BitDeer: From Bitcoin Miner to "AI Second Landlord"

TechFlow Selected TechFlow Selected

BitDeer: From Bitcoin Miner to "AI Second Landlord"

The real bottleneck for AI isn't capital or large models, but electricity.

By: Lin Wanwan

No one initially expected that the real bottleneck for AI wouldn't be capital or large models, but electricity.

With training running at full capacity long-term and AI inference operating 24/7, a critical problem has emerged: not enough power, forcing chips to sit idle. Over the past decade, U.S. power grid infrastructure has lagged significantly, with new high-load grid connections taking 2–4 years on average. This has made "immediately available power" a scarce commodity across the entire industry.

Generative AI has brought a raw and brutal truth into the spotlight: what's in short supply isn't models—it's electricity.

And so the story takes a turn. Cryptocurrency mining companies—those who first treated electricity as a "production input"—are now moving from the periphery to center stage in the world of capital.

Iris Energy (IREN) exemplifies this shift. This year, IREN’s stock surged nearly 600%, rising from $5.12 to $75.73 over 52 weeks. At a time when Bitcoin still offered attractive returns, it boldly redirected its power supply to build its own AI data centers.

When giants like Microsoft stepped in with long-term contracts worth $9.7 billion total, the market gained its first clear view of the practical path from mining to AI: secure power and land first, then bring in GPUs and customers.

But not all mining firms have followed IREN’s lead in betting everything on AI. Amid this power-driven migration of computing capacity, another more measured force deserves attention—Bitdeer.

Bitdeer Technologies Group (NASDAQ: BTDR), founded by crypto pioneer Wu Jihan and headquartered in Singapore, controls nearly 3GW of global power resources. From the outset, it avoided the shallow trap of relying on others for power. As the AI wave arrives, Bitdeer hasn’t chosen IREN’s aggressive "all-in" approach. Instead, it retains profitable Bitcoin mining as its "core business," while steadily upgrading some mining sites into AI data centers.

This “flexible offensive and defensive” strategy makes Bitdeer an ideal case study for understanding how global players are thinking and positioning themselves in this computing race.

To explore this further, we interviewed Wang Wenguang, Vice President of Global Data Center Operations at Bitdeer, to discuss the current state of global AI power shortages and their perspective on mining companies transitioning to AI data centers. Is this just capital speculation, or a genuine demand driven by AI? We had an in-depth conversation on these questions.

Why is the U.S. power shortage so severe?

TechFlow: Let’s start with a broad foundational question—do you think electricity prices will keep rising?

Bitdeer: I believe they will, because this reflects a crucial future supply-demand dynamic.

TechFlow: There’s a common belief in the market that obtaining "power permits" in the U.S. is extremely difficult. Is that accurate?

Bitdeer: It’s not that permits aren’t approved—it’s that the physical expansion of the grid can’t keep pace. After decades of deindustrialization, the U.S. never systematically upgraded its power grid. When mining companies relocated to the U.S. in 2021, many secured grid access and signed PPAs, locking up available power. Then, with the rise of ChatGPT, pure AI players entered the scene only to discover that most immediately usable power was already tied up in mining farms.

This explains why major tech firms prefer partnering with mining companies: rather than waiting 2–4 years to build 500MW from scratch, it’s faster to repurpose existing facilities within 12 months.

TechFlow: When did the industry truly realize that inference is also highly power-intensive?

Bitdeer: Around the time GPT-4 became widespread. As enterprises began embedding models into customer service, office tools, search, risk control, and other applications, inference demands became persistent and scenario-based. Power consumption never dropped as early assumptions suggested.

This triggered two types of changes.

First, engineering upgrades: from enhanced air cooling to liquid or hybrid cooling systems, rack power, power distribution, fire protection, and monitoring have all been elevated to AI data center standards.

Second, resource strategy: power has become the primary bottleneck. The focus is no longer just on "buying GPUs," but on securing power and grid access upfront—long-term PPAs, grid connection timelines, cross-regional capacity backup, and, when necessary, sourcing power upstream like miners do (self-generation or direct procurement).

