impact retail investors and traders, miners are currently less vulnerable. However, if miners’ access to financing becomes more constrained, conditions could deteriorate—breaking the growth flywheel and forcing miners to increase reliance on ancillary businesses to sustain operations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News