We saw this trend long ago in mining: chips can scale infinitely (silicon comes from sand), but power cannot. In Canada, we used natural gas self-generation to ensure stable mine operations—that’s the same logic. Today’s AI situation is almost identical.

TechFlow: How does the power demand of AI data centers differ from traditional internet data centers?

Bitdeer: It’s not a quantitative difference—it’s a difference in magnitude. Traditionally, a 20–30 MW internet data center was already considered sizable. Now, AI data centers routinely require 500MW or even 1GW. AI has transformed data centers from a "rack business" into a "power engineering" project. Everything must be recalibrated: lines, substations, cooling, fire safety, redundancy, PUE… Traditional data center experience remains useful, but insufficient.

TechFlow: Why has power become the scarcest upstream factor?

Bitdeer: Chips can scale because they come from silicon and production management; power cannot scale easily because it depends on power generation and grid upgrades. Miners have long experimented with "upstream energy sourcing," including self-generation projects in Canada. AI follows the same path—whoever secures power first gains deployment time advantage.

The New AI Battlefield: From "Chasing GPUs" to "Chasing Grids"

TechFlow: What exactly needs to change when a mining facility transitions to an AI data center? People used to say "Bitcoin computing power can run AI," but ASIC mining chips aren’t compatible with the GPUs needed for AI. So how can mining companies now "provide AI computing power"?

Bitdeer: Globally, mining was once divided into two parts: Bitcoin relied on ASIC chips—highly efficient but single-purpose; Ethereum used NVIDIA GPUs—more general-purpose, but exited mining after switching to PoS.

So today, when people talk about "mining sites turning to AI," they almost always mean Bitcoin mining sites undergoing transformation. The key point is that these sites no longer compute hashes—they upgrade themselves into AI data centers.

This is an infrastructure overhaul: removing ASIC racks and replacing them with GPU servers; upgrading basic power systems to professional-grade N+1/2N redundant power distribution; shifting from conventional air cooling to high-density GPU-capable cooling systems; and standardizing room sealing, dust protection, fire safety, and monitoring into auditable, compliant facilities.

Once these four steps are completed, a crypto mine transforms from a "mining workshop" into an "AI server room."

Why can miners move faster than big AI firms building from scratch? Power.

AI is a business of "electricity and heat." Building an AI data center typically takes 3–4 years—the time cost is the biggest barrier. Miners happen to hold these "hard assets," giving them a head start in the transition race.

TechFlow: Recently, Microsoft and Amazon signed long-term AI contracts with crypto mining firms. Iris Energy (IREN) signed a $9.7 billion, five-year deal with Microsoft; another firm, Cipher, signed a $5.5 billion, 15-year agreement with AWS. These are seen as the first major collaborations between mining firms and tech giants. What’s your take?

Bitdeer: Iris Energy is a forward-thinking Australian company with a long history of mining in the U.S.

Iris Energy’s pivot toward AI acted like a flare—while Bitcoin prices were high and peers were expanding mining operations, it redirected part of its power to build its own AI data centers. This move attracted AI companies directly.

The real catalyst came from hyperscalers putting real money on the table—like Microsoft’s $9.7 billion commitment. For the first time, the market clearly saw that collaboration between miners and tech giants isn’t just about "technical integration," but about "exchanging power for time."

AI hype amplified infrastructure demand, opening up cooperation space.

TechFlow: Why are leading mining firms currently more likely to be chosen by U.S. AI giants?

Bitdeer: Because of "available power + engineering delivery speed." The site selection and grid connection decisions made by miners in the previous cycle now serve as front-loaded capital for AI data centers. Time is the greatest discount factor—it determines who can go live during the window period, acquire customers, and generate rolling cash flow.

TechFlow: How difficult is land selection for AI data centers?

Bitdeer: Generally not very difficult. In the U.S. and most countries, what’s truly scarce is power, not land.

The reason is simple: places with access to large-scale power are usually energy-rich zones (natural gas fields, coal belts, near hydropower stations, etc.), which tend to be sparsely populated with low land costs.

For example, Bitdeer’s large data centers in Norway and Bhutan are located far from population centers, where power resources are concentrated and land is cheap. The same applies in the U.S.—these campuses aren’t in urban cores but in more remote areas, making land easy to find and inexpensive. The first principle of site selection is power and grid access; land typically follows power and isn’t a major bottleneck.

TechFlow: AI is now described as an upstream business involving "steel, power, and land," almost like a form of real estate. What’s your view?

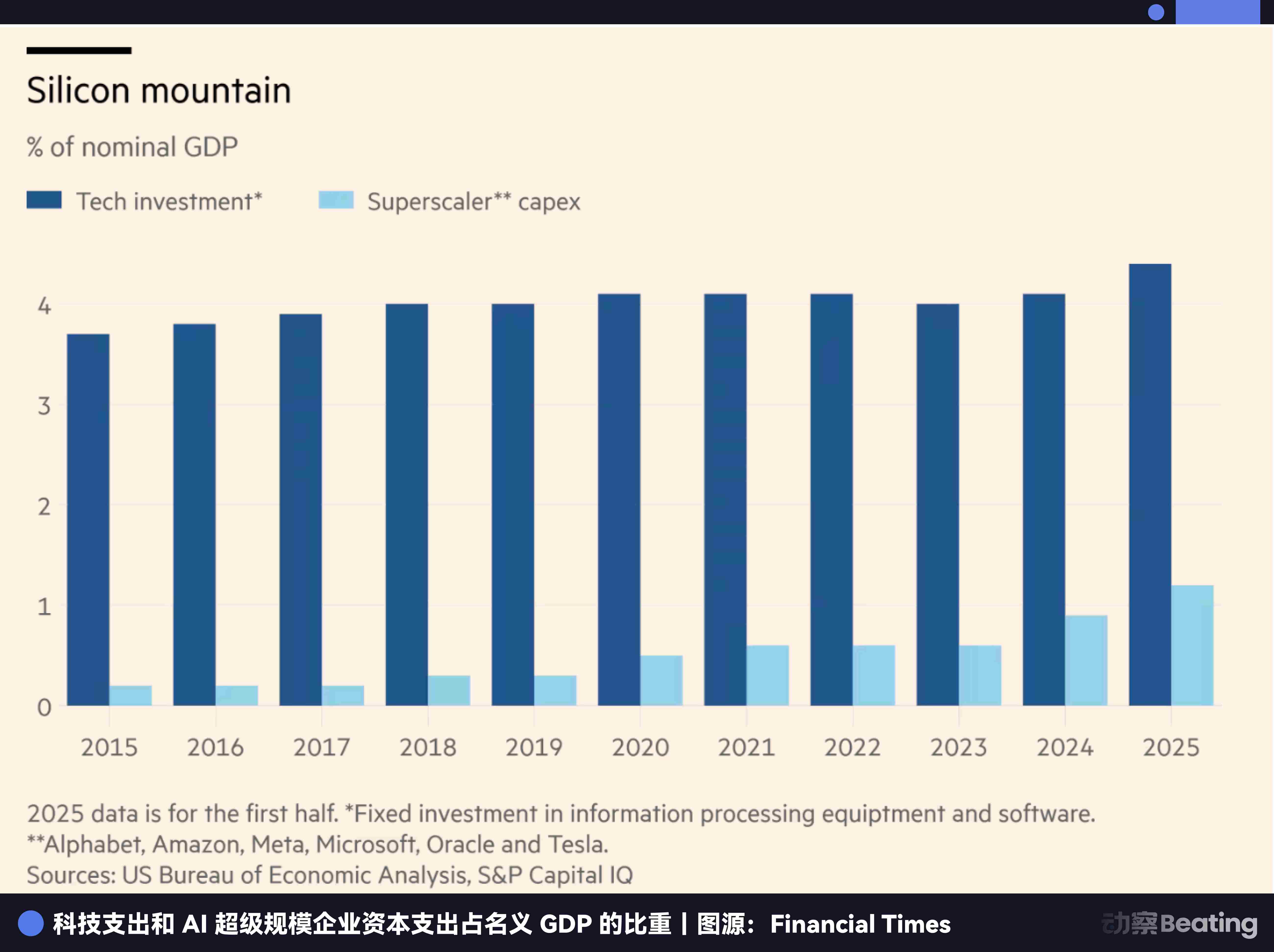

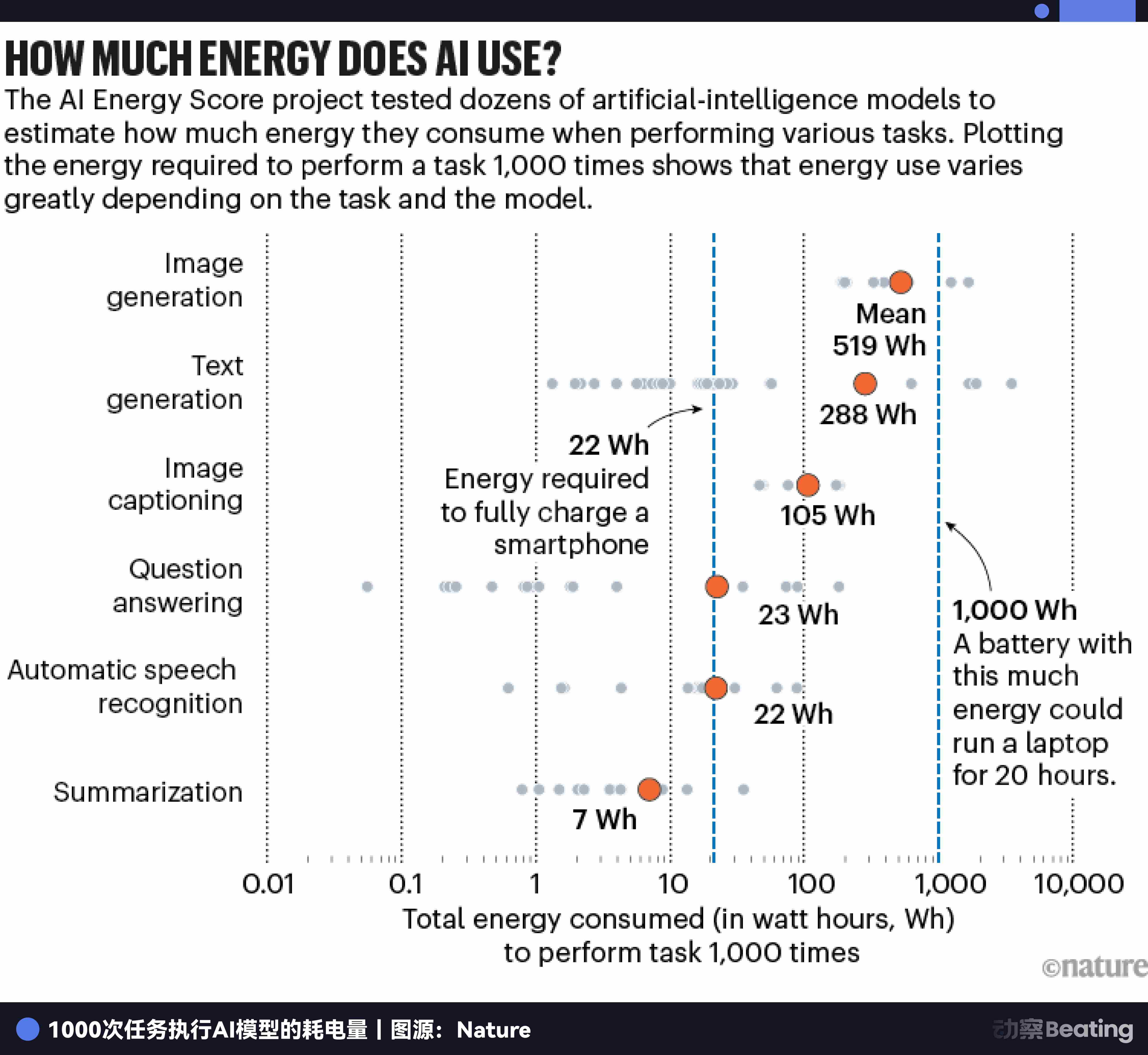

Bitdeer: After large models emerged, AI’s power intensity far exceeded most expectations.

Initially, people thought "training consumes power, but inference would be light." But the opposite proved true—once inference goes mainstream, it remains persistently power-hungry. As ChatGPT and DeepSeek enter daily use and more endpoints connect, the baseline inference load keeps rising.

From an engineering perspective, AI is fundamentally a resource-intensive industry:

-

Chip side: Accelerator cards during training run at nearly 100% load, inherently consuming high power;

-

Data center side: Thermal density far exceeds traditional servers, significantly increasing PUE—cooling itself consumes substantial electricity;

-

Scale side: Power demand for AI data centers has jumped from the traditional 20–30MW range to 500MW or even 1GW levels—unimaginable in the traditional internet data center era.

So comparing it to real estate is only half right. Yes, it requires land, buildings, and long construction cycles (often 3–4 years). But what determines survival is power and heat—securing high-capacity grid access on time, achieving N+1/2N redundancy, and implementing efficient cooling. In this sense, it closely resembles industries dependent on steel, power, and land.

What Are the Characteristics of AI Data Centers?

TechFlow: What characterizes the model of data centers under construction in the U.S.?

Bitdeer: Due to power constraints and historical development paths in the U.S., hyperscalers often need to get directly involved and partner with mining firms to access available power.

TechFlow: Can foreign companies realistically build AI data centers in the U.S.?

Bitdeer: Simply put, AI data centers are highly regional businesses. Large-scale deployments involving hundreds of megawatts and thousands of GPUs are still dominated by U.S.-based tech giants. We’re talking specifically about AI data centers, not traditional internet data centers.

TechFlow: Could AI data centers evolve into geopolitical tools? Would that affect your decisions?

Bitdeer: I agree with that assessment.

At its core, AI relies on data, which is naturally constrained by sovereignty and security concerns. To prevent data leaks and security risks, regions are tightening regulations: even if the U.S. allows foreign investment in data centers, as AI handles increasingly sensitive data, most countries will likely move toward "local deployment, local compliance, data not leaving borders."

In short, U.S. AI stays in the U.S., Middle East AI in the Middle East, European AI in Europe—regionalization will be a long-term trend.

Industry Landscape and Potential

TechFlow: Beyond IREN and Bitdeer, which mining firms have the most potential to transition to AI data centers?

Bitdeer: To assess potential, first check whether a company controls large-scale power, then whether it can quickly convert mining sites into GPU server rooms. Those with grid access, land, substations, capable of N+1/2N redundancy and liquid/high-density cooling, are best positioned to win AI contracts.

On the other hand, pure托管/light-asset operators who don’t control power or campuses are at a disadvantage in transitioning to AI data centers.

In the U.S., firms like Riot, CleanSpark, Core Scientific, TeraWulf, and Cipher—those with owned resources and reliable scalability—are more likely to attract attention from major tech firms.

The conclusion is straightforward: power is the ticket, conversion capability is speed—only those with both can lead the race.

Overall, the key lies in who controls "high-quality, sustainable, high-load, readily available power." Companies with significant owned grid resources have greater potential; those focused on托管with limited owned energy and campuses hold no advantage in this structural shift.

What Is Bitdeer Thinking?

TechFlow: What is Bitdeer’s strategy and path in transitioning from mining to AI?

Bitdeer: Mr. Wu Jihan has always focused on building a full industrial chain. Bitdeer controls approximately 3GW of power and campus resources—our biggest foundational advantage.

When we first entered AI, we didn’t anticipate that power would become the core bottleneck. Initially, we pursued a self-built, self-operated model: we partnered with NVIDIA to become an NVIDIA PCSP, deployed a small-scale H100 cluster in Singapore, launched our own AI Cloud, and began offering training services externally—this project is already operational.

We’ve since expanded to a second data center in Malaysia. As hyperscalers entered the space and began collaborating with mining firms, we simultaneously advanced the upgrade of high-load campuses into AI data centers: we’ve announced plans to fully transform a ~180MW site in Norway into an AI DC, and similarly convert a ~13MW site in Washington State, U.S.

In essence, AI is very similar to crypto mining—it’s a business of "power + infrastructure." With end-to-end capabilities spanning power, campuses, and computing operations, our transition to AI is relatively smooth.

TechFlow: What are the key differences between Bitdeer and other mining firms like IREN?

Bitdeer: Three points. First, we won’t fully transition into an AI-only company. Based on our analysis, crypto mining currently offers better profits than AI data centers, with stable cash flow and solid returns.

Our second advantage is international engineering execution capability. Bitdeer’s engineering team is unmatched globally. While typical AI data centers in the U.S. take around two years to complete, we can usually deliver in 18 months. By parallelizing construction and coordinating supply chains—we synchronize civil works, mechanical/electrical systems, power distribution, and cooling—compressing a standard 24-month timeline down to about 18 months, accelerating usable capacity deployment.

Third, our corporate strategy remains conservative: the AI industry is young—even younger than crypto. We avoid going "all-in," aiming instead for sustainable, long-term growth.

TechFlow: Where are Bitdeer’s current power infrastructure deployments mainly located?

Bitdeer: Bitdeer currently operates around 3GW of power and related infrastructure across five countries—U.S., Canada, Norway, Ethiopia, and Bhutan—supporting both mining and AI data center development and operations.

Cost and Financing

TechFlow: Goldman Sachs reported that building an AI data center could cost up to $12 billion. Is it really that expensive?

Bitdeer: Yes, the scale is indeed massive—tens of times higher. Here’s an intuitive comparison: Bitcoin mining farm (U.S.): ~$350,000–400,000 per MW. AI data center: ~$11 million per MW. Because AI data centers represent a complex of "heavy electromechanical systems + strict standards," plus grid connection queues, environmental/energy assessments, and regional compliance, typical project cycles last 18–36 months.

You realize that building an AI data center isn’t about "adding more GPUs"—it’s about turning a piece of land into a "city of power" capable of absorbing 500MW–1GW, properly connecting electricity, dissipating heat, ensuring redundancy, and meeting compliance—all of which are extremely costly.

TechFlow: Where does the money come from? Will financing be required?

Bitdeer: Honestly, yes—everyone needs financing.

Here are common financing methods in the industry:

1. Project financing / infrastructure loans: Use campuses and equipment as collateral, backed by long-term leases or power offtake agreements (customer commitments to buy computing power for years) to reassure banks.

2. Equipment leasing / sale-leaseback: Lease GPUs and certain electromechanical components to spread costs over time, avoiding large upfront cash outlays.

3. Long-term PPA: Lock in electricity rates and capacity first, making lenders more willing to offer low-interest debt.

4. Partnering with big tech: Secure minimum spend commitments, prepayments, guarantees, or even joint ventures (JV) from major customers, enabling access to cheaper capital.

These terms are visible in partnerships like IREN, CoreWeave with Google/Microsoft.

TechFlow: Will Bitdeer seek financing? Will there be announcements soon about collaborations with major tech firms?

Bitdeer: We can’t disclose much on that yet.

Conclusion

Shortly after our interview, Bitdeer delivered its next strategic move in the capital markets.

On November 13, Bitdeer announced it will raise $400 million through convertible preferred notes, with an option for initial purchasers to buy up to an additional $60 million within 13 days—bringing the total potential funding to $460 million. The funds will support data center expansion, ASIC miner R&D, AI and HPC cloud business growth, and general corporate purposes.

At a time when electricity has become the most critical upstream resource in the AI industry, where these $460 million are invested—on which plots of land, connecting how many megawatts of new load—will largely determine Bitdeer’s position in the next round of computing competition.

For Bitdeer, this capital injection is akin to inscribing the insights from our discussion onto its balance sheet: one end anchored in mining as a cash-flow-generating core, the other extending into AI data centers—a long-term, high-potential business line. It may not immediately show up in next quarter’s revenue or profit, but over the coming years, it will gradually reshape the power dynamics of the computing industry—who gets a seat at the negotiation table, and who remains stuck waiting on the grid connection list.

Looking back from the outcome, the story of this wave of AI infrastructure isn’t complicated: power has become the true upstream, time has become the new currency, and the campuses and grid access held by mining firms have turned into "legacy assets" that others can’t buy no matter how much they pay.

When the noise around models and applications eventually fades, the market will likely re-examine the fundamentals: compelling narratives won’t matter anymore. Only those companies that can connect every megawatt and run it stably in a power-constrained world will earn the right to stay at the table in the next phase.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News